T. C.

SELÇUK ÜNİVERSİTESİ

SOSYAL BİLİMLER ENSTİTÜSÜ

İŞLETME ANABİLİM DALI

MUHASEBE FİNANSMAN BİLİM DALI

THE EFFECT OF ACCOUNTING INFORMATION SYSTEM

ON MANAGEMENT DECISIONS: EMPIRICAL EVIDENCE

FROM KONYA PROVINCE MANUFACTURING FIRMS

Hussein Farah YUSUF

Yüksek Lisans

Danışman

Prof.Dr. Ali ALAGÖZ

iv R. T.

SELÇUK UNİVERSİTY

DIRECTORATE OF SOCIAL SCIENCE INSTITUTE S tu d en t’s Name &

Surname : Hussein Farah YUSUF Number : 144227031018

Department : Business Administration/Accounting and Finance Program: Masters with Thesis

Title of the Thesis

: THE EFFECT OF ACCOUNTING INFORMATION SYSTEM ON MANAGEMENT DECISIONS: EMPIRICAL EVIDENCE FROM KONYA PROVINCE MANUFACTURING FIRMS

ABSTRACT

Nowadays business organizations are operating and competing in an information age. Information systems (IS) are widely used by many organizations to automate existing operation and to improve performance activities efficiency, and most the researches have shown that information the system did improve Managerial decision-making also enhances the operational efficiency. Accounting information system (AIS) is one of an essential component of a modern information system. The primary objective of the thesis is to examine the impact of effective Accounting information system (AIS) on the organizational Decision-making. This research would add value by providing a significant contribution towards the use of AIS practices among Konya manufacturing firms. This research would add value by providing a vital contribution towards the application of AIS with Konya province manufacturing firms. This study used a quantitative research design in collecting primary data using questionnaires design as data collection method. The unit analysis of a survey of the business owners, managers, and the accountants of Konya manufacturing. The sampling was done on 333 owners, managers, and accountants in the Industrial Area of Konya-Turkey. The gathered data were analyzed utilizing the Statistical Package for the Social Sciences (SPSS V23) program. The findings of this study reflect the results of previous studies that there is a significant relationship between effective AIS and better organizational decision-making. That shows the Konya-Turkey Manufacturing firms can enhance their performance through a practice of AIS.

Key Words: Accounting Information System, Information System, Decision-Making, Information Quality, Internal Control.

v T. C.

SELÇUK ÜNİVERSİTESİ Sosyal Bilimler Enstitüsü Müdürlüğü

Ö ğr en ci n in

Adı Soyadı : Hussein Farah YUSUF Numarası : 144227031018

Anabilim Dalı : İşletme

Bilim Dalı : Muhasebe Finansman Programı: Tezli Yüksek Lisans Tezin Adı

MUHASEBE BİLGİ SİSTEMİ ETKİNLİĞİNİN

YÖNETİM KARARLARI ÜZERİNE ETKİLERİ: KONYA İLİNDEKİ IMALAT İŞLETMELERDE BİR UYGULAMA

ÖZET

Günümüz bilgi çağında çalışan iş organizasyonları sürekli rekabet halindedir. Bilgi sistemleri (BS), birçok kuruluş tarafından mevcut operasyonları sistematikleştirmek ve faaliyetlerindeki verimliliğini artırmak için yaygın olarak kullanılmaktadır. Yapılan araştırmalar da bilgi sistemini kullanan işletmelerin yönetimsel karar verme süreçlerini iyileştirdiğini göstermektedir. Muhasebe bilgi sistemi (MBS) ise, modern bilgi sisteminin temel bileşenlerinden biridir. Bu tezin temel amacı, etkin olarak kullanılan Muhasebe Bilgi Sisteminin (MBS) örgütsel karar verme süreçleri üzerindeki etkisini incelemektedir. Bu araştırma ile aynı zamanda Türkiye-Konya’da faaliyet gösteren imalat işletmelerinin Muhasebe Bilgi Sistemi uygulamalarını kullanmalarına yönelik önemli bir katkı sağlaması ve işletmelere değer katması hedeflenmektedir. Çalışmada, veri toplama yöntemi olarak Konya ilindeki imalat işletme sahipleri, yöneticileri ve muhasebe çalışanlarından sağlanan niceliksel bilgiler ışığında birincil verilerin toplanması ile anket yöntemi kullanılmıştır. Anket için seçilen örneklemde Türkiye-Konya Sanayi Bölgesinde faaliyet gösteren 333 işletmenin sahipleri, yöneticileri ve muhasebecilerinden sağlanan niceliksel bilgiler baz alınmış ve bu bilgiler SPSS V23 programı kullanılarak analiz edilmiştir. Yapılan araştırmanın sonucunda Muhasebe Bilgi Sistemi ile Örgütsel Karar Verme süreçleri arasında anlamlı bir ilişkinin olduğu gözlemlenmiştir ve Konya-Türkiye İmalat işletmelerinin Muhasebe Bilgi Sistemi uygulamalarını etkin bir şeklide kullanmaları halinde faaliyetlerindeki performanslarını ve verimliliklerini arttırabileceğini gözlemlenmiştir.

vi

I sincerely thank the Almighty God for taking me through my academic journey successfully by giving me the strength, courage, and patience during my entire study period.

I would like to record my gratitude to Prof.Dr. Ali ALAGÖZ for his supervision, advice, and guidance from the very stage of this research as well as giving me extraordinary experiences throughout the work. Above all and the most needed, he provided me with constant encouragement and support in various ways.

I would like to thank all (Accounting and Finance department) lecturers, for their great effort throughout my study. Special thanks to my adorable parents. My parents deserve special mention for their dedicated support and prayers. I wish to give my sincerest and deepest gratitude to my Friends for their encouragement and great support. I would like to appreciations to all my friends and, everyone who has helped either directly or indirectly for the completion of this project.

Finally, I would like to record my gratitude to Yurtdışı Türkler ve Akraba Topluluklar Başkanlığı (YTB) for the scholarship they provided throughout my graduate education.

vii

DEDICATION... i

DECLARATION PAGE ... ii

BILIMSEL ETIK SAYFASI ... iii

ABSTRACT ... iv

ÖZET ... v

ACKNOWLEDGEMENT ... vi

TABLE CONTENTS ... vii

LIST OF FIGURES ... xii

LIST OF TABLES ... xii

ABBREVIATION AND ACRONYMS ... xiii

INTRODUCTION... 1

Information system’s concept ... 2

Accounting Information System’s Concept and Scope ... 4

Statement of the Problem ... 5

Research Questions ... 6

Research Objectives ... 6

Significant of the Study ... 6

CHAPTER ONE ... 7

ACCOUNTING INFORMATION SYSTEM... 7

1.1. Technology and Accounting information systems ... 7

1.2. Internal Control and Accounting Information System... 9

1.3. Components of Internal Control Systems ... 10

viii

1.3.1.2. Board of Directors’ duty on Internal Control Activities ... 12

1.3.1.3. Assignment of Authority and Responsibility ... 12

1.3.1.4. Commitment and Competence ... 13

1.3.1.5. Management’s Philosophy and Operating Style ... 13

1.3.2. Risk Assessment ... 13

1.3.2.1. Target Determination ... 14

1.3.2.2. Event Identification ... 14

1.3.2.3. Risk Detection ... 15

1.3.2.4. Risk Measurement ... 15

1.3.3. Control Activities (Control Procedures) ... 16

1.3.3.1. Delegation of Responsibility and Approval Procedures ... 16

1.3.3.2. Segregation of Duties ... 16

1.3.3.3. Controls on Access to Resources and Records ... 17

1.3.3.4. Verification ... 17

1.3.3.5. Performance Review ... 18

1.3.4. Information and Communication ... 18

1.3.4.1. Information System ... 18

1.3.4.2. Communication ... 20

1.3.5. Monitoring ... 20

1.3.5.1. Continuous Monitoring ... 20

1.3.5.2. Special Reviews ... 20

1.4. Internal Control System Models ... 21

1.4.1. COSO Model ... 21

1.4.2. CobiT Model ... 22

1.4.3. SysTrust Model ... 22

1.5. Measuring the effectiveness of AIS ... 23

1.6. Characteristics of Accounting Information System’s Quality ... 24

1.7. Decision-Making... 27

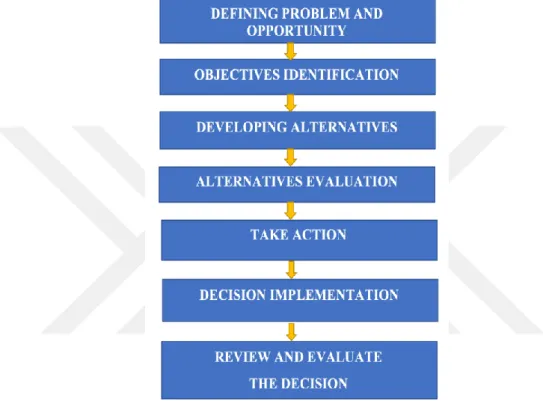

1.7.1. Decision-Making Process ... 28

1.7.1.1. Defining problem and opportunity... 29

1.7.1.2. Identifying the Objectives ... 30

1.7.1.3. Developing Alternatives ... 30

ix

1.7.1.6. Decision Implementation ... 31

1.7.1.7. Review and Evaluate the Decision ... 32

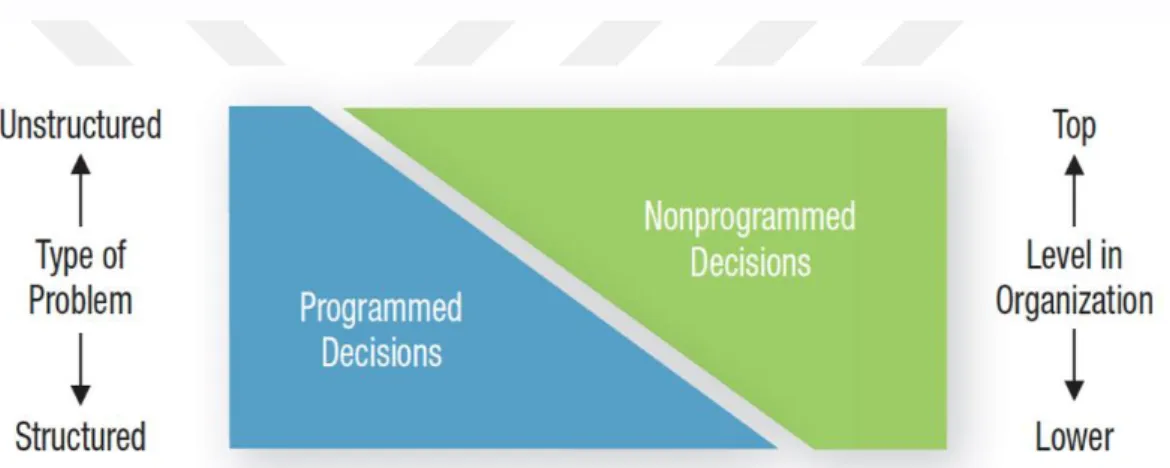

1.7.2. Types of Decision ... 32

1.7.2.1. Programmed Decision ... 33

1.7.2.2. Nonprogrammed Decision ... 34

1.7.3. Decision-Making Conditions ... 34

1.7.3.1. Decision-Making under certainty ... 34

1.7.3.2. Decision-Making under risk ... 35

1.7.3.3. Decision-Making under uncertainty ... 35

1.7.4. Decision-Making Styles ... 36

1.7.4.1. The Directive Style ... 37

1.7.4.2. The Analytical Style ... 38

1.7.4.3. The Conceptual Style ... 38

1.7.4.4. The Behavioral Style... 38

1.7.5. Decision-Making Models... 38

1.7.5.1. Classical/Rational Decision-Making Model ... 38

1.7.5.2. Nonrational Decision-Making Model ... 39

1.8. Decision-Supporting Role of Managerial Accounting Information ... 39

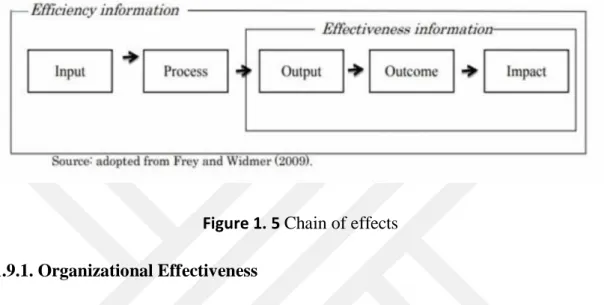

1.9. The Concept of Efficiency and Effectiveness ... 40

1.9.1. Organizational Effectiveness ... 41

1.9.2. Organizational Efficiency ... 42

1.9.3. Effective but inefficient Enterprises ... 43

1.10. Organizational Performance ... 45

1.11. Empirical Studies ... 46

CHAPTER TWO ... 49

MATERIAL AND METHODS ... 49

2.1. Introduction ... 49

2.2. Research Design... 49

2.3. Research Model ... 49

2.4. Research Hypothesis ... 50

x

2.5.2. Sample Size ... 51

2.6. Data Collection ... 51

2.7. Unit of Analysis ... 52

2.8. Research Instrument... 52

2.9. Process of Data Analysis ... 52

2.9.1. Reliability and Validity Analysis ... 52

2.9.2. Data Analysis ... 53

2.10. Conclusion ... 53

CHAPTER THREE ... 54

DATA ANALYSIS AND RESEARCH FINDINGS... 54

3.1. Introduction ... 54

3.2. Summary of Collected Data ... 54

3.3. Participants’ Profile ... 55

3.4. Data Analysis ... 59

3.4.1. Validity and Reliability ... 59

3.4.2. Descriptive Analysis ... 60

3.4.3. Correlation Analysis ... 68

3.4.4. Regression Analysis ... 70

3.5. Conclusion ... 71

CHAPTER FOUR ... 72

DISCUSSIONS, RECOMMENDATION AND CONCLUSION ... 72

4.1 Introduction ... 72

4.2 Results Discussion ... 72

4.3 Managerial Implications of AIS... 73

4.4 Conclusion and Recommendations ... 74

References ... 76

xi

xii

LIST OF FIGURES

Figure 1. 1 Factors influencing the design of AIS ... 8

Figure 1. 2 Decision Making Process ... 29

Figure 1. 3 Relationship Types of Problems, Types of Decisions, and Organizational Level ... 33

Figure 1. 4 Decision-Making Styles. ... 37

Figure 1. 5 Chain of effects ... 41

Figure 1. 6 Characteristics of effectiveness and efficiency ... 43

Figure 2. 1 Conceptual Framework ... 50

LIST OF TABLES Table 3. 1 Responses Rate ... 54

Table 3. 2 Distributions of Participants by Educational Qualification ... 55

Table 3. 3 Distributions of Participants by Age ... 55

Table 3. 4 Distributions of Participants by Job Experience ... 56

Table 3. 5 Distributions of Participants by Job Title ... 56

Table 3. 6 Distributions of Participants by Firm’s Industry ... 57

Table 3. 7 Distributions of Participants by Legal Status of the company ... 57

Table 3. 8 Distributions of respondents by Firm’s number of employees ... 58

Table 3. 9 Distributions of respondents by number of employees in Accounting Department ... 58

Table 3. 10 Validity and Reliability Analysis ... 59

Table 3. 11 Percentage Distributions, Standard Deviation and Arithmetic Mean Values for Accounting System... 60

Table 3. 12 Percentage Distributions, Standard Deviation and Arithmetic Mean Values for Effective Accounting Information System ... 63

Table 3. 13 Percentage Distributions, Standard Deviation and Arithmetic Mean Values for Decision-Making dimension ... 66

Table 3. 14 Pearson Correlation Matrix Analyses Between the Variables ... 69

xiii

ABBREVIATION AND ACRONYMS

AIS: Accounting information system IS: Information System

MIS: Management Information System

COSO: Committee of Sponsoring Organizations of the Treadway Commission AICPA: American Institute of Certified Public Accountants

AAA : American Accounting Association FEI: Financial Executives International IIA: Institute of Internal Auditors

IMA: Institute of Management Accountants

CobiT: Control Objectives for Information Technology ISACA: Information Systems Audit and Control Association CICA: Canadian Institute of Chartered Accountants IQ: Information Quality

FASB: Financial Accounting Standard Board SPSS: Statistical Package for Social Sciences SMEs: Small and Medium Enterprises

INTRODUCTION

Nowadays, rapid and continuous developments in information and communication technologies have brought quick change in the field of business as it is in every area and have profoundly affected the way of doing business. The use of information that companies will obtain in information systems has made businesses competitive in globalized commercial environments. In this context, accurate, reliable, timely information generation and use to enable enterprises to deliver quality, cost-effective and speed advantages it has become more mandatory from the point of view. This rapid and continuous change has also made it necessary to make significant changes in the structures of the information systems that will meet enterprise needs (Hall, 2012; Romney, Steinbart, Zhang, & Xu, 2006; Sürmeli, 2007).

Accounting involves processes for assisting the users of financial statements for preparing performance reports and recording financial transactions to exhibit financial position to take managerial decisions. Thus, accounting is defined as the process of describing, classifying, summarizing and reporting transactions related to the purposes of the entity's financial structure (Weygandt, Kimmel, KIESO, & Elias, 2010). Therefore, accounting information is used to measure financial information about an entity's economic activities and to report this financial information to various users. The primary purpose of accounting information is to provide managers with information that can utilize in the decision-making process. In this context; accounting, which is an essential tool in business management, constitutes the necessary information system for all phases of management and decision-making process, besides being an indicator reflecting financial results for businesses(Needles, Powers, & Crosson, 2013; Wild, 2009).

Accounting information systems provide significant contributions to increasing the efficiency and effectiveness of enterprises. This method is to provide coordination between the departments in the funded business and to present the

collected information to the information users in a typical arrangement with other business departments. The accounting information system is a system that enables the operation to be carried out more healthily for each area while at the same time operating as a whole. In this respect, the accounting information system is of the utmost importance regarding ensuring the continuity of the business and the formation of a healthy business culture (Whittington & Pany, 2014).

Accounting information system (AIS) is one of an essential element of modern information system (IS). Developments in the areas of accounting, information technology (IT) and IS over the last decades of the twentieth century have widened the range and roles of AIS (Reid, 2000). AIS increases the need for a systematic information system that gathers the necessary numerical data required by the business management, transforms that data into useful information that managers can use, and presents the results to the managers whenever they are needed (Romney & Steinbart, 2000)

Information system’s concept

Today, Information It is the primary source for businesses, societies, and economies. The main reason behind this is that competitive superiority has turned into intellectual values rather than physical products (Simkin, Norman, & Rose, 2014). Information is a collection of data that provides explanations about a subject. It is also called data processing (Romney & Steinbart, 2000). The information system input is the data, and the output is the information. Information system processes When data is converted into information (Durucasu, 2012). An information system is an all-in-one and interrelated element for planning, controlling, coordinating, analyzing and deciding information gathering, storing, and sharing as needed (Reid, 2000). Businesses regularly obtain the information they need from information systems (Alagöz & Allahverdi, 2011; Romney & Steinbart, 2000). Information systems are an essential tool regarding organizational success. Technology and human work together in information systems. Information systems were a series of human resources, programs and managerial processes that turned data into

meaningful information for decision makers to accomplish specific objectives (Hall, 2012).

Information systems are structures formed by interconnected elements such as collecting, processing, storing and distributing generated information to support the decision-making mechanisms as well as to organize the organization (Dinç & Abdioğlu, 2009). Businesses need information systems where knowledge and information are obtained to remember the past, to follow the present and to plan the future (Bodnar & Hopwood, 2014). Initially, information systems are used to provide business information flow, but today it is used to carry both in and outside business information flows (Alagöz & Allahverdi, 2011). Because businesses have different and complicated information flows, it is important to choose which method of related information will be received, how it will be used and processed by the administrators in the process of decision making (Mizrahi, 2011).

The system is two or more components interact with one another to achieve an aim. Systems contain subsystems and sub-systems perform specific functions of the system as a component (Romney & Steinbart, 2000). Data process is a sequence of operations that allows the data to arrive at the information state. As a method of information processing, recording, sorting, classifying, computing, summarizing, saving, reusing, duplicating and forwarding. These procedures in the information processing manner are briefly explained below:(Sürmeli, 2007):

• Recoding: determination and documentation of the transactions regarding the parties, time, subject, quantity and amount of data or information to be collected, accumulated and then processed to the system to ensure the entry of the data into the system for various processing.

• Classification is the arrangement of data or information based on particular groups and more specific, more specific sub-groups among themselves. • Computation it is the process of implementing mathematical models

according to the property of the information that is desired to be obtained, Such as addition, subtraction, multiplication, division of data.

• Summarizing is to convert large numbers of information into a shorter and more convenient way, taking into account the requirements and time of information users.

• Storage the accumulated data and the information generated are stored in various files according to their characteristics and other properties to be used again in the future.

• Reusing the stored data or information is used again to generate a variety of information or reports.

• Duplicating it is the process of replicating data or information as necessary, and copies will be given to users of information.

• Delivering it is the transmission of data or information from the source to the users, institutions, and related departments.

Accounting Information System’s Concept and Scope

The Accounting Information System is a broad concept that includes traditional accounting, such as financial accounting and cost accounting. It is the most important and the oldest of the fundamental management information systems (Gelinas, Dull, & Wheeler, 2011). The accounting systems is a scheme that collects, classifies, records, measures and inspect information about the business. It enables storage of information and creation of a database of enterprises to make profit maximization more efficient (Needles et al., 2013). Accounting Information System is a system that has different characteristics from other accounting areas. Furthermore, it covers all functions of the organization and accounting system; It can also be equalized to the brain system of a business organization. Business managers have many benefits in their decision making.

An accounting information system, one of the primary tools that impact the success of businesses, provides the necessary information when management perform their decision-making tasks (McLeod & Schell, 2007; O'Brien & Marakas, 2006). Systems implemented in enterprises seem to be different from each other, but they are in constant communication with each other. For example; Management Information Systems provides information support to managers in decision-making

stages. This support may include information on in a financial structure, as well as a change expected at the market prices at the same time as the effects on the productions of the enterprises. An AIS consists of five components (Romney & Steinbart, 2000):

• Peoples who operate the system and perform various functions,

• Procedures and Manuals that related to business activity that collect, process and store automatically or with human effort,

• Data is related to the business processes of organizations.

• Software that processes the organization's data to provide meaningful information,

• Information Technology Structure. Statement of the Problem

In today's intensely competitive business environments, its need to use information and information technologies successfully so that they can survive and continue their operations profitably. Accounting information systems are essential information that business management needs. It is evident that the decisions taken without consulting the accounting information will be incomplete and inaccurate. It is well-known that the principal goal of business organizations is to maximize earnings either regarding increases in business productivity or by achieving fast expansion in market control, to achieve this goal, Business entities require being active to the changes in the circumstances, in particular to the information technology revolution.

Bodnar and Hopwood (2014) argue that an adequate Accounting Information System improves the quality of information, in that way permitting for more informed decisions by internal and external users of the financial information, Accounting Information System deficiency can result to poor decision making and that will affect Organizational performance. In the light of this scenario, this study is initiated to investigate to what extent an effective Accounting Information system affects Managerial Decision Making at Konya Manufacturing Firms.

Research Questions

This study attempts to answer the subsequent questions:

1. How Accounting Information system effects Organizational Decision-Making process?

2. What is a Role of effective Accounting information system on managerial decision making?

Research Objectives

Through this study it will achieve the following objectives:

1. To investigate the impact of effective Accounting Information systems on managerial decision making.

2. To examine the relationship among the effective accounting information systems and better decision making

Significant of the Study

This study will be of critical, and it will contribute to the literature of accounting information in the Middle East and especially in Turkey because it enhances and provides an adequate contribution to establishing better organizational Efficiency and Profitability. AIS is thought capable of magnifying performance, information processing, and prepare reports.

Results of this research contribute to the theory and idea both in AIS, Organizational Efficiency, and production, besides other areas. For example, it can help stimulate the awareness of performance issues in the AIS field. Besides Small and Medium Enterprises may benefit from the findings of this study and also may help to design, practical policies that may address the Managerial development and improve businesses profitability. Additionally, Results of this study may contribute to the existing information and literature that may be applied academicians who may wish to carry out further researches on a related subject matter.

CHAPTER ONE

ACCOUNTING INFORMATION SYSTEM

1.1. Technology and Accounting information systemsRapid developments in computer technology effects on accounting systems and highlighted the information systems within the framework of management's decision-making dimensions. Controlling data input and output has also been a factor in the profitability of businesses (Gökdeniz, 2005). Developments in information technology have intensely improved accounting systems and changed economic circumstances. Computers and other digital technologies have improved office productivity helping the prompt exchange of documents, research, teamwork with Faraway partners and the collection and analysis of data. Information technology gave all sorts of personal economic participants the new essential tools for identifying and seeking economic and business opportunities (Shanker, 2013).

The utilization of information technology significantly influences the operations of the company (Romney & Steinbart, 2000). Therefore: business needs to recognize the role of Information technology in the organization and its influences on the organizational processes (Von Hellens, 1997). An accounting information system supported by proper information technology is a requirement for management in modern business conditions. The quality of accounting information Relies on the integrity of accounting information system as well as its relation to other business areas (Mamić Sačer & Oluić, 2013). Integrated business application (IBA) supports accounting systems to add value to the business. As a result, an organization uses reliable, timely and accurate information(Warman & Davies, 1998). Accounting data processing approved by relevant Information creates a reduction in the cost of accounting information production the increase of confidence in accounting information and becomes time and energy saving (Von Hellens, 1997).

Accounting information system is, historically Observed, defined by information technology improvement. In that insight, some study results indicate that business organizations rearrange their accounting information systems, especially in

the field of cost accounting, as a response to the variations in the conditions and as a reaction to the latest technologies (Sürmeli, 2007). In small and medium-sized enterprises, accounting systems are now computerized and provide them with unlimited benefits (Simkin et al., 2014). In other respects, a significant privilege in computer use also allows for certain types of information to be uploaded, processed, transmitted and applied. The management of large databases, loading and relocating of the operations, the rapid realization of the return of the process to the remarkably extensive areas of information in the timely way of delivering speed to businesses (Murthy & Groomer, 2003).

The formation of the Accounting Information System in a business organization is carried out within the scope of organizational culture, strategic planning, and the integration of information technology (Sürmeli, 2007). For this reason, it is necessary to indicate the level of the Accounting Information System in the enterprises and the areas of interaction. These areas are exhibited in Figure 1 below.

Figure 1. 1 Factors influencing the design of AIS

As shown in Figure 1 above, there are various systems that businesses have implemented. Therefore, it is realized that the effects of information technology on accounting information systems are within the scope of both organizational culture and strategic planning. Figure 1 also exhibits that latest improvement in IT affects the design of an AIS. Indeed, in the prior decade, IT has genuinely transformed the means that accounting and various other business activities are carried. Furthermore, that influence is expected to continue in future. There are several chances to finance in Information Technology that the AIS can be enhanced to add value to a firm. Most Companies, nevertheless, do not have endless resources. Therefore, a significant decision involves recognizing which Possible AIS improvement are expected to return the highest profit. Decision Making rationally involves that accountants and information system professionals understand their Company's strategy (Romney & Steinbart, 2000).

1.2. Internal Control and Accounting Information System

Accounting information system is formulated on the theoretical root of accounting practices and accounting on the application of contemporary information technology theory and practice of interdisciplinary, accounting information systems as an essential segment of the department of information systems (Fanxiu, 2016). Accounting information system is a computer use platform. Its includes idea of system analysis, design and build up to the financial control of the accounting business for automatic processing, providing financial information to inform users. Moreover, it will be able to support business analysis and predicting, and relevant management decisions to provide helpful and timely information on contemporary systems (Hall, 2012; Masli, Peters, Richardson, & Sanchez, 2010).

Accounting information system purpose is to provide services for decision makers of enterprise management, for the government's social economy, market regulation and macro-control decision-making, as well as provide relevant information services for those who require extra information (Bedard & Graham, 2011). Accounting information system itself has become a very complicated system,

which needs to develop the control schemes in its internal settings matching control guidelines and control standards.

The internal control allows an organization reduce the risks caused that the entity no longer reaching its objectives (Carmichael, Willingham, & Schaller, 1996; Johnstone, Gramling, & Rittenberg, 2013; Whittington & Pany, 2014). The structure of the whole financial control and operational auditing the company's internal control system determines the scope of the audit work. Investigation of the internal control system informs the audit team about how the business divisions to be audited and what kind of relationship they have with other divisions (Vijayakumar & Nagaraja, 2012). In this way, the independent auditor learns the structure of the internal control system. The auditor's objective at this stage; To examine the degree of compliance with the written and verbal control procedures of the operations (Spira & Page, 2003).

Internal control is a tool used by the management to mediate the execution of the management function and to ensure its operation. However, it does not take the place of management (Alagoz 2008). The underlying philosophy of the existence of internal control is based on the idea that individuals will move from their organizational interests to their interests (Ross, 1973). Internal control system compatible with each other and a system of mutually supportive measures. Some of these controls have been developed based on business processes, while others have operated independently of business processes(Graves, Longenecker, Marsh, & Milstead, 2003). Internal Control is rules and procedures aimed at helping one process to be always performed in the right manner(Ge & McVay, 2005). It should not be forgotten that people influence internal controls, provide reasonable assurance and are a means of reaching the objectives of the enterprises (Beneish, Billings, & Hodder, 2008).

1.3. Components of Internal Control Systems

As a result of economic and technological developments, enterprises have become large and complicated structures, the working scales have been diversified,

and the operations of the enterprises have become unable to be monitored with simple control methods. In the past, the control of a single person has been enough to make sure that the activities in a business are carried out as planned, but nowadays, in order to ensure that the business activities are in harmony with the business objectives, the need for a comprehensive, structured and detailed Internal control that includes all the working segments has become inevitable (COSO, 1992). The internal control systems mechanisms of consist the following; control environment; the entities risk assessment, the information system, control activities and the monitoring (Financial Reporting Council, 2013).

1.3.1. Control Environment

Control Environment is a series of standards, processes, and structures that come up with the foundation of internal control application throughout the organization (Johnstone et al., 2013). The control environment refers to the general viewpoint of management, consciousness, and actions of directors regarding the importance of internal control system of the organization. The control environment has a broad impact on the way business activities are structured, the way in which aim is created, and the way in which risks are assessed (Hayes, Wallage, & Gortemaker, 2014).

The control environment is the basic element of internal control. the extent to which internal control can be successful depends on the control environment which it is located. The control environment refers to the procedure the institution works. Every individual in business should know the limits of their responsibilities and authorities. Because the employees play the most important role in the realization of control (Yang & Guan, 2004). The main source of the control environment is institutional history, corporate culture and management philosophy. The elements that make up the control environment are:

1.3.1.1. Integrity and Ethical Values

The board of directors and the senior management are responsible for ensuring that the directives, conduct and activities of the company at all levels of the operation of the internal control structure and integrity are important values related to

professional ethics and should be an attitude, should be maintained (COSO, 1992). The board of directors and top management must establish behavioral standards (rules) related to integrity and professional ethics and must ensure that these rules are understandable in every stage of the business, outside service providers and business partners. The Organization should assess its commitment to the expected behavioral rules of individuals and employees and, if there is a deviation and should be determined in a timely and appropriate manner(Johnstone et al., 2013; Whittington & Pany, 2014).

1.3.1.2. Board of Directors’ duty on Internal Control Activities

Board of Directors; Impartial, independent from management, qualified and have a sufficient number of members. The board identifies its members' knowledge, skills, and expertise and makes periodic evaluations. The aim is to question senior management when necessary and to take necessary precautions(O'Leary, Iselin, & Sharma, 2006). Root and Grumman (1998) stated that the supervisory responsibility belongs to the board of directors. The board undertakes supervisory responsibilities or authorizes senior executives to achieve this goal. The board monitors, manages and guides the efficiency, efficiency and operation of the internal control structure. 1.3.1.3. Assignment of Authority and Responsibility

The top management and the board of directors should consider all aspects of the business including all departments of the business, legal regulations and outsourcing service providers (independent auditing, financial consulting, education, etc.) in order to achieve the set objectives (Erdoğan, 2009). Management identifies and assesses the communication lines reporting how to make reports in order to ensure that information flows, responsibilities and authorities can be fulfilled at every stage of the business so that business operations can be maintained (Robertson & Louwers, 1999). The board of directors determines the authority and responsibilities at each stage of management and management, authorizing them, delimiting authorities and assigning responsibilities in accordance with the order of departure of the duties (Graves et al., 2003).

1.3.1.4. Commitment and Competence

The control environment of the organization will be more successful if its culture is one in which quality and capability are openly evaluated. Competence is the knowledge and skills needed to achieve tasks that define the work of the individual. Management should specify the skill levels for particular jobs and make sure those with the necessary training, experience and intelligence do the job (Hayes et al., 2014).

1.3.1.5. Management’s Philosophy and Operating Style

The philosophy and manner of management is based on their perspectives and approach to financial reporting, accounting issues, taking and managing business risks, A personal example from top management and the board provides a clear indication to staffs about the organization's culture and the significance of control. specific, the General Manager plays a key role in controlling whether Lower-ranking personnel decides to obey, adhere to or ignore company regulations and the kind of business risks accepted (COSO, 2013; Dittenhofer, 2001; Whittington & Pany, 2014).

1.3.2. Risk Assessment

Any business faces many risks that may arise from internal or external sources. The risk in terms of business; Can be defined as an event or occurrence that may adversely affect the achievement of the business objectives(COSO, 1992). Businesses must successfully manage the risks they face in order to achieve their business objectives. Risk management; Board of Directors, executives, and employees are actively involved in the process (Robertson & Louwers, 1999). In this process, the events that can be considered as risk are defined, the risk acceptance level of the operations against the determined risks is indented and risk is evaluated within the framework of the risk acceptability level. The given response is; According to the level of risk acceptance; Acceptance of risk, reduction of risk, sharing of risk, or avoidance of risk (COSO, 2013).

1.3.2.1. Target Determination

The first step in establishing a successful risk management process in an enterprise is to set realistic and achievable goals (Bell, Landsman, & Shackelford, 2001). The main goal of businesses is to make profits and grow. Different sub-goals are determined while activities are being carried out to achieve the main goal (Williams & Heins, 1985). For example, if an enterprise intends to offer a new product to the market, the sub-objectives such as the creation of the necessary production line for it and the recruitment of qualified personnel to be employed in that production line will be determined in the sub-objectives. In terms of business, risk assessment is the process of predicting the risks that may affect the operation and taking the necessary measures if it takes place in order to reach the objectives with strategic precaution for the enterprise(Whittington & Pany, 2014). Studies have shown that they are more successful than others in achieving the goals set by the enterprises establishing the risk management processes to identify, evaluate and provide the necessary responses to these risks (Dowd, 1998; Johnstone et al., 2013; Moeller, 2008).

1.3.2.2. Event Identification

There are many different types of events, opportunities or risk factors during business operations. For example, for a business that supplies raw materials to abroad, a sudden increase in exchange rate risk may be an opportunity or risk for an enterprise that sells their products to the abroad. Therefore, the events that can affect the achievement of the targets set in the enterprises should be determined and these events should be assessed as risk or opportunity(COSO, 1992). When handling a business risk, the most important points to be considered is the type of risk. Enterprises need to manage risks and they face; Inherent risk and residual risk; inherent risk is the risk that an activity would constitute if no restraint or other reducing factors were in place(Johnstone et al., 2013). Residual risk is the type of

risk that continue to exists after proactive actions have been take (Williams & Heins, 1985). Risk assessment is a two-dimensional process. When a risk is taken into account in an undertaking, it should be considered both in terms of occurrence and effect (Armour, 2000).

1.3.2.3. Risk Detection

The strategic approach to risk assessment is based on identifying risks to the key organizational goal. Risks associated with this goal are taken into account and then Calculated the significant of the risks. Identifying the significant of risks is important, not only to identify the most important areas that need to be allocated to the sources of risk appraisal but also to disseminate the responsibility to manage those risks (Rasmussen, 1997).

An institution's performance may be at risk, depending on internal and external factors at both institutional and operational levels. The risk assessment should take into account all risks (including the risk of corruption and fraud) that may arise (Whittington & Pany, 2014). New approach facilitates the identification of changes in the risk profile of an organization through changes in the economic and regulatory environment, internal and external working conditions, and disclosure of new or modified goals. Adequate tools for risk identification should be adopted (Dowd, 1998). Two of the most commonly used tools are risk screening and risk self-assessment (Raz & Hillson, 2005).

1.3.2.4. Risk Measurement

In principle, it is not enough to determine a particular risk, but also to evaluate the risk (magnitude) and to assess the likelihood of a risk to decide how to deal with risk. Although some risks are numerically identifiable (e.g., financial risks in particular), the methodologies for analyzing risks differ, since it is often difficult to characterize (for example, reputational risk). Later, this risk is only intangible, rather than a subjective one. In this sense, risk measurement is more than an art. However, taking advantage of the systematic risk rating criteria learns the process attribute by

providing a framework for ongoing evaluations (Curtis & Wu, 2000; Demirbaş, 2005; Hanim Fadzil, Haron, & Jantan, 2005).

According to Dowd (1998) stated that risk measurement key objective is to inform the management about the priority risk areas that need to be addressed. For this reason, it is often necessary to develop some frameworks that categorize all risks as high, moderate and low. With such measures, risks can be rated for management decisions by identifying management priorities and what needs to be addressed (for example, those with a high potential for and potential impact).

1.3.3. Control Activities (Control Procedures)

Control procedures are the policies and procedures put into practice to mitigate the risks and achieve the objectives of the business organization. To be effective, control activities must be reasonably relevant, directly linked to the continued functioning and cost competitiveness, comprehensive, reasonable and control objectives as planned throughout the period (COSO, 1992). Control activities are assigned to the organization in general, to all levels and all functions. These activities include a series of control activities, such as the following:

1.3.3.1. Delegation of Responsibility and Approval Procedures

Authority transfer and execution shall be carried out only by persons who act as a proxy. A delegation is a fundamental tool that enables strong business and operations to be initiated when the management requests it. Authorization procedures must be documented and communicated to managers and employees; the documentation should include the specific conditions and duration of the transferred powers. Compliance with the terms of a delegation means that employees are required to act within direct lines and limits as governed by law or regulation (Whittington & Pany, 2014).

1.3.3.2. Segregation of Duties

A person or a team should not control all significant stages and areas of a business or process to reduce the risks of fraud, errors, wastefulness or rule violation

and the risk of detection such problems (COSO, 1992). On the contrary, tasks and responsibilities should be systematically shared among a large number of people to ensure check and balance effectiveness. Transaction recording, interpreting them and monitoring or supervising them are essential tasks. However, the settlement may reduce or eliminate the effectiveness of the internal control activity (Hanim Fadzil et al., 2005). A small organization may not have enough staff to carry out this control completely. In such cases, the management should be alert to the risks and compensate these risks with other controls. Rotating employees can help ensure that a single person does not take too long time with all the crucial stages of business and operations (COSO, 2004). Also, the encouraging the use of annual leave or providing compulsory annual leave may also facilitate the reduction of risks by providing a temporary rotation of the duties (Financial Reporting Council, 2013).

1.3.3.3. Controls on Access to Resources and Records

The access to resources and records must be restricted to those authorized to retain and use them (Yang & Guan, 2004). Responsibility for accountability; receipts, inventory availability or entrusted with assignments and other records relating to the transfer of the Goods is proved. Restricting access to resources makes it easier for the public to reduce the risk of unauthorized use or loss and to adhere to direct management. The degree of the limitation depends on the sensitivity of the source and the awareness of the risk of loss or abuse, both of which must be periodically monitored. When the sensitivity of an entity is decided, the cost, portability, exchange value must be taken into account (COSO, 2004).

1.3.3.4. Verification

The transactions and essential works should be confirmed before and after the process; For example, when the goods are delivered, the quantity of the goods delivered is confirmed by the quantity of the goods ordered. Then, the number of the invoiced goods and the number of the goods delivered are confirmed. Inventory records are also verified by inventory counting (Hayes et al., 2014).

1.3.3.5. Performance Review

Activity performance is regularly assessed according to a set of standards for assessing effectiveness and efficiency. If performance reviews have concluded that the actual achievements do not meet the established goals or standards, the processes and activities established to achieve the goal should be re-audited to determine if improvement is needed (Ge & McVay, 2005).

1.3.4. Information and Communication

Information and communication are vital to the realization of the overall objectives of internal control(COSO, 1992).

1.3.4.1. Information System

Reliable and appropriate information is preconditioned, and transactions are instantly recorded and correctly classified. Significant information should be identified and communicated to the staff (timely communication with the right people) in a format and context that will enable them to fulfill their internal control and other responsibilities. For this reason, the internal control system and all transactions and essential transactions must be fully documented. The quality of information influences the power of management to make appropriate decisions, and the information should be timely, up-to-date, accurate and accessible (Armour, 2000).

According to Whittington and Pany (2014) argued that information and communication are vital in the realization of all internal control objectives. For example; One of the objectives of internal control is to fulfill the obligations related to public accountability, This can be done through the preparation and store the reliable and appropriate financial and non-financial information by announcing such information through reports timely and impartial disclosures. Information and communication are related to the performance of the organization, and it increases the likelihood that the activities will regularly be evaluated, by the ethical rules,

economically efficient and effectiveness. In many cases, some information must be provided or communication established to comply with the statutes and regulations.

The information is needed at all levels of the organization to establish adequate internal control and achieve its goals. Therefore, the creation of meaningful, reliable and appropriate information should be determined and provided and announced to them promptly, permitting them to fulfill their control and other responsibilities. The requirement for reliable and appropriate information is that jobs and transactions are promptly recorded and correctly classified. Also, business operations must be categorized appropriately to ensure that management obtains reliable information, This means the arrangement, sorting, and formatting of information obtained from reports, schedules and financial statements (Johnstone et al., 2013).

The Information systems generate reports dealing with its activities, including financial and non-financial, relevant information, and possible to conduct and control its activities. The system is concerned not only with quantitative and qualitative forms of data generated within the organization but also with the information required by outside activities and circumstances regarding information-based decision-making and reporting (COSO, 1992).

The documentation should be readily understood (e.g., flow charts and texts) to provide information and reporting quality, to achieve internal control activities and responsibilities, and to enable the internal control system to monitor all transactions and essential business activities more efficiently and efficiently. These documents should be accessible to find when needed (Root & Grumman, 1998). The documents of the internal control system should include the organizational structure and policies, the description of the types of activities and the associated objectives and control procedures (Curtis & Wu, 2000). The organization must have written evidence of the elements of the internal control process, including the objectives and control activities (Robertson & Louwers, 1999).

1.3.4.2. Communication

All personnel should receive clear messages from the senior management to ensure that they fulfill their control responsibilities seriously (Root & Grumman, 1998). They should know how to connect their activities with others' work and their role in the internal control system. It is also necessary to establish effective communication with third parties outside the organization (COSO, 1992). One of the most critical communication channels is between management and staff. Communication should increase awareness of the importance and relevance of effective internal control, ensure that the organization have the risk-taking capacity and risk assumptions and recognizes the roles and responsibilities of personnel in creating and supporting impacts on internal control elements (COSO, 2013).

1.3.5. Monitoring

Internal control systems should be monitored to evaluate system performance during the period. The monitoring function is performed through routine monitoring activities, special evaluations, or a combination of both (COSO, 2013).

1.3.5.1. Continuous Monitoring

Continuous monitoring of internal control involves normal, repetitive work activities. Such monitoring activities include regular management and surveillance activities and other measures taken by the staff during day to day business activities. Continuous monitoring activities: Includes each element of control and relates to measures taken against internal control systems that are not regular, moral, economical, efficient and effective(COSO, 2004).

1.3.5.2. Special Reviews

The scope and frequency of appropriate evaluations determine the effectiveness of risk assessment and continuous monitoring procedures. Specific individual assessments include an assessment of the effectiveness of the internal control system and ensure that the internal control performs the desired results based on predetermined methods and procedures. Internal control deficiencies should be

reported to appropriate levels of management (COSO, 1992). The monitoring function should ensure that audit findings and recommendations are met satisfactorily and immediately (Root & Grumman, 1998).

Control is the measurement of current business success and the determination of the likelihood that success will achieve the specified objectives. Control-based on the results obtained from the existing activities are reviewed against the objectives set in the planning process. In this respect, planning and control are like two brothers that are not separated from each other. Control can be defined as a process leading to directing activity to predetermined objectives. The concept lies in recognizing that a given activity gives the desired results. To be able to control as it is understood from this definition, the desired results must be known (COSO, 1992; Hayes et al., 2014; Whittington & Pany, 2014).

The control process is carried out in particular stages, as there is a comparison process with predetermined standards to correct existing activities if they deviate. The most important idea in control is to determine what the results should be or what is expected activity. The results of a managerial or other organizational activity must be compared to a specific criterion, and gain control. These standards are called standards.

1.4. Internal Control System Models

There are different internal control systems Models. Here some internal Control Models; Committee of Sponsoring Organizations(COSO), Control Objectives for Information Technology (CobiT), Electronic System Assurance and Control (eSAC) and System Trust (SysTrust).

1.4.1. COSO Model

Committee of Sponsoring Organizations of the Treadway Commission (COSO) is an organization created 1985 by the American Institute of Certified Public Accountants (AICPA), the American Accounting Association (AAA), the Financial Executives International (FEI), the Institute of Internal Auditors (IIA) and the

Institute of Management Accountants (IMA). The internal control system created by these organizations cover the whole of the operation. The responsibility of the internal control system for the management of the board and the managers, and the responsibility for the efficient operation of the internal control system. The internal control system designed by COSO to provide regulatory and reliable financial reporting, operational efficiency and regulatory compliance, it consists of five key elements; Control Environment, Risk Assessment, Control Activities, Information and Communication and Monitoring (Alagoz 2008).

1.4.2. CobiT Model

CobiT (Control Objectives for Information Technology) Developed by the ISACA (Information Systems Audit and Control Association) in 1996, is a set of best practices for Information Technology Management. It brings together managers, auditors, and IT users to transform their business objectives into computing goals, the resources needed to achieve those goals, At the same time, it enables to use sub-structures of information technologies effectively (Ridley, Young, & Carroll, 2004).

In this model, which aims to control the risks arising from the Information Technology System used by the business, the scope of the internal control system is the whole business, including the information processing technology used in the business. The responsibility for establishing an internal control system that ensures reliable financial reporting, operational efficiency, regulatory compliance, completeness, correctness, and confidentiality of the information produced is governed by the management, internal auditor and independent auditors are responsible for ensuring the effectiveness of the system (Ridley et al., 2004).

1.4.3. SysTrust Model

The SysTrust is a certainty system that was together established by the American Institute of Certified Public Accountants (AICPA) and the Canadian Institute of Chartered Accountants (CICA). It aims to provide the reliability of information produced in digital systems. In a SysTrust engagement, the specialist appraises and tests whether or not a particular system is reliable when measured in

contradiction of three fundamental principles: accessibility, security, and integrity. The responsibility for efficient operation is independent external auditors (Pugliese & Halse, 2000)

1.5. Measuring the effectiveness of AIS

Accounting involves processes that enable the users of financial statements to make decisions in business management and preparing performance reports and recording financial transactions to demonstrate the financial position. Thus, accounting is defined as the process of identifying, classifying, summarizing and reporting transactions related to the purposes of the entity's financial structure (Elliott & Elliott, 2007). Therefore, accounting information is used to measure financial information about an entity's economic activities and to report this financial information to various users.

The main purpose of accounting information is to provide managers with information that can be used in the decision-making process. In this context; accounting, which is an important tool in business management, constitutes the necessary information system for all phases of management and decision-making process, besides being an indicator reflecting financial results for businesses. Accounting information is sometimes referred to as financial accounting information and provides information to the internal departments of a company.

The effectiveness of an information system can be described from many different aspects (DeLone & McLean, 1992). An effective accounting information system; it should provide the flexibility of the accounting system and a good cost-income relationship to ensure that the entity's cash payments and cash outflows are transferred in time to the accounting records, the appropriateness of the proper functioning of the accounting system for staff and organizational structure (Ahrens & Chapman, 2004).

Evaluation of an effective system can be presented through the output produced as required, improve performance, increased productivity, and enhanced control over the decision associated with the information that is provided by the AIS.

Therefore, the information generated expected can make the decision-making process more productive. The information delivered is more straightforward to interpret and understand, as well as that the distribution of information to all functional departments could be updated (Ugboma, 2004).

The effectiveness of Accounting information system (AIS) as a decision, the decision-maker, observes about the information output provided by the transaction processing system, the management reporting, and the whether the budgeting systems meet their requirements in the control of tasks the coordination (Nicolaou, 2000). The appraisal of the effectiveness of AIS depends on the application of AIS as perceived by the user concerning the quality of the information generated. The quality of information relies on the reliability, report forms, relevance and timeliness for the decision maker (Kim, 1988).

Nicolaou (2000) & Yeunyong (2007) highlighted that there is a correlation between the application of an integrated system and the effectiveness of the Accounting Information system(AIS). The application of the ERPS has caused the effectiveness of AIS. The effectiveness of AIS can be expressed through the quality of the accounting information output and the entity's internal control (Alzoubi, 2011). The effectiveness of the AIS also depends on the perception of the decision maker about the usefulness of the information generated by the system. How the information satisfies their needs about the operational processes, managerial reporting, budgeting, and control of the organization (Sajady, Dastgir, & Nejad, 2012).

1.6. Characteristics of Accounting Information System’s Quality

Recently, companies are operating and competing in an information age. Information currently becomes a significant resource for most business organizations. Information Quality (IQ) issues have become extremely valuable for firms that want to work correctly, obtain a competitive advantage, or to survive in a contemporary business environment. Incorrect and inadequate data usually

negatively affect the competitive achievement of a business organization (Redman, 1992).

Information is frequently being acknowledged a fundamental economic resource and as one of the Organization's most valuable assets. The information provides the capability to deliver services, make accurate decisions, enhance performance, achieve competitive advantage and can additionally be sold directly as a product in its right (Moody & Walsh, 1999). According to Glazer (1993) stated companies that successfully combine an information technology strategy With their business strategies do so by focusing on the information itself, rather than on technology, as the real carrier of value and source of competitive advantage.

Various study efforts have been performed in the appraisal of information quality and information systems quality, and as a result of many models of information and information systems quality have been developed. One of the earliest models was Shannon’s model of communication from 1948. In which he extended the comprehensive theory of communication to add some factors, in particular, the influence of noise in the channel and savings possible due to the mathematical structure of the initial message and due to the nature of the last destination of information (Shannon, 1948). According to Mason (1978) developed a conceptual framework for evaluating the output of an information system, and based on communication theory, and he originated four methods to output measurement: technical level output, semantic level output, functional output, and influence or practical level output.

Based on theories of semantic information, including Dretske’s semantic theory of information, Devlin’s infon Theory, stamper’s Organizational semantics, and Floridi’s revised standard definition of information, Hu and Feng have created a data- information quality model under an information Source (S), Information Bearer(B), Information Receiver(R) Framework (Hu & Feng, 2005). Behind a comprehensive review of conceptual and empirical studies on information systems, DeLone and MacLean concluded that there are many measures of information systems success, which all fall in one of the six interrelated and interdependent

categories of formation information system's success model. These categories are system quality, information quality, use, user satisfaction, individual impact and organizational impact (DeLone & McLean, 1992).

According to Wang and Strong (1996) established a framework, based on the characters of data quality related to data consumers. They state accuracy, objectivity, believability, reputation, value-added, relevancy, timeliness, completeness, appropriate amount of data, interpretability, a case of understanding, representational consistency, concise representation, accessibility and access security as the most important data attributes.

Numerous information quality and information systems quality models have been manifested in different studies. Researchers indicated that information quality and information systems quality could not be uniquely defined since researchers are multidimensional concepts. Accordingly, information quality frameworks contain some quality dimensions or categories derived ordinarily based on some research method in a particular area with the set of quality metrics, criteria, components, items, or attributes (Hu & Feng, 2005).

The success of a business organization is reliant on the quality of its information, which is implemented within the enterprise information system. The information system is the set of procedures by which data are collected, processed into information, and assigned to users. The Quality of information system can be managed and controlled only if the quality of all of its components (People. data, information, technology, and work practices) is preserved (Von Hellens, 1997). Two generic types of systems emerge from the categorization: the accounting information system (AIS) and the management information system (MIS), Which are integrated to realize operational efficiency.

The primary Goal of AIS's is to generate information that shows enterprise's financial position and its business performance. To enhance accounting information helpfulness in the organizational decision-making process, information that satisfies some quality characteristics is expected. The factors impacting on data quality for