T.C.

ANKARA YILDIRIM BEYAZIT UNIVERSITY

SOCIAL SCIENCES INSTITUTE

THE INFLUENCE OF POLITICAL TIES ON FIRM

OUTCOMES UNDER POLITICAL HAZARD CONDITIONS:

A LONGITUDINAL RESEARCH ON TURKISH

ELECTRICITY INDUSTRY BETWEEN 2004 AND 2015

PhD DISSERTATION

Nazlı Berberoğlu Yılmaz

MANAGEMENT AND ORGANIZATION PhD PROGRAMME

ii

T.C.

ANKARA YILDIRIM BEYAZIT UNIVERSTY

SOCIAL SCIENCES INSTITUTE

THE INFLUENCE OF POLITICAL TIES ON FIRM

OUTCOMES UNDER POLITICAL HAZARD CONDITIONS:

A LONGITUDINAL RESEARCH ON TURKISH

ELECTRICITY INDUSTRY BETWEEN 2004 AND 2015

PhD DISSERTATION

Nazlı BERBEROĞLU YILMAZ

MANAGEMENT AND ORGANIZATION PhD PROGRAMME

Tez Danışmanı: Prof. Dr. Şükrü ÖZEN

Ankara, 2019

This study is supported by the Scientific and Technological Research Council of Turkey (TÜBİTAK) 2214 International Research Scholarship Programme.

iv

DECLARATION

I declare that this thesis is my own work, that I have no unethical behaviour in violation of patents and copyrights at all stages from the planning to writing of the thesis, that I have obtained all the information in this thesis within the academic and ethical rules and that I have cited all the information and interpretations used in this thesis.

Date (16.12.2019)

v

ACKNOWLEGMENT

Firstly, I would like to express my sincerest gratitude to Prof. Dr. Şükrü ÖZEN to whom teach me not only how to create the theoretical construction of this thesis, but also the everything I know about how to be a scientist. With his illuminating point of view, he was my guide in this long path and taught me how to ask the right questions. He showed me to evaluate the knowledge and to look further, which I think is the most important feature of an academician. I would always be happy to meet him and find an opportunity to study with him.

I especially would like to thank Prof. Dr. Çetin ÖNDER and Prof. Dr. Kerim ÖZCAN for their precious contributions to this study. Their guidance helped me to see the points that have the potential to upgrade the study.

I really appreciate Prof. Dr. Tazeeb RAJWANI not only allocating his time during my visit to the University of Essex Business School, but also his contributions to this study that guided me to think deeper.

In particular, I would like to thank Olgun SAKARYA from the Union of Turkish Engineers and Architects. I am gratefully indebted to his very valuable supports and his endless knowledge about the Turkish electricity industry that shed light on this thesis.

I think it is essential that I thank my workmates Assist. Prof. Dr. İklim GEDİK BALAY, Assist. Prof. Dr. BİLGE CANBALOĞLU, Assist. Prof. Dr. Murat ULUBAY, Melek MUTİOĞLU ÖZKESEN, and Ayyüce MEMİŞ. They are not only my colleagues but also friends who don’t spare their advice, contributions, technical knowledge, and endless patience from me especially at the hard times when I was writing this thesis.

I must express my very profound gratitude to my mom and dad for their precious teachings. They taught me to be determined and to fight against difficulties for the things that I believe in. And I owe special thanks to my sister for sharing her love with me every time I feel desperate.

My acknowledgements would not be complete without thanking my dear husband. He motivated me in the darkest moments. I feel myself stronger with his love and existence.

i ABSTRACT

The Influence of Political Ties on Firm Outcomes Under Political Hazard Conditions: A Longitudinal Research on Turkish Electricity Industry Between 2004

and 2015

Corporate Political Ties (CPTs) play a key role in firms as their non-market activity. Thus, the corporate political tie has received considerable attention in recent years. In these studies, the political connections of firms are classified as formal and informal connections. This classification, on the other hand, based on the economic developmental level of the countries in general. Accordingly, while formal connections prevail in the developed countries, informal connections are typical for the developing countries in which crony capitalism is dominant. However, this economic-based view oversimplifies the nature of CPTs. On the other hand, a growing body of evidence suggests positive, negative and mixed values of the CPTs for the firms. In general, it has been showed that CPTs' positive effects on firm outcomes may change into negative in regard to contextual, organizational or market factors. These studies are generally conducted in the countries which experience a transition in the economy or an unexpected change in the political actors. However, no known empirical research has focused on the impact of ties on firm outcomes in a context in which the change in the political environment occurs incrementally.

The principal objective of this project, therefore, to investigate the nature of political connections from a macro institutional perspective and the CPT-firm outcome relation in a political environment where the change occurs gradually.

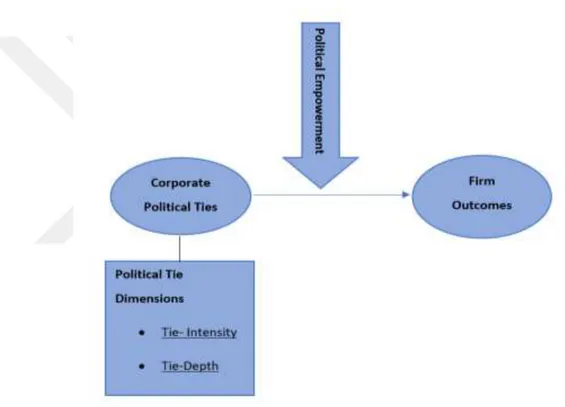

This study provides a novel approach to explore the context-specific nature of CPTs by considering the macro determinants in the Turkish electricity sector between 2004-2015. Relatedly, the results show that within a state-dependent framework CPTs have two structural dimensions namely tie-intensity and tie-depth. The principal finding of this research is that, while tie-intensity have a positive effect on firm outcomes, its impact turns into negative with the empowerment of the ruling party. Furthermore, tie- depth’s impact is positive when the ruling party increases its political power, otherwise, it doesn’t have a significant effect on firm outcomes. The present results support the mixed value of CPTs with its contribution that, this contingency not only depends on the radical changes of

ii

political environment or transitions in the economy but also on the incremental changes in the environment. Furthermore, it has been shown that the dimensional structure of CPT also influential on the mixed value of CPTs.

Key words: non-market activities, corporate political ties, national business system, state-dependent business system

iii ÖZET

Siyasi Bağların Siyasi Risk Koşullarında Firma Sonuçlarına Etkisi: 2004-2015 Yılları Arasında Türkiye Elektrik Sektörü Üzerine Boylamsal Bir Araştırma

Kurumsal Siyasi Bağlar (KSB), firmaların piyasa dışı faaliyetleri olarak çıktıları üzerinde önemli bir rol oynamaktadır. Bu nedenle, son yıllarda büyük ilgi görmektedirler. İlgili çalışmalarda firmaların siyasi bağlantıları resmi/biçimsel ve resmi olmayan/kişisel bağlantılar olarak sınıflandırılmıştır. Bu sınıflandırma ise genel olarak ülkelerin ekonomik kalkınma düzeylerine dayanmaktadır. Buna göre, gelişmiş ülkelerde biçimsel bağlantılar hâkim olmakla birlikte, resmi olmayan bağlantılar, eş-dost kapitalizminin hâkim olduğu gelişmekte olan ülkeler için tipiktir. Ancak, bu ekonomik temelli görüş KSB’lerin doğasını gereğinden fazla basitleştirmektedir. Öte yandan, giderek artan sayıda çalışma firmalar için KSB'lerin pozitif, negatif ve karma etkilerini ortaya koymaktadır. Genel olarak, KSB'lerin firma sonuçları üzerindeki olumlu etkilerinin bağlamsal, örgütsel veya piyasa faktörlere bağlı olarak olumsuza dönebileceği gösterilmiştir. Bu çalışmalar genellikle ekonomik geçiş veya siyasi ortamda beklenmedik bir değişim yaşandığı dönemlerde yapılmıştır. Bununla birlikte, bilinen hiçbir ampirik araştırma, siyasi ortamdaki değişimin aşamalı olarak gerçekleştiği bir bağlamda bağların firma sonuçları üzerindeki etkisine odaklanmamıştır.

Bu nedenle, bu tezin temel amacı, politik bağlantıların ulusal iş sistemi perspektifinden ve, KSB-firma çıktısı ilişkisini ise değişimin aşamalı olarak gerçekleştiği bir siyasi ortamda incelemektir.

Bu çalışmada, KSB’lerin doğası ve firma çıktıları üzerindeki etkileri yeni bir metodolojik yaklaşımla 2004-2015 yılları arasında Türkiye elektrik sektöründe incelenmiştir. Sonuçlar bağlama özgü iş sistemine bağlı olarak siyasi bağların bağ yoğunluğu ve bağ derinliği olmak üzere iki yapısal boyuta sahip olduğunu göstermektedir. Bu araştırmanın temel bulgusu, bağ yoğunluğunun firma sonuçları üzerinde olumlu bir etkiye sahip olmasına rağmen, iktidar partisinin güçlenmesiyle etkisinin olumsuza dönüşmesidir. Ayrıca, iktidar partisi siyasi gücünü artırdığında bağ derinliğinin etkisi olumlu iken, aksi durumda firma çıktıları üzerinde anlamlı bir etkisinin olmadığı görülmüştür. Mevcut sonuçlar, KSB’lerin değişken etkisinin sadece siyasi ortamdaki radikal değişikliklere veya ekonomideki geçişlere değil, aynı zamanda politik aktörün gücünde

iv

kademeli olarak meydana gelen artışa da bağlı olduğu göstermektedir. Ayrıca, KSB’nin çok boyutlu yapısının bağların karma etkileri üzerinde de etkili olduğu gösterilmiştir.

Anahtar kelimeler: piyasa dışı faaliyetler, kurumsal politik bağlar, ulusal iş sistemi, devlete bağlı iş sistemi

v

TABLE of CONTENTS

ABSTRACT ... i

ÖZET ... iii

TABLE of CONTENTS ... v

INDEX of ABBREVIATIONS ... vii

LIST of FIGURES and PICTURES ... viii

LIST of TABLES ... ix

1. INTRODUCTION ... 1

2. FIRM- GOVERNMENT INTERACTION and CORPORATE POLITICAL TIES ... 6

2.1. Non-Market Activities of Firms ... 6

2.2. Corporate Political Activity ... 8

2.3. Corporate Political Tie... 11

2.3.1. Corporate Political Tie Definitions ... 11

2.3.2. Value of Corporate Political Ties ... 13

2.3.2.1 Positive Value of CPT ... 14

2.3.2.2. Negative Value of CPT ... 15

2.3.2.3. Mixed Value of CPT ... 17

2.4. Critique of the Studies on CPT ... 19

3. CORPORATE POLITICAL TIES FROM NATIONAL BUSINESS SYSTEM PERSPECTIVE ... 23

3.1. The National Business System ... 23

3.2. Macro-Institutions Determining Business System Characteristics ... 27

3.3. Types of Business Systems ... 30

3.4. Relating National Business System Approach to Corporate Political Ties ... 34

4. THEORETICAL FRAMEWORK AND HYPOTHESES ... 38

4.1. The Turkish Business System... 39

4.2. The Political Environment of Turkey in the Last 15 Years ... 43

4.3. Hypothesis Development ... 48

5. METHODOLOGY ... 54

5.1. Research Context ... 54

5.3. Sample ... 58

5.4. Data Collection Method ... 60

5.5. Variables ... 64

6. ANALYSIS AND RESULTS ... 69

vi

6.2. The effect of political ties on firm outcome ... 82

7. DISCUSSION and CONCLUSION ... 87

8. FUTURE DIRECTIONS ... 92

9. REFERENCES ... 94

10. APPENDIX ... 104

10.1. Example of The Events... 107

10.1.1.Opening Ceremony ... 107 10.1.2. Signing Ceremony ... 108 10.1.3. Invitation ... 110 10.1.4. Meeting ... 111 10.1.5. Award Ceremony ... 112 10.1.6. Visit ... 113

vii

INDEX of ABBREVIATIONS

CEO: Chief Executive Officer CPA: Corporate Political Activity CPT: Corporate Political Tie

CSR: Corporate Social Responsibility ECHR: European Court of Human Rights EML: Electricity Market Law

EMRA: The Energy Market Regulatory Authority- Enerji Piyasası Denetleme Kurumu FBG: Family Business Group

HPC: Higher Planning Council IMF: International Monetary Fund

JDP: Justice and Development Party- Adalet ve Kalkınma Partisi

MENR: Ministry of Energy and National Resources- Enerji ve Tabi Kaynaklar Bakanlığı NBS: National Business System

PAC: Political Action Committee POLCON: Political Constraint Index ROA: Return of Assets

TEAŞ: Türkiye Elektrik A.Ş.

TEİAŞ: Türkiye Elektrik İletim A.Ş.

TETAŞ: Türkiye Elektrik Taahhüt ve Ticaret A.Ş. TEÜAŞ: Türkiye Elektrik Üretim A.Ş.

viii

LIST of FIGURES and PICTURES

Figure 6. 1. The political empowerment of the ruling party ... 71

Figure 6. 2. Capacity of firms in regard to market experience ... 77

Figure 6. 3. Capacity of firms in regard to the facility type ... 78

Figure 6. 4. Capacities in regard to holding affiliation ... 79

Figure 6. 5. Tie-intensity in regard to types of agent... 81

Figure 6. 6. Tie-depth regard to types of agent... 81

Figure 6. 7. The total electricity generation per year in turkey ... 82

Picture 10. 1. Opening Ceremony ... 107

Picture 10. 2. Signing Ceremony ... 109

Picture 10. 3. Invitation ... 110

Picture 10. 4. Meeting ... 111

Picture 10. 5. Award Ceremony ... 112

ix

LIST of TABLES

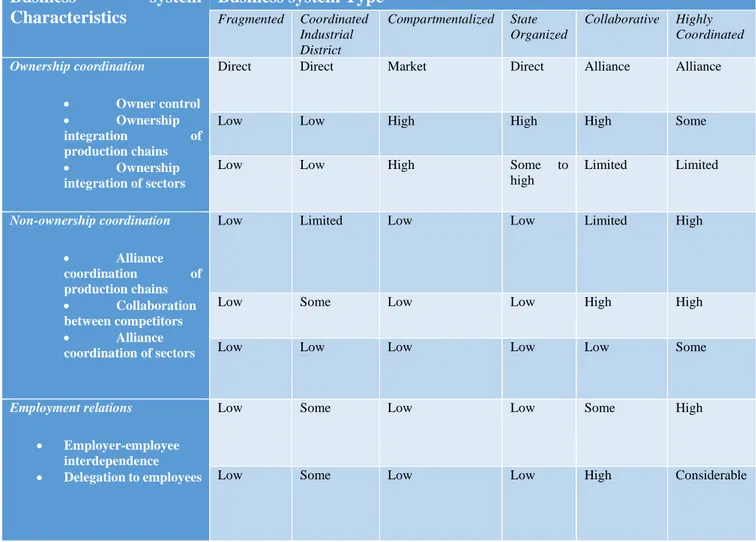

Table 3. 1. Key characteristics of business system ... 25

Table 3. 2. Key institutional features structuring business system ... 27

Table 3. 3. Six types of business systems ... 31

Table 3. 4. Institutional features of business systems ... 31

Table 5. 1. The Definition of the Events ... 61

Table 5. 2. Politicians and Position Values ... 62

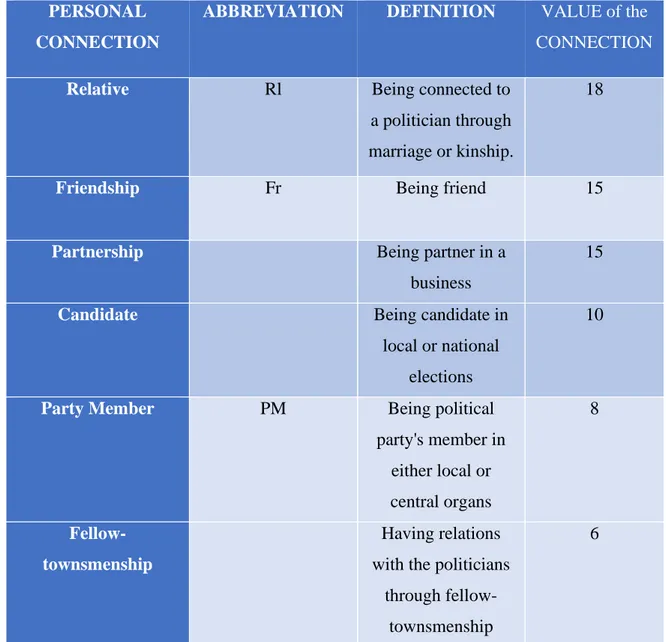

Table 5. 3. Engaged Connections, Definitions and Values ... 63

Table 5. 4. The POLCON Index of Turkey ... 68

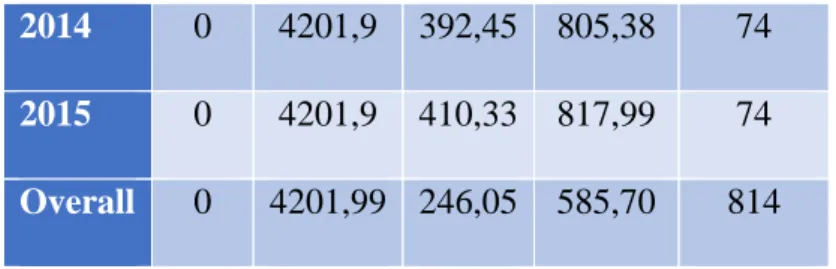

Table 6. 1. Descriptive statistics of dependent variable ... 69

Table 6. 2. Descriptive statistics of independent variables ... 70

Table 6. 3. Descriptive statistics of control variables ... 71

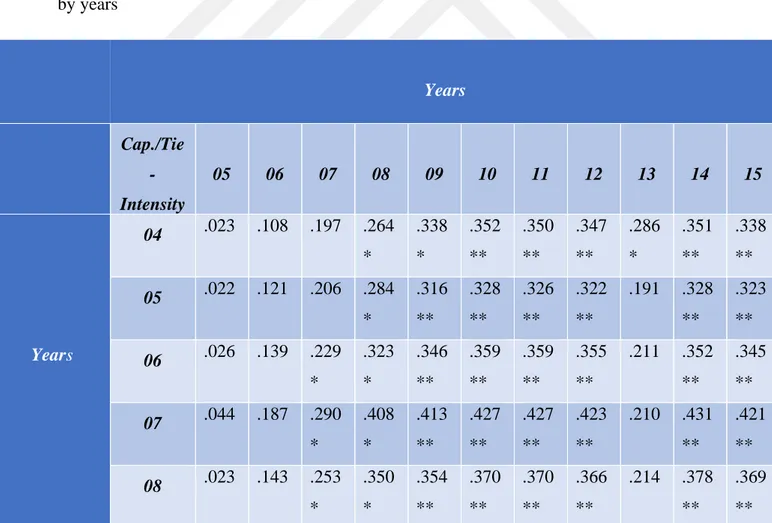

Table 6. 4. Correlation coefficients of installed capacity and tie-intensity relation by years ... 72

Table 6. 5. Correlation coefficients of installed capacity and tie-intensity relation for 11 Years ... 73

Table 6. 6. Correlation coefficient of installed capacity and tie-depth relation by years ... 74

Table 6. 7. Correlation coefficient of installed capacity and tie-depth for 11 years ... 74

Table 6. 8. Correlation coefficients of installed capacity and control variables by years .. 75

Table 6. 9. Correlation coefficients of installed capacity and control variables for 11 years ... 76

Table 6. 10. The frequency of market experience ... 77

Table 6. 11. The frequency of facility type ... 78

Table 6. 12. The frequency of holding affiliation ... 79

x

Table 6. 14. Evaluation of hypotheses ... 85 Table 10. 1. Breush-pagan and Honda test statistics of installed capacity for the Model 1 ... 104 Table 10. 2. Hausman test statistics of installed capacity for the Model 1 ... 104 Table 10. 3. Breush-pagan and Honda test statistics of installed capacity for the Model 2 ... 104 Table 10. 4. Hausman test statistics of installed capacity for the Model 2 ... 105 Table 10. 5. Breush-pagan and Honda test statistics of installed capacity for the Model 3 ... 105 Table 10. 6. Hausman test statistics of installed capacity for the Model 3 ... 105 Table 10. 7. Breush-pagan and Honda test statistics of installed capacity for the Model 4 ... 105 Table 10. 8. Hausman test statistics of installed capacity for the Model 4 ... 105 Table 10. 9. Breush-pagan and Honda test statistics of installed capacity for the Model 5 ... 106 Table 10. 10. Hausman test statistics of installed capacity for the Model 5 ... 106 Table 10. 11. Breush-pagan and Honda test statistics of installed capacity for the Model 6 ... 106 Table 10. 12. Hausman test statistics of installed capacity for the Model 6 ... 106

1 1. INTRODUCTION

Corporate Political Ties (CPT) of firms have received considerable scholarly attention in recent years. A primary concern of these connections is to shape policymakers’ decisions in a favourable way which translates into benefits that create competitive advantage and strong market position for firms. Recent evidence suggests varying benefits, from easy access to resources and some critical information to low-interest credit (Dieleman & Boddewyn, 2012; Dieleman & Sachs, 2006; Leuz & Oberholzergee, 2006; Okhmatovskiy, 2010; Faccio, Masulis, & McConnell, 2006). On the other hand, these positive relations between political ties and the firm outcome has been challenged by the studies that demonstrating either neutral or negative relation (Lawton, Mcguire, & Rajwani, 2013; Mellahi, Frynas, Sun, & Siegel, 2016b). Thus, evidence for the outcomes of political connections remains mixed.

The primary aim of this thesis is to provide an explanation to these equivocal results by approaching CPT from the National Business System (NBS) perspective. Although, previous studies, which majority of them depends on the cross-sectional data, have mentioned the importance of macro institutions on this relation they didn’t take the NBS perspective in order to investigate ties in detail. In the current study, the institutional elements, specifically the national business system, are thought to shape the CPTs by providing a framework that indicates how ties between government and business have been developed and evolved. Moreover, it is argued that besides determinant institutions’ cyclical changes in the related context also create another factor in which CPTs and their outcomes are affected directly. Despite the importance of these context-specific macro institutions and conditions, there remains a paucity of evidence in the CPT literature on them. For example, studies that have demonstrated positive relations suggested that in a politically stable environment firms that have political ties to the ruling party benefit from these ties. On the other hand, studies that suggested negative CPT-firm outcome relations, explained this negativity through a radical change in the political environment. Radical changes in these studies generally refer to changes that replace the existing political and economic conditions with an entirely new one. These studies illustrate that existing ties to the previous regime may be a liability for a firm in an unexpected change in political power (Henisz & Delios,

2

2004; Siegel, 2007). However, they have not given credit to evolutionary changes, rather than radical changes, in the existing macro institutional context that shape the contingent value of CPTs. Although they have considered the conjuncture of the related country, none of them has touched upon how macro institutions affect the way of establishing these ties which in turn may have the ability to affect the nature and consequence of the relations.

Another common deficiency of these studies is that they are generally based on the data that comprise a short period of time which hinders understanding the related context comprehensively. These cross-sectional designs generally focus on the CPT-outcome relation and its antecedents, moderators, and mediators. The few studies in the CPT literature, however, which focus on a long period of time, suggest that CPT-outcome relation can go both ends regarding the change in checks and balances in the political environment (Peng & Luo, 2000; Pei Sun, Mellahi, & Thun, 2010; Pei Sun, Xu, & Zhou, 2011; Yan & Chang, 2018). Despite their valuable explanations for mixed CPT-outcome relation, they still lack considering the possibility that the nature of the ties themselves may also affect this relation. Although extensive research has been carried out on CPT- outcome relation, no single study exists, which considers the following questions: Do the political tie have a composite structure? Do the ways in which political ties are established vary with regard to the institutional context? Do the variations in the status of political actors connected match with the variations in their influences on firm performance? How do national system characteristics influence the contingent value of ties regarding their performance outcomes? Rather, almost all the studies so far, have inclined to take CPT’s as a composite and a common concept which is established and developed similar ways in every context. This way of thinking overlooks the macro institutions in an environment, the possible dimensional structure of the political ties that arise from these institutions and the firm outcomes that are provided by these contextually shaped ties.

The central premise of this study, thus, is that macro institutional environment, namely the national business system and political economy, of countries has a shaping effect on political ties which in return may cause different CPT- firm outcome relations. Thus, this context-specific nature of ties may create mixed results in a long period of time.

According to the extant literature, political ties may be formally and informally created among several levels between the actors from political and organizational areas of countries. Formal ties can broadly be defined as relationships created as managerial or board

3

level ties or institutional ties. Informal ties, on the other hand, tend to be used to refer to personal relations that are developed with political actors over friendship or family bonds. In the literature, both formal and informal ties are treated as if they are established at a similar level and between the similar levels of actors in every country. Moreover, especially informal ties are treated as if they only cover the personal connections without giving any detailed explanation on their features. However, regarding the macro institutional characteristics of countries, organizational actors and their position in the firms, and also related politicians’ position in the political parties or governments may vary, which in return cause to variations in the CPT-firm outcome relation. This lack of institutional point of view indicates a need for assessing the CPT and firm outcome relation by considering the macro institutional context of countries.

Along with the macro institutions, political and economic changes may also cause contingent results in the political tie- firm outcome relations over time within the same country. Research on the change in the economic and political environment of a country in the CPT literature has been mostly restricted to limited conditions which are a transition or a radical change in either economy policies or political areas. Whereas transition refers to change of the economic policy, for example from import- substitution to liberalization, radical change refers to the irreversible, sudden or unexpected switches, such as military coup or revolutions. Specifically, the studies that show mixed results of the political tie- firm outcome relation have explained these contingent results through these changes. However, it is not necessary to restrict the changes into a radical transition in the economy policy or in the political environment. According to Henisz and Delios (2004) countries may face a political hazard which may also change the political power balance in the related context. These political hazards occur if the political structure enables policymakers to exercise unlimited power. In other words, political hazard refers to the situation in a political environment in which institutions lack checks and balances when the ruling party becomes politically empower and unconstrained in its discretion power over the executive, legislative or juridical branches (Henisz, 2000). This kind of situation may cause a power shift from one political body to another and may cause incremental institutional changes that result in changes in the CPT-outcomes relationship. Up to now, far too little attention has been paid to this kind of change in the corporate political ties field. Previous studies have failed to consider what is the effect of such a political hazard on CPT- firm outcome relation in a business system.

4

This thesis, hence, is set out to investigate the nature of corporate political ties as shaped by the national business system and the dynamic nature of the relationship between CPT and firm outcomes in an environment where the ruling party’s political power incrementally increase. It has been thought that the national business system, which is shaped by the structure of the political-economic system of a country, influence both the nature of ties and how these ties are adapted to changes in politics. The study, thus, draws on the national business system approach which enables to consider CPTs in a macro institutional context that, in return, provides a rich contextual background to understand corporate political ties beyond their formal and informal characteristics. In this thesis, based on the institutional context of a state dependent business context, namely, Turkey, we propose a more nuanced conceptualization of political ties. We particularly describe two dimensions of political ties, which enable us to grasp the tie concept in a more comprehensive way. These two dimensions are the intensity and depth of political ties. The tie- intensity is composed of two sub-dimensions which are tie-frequency and tie-breadth. The frequency of political ties refers to how many times in a given period business people and politicians physically come together in meetings, ceremonies, formal visits or social gatherings. The breadth of political ties, on the other hand, refers to how many different politicians in a political party a business person is connected to. Together these sub-dimensions constitute the tie-intensity dimension that refers to the scope and repetition of political connections. Finally, the depth of political ties is about the quality of ties between business people and politicians. This quality is rather related to the strength of political ties, which get higher degrees when they are based on kinship and friendship, but it also involves classmate ship, fellow townsmenship, political comradeship and the political position of the related politician within Turkish context.

Consequently, the study sought to answer the following specific research questions: How national business system shape a corporate political tie between a firm and a politician? and How the effect of political ties on the firm outcomes change in a situation that the ruling party becomes politically empower?

The current thesis uses archival data from the national newspapers, trade organization gazettes and ministry databases to create the data set to examine the nature of ties and also their firm-level outcomes. In order to show the effect of the business system on both CPTs and their outcomes, Turkey, as a state-dependent business system, has been chosen which is different than the Anglo-Saxon systems that are prevailed in the literature. With it's

5

distinctive, yet generalizable to another state-dependent context, the design of this study is thought to provides new insights into corporate political tie literature. Turkey offers a rich context in order to analyse the research questions, with its national business system and the changes in its political environment in the last 15 years. Besides, with the feature of a strong state which has created family business groups through economic support policies that have made ties always crucial for firms, Turkey is a proper case in order to show the national business system’s effect on CPTs.

The thesis is divided into eight distinct chapters. The following chapter gives an overview of the corporate political tie literature. In that section, definition, approaches, and studies up to now will be discussed. Chapter three highlights the key theoretical concepts of national business system. It also discusses the main characteristics of national business system in Turkey and what NBs offer for the corporate political tie concept. The fourth chapter draws together the various strands of the thesis. Hypotheses will be explained in that chapter. Chapter five is concerned with the methodology employed in this study. The results of analyses are provided in the chapter six. In the seventh chapter, the findings of the study and their implications for CPT and national business systems literature are discussed. In the final chapter, the future directions for the further studies are presented.

6

2. FIRM- GOVERNMENT INTERACTION and CORPORATE POLITICAL TIES

CPT has been an important concept in the study of organizations’ non-market activities. Hence, this chapter is concerned with the theoretical roots of CPT, its relationship with other concepts in the non-market studies and ties' effect on the firm outcomes. First, non-market field and its sub-fields are briefly discussed. Secondly, the chapter continues to compare the Corporate Political Activity (CPA) concept to CPT within the scope of the study. Thirdly, the findings on CPT- firm outcome relations in the literature are provided. Finally, the chapter concludes with a criticism of the existing studies of CPT- outcome relation and explains the potential contributions of the thesis on this issue.

2.1.Non-Market Activities of Firms

Contrary to the prevailing assumptions of the orthodox economy that accepts the economic action disembedded from the social and political spheres, it has been shown that exchange relations do not occur in an abstract environment (Jessop & Ngai-Ling, 2006). Hence, organizations do not only deal with the market environment that consists customers, competitors and suppliers but also consider other actors that operate within the environment. The most prominent one of these actors is the state by all means. With the power of making law, it is possible for the states, with regard to the political economy of the context, to intervene in the market through mechanisms such as direct recruitment or direct investments (Buğra, 1994). Moreover, states do not only organize the functioning of the national economy but also are important economic actors themselves (Okhmatovskiy, 2010). Although they are constrained by the laws and institutions of the related context, their relatively superior position in the economy leads organizations to develop strategies to connect with this power in order to increase the organizational performance and to maintain their basic existence. Therefore, it is a common occurrence in almost every country to develop relations with states in varying means and forms, regarding the characteristics of the

7

context (Fisman, 2001; Lawton et al., 2013; Shaffer & Hillman, 2000).

This intersection between governments and organizations has been attracting researchers’ attention from different disciplines of social sciences. For example, economists typically study on the industry level and concentrate on the exchange between the parties. They see the political relations from exchange perspective wherein the public policy is traded with financial support and votes (Barley, 2007; Cropanzano & Mitchell, 2005; Goldman, Rocholl, & So, 2009; Kumar, Thakur, & Pani, 2015). It has been pointed out this mutual relationship and noted that the decisions of the conglomerates would affect not only their own interests but also the interests of the state and nation (Barley, 2007). Political scientists, on the other hand, see the policies as an outcome of interest group competition. In other words, they examine how political donations and lobbying activities affect the government's decisions (Goldman, Rocholl, & So, 2010). Economic justice, regime type, and allocative efficiency are the main concerns of political scientists. They see the organizations as entities that typically focus on institutional and political factors that provide favourable policies to them while undermining the public interest and democratic processes (Kumar et al., 2015; Lux, Crook, & Woehr, 2011; Shaffer & Hillman, 2000; Pei Sun, Hu, & Hillman, 2015). Relatedly, political economy researchers investigate these intersections from economic justice and allocative efficiency perspective and focus on the corruption and clientelist side of the political activities. For example, a study revealed that how client business networks and lobbyists in Mexico make use of pro-business programs of neoliberal transition (Salas-Porras, 2005). It has been shown that the activities of pro-business networks shape the policy agenda to turn the economic policy from protectionist to open and market-led economics that favors the networks’ improvement.

Organizational studies, on the other hand, also attach importance to these activities regarding the requirement of coping with the political environment that effects the firm outcomes. The concept is being explored by researchers from a variety of different perspectives such as institutional theory, stakeholder theory, resource dependence theory, resource-based view, and agency theory (Mellahi et al., 2016b). All of these theories provide varying explanations to non-market activity from core assumptions and drivers to key predictions and mechanisms that firms implement. Institutional theory, for example, argue non-market activity for acquiring legitimacy from institutional actors which provides survival and growth for the firms. It explains that these activities help firms to reinforce its legitimacy. The key mechanism that institutional theory offers is conforms to predominant

8

institutional pressures and norms. Stakeholder theory, on the other hand, put emphasis on stakeholder’s support and explain that non-market activity is an important endeavour in order to get that support. The resource-based view concentrates on the firm-specific non-market capacities which are thought to provide competitive advantage. Agency theory, separately, holds a different perspective and assumes that the key driver of these activities is to accomplish managers’ own interest and focus on the managers’ motivation to engage in the non-market activities. All these theories provide a valuable perspective to non- market political activity studies. The resulting benefits provided by the non-market activities to the organizations include reducing environmental uncertainty, lowering transaction costs and increasing long-term sustainability (Hillman, Keim, & Schuler, 2004; Mellahi, Frynas, Sun, & Siegel, 2016a).

Along with other theories, the resource dependence theory also provides an explanation to non-market activities, and advocates that in order to acquire critical resources which are controlled by the other participants, firms have to engage in these kinds of activities. Thus, firms eliminate the ambiguity in the environment and guarantied the flow of required sources. Resource dependence theory, therefore, suggests the Corporate Political Activity (CPA) concept that explains the state- firm relations.

Before proceeding to examine CPA, it is important to be given a basic distinction in the literature. Researchers who have studied relations of firms with the state, politicians and political parties have focused on another concept other than CPA, namely Corporate Social Responsibility (CSR). While CSR concentrates on the organizational activities that provide a social good, CPA, on the other hand, focuses on the organizational strategies and activities that are implemented for the firm interests in the political environment. It is beyond the scope of this study to examine CSR and its implications.

2.2.Corporate Political Activity

The concept of Corporate Political activity has been broadly defined as “corporate

attempts to shape government policy in ways favorable to the firm” (Hillman et al., 2004).

This definition puts the emphasis on the need for engaging political actions when there is a possibility to secure and increase the resources that are kept hold of by state/ government.

9

Moreover, as resource dependence researchers stated when firms cannot manage the environmental uncertainty through inter-organizational linkages, managers steer their efforts to create their environment by employing political activities (Hillman, Withers, & Collins, 2009; Pfeffer & Salancik, 2003;Barron, 2010). Hence, it can be assumed that firms engage in these activities both in order to reduce the uncertainty that affects the critical resources and also make the state to behave in a way that is favorable to firms. In other words, CPA focuses on both the environmental dependencies and also insider impetuses that motivate organizations to engage in these kinds of political actions. Moreover, CPA provides subsidiary explanations for non-market engagements of firms with its antecedents and strategies.

Meta-analyses of CPA literature have revealed the antecedents which can be classified under three categories at a different level of analysis, namely; firm, industry and institutional levels (Hillman et al., 2004). Firm-level antecedents are based upon the firm size, firm’s financial resources and dependencies on government contracts which are motives for managers to engage in corporate political activities. For example, the size of the company seen as a proxy for the resources that organizations have, which are also the determinant of political activity inclination of the related organization. It has been indicated that large firms are more inclined to engage in political activity alone, while smaller organizations are acting as a group. Industry-level antecedents, on the other hand, based the political activities on the density of related industry, and the relevant studies report that organizations in concentrated industries are more inclined to engage in lobbying and campaign contribution than those in the fragmented industries. Additionally, it has been found that organizations that get most of their revenue from government tenders or that operate in sectors in which government interventions and regulations are high have more tendency to apply CPA. The effects of institutional level antecedents, on the other hand, on CPA are investigated through the differences among countries regard to the formal and informal rules. At the institutional level, corporate political activities of the organizations may differ regarding the institutional framework of the related country. It has been proposed that organizations’ corporate political activities may vary across countries with parliamentary system vs. congressional system, or with strong parties vs. weak parties. Also, incumbent politicians, ideology, political competition, regulation, government sales, and dependent politicians are found to be the institutional level antecedents of CPA that steer firms to engage in the political activities (Hillman et al., 2004; Lux, Crook, and Woehr,

10 2011).

Regarding the moderators of CPA, it has been listed that market attractiveness and political resources of the firms, moderates firms’ choices (Kumar, Thakur and Pani, 2015). Basically, it has been pointed out that the organization’s decision on political participation is affected by the degree of market attractiveness which refers to the competition in the market. If the competition is high, it has been suggested that the attractiveness of the market would be less. Political resources, on the other hand, refers to firm-specific resources, which is prestige, and philanthropic activities. These activities enable firms to gain legitimacy in the eye of both politicians and the public. Accordingly, it has been showed that the likelihood of an organization to show CPA behavior depends on the political resources it has in hand.

With respect to CPA’s strategies, in the literature, three different strategies that firms implement in order to engage in political spheres has been proposed. These are classified as 1) financial, 2) informational and, 3) relational strategies (Rajwani & Liedong, 2015). Financial strategies are financial contributions to the political parties or political actors, which in return bring firms a connection to political actors in order to create political influence over them (Hersch, Netter, & Pope, 2008). This strategy is generally implemented through political action committees (hereafter PAC) and corporate spending (Witko, 2011). In the literature, it has been observed that financial contributions are to be more suitable for the contexts where financial aids/contributions are audited through the laws. For example, by courtesy of the transparency legislation in Germany, it is possible to obtain information about parliament members’ extra revenues (Alexandra; Niessen & Ruenzi, 2009). Therefore, it is become easier to detect which party or political actor accept a donation from which firm and in what amount. This also means that there are more transparent connections between parts. Informational strategies, likewise, are more common in countries where participatory democracies are practiced such as USA. Firms in these contexts participate in governmental agencies and decision-making bodies in order to give a contribution to the regulations and legislations that have not yet been put into practice. Thus, through lobbying, petition and comment strategies firms have a chance to contact governmental agencies before the legislation proposed for the parliamentary and executive approval (Rajwani & Liedong, 2015).

Before moving on to the relational strategies, it is important to mention a cleavage in the CPA literature. The relationship between CPA and CPT is considered in two different

11

ways. While one group takes CPT as a different concept than CPA; others accept the CPT as a sub-strategy of it, namely the relational strategy of the CPAs. The former, indeed, refuses the idea of CPA strategies in a categorical way and considers every technique as a separate strategy of firms. Thus, according to this group, CPT is a way of connecting politicians which is not different than lobbying or PAC contributions (Bonardi & Keim, 2005; A. J. Hillman et al., 2004; A. Hillman & Keim, 1995). The latter group, on the other hand, support the idea that CPT is a sub-strategy of CPA which is implemented through personal connections (Lawton et al., 2013; Rajwani & Liedong, 2015; Faccio, 2006). Although both groups give credit to the contextual differences among the countries the basic distinction between them arises from the point they focus on. The first group focuses on the political connections with regard to their effect on getting the desired policy outcomes. In other words, political connections are considered by CPA researcher as the relational strategies to the governments that provide firms favourable policy outcomes. On the other hand, CPT researchers consider more the firm outcomes that these political connections provide. Rather than the policy outcomes, firm outcomes such as lower bank credits, higher firm performance and debt financing are the political connection’s outcomes for the firms that CPT researchers attach importance. In the existing study the political connections will be investigated by embracing the second group’s point of view.

2.3.Corporate Political Tie

2.3.1. Corporate Political Tie Definitions

The Corporate Political Tie (CPT) has been studied by several researchers from different contexts. However, the conceptual definition of CPT is provided by Faccio (2006) as “the boundary-spanning personal and institutional linkages between firms and

constituents’ parts of public authorities.” As can be understood from the definition the main

cleavage of the CPT is depended on the informal and formal tie division. Here, while

personal linkages refer to informal connections between parts, institutional linkages refer to

formal ties.

On the other hand, regarding the institutional differences in varying contexts, the operational definitions used by researchers are diversifying. Thus, the definition of CPT varies among studies; however, the formal and informal dichotomy remains in general.

12

Formal ties are mostly used to refer the structural connections through ownership arrangements in which state itself, its agencies or incumbent politicians/officials are in the ownership status of firms or in the board of the firm. A well-known formal-CPT definition is given by Faccio et al. (2006) ; “a company is defined as politically connected if at least

one of its top officers (defined as the company’s chief executive officer, chairman of the board (COB), president, vice-president, or secretary of the board) or a large shareholder (defined as anyone controlling at least 10% of the company’s voting shares) was head of state (i.e., president, king, or prime minister), a government minister (as defined below), or a member of the national parliament”.

On the other hand, informal ties refer to interpersonal ties that are created between persons. These informal-CPTs are defined several ways, such as; “a firm's directors or

major shareholders have informal ties with leading politicians through personal encounters”(Adhikari, Derashid, & Zhang, 2006) or “a firm’s informal social connections with government officials in various levels of administration, including central and local governments, and officials in regulation agencies, such as tax or stock market administrative bureaus”(Zhou & Li, 2010).

There are also other definitions that point cross-relations between persons and organizations. Although there is no clear evidence on either they involved in formal or informal ties, it has been thought that they can be classified under formal ties. These relations are created between either firm representatives and political institutions or politicians and firms (P. Sun, Mellahi, & Wright, 2012). The first connection refers to the situation of firm representatives that are appointed or elected in political assignments. The second connection, on the other hand, refers to a CEO or board member that currently or formerly served in any department of state or government. For example, the CPT definition by Sun et al. (2011) refers to this cross- relations; “firms with ownership ties to the Shanghai government and

board members with career experience in municipal government”. A further example of this

kind of CPTs is given by Hillman, Zardkoohi, and Bierman (1999) as “Executives may serve

at the federal or state cabinet-level, as elected politicians, in executive and administrative departments, or as consultants or members of special committees”.

In the majority of CPT literature, however, given operational definitions are observed to involve all these connection descriptions in varying combination. What is remarkable about these combined definitions is that they recognize the contextual determinants that

13

shape the political ties. They put emphasis on that firms in a different context create their political connections through varying combinations of tie establishment ways defined by the institutions of the related country. In other words, despite the fact that there is the general frame of the definition, rather than suggesting a universally accepted definition CPTs' context-specific nature is revealed in these studies. However, as it is the case in the conceptual definition, they still tend to categorize ties as either formal or informal. As an illustration CPT of Malay firms is defined by Hassan et al. (2012) as; “a firm can be regarded

as politically connected either because the state directly owns the company, or because the company's stocks are taken by government-controlled institutions or the informal relations between the top managers or the owners of the company and government officials”. Another

example is provided by Faccio (2006) for 42 countries. She defined CPT as; “a company is

connected with a politician if one of the company’s large shareholder or top officer is: (a) a member of parliament, (b) a minister or head of state, or (c) closely related to a top official”.

The most comprehensive definition of CPT in that regard is given by Yeh, Shu, and Chiu (2013) for Taiwan firms that determine multiple criteria for them being politically connected; “when at least one of the following conditions is met: (1) the firm was founded

or run by the political party; (2) the political party is one of the firm's large shareholders; (3) the chairman or CEO publicly supports the presidential candidate representing a certain political party, participates in or has his/her employees participate in the presidential campaign or was described by at least one major newspaper as being supportive of a certain political party; and (4) one of the firm's large shareholders,11 directors or top officers is/was a member of parliament, a minister or a top government official”.

In the light of these combined definitions of the CPT literature, in the existing study, the definition of CPT has been accepted as broad meaning that involves formal, informal and cross- relational ties between related parts. Hence, structural ownership ties, inter-personal social relations, relations between politician and company and firm representative and a political party have been investigated.

2.3.2. Value of Corporate Political Ties

The greater part of the literature on corporate political tie focus on the value of CPTs to firms. This value has been associated with the firm outcome that is achieved via these connections. Thus, if a connection brings benefits to the firm or positively correlated with

14

the firm performance it can be named as positive CPT value. On the contrary, CPTs that cause underperformance to a firm, or negatively correlated with the firm outcomes are titled as negative CPT value. Moreover, if a firm gets varying outcomes, either positive or negative, the value of CPT is called mixed. Accordingly, studies on CPTs’ values can be classified under three categories respectively, positive-outcome, negative-outcome and mixed-outcome studies (Lawton et al., 2013; Mellahi et al., 2016).

2.3.2.1 Positive Value of CPT

Many recent studies (Goldman et al., 2010; Mellahi et al., 2016b; P. Sun et al., 2012) have shown that, in comparison to their non-connected peers, politically connected firms get benefits such as access to debt financing, lower taxation, legitimacy, entrance to industry and profitable government contracts, which in return provides higher performance and competitive advantage for them. Remarkable examples of positive value CPT studies are given below.

A longitudinal study of CPT by Peng and Luo (2000) reports that interpersonal ties which are established between the government officials and organizations are more beneficial and significant than the connections that are constituted among organizations in terms of gaining access to the critical resources. According to the study, while managerial ties with rivals are providing higher market share in low-growth industries, they do not have any influence on the Return of Assets (ROA) of firms. On the other hand, the study reveals that political ties bring higher market share and ROA for both high- growth and low- growth industries.

A further example of positive-outcome CPT is provided by Leuz and Oberholzer-Gee (2006). In this study that investigated whether political connections substitute global financing or not, it was showed that Indonesian politically connected firms are less inclined to get global financing than their non-connected peers both earlier and during the Asian crisis. The study concludes that, due to their privileged access to low-interest financing from domestic banks, politically connected firms do not need any foreign financing in the course of the crisis. Relatedly, the study reported political connections as a substitute for global financing in relationship-based systems.

15

connected to politicians through different ways in 42 countries are benefiting from getting easy access to debt financing,as well as lower taxation that creates competitive advantage in the market. Moreover, the study finds that firms that create connections between their owners and head of the related state gain higher benefits than not only their non-connected rivals but also connected peers that have a connection at the lower-level officials of the state. Further, a study that is conducted by Faccio et al. (2006) in 35 countries reveals that the likelihood of being bailed out by the government of the firms that have political ties is higher than the non-connected firms.

Another study that implies positive CPT- firm outcome relation is conducted by Hillman (2005). The study provides evidence that US firms in heavily regulated industries are more inclined to give place to politicians in their boards which, in return, is reported higher market performance than their non-connected peers. Similar pieces of evidence are provided by Niessen and Ruenzi (2010) for German firms. According to this study connected firms have better sales, market capitalization and total assets in comparison to non- connected ones in heavily regulated industries. Furthermore, studies from several countries on CPT- outcome relation have shown beneficial returns for firms such as higher stock returns and performance and lower indebtedness (Boubakri, Cosset, & Saffar, 2012; Claessens, Feijen, & Laeven, 2008).

Collectively, these studies outline a critical role for corporate political ties for the firm. According to them, firms that establish political ties to the state of government officials and politicians are treated preferentially in comparison to their rivals, which in turn provides positive outcomes that bring competitive advantage.

2.3.2.2. Negative Value of CPT

Contrary to previous positive outcome studies, some researches demonstrate the negative effects of corporate political tie to the firms. These negative effects are mostly related to the times when there is a change in political and/or economic systems of the related context, which means a change in the institutional arrangements. However, some studies also imply that radical political or economic changes are not always the reasons for the negative CPT-outcome relationship; it also takes place when there is no considerable contextual changes. Below, negative value CPT studies in the literature are given.

16

One well-known study on the negative effect of CPT on firm outcomes is done by Fisman (2001). In this study, it is shown that firms that have close relations with the existing president have been affected negatively when an adverse situation of the president’s health occurred. Accordingly, it was demonstrated that Indonesian firms’, that have well-connections to President Suharto, stock prices declined after the death of Suharto in Jakarta Stock Exchange. Similarly, further evidence is provided by Faccio and Parsley (2006) on the negative effect of sudden changes in the political environment from several countries all over the world. According to the study examining the impact of 206 politicians' sudden death on firm value, deaths have been showed affected negatively the stock prices of firms that have close relations with the deceased politicians.

Another study that supports the negative value view is provided by (Johnson & Mitton, 2003). In their study, it is reported that Malaysian politically connected firms had fewer stock returns than their non-connected counterparts in the early stages of the Asian Crisis, although they caught the average on later stages. To further examine the negative value of CPT, Bliss and Gul (2012) focused on the perceived risk of connected firms in Malaysia. According to the findings, Malay firms that have closer ties to government are classified as higher risk companies which, in return, cause them to lend at higher interest rates. The study concludes that connected firms that give more place to independent directors have managed to decrease their risky position in the eyes of their lenders.

The last example of negative CPT value is a longitudinal study conducted in the USA by Hadani and Schuler (2013). As it has been stated in the previous works, being politically connected is associated with both lower market and accounting performance. According to study, firms that have former politicians in their boards experienced a worse performance, with exception that if the firm operates in regulated industries.

Overall, these studies illustrate how corporate political ties of firms have negative consequences regarding the firm outcomes, which imply the negative value of CPTs. They suggest that even though organizations enjoy the advantages that the political party in power provides them, when unexpected changes in political sphere occur, previous political relations with the government may inhibit their performance. Moreover, they may be the victim of retribution and direct government efforts at exclusion (Fisman, 2001; Siegel, 2007). Besides, not only the sudden changes in the environment, it has been showed that it is also possible to get a negative outcome from CPTs regards to industry-specific or

firm-17 specific reasons.

2.3.2.3. Mixed Value of CPT

Two important themes emerge from the studies discussed so far: the value of corporate political ties for firms either be positive or negative. However, such studies remain narrow in focus dealing only with the outcome of CPTs. Through these outcomes, they infer whether there are any benefits for the firm or not. Instead, there are other studies in the literature that focus on both the process and the outcome achieved at the end of this process. These studies are the ones that propose the mixed value of CPTs.

According to these studies, the value of the CPT can go both ends, either positive or negative, in regard to contextual, organizational or market factors. For example, after the liberal transition in Indonesia, it has been claimed that the economic context has been changed from relation-based to market-based model (Dieleman & Sachs, 2006). The study explained that the relation-based economy in crony capitalist countries is an economic environment where economic occasions mostly arise from personal connections with politicians. Thus, these relations accepted as non-transparent. On the other hand, market- based economy is referred to an economic area where business decisions and opportunities are autonomous from personal ties. Accordingly, between these two polar it has been shown that, while firms benefit from their CPTs with the government in relation-based economy, when an institutional change occurs and the economy turn into the market- based, these CPTs may become a liability. The study concludes that; CPTs has a value that contingent upon the context they operate in. Thus, firms have to decide their CPT strategy, in order to achieve benefits, according to the economic environment which oscillates between relation- and market-based continuum.

Perhaps the best- known study on the mixed value of CPT is conducted as a case study by Siegel (2007) in South Korea. The study supports the idea of changing CPT value by showing that, after an unexpected change in political regime a previous political liability that arises having ties to the adversaries of the regime may turn into an asset. It has been evidenced in the study that while connections to the previous regime help Korean firms to create cross-border alliances before the liberal transition, they lost their privileged position due to change in both political and economic regimes. On the other hand, firms that suffer from their ties to the adverse political groups in the before-change era, have utilized these

18

ties for creating cross-border alliances which they can hardly achieve before.

Further evidence on mixed value has been provided by Sun et al. (2010). They showed that not only the focal firms’ but also the foreign firms’ CPT values in a host country can be vulnerable to the changes in the environment. This longitudinal study investigates the value of political embeddedness in rapid changes. It has been shown that multinational companies in the transition of China, have been suffered from their close political relations after the economic transition. Further, the study concludes that especially in emerging countries embedded political connections which are valuable in one point in time can be a burden at another time point due to their hard-to-break structure.

In a comprehensive study of changing CPT outcomes, Sun et al. (2012) found that not only the transition in political and economic institutions but also intra- and inter-organizational factors and market/ non-market environments affect the outcome of CPTs. Relatedly, firms’ CPT value may be determined by the differences in industry characteristics and competitive dynamics in the related industry; strength, structure, type and composition of ties; institutional imperatives in national business system; ownership type and structure, managers’ ability, incentives and willingness to create ties besides firms’ vulnerability to managers’ turnover. A longitudinal study by Wu et al. (2012) has supported the idea of ownership effect on CPT outcomes. It has been showed that while politically connected private firms get more government subsidiaries than non-connected ones, state-owned enterprises, on the other hand, have a lower value. Further evidence came from the study of Sun and Mellahi, et al. (2015) on the effect of tie types on the tie value. According to the study, in an adverse shock in political area in China, managerial ties to the government affect the firm value negatively, while ownership ties show no significant effect. Thus, firms that combine two types of ties were shown to expose less value cutback in the market, in comparison to the firms that only establish managerial ties.

There are studies, also, shows the mixed CPT outcomes due to the connections with rivalry political institutions. The first example is a longitudinal study that is conducted in Taiwan by Zhu and Chung (2014). The study shows the difference in CPT outcomes under the united and divided governments. Accordingly, under the united governments era, ties to the ruling party provide a fertile environment for the entry into unrelated industries, while ties to opposition party create a hostile environment for such a venture. On the other hand, the study gives evidence on that, under divided government, ties to ruling party still offer

19

benefits for market entry, however, portfolio ties that include ties to both ruling and opposition parties provide more opportunity than the former one. Further evidence is provided by Yan and Chang (2018) with a longitudinal study in China. The study stated that, when the rivalry between focal and rival governments are intensive, ties to the rival government inhibit the firm performance, while ties to focal government augment it. It has been shown that the way to eliminate this negative effect of CPT on performance is to create linkages to the constraining government which has right to limit the focal government.

Taken together, these studies support the notion that firms CPTs’ outcomes and values cannot be either only positive or negative for all times. Rather, depending on varying determinants, the outcomes can be oscillating between negative and positive continuum. Thus, CPTs can be both beneficial or counterproductive for the firms in regard to the change in the institutional environment, type of connections or rivalry in the political environment.

2.4. Critique of the Studies on CPT

Overall, these studies provide reasonably consistent evidence of an association between corporate political ties and firm outcomes. It has been shown, in brief, that this relationship can be either negative, positive or both. For every scenario, the importance of CPTs for firms is clearly indicated. However, there is still room for more explanations on both the nature and outcomes of CPTs in order to grasp the concept more properly. With this in mind, some vague points in the literature, that required detailed investigations from a different perspective, and the potential contribution of the existing study in that regard are discussed below.

The first reason for the ambiguity is arising from the tendency of categorizing countries, and therefore firms’ political engagements, in regard to the economic developmental level of them. Accordingly, in developed countries political activities are told to be mostly created through formal and transparent ways which are having a former politician in the board, lobbying, political action committee (PAC) contributions, petitioning, etc. It has been indicated that, since institutional voids are less or none in these context and market supporting institutions are well defined, firms’ political activities are transparent and legal (Boubakri et al., 2012; Dieleman & Sachs, 2006; Fisman, 2001; Sun et al., 2012). On the contrary, due to the crony capitalism which is prevailed in developing (emerging) countries, firms are stated to be inclined to establish personal connections, which

20

are developed through the nonapparent way in back stages, with government officials, presidents, prime ministers, and their close relatives. (Faccio, 2006, 2007). These countries are pictured as the contexts in which institutions such as democracy and rule of law are poorly developed which consequently make way for weak property rights, non-democratic governments, high state intervention in the market and high level of corruption (Dieleman & Boddewyn, 2012; Henisz & Zelner, 2003). Thus, a question of which ties, formal or informal, are widespread and how they are formed are reduced to the economic development level, in which formal and informal ties are offered for developed and developing countries, respectively.

This economic development-based categorization, moreover, does not only limit the understanding of tie establishment and development processes. But also, this approach is thought to clearly overlook the macro institutional factors beyond the economic development level, that have the potential to affect the reasons and ways of tie establishment. For example, rather than economic development or lack of democracy, organizational forms, namely national business systems (NBS), that are constituted by macro institutional forces may also affect the corporate political ties. Furthermore, especially the states’ position in the economic field can be determinant for the CPTs, especially the development ways and the nature of ties. Thus, from macro perspective it can be assumed that firms may not only create linkages in order to gain competitive advantage but also in order to gain legitimacy in the eye of both state and society which also affects their productivity and efficiency (Morgan et al., 2005; Whitley, 1999). For example, in the state-dependent business systems where the state is so strong that it becomes a sole source of legitimacy, firms usually grown by the state support are by definition linked to the political power not just because of their motivations for being more profitable, but because of motivation for being legitimate to survive. This assumption considers CPTs as an activity that determined not only to be in rapport with the economic environment constituted competitors and markets but also by other macro institutional determinants which primary of them is the role of the state in the context.

Second, to base the type and nature of ties on the economic developmental level of countries and to restrain them either being formal or informal clearly oversimplifies ties. As it has been called by some studies in the literature (Doh et al., 2012; Lux et al., 2011; Mellahi et al., 2016a) in order to provide a more concrete picture of corporate political tie concept, more fine-grained descriptions are needed. For example, what techniques does a firm utilize in order to be politically connected? In USA context, for instance, it has been known that