T.C.

ANKARA YILDIRIM BEYAZIT ÜNİVERSİTESİ

THE INSTITUTE OF SOCIAL SCIENCES

MONETARY POLICY AND FINANCIAL MARKETS

IN ALGERIA AND KUWAIT

PHD THESIS

MABRUKA MOHAMED

BANKING AND FINANCE PROGRAM

T.C.

ANKARA YILDIRIM BEYAZIT ÜNİVERSİTESİ

THE INSTITUTE OF SOCIAL SCIENCES

MONETARY POLICY AND FINANCIAL MARKETS

IN ALGERIA AND KUWAIT

PHD THESIS

MABRUKA MOHAMED

BANKING AND FINANCE PROGRAM

Prof. Dr. Afşin ŞAHİN

APPROVAL PAGE

This is to certify that the thesis entitled with “Monetary Policy and Financial Markets in Algeria and Kuwait” submitted by Mabruka MOHAMED is fully adequate, in scope and quality and approved for the degree of Doctor of Philosophy at a Deparment of Banking and Finance, Instutute of Social Sciences, Ankara Yıldırım Beyazıt University by the following commitee members.

Title Name Surname Institution Signature

Prof. Dr. Afşin ŞAHİN (AHBV, Banking)

Prof. Dr. Ayhan KAPUSUZOĞLU (AYBU, Banking and Finance)

Prof. Dr. Nildağ Başak CEYLAN (AYBU, Banking and Finance)

Prof. Dr. Hakan BERUMENT (Bilkent, Economics)

Prof. Dr. Yeliz YALÇIN (AHBV, Econometrics)

Thesis Defense Date: 01/07/2019

I certify that this thesis satisfies all the reguirements for the degree of Doctor of Philosophy in Department of Banking and Finance that is set by the Instutute of Social Sciences, Ankara Yıldırım Beyazıt University.

Director of the Instutute of Social Sciences Title Name Surname

ETHICAL DECLARATION

I hereby declare that all information in this thesis has been obtained and presented in accordance with academic rules and ethical conduct. I also declare that, as required by these rules and conduct, I have fully cited and referenced all material and results that are not original to this work; otherwise I accept all legal

responsibility. (01-07-2019)

Signature: ……… Name , Surname: MABRUKA MOHAMED

ACKNOWLEDGEMENTS

Firstly, I would like to express my sincere gratitude to my advisor Prof. Dr. Afşin ŞAHIN for the continuous support of my Ph.D. study his patience, motivation, and immense knowledge. His guidance helped me in all the time of research and writing of this thesis.

Besides my advisor, I would like to thank the rest of my thesis committee: Prof. Dr. Ayhan KAPUSUZOĞLU, Prof. Dr. Nildağ BAŞAK, Prof. Dr. Hakan BERUMENT and Prof. Dr. Yeliz YALÇIN for their insightful comments and encouragement critics. I would like to acknowledge all my Professors in Yildirim Beyazit University for the lectures and information that I have taken during my study, which assists me to improve my knowledge in the area.

I would like to thank my friend Ayyüce MEMIŞ for her endless support from the first day I started my Ph.D. study until I completed my research

At the end, I would like to extend my gratitude to my husband and sons for their patience and support throughout writing this thesis, and my life in general, and I would like to thank my family; my mother, brothers, and sisters for their continuous support and help.

ABSTRACT

MONETARY POLICY AND FINANCIAL MARKETS IN

ALGERIA AND KUWAIT

Mohamed, Mabruka

Ph.D., Department of Banking and Finance Supervisor: Prof. Dr. Afşin Şahin

2019, 230 pages

The exchange rate is one of the most important variables for small open economies such as in Algeria and Kuwait, where any change in the exchange rate in these countries will have a substantial effect on prices, economic growth, and the stock market. This thesis aims to set out the dynamics of monetary policy implementation in Algeria and Kuwait. This thesis will analyze the effects of monetary policy instruments on the exchange rate under distinct oil price levels in Algeria, with quarterly data spanning from 2001 and 2016 and using Towbin and Weber (2013)’s interacted vector autoregressive model. The empirical evidence suggests that the effects of monetary policy instruments on the exchange rate are not the same for the low and high level of real oil prices. The money supply has more influence on the exchange rate when the oil price level is high while the effect of money supply on the exchange rate is negative when the oil price is low. The interest rate has no impact on the exchange rate for both high and low levels of oil prices. For Kuwait, we examine whether there is a symmetric or an asymmetric relationship between the exchange rate and the stock market by using Autoregressive Distributed Lag (ARDL) model and Non-linear Autoregressive Distributed Lag (NARDL) model with monthly data spanning from June 2002 to May 2018. Based on the linear and nonlinear ARDL models, we find that there is a role of the exchange rate on the stock price for Kuwait. Both models indicate that the domestic currency appreciation has a positive effect on the stock price in a short time and then the effect becomes negative. Moreover, based on the non-linear model the depreciation in local currency has more effect on stock prices by a negative sign. Thus, the asymmetric relationship is valid for the case of Kuwait.

Keywords: Monetary Policy, Exchange Rate, Oil Price, Interacted VAR, Algeria, Stock

ÖZET

CEZAYİR VE KUVEYTTE PARA POLİTİKASI VE FİNANSAL

PİYASALAR

Mohamed, Mabruka

Bankacılık ve Finans Doktora Programı Danışman: Prof. Dr. Afşin Şahin

Haziran 2019, 230 sayfa

Döviz kuru Cezayir ve Kuveyt gibi döviz kurunun fiyatları ekonomik büyüme ve hisse senedi piyasasına önemli etkileri olduğu küçük dışa açık ekonomilerde en önemli değişkenler arasında yer almaktadır. Bu tez çalışmasında Cezayir ve Kuveyt’teki para politikası uygulamaları dinamikleri ortaya konulmaktadır. Para politikası enstrümanlarının farklı petrol fiyatları düzeyi altında döviz kuruna etkisi 2001 ve 2016 yılları arası için Towbin ve Weber (2013)’in etkileşimli vektör otoregresif modeli yardımıyla analiz edilmiştir. Ampirik bulgulara göre para politikası enstrümanlarının döviz kuruna etkileri yüksek ve düşük reel petrol fiyatları düzeyi için aynı değildir. Para arzının döviz kuru üzerindeki etkisi petrol fiyatı düzeyi yüksek iken daha fazladır. Petrol fiyatı düzeyi düşük iken ise para arzının döviz kuru üzerindeki etkisi negatiftir. Faiz oranının yüksek ve düşük petrol fiyatları düzeyinde döviz kuru üzerinde etkisi yoktur. Kuveyt ık ılgılı olarak, Otoregresif Gecikmeli Dağıtılmış )ARDL) model ve Doğrusal Olmayan Otoregresif Gecikmesi Dağıtılmış (NARDL) model yardımıyla 2002 Haziran -2018 Mayıs verisi Kullanarak döviz kuru ve Hısse Senedı Pıyasası arasında simetrik ya da asimetrik ilişkisinin olup olmadığını incelenmektedir. Doğrusal ve doğrusal olmayan ARDL modellerin göre Kuveyt’te döviz kurunun hisse senedi fiyatı üzerinde bir rolü vardır. Her iki modele göre de, yerli paranın değer kazanması hisse senedi fiyatlarını kısa dönemde pozitif etkilemektedir ve daha sonra etki negatife dönmektedir. Dahası, doğrusal olmayan modele dayalı olarak, yerli paranın değer kaybetmesinin negatif işaretli olarak hisse senedi fiyatlarını daha fazla etkilemektedir. Böylece, asimetrik ilişkinin Kuveyt için geçerliliği söz konusudur. Anahtar Kelimeler: Para Politikası, Döviz Kuru, Petrol Fiyatı, Etkileşimli VAR, Cezayir, Hısse Senedı Pıyasası, NARDL, Kuveyt.

CONTENTS

APPROVAL PAGE ... ii

ETHICAL DECLARATION ... iii

ACKNOWLEDGEMENTS ... iv

ABSTRACT ... v

ÖZET ... vi

CONTENTS ... vii

LIST OF ABBREVIATIONS ... xii

LIST OF TABLES ... xiv

LIST OF FIGURES ... xvii

... 1

INTRODUCTION ... 1

1.1. Literature reviews ... 2

1.2. Problem of this study ... 3

1.3. Aims of the study ... 4

1.4. Importance of this study ... 4

1.5. Contributions of the Thesis ... 4

... 7

MONETARY POLICY AND EXCHANGE RATE BEHAVIOR ... 7

2.1 . Exchange Rate Regimes ... 7

Fixed Exchange Rate System ... 10

Freely Floating Exchange Rate System ... 14

Managed Float Exchange Rate System ... 16

2.2. Currency Interventions ... 17

Indirect Intervention ... 18

2.3. Choosing the Appropriate Exchange Rate System ... 18

2.4. Monetary Policy and Exchange Rate under the Mundell- Fleming Model ... 20

Floating Exchange Rate for Small Open Economy ... 22

Small Open Economy under a Fixed Exchange Rate ... 24

2.5. Exchange Rate Policies in Arab Countries ... 27

Arab Countries Used Pegged Exchange Rate System ... 29

Oil Price and Exchange Rate System in Arab Countries ... 36

2.6. Money, Banking and Capital Market in Arab Countries ... 39

Arab Banking Sector by Assets ... 41

Arab Capital Markets ... 42

2.7. Macroeconomic Developments in Arab Countries ... 43

... 45

MONETARY POLICY AND EXCHANGE RATE IN ALGERIA ... 45

3.1. Background about the Algerian Economy ... 46

3.2. Fluctuation Dynamics of Oil Price (1971-2016) ... 46

3.3. The Place of Oil within the Algerian Economy ... 48

The Impact of Oil Price on Foreign Exchange Reserves ... 50

The Adequacy of Exchange Reserves in Algeria ... 51

The Impact of Oil Prices on the Development of External Debt ... 54

3.4. Monetary Policy Implementation in Algeria ... 54

Monetary Policy Objectives in Algeria ... 55

Developments in Money Supply and its Components in Algeria ... 57

The Velocity of Money and Liquidity Ratio in Algeria ... 59

Monetary Policy Instruments in Algeria ... 61

3.4.4.2. Deposit Auction Facility ... 62

3.4.4.3. Marginal Deposit Facility ... 64

3.4.4.4. Discount Rate ... 65

3.4.4.5. Open Market Operations ... 65

3.5. Resource Control Fund ... 66

3.6. The Effectiveness of the BA Instruments to Manage the Liquidity ... 68

Sterilization Policy ... 68

Measuring the Degree of Sterilization ... 69

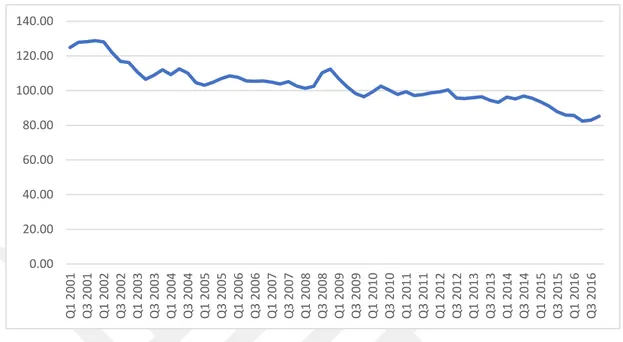

3.7. The History of Exchange Rate Policy in Algeria ... 70

The Effects of Depreciating the Exchange Rate in Algerian Economy ... 74

3.8. Literature Review on the Effects of Monetary Policy on Exchange Rate ... 76

3.9. Data Set ... 81

3.10. Methodology ... 82

Stationary Tests for the Time Series Data ... 82

Unit Root Test Results ... 83

Lag Length Criteria ... 84

Previous Literature Written Using IVAR ... 85

3.11. Empirical Results and Discussion ... 87

... 99

ANALYZING ASYMMETRIC EFFECTS OF THE EXCHANGE RATE ON THE STOCK MARKET BY THE NARDL METHOD: AN EMPIRICAL EVIDENCE FOR KUWAIT ... 99

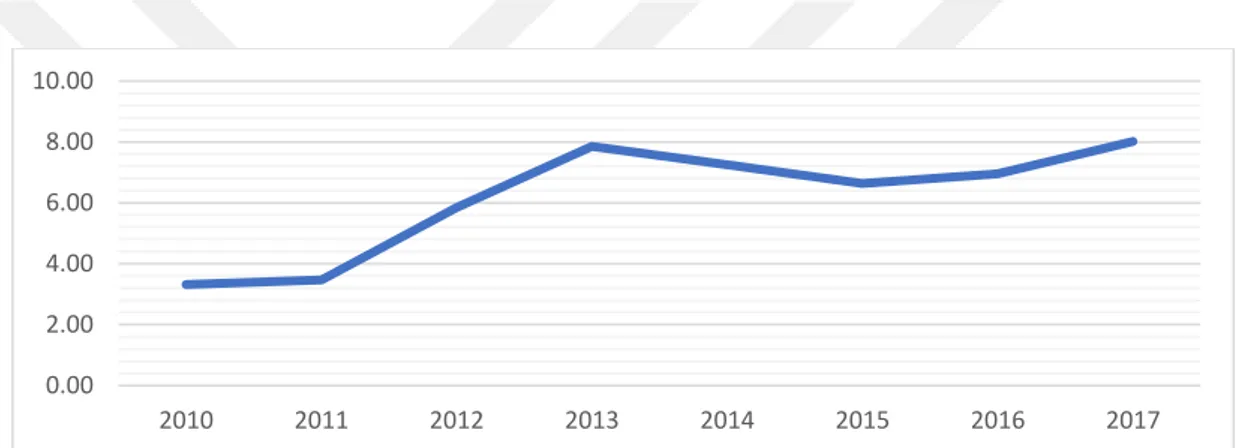

4.1. Monetary Policy Implementation in Kuwait ... 100

4.2. Monetary Policy Tools in Kuwait ... 104

Interest Rate Policy ... 104

4.2.1.2. Interest Rate on Time Deposits ... 108

4.2.1.3. Public Debt Instruments ... 111

4.2.1.4. CBK Bonds and Tawaruq ... 112

4.2.1.5. The Activity of the Interbank Deposit Market ... 114

4.2.1.6. Balances of Local Bank Accounts with the Central Bank ... 115

4.3. Exchange Rate Policy in Kuwait ... 115

4.4. Stock Exchange Market in Kuwait ... 118

Market Segmentation ... 120

4.4.1.1. Premier Market... 120

4.4.1.2. The Main Market ... 120

4.4.1.3. Market Auctions ... 121

4.5. Theoretical Underpinning for the Empirical Investigation ... 121

4.6. The Efficient Market Hypothesis ... 124

4.7. Basic Theories of the Interaction Relationship between Exchange Rate and Stock Prices ... 125

Flow-Oriented Exchange Rate Models ... 126

Stock-Oriented Model... 127

4.8. Literature Review ... 128

Literature Review of the Symmetric Relationship between Exchange Rate and Stock prices (Multivariate Model) ... 128

Literature Review of the Symmetric Relationship between Exchange Rate and Stock prices (Bivariate Model) ... 135

Literature Review for Asymmetric Relationship between Exchange Rate and Stock Market ... 142

4.9. Methodology ... 144

Data ... 144

Unit Root Test Results ... 152

Basic Long-Run Model Results ... 155

The Results of the ARDL Bounds Test of Cointegration ... 156

4.10.3.1. Results from the Hypothesis No: 1 ... 160

4.10.3.2. Results from the Hypothesis No: 2 ... 161

4.10.3.3. Results from the Hypothesis No: 3 ... 161

4.10.3.4. Results from the Hypothesis No: 4 ... 161

4.10.3.5. Results from the Hypothesis No: 5 ... 162

4.11. Non -linear Autoregressive Distributed Lag (NARDL) ... 162

Empirical Results for the NARDL... 169

... 175

SUMMARY AND CONCLUSION ... 175

REFERENCES ... 183 APPENDIX A ... 208 APPENDIX B ... 209 APPENDIX C ... 210 APPENDIX D ... 217 APPENDIX E ... 223 APPENDIX F ... 227 CURRICULUM VITAE ... 230

LIST OF ABBREVIATIONS

ADF Augmented Dickey-Fuller Test,AIC Akaike Information Criterion APT Arbitrage Pricing Theory

ARDL Autoregressive Distributed Lag model

AREAER Annual Report on Exchange Arrangements and Exchange Restrictions

BA Bank of Algeria

BAM Bank Al-Maghrib

CA Current Account

CBB Central Bank of Bahrain CBE Central Bank of Egypt CBI Central Bank of Iraq CBJ Central Bank of Jordan CBK Central Bank of Kuwait

CBUAE Central Bank of the United Arab Emirates CMA Capital Market Authority

CPI Consumer Price Index

CUSUM Cumulative Sum of Recursive Residuals DW Durbin Watson Statistic

ECM Error Correction Model ECU European Currency Unit

EG Engle-Granger

EU European Union

EXC Exchange Rate

GCC Gulf Cooperation Council GDP Gross Domestic Product

HQ Hannan-Quinn

ICMA International Capital Markets Association IMF International Monetary Fund

IOSCO The International Organization of Securities Commission IP Industrial Production

IVAR Interacted Vector Autoregressive Model JJ Johansen-Juselius

KD Kuwait Dinar

KIBOR Kuwait Inter-Bank Offered Rate

KPSS Kwiatkowski–Phillips–Schmidt–Shin Test KSE Kuwait Stock Exchange

LIBOR London Inter-Bank Offered Rate

LSTRECM Nonlinear Smooth Transition Regression Error Correction Model

M2 Money Supply

NARDL Non-linear Autoregressive Distributed Lag

NX Net Exports

OLS Ordinary Least Squares OMO Open Market Operation

OPEC Organization of Petroleum Exporting Countries PBOC People's Bank of China

PP The Phillips and Perron Test QCB Qatar Central Bank

SAIBOR Saudi Arabian Interbank Offered Rate SIC Schwarz Information Criterion

SDRs Special Drawing Rights SP Stock Prices

SSE Sustainable Stock Exchanges Initiative STR Smooth Transition Regression

SUSUM Cumulative Sum of the Squares of Recursive Residuals TECM Threshold Error-Correction Model

LIST OF TABLES

Page

Table 2.1 Exchange Rate Arrangements, 2009–17 [46] ... 12

Table 2.2Exchange Rate Arrangement in some Arab Countries [46] ... 14

Table 2.3Exchange Rate Arrangements in Arab Countries [46] ... 28

Table 2.4Development of deposits in Arab banks (2016-2017) (USD Million) [60] ... 40

Table 2.5Loans and Credit Facilities for Arab Commercial Banks (2016-2017) (USD Million) [60]... 41

Table 3.1Foreign Exchange Reserves of Algeria, 2000 -2016 (Billions of the US Dollar) [78] ... 52

Table 3.2The Development of M2 and its Components in Algeria [74, 75] ... 58

Table 3.3Velocity of Money and Liquidity Ratio in Algeria (2001-2016) [74, 75] 60 Table 3.4Require Reserve and Interest Rate Changes from 2001 to 2016 ... 62

Table 3.5Deposit Auction Facility Rate ... 63

Table 3.6Deposit Facility Rate ... 64

Table 3.7The Movement in the Discount Rate at the Central Bank of Algeria ... 65

Table 3.8The Developments of Revenue Fund in Algeria (2000-2015) ... 67

Table 3.9Exchange rate (number of Algerian Dinar against US dollar) 1971 – 1990 [84] ... 71

Table 3.10Literature Review about the Effect of Monetary Policy on Exchange in Developed Countries ... 77

Table 3.11 Literature Review about the Effect from Monetary Policy on Exchange in Developing Countries ... 78

Table 3.12The Augmented Dickey-Fuller and Phillips-Perron Unit Root Tests ... 84

Table 4.1 Money Supply Developments from 2001-2017 [125] ... 101

Table 4.2 Structure of Interest Rates 2001 – 2017 (percent per annum) [124] ... 105

Table 4.3 Interest Rates on Customer Time Deposits in Both KD and US Dollar (Average Rate %) [124] ... 108

Table 4.4 CBK Bond for Three and Six Months from 2005 to 2010 ... 112

Table 4.5 CBK Bond and Tawaruq for Three and Six Months from 2011 to 2017 113 Table 4.6 Inter-Local Bank Interest Rates on KD Deposits (Percent per Annum) [125] ... 114

Table 4.7 The Claims of Local Banks on CBK and From CBK on Local Banks from 2013 -2017 ... 115

Table 4.8 Recent Studies Using Multivariate Model ... 130

Table 4.9Descriptive Statistics of Variables ... 152

Table 4.10 Augmented Dickey-Fuller Unit Root Test ... 153

Table 4.11 Phillips and Perron Unit Root Test ... 154

Table 4.12 KPSS Unit Root Test ... 154

Table 4.13 Breakpoint Unit Root Test ... 155

Table 4.14 ARDL Bounds Test ... 157

Table 4.15 Short Run Coefficients using the ARDL Approach and the Error Correction Model ARDL (4,1,12,6,0, 1) selected based on Akaike Information Criterion ... 158

Table 4.16 Short Run Coefficients using the ARDL Approach and the Error Correction Model ... 158

Table 4.17 Long Run Coefficients Estimated by ARDL Approach ... 159

Table 4.18 Literature Reviews on NARDL ... 165

Table 4.19 Results of Bound test for Co-integration ... 171

Table 4.20 Long-run Coefficient Estimates ... 172

Table 4.21 Short Run Coefficients using the NARDL Approach and the Error Correction Model ... 172

Table A. 1 Market Capitalization to GDP from 2000 to 2015 ... 208

Table B. 1 Data sources ... 209

Table C. 1 Companies in Three Kuwait Market (Premier, Main and Auction

market) ... 210

Table D. 1 Source of the variables for ARDL and NARDL model ... 217

Table D. 2 A Least Squares method results ... 219

Table E. 1 Correlogram of residuals ... 223

Table E. 2 Serial Correlation test ... 223

Table E. 3 Heteroskedasticity Test: Breusch-Pagan-Godfrey ... 224

Table E. 4 Heteroskedasticity Test: ARCH ... 224

Table E. 5 Heteroskedasticity Test: White ... 224

Table E. 6 Heteroskedasticity Test: Harvey ... 225

Table F. 1 Correlogram of residuals ... 227

Table F. 2 Serial Correlation test ... 227

Table F. 3 Heteroskedasticity Test: Breusch-Pagan-Godfrey ... 228

Table F. 4 Heteroskedasticity Test: ARCH ... 228

LIST OF FIGURES

Page Figure 2.1 Process for Revised Classification by IMF (Veyrune, Kokenyne,

Habermeier, and Anderson (2009)) p 9 ... 9

Figure 2.2 Market Demand and Market Supply of US Dollar Under the Floating Exchange Rate ... 15

Figure 2.3 The Effect from Monetary Policy Expansionary under Floating Exchange Rate System ... 23

Figure 2.4 The Effect from Monetary Policy Expansionary under Fixed Exchange Rate System ... 25

Figure 2.5 Impossible Trinity and Exchange Rate Regime ... 27

Figure 2.6 Egyptian Pound to U.S. Dollar Exchange Rate ... 34

Figure 2.7 Exchange Rates, Domestic Currency per Euro, End of Period, Rate in Saudi Arabiae ... 35

Figure 2.8 Exchange Rates, Domestic Currency per Euro, Period Average, Rate for Bahrain ... 35

Figure 2.9 Exchange Rates, Domestic Currency per Euro, Period Average, Rate. for Kuwait ... 36

Figure 2.10 Growth Rates of Local Liquidity in the Arab Countries for 2016 and 2017 ... 40

Figure 2.11 Market Share of Banking Sectors Out of The Total Arab Banking Sector ... 42

Figure 2.12 Arab Stock Exchange Performance in 2017 ... 43

Figure 2.13 GDP of Arab Countries from 2001to 2017 ... 44

Figure 3.1 History of Crude Oil Price (1971-2016) (in US dollar) ... 46

Figure 3.2 Hydrocarbons Revenues and Non- Hydrocarbons Revenues during the period 2000-2015 (Billion of the Dinar) ... 49

Figure 3.3 Current Account (2001-2016) (Billion dollars) ... 50

Figure 3.4 Relationship between Foreign Exchange Reserves and Oil Price during 2000-2016... 51

Figure 3.6 External Debt (2000-2016) ... 54

Figure 3.7 The Difference between Actual and Target Inflation Rate in Algeria ... 56

Figure 3.8 Relationship between Growth Rate in M2 and CPI (2001-2016) ... 57

Figure 3.9 Changes in Revenue Fund during 2000-2015... 67

Figure 3.10 Nominal Effective Exchange Rate From 2001 to 2016 ... 73

Figure 3.11 Relationship between Exchange Rate and Net Exports ... 75

Figure 3.12 Relationship between Exchange Rate and Income ... 76

Figure 3.13 Inverse Roots of the Characteristic AR Polynomial ... 85

Figure 3.14 Cumulative Impulse Responses for One- Standard -Deviation Money Supply Shock When Real Oil Price at 90th Percentiles for Six Periods . 88 Figure 3.15 Cumulative Impulse Responses for One- Standard -Deviation Money Supply Shock When Real Oil Price at 75th Percentiles for Six Periods . 88 Figure 3.16 Cumulative Impulse Responses for One- Standard -Deviation Money Supply Shock When Real Oil Price at 50th Percentiles for Six Periods . 89 Figure 3.17 Cumulative Impulse Responses for One- Standard -Deviation Money Supply Shock When Real Oil Price at 25th Percentiles for Six Periods . 89 Figure 3.18 Cumulative Impulse Responses for One- Standard -Deviation Money Supply Shock When Real Oil Price at 10th Percentiles for Six Periods . 90 Figure 3.19 Cumulative Impulse Responses for One- Standard -Deviation Interest Rate Shock When Real Oil Price at 90th Percentiles for Six Periods ... 92

Figure 3.20 Cumulative Impulse Responses for One- Standard -Deviation Interest Rate Shock When Real Oil Price at 75th Percentiles for Six Periods ... 92

Figure 3.21 Cumulative Impulse Responses for One- Standard -Deviation Interest Rate Shock When Real Oil Price at the 50th Percentiles for Six Periods ... 93

Figure 3.22 Cumulative Impulse Responses for One- Standard -Deviation Interest Rate Shock When Real Oil Price at the 25th Percentiles for Six Periods ... 93

Figure 3.23 Cumulative Impulse Responses for One- Standard -Deviation Interest Rate Shock When Real Oil Price at the 10th Percentiles for Six Periods ... 94

Figure 3.24 Cumulative Impulse Responses for One- Standard -Deviation exchange rate Shock when Real Oil Price at 90th Percentiles for Six

Periods ... 95

Figure 3.25 Cumulative Impulse Responses for One- Standard -Deviation exchange rate Shock when Oil Price at 75th Percentiles for Six Periods 95 Figure 3.26 Cumulative Impulse Responses for One- Standard -Deviation exchange rate Shock when Real Oil Price at 50th Percentiles for Six Periods ... 96

Figure 3.27 Cumulative Impulse Responses for One- Standard -Deviation exchange rate Shock when Real Oil Price at 25th Percentiles for Six Periods ... 97

Figure 3.28 Cumulative Impulse Responses for One- Standard -Deviation exchange rate Shock When Real Oil Price at 10th Percentiles for Six Periods ... 97

Figure 4.1 Consumer Price Index Changes from 2002: 06 to 2018:03 ... 101

Figure 4.2 Money Supply in Kuwait (log form) ... 102

Figure 4.3 The Interest Rate Structure in Kuwait from 2001 to 2017 ... 106

Figure 4.4 The Discount Rate Changes in Kuwait and the US from 2001 – 2017 . 107 Figure 4.5 Interest Rate for One Month on KD and US Dollar Deposits ... 109

Figure 4.6 Interest Rate for Three Months on KD and US Dollar Deposits ... 109

Figure 4.7 Interest Rate for Six Months on KD and US Dollar Deposits ... 110

Figure 4.8 Interest Rate for Twelve Months on KD and US Dollar Deposits ... 110

Figure 4.9 Balance of total Public Debt Instruments from 2001 to 2017 ... 111

Figure 4.10 Balance of total and CBK Bonds and Tawaruq from 2005 to 2017 .... 113

Figure 4.11 Evolution of the KD Exchange Rate 2002:06 - 2018- 03 (The price of the dollar against one dinar) ... 117

Figure 4.12 Transmission Mechanism the Effect from Exchange Rate to Stock prices Through Import and Export channels. ... 127

Figure 4.13 Steps of the ARDL Test Model ... 148

Figure D. 1 Graph of the Variables ... 218

Figure E. 1 The Stability Test for ARDL... 225

Figure E. 2 The Stability Test for ARDL... 226

Figure F. 1 The Stability Test for ARDL ... 229

INTRODUCTION

After the collapse of the Bretton system in 1973, countries were seeking a suitable exchange rate regime to achieve their goals commensurate with their economy and monetary objectives. In order to affect their currency in proportion to their goals, it was necessary to employ an appropriate monetary policy and tools associated with it. The goal of the monetary policy is to manage variables such as money supply or interest rate within the economy. In most countries, central banks are responsible for implementing a monetary policy, which is generally aimed to stabilize the nation's currency, maintain low unemployment, prevent increasing price persistently and sustain long-term economic growth. The exchange rate is one of the main prime indicators that shows the economic health of the country, which reflects domestic and foreign confidence in the domestic currency. Thus, the primary goal of monetary policy is to manage it according to their targets and goals.

The exchange rate systems divided into three main categories, which are floating, fixed, and managed floating exchange rates. Fixed exchange rates include the pegging the local currency to another foreign currency such as the US dollar or to a basket of currencies. In Arab countries, they have adopted different exchange rate systems formally; all Gulf Cooperation Council (GCC) currencies except for Kuwait are pegged to the US dollar. Jordan and Iraq's currencies are all also pegged to the US dollar. On the other hand, Morocco, Libya, and Kuwait have pegged their currencies to a basket of currencies. Alternatively, Mauritania, Yemen, Sudan, Tunisia, Algeria, and Egypt were adopted floating and managed floating exchange rate while Lebanon used a stabilized arrangement, which as a type of peg exchange rate system.

In general, the exchange rate in Arab countries is affected by the financial markets like oil market because most of them are oil producer countries. For this reason, they attempt to benefit more from monetary policy tools to affect the exchange rate, which

has a big impact on their economy. On the other hand, some financial markets such as the stock market are affected by the exchange rate.

1.1. Literature reviews

In literature, it can be frequently encountered with studies that analyze the effect of monetary policy tools and exchange rate by a different methodology for developed and developing countries. Dutt and Ghosh [1], Miyakoshi [2], Rapach and Wohar [3], Zettelmeyer [4], Kearns and Manners [5], Long and Samreth [6], Liew, Baharumshah, and Puah [7], Noredean [8], Khordehfrosh Dilmaghani and Tehranchian [9], Ojede and Lam [10] are using single equation to examine this relationship and most of them find a significant relationship between them.

Many studies benefit from the linear Vector Autoregressive model (VAR) to investigate the effect of monetary policy on exchange rates such as Eichenbaum and Evans [11], Bjørnland [12], Bjørnland and Halvorsen [13], Hafeez and Hussain [14], Omolade and Ngalawa [15] and the results were mixed related to the countries and the period is chosen.

In this study, IVAR model will be utilized to examine the effect of monetary policy on exchange rate under different level of oil prices following Şahin, Doğan, and Berument [16], Ülke and Berument [17], Ülke [18] and Balcilar, Demirer, Gupta, and van Eyden [19] who used this methodology.

In this thesis also we examine the effect of exchange rate on stock prices and other macroeconomic variable which is examined by many researchers as beginning of 1991 such as Madura [20], Chen et al. [21], Mukherjee and Naka [22], Ibrahim and Aziz [23], Al-Sharkas [24], Tian and Ma [25], Chortareas et al. [26], Liu and Tu [27], Parsva and Lean [28], Eita [29], Inegbedion [30], Lin [31], Basher et al. [32], Groenewold and Paterson [33] . However, some researchers employed the Bivariate Model to investigate only the relationship between stock prices and exchange rate such as Bahmani-Oskooee and Sohrabian [34], Abdalla and Murinde [35] and Nieh and Lee [36] where the results were mixed related to the period selected, the frequency of data and the degree of development of countries and their markets. In addition, there is no

empirical consensus on the relationship between exchange rates and stock prices and the direction between them and most of the empirical studies indicate a short-run relationship but not a long-run relationship.

The relationship between exchange rate and stock prices also was examined by non- linear model by Koutmos and Martin [37], Ismail and Bin Isa [38], Bahmani-Oskooee and Saha [39] and Cheah, Yiew, and Ng [40], where they find an asymmetric relationship between the two variables. In this study, we employed a Non-linear Autoregressive Distributed Lag (NARDL)model to examine the asymmetric relationship between exchange rate and stock prices in Kuwait following Tobwin and Weber’s [41].

1.2. Problem of this study

- The impact of oil price movements from high, medium to a low level for Algeria is considered as a challenge for monetary authorities to use monetary policy tools (money supply) for effecting the exchange rate. I will insert this problem with this question: Is the monetary policy tool in Algeria is effective over the exchange rate under oil price movement? I will use the IVAR model to answer this question. - Many studies benefit from the linear methods to analyze the effects of appreciation

and depreciation of the domestic currency of stock price with the magnitude of change remaining the same in both cases. However, in the case of Kuwait, the result may be nonlinear because appreciation and depreciation in Kuwaiti diner might not have similar effects in terms of magnitude on stock prices. This problem can be inserted as if there is an asymmetric relationship between the exchange rate and the stock market in Kuwait. Autoregressive Distributed Lag (ARDL) model and Non-linear Autoregressive Distributed Lag (NARDL) model will use to search for investigating this research problem.

1.3. Aims of the study

This thesis attempts to show that:

- Study the exchange rate system with a focus on exchange rate regimes and monetary policy implementation in Arab countries.

- Study the Mundell- Fleming Model to interpret the relationship between monetary policy and exchange rate in small open economies such as Algeria and Kuwait. - Examine the impact of monetary policy on the exchange rate, output, and prices

related to the changes in oil price in Algeria.

- Examine the symmetric relationship between exchange rate and stock prices, money supply, prices, interest rate, and oil price and asymmetric effects of exchange rate on the stock market in Kuwait.

1.4. Importance of this study

- Examining the effect of monetary policy tool on macroeconomic performance by taking into account the oil price movement, this may be beneficial for policymakers in oil-producing countries to be aware and follow up the influence from the monetary policy of an economic and financial variables by considering oil price as an interaction variable from high, medium to a low level.

- Studying the relationship between stock markets and macroeconomic variables, especially the exchange rate in Kuwait will be interesting for both policy makers to select better policies and for investors to know which variable leads to stock price volatility.

1.5. Contributions of the Thesis

Many studies examine the relationship between monetary policy and exchange rate in different countries, but most of these studies have been carried out in developed economies; there are only a few studies for developing economies. Part of this dissertation (Chapter three), therefore, aims at contributing to the existing literature by investigating the relationship between monetary policy and exchange rate. As far as we know, there is no other study that analyzes the relationship between monetary

policy and exchange rate for Algeria benefiting from the Interacted Vector Autoregressive (IVAR) method.

Moreover, few studies are concerned with oil-producing Arab financial markets. In addition, the link between Arab stock markets and the exchange rate remains a relatively unexplored area of research for these countries. In Chapter four, we attempt to participate in the existing studies by examining the impact of an increase or decrease of exchange rate on the stock market in Kuwait by using Nonlinear Autoregressive Distributed Lag (NARDL) model.

The dissertation and the objectives of chapters are presented in the following manner: Chapter 2 describes an exchange rate system and the effect of government intervention on the currency movement. Then, the Mundell-Fleming Model is presented and the relationship between monetary policy and exchange rate system are investigated. We also give brief information about the exchange rate arrangement and monetary policy implementations for Arab countries.

In Chapter 3, we analyze the Algerian’s economy, which is an oil producer country with brief information about the monetary policy and exchange rate history for Algeria. Then we discuss the role of oil price levels during the phase of the effectiveness of monetary policy decision considering the exchange rate level. In other words, we examine the ability of monetary policy tools to depreciate or appreciate the Algerian Dinar against the US dollar related to their goals under a different level of oil price in an open economy.

In Chapter 4, we present the monetary policy and its tools in Kuwait and its exchange rate history. Moreover, this chapter included theories that interpret the relationship between exchange and stock markets. Then we examined the relationship between stock markets and macroeconomic variables, especially the exchange rate for Kuwait by investigating the asymmetric effects of exchange rate on the stock markets where we employed the bounds testing approach to investigate the short and long run dynamics between stock prices and exchange rates. In this chapter, we investigate the relationship between the stocks markets and macroeconomic variables in Kuwait by a

linear model (ARDL) with focusing on exchange rate where it is used to examine the possible asymmetric relationship with the stock market by NARDL.

MONETARY POLICY AND EXCHANGE RATE

BEHAVIOR

Globalization has changed the economic and monetary policy orientations of several countries, the pressures exerted by globalization on emerging countries in general and Arab countries in particular as an increase in the effectiveness and the advantages of adopting an appropriate monetary policy and an increase in the disadvantages of adoption inappropriate monetary policy. However, there is no appropriate or effective monetary policy without an appropriate exchange rate system, and thus choosing an appropriate exchange rate regime leads to macroeconomic stability and maintaining the competitiveness of the country.

Every country must select its exchange rate system that an takes advantage of its economy, but the experiences that faced countries, especially emerging ones during the crises generated a sharp conflict among economists on the factors that determine the appropriate choice of the exchange system. However, these factors change over time in terms of the structural and economic characteristics of the state along with the movement of capital and the nature of the shocks, which it is exposed.

2.1. Exchange Rate Regimes

Exchange rate regimes have evolved considerably in recent years, especially after the collapse of the Bretton 1973 system. At the beginning of the twentieth century, the only option which available to countries was the fixed exchange system (gold base) but after the collapse of the Bretton system, countries had an option to adopt a specific exchange rate system. The exchange-rate system options have diversified over the years from fixed to flexible systems. In general, exchange rate systems are classified related to the degree of controlling by the government, which includes fixed exchange systems, intermediate exchange systems, and flexible exchange systems.

According to the IMF classification, there are ten categories of exchange rate de facto arrangements related to the available information of member countries. The first type is soft pegs that divided into four categories, which are a conventional pegged arrangement, pegged exchange rate within horizontal bands, Stabilized arrangement, crawling peg and crawl-like arrangement. The second type is hard pegs that divided to exchange arrangement with no separate legal tender and currency board arrangement. The third type is floating regimes which split to floating and free floating and the last type is residual that include another manage arrangement.

IMF classified the countries related to their de jure or announced exchange rate arrangements. The information about de jure arrangements is collected systematically for the IMF membership as part of the Annual Report on Exchange Arrangements and Exchange Restrictions (AREAER) exercise. On the other hand, some countries have policies and consequences are not in agreement with the de jure arrangement. In this case, the IMF decided to set the suitable de facto classification to decrease the possibility of the difference between the two classifications. To do this the IMF used the process in three main steps as shown in Figure 2.1.

Figure 2.1 Process for Revised Classification by IMF [42]

According to Figure 2.1 sometimes the de jure arrangement for the country is the same with a de facto arrangement such as the hard peg arrangement (currency boards or formal dollarization). However, for countries that have a difference between de jure and de facto arrangement, IMF distinguishes between the two arrangements related to the market determination. For example, if the exchange rate is set mostly by market power and there is no intervention over the past six months, except for limited intervention to handle disorderly market conditions so it determined as free floating. On the other hand, for other de facto arrangements that do not classify as floating, the IMF identifies them to be in soft peg arrangements such as stabilized or crawl-like. Any arrangement which does not join to the previous categories is determined to be in the other managed arrangements [42].

Fixed Exchange Rate System

Exchange rate under a fixed exchange rate system is constant or fluctuates within narrow boundaries. To achieve that the central bank intervenes to prevent any changes by recompense any imbalance between the demand and supply for the currency. According to the Bretton Woods agreement, from 1944 to 1971, all currencies were valued in terms of gold and thus during the Bretton woods era exchange rates were fixed to gold, for instance, the US dollar was valued by 1/35 ounce of gold [43]. At that time, coins and bills could convert to gold by central banks. Moreover, central banks could use gold to pay for the balance of payments deficits [44].

Traders prefer to make their international trades in countries, which have a fixed exchange rate system because of that they could trade without fear about the exchange rate movement between their local currencies and the country’s currency where they trade in it. Therefore, they will insulate their trade about currency risk. Moreover, firms could work in direct foreign investment without disquiet about exchange rate changes and thus they could convert their earning without apprehension from diminishing the value of a currency against the home currency. However, the fixed exchange rate still has currency risk because the government may decide to change the value of the specific currency [43].

The pegged exchange rate system is part of the fixed exchange rate, according to this system; there are several choices for setting the currency’s value. The extreme one is that a country abandons its currency and using the currency of another country such as the dollar or the euro. The other common one is the country pegs its currency to one currency like a dollar or to a basket of currencies (also called intermediate regimes) usually that mostly trade. For instance, between 2005 and 2008 China pegged the yuan to a basket of currencies such as (dollar -euro and yen). However, it did not declare the number and the weight of currencies in the basket. Some countries do not disclose both currencies that pegged and the weight of currencies such as Kuwait.

Special Drawing Rights (SDRs) are the most well-known example of a currency basket. The IMF created SDRs in 1968 as an alternative reserve asset, which has the same gold value as the dollar to provide another acceptable asset in addition to the

Dollar. Until 1976 SDRs was expressed in gold, but after that, it became a basket currency [44].

There are two types of pegged exchange rate system, the first one is the hard peg which means that the exchange rate is not allowed to change such as formal dollarization, currency unions, and currency boards and the other one is soft pegs which indicate that the exchange rate can fluctuate in a set band [45]. According to the IMF arrangement in 2017, the soft pegs include the conventional pegged arrangements, which was explained the previous section, pegged exchange rates within horizontal bands, crawling pegs, stabilized arrangements, and crawl-like arrangement, which will define in the next section:

Pegged exchange rates within horizontal bands: These systems are similar to traditional fixed systems, but there is greater potential for volatility by adding some margins in term of that the increase in the nominal (or real) volatility will be around the central price. So that the value of the currency remains confined within ranges of volatility not less than ± 1% around the fixed central price, or the margin between the maximum and minimum exchange rate value is more than 2%. This system provides a limited degree of authority to implement monetary policy according to the extent of volatility. The central banks in this system intervene in the exchange market within the small margin if necessary, for extended periods. Although it is within narrow, it is adjusted in the case of unbalance or in the case of great pressure. However, this system has been severely affected by successive crises and has become less attractive at the international level since 2001.

Crawling pegs: this system adopted a fixed exchange rate, but with widening the limits at which exchange rates can fluctuate. This system allows countries that face imbalances to announce small changes in their exchange rates until the balance is achieved. This system is appropriate for countries that have a high inflation where they can adjust regularly the fixed rate of exchange is in the form of a small reduction in response to some indicators such as the difference level between local inflation and inflation in the countries of the trading partner or inflation target and inflation expected in the country ofthe trading partner. As another fixed exchange rate system, the role of monetary policy is relatively small.

A stabilized arrangement: requires an exchange rate on the market that remains within a 2% margin for six months or more. The margin of stability can be a single currency or a basket of currencies According to IMF [46], the stabilized arrangement set the second largest category between the soft pegs by 30 percent.

Crawl-like arrangement: under a crawl-like arrangement, the exchange rate has to stay within a narrow margin of 2% for six months or more. Normally, the minimum rate of change is more than the allowed rate, but with crawl-like, the arrangement will be taken into account that the annualized rate of change must be at least 1% and thus the appreciatesor depreciates in the currency will be done in a monotonous and persistent manner [42].

Over the period of 2009-2014, the number of countries that used soft peg arrangement increased while the number of countries that employed the floating exchange rate decreased. However, from 2015 until 2017 both systems were increasing as shown in Table 2.1.

Table 2.1 Exchange Rate Arrangements, 2009–17 [46]

Exchange Rate Arrangement 2009 2010 2011 2012 2013 2014 2015 2016 2017

Hard peg 12.2 13.2 13.2 13.2 13.1 13.1 12.6 13.0 12.5

Soft peg 34.6 39.7 43.2 39.5 42.9 43.5 47.1 39.6 42.2

Floating 42 36.0 34.7 34.7 34.0 34.0 35.1 37.0 39.5

Other managed arrangement 11.2 11.1 8.9 12.6 9.9 9.4 5.2 10.4 9.4

Source: IMF (2017), Annual Report on Exchange Arrangements and Exchange Restrictions.

In general, governments try to peg their currencies to a nother reserve currency such as the US dollar or euro to ensure that the value of their currency maintains stable against other currencies. Countries can benefit from this system to stimulate capital inflows by attracting foreign investors who look for a stable country that has better investment opportunities. However, the pegged exchange rate system might cause instability in a country’s economy, especially if this country has political or economic problems. Therefore, if foreign investors believe the peg might break, they will sell

their investment and look for another stable country [43]. The other potential problem for the countries that peg to the other currencies such as a dollar is that the Federal Reserve may have different monetary policy objectives than these countries. For instance, in 2010, the Federal Reserve's prime monetary policy objectives were to avoid deflation and lower unemployment. However, many emerging countries that peg to the US dollar such as China did not have problems with low inflation or high unemployment during that time. However, they decrease the interest rate following the US policy. China, for example, in 2010–2011 witnessed rising in the prices because of excess liquidity as a result of decreasing the interest rate [47]. Next section represents some experiences of countries used the pegged exchange rate system.

In April 1972, a number of European countries created a pegged exchange rate arrangement called Europe’s Snake Arrangement. The goal from this snake was to keep their currencies within limits. However, the snake was hard to maintain because of the fact that the market pressure leads to move some currencies outside limits. As a result, a number of members withdrew from the snake.

Because of problems that come with the snake arrangement, in March 1979 the European Monetary system (EMS) was employed exchange rate of a member of the countries which movement within specified limits. They tied it to the European currency unit (ECU)1 and thus the authorities intervene in order to maintain the exchange rate within boundaries.

In 1994, the central bank of Mexico pegged their currency (peso) to the US dollar, but the peso’s value fluctuated within a band against the US dollar. Mexico’s pegged system led to a deficit in trade balance because of that, the peso became stronger than it should have been and this led to increased imports by firms and consumers.

Some Arab countries, especially that are exporting the oil such as Saudi Arabia and the United Arab Emirates have pegged their currency to the Dollar. However, from 2006 to 2008 as an example, the dollar depreciates against the euro and some other currencies, and thus, any country has pegged its currency to the US dollar also

depreciate [43]. Table 2.2 shows some Arab countries peg to the dollar and others that peg to the index of currencies.

Table 2.2Exchange Rate Arrangement in some Arab Countries [46]

Conventional

Peg (US dollar)

Currency

Conventional

Peg (Composite)

Currency

Bahrain dinar Kuwait dinar

Oman riyal Morocco dirham

Qatar riyal Libya dinar

Saudi Arabia riyal

United Arab

Emirates

dirham

Source: IMF, Annual Report on Exchange Arrangements and Exchange Restrictions, October 2017

Freely Floating Exchange Rate System

Freely floating exchange rate is also called clean float which determined by the interaction of currency supplies and demands. In other words, the exchange rate value under the freely floating exchange rate system is set by the market power without any intervention from the government authorities.

The currency’s value under a flexible exchange rate is like other things that determine related to the supply and demand. For instance, an increase in the demand for the dollar in front of foreign currency led to appreciate the dollar (raise its price). However, an increase in the supply on it will decrease its price causing deprecation its value [45]. Figure 2.2 shows the market demand and supply for the US Dollar.

Figure 2.2 Market Demand and Market Supply of US Dollar Under the Floating Exchange Rate

As shown in Figure 2.2 under a floating exchange rate, an increase in the demand for the US dollar from D1 to D2 leads to appreciating it in the foreign market while the changes in supply from S1 to S2 puts downward pressure on the dollar in the foreign exchange market and causes it to depreciate.

Many counties, especially the developed countries prefer to employ freely floating exchange rate system because this system insulates the country from the inflation, unemployment problem of other countries because the system has the ability to quickly adapt to internal or external shocks [43]. The other advantages of this system are that central banks no longer need to keep large amounts of foreign currency as a reserve, ensures a permanent balance of payments balance through continuous exchange rate fluctuations and gives absolute freedom to the country to follow its internal monetary policy without external constraint. Moreover, this system discourages speculative activity. However, some of the disadvantages of this system can be explained as follows: the first disadvantage of variations in the value of the national currency leads to losing economic agents their trust in the national currency and the second one is that the fluctuation of exchange rates daily generates uncertainty and risk for the traders about the values of future exchanges. Although exchange risk can be covered, the costs D 1 Quantity D2 S2 EXC S1

will increase costs and the other disadvantage is the instability of exchange rates leads to the phenomenon of global inflation through the deterioration of the values of the currencies of countries.

In reality, pure floating exchange rate system is clearly not used by countries because central banks usually intervene in a foreign exchange market where central banks affect their value by buying and sell their own currencies [44].

Managed Float Exchange Rate System

The managed exchange rate system is also named dirty floating which combines between both fixed and freely floating exchange rate [43].

Central banks in different countries can intervene in foreign exchange markets to manage their currency’s value. There are three main approaches have used by central banks to intervene in the foreign exchange market for managing their currencies: First, smooth exchange rate movement: under this approach, central banks attempt only to maintain an orderly pattern of exchange rate movement instead of facing market forces where the governments enter into the foreign market to buy and sell related to their objective. This approach has been used to moderate or prevent unexpected fluctuations for short and medium-term whose influence is expected to be only temporary [47].

Some central banks try to smooth exchange rate to get some advantages from it such as keeping business cycles less volatile, reducing exchange rate uncertainty and thus encouraging the international trade and might reduce fears in both financial markets and speculate activity that comes from changes in the value of currency [43].

The second approach is leaning against the wind: this approach prevents unexpected short- and medium-term fluctuations that come from random events whose impacts are predicted to be only temporary. The aim of this approach is to delay exchange rate changes and thus, the government can intervene to reduce the uncertainty that causes due to the exchange rate changes for exporters and importers.

The third approach is unofficial pegging which includes resisting, for reasons are not associated with exchange market forces (exchange rate changes). Historically, Japan has resisted revaluation of the Yen because of the fear of its consequences on Japanese exports. On the other hand, under unofficial pegging, the governments do not commit to announcing a given exchange rate level.

With a managed floating system, the daily volatility for the currency is less than a free-floating system. Moreover, by the managed free-floating system, the country can avoid currency crises related to the balance of payments problems due to the government can give up the peg quickly rather than maintain a rate that is unsustainable [47].

2.2. Currency Interventions

Central banks especially that are employing fixed or pegged exchange rate system attempt to maintain the currency within boundaries and thus the currency with not rise above or fall down the benchmarkable because the central bank will intervene to prevent any changes. However, without any intervention, the currency will become more volatile. Moreover, central banks may intervene to insult the value of currency from temporary disturbances.

Exchange rates are affected by government policies. Some governments have used policies to affect the exchange rate directly and other governments influence it indirectly by affecting economic conditions. The following section represents how governments affect exchange rates.

Direct Intervention

Central banks can intervene directly by exchanging their currency in the foreign exchange market. For instance, if the Federal Reserve (Fed) wants to depreciate the dollar against the Pound, it may intervene it directly by exchanging dollars by the reserves of the Pound in a foreign market. In other words, floating the market with dollars and thus the supply of dollars becomes more than the demand. As a result, the dollar will depreciate. On the other hand, if the Fed desires to strengthen the dollar in front of the pound, it can exchange pound to dollars in the foreign exchange market and thus putting upward pressure on the dollar. As a result, the dollar will appreciate.

There are two types of direct intervention, which are non-sterilized and sterilized intervention. Non-sterilized intervention means that the central bank intervenes in the foreign exchange market without any adjustment for changes in the money supply. For instance, if the central bank exchanges its currency for foreign currency in the foreign exchange market to weaken its currency against other currencies. As a result of the money supply, of this currency increase.

In a sterilized intervention, the central bank intervenes in the foreign exchange market and simultaneously it engages to offset the money supply of treasury securities and thus the money supply will unchanged [43].

To neutralize these effects, the central bank can sterilize the impact of it on the local money supply through an open-market operation, sale or purchase of treasury securities by buying enough T-bills as an example the money supply can return to the previous level. For instance, in 2003, the People's Bank of China (PBOC) issued 250 billion Yuan in short-term notes to commercial banks. However, the economy whiteness excess liquidity, for this reason, the PBOC sought to sterilize the Yuan by raising its reserve requirements for a financial institution which led banks to hold more money on deposit and create fewer loans [47].

Indirect Intervention

The central banks can affect their currencies indirectly through influence on some factors that determine the value of currency such as an interest rate. For instance, the central bank could increase the interest rate if it is willing to appreciate its currency. In another word, increasing the interest rate leads investors to transfer their fund to the country that has a higher interest rate. As a result, the demand for this currency increase and this, in turn, leads to depreciate the currency against other currencies [43].

2.3. Choosing the Appropriate Exchange Rate System

Before many years, researchers have become more focused on understanding the most appropriate exchange rate regime for every individual country. They look for the effect of this system on the country’s macroeconomy, for instance, the frequency of currency crisis, the rate of inflation and the rate of economic growth. According to Frankel [48],

there is no single currency regime that is best for all countries or even best for the same country in all time.

Despite many economics prefer a floating exchange rate system, there is a consensus about that each country has unique conditions and there is no valid system for all countries. According to some econometric’ viewers, for countries that employ a fixed exchange rate system was better in term of controlling the inflation, but they had slower economic growth. Therefore, under this view, these countries must be very careful about issuing new money in order to maintain the exchange rate at a fixed level [45].

A choice an exchange rate regime depends on a country’s policy objectives such as low inflation, external stability, and international competitiveness and how those objectives are influenced by different exchange rate system and the tradeoffs between these objectives. However, these objectives and the tradeoffs are changing over time, causing changes in the currency regime for the countries [47]. The following section is provided with some literature reviews about the optimal exchange rate system for countries:

Friedman [49] and Mundell [50] argue that the choice between fixed and floating exchange rate regime is mainly related to sources of nominal or real shocks and the degree of movement of capital. For instance, in an open economy that characterized by capitalist movement, the floating exchange rate provides protection from real shocks, such as a change in export while the fixed exchange rate is desirable if the economy may expose to nominal shocks more such as a shift in demand for cash. Stockman [51] states that there are two arguments about choosing an exchange rate system. The first argument is for the pegged exchange rate, according to traditional arguments if there are two countries have similar economic structures and faced similar exogenous shocks, it will be better-employed common currency or fixed exchange rate. Moreover, pegging the exchange rate gives credibility and an obligation to monetary policy and they claim that the floating exchange rate cause volatility and uncertainty in the currencies and thus the currencies are over or under-valued.

The other arguments are for floating exchange rate, they claim that many countries have different economic structures and witness idiosyncratic shock can benefit from floating exchange rate and they argue that the pegged exchange rate prevents the use of monetary policy to achieve the domestic objectives. In addition, the pegged exchange rate lead to misalignments in the international trade and financial flow and it may collapse in a costly currency crisis in order to the face of speculative attacks. Bubula and Ötker [52] assume that intermediate exchange rate regimes are more crisis-prone than hard pegs or floating exchange rate system.

Trifonova and Kovachevich [53] examine the relationship between government finance indicators and the exchange rate system. They selected government balance and gross government debt as a percentage of Gross Domestic Product (GDP) as government finance indicators. They divided the sample into four groups related to their exchange rate system, which are fixed exchange rate, floating exchange rate, currency board, and the other group includes the Eurozone member states). The results indicate that the countries used in the currency boards have a much lower level of government debt than those used in floating exchange rates and the euro area countries. Moreover, the impact of the exchange-rate system on the budget balance does not show equally strong results. However, the countries with a currency board still have a better statistical budget balance than other countries.

In general, central banks must know how can affect its monetary policy tool with different exchange rate system to achieve their goals whether it’s floating or fixed exchange rate system. Mundell-Fleming model analysis the dynamic between monetary policy and exchange rate system and this is explained in the next section.

2.4. Monetary Policy and Exchange Rate under the Mundell- Fleming

Model

Mundell-Fleming model was set by Robert Mundell and Marcuse Fleming in 1960 [54]. In 1999, Robert Mundell won the Nobel Prize for his study in open-economy macroeconomics, which includes this model. The model is subjected to an analysis of the effect of equilibrium balance payments in exchange rate determination. In other

words, this model combines the internal equilibrium of the good market, the money market and the external equilibrium represented by the balance of payments.

The model focuses on the relatively small open economy that does not affect by the direction of interest rates in the rest of the world. Therefore, the main assumption of the Mundell Fleming model is that:

1- Perfect capital mobility:

According to this assumption, the interest rate in the domestic economy is determined by the interest rate in the rest of the world. Such as the following where r is the domestic interest rate and r* is for the foreign interest rate:

r = r* (2.1) According to this assumption, the interest rate in a small open economy is exogenously fixed because the economy is small compared to the world economy and thus it cannot affect the world interest rate. In another word, the economy can lend or borrow as it wants from the foreign financial market without influence the world interest rate because it increases the interest rate in the small open economy, attract foreign capital to start lending to this economy and thus capital will inflow in the economy causing increase the money supply in this economy and thus interest rate return to the previous level.

2- The price level is fixed for domestic and abroad:

Under this assumption, the nominal exchange rate (e) is equal to the real exchange rate (ep/p*) because both domestic and foreign prices are unchanged. Suppose, for instance, the nominal exchange rate of Algerian dinar for one dollar is appreciated from 100 to 90; thus, the real exchange rate will rise as well. In turn, the export will fall, and import will rise because the domestic goods become more expansive comparing with foreign goods.

Mundell Fleming has developed the Keynesian model IS-LM that examines the interaction between goods and the money in a closed economy by adding another term,

which the nominal exchange rate is. Let’s start with the goods market, which presented in the following equation (IS equation):

𝑌 = 𝐶(𝑌 − 𝑇) + 𝐼 (𝑟 ∗) + 𝐺 + 𝑁𝑋(𝑒) (2.2) Where Y is the aggregate income, C is the sum of consumption, which has a positive relationship with income and a negative relationship with tax. I is the investment that depends negatively with the world interest rate. G is the government purchasing and NX is the net export (import-export) that depends negatively with the nominal exchange rate.

The equilibrium in the goods market is affected by two financial variables, which are the nominal exchange rate and the interest rate. In other words, the expenditure on goods and services is related to these two variables. However, under the perfect capital mobility, the domestic interest rate r is equal to the world interest rate r* as stated in the IS equation (2.2). On the other hand, under the Mundell Fleming Model, the money market is represented by the LM curve:

𝑀

𝑃 = 𝐿(𝑟 ∗ , 𝑌) (2.3)

Equation 3 shows that the supply of real money balances M/P is equal to the demand for money which depends negatively with r* and positively with Y.

According to Mundell Fleming model, the money supply (M) is an exogenous variable controlling by the central bank and because this model analysis the short -run variations, it assumes the prices P is also fixed and the last assumption is the domestic interest rate r is equal to the world interest rate r* the world.

Floating Exchange Rate for Small Open Economy

Mundell -Fleming model assumes that the behavior of any economy depends on the exchange rate regime. The floating exchange rate is a rate determine by market force and it changes related to the economic conditions. Suppose, for instance, the central bank decides to increase the money supply and because the price is fixed according to Mundell- Fleming assumptions, the increase in the money supply lead to increase in

the real money balances. Thus, the increase in the real money balances will shift the LM to LM*causing increases in income and decreasing in the exchange rate as stated

in Figure 2.3.

Figure 2.3 The Effect from Monetary Policy Expansionary under Floating Exchange Rate System

Figure 2.3 summarizes the effect of the monetary expansion under floating exchange rates on the LM curve, exchange rate, and income. As it can be seen, the LM curve shifts to the right, the exchange rate goes down, leading to an increase in income. In general, Mundell Fleming suggests that the exchange rate and interest rate are the main two variables that affect the economy, the increase in money supply as the monetary expansion leads to increase the pressure on the domestic interest rate to go down, causing capital outflows from the domestic economy because the investors look for higher return by taking a higher interest rate from abroad. This capital outflow will have two effects, the first effect is preventing the domestic interest rate (r) to become less than the world interest rate (r*). The second effect from capital outflow is that investors who seek the highest return from abroad will convert the domestic currency to foreign currency. Thus, the money supply of domestic currency rises in front of

Exchange rate, e IS LM LM* Income, output Y e 1 e 2

foreign currency. As a result, depreciate the value of the domestic currency. The depreciation in domestic currency makes the domestic goods cheaper comparing with foreign goods. So, the exports become more than imports and income increase. In sum, the monetary policy affects the income instead of interest rate in a small open economy.

Small Open Economy under a Fixed Exchange Rate

The central bank under the fixed exchange rate decides the value of the domestic currency against the foreign currency and become ready to buy and sell the domestic currency to keep the value of the exchange rate at the decided level.

The main goal of monetary policy concerning the exchange rate for countries that use a fix exchange rate is to keep the value at the announced price. The central bank becomes ready to buy and sell the local currency in order to maintain the exchange rate at the fixed level, the money supply change automatically to reach the announced level of the central bank. Consider, for instance, the central bank sets the exchange rate at 100 Algerian dinars per dollar. However, the market exchange rate is 200 dinars against the dollar. Therefore, there is a profit opportunity for arbitrages [55].

Under the fixed exchange rate system, increasing the money supply as monetary expansion by buying the bonds as an example, lead to shifting the LM curve to the right, causing low in the exchange rate as shown in Figure 2.4.

![Figure 2.10 Growth Rates of Local Liquidity in the Arab Countries for 2016 and 2017 [60]](https://thumb-eu.123doks.com/thumbv2/9libnet/3389789.12818/61.892.168.785.121.411/figure-growth-rates-local-liquidity-arab-countries.webp)

![Figure 3.2 Hydrocarbons Revenues and Non- Hydrocarbons Revenues during the period 2000-2015 (Billion of the Dinar) [74, 75]](https://thumb-eu.123doks.com/thumbv2/9libnet/3389789.12818/70.892.157.807.278.618/figure-hydrocarbons-revenues-hydrocarbons-revenues-period-billion-dinar.webp)

![Figure 3.4 Relationship between Foreign Exchange Reserves and Oil Price during 2000- 2000-2016 [78]](https://thumb-eu.123doks.com/thumbv2/9libnet/3389789.12818/72.892.155.786.127.528/figure-relationship-foreign-exchange-reserves-oil-price.webp)

![Figure 3.7 The Difference between Actual and Target Inflation Rate in Algeria [84, 85]](https://thumb-eu.123doks.com/thumbv2/9libnet/3389789.12818/77.892.159.781.124.493/figure-difference-actual-target-inflation-rate-algeria.webp)