48

available online at www.ssbfnet.com

Regional Development and Effects of Investment Banks

Ismail Erkan Celik, PhD

a,

Umit Hacioglu, PhD

b, Hasan Dincer,PhD

ca Beykent University, Beykent University, Department of Banking and Finance, Ayazaga, Istanbul, 34500, Turkey

b Beykent University, Department of Capital Markets and Portfolio Management, Beylikduzu Campus, Istanbul, 34500, Turkey

b Beykent University, Department of Capital Markets and Portfolio Management, Beylikduzu Campus, Istanbul, 34500, Turkey

Abstract

The World Bank is the most important financier for international investment. The bank opens credits mostly for investment projects in developing countries. Turkey has received various investment credits since its membership to the World Bank on March 11, 1947. The credits were used for economic and social domains. Turkey has also been granted credits from the European Investment Bank (EIB). The credits received are composed of micro credits that belong to small and medium enterprises (SMEs). A regional development bank, Islamic Development Bank, has also received credits through Eximbank and Industrial Development Bank of Turkey (TSKB) to finance Turkish SMEs. This paper deals with Turkish investment strategies in the framework of basic principles of investment – development banks.

Keywords: The World Bank; Investment Banks; International investment; Regional development

© 2012 Published by SSBFNET

1. Introduction

Following the Great Depression of 1929, banking and other financial services were separated from each other. However, the number of countries separating them is not that high. Investment banks have assumed key positions in the progress and growth of American economy. The best example would be the financing of the railroad construction in the country during 1700’s and 1800’s. Most of these banks were also dealing with deposit banking. Things changed after 1933, and banks were restrained from savings banking. Institutional and operational characteristics of investment banks vary across countries. While investment banks in industrialized countries target real sector and economic growth, those in developing countries need external sources due to insufficient capital. Therefore these banks primarily deal with economic development (Mishkin, 1992: 78-88; Mishkin, 2004: 330-337; Grinblatt and Titman, 2002: 4-22; Hubbard, 2002: 52-66; Peter and Marguis; 2005: 45-72; Trescott, 1965: 88-102; Dornbusch and Fischer; 1988: 12-26; Hubbard, 2002: 52-66).

Turkey has been receiving investment credits since its membership to the World Bank on March 11, 1947. Turkey’s share of capital in the World Bank is 832.8 million dollars. This number is equal to %0.53 of the total capital. As for the types of investment credits, they are “re-organization of Ministry of Health”, “renewable energy project”, “electricity distribution and rehabilitation project”, “energy community of South East Europe”, “Istanbul Seismic Risk Mitigation and Emergency Preparedness Project”, series of “export finance intermediary loan”, “small and medium enterprises loan”, “restoring equitable growth and employment programmatic development policy loan”.

Besides those stated above, Country Partnership Strategy for 2008-2011 enacted in February 2008 aimed “to help Turkey complete its harmonization process for EU membership, and bring steady growth, fair distribution of income, globally competitive power, and knowledge society. Thus, Turkey has received $4,969 billion credit from the World

49

Bank to finance above mentioned projects; almost $5 billion. Moreover, Turkey has received more than $818 billion from the European Investment Bank to finance development projects. Part of this finance has been used in supporting investment plans of SMEs, eliminating economic and social inequalities between regions, supporting environmental protection and sustainable environmental policies, fight against the adverse effects of climate change, support for the initiatives of sustainable and safe energy, and support for the creation of the transportation, energy, and communication networks in the Union.

This paper primarily deals with the objectives and duties of certain investment banks worldwide and their relation with Turkey. In this vein, pre-Bretton Woods international monetary system is explained and monetary movements of the period are analyzed. Besides, The World Bank, which opens credits to worldwide investments are scrutinized. How the World Bank operates, credits (investment, adjustment, hybrid, and common loans) it has opened have been studied. Affiliates of the World Bank are also analyzed.

But this paper primarily deals with the banks opening investment credits to Turkey and their relation with the country. The paper evaluates the relationship between the World Bank and Turkey, Turkey’s capital share in the World Bank, and the received investment credits. The paper also investigates Regional Development and Investment Banks such as European Investment Bank, Bank Asya, Islamic Development Bank, African Development Bank and their expectations.

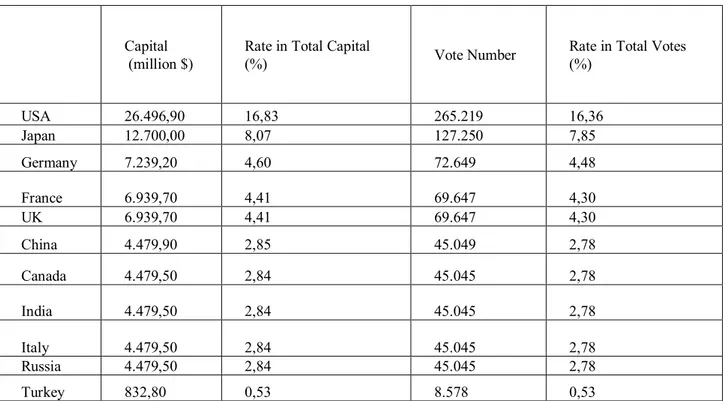

2. The World Bank and its Relation with Turkey

Turkey has become a member of the World Bank on March 11, 1947. Since its membership, Turkey has benefited from various credits of the World Bank. Depending of their capital share in the Bank, members have varying voting rates. Below in Table 1, capital shares and voting rates of ten member countries are listed. As one can see in the table, the biggest capital share and the voting rate belong to USA. Developed economies such as Japan, Germany, France, and UK follow USA. Turkey’s share in World Bank’s total capital amounts to % 0,53. This makes up $832.8 million ( www.worldbank.org).

Table 1: 10 Biggest Economies in Terms of Capital Share in the World Bank and Turkey

Capital (million $)

Rate in Total Capital

(%) Vote Number

Rate in Total Votes (%) USA 26.496,90 16,83 265.219 16,36 Japan 12.700,00 8,07 127.250 7,85 Germany 7.239,20 4,60 72.649 4,48 France 6.939,70 4,41 69.647 4,30 UK 6.939,70 4,41 69.647 4,30 China 4.479,90 2,85 45.049 2,78 Canada 4.479,50 2,84 45.045 2,78 India 4.479,50 2,84 45.045 2,78 Italy 4.479,50 2,84 45.045 2,78 Russia 4.479,50 2,84 45.045 2,78 Turkey 832,80 0,53 8.578 0,53 Source:http://siteresources.worldbank.org/BODINT/Resources/2780271215524804501/IBRDCountryVotingTable. pdf, (26.11.2010)

According to the regulations of the World Bank, a country’s capital share is not parallel to the credit it can obtain. That said, it is directly linked to voting rate and thus, has effect on organization’s decision making processes. In other words, voting rate is the basic means that countries can use to manipulate organization’s decisions and actions. This

50

fact has encouraged countries to become members with higher capital shares (Öztürk, 2007: 46-52). Turkey has benefited from World Bank credits in various projects. Some of these projects are as follows (www.worldbank.org)1:

Health Transition Project Adaptable Program Loan: While only %24 of the poorest one-tenth of the total

population was covered by health insurance, this number increased to %82 in 2008. Whereas the number of people registered to family medicine system in 15 pilot cities in 2003 was zero, the rate increased to %90 in 33 cities in 2009. While patient satisfaction rate for medical services in public hospitals was %38 in 2003, it increased to %67 in 2009. Social security system were centralized and transferred to the Ministry of Health. Now people can choose where to be treated.

Renewable Energy Project: Renewable energy sources (hydro, geothermal, wind, landfill gas) that can produce

yearly 3.810 GWh and 966 MW electricity, as well as reducing at least 1.7 million ton of greenhouse gas emission.

Electricity Distribution and Rehabilitation Project: In the framework of the project, frequency of duration of power

cuts that consumers suffered has decreased in eight targeted regional distribution company; on the other hand, collection of revenues in these eight regional distribution companies has also decreased.

Energy Community of South East Europe Project: In 2006, a competitive electricity market of wholesale started

operating. Whereas the rate of transmitted electricity (which means electricity sold on the market) was very low, it increased to %30 in 2009. While the number of system-related accidents was 21 in 2004, this number decreased to 19 in 2008.

Istanbul Seismic Risk Mitigation and Emergency Preparedness Project: 418 public buildings were reinforced or

re-built for earthquakes. 69 additional buildings (among which are hospitals) are being reinforced, and 110 schools are in tender processes for reinforcement. Reinforced and re-built schools host around 1 million students and 33,300 teachers. Hospitals give services to more than 25,000 patients daily, and this number might triple in case of a disaster.

Export Finance Intermediary Loan: Export rates of targeted companies averagely increased % 81. While the real

rate of growth in these participant companies was %10.4 between 2005 and 2008, the rate for the companies compared was % 0. It is observed that participant companies are likely to develop new products (% 58 as opposed to % 29), improve environmental management (% 79 as opposed to % 47), accept new technologies to reduce costs (% 88 as opposed to % 61), export to new markets (% 69 as opposed to % 48) and extend their customer base (% 79 as opposed to % 58).

Small and Medium Enterprises (SMEs) Loan: With a focus on underserved regions such as Eastern Anatolia and

hinterlands, 500 companies are granted medium term financing throughout Turkey. Participant SMEs represent more than 20 sectors, including printing, plastics, tourism and food.

Restoring Equitable Growth and Employment Programmatic Development Policy Loan: The peak point of the use

of neutral intermediaries in crises has been more than $1 billion. The number of people who benefited from short term work subsidies was 40,000 in December 2009. While the amount of credits granted to SMEs was 83.9 billion TL in late 2009, this number increased to 103.6 billion TL in July 2010. The number of people participating İŞKUR’s vocational training programs is expected to reach 300,000 in the two year period between 2009 and 2010.

Besides the projects listed above, Country Partnership Strategy for 2008-2011 enacted in February 2008 is based on the Ninth Development Plan which aims “to help Turkey complete its harmonization process for EU membership, and bring steady growth, fair distribution of income, globally competitive power, and knowledge society”. This strategy was drawn up by government, businesses, and non-governmental groups. Country Partnership Agreement anticipates collaboration for development in three major fields: increasing Turkey’s competitiveness and creating more and better job opportunities; reinforcing Turkey’s health and social security systems; providing more efficient public services.

1

http://web.worldbank.org/WBSITE/EXTERNAL/COUNTRIES/ECAEXT/TURKEYINTURKISHEXTN/0,,print:Y~isCURL:Y~contentMDK:21698636 ~pagePK:1497618~piPK:217854~theSitePK:455688,00.html. (31.01.2013)

51

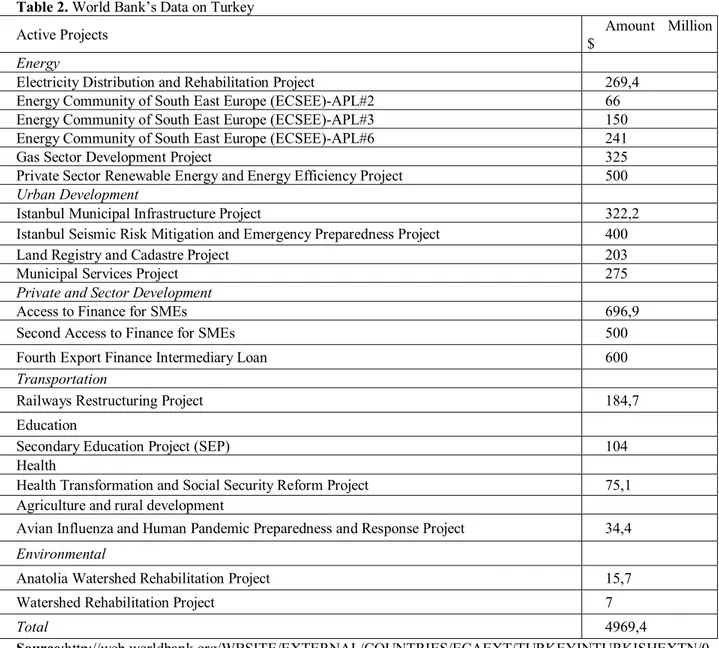

Table 2. World Bank’s Data on Turkey

Active Projects Amount Million

$

Energy

Electricity Distribution and Rehabilitation Project 269,4

Energy Community of South East Europe (ECSEE)-APL#2 66

Energy Community of South East Europe (ECSEE)-APL#3 150

Energy Community of South East Europe (ECSEE)-APL#6 241

Gas Sector Development Project 325

Private Sector Renewable Energy and Energy Efficiency Project 500

Urban Development

Istanbul Municipal Infrastructure Project 322,2

Istanbul Seismic Risk Mitigation and Emergency Preparedness Project 400

Land Registry and Cadastre Project 203

Municipal Services Project 275

Private and Sector Development

Access to Finance for SMEs 696,9

Second Access to Finance for SMEs 500

Fourth Export Finance Intermediary Loan 600

Transportation

Railways Restructuring Project 184,7

Education

Secondary Education Project (SEP) 104

Health

Health Transformation and Social Security Reform Project 75,1

Agriculture and rural development

Avian Influenza and Human Pandemic Preparedness and Response Project 34,4

Environmental

Anatolia Watershed Rehabilitation Project 15,7

Watershed Rehabilitation Project 7

Total 4969,4

Source:http://web.worldbank.org/WBSITE/EXTERNAL/COUNTRIES/ECAEXT/TURKEYINTURKISHEXTN/0

,contentMDK:21024681~pagePK:141137~piPK:141127~theSitePK:455688,00.html

In Table 2, one can see the projects and areas where the credits from the World Bank were used. The credits Turkey has received from the World Bank for different projects amount to almost $5 billion.

3. Regional Development and Investment Banks

European Investment Bank (EIB) is EU’s long term financing institution for public and private organizations to sustain their investments. Found in 1958, the bank belongs to EU member states. The bank has provided more than $818 billion to support project in EU member, candidate and partner states (bei.europe.eu)2. The bank is a non-profit organization, primarily aiming to finance lasting projects3.

Objectives and subsidy policies of European Investment Bank can be names as follows (eib.org)4: supporting investment plans of SMEs; eliminating economic and social inequalities between regions, supporting environmental

2

European Investment Bank in Turkey www.bei.europa.eu/attachments/country/turkey_2010_tr.pdf (25.04.2011) 3

DEİK, Avrupa Yatırım Bankası, http://www.deik.org.tr/pages/TR/DEIK_CokTarafliKuruluslar.aspx?ctID=13&IKID=10, (23.04.2011). 4

52

protection and sustainable environmental policies, fight against the adverse effects of climate change, support for the initiatives of sustainable and safe energy, and support for the creation of the transportation, energy, and communication networks in the Union.

Apart from countries in the Union, the Bank supports various projects from more than 150 countries. Financing mainly the projects inside the EU, the institution reserved % 88 of the total 72 billion euro of its funding sources for projects inside the EU during 2010 ( eib.org)5.

Asian Development Bank (ADB) is an international financing institution that aims to increase life standards of its member developing countries and reduce poverty. Founded in 1966, the bank has 67 members. While 48 members are regional countries, 19 of them are at a distance. Asian Development Bank primarily supports projects of states, private sectors, non-governmental organizations, and development agencies. The strategy of the bank is based on real growth, environmentally sustainable growth, and ensuring regional integration (adb.org)6.

Islamic Development Bank (IDB) was founded in 1974. The bank has 56 members. In accordance with Islamic philosophy and principles (sharia), the bank aims contributing to the economic development and social progress of member states and Muslim societies7. The bank’s functions are as follows: contributing to the capital of organizations or efficient projects in member countries, opening credits to public and private sectors projects, supporting progress in trade and technical collaboration, contributing to actions of development, doing research on how to conduct financial and banking activities in accordance with Islamic rules (hazine.gov.tr)8. Types of financing that the Bank undertakes include loan without interest, participating equity capital, leasing, and dividend.

Areas of priority are as follows: humanitarian and agricultural development, food sufficiency, developing infrastructure, trade among members, development of private sector, Islamic economy, research, development and re-organization of banking and finance (Bacak, 2007: 75).

African Development Bank (AFDB) is a multilateral development bank. Founded in 1964, the bank has 77 members. %53 of these members are African countries, %24 is from the Americas, Asia, and Europe. The Bank’s primary target is to fight poverty, and to increase the economic and social welfare of the peoples. Besides these targets, the banks aims to improve regional welfare through technical support, participating in equity capital, and credits (deik.org.tr)9.

4. Regional Development and Turkey Strategies of Investment Banks

Shareholding structure of The European Investment Fund is composed of European Investment Bank (EIB - % 61), European Commission (% 30) and 30 public and private organizations (% 9). Industrial Development Bank of Turkey (TSKB) is a shareholder of EIF since September 2006. EIB has actively contributed to the development of venture capital sector in Turkey during last three years. This was realized through investing 54 million EUR to independently managed funds, Actera Partners and Turkish Private Equity Funds II and implementing tailor-made program for Turkey, Istanbul Venture Capital Initiative (iVCi). iVCi is fully managed by the funds of European Investment Fund and mutual funds and allocated to Turkey. Last closing was on March 31, 2009 and worth 160 million EUR. Investors of iVCi are Small and Medium Enterprises Development Organization (KOSGEB), Technology Development Foundation of Turkey (TTGV), Development Bank of Turkey (TKB), GarantiBank, National Bank of Greece, and European Investment Fund (eib.org)10.

European Investment Bank has been active in Turkey since mid-1960. The amount of financing the Bank provided to this EU candidate country between 2001 and 2005 reached 3.1 billion EUR. This number also underlines commitment made for the country’s economic development. Public and private members of the sector which benefited from EIB funds are foreign investors, central and regional administrations, regional banks and industrial organizations (deik.org.tr)11. During its activities in Turkey for more than 40 years, European Investment Bank has invested around 15 billion EUR to country’s economy.

5

Europan Investmant Bank, www.eib.org/about/index.htm?lang=en (26.04.2011). 6

Asian Development Bank, www.adb.org/About/default.asp (26.04.2011) 7

İslam Kalkınma Bankası, www.hazine.gov.tr/irj/go/km/docs/.../ISLAMKALKINMABANKASI.pdf, (25.04.2011). 8

Islamic Development Bank, www.hazine.gov.tr/irj/go/km/docs/.../ISLAMKALKINMABANKASI.pdf, (25.04.2011) 9

DEİK, African Development Bank, www.deik.org.tr/pages/TR/DEIK_CokTarafliKuruluslar.aspx?ctID=18&IKID=10 (26.04.2011) 10

EIB, European Investment Bank in Turkey, European Investment Bank, www.eib.org/attachments/country/turkey_2010_tr.pdf 11

53

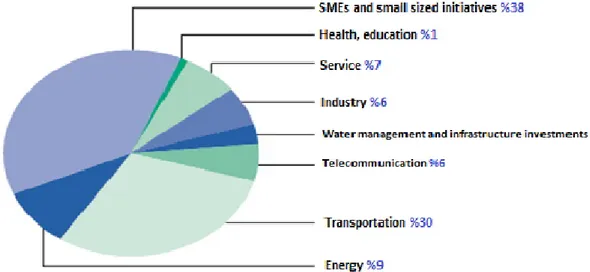

Figure 1: Distribution of Credits According to Sectors: 2005–2010 Source: www.eib.org/attachments/country/turkey_2010_tr.pdf

Sectors supported by European Development Bank (eib.org)12

• Energy production, transportation, storing and distribution (renewable energies including electricity, petroleum, gas, wind and solar energy)

• Energy efficiency • Industry

• Information technology and media

• Infrastructure (including municipal and environmental infrastructure) • Manufacturing

• Research and Innovation • Services

• Small and Medium Enterprises (SMEs) • Tourism

• Telecommunication

• Transportation (including transportation infrastructure, railroad cars, buses, subways etc.)

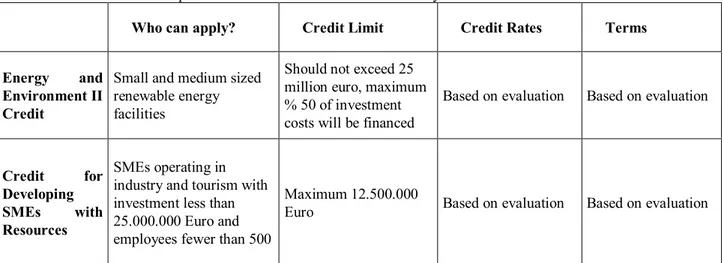

As can be seen in Table 3, Turkey has received various credits from European Investment Bank; and the majority is for the development of SMEs. These credits are granted based on certain conditions and limits.

12

54

Table 3: Credits that European Investment Bank will Grant to Turkey

Who can apply? Credit Limit Credit Rates Terms

Energy and Environment II Credit

Small and medium sized renewable energy facilities

Should not exceed 25 million euro, maximum % 50 of investment costs will be financed

Based on evaluation Based on evaluation

Credit for Developing

SMEs with

Resources

SMEs operating in industry and tourism with investment less than 25.000.000 Euro and employees fewer than 500

Maximum 12.500.000

Euro Based on evaluation Based on evaluation

Source: The table is based on the data available on

http://www.kalkinma.com.tr/bankamiz-kaynakli-yatirim-kredisi.aspx (01/06/2011).

In July 2010, European Investment Bank launched Greater Anatolia Guarantee Facility (GAGF). This regional development enterprise targets SMEs and micro-enterprises in 43 cities in Turkey. GAGF project gathers two powerful projects of EIB Group which are long-term loans and sharing portfolio risk. It aims to create a credit volume around 500 million EUR for SMEs and micro-enterprises in the underdeveloped areas in Turkey covering a credit of 250 million EUR from EIB and a resource of 32 million EUR from EU’s Instrument for Pre-Accession Assistance (IPA) ( Bacak, 2007:6-28).

From 1976 to 1998, Islamic Development Bank financed projects and commerce worth $2.4 million in Turkey. In that period, the bank provided the second most credit opportunities to Turkey after Pakistan among its member countries. $1.7 million of those credits were allocated to finance import, while $184 million was allocated to finance export. One fourth of the whole credit was granted to finance projects in social and private sectors. In this period, the bank approved credits for infrastructure, industry, health, transportation, energy, education, agriculture and financial sectors. While all the credits in these areas were given to public sector, those regarding the trade were given to private sector.13

Since 2003, Islamic Development Bank opened credits to many public and private projects or trade financing. Recently, Islamic Development Bank extended its credit opportunities to SMEs. With the help of Participation Banks, they have opened $60 million credit in Turkey.14

Islamic Development Bank generally grants investment credits to public sector, while they mostly grant financial loans to private sector for export. However, after 2008 economic crisis they have begun to open credits to SMEs in Turkey. The bank assures equal distribution of credits not through Eximbank or Turkish Industrial Development Bank, but through commercial banks. See Table 4 below for the recently granted credits.

13

http://www.ekodialog.com/Makaleler/islam-konferansi-teskilati-ve-bankasi.html (01.05.2011) 14

55

Table 4: Credits given by Islamic Development Bank in Turkey

Who can apply? Credit Limit Credit Rates Term

Investment Credit

Investors with external loan prediction under Financing The Investment part on

Investment Incentive

Certificate

Minimum $500.000,

Maximum $10.000.000

Credit can be granted for the %100 of the equipment costs Based on evaluation Import Financing Credit Intended for Export

Using the imported products on credit in the production of export goods

Between 100.000,-

Euro and 2.000.000,- Euro

While financing import transactions, a loan up to %80 of the import volume can be used

Based on goods financing import and the terms of the credit

Investment Credit

Used in financing the investors buying domestic

and imported

machines-equipment and assembling

costs of machines-equipments Minimum 35.000 Islamic Dinar (İD), maximum 3.500.000 İD (1 Islamic Dinar = 1 SDR) Based on evaluation Terms up to 10 years and maximum a 3 year grace period

Source: Based on http://www.kalkinma.com.tr/islam-kalkinma-bankasi-kaynakli-yatirim-kredisi.aspx, http://www.taryat.gov.tr/bilgibank/finansalternatifleri.pdf, ww.antakyatso.org.tr/tkb.doc

5. Conclusion

In Turkey’s growth process, investment and development banks play an important part. By granting various resources, they have provided necessary finance for the real sector with the support of the World Bank, its affiliates and IMF.

Turkey has utilized the credits of the European Investment Bank. They provided 250 million EUR of resource credits and 32 million EUR of credit to be used in micro-credits for SMEs. Turkey has been granted various credits from Islamic Development Bank (a regional development bank) to finance SMEs, through Eximbank and Industrial Development Bank of Turkey. The minimum limit of investment credits is $500.000, while it is maximum $10.000.000. Credits worth 100.000 and 2.000.000 EUR were granted by the Islamic Development Bank as import financing loan intended for export. These loans and investment subsidies were used investors to buy new imported and domestic equipments.

Turkey has also utilized IMF loans. IMF is an association granting countries loans to meet the adverse balance of short term payments. Turkey has taken loans from IMF to meet the adverse balance of payments (Since most of the loans were used in financing investments, IMF categorized their loans as such). From 1961 to 2005, Turkey signed Stand-by agreements with IMF and received various loans. During this period, the biggest loan was taken in 1999; and in a 36-month period of Stand-by agreement, 15.038.40 million SDR was used from IMF resources. Finally, Turkey used 1.665.51 million SDR out of 6.662.04 million SDR in 2005, in accordance with the Stand-by agreement for a 36

56

month period. Since 2005, Turkey has not received any loans in the framework of Stand-by agreement with IMF. However, payments are still remitted.

As a result, one can see that Turkey has resources from international associations for investment and development, but for sustainable growth and development all the resources should be used properly, and based on efficiency. Another key topic for research can be the efficiency of resources, development and investments.

References

Ashcraft, Ab B. & Schuermann, T. (2006). Understanding the Securitization of Subprime Mortgage Credits: Foundations and Trends, In Finance, Vol2. No 3.

Bacak, A. (2007). Türkiye’de Kalkınma ve Yatırım Bankacılığı ve Finansal Performanslarının Değerlendirilmesi:

Türkiye Kalkınma Bankası-TKB-İncelemesi, (Unpublished Master’s Thesis), Muğla Üniversitesi SBE.

Beatty, R. P. & Ritter, J. R. (1986). Investment banking, reputation, and the underpricing of initial public offerings,

Journal of Financial Economics, Vol. 15, Issues 1–2.

Chemmanur, T. & Fulghieri, P. (1994). Investment Bank Reputation: Information Production, and Financial Intermediation, Journal of Finance, Vol 49, Issue 1.

Dornbusch, R. & Fischer, S. (1998). Makroekonomi. İstanbul: McGraw-Hill-Akademi.

Dugar, A. & Nathan, S. (1995). The Effect of Investment Banking Relationships on Financial Analysts' Earnings Forecasts and Investment Recommendations, Contemporary Accounting Research, Vol.12, Issue 1.

Grinblatt, M. & Titman, S. (2002). Financial Markets and Corporate Strategy. Second Edition. NY: McGraw Higer Education

Heffernan, S. (2005). Modern Banking. West Sussex: John Wiley and Sons Ltd.

Hubbard, R. G. (2002). Money the Financial System and the Economy. Fourth Edition. NJ: Addison Wesley Co. Kofman, E. & Youngs, G. (1996). Globalization: Theory and Practice. London: Continuum International Publishing. Mishkin, F. S. ( 1992). The Economics of Money and Financial Markets. 3. Edition. NY: Harper Collins Publisher. Mishkin, F. S. (2004). The Economics of Money Banking and Financial Markets. 7.Edition. London: Pearson. Öztürk, İ. (2007). Dünya Bankası Politikaları. MPRA Paper No. 335.

Peter, R. & Marquis, M. (2005). Money and Capital Markets, The Financial System in an Increasingly Global Economy. 10.Edition. NY: Rwin/McGraw-Hill.

Seyidoğlu, H. (2006). İktisat Bilimin Temelleri. İstanbul: Güzem Can Yayınları.

Smith, C. W. (1986). Investment banking and the capital acquisition process, Journal of Financial Economics Vol.15, Issues 1–2.

Trescott, P. (1965). Money, Banking and Economic Welfare. NY: McGraw Hill.

Internet Sources:

Asian Development Bank, www.adb.org/About/default.asp (26.04.2011) Avrupa Yatırım Bankası, Türkiye’de Avrupa Yatırım Bankası,

www.bei.europa.eu/attachments/country/turkey_2010_tr.pdf (25.04.2011).

DEIK, http://www.deik.org.tr/pages/TR/DEIK_CokTarafliKuruluslar.aspx?ctID=13&IKID=10

DEİK, Afrika Kalkınma Bankası, www.deik.org.tr/pages/TR/DEIK_CokTarafliKuruluslar.aspx?ctID=18&IKID=10 (26.04.2011)

DEİK, Avrupa Yatırım Bankası,

57

EIB, Türkiye’de Avrupa Yatırım Bankası, European Investment Bank, www.eib.org/attachments/country/turkey_2010_tr.pdf

EIB, Türkiye’de Avrupa Yatırım Bankası, European Investment Bank, www.eib.org/attachments/country/turkey_2010_tr.pdf. s.7

Europan Investmant Bank, www.eib.org/about/index.htm?lang=en (26.04.2011).

http://www.ekodialog.com/Makaleler/islam-konferansi-teskilati-ve-bankasi.html (01.05.2011)

http://www.tkbb.org.tr/index.php?option=com_content&task=view&id=2175&Itemid=846 (02.06.2011) http://www.worldbank.org/, (26.11.2010)