T.C.

SELÇUK ÜNİVERSİTESİ

SOSYAL BİLİMLER ENSTİTÜSÜ

İŞLETME ANABİLİM DALI

MUHASEBE FİNANSMAN BİLİM DALI

THE EFFECTS OF INTEGRATED FINANCIAL

MANAGEMENT INFORMATION SYSTEM (IFMIS) ON THE

FINANCIAL STATEMENTS

(ENTEGRE FİNANSAL YÖNETİM BİLGİ SİSTEMİNİN (İFMİS) MALİ TABLOLARINA ÜZERİNDEKİ ETKİSİ)

SAMUEL MUGAGA

YÜKSEK LİSANS TEZİ

DANIŞMAN

PROF. DR. NAİM ATA ATABEY

i SCIENTIFIC INTEGRITY AND PROFESSIONAL ETHIC PAGE

T.C. SELÇUK ÜNİVERSİTESİ

Sosyal Bilimler Enstitüsü Müdürlüğü

Bilimsel Etik Sayfası

Ö ğ r e n c in in

Adı Soyadı Samuel Mugaga

Numarası 144227031019

Ana Bilim / Bilim Dalı

İşletme Anabilim Dalı

Muhasebe Finansman Bilim Dalı

Programı Tezli Yüksek Lisans Doktora

Tezin Adı

The effects of Integrated Financial Management Information System (IFMIS) on the Financial Statements.

Bu tezin proje safhasından sonuçlanmasına kadarki bütün süreçlerde bilimsel etiğe ve akademik kurallara özenle riayet edildiğini, tez içindeki bütün bilgilerin etik davranış ve akademik kurallar çerçevesinde elde edilerek sunulduğunu, ayrıca tez yazım kurallarına uygun olarak hazırlanan bu çalışmada başkalarının eserlerinden yararlanılması durumunda bilimsel kurallara uygun olarak atıf yapıldığını bildiririm.

………. Öğrencinin imzası Alâaddin Keykubat Kampüsü Selçuklu 42079

KONYA Telefon : (0 332) 241 05 21-22 Faks : (0 332) 241 05 24

ii

iii

T.C.

SELÇUK ÜNİVERSİTESİ Sosyal Bilimler Enstitüsü Müdürlüğü

Ö ğ r e n c in in

Adı Soyadı Samuel Mugaga

Numarası 144227031019

Ana Bilim / Bilim Dalı

İşletme Anabilim Dalı

Muhasebe Finansman Bilim Dalı

Programı Tezli Yüksek Lisans Doktora

Tezin Adı Entegre Finansal Yönetim Bilgi Sisteminin (İFMİS) Mali Tablolarına Üzerindeki Etkisi

ÖZET

Son 20 yılda, gelişmekte olan ülkeler, bütçe planlamasını geliştirmek, tedarik süreçlerini otomatikleştirmek, otomatik gelir tahsilatlarını geliştirmek, nakit yönetimini geliştirmek, devlet sabit varlıklarını yönetmek, otomatik uzlaşma arttırmak, tüm devlet harcamalarının ödenmesi ve kamu kaynaklarının kullanımında şeffaflık ve hesap verebilirliğin sağlanması için Entegre Finansal Yönetim Bilgi Sistemi (İFMİS) kabul etmeye başlamışlardır. Uganda'da, 2003/4 Finansal yılında Entegre Finansal Yönetim Bilgi Sistemi (İFMİS) tanıtılmıştır. Bu araştırmanın amacı, Entegre Finansal Yönetim Bilgi Sisteminin (İFMİS) Kamuli bölgesinde Mali tabloların kalitesi üzerine etkilerini araştırmaktır.

Bunu başarmak için araştırma, Kamuli bölgesini örneği alarak, aşağıdaki hipotezleri kullandı: İFMİS Uygulama Stratejisinin Mali tablolar kalitesini üzerinde önemli bir etkisi vardır, İFMİS İnsan Kaynakları Kapasitesinin Mali tablolar kalitesini üzerinde önemli bir etkisi vardır, İFMİS Teknolojisi Mali tablolar kalitesini üzerinde önemli bir etkisi vardır, İFMİS İşlem Süreçleri

iv Mali tablolar kalitesini üzerinde önemli bir etkisi vardır, İFMİS Yasal çerçevesinin Mali tablolar kalitesini üzerinde önemli bir etkisi vardır ve Kalitatif özelliklerin Mali tablolar kalitesini üzerinde önemli bir etkisi bulunmaktadır.

Araştırma tanımlayıcı araştırmayı benimsemiş, anket formları kullanılarak toplanan temel verileri kullanmış ve SPSS kullanarak Faktör analizi, Ortalama, Standart Sapmalar, Korelasyon ve Regresyon analizi ile değerlendirilmiştir. Halen sistemi kullanan Finans ve Muhasebe, Denetim ve Satınalma, Eğitim ve Sağlık, Planlama ve İdare bölümlerinde çalışan Kamuli bölgesinden 130 katılımcının örnek bir nüfusu kullanılmıştır.

Araştırmanın bulguları, İFMİS Uygulama Stratejisi, İnsan Kaynakları Kapasitesi, Teknoloji, İşlem Süreçleri ve Yasal Çerçevenin önemli ölçüde Mali Tabloların kalitesini etkilediğini göstermiştir. Korelasyon ve Regresyon analizi kullanılarak, Kamuli bölgesinde İFMİS'in ve Mali Tabloların kalitesi ile pozitif ve önemli ilişki olduğu ortaya çıkmıştır. Böylece, araştırmacı, Entegre Finansal Yönetim Bilgi Sistemi'nin (İFMİS) Kamuli bölgesinde, Mali Tablolar kalitesi üzerinde pozitif ve önemli bir etkisi olduğu sonucuna varmıştır.

Araştırmacı, bölgesinin sistem uygulama sürecini ve sistem insan kaynakları kapasitesini güçlendirmek için kullanılacak yeni ve pratik bir yasal çerçeveyi yeniden geliştirmesini önerdi. Bu, sistemin paydaşlar tarafından daha fazla kabul edilmesine ve sadık sunum anlaşılabilirliğini, doğrulanabilirliğini, karşılaştırılabilirliğini ve olayların zamanlamasını gibi uygunluğunu etkileyen faktörleri belirlemede yardımcı olacak dolayısıyla kaliteli Mali tablolara götürecektir.

Anahtar Kelimeler: Entegre Finansal Yönetim Bilgi Sistemi (İFMİS), Mali Tablolar, Uygulama Strateji, İşlem Süreçler, Şeffaflık ve Hesap Verebilirlik, Kalitatif Özellikler ve Yasal Çerçeve.

v

T.C.

SELÇUK ÜNİVERSİTESİ Sosyal Bilimler Enstitüsü Müdürlüğü

Ö ğ re n ci n in

Adı Soyadı Samuel Mugaga

Numarası 144227031019

Ana Bilim / Bilim Dalı

İşletme Anabilim Dalı

Muhasebe Finansman Bilim Dalı

Programı Tezli Yüksek Lisans Doktora

Tezin Adı The effects of Integrated Financial Management Information System (IFMIS) on the Financial Statements

ABSTRACT

For the last 20 years, developing countries embarked on the adoption of Integrated Financial Management Information System (IFMIS) in a bid to improve budget planning, automate the procurement processes, enhance automated revenue collections, improve cash management, manage government fixed assets, boost auto reconciliation, payment of all government expenditures and to ensure transparency and accountability in the handling and use of public resources. In Uganda, the Integrated Financial Management Information System (IFMIS) was officially introduced in 2003/4 financial year. The purpose of this study was to find out the effects of an Integrated Financial Management Information System (IFMIS) on the quality of financial statements in Kamuli district. To achieve this, the study used the following hypotheses that: the IFMIS implementation strategy has a significant effect on the quality of financial statements, that IFMIS human resource capacity has a significant effect on the quality of financial statements, that IFMIS technology has a significant effect on the quality of financial statements, that IFMIS transaction processing

vi has a great effect on the quality of financial statements, IFMIS legal framework has a great effect on the quality of financial statements, and that the Qualitative characteristics have a significant effect on the quality of financial statements in Kamuli district.

The study adopted descriptive research, used primary data that was collected by use questionnaires and analyzed using SPSS by coming up with Factor analysis, Means, Standard Deviations, Correlation and Regression analysis. A sample population of 130 respondents from Kamuli District currently working in the departments of Finance and Accounts, Audit and Procurement, Education and Health, Planning and Administration who are actively using the system was used.

The findings of the study indicated that to a great extent, IFMIS Implementation Strategy, Human Resource Capacity, Technology, Transaction Processing and Legal Framework had an effect on the quality of financial statements. Using Correlation and a Regression analysis, it was also revealed that there was a significant positive relationship between the effect of IFMIS and quality of Financial Statements in Kamuli district. Thus, researcher concluded that Integrated Financial Management Information System (IFMIS) positively and significantly had an effect on the Quality of Financial Statements in Kamuli district.

The researcher recommended that the district redevelops a new and practical legal framework to be used to strengthen the system implementation process and the system human resource capacity. This will help to seek more acceptance of the system from the stakeholders. And will also help to determine the factors that influence the relevance, faithful presentation understandability, verifiability, comparability and timeliness of events hence quality financial statements.

Keywords: Integrated Financial Management Information System (IFMIS), Financial Statements, Implementation Strategy, Transaction Processing, Transparency and Accountability, Qualitative Characteristics and Legal Framework.

vii

TABLES OF CONTENTS

Page

SCIENTIFIC INTEGRITY AND PROFESSIONAL ETHIC PAGE ... i

YÜKSEK LİSANS TEZİ KABUL FORMU ... ii

ÖZET ... iii

ABSTRACT ...v

TABLES OF CONTENTS ... vii

LIST OF TABLES AND FIGURES ... xii

LIST OF ABBREVIATIONS ... xiv

INTRODUCTION OF THE STUDY ...1

CHAPTER ONE: FINANCIAL STATEMENTS ...3

1.1. Definitions ... 3

1.1.1. Financial Accounting ... 3

1.1.2. Government (Public) Accounting ... 4

1.1.3. The Conceptual Framework of Financial Accounting ... 4

1.1.4. Financial Reporting ... 6

1.1.5. Financial Statements ... 6

1.2. Purpose of Financial Statements ... 6

1.3. Assumptions of Financial Statements ... 7

1.3.1. Going Concern Assumption ... 8

1.3.2. Accrual Assumption ... 9

1.3.3. Faithful presentation and Compliance Assumption ... 9

1.3.4. Consistency of Presentation ... 10

1.3.5. Materiality and Aggregation Assumption ... 10

1.3.6. Offsetting Assumption ... 11

1.4. Components of Financial Statements ... 11

1.4.1. Statement of Financial Performance ... 11

1.4.2. Statement of Financial Position... 12

1.4.3. Statement of Changes in Net Assets or Equity ... 13

viii

1.4.5. Notes to the Financial Statements of an entity ... 15

1.5. Qualitative Characteristics of Useful Financial Information ... 15

1.5.1. Fundamental Qualitative Characteristics ... 17

1.5.1.1. Relevance ... 17

1.5.1.2. Faithful presentation ... 17

1.5.2. Enhancing Qualitative Characteristics ... 18

1.5.2.1. Comparability ... 18

1.5.2.2. Verifiability ... 19

1.5.2.3. Understandability ... 19

1.5.2.4. Timeliness ... 19

CHAPTER TWO: INTEGRATED FINANCIAL MANAGEMENT INFORMATION SYSTEM (IFMIS). ... 21

2.1. Definitions ... 21

2.1.2. Accounting Information Systems (AIS) ... 21

2.1.3. Public Financial Management ... 22

2.2. Accounting Information Systems (AIS) used in Uganda ... 23

2.2.1. Treasury Single Account (TSA) ... 23

2.2.2. Integrated Personnel and Payroll Management system (IPPS) ... 24

2.2.3. Wage Bill and Payroll Management System ... 24

2.2.4. The Output Based Tool (OBT) ... 25

2.2.5. The Integrated Financial Management Information System (IFMIS) ... 25

2.3. Objectives of an Integrated Financial Management Information System (IFMIS). . 28

2.4. Implementation Process (Strategy) of an IFMIS ... 29

2.4.1. Preparatory Stage ... 29

2.4.2. Systems Design Stage ... 29

2.4.3. Procurement Stage ... 30

2.4.4. System Implementation Stage ... 30

2.5. Benefits of Implementation of an Integrated Financial Management Information System (IFMIS). ... 32

2.5.1. General benefits of Implementation of an Integrated Financial Management Information System (IFMIS). ... 32

ix

2.5.1.1. Planning ... 32

2.5.1.2. Confidence and Credibility ... 33

2.5.1.3. Quick Decision Making ... 33

2.5.1.4. Reduced Transaction Costs ... 33

2.5.2. Specific Benefits of IFMIS Implementation to the Government entities in Uganda ... 34

2.5.2.1. Reconciliation of Transactions ... 34

2.5.2.2. Improvement in Funds Management ... 34

2.5.2.3. Improvement in Wage bill and Payroll management ... 35

2.5.2.4. Improvement in Budget Management ... 35

2.6. Challenges of Implementing an Integrated Financial Management Information System (IFMIS). ... 36

2.6.1. Institutional challenges ... 37

2.6.2. Technical challenges ... 38

2.6.3. Human resource challenges ... 40

2.6. The effect of an Integrated Financial Management Information System (IFMIS) on improvement of the Quality of Financial Statements. ... 42

2.6.1. IFMIS Implementation Strategy and Quality of Financial Statements ... 42

2.6.2. IFMIS Human Resource Capacity and Quality of Financial Statements ... 44

2.6.3. IFMIS Technology and Quality of Financial Statements ... 47

2.6.4. IFMIS Transaction Processing and Quality of Financial Statements ... 48

2.6.5. IFMIS Legal Framework and Quality of Financial Statements ... 51

2.6.6. Qualitative characteristics and Quality of Financial Statements ... 54

CHAPTER THREE: THE EFFECTS OF INTEGRATED FINANCIAL MANAGEMENT INFORMATION SYSTEM (IFMIS) ON THE QUALITY OF FINANCIAL STATEMENTS ... 57

3.1. Objectives of the Study ... 57

3.2. Significance of the Study ... 57

3.3. Hypotheses of the Study ... 58

3.4. Scope of the Study ... 59

3.5. Limitations of the Study ... 59

x

3.6.1. Research Design ... 60

3.6.2. Target Population ... 61

3.6.3. Sampling Size ... 61

3.6.4. Sampling Technique ... 61

3.6.5. Data Collection Methods ... 62

3.6.6. Data Collection Procedures ... 62

3.6.7. Validity and Reliability of the Research Instrument... 63

3.6.8. Measurement of Variables ... 64

3.7. Data Analysis and Presentation Methods ... 65

3.7.1. Data Analysis ... 65

3.7.2. Presentation and Analysis of results of the Study ... 65

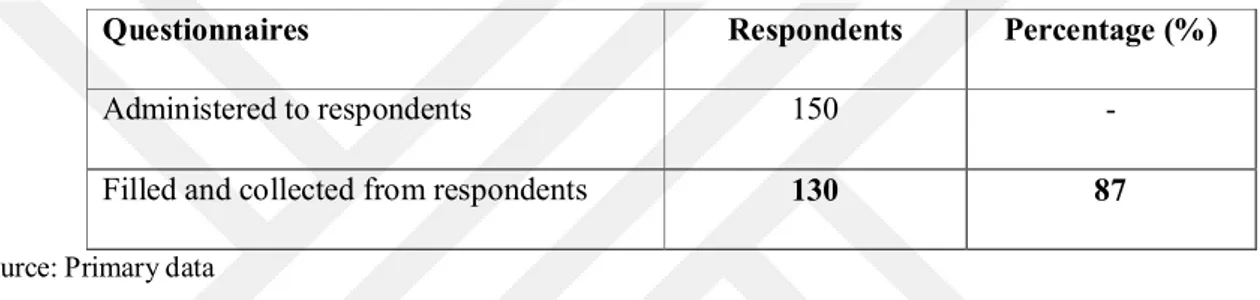

3.7.2.1. Response rate of the study ... 66

3.7.2.2. General Information ... 66

3.7.2.3. Gender of Respondents ... 67

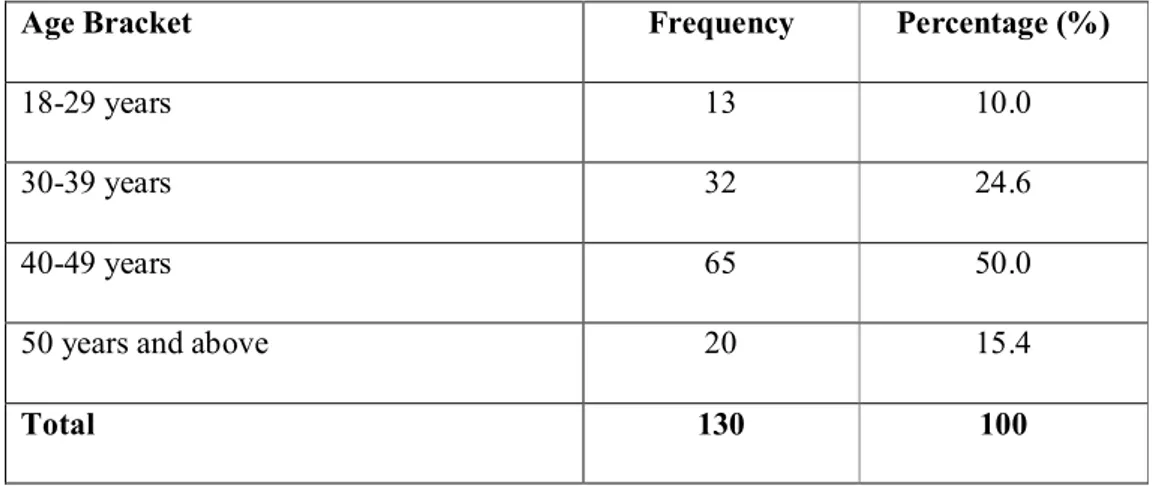

3.7.2.4. Age of Respondents ... 67

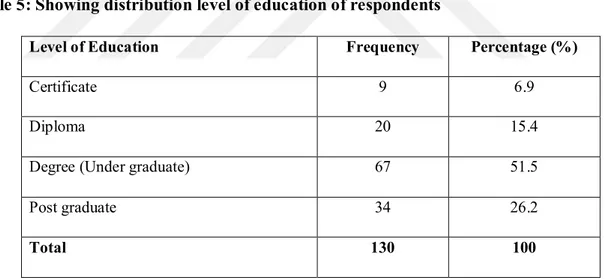

3.7.2.5. Level of Education of Respondents ... 68

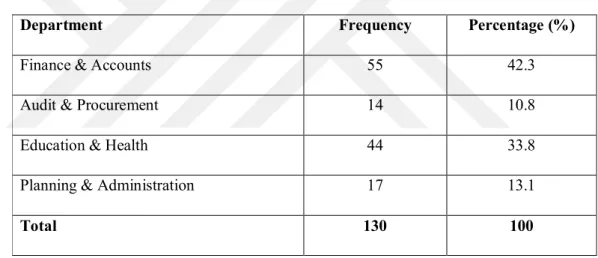

3.7.2.6. Department of Respondents ... 69

3.7.2.7. Experience (Number of years worked) in the Department of Respondents 70 3.7.2.8. Frequency of IFMIS Use ... 70

3.7.2.9. Responses on the effect of an IFMIS Implementation Strategy on Financial Statements in Public sector entities ... 71

3.7.2.10. Responses on the effect of IFMIS Human Resource Capacity on Financial Statements in Public sector entities ... 73

3.7.2.11. Responses on the effect of IFMIS technology on Financial Statements in Public sector entities ... 75

3.7.2.12. Responses on the effect of IFMIS Transaction Processing on Financial Statements in Public Sector entities... 77

3.7.2.13. Responses on the effect of IFMIS Legal Framework on Financial Statements in Public Sector entities ... 80

3.7.2.14. Responses on the Qualitative characteristics on Financial Statements Preparation in Public sector entities ... 82

xi

3.7.2.14.1. Pearson Correlation Coefficient (r) ... 85

3.7.2.14.2. Regression Analysis ... 87

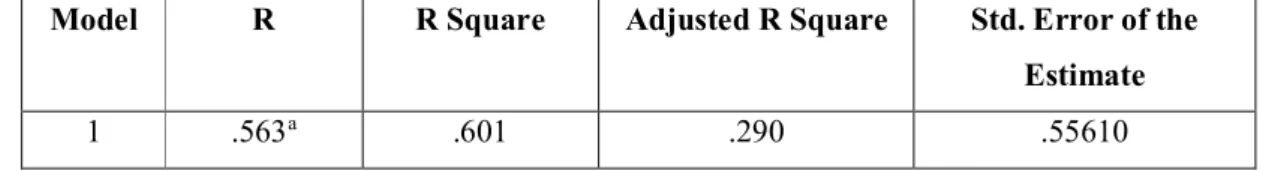

3.7.2.14.2.1. Model Summary Regression Analysis of the study ... 87

3.7.2.14.2.2. ANOVA Analysis of the study ... 88

3.7.2.14.2.3. A multiple Regression analysis of the study ... 88

3.8. Discussions, Conclusions and Recommendations of the Study ... 90

3.8.1. Summary of the Study ... 90

3.8.2. Discussions of the hypotheses of the study ... 91

3.8.3. Conclusions of the study ... 96

3.8.4. Recommendations of the study ... 98

3.8.5. Recommendation for further studies ... 100

REFERENCES ... 101

Appendix 1: Statement of Financial Performance (Extract) ... 107

Appendix 2: Statement of Financial Position (Extract) ... 109

Appendix 3: Statement of Changes in Equity/ Net worth (Extract) ... 110

Appendix 4: Cash Flow Statement (Extract) ... 111

Appendix 5: Acceptance Letter ... 113

Appendix 5: Questionnaire of the Study ... 114

xii

LIST OF TABLES AND FIGURES

Figure 1: The Conceptual Framework of Financial Accounting………...…………...5

Figure 2: Classification of the Qualitative Characteristics of Useful Financial Information………...16

Table 1: Showing the Reliability test (Cronbach’s Alpha coefficient) for all the variables under study...64

Table 2: Showing Response Rate of Respondents...66

Table 3: Showing the Gender Composition of Respondents...67

Table 4: Showing the Age distribution of respondents...67

Table 5: Showing the Distribution level of education of respondents...68

Table 6: Showing the Department distribution of respondents...69

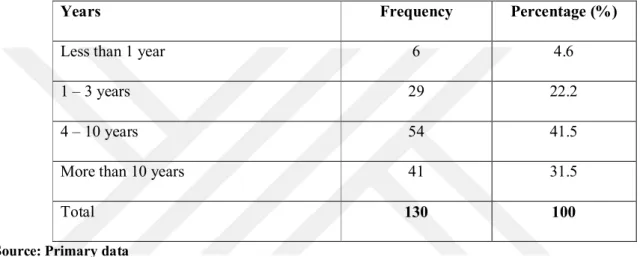

Table 7: Showing the Experience (number of years worked) of respondents in the department...70

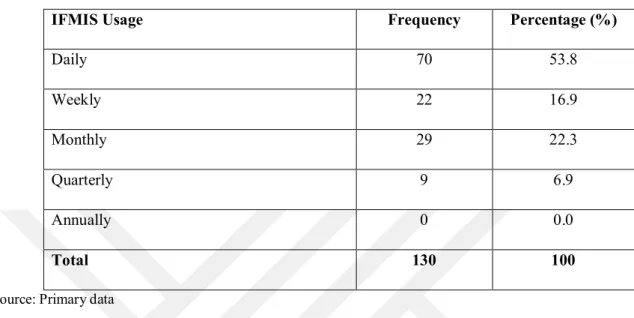

Table 8: Showing the IFMIS usage of respondents...71

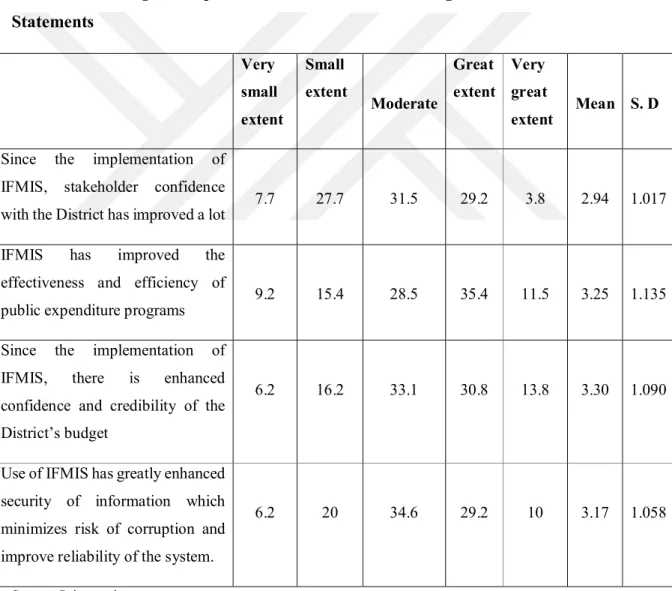

Table 9: Showing the Responses on the effect of an IFMIS Implementation Strategy on Financial Statements...72

Table 10: Showing the Responses on the effect of IFMIS Human Resource Capacity on Financial Statements...74

Table 11: Showing the Responses on the effect of IFMIS technology on Financial Statements in Public sector entities...76

Table 12: Showing the Responses on the effect of IFMIS Transaction Processing on Financial Statements...78

xiii

Table 13: Showing the Responses on the effect of IFMIS Legal Framework on Financial

Statements...80

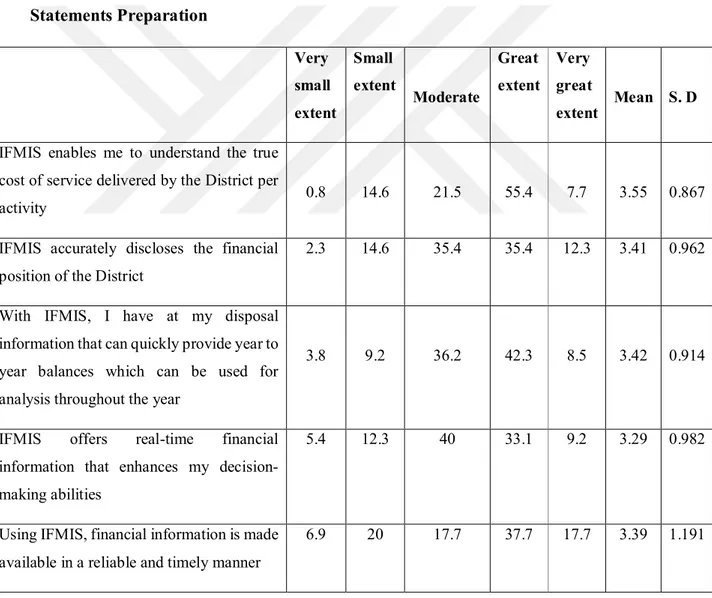

Table 14: Showing the Responses on the Qualitative characteristics on Financial StatementsPreparation...82

Table 15: Showing the Pearson Correlation Coefficient (r) Analysis of the study...86

Table 16: Showing the Model Summary Regression Analysis of the study...87

Table 17: Showing the ANOVA Analysis of the study...88

xiv

LIST OF ABBREVIATIONS

AIS: Accounting Information Systems

ASSADPAM: Association of Southern African Schools and Departments of Public Administration and Management

FMIS: Financial Management Information System IAS: International Accounting Standards

IASB: International Accounting Standards Board IFAC: The International Federation of Accountants

IFMIS: Integrated Financial Management Information System IFRS: International Financial Reporting Standards

IPPS: Integrated Personnel and Payroll Management system IPSAS: International Public Sector Accounting Standards IPSASB: International Public Sector Accounting Standards Board MFPED: Ministry of Finance, Planning and Economic Development OBT: The Output Based Tool

PKF: Pannell Kerr Forster S.D: Standard Deviation

SPSS: Statistical Package for Social Sciences TPS: Transaction Processing System

1 INTRODUCTION OF THE STUDY

Integrated Financial Management Information Systems (IFMIS) is a set of computer programs, databases, processes and procedures that assist in the daily operations of originating, receiving, recording, processing transactions related to budget authority, requests for financial resources, loan and grants, payment of bills, assessments of taxes, duties and other levies, recording receipts and managing deposits in government bank accounts so as to enable planning, preparation and approval budgets, approval of payments, monitoring and reporting on the financial resources collected, available and expended (Hashim, 2014: 1). Additionally, IFMIS is a computerized reporting system that is being used by governments and other entities to handle both the financial and non-financial management functions into a one set of applications that is helping in initiating, spending and monitoring of budgets, processing of payments, managing and reporting on financial activities (Munyambonera & Lwanga, 2015: 11).

In Uganda, the Integrated Financial Management Information System (IFMIS) was officially introduced in 2003/4 financial year as a result of the various Public Financial Management Reforms (PFMR) which were initiated by government to improve fiscal management in order to achieve more timely, and accurate information for both local and central government, to ensure transparency and accountability in the handling and use of public resources, to strengthen the Government Financial Management Processes and provide better expenditure controls, to enhance operational effectiveness by improving quality of data and making it available for use and sharing by all the IFMIS stakeholders, to standardize and automate government financial management processes to reduce redundant and unnecessary tasks and activities so as to maximize the cost effectiveness of the expenditure of public funds and finally to improve revenue management through the use of the revenue management module (MFPED, 2015: 1-2).

Before the introduction of IFMIS, the country was using Financial Management Systems which were characterized with largely manually managed data, no uniform chart of accounts, inaccurate and unreconciled financial statements, and backlogs of unaudited financial records (MFPED, 2015: 1-2). It is approximately 14 years since system introduction

2 and the IFMIS modules currently in operation include: the General ledger module, Budget Accounting module, Receivables module, Purchasing module, Payables module, Cash management module and the Fixed Asset Management module (Munyambonera & Lwanga, 2015: 11-12). The reports that are being generated by the IFMIS modules include: the bank reconciliation statements, financial statements, trial balances, imprest registers, asset registers, and monthly returns among others (Omondi, Amuhaya, & Kibet, 2016: 87).

Although the system has registered a lot of improvements compared to the previous financial accounting systems, there are still gaps in the budget planning and procurement processes, issues of transparency and accountability, corruption scandals, and poor quality of financial reports presented by many government sector entities. A case in point is Kamuli district where district budgeted for Local revenue collections of UGX. 1,073,600,000. However, only UGX. 182,574,052 that is to say 18% of the budgeted amount was realized resulting in a shortfall of UGX. 891,025,948 an equivalent of 82% under performance (Auditor General, 2016: 6). This was supplemented with UGX. 6,631,109 salary overpayment that was revealed by IFMIS during the annual audits Year ended 30th June 2016 (Auditor General, 2016: 14). All this have made the processes of inspection, auditing, financial reporting, budgeting, transparency and compliance with the required International Accounting Standards (IAS) and International Public Sector Accounting Standards (IPSAS) too difficult as there are no proper and timely financial and non-financial records on which to base and prepare a set of financial statement that can be audited by the Auditor General at the end of each financial year (MFPED, 2015: 1-2). It is on this basis that the researcher has come out to find out whether the introduction of an Integrated Financial Management Information System (IFMIS) has an effect on the quality of financial statements prepared and presented by Kamuli distrıct.

3 CHAPTER ONE: FINANCIAL STATEMENTS

In this chapter, the researcher discussed in details the definitions of (Financial Accounting, the Conceptual Framework of Financial Accounting and Financial Statements), Purpose of Financial Statements, Assumptions of Financial Statements, Components of Financial Statements, Qualitative Characteristics of Useful Financial Information and the effect of an Integrated Financial Information Management Systems (IFMIS) on the Quality of Financial statements.

1.1. Definitions

In this chapter, the researcher discussed in details the definitions of Financial Accounting, the Conceptual Framework of Financial Accounting and Financial Statements as defined by different authors and researchers.

1.1.1. Financial Accounting

Financial accounting is the process of identifying, measuring and communicating economic information to others so that they are able to make informed decisions (Donald, Weygandt, & Warfield, 2016: 4). Similarly, Financial accounting is a process that involves preparation, reporting, and interpretation of financial and non-financial information that can be used by both internal and external users to make informed decisions (Horngren et al., 2012: 2). The financial and non-financial information should aid users in the interpretation of the past and current performance of the entity in order to forecast the future performance before making any decisions about the entity (Stice, James, & Skousen, 2010: 8-9). For financial accounting information to be useful to users, it must be prepared in accordance to the International Accounting Standards (IAS) for private entities and International Public Sector Accounting Standards (IPSAS) for public sector entities with guidance of the conceptual framework.

4 1.1.2. Government (Public) Accounting

Public Accounting is a specialty that deals with collection, recording, classification and reporting functions for public institutions (Dağ, 2015: 19). In addition, Government Accounting is process of sorting, analyzing and recording meaningful and credible information for the concerned individuals and organizations about accounting business activities which wholly or partly carry financial qualities (Karaarslan, 2005: 1). The general purpose of Government Accounting is revealing the cost of the services it performs so as to create a basis for analysis of their effectiveness and efficiency, the changes in revenue and expenses within the state administration and institutions as accounted for and reported in accordance with the International Public Sector Accounting Standards (Dağ, 2015: 25). Government accounting system uses Cash Based Accounting, Accrual Based Accounting, Modified Cash Based Accounting and Modified Accrual Based Government Accounting methods. For the case of Uganda entities, she is using Modified Cash Based Accounting.

1.1.3. The Conceptual Framework of Financial Accounting

The Conceptual Framework is a set of objectives and fundamentals that are used in the establishment of concepts that underlie financial reporting (IPSASB, 2013: 7). The Conceptual Framework entails the objectives of financial reporting, the elements of financial statements, the Qualitative Characteristics of Useful Financial Information, the recognition and measurement requirements of the elements and lastly, the concept of capital and capital maintenance (Donald et al., 2016: 44). The Conceptual Framework assists the Accounting boards in the development of future Public Sector Accounting Standards on revision of the existing standards, helps the accounting boards in harmonization of Public Sector Accounting Standards across the globe, assists preparers of Financial Statements in applying the Public Sector Accounting Standards and helps users of Financial Statements to interpret the financial and non- financial information contained in the Public Sector Financial Statements prepared in accordance to the International Public Sector Accounting Standards (IPSASB, 2013: 9-10). The Conceptual Framework of Financial Accounting can be summarized as follows

5 Figure 1: The Conceptual Framework of Financial Accounting

Source: (Donald et al., 2016: 40).

According to the figure above, the Conceptual Framework of Financial Accounting is divided into three levels that includes: the first level, second level and third level (Donald et al., 2016: 40). The first level is a level that identifies the objective of financial reporting, the second level of explains the qualitative characteristics of useful financial reporting and the elements of financial statements (Donald et al., 2016: 41). Finally, the third level of the framework discusses the recognition, measurement and disclosure concepts used in the formulation and application of accounting standards for both the private and public sector entities. The third level also discusses the assumptions, principles, and a cost constraint concepts that are used while formulation and application of accounting standards in both sectors (Donald et al., 2016: 50).

6 1.1.4. Financial Reporting

Financial Reporting is the process of communicating financial information that is accurate, transparent, consistent, reliable and relevant within time bound to decision-makers. It provides information useful for making investment decisions. Its disclosure provides both quantitative and qualitative information for its user’s effective use and reliable decisions. In other words, it presents information in a way that can be understood by users. In other words, financial reporting effectiveness is viewed as the communication of relevant financial information to decision- makers (Maidoki, 2013: 69-71).

1.1.5. Financial Statements

The International Accounting Standards Board (IASB) and the International Public Sector Accounting Standards Board (IPSASB) puts it clear that financial statements are means through which an entity can communicate its financial and non-financial information to its stakeholders for example the employees (in the various Ministries, Departments, Agencies and Local government councils), taxpayers, members of the legislature, creditors, suppliers, the media and International Governmental Organizations (IFAC, 2014: 27). Financial reports are means through which an entity can communicate all the information about its past and present resources, obligations and performances clearly highlighting the strengths and weakness of an organization throughout the financial year (Maidoki, 2013: 70).

1.2. Purpose of Financial Statements

The main purpose of Financial Statements is to provide information about the financial position and performance of the entity (PKF, 2017: 28). The provision of this financial statements enables users to obtain information about the sources of the entity’s funds, and resource allocations, helps users to know how the entity is financing its activities and to determine whether the entity has the ability to finance its activities to meet its liabilities and commitments (Obaidat, 2007: 26). This all will enable users to make informed decisions (Maidoki, 2013: 71). Financial Statements also provide information about the entity’s changes in Net Assets or Equity, liquidity and solvency position of the entity, this enrich

7 users with more information that can be used for comparison purposes of the entity to other entities in relation to accountability, provision of goods and service delivery (IFAC, 2014: 142).

In a researcher that was carried out to examine the effect of financial statements in investment decision making by commercial banks using Bank of Kigali as the case study on a target population of 150 and sample size of 110 respondents. The study revealed through use of financial statements that were provided by Bank of Kigali, 82% of the investment decisions that were made were based on financial statements analysis as indicated in the measure of association. Financial statements analysis was carried out on Financial Statements using the gearing ratios, liquidity ratios, cost analysis ratios and profitability ratios as these are fundamental in determining the entity’s performance (Mukarushema, Kule, & Mbabazi, 2016: 279). In another study by Maidoki 2013 on evaluation of financial reports being instruments for effective managerial planning and decision-making on the staff of WEMA Bank branches in the Western States of Nigeria. It was concluded that financial reporting can be used as a device for disclosure of organization’s financial dealings that may eliminate some problems resulting from inappropriate planning and decisions. Thus, Financial statements enhances transparency and accountability which may help to build public confidence on the entity’s activities (Maidoki, 2013: 73).

1.3. Assumptions of Financial Statements

These are specific rules or guidelines that are being followed in the preparation, presentation, recognition, measurement and disclosure of items in the Financial Statements to ensure information reported is relevant and faithfully presented. These assumptions include: Going Concern assumption, Accrual assumption, Faithful presentation and Compliance assumption, Consistency assumption, Materiality and Aggregation assumption and Offsetting assumption (Atabey, Parlakkaya, & Alagöz, 2015: 32-33).

8 1.3.1. Going Concern Assumption

This is an accounting assumption that assumes that the entity will exist and carry on its operational activities for a foreseeable future so as to meet its objectives and commitments. Thus, based on this assumption, entities prepare and present their financial statements clearly classifying the Revenue, Expenses, Equity, Liabilities and Assets both current and noncurrent. The assumption also allows management to depreciate assets over their expected useful life, recognition of revenue in the period it’s earned and valuation of all assets at their historical cost or expected future cash flows. This does not only provide a true and fair view of financial statements but also provide an assurance to the investors of funds that the entity will continue operations and meet their specific needs and interests (Atabey et al., 2015: 25).

IAS 1 and IPSAS 1 (Presentation of Financial Statements) requires management make an assessment of the entity’s ability to continue as a going concern, the appropriateness and disclose all the significant factors that cast doubt on the going concern assumption upon each preparation of Financial statements (KPMG, 2016: 1). According to the International Standards on Auditing (ISA 570: Going Concern), the significant conditions that cast doubt on the going concern assumption are categorized into financial, operating and other conditions. The financial conditions exist when the entity’s fixed term borrowings are approaching maturity and the entity has no specific repayment plans, there are indictors of withdrawal of financial assistance and aid by investors, the entity is experiencing adverse financial ratios and negative cash flows, inability to pay accumulated creditor dues and arrears of dividends by the entity (IAASB, 2015: 565). Operating conditions exist when management declares the intentions to liquidate the entity, there are key changes in management and staff turnover, emergency of a successful competitor, loss of key market, customers and suppliers of goods and services. However, it is logical and appropriate to assess the going concern of public entities individually rather than the government as a whole because each entity may have its specific going concern conditions. When management assesses and determines that it will be able to continue for a foreseeable future, the Financial Statements of the entity can be prepared and presented using the liquidation method. This approach requires recording, recognition and classification all non-current assets for example Property, Plant and Equipment as currents assets, ceasing of all depreciation expenses and

9 recognition of all non-current assets at their Net Realizable Value (selling price less costs of disposal).

1.3.2. Accrual Assumption

This is an underlying assumption that requires recognition of transactions or items of Assets, Liabilities, Equity, Expenses and Revenue in the financial statement when they satisfy the definition and recognition criteria of those elements in the framework. Therefore, while using the accrual assumption, revenue is recorded in the Financial statements when it is earned and realised not when it is actually received or paid and expenses are recorded when they ae actually incurred. Thus, transactions and other events are recorded and recognized in the Financial statements of the period to which they relate (Atuilik, Babonyire, & Nicholas, 2016: 683). In computation of the surplus or deficit for the year, the assumption requires matching all the revenue earned against the expenditures incurred in earning the revenue. This aid ascertaining the exact costs incurred to earn the surplus or deficit recognized in the financial statements (Weetman, 2011: 8). Application of accrual assumption also allows preparers of financial statements to record all transactions and events both financial and non-financial that relate to that reporting period hence revealing the realistic state of non-financial affairs of the entity that aids in decision making on economic and investment parameters. Although, the assumption is one of the basis for preparation and presentation of elements included in the financial statements, it involves a lot of estimates when determining the amounts recognized for example: depreciation rates of assets, Useful life and salvage value of Assets, Provision for bad debts and the cash flow estimates. These estimates are subjective and may not be reflective of the actual state of financial affairs of the entity that is why some governments are using the Cash basis of Accounting as an alternative to prepare and present their Financial statements (Atuilik et al., 2016: 683).

1.3.3. Faithful presentation and Compliance Assumption

According to IAS or IPSAS, Financial statements are fairly presented when all the transactions, events and other conditions of items of Assets, Liabilities, Expenses and

10 Revenues are faithfully presented and comply with all the required standards. Compliance entails application of all the required accounting standards, policies and disclosures of the items included in the financial statements so as to provide information that is relevant, understandable and comparable. A faithful presentation requires an entity to disclose a statement in the Notes to the Financial statement that the entity has complied with all the required accounting standards, policies and disclosures and incase of any departures from the requirements, the entity discloses the nature, reasons and the effect of the departure on each of the items presented in the Financial statements.

1.3.4. Consistency of Presentation

This refers to the application, presentation, recognition, classification and disclosure of items in the financial statements in a consistent manner from one reporting period to another (Atabey et al., 2015: 27). The conceptual framework requires all entities to apply the same accounting standards and policies from one accounting period to another unless when the change is required by the International Financial Reporting Standards (IFRS) and when the change will provide appropriate information that is more relevant and reliable to the users of financial statements.

1.3.5. Materiality and Aggregation Assumption

All material items are presented separately and disclosed in the financial statements. An item can be material individually or when aggregated with other items of similar nature or function (Atabey et al., 2015: 28). An item is material when its omission or misstatement affects the decision-making processes of the users taken on the basis of the financial statement. Thus, entities should present a summary of transaction and other events which are material aggregating and classifying them according to their nature or function. If an item is not material individually or when aggregated with other similar items, it should be disclosed in the Notes to the financial statements clearly stating the amount, management’s reason as to why the item or items are considered immaterial.

11 1.3.6. Offsetting Assumption

According to International Financial Reporting Standards (IFRS), the entity shall not offset Assets against Liabilities, and Revenues against Expenses while recording, presenting, classifying and recognition them in the Financial statements unless when the offsetting is required and permitted by the same standard or will result into a better presentation of items in the Financial statements. The offsetting assumption lays foundation for the measurement basis and recognition criteria of all the items separately in the financial statements.

1.4. Components of Financial Statements

Examples of Financial Statements prepared and presented by public entities include: Statement of Financial Performance, Statement of Financial Position, Statement of Cash Flows, Statement of Changes in Net Assets or Equity and the Notes to the Financial Statements of an entity (Yalkın, 2012: 51).

1.4.1. Statement of Financial Performance

This is a financial statement that provides information about the entity’s operating revenue, operating expenses and any surplus or deficit for the accounting period (Atabey et al., 2015: 158; Karasioğlu, 2014). IPSAS 9(Revenue from exchange transactions) asserts that revenue is recognized in the Statement of Financial Performance when it is probable that any future economic benefits or service potential associated with the item of revenue will flow to the reporting entity and its benefits can be reliably measured. According to the Conceptual framework 2010, Revenue is recognized in the Statement of Financial Performance when there is an increment in future economic benefits or service potential as a result of increase in Assets or decrease of Liability and the revenue can be reliably measured (IASB, 2010: 35).

The items of operating revenue presented in the financial performance include: The Taxes, Fines, Fees, Penalties & Licenses, Revenue from exchange transaction, transfers from other government entities and other revenue received by the entity (See: Appendix 1). IPSAS

12 9 also asserts that revenue is measured at fair value of the consideration received or receivable (IFAC, 2014: 307).

In relation to operating expenses, it is recognized in the Statement of Financial Performance when it is probable that any future economic benefits or service potential associated with its consumption will result into reduction in assets or increase in liabilities and when the expense can be reliably measured (IASB, 2010: 36). International Public Sector Accounting Standards (IPSAS 1) Presentation of Financial Statements requires a public-sector entity to choose the method of classification of operating expenses (either classification of expenses by nature or classification of expenses by function) in the statement of financial performance. The decision on the classification of expenses to be presented and disclosed in the statement of financial statement depends on the nature of the entity and the regulatory factors. Classification of expenses by nature includes wages, salaries, employee benefits, Grants, depreciation & amortization and other operating expenses. This is different from classification of expenses by function where expenses are classified according to the activity it was incurred and paid for in the entity (See: Appendix 1).

1.4.2. Statement of Financial Position

This is a statement which presents, classifies and summarizes Assets, Liabilities and Equity according to their recognition criteria and measurement requirements (Atabey et al., 2015: 37). It is from this explanation that IASB and IPSASB derives the equation, Assets= Liabilities + Equity (See: Appendix 2). On initial recognition, Assets are debited, Liabilities and Equity are credited in the statement of financial position (Atabey et al., 2015: 150; Yalkın, 2012). The International Federation of Accountants (IFAC), defines assets as resources controlled by an entity as a result of past events and from which future economic benefits or service potential are expected to flow to the entity (PKF, 2017: 65). The IFAC in addition, defines liabilities as present obligations of the entity arising from past events, the settlement of which is expected to result into the outflow from the entity of resources embodying economic benefits or service potential and finally, it defines equity as the residual amount found after deducting all of the entity’s liabilities from all of the entity’s assets (PKF, 2016: 65-66).

13 Both Current and Non-Current Assets are recognized in the statement of financial position when they meet the recognition definition of an element. They are recognized when it is probable that any future economic benefits or service potential associated with the item will flow to the reporting entity and when the cost of the item can be reliably measured (Atabey et al., 2015: 49). The conceptual framework requires presentation and classification of assets in the Statement of Financial Position as either Current or Non-Current Assets. Assets are presented, classified and disclosed as current assets when they are held by the entity in the normal course of business primarily for trade or consumption, its cash or cash equivalent, and are expected to be realized within one year after the reporting date. Assets outside this are classification are Non-Current Assets (Dağ, 2015; Karasioğlu, 2014: 243).

Liabilities are recognized in the statement of financial position when they meet the recognition definition of an element. They are recognized when it is probable that any future economic benefits or service potential associated with the item will flow from the reporting entity and when the cost of the item can be reliably measured. Liabilities are presented, classified and disclosed as current liabilities when they are held and incurred by the entity in the normal course of business and are expected to be settled within one year after the reporting date (Dağ, 2015: 459). Liabilities outside this classification are Non-Current Liabilities (Karasioğlu, 2014: 435).

1.4.3. Statement of Changes in Net Assets or Equity

This provides information about the entity’s changes in Net Assets or Equity clearly presenting in the statement the capital contributions by owners, distributions to owners, revaluation reserve, Reserve transfers, Accumulated surplus or deficits for the accounting period (Dağ, 2015: 650). The contributions by owners and distributions to owners recognized in the Statement of Changes in Net Assets or Equity is only amount that gives rise to residual interest in the entity in the form of rights to Net assets or Equity (PKF, 2016: 95-96).

International Public-Sector Accounting Standards (IPSAS 1) Presentation of Financial Statements requires presentation of accumulated surplus or deficits at the beginning of the accounting period and at the end clearly stating the changes if any and the

14 reconciliations that were made. It also requires making a note of disclosure to the financial statements any changes in the Net assets or Equity during the period, the reasons for the changes and the financial effects of the changes on the entity (IFAC, 2016: 190-192).

1.4.4. Statement of Cash Flows

IAS 7 and IPSAS 2 (Statement of Cash Flows) requires a reporting entity to provide information about the position of cash and cash equivalents at the beginning and at the end of the period, the cash flows from operating activities, investing activities and financing activities clearly stating their net balances (See: Appendix 4). The objectives of preparation and presentation of Statement of Cash Flows are to provide accountability for the resources entrusted to various public sectors clearly illustrating how the entities are raising the cash been required to fund its activities, how the cash was allocated and spent (PKF, 2016: 101). IPSAS 2 (Statement of Cash Flows), also adds that information contained in the Statement of Cash Flows helps users to assess the liquidity and solvency position of an entity, the sources of funds, the activities on which the funds were spent on before making decisions of whether to commit their resources towards financing the entity’s activities (IFAC, 2014: 141).

Operating activities contain cash flows from cash generating activities for example: Cash receipts from (taxes, fines & penalties, grants, transfers, royalties and other revenues), cash payments to suppliers, employees and other operating expenses (Flood, 2017: 71). Investing activities contain cash flows that result into acquisition and disposal of Non-Current Assets and other investments that are excluded from cash equivalents (Flood, 2017: 70). Financing activities contain cash flows that affect the equity structure and borrowing position of the entity for example: Cash proceeds from issuing (debentures, bonds, loans and any other long-term loan) and cash payments for borrowed funds (Flood, 2017: 70).

Statement of Cash Flows are presented either using the direct or indirect method. Under the direct method, the entity uses the gross revenue and payments to obtain the net cash flows from operating activities that is adjusted for all items involving investing and financing activities. Under the indirect method, the entity’s operating net surplus of deficit is

15 adjusted for the effects in non-cash transactions and all items involving investing and financing activities(IFAC, 2014: 148) Although the International Federation of Accountants (IFAC) recommends the direct method because it provides information that can be used to forecast future cash flows, several researches reveal that the indirect method is the most preferred and used method of preparation and presentation of cash flows by both private and public sector entities.

1.4.5. Notes to the Financial Statements of an entity

This presents additional information that enables users to better understand the figures presented in the financial statements. It also provides information that cannot be quantified but useful in the analyzation for example the accounting standards and policies used, reasons for changes in accounting policies and figures presented, reasons for omission of any figure and any other non-financial information that is to say the entity’s Contingent liabilities, future plans and objectives (IFAC, 2014: 110-111).

1.5. Qualitative Characteristics of Useful Financial Information

According to the Conceptual Framework for Financial Reporting 2010, it is through using the qualitative characteristics that an entity is able to provide useful financial and non-financial information about the economic position of the entity which can be used for accountability and decision making (IASB, 2010: 16). The International Accounting Standards Board (IASB) and the International Public-Sector Accounting Standards Board (IPSASB) both agree that the qualitative characteristics that are used while reporting on Financial Statements of private and public-sector entities are categorized into the fundamental and enhancing qualities depending on the extent it affects the usefulness of information (Flood, 2017: 15). Fundamental qualities are relevance and faithful presentation while enhancing qualities are comparability, understandability, verifiability and timeliness (PKF, 2017: 29-30). Even though the conceptual framework for Public sector entities requires application and integration of all the qualitative characteristics, it is usually hard for entities to provide a balance among all these qualities. Thus, to keep a balance and integration

16 between these qualitative characteristics, the materiality and cost benefit principles are applied (IFAC, 2014: 57-59). The classification of the Qualitative Characteristics of Useful Financial Information can be summarized as in the figure below:

Figure 2: Classification of the Qualitative Characteristics of Useful Financial Information

Source: (Flood, 2017: 15).

As illustrated in Figure 2 above, according to (Flood, 2017: 15), the Qualitative Characteristics of Useful Financial Information are classified into the Fundamental and the Enhancing Qualitative Characteristics. The fundamental qualitative characteristics are further sub divided into two for example; relevance and faithful presentation qualities. This also applies to the enhancing qualitative characteristics that are sub divided into four for example; comparability, verifiability, understandability and timeliness (Donald et al., 2016: 42-45).

17 1.5.1. Fundamental Qualitative Characteristics

Fundamental Qualitative Characteristics are qualitative characteristics that increases the usefulness of information prepared and presented in the financial statements for financial reporting. These include relevance and faithful presentation qualities (See Figure 2).

1.5.1.1. Relevance

The objective of financial reporting is to provide financial and non-financial information which is relevant for decision making (IPSASB, 2013: 26). This fundamental qualitative characteristic asserts that for information to be relevant in decision making, it must be predictive, confirmatory in valve or both (IFAC, 2014: 51-52). Financial and non-financial information is predictive if it allows users to compare its past, current and future trends so as to make informed decision about the entity. On the other hand, financial information is confirmatory, if it can be traced from the past to the present expectations. The preparers of financial statements are required to use both the predictive and confirmatory processes to obtain information that is material for decision making (Flood, 2017: 16). Information on financial position and performance is often used to predict future position, performance and other events of interest to the users for example the likely dividend to be paid or declared by the entity, opportunities of wage rise on the side of the employees. However, for information to be relevant in decision making, it must have the materiality concept in addition to a predictive valve and confirmatory valve. Thus, information is irrelevant if it’s incapable of influencing the decision of the users of financial statements (Donald et al., 2016: 42).

1.5.1.2. Faithful presentation

The Conceptual Framework for General Purpose Financial Reporting by Public Sector Entities (Final Pronouncement), states that financial statement information is faithfully presented when it depicts the concept of completeness, neutrality and free from material errors (IPSASB, 2013: 27). Financial statement information is complete when all the information required to be described about a specific event is presented. In addition,

18 financial statement information is neutral when it is prepared and presented not to target a specific user group but for the interest of all the financial statement stakeholders (Flood, 2017: 16). In the same manner, financial information is free from errors when individually or in aggregation with other related information, the omitted or misstated information does not influence the decision of the users (IPSASB, 2013: 27-28). However, both the International Accounting Standards Board (IASB) and the International Public Sector Accounting Standards Board (IPSASB) does not clearly pronounce itself in the conceptual framework on the determination of materiality concept thus leaving gaps in the determination of the materiality threshold of an item, this poses a challenge to the relevance and faithfully presentation qualities in many entities as materiality levels differ from entity to entity and what is material in one reporting entity individually maybe immaterial in another reporting entity in the same sector (IPSASB, 2013: 30-31).

1.5.2. Enhancing Qualitative Characteristics

These are qualitative characteristics that complement and assist users to differentiate between more meaningful and less meaningful financial statement information. This enhancing qualitative characteristics include: Comparability, Verifiability, Timeliness and Understandability (Donald et al., 2016: 46-48; IASB, 2010).

1.5.2.1. Comparability

IAS 1 and IPSAS 1 (Presentation of Financial Statements) asserts that one of the main objective of preparation and presentation of financial statements is to enable comparability of information within the entity, with other entities within the same sector or outside (PKF, 2017: 46). Financial statement information is comparable when the users are able to make similarities and differentiation between the presented events within entity, from entity to entity or sector to sector. To achieve comparability, the concepts of consistency and uniformity are applied especially during the process of recognition, measurement and disclosure of financial statements (PKF, 2016: 29). However, consistency only does not result into automatic comparability of financial information, for financial information to be

19 comparable, it must be prepared in relation to all the qualitative characteristics of useful financial information (Flood, 2017: 17).

1.5.2.2. Verifiability

Verifiability is obtained when different preparers and users of financial statements for example auditors are able to apply similar recognition and measurement methods of accounting to arrive at similar results and conclusions on a specific event. This is obtained by using direct verification, indirect verification or both on the information at hand (Donald et al., 2016: 47).

Direct verification is mostly used by preparers of financial information to minimize measurer and measurement bias. However, the verifiability qualitative characteristic does not guarantee that the financial information is relevant or faithfully presented, it is use on conjunction with other qualitative characteristics (Flood, 2017: 17).

1.5.2.3. Understandability

This enhancing qualitative characteristic entails recognition, classification, disclosing and presentation of financial and non-financial information in the financial statements in a manner that is clear and concise so that users are able to make their own interpretation and conclusions on a given item (Flood, 2017: 17). However, accounting information should not be excluded from the financial statements in pretense that it is too complex or difficult to some users to understand. This is because users of accounting information are expected to have a reasonable knowledge about the entity’s activities and the environment in which the entity operates (PKF, 2017: 30).

1.5.2.4. Timeliness

According to the Conceptual Framework for Financial Reporting 2010, timeliness is an enhancing qualitative characteristic that requires availing information about the financial statements at the right time so that users are able to make decision before the information

20 loses the capacity to influence their decisions. This is more applicable to prospective financial and non-financial information (IASB, 2010: 21).

Although, financial statement information aid in decision making both internally and externally, provision of this information comes with a cost. Incorporating all the qualitative characteristics into one set of financial statements comes with costs of collecting, processing, analyzing, presentation and dissemination of the information. This costs impact on the limited resources that are available and sometimes necessitate redirecting resources that would have been used to efficiently and effectively strengthen service delivery in the other public-sector entities.

Finally, qualitative characteristics work together to provide meaningful information. For information to be relevant, it must be faithfully prepared and presented on time and understandable by users. However, in practice it is challenging to provide a balance among the qualitative characteristics thus the entity must ensure this constraint is addressed.

21 CHAPTER TWO: INTEGRATED FINANCIAL MANAGEMENT INFORMATION

SYSTEM (IFMIS).

This chapter seeks to cover the definitions is of an Information System (IS), Accounting Information Systems (AIS), Accounting Information System (AIS) used in Uganda, Integrated Financial Management Information System (IFMIS), Objectives of an IFMIS, Implementation process (Strategy) of an IFMIS, Factors affecting the effective and efficient implementation of an IFMIS, Benefits of Implementation of an IFMIS and Challenges of Implementing of an IFMIS.

2.1. Definitions

This sub section entails the definitions of an Information system (IS) and an Accounting Information System (AIS) as defined by different scholars and authors.

2.1.2. Accounting Information Systems (AIS)

An Accounting Information System (AIS) is an information system for collecting, storing and processing of both financial and financial data in to financial and non-financial information that is used by decision makers (James, 2011: 4). In addition, it is put clear that Accounting Information System (AIS) is a collection of people, equipment that are well designed to transform financial and other data into information that has to be communicated to a variety of users for decision making (Drury, 2013). Companies and entities can benefit from the era of globalization if its accounting information system (AIS) is developed and secure (Nzomo, 2013: 2).

An Accounting Information System (AIS) consists of Transaction Processing System (TPS), Financial Reporting System (FRS) and Management Reporting System (MRS). The Transaction Processing System (TPS) is an Accounting Information System that process data into information that can be used by other Accounting Information Systems to support the daily activities of the entity. Financial Reporting System (FRS) is an Accounting Information System that processes information generated by the Transaction Processing System into

22 Financial and non-financial reports such as Financial Statements, Tax Returns and other legal documents that may be used for decision making. Management Reporting System (MRS) is an Accounting Information System which helps to process Financial and non-financial data into financial reports (Budgets, Variance reports, Cost Volume-profit Analysis) which are used by the entity in the day to day operations (James, 2011: 9-10).

The main objective of an Accounting Information System (AIS) is to provide quality and timely financial and non-financial information about government entities’ Financial Performance and Financial Position to stakeholders which information acts as a basis for decision making. This is evidenced from the research carried out on construction companies in Ibanda in Nigeria to find out the effect of Accounting Information System on Organizational effectiveness (Onaolapo & T, 2012: 183-189). Based on the findings from the survey, it was concluded that Quality financial reports produced as a result of use of Accounting Information System lead to better decision making thus improving Organizational effectiveness. In another research of (Daw and Teru), it was concluded that the use of Accounting Information System helped management in making quick management decisions based on the quality of financial reports and improved internal controls that were as a result of use of the Accounting Information System (Daw & Susan, 2015: 976-984). However, for an Accounting Information System to be effective and efficient, all its data production processes, data storage devices and other internal controls should be sound because the output of the Accounting Information System depends on the quality of data (XU, 2009: 1-11).

2.1.3. Public Financial Management

Public financial management involves the planning and management of financial resources with the objective of improving income distribution, resource allocations and value for money. The spending portion covers the budget cycle, budget preparation, internal controls, internal and external auditing, procurement, monitoring and supervision of financial reporting (Mburu & Ngahu, 2016: 779). A strong Public Financial Management system ensures that the government thorough its various agencies, departments, ministries and authorities raise, manage, and spend public resources in an efficient, effective and transparent

23 manner with the aim of improving accountability and service delivery (Odolo & Gekara, 2015: 17).

2.2. Accounting Information Systems (AIS) used in Uganda

In Uganda, Accounting Information Systems are being used both in government and private sectors to collect, analyse, process, summarise and to store financial and non-financial information. However, the following are some of the major Accounting Information Systems used by government entities in Uganda:

2.2.1. Treasury Single Account (TSA)

Treasury Single Account (TSA) is a bank account or a set of linked accounts through which the Government transacts all its Receipts and Payments. The Treasury Single Account (TSA) was officially introduced in 2013by the Ministry of Finance, Planning and Economic Development (MFPED) so as to consolidate all the accounts that were running in Bank of Uganda and all other Commercial Banks into one account that could be easily managed, monitored and controlled by MFPED. Also, it was to ensure unification of Government banking and traceability of all fund transfers, improve the day to day cash and debt management and to eliminate to longtime problem of cash rationing (Munyambonera & Lwanga, 2015: 7-10).

Since the introduction of Treasury Single Account (TSA), there have been improvements in cash management as all the funds are managed and monitored on a consolidated account, better utilization of the idle funds that were scattered in the various account in ministries, departments and agencies (MDAs) and finally reduction in transaction costs (Bank charges, interests on delayed payments) that were as a result of the many bank accounts that held in various Financial Institutions (Muhakanizi, 2014: 5).

24 2.2.2. Integrated Personnel and Payroll Management system (IPPS)

This was an integrated information system that was officially introduced in 2011to improve the payroll and pension management, strengthen accountability of Public funds, reduce on paper and standardize the human resource process from recruitment to separation in Ministries, Department and Agencies (MDAs). Before the introduction of Integrated Personnel and Payroll Management system (IPPS), the payroll systems in Ministries, Department and Agencies (MDAs) was composed of errors and omissions of staff on the payroll, delays in salary approvals and ghost staff on the payroll. Although, the introduction of IPPS encountered many challenges especially during the interface period with IFMIS. These included limited number of staff to help in the process of entering and transferring data from the old system to IFMIS, checking and verifying the data transferred, and system delays a result of data overload and approval controls needed before the data would be uploaded into the new system. All these created inefficiencies and delays in the provision of financial reports to be used by decision makers (Munyambonera & Lwanga, 2015: 19-21).

2.2.3. Wage Bill and Payroll Management System

This is a decentralized Wage Bill and Payroll Management System that was officially introduced in 2014 by Government to address the challenges of inaccuracies in the payroll system, salary payment delays of staff, incorrect bank accounts of staff, ghost workers on payroll of the Ministries, Department and Agencies (MDAs). The Wage Bill and Payroll Management System has helped to eliminate ghost workers as the system has eased the monitoring and confirmation of the number of workers on the payroll by printing and displaying staff names with their respective salaries on Public notice boards in their respective offices. In an audit report between July to September 2014, of the Audit General indicated that the Government saved over 100 billion as a result of cleaning and verification of the Wage Bill and Payroll Management System. The introduction of the system also reduced the payment time of workers’ salaries and improved management of salary arrears through decentralization of authority and responsibility to the Accounting Officers who can authorize payment of missed salaries and arrears (Munyambonera & Lwanga, 2015: 14). As any other system, the system is facing challenges especially the implementation method used.