Adıyaman Üniversitesi

Mühendislik Bilimleri Dergisi

12 (2020) 24-33

FOREST COSTS PAID BY ENTERPRISES DURING INVESTMENT

PERIOD TO CARRY OUT MINING OPERATIONS IN FORESTLANDS

Taşkın Deniz YILDIZ

1*1Adana Alparslan Türkeş Science and Technology University, Faculty of Engineering, Department of Mining Engineering,

Adana, 01250 Türkiye

Geliş tarihi: 17.03.2020 Kabul tarihi: 01.06.2020 ABSTRACT

In order to carry out mining operating activities in forest areas that overlap with the mineral reserves, mining investors are asked to pay forest land permit fees, reforestation fees, and other fees (such as security deposit, service, and report) to the forest administration. These fees include the fees paid by mining investors as investment period costs prior to starting mining operating activities, and reforestation fees and other fees. The shares of fees within the amounts of mining investment paid by mining enterprises to forest administration only during the investment period is an object of curiosity. In order to determine this, a survey was conducted to mining enterprises via the ‘’Survey Monkey’’ online survey program. In this study, the variation of the shares of each of these fees within the amount of mining investment, according to the mineral groups was analyzed. According to this analysis, the reforestation fee of the mining companies participating in the survey receive an average share of 3.44% and the other fees have a share of 0.72%. Considering the forest land permit fees paid each year during the operation period, these costs, which are paid only once during the investment period, may force the mining enterprises economically in the presence of other costs.

Keywords: Cost; Forest; Investment; Mining; Operation

ORMAN ALANLARINDA MADEN İŞLETME FAALİYETLERİ

YAPILABİLMESİ İÇİN İŞLETMELERİN YATIRIM DÖNEMİNDE

ÖDEDİĞİ ORMAN BEDELLERİ

ÖZET

Maden rezervleriyle çakışan orman alanlarında maden işletme faaliyetleri yapılabilmesi için maden yatırımcıları orman idaresine; orman arazi izin bedeli, ağaçlandırma bedeli ve (teminat, hizmet ve rapor gibi) diğer bedeller vermektedir. Bunlar içerisinde maden işletme faaliyetlerine başlamadan önce maden yatırımcılarının yatırım dönemi gideri olarak verdiği bedeller; ağaçlandırma bedelleri ve diğer bedellerdir. Maden işletmelerinin sadece yatırım döneminde orman idaresine verdiği bedellerin maden yatırım tutarları içerisinde aldığı paylar merak konusudur. Bunun tespit edilebilmesi doğrultusunda "Survey Monkey" anket programı aracılığıyla maden işletmelerine anket gerçekleştirilmiştir. Bu çalışmada bu bedellerin her birinin maden yatırım tutarları içerisinde aldığı payların maden gruplarına göre değişimi analiz edilmiştir. Bu analize göre ankete katılan maden işletmelerinin yatırım tutarları içerisinde ağaçlandırma bedeli ortalama %3,44, diğer bedeller ise %0,72’lik bir pay almaktadır. İşletme döneminde her yıl ödenen orman arazi izin bedelleri de dikkate alındığında, sadece yatırım döneminde bir kez ödenen bu bedeller, diğer maliyetlerin varlığında tek başına, maden işletmelerini ekonomik açıdan zorlayabilir.

1. Introduction

Forest resources provide numerous and multifaceted benefits to society through its functions, such as the production of wood raw materials, recreation, aesthetics, community health, hydrological, conservation of wildlife, and biodiversity. Thus, forest management bears various costs while providing these benefits through forestry activities [1]. It is necessary to estimate the value of the deprived forest benefits due to the allocation of forests to mining, and to determine the cost value to restore the damaged forest to its former quality [2]. Following this determination, in order to carry out mining operating activities in forest lands, some fees are received for the forestlands used. It is foreseen that these costs will be spent on making real community benefiti.

Mining investors do not only pay forest fees to carry out mining operating activities in Turkey. Apart from varying depending on the overlapping of areas, they may face the payment status of expropriation fees, private land fees, or pasture fees. There are also different kinds of expenses such as operating license fees, waste management costs, rehabilitation costs, environmental compliance assurance, share of municipality, state's right, and taxes that mining enterprises are obliged to pay as a result of land useii [7].

In many countries where the mining sector are developing, all property permits, including forest permits received for the mining activities paid during the project, do not exceed 2% of the total mining investment amounts [8, 9]. But, due to the effects of changes in the legislation, there are concrete examples in only forest lands in Turkey that exceed 40-45% of this rate [10, 11].

Forest fees required in Turkey are very high compared to worldwide [12, 13, 14]. These sums paid as the forest fee annually in Turkey exceed the approximate average cost of the land purchase where they are located [15]. In the vicinity of the forest area, privately-owned property can be approximately purchased for USD 9000-18000 depending on its hectare, or on it’s being a wetland or a barren land, hence free of hire purchase [16]. For instance, during a 20-year mining project in Turkey, the fee paid for the forest can reach up to approximately 50-70 times more than the purchase price of the land owned by the private property in the region because of the continuously increasing forest land permit fee [17]. In the case of mining operations being in non-forest properties (e. agriculture, pasture, public/private land..), about more than 20 times differences may occur in the fees to be paid. In this situation, it becomes a critical factor affecting whether the aforementioned mining projects will be carried out or not [14]. In this case, it is not possible for domestic and foreign mining investors to provide economic operability in the mining investments they plan.

At the beginning of the 20th century, the minimum operable cut-off grades were, for example, 30

g/t for gold, 3% for copper, and 12% for zinc [18]. Today, as a result of the increasing demand and prices for minerals, gold mines of less than 0.5-1 g/ton, copper mines with 0.5% cut-off grade, zinc mines with 2% cut-off grade are now economically operable [19]. However, the higher the costs of mining enterprises get, the higher minimum cut-off grade of the ore that they will produce, in parallel with the cost increase, tends to get. This situation will mean the closure of some mining enterprises, leaving the economic operability.

The most important goal of each company is to make maximum profit. The profit or loss of the company depends on two factors. The first is the cost incurred for the amount of goods it will produce and sell. The second one is the income obtained from the goods sold [20]. From the point of mining enterprises, the second factor depends on the mineral prices determined by the stock exchanges based on the mineral demand in the world. The first and more important factor in terms of investment risk is that mining enterprises may be exposed to the influence of mining policies and legislation in the country.

In order for the investment project, which is one of the important tools in economic development, to reach the targets (minimum time, minimum cost, minimum capacity) determined in the project [21]; subsequent regulations due to legislation should not be outside the expected.

In terms of expenditures and risks, the most important activity group to be considered regarding mining is pre-production activities [22]. These activities include the forest permit process. In case the mining operating activities overlap with forestlands in Turkey, it is beneficial to determine how much of a share the fees paid during the investment period from the expenses of the relevant permit period takes within the amounts of mining investment. In this paper:

• Determine how much each and total of the different types of forest fees paid during the investment period by the mining enterprises had shared in the amounts of the mining investment in order to perform mining activities in forestlands in Turkeyiii,

• Determine whether these shares vary according to different mineral groups, • Determine whether these shares have high in mining investment,

• Despite the prediction of the deduction in the forest land permit fee in the last legislative arrangement, it is aimed to discuss the necessity of a deduction in the paid forest fees during the investment period.

First of all, in line with this aim, questions were asked to the mining enterprises through the "Survey Monkey" survey program in May, June, and July 2018 in Turkey to identify such legislation problems in the mining sector and to make a comparative analysis for the results. Some of these questions are about the forest fees to be paid for mining activities in forestlands.

The survey questions were answered by the relevant departments of the mining companies. The answers were transferred collectively to the survey program, regardless of which companies answered the survey, and it wasn’t known what responses were given to the questions. Some of the 97 mining enterprises have chosen not to answer some questions. Respectively, 83 and 82 mining enterprises answered the ‘’reforestation fees’’ and ‘’other fees’’ question examined in the study. Along with these fees, the enterprises that announce their investment amounts are respectively 66 and 63 mining enterprises. These data were analyzed according to different mineral groups. The mineral groups stipulated by the legislation in Turkey are presented in summary (Table 1).

Table 1. Mineral groups in Turkish mining legislation (summary)iv[5].

Ist

Group Minerals

I (a) Sand and Gravel

I (b) Clays and rocks used in cement and ceramics industries

IInd

Group Minerals

II (a) Aggregate rocks and rocks for ready-mix concrete and asphalt

II (b) Dimension stones, Marble, Travertine, Granite, Andesite, Basalt etc.

II (c) Ground/milled rocks for industrial use (Calcite, etc.)

IIIrd Group Minerals Salts (incl. sea, lake, and spring water), CO2 gas (except geothermal, natural gas and petroleum areas,

Hydrogen Sulfide

IVth

Group Minerals

IV (a) Industrial minerals

IV (b) Peat, Lignite, Hard Coal, Anthracite, Asphaltite, Bituminous Schist/Shale Shale, Coccolith/Sapropel

IV (c) Metallic ores, rare earth elements/minerals

IV (ç) Radioactive minerals

In the calculation, the average values of forest fee ranges stated in the survey responses of each mining enterprise were proportioned to total investment amounts. So, average values were calculated for each mineral group.

2. Last Legislative Amendments on Forest Fees

In Turkey, it is projected that temporary facilities built out of necessity and depending on the period of the license to carry out mining operating activities in the forest areas are given permission within the framework set forth by Forest Law No. 6831, Regulation for Implementation of Forest Law and Forest Permitting Regulationv [26, 27, 28]. One of the most significant problems of the mining

sector is the unpredictable forest permit processes and extremely high forest fees [29].

Law No. 7061 that came into force on December 05, 2017 and Article 9 of Mining Law No. 3213 in Turkey have been changed. As a result of this change, a deduction was made in the fees taken from the mining permit in forestlandsvi. Based on this, in the implementing regulation of Article 16 of

Forest Law No. 6831, a change was also made with the Regulations put forth on July 06, 2018. The matter of how and under which circumstances the deduction will be applied are discussed in Article 8. Subsequently, a Circular of the GDF dated August 02, 2018 was published.

According to this with exceptions, for all mineral groups, from all permits, half of the land permit fees shall be taken for the first ten years starting from the date on which the mining operation permit is issued. So, on a site where the mining operation permit is issued after the date of 05th

December 2017, 50% discount will be applied to all forest permits to be given for 10 years by MAPEG (General Directorate of Mining and Petroleum Affairs), mining operation permit date. If the operation permit is in a forest permit field issued before December 05, 2017; after the date of operation permit issued by "MAPEG" starting from December 05, 2017, a discount will be applied for the remaining period of ten years.

However, due to the implementation of the aforementioned Circular by the General Directorate of Forestry, no deduction is applied in the license areas whose first operation permit date (10 years before the effective date of Law No. 7061) is before the date December 05, 2007. This situation eliminated not only the vested rights of mining investors but also removed competition and equal employment conditions between the ones who were given operation permit before the date December 05, 2017 and the ones who were given the permit after this datevii [9].

Nevertheless, in the inscription added to Paragraph 6 of Article 47 of the Law No. 7061 and to Article 9 of Mining Law, there was no mention of ''Operating Permissions First Regulated Date'', and no regulation was made regarding whether the operation permit was issued before the Law No. 7061 or not [9]. Therefore, in the aforementioned Article of the Law, there is no regulation found regarding ”no deduction will be applied for licenses issued before 2007” as well as regarding “deductions will be applied for the remaining period of 10 years in the operation permit issued before 2017”. See on legislative proposals on this matter [14].

Several Mining Associations, particularly the Turkey Miners Association (TMD), suggest the forest land permit fees required from mining enterprises are deducted [13, 14] or –instead of every year- are taken only once during the investment period. Forest land permit fees can be evaluated as an operating period expense. In this case, the share of reforestation fees from forest costs paid by mining enterprises during the investment period and the share of other fees within the amounts of mining investment should be examined.

3. Forest Costs Paid During the Investment Period: Their Ratio to the Amounts of Mining Investment

3.1. Reforestation Fees

3.1.1 Calculation of Reforestation Fee

In forestlands, the reforestation fee is taken once per m². It is determined that the desired reforestation fee for the mining permits given in the forestlands will be spent for the reforestation of these areas. The reforestation fee changes every year for mining enterprises and this fee rises every year according to the rate of the minimum wage in Turkey. The calculation of the "reforestation fee" in the Forest Regulation is stated as; "one-day normal working payment for Workers over 16 years old

that is established to second half of the year by" General Directorate of Minimum Wage Detection Commission" is, the multiplication of the permit area with reforestation unit hectare fee that

determined by the multiplication of minimum wages by the 294 days/hectare coefficient.

As seen from this definition, as the minimum wage increases, the reforestation fee that is asked from the miner are increased in Turkey as wellviii. Accordingly, the reforestation fee is 2.5073 TLix/m2

as of 2019.

3.1.2 Reforestation Fees in Turkey & Their Ratio to Mining Investment Amounts

The survey question, "How much the total reforestation fee you paid / will pay?" is asked to mining enterprises in Turkey. Eighty-three mining enterprises answered to this question. The distribution of these responses, according to different mineral groups, is shown below (Fig. 1).

Figure 1. Reforestation fees paid by mining enterprisesx

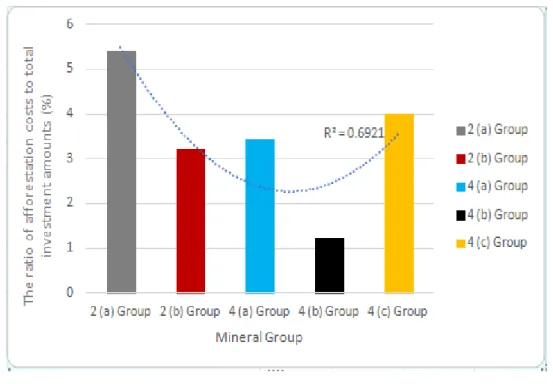

Reforestation fees are envisaged to be given only once at the beginning of the mining operation. Considering this situation, when the amounts paid as ''reforestation fees'' by each mining enterprises answering the survey individually are proportioned to their investment amounts, the following results are obtained on the basis of mineral groups (Table 2).

Table 2. Reforestation costs & averages of investment amounts. Mineral groups Number of mining

Enterprises Average of total investment amounts (TL) Average of reforestation fees (TL) The ratio of reforestation costs to total investment amounts (%) Group 2 (a) 16 39.687.500 950.000 5.40 Group 2 (b) 20 63.425.000 1.975.000 3.21 Group 4 (a) 8 498.312.500 6.500.000 3.43 Group 4 (b) 14 432.346.154 3.475.000 1.22 Group 4 (c) 8 522.750.000 3.132.143 4.00

For all mineral group 66 268.068.182 2.715.086 3.44

As can be seen in the table, the weighted average of the "ratio of reforestation fees to investment amounts" paid by the mining enterprises is 3.44%. This rate alone shows that the ‘’reforestation fee’’ has a high share in the mining investment amount in Turkey. The fact that the investment amounts of 2nd Group of minerals were less than the investment amounts of 4th Group of minerals was finalized

with the situation that the 2nd Group of minerals have a higher share –compared to other groups in

general- in investment amount of reforestation fee. Thus, as shown in the figure below clearly, it is

seen that this share declined gradually from the 2nd Group of minerals to the 4th Group of minerals

(Fig. 2).

Figure 2. The ratio of reforestation costs to investment amounts

It is seen that there is a moderate polynomial correlation (R2 = 0.69) between the mineral groups

and the ratio of reforestation fees to investment amounts. The reason why this change varies among the mineral groups is the variability in the forest permit areas to be operated especially in mining.

3.2. Other Fees

For performing mining operations in forestlands; there are other costs paid to the forest administration (such as security depositxi, service fee, and report fee). The question "How much is the

total amount fee of security deposit, service, and report that you paid/will pay to Forestry Administration? (Excluding land permit fee and reforestation fee)" was asked to mining enterprises.

The answers of 82 mining enterprises according to different mineral groups, are shown below (Fig. 3).

Figure 3. Other costsxii (TL)

The "other fees" that were paid by every mining enterprise which gave this answer were proportioned to their investment amount. The following results were obtained (Table 3).

Table 3. Other Fees & the ratios of other fees to investment amounts. Mineral groups Number of mining

Enterprises Average of total investment amounts (TL) Average of other fees (TL)

The ratio of other fees to total investment amounts (%) Group 2 (a) 15 41,933,333 202,333 1.09 Group 2 (b) 20 63,425,000 270,000 0.77 Group 4 (a) 8 498,312,500 879,688 0.82 Group 4 (b) 13 585,423,077 94,038 0.16 Group 4 (c) 7 583,071,429 889,583 0.74

For all mineral group 63 278,984,127 356,762 0.72

Only the ratio of "the other fees" from forest fees to the investment amounts of mining enterprises has a share too high to be underestimated with a value of % 0.72 as an average. Going from the 1st mineral group to the 4th mineral group, the average investment amounts increase. In fact,

this situation resulted in a decrease in the average value of the ratio of other fees to investment amount going from the 1st group to the 4th group of minerals (Fig. 4).

Figure 4. The ratio of other fees to investment amount

There is a weak polynomial correlation (R2 = 0.55) between the ratio of the other fees to the

investment amounts and the average value (%) of the mineral groups. However, from the 2nd group to

the 4th group, these values give an idea about the ratio changing among the mineral groups.

4. Conclusion and Suggestions

Reforestation and other fees, which are the forest fees paid by mining enterprises during the investment period, have undeniable shares in the investment amounts of these enterprises. The ratios of these fees to investment amounts vary among mineral groups. The ratio of reforestation fee to investment amount varies between mineral groups between 1.22-5.40%. In other fees, this share is between 0.16-1.09%. There are other land use costs paid during the investment period as well as taxes such as forest land permit fees and state right paid each year during the operational period. In the presence of these costs, the “reforestation fee” and “other fees” examined in the study may create a higher investment risk especially for mineral groups with low investment amounts. This situation shows that forest costs paid during the investment period are a cost item that can economically push more the 2nd Group mining enterprises whose investment amounts are lower compared to other

mineral groups. Things to do can be summarized as follows:

• First of all, in the direction of the recommendation of the mining sector, the land permit fees should be taken once, instead of every year, within the forest costs like the other fees specified outside this fee.

• Considering that required forest costs are high at specified rates only during the investment period in Turkey, being one of these fees, lowering the reforestation fee to a more reasonable level – for example deducting in half- with the legislation can make a positive contribution to the development of the mining sector. At this point, determining both the reforestation fee and security deposit, which is one of the other fees, in accordance with the minimum wage rate, can result in a high increase in these fees each year. Instead of this rate, it would be more appropriate if the increase in fees is at least to the extent of annually inflation rate declared in Turkey. Above all, it is beneficial to make such calculations with scientific approaches considering the mining and forestry criteria.

• Thus, when considering the mining operating data analyzed in the study, the ratio of ‘’ reforestation fee’’ to the total investment amount is 1.72% instead of 3.44% (Due to 50% discount of reforestation fee). Thus, these fee deductions to be made can reduce the mining investment risks. Even if these percentages may adversely affect the mining enterprises economically and financially, in the

context of the use of sustainable natural resources, at least making these changes stated in the forest fee types in Turkey will contribute to this sustainability.

References

[1] Kaya G. Determining the values of forest resources. Environmental Economics and Policy, Environmental Volunteers Platform, Istanbul, pp.143-158, 1998.

[2] Ok K, Kaya G. A comparative study on valuation techniques and accounting approach of land allocation rent in practice of Forest Law, Article 16. Journal of Forestry Research 2017; 4 (1): 46-60.

[3] GDF. Ministry of Agriculture and Forestry, GDF 2018 Annual Report. Ankara, 85 p., 2019. [4] Yıldız T.D. The share of required costs in ınvestment amounts for mining operating activities in

pasture lands in Turkey. Journal of Engineering Science of Adıyaman University, 2019; 6 (10): 23-31.

[5]

Yıldız TD. Waste management costs (WMC) of mining companies in Turkey: Can waste recovery help meeting these costs? Resources Policy, Accepted, 2020.[6]

Yıldız TD. Effects of the private land acquisition process and costs on mining enterprises before mining operation activities in Turkey. Land Use Policy, Accepted, 2020.[7] Yıldız TD, Kural O. Costs to be required in the conflict of mining operation activities and private property land of state's treasury & Evaluation of legislation, International Congress of Academic Research (September 16-18), Conference Abstracts, Bolu, pp.201-202, 2019.

[8] Aydın O. Investor is in trouble. (Foreword by Journal Editor). Journal of Mining Turkey 2018; 70, pp.4.

[9]

TMD. The report on mining problems and solution proposals. TMD Sector News Bulletin 2018; 72: 23-36.[10]

Yıldız TD. The survey research done to 97 mining enterprises from the online Survey Monkey(unpublished). 2018.

[11] Yıldız TD. Forest fees paid to permit mining extractive operations on Turkey's forestlands & the ratio to investments. Gospodarka Surowcami Mineralnymi: Mineral Resources Management, (Accepted), 2020.

[12]

Aktan M, Çimen N, Özçelik Y. Implementation of regulatory practices for Turkey and forestrypermits for mining activities. Proceedings of the 25th International Mining Congress of Turkey,

(April 11-14), pp.447-456, Antalya, Turkey, 2018.

[13] TMD. Forest permit problems in mining ındustry and solution suggestions. TMD, Editor: Evren Mecit Altın, 27 p., 2017.

[14] TMD. Mining sector problems and solutions in forest permits. TMD, Istanbul, 37 p., 2019.

[15]

Aydın O. Sector believes that dialogues can overcome any problem. Interview with UmitAkdur. Journal of Mining Turkey 2015; 46: 50-54.

[16]

Köse M, Ünver B. Why should the forest permit fees be revised? Journal of Mining Turkey2019; 77: 134-138.

[17] Journal of Mining Turkey. Mutual statement from sector, about to forest fees (News from Turkey). Journal of Mining Turkey 2018; 70: pp. 6.

[18] Priester M, Ericsson M, Dolega P, Löf O. Mineral grades: an important indicator for environmental impact of mineral exploitation. Mineral Economics 2019; 32 (1): 49-73.

[19] Journal of Mining Turkey. The solution of current account deficit is a strong mining industry. (Interview with Muhterem Köse). Journal of Mining Turkey 2012; 24: 46-53.

[20] Unay C. General Economics. Ekin Publishing, 2nd edition, Bursa, 510 p., 2000.

[21] Köse H, Kahraman B. Mining operation economics. Dokuz Eylül University Faculty of Engineering Publications No: 223, 3rd Edition, Izmir, 339 p., 2009.

[23] Topaloğlu M. Mining Law No. 3213 and related regulations (translation). Istanbul Mineral Exporters’ Association, 617 p., 2016.

[24] Yıldız TD. The impacts of EIA procedure on the mining sector in the permit process of mining operating activities & Turkey analysis. Resources Policy, 2020; 67:

[25] Yıldız TD. Recommendations for authorized administration organization in the mining operation permit process in Turkey. Trakya University Journal of Social Science, 2020; 22 (1): 211-237.

[26] Yıldız TD. Evaluation of forestland use in mining operation activities in Turkey in terms of sustainable natural resources. Land Use Policy, 2020; 96:

[27] Yıldız TD, Kural O, Aslan Z. Problems and solutions in relation to permits required to be perform mining operation activities in forest lands in Turkey. 1st International Şişli Science

Congress (October 24-25), Istanbul, Turkey, pp.159-160, 2019.

[28] Yıldız TD, Kural O, Aslan Z. Problems and solutions in relation to permits required to be perform mining operation activities in forest lands in Turkey. Academic Studies in the Field of Science and Mathematics, Gece Bookstore Publishing, Chapter 2, Istanbul, Turkey, pp.23-46, 2020.

[29] Emiroğlu A. Mining sector problems and solutions in forest permits (Foreword of the Book), TMD, 8-9, 2019.

[30] Mallı NÖ. Examination on the incentive for forest costs within the scope of the Constitutional Court decision. Journal of Mining and Human, 2019; 4: 34-36.

[31] Topaloğlu M. Amendments to the ımplementing regulation of article 16 of the Forest Law. TMD Sector News Bulletin, 2018; 72: 86-88.

[32] https://legalbank.net/belge/asgari-ucretler-16-yasindan-buyukler-ve-16-yasindan-kucukler-icin-2018-yili/2610258/ (Accessed: 13th January 2019).

[33] Central Bank of the Republic of Turkey, 2019. Indicative exchange rates & Central Bank rates by date. Available via: <https://www.tcmb.gov.tr/kurlar/kurlar_tr.html>, (Accessed: 06th

November 2019).

[34] Saraç MS. Charges for marble quarries in forest territories. Proceedings of the 10th International

Marble and Natural Stones Congress and Exhibition of Turkey. December 13-14, Bursa, Turkey, pp.12-19, 2019.

i In 2018 alone, all sectors paid a total of 1.639 Billion TL as permit fee for operating activities to GDF (General Directorate

of Forestry), 295 million TL of this fee was spent on reforestation of the whole Turkey [3]. Especially of all sectors, it can be said that a significant portion of forest incomes is covered by the fees obtained for mining activities.

iiFor different types of these costs, see [4, 5, 6]

iii See the forest fees paid not only during the investment period but also during the mining operation period [11]. iv See the mineral groups stipulated by the Turkish mining legislation [4, 23].

v Regarding license/permit process and environmental regulations in the mining sector in Turkey, see [24, 25].

vi A lawsuit was filed with the Constitutional Court for the annulment of article 47 of the Law No. 7061, where the incentive

provision was foreseen. This request for annulment was rejected by the Constitutional Court's decision numbered 2018/80 on July 05, 2018 [30].

vii Additionally, in line with the opinion of the forest bureaucrats, aforementioned deduction incentives are not applied even

though new operation permit is issued in the extension of the operating permission period. However, the application of this provision, which introduced an incentive provision, to the re-extended operating permissions would be more appropriate for the purpose of the regulation [31].

viii See the minimum wage tariffs [32].

ix 1 USD = 4.84 Turkish Lira (July 16, 2018) [33].

x In the figure, "> 10 million": 10 - 20 million TL, i.e., the average of 15 million TL was accepted.

xi According to the Forest Regulation, “Security deposit” = Permitted forestland (m2) x [reforestation fee per unit area

(TL/m2)/10] [11]. In the event that the mining investor gives up his investment, the forest permit expires, and the activity

ends, the security deposit is returned provided that the obligations specified in the written contract have been fulfilled [34].

![Table 1. Mineral groups in Turkish mining legislation (summary) iv [5].](https://thumb-eu.123doks.com/thumbv2/9libnet/4492752.79042/3.892.130.766.789.1054/table-mineral-groups-turkish-mining-legislation-summary-iv.webp)