:-щ ■■· j. ЛЛ;

■,’ '. ■

J " \

' * 'HF

SERVK l<: QUALi rv IN Λ ( OIVIMERCIAL BANK - A CASE SIIJDY

Λ THESIS

s i m M i r r l · : ! ) l o riii· d i-i’a r i m e n to r m a n a g e m e n i' AND

GRADUA TE SCIIOOE 01· BUSINESS ADMINIS TRA TION OE BiEKEN'T UNIVERSI TY

IN TAR TIAL FUETIEI.MEN'T OF THE RE0UIREMT;N I S FOR THE DEGREE 01·’

MAS TER OF BUSINESS ADMINIS TRA TION

liy I’eliii Genv January 1995

H f

f l l l i . í

‘Sli-é

i 9 3 í

I certify tliat I have read this thesis and it is fully adequate, in scope and in quality, as a thesis for the degree o f Master of Business Administration.

Assist. Prof Selçuk Karabati

I certify that 1 have read this thesis and it is fully adequate, in scojie and in quality, as a thesis for the degree o f Master o f Business Administration.

A.SSOC. I’lof. Brdal Kiel

I certily that 1 have read this thesis and it is fully adequate, in scoj^c and in quality, as a thesis for the degree o f Ma.ster o f Business Administration.

Assist. Ih o f Serpil Sayın

AIÎSIRACT

SKkVICK QDAbI l Y IN A COMMICRCIAL BANK - A CASK S I IIDY

IM'LiN GI7.NÇ M B A, TIII'SIS

Supervisor: Assist. Prof. I)r. Selçuk Karabali

In tlie service sector, in tlie environments where tlie rivalry is very intense and the pioclucts are similar, in order for a firm to have a strong position in the sector with respect to its competitors, delivering quality service should be its distinctive competence. In this study, a real life example from banking sector, Interbank is analyzed. I’hc study aims at demonstrating the importance o f delivering quality service for a firm to succeed in a competitive environment. Gaps that obstruct delivering service quality and the causes o f those gaps arc investigated, and suggestions to eliminate them are made.

OZEl

U Ç A R I BİR BANKADA SERVİS KALİ I ESİ - BİR V A K ’A ÇALIS^IASI

PELİN GI'NÇ M İLA. I'ezi

Tez Yöneticisi: Yarci Doç. Dr. Selçuk Karabalı

Servis sektöründe, rekabetin çok yoğun, ürünlerin de çok benzer olduğu oı tanılarda, firmaların sektörde rakiplerine göre güçlü bir pozisyonda olmaları, ayırdedici özelliklerinin kaliteli servis sunmak olma.sma bağlıdır. Bu çalışmada, bankacılık sektöründen gerçek bir örnek Interbank İncelenmektedir. Bu çalışma, rekabetçi bir ortamda, bir firmanın başarılı olmasında kaliteli servis sunmanın önemini gtistermeyi amaçlamaktadır. Kaliteli servis .sunmayı engelleyen ayrılıklar ve bunların sebepleri araştırılmış, bu ayrılıkları gidermek için öneriler sunulmuştur. Anahtar kelimeler: Servis, Kalite, Bankacılık

ACKNOVV LEIK; EM EN İ S

I would like lo acknowledge my thesis supervisor Assist. I’rof. Selçuk Karabati for his helpful comments, .suggestions and his invaluable supervision throughout the course of this study. I would also like to thank Assoc. Prof Erdal Erel and Assist. Ih o f Serpil Sayın Гог their kind interest in the subject. I would also like lo thank my sister Defne (Jenç for her siijiport, patience and understanding throughout this study.

TA B LE OF' CON l EN IS ABSTRACT. Ô ZE T... ACKNOWLEDGEMENTS... iii TABLE OF C O N T E N T S ... iv LIST OF T A B L E S ...vii LIST OF F IG U R E S ... vii I. INTRODUCTION. II. LITERATURE SURVEY AND DEFINFFIONS. II. I . DETERMINANTS OF SERVICE QUALITY...5

11.1 11.1 11.1 11.1 I I I II ! 11.1 11.1 11.1 II. I 1. Reliability... 5 2. Rcspon.siveness... 5 3. Competence... 5 4. Access... 5 5. Communication...6 6. Credibility... 6 7. Courtesy...6 8. Security...6

9. Understanding the Customer... 7

10. Tangibles... 7

11.2. MAJOR GAPS THAT CAUSE UNSUCCESSFUL SERVICE DELIVERY. 11.2.1. Gap I : Customers’ Expectations - Management’s Perceptions Gap...8

11.2.2. Gap 2: Management’s Perceptions - Service Quality SpecificationsGap.8 11.2.3. Gap 3: Service Quality Specifications - Service Delivery Gap... 9

11.2.4. Gap 4: Service Delivery - External Communications Gap... 9

11.2.5. Gap 5: Customer Perceived Shortfalls... 10

III. ANALYSIS OF THE SITUATION... 12

III. 1. THE GOVERNM ENT’S ACT TO END TI IE CRISIS... 15

IV. POSITION OF INTERBANK... 17

IV. 1. Π ΙΕ POSITION AND IMAGE ΟΓ INTERBANK UN I IL ΊΊΙΕ S I'ART

OF THE CRISIS... 17

IV.2. DECISION OF A NEED FOR CHANGE... 20

IV.3. ANALYSIS OF COMPETITIVE FORCES...2.3 IV.3 . 1. Threat o fN c w Entrants...23

IV.3.2. Powerful Suppliers and Buyers... 24

IV. 3.3. Substitute Products...24

IV. 4. FINDINGS ON THE COMPARISON OF CORPORA ΓΕ BANKING AND PRIVATE BANKING IN INTERBANK...25

V. DETERMINING THE EXISTENCE OF THE SERVICE Q U A U I’Y SIIOICI FALLS AND SUGGESTING SOLUTIONS FOR THEM ... 32

V. 1. ANALYSIS OF GAP I . NOT KNOWING WI lAT CUSTOMERS EXPECT.. 33

V. I . I . Marketing Research Orientation... 35

V I .2. Interaction Between Management and Customers...37

V. 1.3, Upward Communication from Contact Personnel to Management.... 39

V.2. ANALYSIS OF GAP 2: THE WRONG SERVICE QUALI'I’Y STANDARDS 40 V.2.1. Management Commitment to Service Quality... 42

V.2.2. Perception o f Feasibility...44

V.2.3. fask Standardization...45

V.2.4. Goal Setting... 46

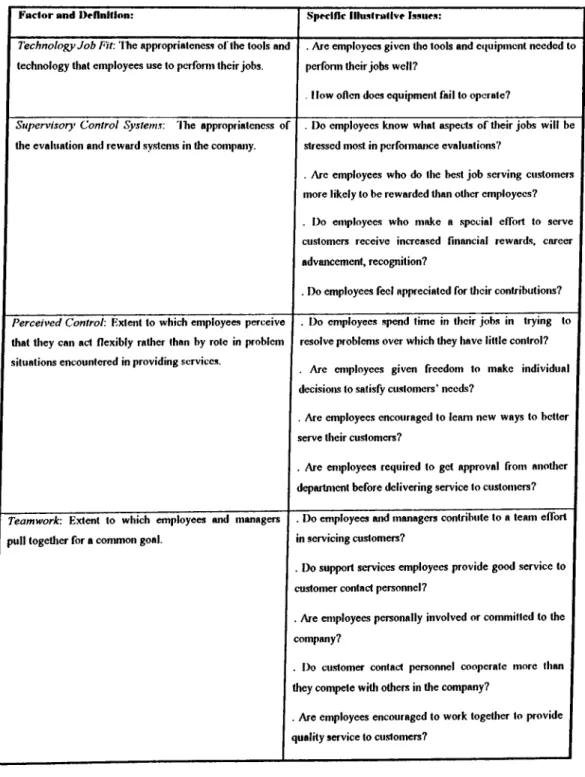

V.3. ANALYSIS OF GAP 3: THE SERVICE PERFORMANCE GAP...47

V.3.I. Role Ambiguity... 50

V.3,2. Role Conllict...50

V.3.3. Employee Job Fit...51

V.3.4. Technology Job Fit... 52

V.3.5. Supervisory Control Systems... 52

V.3.6. Perceived C o n tro l... 53

V.4. ANALYSIS OF GAP 4: WIICN PROMISES DO NOT MATCH DELIVERY. 55 V.4.I. Horizontal Communication...56 V.4.2. Propensity to Overpromise...56 V.5. ANALYSIS OF GAP 5: THE CUSTOMER PERCEPTIONS OF SERVICE

QUALITY GAP... 57 SUMMARY... 62 APPENDIX 1 A- THE QUESTIONNAIRE COMPARING PRIVAT E BANKING AND

CORPORATE BANKING... 65 APPENDIX IB- RESULTS OF THE QUESTIONNAIRE... 72 APPENDIX 2- SERVQUAL QUESTIONNAIRE ON INTERBANK I’AKSIM BRANCH..73 REFERENCES ...83

LIST o r TABLES

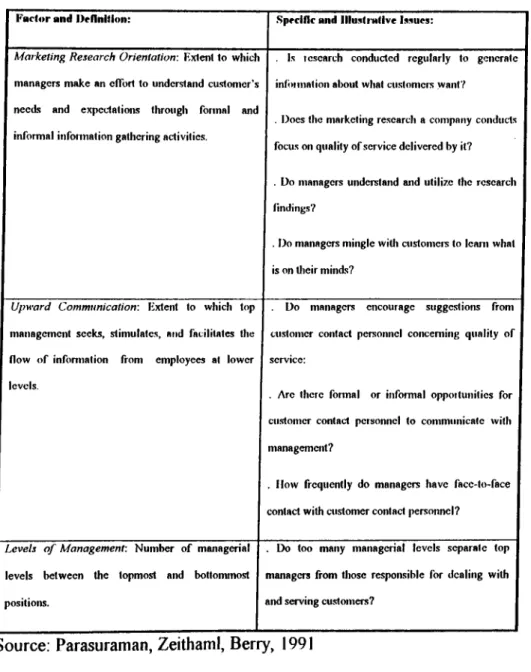

TABLE I. Conceptual Factors Pertaining I'o Gap 1... 34

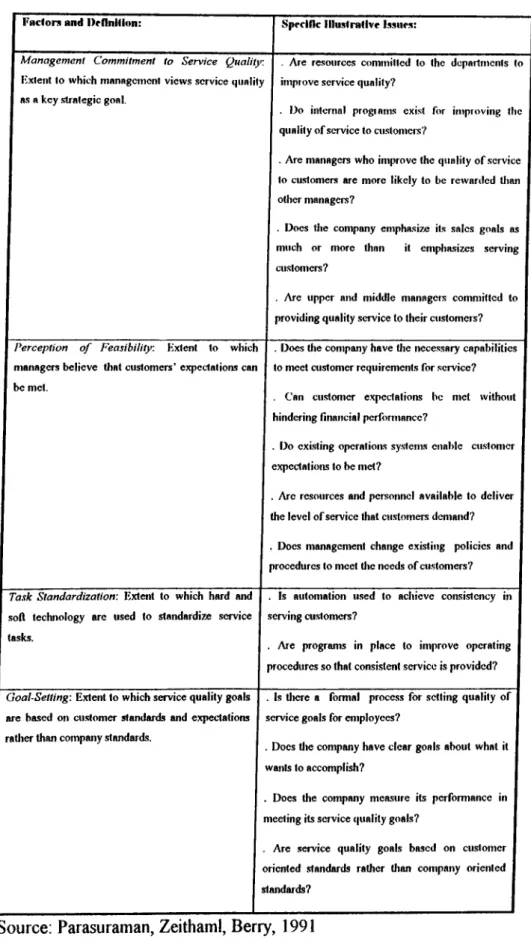

TABLE 2. Conceptual Factors Pertaining To Gap 2 ... 41

TABLE 3. Conceptual Factors Pertaining To Gap 3 ... 48

TABLE 4. Conceptual Factors Pertaining 'I'o Gap 4 ... 55

TABLE 5. Dimensions o f Service Quality...59

TABLE 6. Scores o f the SERVQUAL Questionnaire... 59

LIST OF FIGURES

I . INTRODUCTION

Companies that are striving to achieve a sustainable competitive advantage in today’s business world where the rivalry is aggressively increasing, know that delivering quality service is o f vital importance. Delivering quality service definitely changes the distinctive position o f the company with respect to its competitors positively in the service business (Parasuraman, ZeithamI, Berry, 1991). Excellent service creates customers who are glad they selected that firm and will continue to work with that firm (Parasuraman, ZeithamI, Berry, 1985). In order to achieve this and improve it further, companies should keep on doing continued research on the level o f service quality, customers’ perceptions o f the delivered service quality, the ways o f ofiTering better service quality, the underlying causes o f the problems encountered in service delivery and shortcomings in delivering quality service.

The aim o f this thesis is to demonstrate that the importance given to delivering quality service will lead a firm to success in a very risky and competitive environment. This is supported by research and studies done on a real life example.

In this thesis, how the importance given to service quality plays an important role in achieving competitive advantage, the problems that are faced in delivering service quality, the causes o f those problems and the ways to cope with them are analyzed on a real life example. The thesis is based on a study done on Interbank, a commercial bank in Turkey. This study is

shortfalls in delivering quality service and ways o f measuring them is presented in Chapter 2. The analysis o f the environment, i.e. the finance sector in Turkey, and the crisis that took place in the finance sector at the beginning o f 1994 is presented in Chapter 3. In Chapter 4, the necessity for Interbank to change its strategy is explained. In this chapter, also, the strategy o f Interbank before and after the crisis is analyzed. After that, in Chapter 5, the possible shortfalls o f service quality, ways to determine, measure and eliminate them are discussed. The interviews and questionnaires are done with the personnel o f Interbank and with its customers. In this chapter, some suggestions to decrease the shortfalls o f the delivered service quality are made, too. And, the thesis is concluded with a summary in Chapter 6.

II. LU ERATIJRE SURVEY AND DEFINITIONS

A service can be defined as any perforniance tliat is offered and is intangible and does not result in ownership o f anything (Kotler, 1991). Unlike products, most services are produced and consumed at the same time (Babakus & Mangold, 1992).

As service businesses increase in variety and number, the need for being more marketing and customer oriented arises. For a strong position, service companies focus on competitive differentiation, service quality and productivity; which all interact and affect each other (Kotler, 1991).

In the service business, the customers judge the service quality both on the job done and how it was done by the service provider. Delivering good service quality requires strength in the quality level at which the service is delivered as well as the quality level at which problems and expectations are handled. The manner in which the service is delivered can be a crucial com ponent o f the service from the customers’ point o f view (Parasuraman, ZeithamI, Berry, 1985). The relationship between the customer and the service provider makes the customer keep on or quit working with that firm. Therefore, the companies in service business should pay special attention to the way the service providers deliver the service.

Service quality is defined as setting standards regarding customer needs and meeting them (Parasuraman, ZeithamI, Berry, 1985). Another definition o f service quality can be the discrepancy between the customers’ expectations and perceptions. Service quality is supposed to improve as the perceptions get closer to the expectations (Cronin & 1'aylor, 1992).

In service businesses, the most important competitive weapon is performance, that is called the fifth P o f marketing. Performance makes the customers loyal and separates one firm from another especially in service industries where facilities, equipment, menus are more or less the same. Performance is what differentiates the firm (Parasuraman, ZeithamI, Berry, 1990).

Research conducted on focus groups o f customers from different service businesses shows that custom ers’ expectations o f service quality are influenced by word o f mouth, personal needs, past experience and external communications from service providers. If expectations o f the customers are met, service quality is perceived to be satisfactory, if not, less than satisfactory and if exceeded, more than satisfactory (Parasuraman, ZeithamI, Berry,

II.1. Determinants of Service Quality:

Several research done on dilTerent service businesses like securities brokerage, banking, credit cards came up with the output that there are ten determinants o f service quality. I'hose determinants can be stated as follows (Kotler, 1991; Parasuraman, ZeithamI, Berry, 1985):

II. 1.1. Reliability;

This determinant involves performing the service correctly and at the right time, keeping the promises given to customers.

II.1.2. Responsiveness;

Responsiveness is the degree the service provider is willing to serve the customers.

11.1.3. Competence;

Competence is possession o f the required skills and knowledge to perform the service.

11.1.4. Access:

This determinant involves ease o f contact and approachability, being not busy all the time customers try to get in touch, and having convenient location and suitable working hours.

Customers want to have the information stated in a language tliat appeals to them, the way they can understand.

II. 1.5. Coiniiiiinication;

lI.1.6.Credibility:

Credibility is being trustworthy, honest, believable and having the custom er’s best interests at heart. Characteristics o f the contact personnel, reputation o f the firm, and the degree o f hard sell involved in interactions with the customer are factor influencing the determinant.

II. 1.7. Courtesy:

Being polite, respectful, considerate and friendly; having clean and neat appearance and considering consum er’s property are factors making up this determinant

II.1.8. Security:

Security is being free from danger, risk and/or doubt. Physical safety, financial security and confidentiality are also contained in it.

The service provider’s eflbrt to understand the customer’s needs, learning his/her specific requirements and pay individual attention are components that contribute to this determinant.

II. 1.9. Understanding The Customer;

11.1.10. Tangibles:

Tangibles are defined as the physical facilities, appearance o f the personnel, tools and equipment used in providing the service and physical representations o f the service.

After having stated the criteria the customers use in judging the service quality, the possible shortfalls that can be observed in the quality o f the service from both the provider side and the custom er side will be stated in the following paragraphs.

11.2. Major Gaps that Cause Unsuccessful Service Delivery:

Research done on several different service industries result in the existence o f five major gaps in delivering quality service. Those gaps are caused by the organizational problems and by the customers. The gaps that are within the organization, i.e. that are from the service provider side affect the customer based gaps. So, all o f the gaps should be considered as interlinked and should be minimized as much as possible (Parasuraman, ZeithamI, Berry, 1991,K otler, 1991).

Parasuraman, Zeithaml and Berry developed a framework called SERVQUAL that measures the difference between the customer perceptions and expectations and use this as a measure o f the level o f service quality (Parasuraman, Zeithaml, Berry, 1991). Cronin and Taylor argue that performance based measures, SERVPERF should be used instead o f SERVQUAL, for service quality should be considered as a long term attitude. This scale can help firms develop strategies by observing the service quality scores over time (Cronin, J.J,

Taylor S.A., 1994, Carman J.M., 1990, Cronin, J.J., Taylor S.A., 1992) .

II.2.1. Gap 1: Customers’ Expectations - Management’s Perceptions Gap

This gap relates to management’s perceptions o f what customers expect from service. This gap occurs when management’s perceptions o f what the customers expect in delivering service do not match with the actual expectations o f the customers.

When top management who set the priorities do not fully understand the custom ers’ service expectations, they may make bad decisions and those decisions may result in perceptions o f poor service quality. Hence, the necessary first step in improving quality service for management is acquiring accurate information about customers’ expectations.

11.2.2. Gap 2; Management’s Perceptions - Service Quality Specifications Gap

In order to deliver quality service, companies should set performance standards that reflect the management’s perceptions o f customers’ expectations. If management commitment

is absent in the sense that there should be appropriate service standards for customer expectations o f service quality, then a gap occurs. The quality o f the service delivered is also affected by the standards on which the contact personnel are evaluated and rewarded. When those standards are not present in the system, the quality o f the service that is delivered might be negatively influenced.

II.2.3. Gap 3: SeiTice Quality Specifications - Service Deliveiy Gap

Poorly qualified employees, inadequate internal support, insufllcient capacity to serve are the reasons for the service performance gap to occur. Even though (here are set standards and specifications for the way the service is delivered, still the so called gap is likely to exist due to the reasons stated above. So, only if the standards set in accordance with the custom ers’ expectations are joined with qualified personnel, technology and systems, and the personnel is evaluated on the basis o f these performance standards, then this gap can be eliminated.

11.2.4. Gap 4: Service Delivery - External Coniinunicatioiis Gap

A discrepancy between the actual service delivered and the promised service has a bad effect on consum ers’ perceptions o f service quality, and this is called the gap between service delivery and external communications.

Custom ers’ service perceptions may be enhanced by educating the customers to be better users o f the service and by explaining the facets o f the service process. Customei s who

are aware o f the fact that the company tries to do the best to deliver the service, have a more favorable perception o f the service quality. The discrepancy adversely affects the custom ers’ assessment o f service quality.

II.2.5. Gap 5: Customer Perceived Shortfalls

This gap is closely linked to the other gaps stated above (See Figure 1). Because, the gaps stated in the above sub-sections which are the gaps that refer to the provider side (i.e. stem from internal sources), influence customers’ expectations o f the quality o f the delivered service. Therefore, the intensity, the causes of, the way o f dealing with those gaps will have direct impact on this gap.

This gap can be closed by effectively handling the gaps stated previously. If the causes o f those gaps are correctly determined and eliminated, this gap will get narrower. The extent that the previously stated gaps are minimized and the management o f those gaps are sustained, the smaller this gap is supposed to become.

Figure 1. Service Quality M odel (Source: Kotier, 1991)

III. ANALYSIS OF THE SITUATION

Beginning o f 1994 was a new stage in T urkey’s and Turkish banking sector’s histoiy. The economy and the banking business were faced with a crisis that deteriorated tlie financial and economic balances. The crisis that took place slowed down the economy, caused monetary and financial markets almost to collapse and three banks to be banned from the banking activities.

In this section, the situation o f the banking sector for the first quarter o f the year will be analyzed.

Turkish banking system, including the Central Bank o f the Republic o f I'urkey, consists o f 71 banks (Bankalar Birliği, 1994). By the decision o f the Central Bank o f the Republic o f Turkey on depreciating the currency, and by application o f this decision, the crisis started. The depreciation in the currency was not the major cause o f the crisis, but this last action made the crisis inevitable. Not long after the crisis, TYT Bank, M armara Bankası and Impexbank were suspended from banking activities and their license to accept deposits were deprived. Turkey’s international credibility has suffered, as the country was downgraded three times by the international rating agencies. This affected almost every bank in the system in a negative way, for they relied heavily on foreign debt as the funding method for themselves.

So, the banking system was in a chaos where no credibility and reliability to the system existed (Giiltekin, 1994).

The reasons that made the management o f Central Bank o f the Republic o f Turkey decide that it was necessary that there should be a real depreciation in I'urkish Lira can be explained as follows. The statements below show that the depreciation was inevitable at that moment and was actually the result o f wrong financial policies chosen by the government (Giiltekin, 1994).

The fundamental problem has been the imbalance between the revenues and expenditures o f the public sector. The financing method chosen affected the monetary system negatively and excess liquidity in Turkish Lira has occurred in TL markets due to not enough volume o f borrowing o f the government from the markets to regulate the imbalance stated above. On top o f this, the auctions for the issuing o f the new Treasury Bills have been canceled following one another and interest rates were kept low; causing the market rely on very short term, i.e. overnight borrowing and almost no issuing o f the 3-month or 6-month bonds. The Tax Reform act also caused uncertainties in the system and worsened the system. So, by the end o f January 1994, the domestic borrowing o f the state by the Treasuiy Bonds have almost disappeared.

Because the Treasury could not borrow by the bond auctions, llie way for funding for the Treasury was using legal cash advance from Central Bank o f the Republic o f J'urkey. This has been used up to the limits.

By the Open M arket Operations, Central Bank o f the Republic o f Turkey has tried to pull the excess liquidity away from the system, but still the acts were not satisfactory in terms o f achieving the desired level and this created a pressure on the exchange rates, and the gap between the Central Bank o f the Republic o f Turkey’s declared foreign exchange rates and the interbank exchange rates got larger.

The demand for the Treasury bonds and bills was quite low, so the governm ent’s hope to decrease the excess liquidity by this way did not work. All o f the above factors signaled that the depreciation in Turkish Lira was necessary, so the pressure on foreign exchange rates and the gap between the Central Bank o f the Republic o f Turkey and interbank could be made smaller.

When the depreciation took place, the system was all hit, for almost all o f the banks and many other institutions in the economy had debts in foreign currency and those debts became larger suddenly. The panic in the public made an unusual demand for foreign currency and caused the exchange rates climb further up. The shock in the system, the demand for foreign currency collapsed the system. People withdrew Turkish Liras in their deposits to buy foreign currencies, the money running in the business were changed to foreign currency as soon as it was delivered; and soon after, the money markets were having big trouble with banks having difficulty in being liquid in Turkish Lira and paying back the debts in foreign currencies.

In the following section, the government’s solution to the crisis and the new regulations that were brought in for that purpose and the impacts o f these regulations will be discussed.

111.1, The Government’s Act to End The Crisis

After the failure o f the three banks, the government noticed the need for taking urgent measures in order for the whole monetary system to operate properly again. The main problem in the failure o f these three banks was the liquidity crisis. After the depreciation, the situation o f excess liquidity o f TL in the money markets have changed, and banks started having difficulties in being liquid enough. Then, when the banks started having difficulties in paying their debts and keeping their promises, like a chain reaction, the lines among the banks were cut down to each other, withdrawals by public from the deposit accounts started in a rush, secondary markets where banks borrow and lend on promises almost stopped operating. In such an environment, even where the banks cannot rely on each other, monetary system slowed down and the circulation o f money which makes the economy run has decelerated. Because Turkey’s rating in financial markets was downgraded, borrowing from abroad became too costly and almost impossible. So, no foreign funds could help the monetary system run regularly. Then, the solution could only be domestic funding and borrowing. It was time for the government to take action to bring back the money taken away from the system, either by taking back the deposits that had been withdrawn from the system or by issuing bonds and bills; and hence inject cash to the monetary system to revitalize it. So, the new regulations on April 5, 1994 were put into effect by the government. With these

decisions, full insurance to all deposit accounts in case o f failure o f the banks were guaranteed by the state (Interbank Annual Report, 1994).

The guarantee given was combined with new styles o f time deposits that the period defined for the interest payments could be a minimum o f 7 days. The aim was to push the duration o f borrowing in the money markets from overnight to longer time intervals progressively. The system also had the flexibility o f withdrawing money from the accounts with the agreed interest rate with the condition that it was warned a week before the withdrawal.

These were followed by Treasury auctions o f three-month bills with very high interest rates, so that the state could have cash inflows for its own requirements. I ’he guarantee and the flexibility for the deposit accounts, the bond issuing showed their effects in a short time and the money was back in the monetary system and circulation again. The monetary system started to perform again, the trust lost started to be gained back again, banks were able to pay back their foreign debts. The first step taken for the crisis to be solved and to heal the monetary system has been successful in that sense.

For the sustainability o f the regularly operating monetary markets, other points touched in the April 5, 1994 package, namely the privatization acts, subsidies, shrinkage in governm ent’s acts have to be successfully dealt with (Interbank Annual Report, 1994).

IV. POSITION OF INTERBANK

IV .l. The Position and lnia2e of Interbank Until the Start of The Crisis

“ I f you cling to the past you wither.

If you adjust to the times, you grow with the times But if you anticipate the future and help to shape it The rewards are the greatest o f all !”

Above is the vision statement o f Interbank. The changing economic conditions and regulations by the end o f year 1993 and beginning o f year 1994 led Interbank change its policies and reorganize to be the leading bank in the sector and go beyond it. In a very short time like six months. Interbank has been successful in the new policies and in a new area in banking that was completely unknown to the personnel before.

Before examining the impacts o f the importance given to delivering quality service, the position o f Interbank, the policies o f Interbank till the crisis will be overviewed. Then the need for changing those policies and implementing new ones will be analyzed.

Interbank has been the first to implement the new products and services in many areas o f banking in Turkey. Interbank has worked with top 300 corporations o f Turkey and multinational corporations. Interbank provides a wide range o f corporate, investment banking products and services, project financing to those leading companies. The specialization has been on arranging syndication loans, project financing, international trade activities, and has been one o f the leading corporate banks in the sector. In order to achieve this. Interbank has given importance to its human resources. People working for Interbank are intelligent, innovative and very well educated. And this has been the bank’s almost the most important strength. In addition to this, the care taken for speed, responsiveness, teamwork, strength, precision, leadership and training has helped Interbank reach a leading position in corporate banking in Turkey.

Interbank has worked with corporations only, and with a decision made a few years ago, personal accounts were closed. So, funding for the bank has been either by cash from corporations or by borrowings from foreign banks. Because both Turkey’s and Interbank’s credibility were high until the crisis, it was inexpensive and easy for the bank to borrow in foreign currencies, i.e. fund itself from abroad and lend domestically.

The organizational structure o f the bank is almost flat, giving easy access both horizontally and vertically along the organization. This gives the members o f the bank, the flexibility to work effectively, generate original products and deliver quality service to the customers.

Training is a continued process in the organization and the peisonnel possess up to date information in the areas o f banking and finance by the frequently arranged training programs. These training programs enable the personnel to handle a variety o f jobs in the bank. So, fewer people are enough to do the same amount o f work in Interbank. When a com puter network is combined with this, decentralized office locations are no longer required. Therefore, the office locations were centralized and decreased in number. Because Interbank has chosen its own customers, and most o f the work with those corporations can be performed through PCs, networks, telephones, telefaxes, etc. there exists no requirement o f having many branches.

This has been a snapshot o f Interbank until the beginning o f this year. Since then , the bank examined the new situation o f the markets, country and future; and decided that “change” in many parts o f the organization and policies was vitally important for future success.

In the following sections, analyses on Turkey’s economic conditions, banking sector, financial markets are made. In the light o f these analyses, the required changes for the bank will be stated.

1V.2. Decision of A Need for Change

At the time tlie crisis started, Interbank’s financial position can be analyzed as follows: The bank had to pay back $ 300 millions o f foreign debt in a few months time. Those debts were borrowed with low interest rates and were placed as loans to the corporations in the domestic markets to make profits. However, the increase in the exchange rates changed the position and suddenly the debts were larger than they were planned to be.

The solution in paying back these debts that were due in a very short time could be rolling them over, finding new debts and pay back with them or finding new sources to pay those debts back. I f the first two alternatives for the solution to the problem are examined, it is obvious that they are not feasible. As the country was downgraded three times, the cost o f borrowing was too high for Turkish institutions, and even some o f the lenders did not want to lend at all, regardless o f the price. The credit lines to Turkish financial institutions were cut down. Besides, the debts would again be in terms o f foreign currency, and in an environment where the Turkish Lira depreciated everyday with respect to the foreign currencies, this meant borrowing a continuously increasing debt. Therefore, neither rolling the debts over, nor borrowing new ones from other foreign financial institutions was the sustainable and desired solution to the problem.

The last alternative for the solution was finding new resources o f money to pay back the debts. This could only be achieved by new deposit accounts or cash flows o f the corporate

customers. The cash flows o f the corporate customers had already been a part o f the sources for the bank, so the key was to get new deposit accounts and hence money into the bank.

Having new deposit accounts meant working in a new area o f banking that is called personal and private banking, which the bank was completely a stranger to; and was not designed in that mentality in terms o f the services given and the MIS and the distribution channels. On top o f this, the bank had closed all the personal accounts and hurt people for that reason.

The picture o f the economy and the money markets showed that the exact healing and elimination o f the effects o f the crisis would take a few years with a best case scenario. So, in order to survive and be leading in the market, a sustainable source, a way o f funding had to be found. And this reasoning brought the bank to entering the deposit business in spite o f eveiy challenge facing the bank. Because, foreign originated funding was almost impossible for a couple o f years and the only domestic source for funding was the deposit accounts.

These are factors that made the bank decide to move into this new business, and now the bank is facing a big challenge. Also, the reasons for Interbank to move to a new area o f banking are examined in this section. The following sections are on finding out the differences between the new business the bank is in and the on-going one, and the key points taken into account when the decisions for change have been made.

The only solution that could be sustainable seemed to be changing the strategy and positioning o f the bank in the banking business by adding the notion o f private banking to corporate banking, and focusing on those activities.

In private banking, the products are limited, the personnel is inexperienced, the infrastructure is lacking some facilities. Still this seemed to be the only way to stay competitive especially in the crisis environment.

When the repositioning o f the bank was being done, from top management to the operations employee at the bottom levels o f the organization, the new strategies, the reasons to chose them were explained. So, everyone belonging to the organization was aware o f the fact that this was a necessary act for the future success o f the organization.

If the companies are aware o f the competitive forces in a business, then they can stake out a position that is less vulnerable to attack (Porter, 1979). In positioning, threat o f new entrants, bargaining power o f buyers, bargaining power o f suppliers and the existence o f substitute products are the factors that govern the competition in the business.

When a service firm is positioned, in an environment where the number o f products that can be offered to the consumers is limited and can easily be copied, creating a sustainable competitive differentiation passes through delivering higher quality service than the

competitors, and this can be achieved by exceeding the expectations o f the customers (Takeuchi, Quelch, 1983).

The study will continue by putting the new positioning o f Interbank into Michael Porter’s framework o f competitive forces (1979). The next step after that will be the analysis o f the gaps in service quality. This will be analyzed in detail in the next chapter supported by the interviews done with the personnel and the customers.

1V.3. Analysis of Competitive Factors

IV.3.1. Threat of New Entrants:

When Interbank decided to enter into this new business, private banking; there were certainly barriers that had to be managed well. In such an industry where there are numerous competitors (banks are a total o f 70 in this country), and where all are struggling to grow their share in the market, entering a new business that the bank is a stranger to brings some challenges. Those can be stated as follows. There are many retail banks having many number o f branch offices and are known by the people for years and has created awareness. On the other hand. Interbank has not positioned itself to be known by the people for years. Where the trust to the banking system has been quite a lot damaged, and where people prefer to work with their bank that they have known for years, creating an image that people would trust would be hard.

Besides, the traditional retail banks has branch oiTices everywhere and reach people by advertisements. This was another threat for the bank, because the policy o f the bank was not to have any advertisements. So, it would be a challenge to reach the target markets and create awareness.

IV.3.2. Powerful Suppliers and Buyers;

Since the product that banks can supply to personal accounts are not various and are not differentiated, but relies heavily on prices; the banks are not considered to be powerful. On the other hand, customers are considered to be very powerful in this business where they have the opportunity to chose among all the banks that struggle to work with them. The customer also has the power to switch from one bank to another as soon as he thinks that the prices are no longer beneficial.

IV.3.3. Substitute Products;

There are not different products that can be offered and substituted with deposits. The only substitute here is the Treasury’s public offerings o f bonds that have high yield. This is a threat to all o f the banks, especially when the government puts a cap on the interest rates for the deposit accounts, but issues bonds with high interest rates.

Having analyzed the competitive forces in the banking sector, a conclusion that there is intense rivalry in the sector can be made; There are numerous banks, the products can be offered for personal accounts are limited with two or three in number, switching from one

bank to another is easy for the customers and all o f the banks have different ways o f competing and different understanding o f the competition.

Relying on the bank’s past experience and performance, the image and the strengths o f the bank can be stated as follows: Interbank is a bank that is innovative, competitive, being first to come up with new products. The ability to generate tailor made specific products for the customers, being the first bank in this business in Turkey that started the relationship based marketing approach, having qualified human resources, being flexible enough to go beyond others are the basic strengths that can be mentioned. The major weakness o f the bank is not having enough experience in private banking and personal accounts.

IV.4. The Findings on The Comparison of Corporate Banking and Private Banking in Interbank

The formation o f the exact strategy about private banking was done sometime after the private banking job started in Interbank, There was a time lag between the bank was in this new area and the time policies were set.

A short time after the strategy was formed, an interview was made among the bank personnel. The interviewees were top management, branch managers, account officers in branches, and all other personnel working in Taksim Branch, Interbank.

This interview focused on the differences observed, in the real life experience, between corporate and private banking. The interview is made up o f 40 questions comparing corporate and private banking. The answers are close-ended and are measured on a 5 point scale (See Appendix 1 for the interview questions and results).

The findings o f the interview can be summarized as follows: The location o f the branch offices are not very important for the corporate banking customers, since they can complete their jobs by computer networks, telefaxes, magnetic tapes, etc. Therefore, the corporate banking customer does not feel the necessity to visit the branch offices for the job to be done. On the other hand, the private banking customer wants to visit the branch offices and have face to face contact with the account officers for his/her job to be done. That’s why, the locations o f the branches are important for the private banking customers. They want the offices to be located on easily reachable, downtown centers and prefer them to be many in number, so that problem o f distance will be eliminated. This refers to the

access

determinant o f service quality in Section II. 1.4.Since the private banking customer visits the branches frequently, the outlook o f the office, being clean, neat and tidy, modern designed is also very important for those customers to feel comfortable. This refers to the

tangibles

determinant o f service quality in Section II. 1.10.Private banking customers and corporate banking customers, both want their work to be completed quickly, correctly and want the service personnel that they are in contact with, to

be willing to help them, friendly, kind and nice. Especially, for the private banking customer, the appearance o f the personnel, i.e. whether they look neat and tidy, smiling, friendly, is very important. Because, this job depends heavily on interpersonal relationships. Here the

courtesy, responsiveness

andreliability

determinants o f service quality in Section II. 1 is touched.The private banking customer wants to see the written material immediately after the job is done. The written material should be convenient, practical, easily understandable and not too complicated. Only the necessaiy information should be stated in a language the custom er can understand. There should not be details that he would not use. However, the corporate banking customer wants to know all the details o f the tools and products used. The corporate banking customer is interested in the adaptability o f those tools to financial and accounting records, rather than their user friendliness. Therefore, the outputs o f the products offered to private banking customers and corporate banking customers should be prepared accordingly. The MIS and the computer outputs used in Interbank are designed to serve the corporate banking customers. They are pretty much more suitable to corporate banking customers than private banking customers.

The legal restrictions, tax advantages and different areas o f interest differentiates the products that can be offered to corporate and private banking customers. The products for corporate banking customers can be offered as tailor made, corporation specific products. The specialization o f the bank personnel can be used in the project based products. The

competence

determinant o f service quality in Section II. 1.3 can be observed here.The price and profit obtained by the end is the most important thing for the corporate banking customer, while this is less important for the private banking customer. What is more important for the private banking customer is the account officer he works with. For just the account officer he is working with, he might continue to work with that bank though he can get more profit from another bank. Here, the interpersonal relationships show the importance. The private banking customer wants to be taken care of, wants his account officer to be advising, helping him with the decisions he would make. Because most o f the private banking customers have less knowledge than the corporate banking customers about the financial markets and products the bank can offer, the advises o f the account officer is important for them. In that sense, the trust Ihc private banking customer feels for the account officer is definitely very critical. The more he trusts, the stronger the relationship becomes. To trust the account officer, the customer wants him to be true, open and honest. The same feeling o f trust is also very important for the corporate banking customers. Feeling o f taist deepens the relationships, and builds loyalty. The determinants o f service quality that are related to these are

credibility, communication, security

andunderstanding the customer

o f Section II. 1.The corporate banking customer would not always need the guideness o f the account officer as much as the private banking customer does. The duty o f the contact person in the corporation is dealing with banks and finance, he spends the whole day for this subject; as opposed to the private banking customer who wants to be guided, advised and finish the job quickly and go back to his own work. The private banking customer feels safe when he feels that in his absence the account officer will do the best for him.

The bank chooses the corporate banking customers. On the contrary, the private banking customers are the ones to choose. Hence, the bargaining power o f the private banking customers on the bank is higher than the corporate banking customers. Therefore, the methods to make people be aware o f the bank should be different than the methods used for corporations. Advertisements and PR is necessary for creating awareness on the potential customers. This is not the same for the corporate banking customers in Interbank. Because, the bank has already created an image on their minds.

The above analyses on the competitive forces in the business, the strengths and weaknesses o f the bank and the outcomes o f the comparison o f private and corporate banking interviews results in the following:

The bank had to enter the market aggressively where there was intense rivalry. In entering, in order to cope with traditional retail banks, the bank should create the same feeling o f loyalty they did, and make itself known by people. As price can be a key factor in an environment where inflation rate is veiy high, the bank had to generate aggressive pricing policies and extremely well service for sustainability.

Since in the business the products offered by all competitors are more or less the same, the service quality will be the key determinant in differentiation. This necessitates paying extra attention to service quality and to account officers who are in direct contact with the customers.

Because the business is dependent on relationships and the account officer is very important for the customer, the turnover rate among the account officers should be kept low by adequate human resource policies the bank will set.

The technology is also a big supporting element to the account officer in delivering the service. In this case, the updating o f the MIS in a style to fit to the private banking business is urgent. So, the level o f service quality can be improved. 7'he private banking business has to be conducted in places that are easily reachable by people.

For the above points to be successfully dealt with, the management decided to take those actions:

Quality in the service delivered and satisfying the customers will be the most important thing to take into account in setting new policies. They decided to use the qualified human potential for aggressive and direct marketing. As the mindset o f the account officers was customer and relationship based, it would be the same act to have direct contact with the prospect customers the account officers chose. And, once the prospects become the actuals, by w ord o f mouth the customer network would enlarge. The loyalty and trust to the bank would be achieved. This would be done by having relationship based business with the customers, being true, open, quick, accurate and advising to them. The bank would be made known. This would be done by sponsoring community acts and direct marketing efforts. To be closer to people, new branch offices located in downtown and central areas would be opened.

To be successful in all o f the above and to sustain the success, service quality would be the key factor to be taken seriously. So, close contact with the customers would be continued, up to date training to personnel would be given, brainstorming would be done with the personnel to share new ideas and problems.

The management made all the previously stated decisions after detailed meetings and in an environment that all the banks were laying off the employees. On the contrary, the bank was making a decision in the direction o f expansion.

In the following chapters o f this study, the results o f the interviews done with the account officers, management and other bank personnel as well as with the customers, about the problems faced in achieving quality service, how they were handled will be discussed.

V. DETERMINING THE EXISTENCE OF H IE SERVICE QUALITY SHORTFALLS AND SUGGESTING SOLUTIONS FOR THEM

As stated in section II 2, there are five major gaps, i.e. shortfalls, contributing to the service quality. Four o f these gaps are stemming from the inner organizational dynamics o f the service provider. The first four gaps come together and contribute to the fifth gap, the custom ers’ perceptions o f service quality shortfalls (Parasuraman, ZeithamI, Deny, 1991).

In this chapter, the findings on causes o f these gaps and existence o f these gaps in Interbank Private Banking will be explaitied. Interviews were done with the account officers, with top management, managers in Private Banking department, branch managers and the operations employees working in the branches to determine the differences in the position the bank is in, the feelings o f the personnel about the new situation, how they value service quality, problems encountered in delivering service quality on the provider side, and the suggestions for improvement.

The interviews done with the customers aim at measuring the perceptions o f the customers o f the delivered service quality and the difference between their expectations and what they perceive.

To measure the existence o f the fifth gap, Zeithaml, Berry and Parasuraman’s SERVQUAL framework has been used (Parasuraman, Zeithaml, Berry, 1986). Questionnaire in Appendix 2 was applied to 50 customers o f Taksim Branch, Interbank. The results will be presented in the following sections. Finally, some suggestions that would help to close the gaps that are present within the bank are discussed in this chapter.

V .l. Analysis Of Gap 1: Not Knowing What Customers Expect

As previously discussed in section 11.2.1., this gap occurs when the management does not really understand what the customers expect (Parasuraman, Zeithaml, Berry, 1991).

There are three reasons contributing to the occurrence o f this gap. fhese are, not being marketing research oriented, lack o f upward communication and having too many levels o f management.

Here, in the following paragraphs, the situation observed for Interbank for the stated reasons are analyzed. If there exists a problem in terms o f those reasons, the methods to solve it are stated or suggestions are made for closing the gap.

Table 1 shows the factors that make the gap occur and some specific questions to determine whether those factors exist.

Table 1; Factors Pertaining to Gap

Factor and Definition; Specific and Illusti'ative Issues:

Marketing Research Orientation: Kxlent to which . Is lesearch conducted regularly to generate managers make an cflbrl to understand customer’s

needs and expectations through formal and

inibimation about what customers want?

. Does the marketing research a company conducís informal infomiation gathering activities.

focus on quality of service delivered by it?

. Do managers understand and utilize the research findings?

. Do managers mingle witli customer's to learn what is on tlieir minds?

Upward Communication: Kxtent to which top Do managers encourage suggestions from managcfnent seeks, stimulates, and facilitates the customer contact personnel concerning quality of flow o f infomiation from employees at lower service:

levels.

. Arc there fonnal or informal opportunities for cii.storner contact personnel to communicate with management?

. IIow frequently do managers have face-to-face contact with customer contact personnel?

Levels o f Management: Number of managcnal . Do too many managerial levels separate top levels between the topmost and bottommost managers from tJiosc responsible for dealing with

positions. and serving customers?

V.1.1. Marketing Research Orientation;

Marketing research has been done only once on the customers by a marketing research company the bank hired. The research should be repeated in shorter time intervals and should be continuous. The only continuous research done is to see the demographic characteristics o f the customers. This is done by distributing written forms to customers which seem antipathetic to most o f the customers. The research should be conducted more on pshychographics, i.e., the life style o f the customers rather than the demographic characteristics o f the customers.

The research done by the marketing research company the bank hired, lacks reflecting the up to date findings. The research should be repeated at least at eveiy quarter to maintain its validity. The sample chosen by the marketing research company should also fit to the target customer profile o f this bank. When the sample also includes people that are out o f the target, the findings from the data gathered might be misleading. If untargeted customers are contained in the sample, the awareness record o f the bank might be low in the research findings o f the marketing research company. The marketing research company should also be careful in testing the position o f the bank. The banks that are targeting the same segments should be considered as competitors. Choosing the banks with different strategies and target markets as competitors would result in wrong findings.

The research conducted should have three main components. One o f the components should be the measurement o f the difference between the customer perceptions and expectations in Interbank. The next component should test the position o f the bank with

respect to its competitors. The final component should try to find out the expectations o f the consumers from the whole banking system in Turkey. This last component should also focus on finding out the demands o f the consumers the banking system cannot provide.

Another point to mention here is that the findings should be shared with middle management and account officers. Then feedback and comments can be given by those people. Those comments might be helpful in arranging the scope o f the next research. Also, the account officers would use the information obtained by the research in their relationships with the customers.

The account officers should try to form a relationship based working style with the customers. While doing that, they should also question the perceptions o f the customers o f the service quality in this bank, their expectations from the system and from Interbank. This kind o f research has helped the bank more than the research the marketing research company conducted. With the help o f the data gathered, the bank made decisions to change the way some services are delivered to customers. This kind o f research is less expensive when compared to the other. Also, because the account officer is the one who conducts it during the conversation, and because the customer gives open ended answers, it reflects also the specific requests. But, this kind o f research is not sufficient, for it is on only Interbank’s customers, not the customers o f the competitors.

The research conducted is only valuable when decisions are made in the light o f the findings, and action is taken to improve the service quality. The management and account

officers should be in continuous contact and evaluate and discuss the findings o f the research done. Those meetings should be arranged frequently, so the action to improve the service quality can be taken quickly. Therefore, the periods the research is repeated should be kept as short as possible, and the action plan o f the organization should be to go one step further.

Lack o f marketing research or not repeating the research enough to have up to date information, both on the customers o f Interbank and on the business might lead the managers to deviations from what the customers expect. Interbank should spend more on marketing research, though the need for it may seem not necessary, the bank will benefit from it in the future as the business grows and the bank is beyond others by knowing what the customers expect and what all others can and cannot provide. Waiting until the urgent need arises will most probably be late for the bank to maintain its position in the market.

V.1.2. Interaction Between Management and Customers;

Interbank’s marketing policy is based on relationship building. Therefore, knowing the customer, his/her lifestyle, etc. are important factors to consider. When the private banking business started, including top management, every member o f the organization was inexperienced on the subject. But, the belief was that, applying the relationship based approach also to this area would result positively. So, every branch manager tried to get in contact with private banking customers o f that branch. This would create trust, closeness, the feeling o f being important. Besides, a backup system has been generated and a backup account officer is assigned to some other account officer’s customer to get in touch in the absence o f the account officer. This makes the customer be able to reach the bank and have a

feeling that he will always get the answer to his questions. I ’he policy that has already been explained eliminates the lack o f interaction between management and customers, and hence eliminates the occurrence o f Gap 1.

Recently, to grow the relationships, top management o f Interbank has started joining the customer calls, atid try to get to know the private banking customers. This also creates a robust basis for the future relationships with the customer and the potential customers that would be reached by word-of-mouth.

Interbank should continue to visit the customers with the managers and organize PR activities, so that occasions for meeting the customers would increase. Visiting the customers with branch managers and top management makes them feel they are important. The problems o f the customer can be directly communicated to the top management during the custom er calls. When the customer demands a specific, tailor made service, the decision to deliver that service can be given easily if the top management knows the customer. Discussions on the way the service is delivered becomes more healthy and finally, the action taken is beneficial for both the customer and the bank.

The human factor is very important in delivering quality service. Customers pay attention to the way the service is delivered. As the bank personnel get closer to the customers, the satisfaction level o f the customers from the service quality increases.

V.1.3. Upward Communication From Contact Personnel to Management:

Since the ones that are closest to the customers are the contact personnel, i.e. account officers in Interbank’s case, they are the key points to understand how the business is going on, and how custom ers’ desires can be met. Top management can only discover the problems lived through and can generate solutions and new alternatives with the feedback received from the account officers.

In this bank, because even the top management was inexperienced on the subject and they wanted to recover quickly in the market, from the beginning o f this business, meetings and interviews were held with the account officers to share their experiences, the difficulties they face, and the suggestions they can make to each other. Every evening, meetings are done at the division o f Private Banking and is open to all account officers from the branches to share the ideas and make brainstorming on some specific matters.

Those meetings enabled Interbank to realize the difficulties and problems in a short time, and sharing ideas led to recovering them quickly also. Those meetings are very important for the top management to understand customers’ expectations.

An overall summary in existence o f this gap and the suggestions are described in this paragraph. The managers know what the customers expect and set priorities according to those expectations. The key sources are the account officers and the relationship based marketing strategy that keeps this gap small. However, marketing research should also be conducted to monitor both the banks’ moves and the changing and increasing expectations o f

the customers. In a case where Interbank wants to be the leading and the innovative, it is very important to conduct continuous marketing research. So, the trends in the way expectations change can be viewed punctually and products meeting the changing demands can be generated.

V.2. Analysis Of Gap 2; The Wrong Service Quality Standards

The next gap that can be faced after understanding what the customers expect is the gap caused by setting the service quality standards for the organization to be able to deliver what the customers expect. This is what will be called as Gap 2 (Parasuraman, ZeithamI, Berry, 1991).

This gap arises because o f inadequate management commitment to service quality, perception o f unfeasibility, inadequate task standardization and absence o f goal setting.

Table 2 shows the factor pertaining to this gap and also the questions that are used to determine the presence o f the factors.

Table 2: Factors Pertaining to Gap 2

Factors and DeflnHion: Specific lilusfrative Issues:

Management Commitment to Service Quality. I . Are resources committed to the departments to Fxtent to which management views service quality I improve service quality?

as a key strategic goal.

. Do intemni progiams exi.st for improving the quality of service to cuslonici^?

. Are managers who improve the quality of service to customers are more likely to be rewarded tlian other managers?

Does tJie company emphasize its sales goals as much or more than it emphasizes serving customers?

. Are upper and middle manageis committed to providing quality service to their customers?

Perception o f Feasibility: Extent to which I . Does tlie company have tlie necessary capabilities managers believe tliat customers’ expedations can | to meet customer requirements for service? be met.

. Can customer expectations be met without hindering financial perfonnance?

Do existing operations systems enable cu.stomer expectations to be met?

Arc resources and personnel available to deliver the level of service that customers demand? . Docs management change existing policies and procedures to meet tlie needs of customers?

Task Standardization: Extent to which hard and I . Is automation used to acliieve consistency in soft technology are used to standardize service I serving customers?

tasks.

. Are programs in place to improve operating procedures so that consistent service is provided?

Goal-Setting: Extent to which service quality goals I . Is tlicre a formal process for setting quality of | are based on customer standards and expectations I service goals for employees?

ratlier than company standards.

, Does the company have clear goals about what it wants to accomplish?

. Docs the company measure its performance in meeting its service quality goals?

. Are service quality goals based on customer oriented standards rather tJian company oriented standards?

Source: Parasuraman, ZeithamI, Berry, 1991