I T.C

SELCUK UNIVERSITY

INSTITUTE OF SOCIAL SCIENCES DEPARTMENT OF BUSINESS

ADMINISTRATION IN ACCOUNTING AND FINANCE

FOREIGN TRADE AND INVESTMENT ANALYSIS: A

COMPARATIVE ANALYSIS BETWEEN TURKEY AND

ETHIOPIA

Jemal Ibrahim SEID

MASTER THESIS

Dr.Öğr.Üyesi İBRAHİM EREM ŞAHİN

VI Özet

Bu tez, iki ülkenin (Türkiye ve Etiyopya) ticaret ve yatırımdaki karşılaştırmalı ilişkisini incelemektedir. Türkiye ile Etiyopya arasındaki geleneksel ticaret varsayımına ve doğrudan yabancı yatırımlara (DYY) paralel ve karşılaştırılabilir düzeydeki zorluklara ve Fırsatlara bakyor. Doğrudan yabancı yatırımın niteliğine ve işlevine dayanarak, doğrudan yabancı yatırımın hem Türkiye'nin üretimini hem de Etiyopya ile bağımsız ticaretini destekleyen tarafsız bir sermaye akışı olduğunu savunmaktadır. Bu nedeniyle doğrudan yabancı yatırım üretim ve dağıtımda ticareti desteklemektedir. Ardından, ticaretin sırasıyla DYY ve DYY üzerindeki ticaret etkisini vurgulamaya çalışır. Bu Tez ayrıca, DTÖ rejimi altındaki İkili Yatırım Anlaşmasını tartışarak önerilen İkili anlaşması‘nin uyumlu olduğunu gösteriyor. Son olarak, ilişkideki zorlukları ve fırsatları belirlemeye çalışmaktadır. Ticaret ve DYY, kısıtlayıcı ve hem ticareti hem de DYY'yi çarpıttığı ve dolayısıyla yerel ve ekonomik refahı azalttığı sonucuna varılmıştır. Bu nedenle, hükümetler kısıtlayıcı ve teşvik edici ticaret ve DYY'yi düzenlemeler yapmaya çalışmalıdır.

VII Abstract

This thesis examines the comparatıve relation of the two countries (Turkey and Ethiopia) in trade & investment. The thesis challenges the conventional postulate of trade and foreign direct investment (FDI) as parallel and comparable between Turkey and Ethiopia. Based on the nature and function of FDI, it argues that FDI is a neutral capital flow that underpins both Turkish production and independent trade with Ethiopia, and therefore, FDI always supports trade in the production and distribution among them. Then, it tries to highlight the impact of trade on FDI and FDI on trade respectively. The thesis also argues for a Bilateral Agreement on Investment (BAI) under the WTO regime, and demonstrates that the proposed BAI is compatible with the WTO regime. Finally, it tries to identify factors challenges and opportunities in the relation. It concludes that trade and FDI, restrictive and incentive, trade and FDI restrict or distort both trade and FDI and therefore reduce domestic and economic welfare. Therefore, governments should abandon restrictive and incentive trade and FDI.

VIII Dedication

IX ACKNOWLEDGEMENTS

First of all I would like to thank my thesis advisor Dr.Öğr.Üyesi İBRAHİM EREM ŞAHİN for his guidance, advice and encouragements during the research.

Then, I must express my gratitude to Hassen Ibrahim, Mahmud Kasim, Ibrahim Abdulaziz, Kamil Abdulmenan, and my friends in Turkey and Ethiopia for providing me with unfailing support and continuous encouragement throughout my years of study and through the process of researching and writing this thesis.

X TABLE OF CONTENTS Table of Contents Pages ÖZET ... VI SUMMARY ………..….. VII ACKNOWLEDGEMENTS ... IX TABLE OF CONTENTS ... X Abbreviations ... XIV List of Tables ... XVI List of Figures ... XVII

1. INTRODUCTION ... 1

1.1 Background of the Study ... 1

1.2 Research Questions ... 5

1.3 Research Objectives ... 5

1.4 Statement of the Problem ... 6

1.5 Contribution of the research ... 6

1.6 Motivation ... 7

1.7 Organization of the Thesis ... 7

2. TURKEY AND ETHIOPIA‘S FOREIGN TRADE AND INVESTMENT RELATIONS ... 9

2.1 Foreign Trade ... 9

2.1.1 The Definition of Trade ... 9

XI

2.1.3 International Trade Theories ... 12

2.1.3.1 Classical trade theory ... 13

2.1.3.2 The Factor proportion theory ... 13

2.1.3.3 Product life cycle theory ... 14

2.2 Investment and the Definition ... 15

2.2.1 The Definition ... 15

2.2.2 Foreign direct investment theories ... 17

2.2.3 Types of Foreign Direct Investments ... 18

2.2.4 Direct versus indirect investing ... 19

2.2.5 Investment environment ... 20

2.2.6 Importance of FDI... 21

2.3 Relationships ... 23

2.3.1 Background Information on Africa and the Relation with Turkey ... 23

2.3.2 Africa – Turkey Relation in Economy ... 23

2.3.3 Historical Relationship between Turkey and Ethiopia ... 27

2.3.4 Ethiopia-Turkish Investments and Business ... 29

2.4 The Relationship between Foreign Trade and FDI ... 31

2.4.1 Trade as a Function in Domestic Production ... 33

2.4.2 Trade as a Business Mode for Specialized Domestic Distribution ... 34

2.4.3 Trade and FDI under International Production ... 35

2.4.4 Trade and FDI in Resource-seeking International production ("R production") ... 36

2.4.5 Trade and FDI in Market-seeking International Production (M production) ... 36

2.4.6 Trade and FDI in Efficiency-seeking International Production (E-production) ... 37

2.4.7 Effects of FDI in Independent Intra-firm Trade ... 40

XII

2.4.9 The Relationship between Trade and FDI at National Level ... 42

2.5 Impact of Foreign Direct Investment and Trade on Economic Growth ... 42

2.6 Relationships between Trade and FDI Policies ... 46

2.6.1 Trade Liberalization during the 1980s and 1990s... 47

2.6.2 Trade Liberalization in the 2000s and After ... 50

2.7 Trade and investment agreements between Turkey and Ethiopia ... 52

2.7.1 Turkish Engagement in Ethiopia ... 54

2.7.2 Turkish and Ethiopian recent profile in terms of Economy ... 55

2.8 Economic Growth Experience ... 57

2.8.1 Turkey‘s FDI Inflow ... 61

2.8.2 Growth in Total Trade ... 65

2.8.3 Trade Samples ... 68

2.8.4 Merchandise trade ... 69

2.8.5 Bilateral Trade Relations... 70

2.8.6 Merchandise Imports ... 72

2.8.7 Trade in Service ... 72

2.8.8 The Total Trade and Balance between Turkey and Ethiopia ... 74

2.8.9 Foreign Direct Investment in Ethiopia ... 77

2.8.10 Trends of Turkish FDI to Ethiopia from 2003 to 2017 ... 80

3. RESEARCH DESIGN AND METHODOLOGY ... 84

3.1 Primary Data Source ... 84

3.1.1 Questionnaire ... 84

3.1.2 Interview ... 86

3.2 Secondary Data Sources ... 86

XIII

3.3.1 Challenges of Trade ... 87

3.3.1.1 Results of Data Collected Through Questionnaire ... 87

3.3.1.2 Exchange Rate Problems during payments ... 88

3.3.1.3 Market Changes ... 88

3.3.1.4 Distance and Risk in transit ... 89

3.3.1.5 Business Communication Methods... 91

3.3.1.6 Market Information ... 91

3.3.2 Challenges of Investment ... 92

3.3.3 Discussion ... 93

4. CONCLUSION AND RECOMMENDATION ... 95

References .. ………101

Appendices ... 111

Appendix 1: Turkey‘s FDI inwards in the Manufacturing Sub-Sectors (2000-2013) Source: from OECD.SAT ... 111

Appendix 2: Turkish Bilateral Trade in Goods with Ethiopia 1995 - 2016... 111

Appendix 4: Data on Turkey‘s Trade activity (1989 -2016) ... 113

Appendix 5: Data on Turkey‘s Trade activity (1989 -2016) ... 114

Appendix 6: Questionnaire (English and Amharic language version) ... 115

XIV Abbreviations

(ADLI) --- Agricultural Development Led Industrialization (ATS) --- Alternative Trading System

(BIT) --- Bilateral Investment treaty

(COMESA) --- Common Market for Eastern and Southern Africa (DTT) ---- Double Tax Avoidance Treaty

(FDI) ---- Foreign direct investment

(FERA) --- Foreign Exchange regulation Act (FPI) --- Foreign Portfolio Investments (FTCs) --- Foreign Trade Corporations

(GATS) ---- General Agreements on Trade in Services (GATS) --- General Agreements on Trade in Services (GATT) --- General Agreement on Tariffs and Trade (GNP) --- Gross National Product

(GSP) --- Generalized System of Preference (GTP) --- Growth and Transformation Plan (GTP) (ICC) --- International Chamber of Commerce (IDS) --- Industrial Development Strategy (IHH) --- Freedoms and Humanitarian Relief (IPO) --- Initial Public Offering

(LDCs) --- Less Developed Countries (MFN) --- Most- Favored-Nation (MFT) --- Ministry of Foreign Trade (MNCs) --- Multinational companies‘ (NAV) --- Net Assets per Value (OGL) --- Open General Licensing (OTC) --- Over-The-Counter

(POE) --- Publically Owned Enterprises (RFDI) ---- Reverse foreign direct investments (ROA) --- Return on assets

XV (ROS) ---- Return on sales

(SITC) --- Standard International Trade Classification (SSI) --- Small-Scale Industries

(TNC) --- Transnational Corporation

(UNCTAD) --- United Nations Conference on Trade and Development (WTO) --- World Trade Organization

R&D --- research and development (R&D) SMEs --- (small to medium sized enterprise)

XVI List of Tables

Table 2.1: Turkey‘s FDI inflow by Sectors, 2013-2016, (Millions of US$) ... 62

Table 2.2: Turkey‘s FDI inflow for Average Manufacturing Sector (2000-2013) ... 63

Table 2.3: Merchandise trade of GDP for Turkey and Ethiopia ... 70

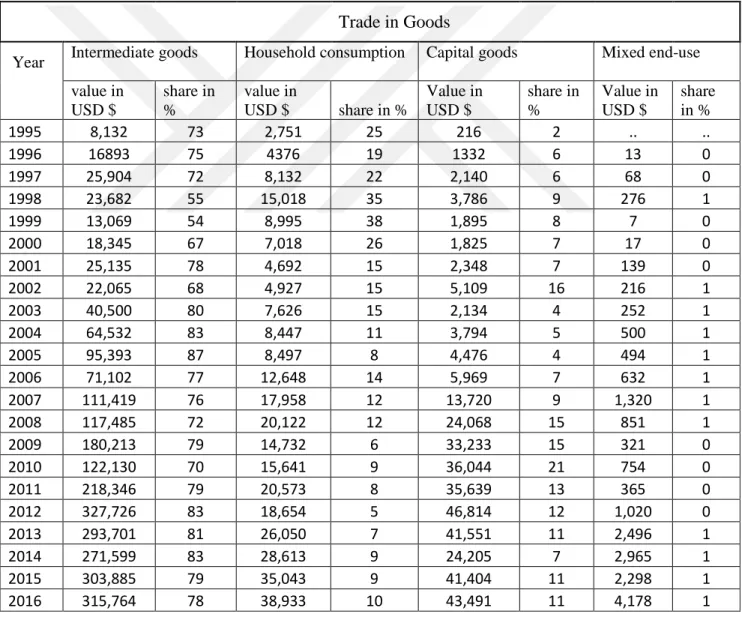

Table 2.4: Average values & shares of Turkish Bilateral Trade in Goods with Ethiopia (1995-2016)... 71

Table 2.5: Imports of Goods for Turkey and Ethiopia in Billion ($) ... 72

Table 2.6: Turkey‘s Service Exports in billion ($) from (1989 – 2016) ... 73

Table 2.7: Ethiopia Turkey Trade Relations (2000 -2017) ... 74

Table 2.8: List of Licensed Foreign Direct Investment (FDI) Projects from 2003-2017 ... 79

Table 2.9: Summary of Turkey‘s Licensed Investment Projects and Investment Status in Ethiopia Since August 22, 1992 - March 13, 2017 ... 80

Table 2.10: Summary of Turkey‘s Licensed Foreign Direct Investment (FDI) Projects and the Status, Since August 22, 1992 - March 13, 2017 ... 83

XVII List of Figures

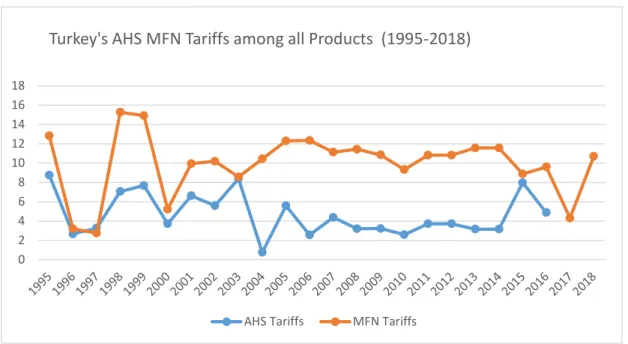

Figure 2.1: Turkey‘s AHS and MFN tariffs among all products (1995-2018) ... 51

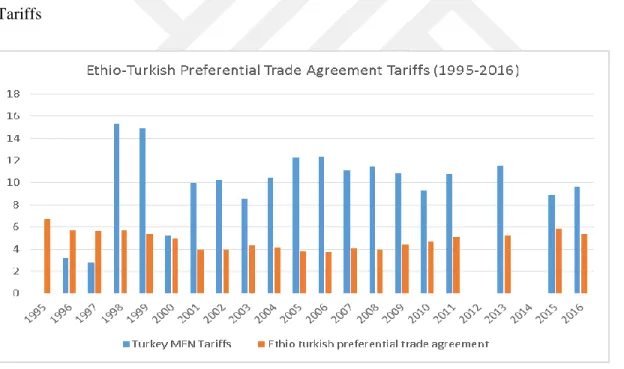

Figure 2.2: Ethio- Turkish Preferential Trade agreement Tariffs (1995-2016) comparing to Turkey's MFN Tariffs ... 52

Figure 2.4: Average Growth Rate of GDP in Constant Price for Turkey ... 60

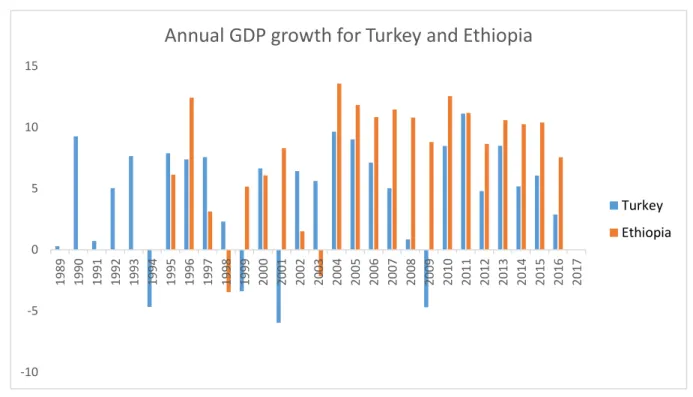

Figure 2.6: Relative Annual Growth of GDP for both Turkey and Ethiopia (1989 -2017) ... 66

Figure 2.7: Turkey's Trade in goods and services in Billions of USD $ (1982-2017) ... 67

Figure 2.8: share of services in the Exports of Turkey (1989 -2017) ... 68

Figure2.9: Merchandise Trade (% of GDP) For and Ethiopia ... 69

Figure 2.10: Trade in Service between Turkey and Ethiopia ... 73

Figure 2.11: Total Trade and Balance between Turkey and Ethiopia (20016 - 2017) ... 75

Figure 2.12: Turkey's direct investment in Ethiopia and Sub- Saharan Africa ... 78

Figure 2.13: Number of Licensed Turkish Investment to Ethiopia (2003 - 2017) ... 81

Figure 3.1: Responses on Problems of Payment due to fluctuating Exchange Rate ... 88

Figure 3.2: Problems of frequently Market changes ... 88

Figure 3.3: Effects of distance ... 90

Figure 3.4: Respondents participation in Business Forum ... 90

Figure 3.5: Respondent‘s interest in business communication method ... 91

1 1. INTRODUCTION

The purpose of the introduction is to demonstrate the significance of the study of foreign trade and foreign direct investment (FDI) by indicating the strong linkage between trade and FDI from relevant trade and FDI figures and other empirical evidence.

1.1 Background of the Study

Accommodation of capital and investment are among the main factors of economic development of a country. In nation where domestic capital accommodations are less sufficient, attracting foreign capital has been seen as an important funding alternative for their development. Foreign capital may enter a country in terms of foreign investment, foreign aid and/or borrowing.

In the past three decades, foreign investment has replaced external debt as the main source of foreign capital in developing countries. Foreign investment is advantageous for both the investor and the host states of the investment. Whereas the host state benefits from the foreign investment to develop their economy, the investor also may have access for new markets, cheap factors of production and etc... .

Foreign investment is usually divided in to two, portfolio investment and foreign direct investment (FDI). In portfolio investment, the foreign investor invests in an already established enterprise in a foreign state while in FDI, the foreign investor owns his own enterprise. In portfolio investment, the investor has little chance to influence the management of the enterprise, may withdraw its investment easily in case of risks, etc. The portfolio investment is usually a short term investment that may leave the country any time and exposes the economy of a country for speculative shocks. Unlike portfolio investment, FDI, is more stable and unlike foreign lending (loans), the investors bare the risks by themselves.

Foreign direct investment has a number of advantages for a country. FDI creates new job opportunities, facilitate technology and knowledge transfer,

2

generate foreign currency by promoting export, expand the domestic market, etc. On the part of the investor, on the other hand, access to cheap resources, some incentives from host countries, environmental deregulations, etc.… are expected benefits from the foreign investment. But, there have been concerns about foreign capital in general and FDI in particular since the period of Aristotle. The concerns basically are related with undermining the sovereignty of nation states and replacing them with the power of Multi-National Corporations (MNC). All in all, the usual Justification for the conclusion of BIT are proving wrong.

For long period of time, FDI was left for domestic regulations. Cases concerning international law generally revolve around three issues: (1) The treatment of foreigners‗ property by the host State; (2) the international responsibility of States for acts in violation of international law; and (3) the exercise of diplomatic protection by the investor‗s national State.

Most developed countries have interesting to engage in foreign direct investment so their companies want to invest in developing countries. But why they want to invest in developing country? That is because of many causes may do for these. The first reason comes down in to the fact that developing Countries are inbounded in important natural resources which could be very useful for the company as an input or because of market availability in that country that big market makes help for growing business and it could make a good potential of market to mobilize huge business and produce it easily. The other reason comes down in to the fact that labor cost may could much lower as much as multinational cooperation and/or it may be because of restriction in business operation.

When we talk about multinational cooperation investing abroad, many advantages will happening to the developing country. One of these is through injection that in to the circular flow of income in that country and increasing in potential of growth which makes more potential of productivity in economy and sustainability growth of the development.

3

Developing further in the society will be when it comes to looking a specifically growth and sustainability which is meeting the needs of the present without reducing the ability of future generation and to meet their needs. The growth itself leads to the sustainable Development other than any resource depression and resource degradation. Otherwise the foreign direct investment may have negatively impact on the growth rather than raising productivity and using resources efficiently in the economy and this impact of foreign direct investment will be indirectly on human capital.

Foreign direct investment mostly have been considered as an option and opportunity in order to integrate in to foreign trade system and to improve host business sector as possible choice to Export, to access international market by sophisticating the product.

Ethiopia-Turkey relations mark one of the earliest bilateral links. Historically, relations between Ethiopia and Turkey date back to the sixteenth century. Since then, the bilateral relations between the two countries have passed through complex dimensions and multiple stages. Both changes in domestic and international environments are obviously prominent in shaping and changing the scope and depth of their relations. The current phase of relations between the two nations has developed out of such important changes at domestic and global levels. Today the bilateral relations between the two countries encompass several elements. In this era of globalization, the diplomatic relations between Ethiopia and Turkey have reached a higher stage, though certain challenges. Studying the bilateral relations in foreign trade and foreign direct investment, in the era of globalization is perhaps one of the most interesting and appropriate approaches to understand dynamics of relations.

Observers agree that Ethiopia has experienced fast economic growth with the average growth of 7%-12% in the last two decades. Being Ethiopia the second most populous country in Africa and one of the fastest-growing economies in the world, results more purchasing power and makes the relations more strong. Ethiopian economy is a mixed and transition economy with a large public sector. But the

4

government is in the process to privatizing many of the state-owned businesses and moving toward a market economy.

When we come to Turkey, after the implementation of the liberalization since the 1980s, the Turkish economy has experienced a period of substantial growth. As one of the important and significant change in this stage of development, becoming Turkey a member of the World Trade Organization (WTO) in 1995. Due to this, it produced an agreement with the European Union, enabling Turkey to join the Customs Union on January 1, 1996. As the consequence of these developments, foreign trade in respect to both exports and imports has grown rapidly. Remarkable changes in the structure of exports have been achieved, which enables Turkey to move forward from agricultural products to industrial products.

Turkey has been able to make full use of and derive benefit from its position of comparative advantage of foreign trades. And this trade liberalization has an advantage to find and open new markets and led to free and fair trade.

In the past few years, Ethiopia has fast and good experience in the GDP economic growth as a developing country. In this paper I analyze Turkish investment and foreign trade in Ethiopia. In my relative view between the two, I overviewed the success stories and experience of Turkey to suggest that foreign direct investment (FDI) great impact on the country‘s economic relationship as a powerful tool for export promotion as well as domestic market. But Turkey‘s experience can‘t be taken as general as to Ethiopia.

The data shows foreign trade and Turkish foreign direct investment in Ethiopia from 2001 through 2018 using the available database. I tried to describe High lightly the relation in foreign trade and foreign direct investment between the two.

The main focus of this paper is also to explore the factors and determinants of the foreign trade and direct investment relations in the economy that may influence the performance of foreign Trade and foreign direct investment. Considering the Turkish investment in Ethiopia and as Turkey as a more developed

5

country in Trade and investment levels than Ethiopia, and as the world's 17th largest national economy, Turkey has a good experience in the side of more attractive market for the investors of business and industrial products.

Putting on the data taken as a sample, I believe that the study makes some contributions to those who want go further on the economic relationship between Turkey and Ethiopia in foreign Trade and Investment performance.

To address some related topics with, I tried to cover the trade and investment performance in different measures like rating the percent of profitability in investments to the total number of attempted to invest, measuring the profit and loss, Holding on the period that the investors or company needs to continue holding on the stock and market benchmarks which is deciding to invest again or to stop it according to the market availability.

1.2 Research Questions

This study try to answer the following questions:

(1) What is the overall aspects extent of foreign trade and investment both in Ethiopia and Turkey?

(2) What are the factors and determinants of the foreign trade and direct investment relations between Tuerkey and Ethiopia that may influence the performance?

(3) How is the Access of Turkey in Ethiopia towards the existing opportunities in trade and investment and What are the economic relations between Ethiopia and Turkey?

1.3 Research Objectives

The study has the following specific objectives:

Examining the trade and foreign direct investment between Turkey and Ethiopia relationship the growth rate and its determinants.

6

Examine the structure and performance of the Ethiopian and Turkey‘s foreign trade and Foreign Direct Investment during the three decades starting from the 1991 to 2017.

Suggest a possible recommendation for decision makers regarding how to promote growth rate in foreign trade and foreign investment and informs other concerned bodies.

1.4 Statement of the Problem

There are several reasons for studying Ethiopia-Turkey relations in foreign trade and foreign direct investment. Even though Ethiopia-Turkey relations in foreign trade and foreign direct investment have been marked by dramatic growth and unprecedented outcomes, scholarly attention is lacking in the field. Yet, there are few literatures that worth mentioning in the field.

The main reason is to identify similarities between Ethiopia and Turkey and summarizes how the domestic similarities differently led to unequal development levels. Despite similarity in geography, resource endowments, pressure for modern development, demography, history, foreign relations and regional stability, Turkey unlike Ethiopia achieved advanced economy. Thus, Ethiopia should follow Turkey‘s path of development endeavor.

The literature fairly compares Ethiopia and Turkey and concludes that the former will benefit by sharing experiences of the latter. The literature attempts to answer the question ‗what ought to be done? Without describing the nature and scope of existing bilateral relations in trade investment. Foreign direct investment has been seen as important to any developing country for the development of the economy.

1.5 Contribution of the research

The study may contribute a role by helping the host and home country in order to strength the business relations. Indeed there are limited studies in the area which relates with about foreign trade and investment between Turkey and Ethiopia.

7

There may be some other studies but it focus on one host or home country of foreign investment and foreign trade of one country, but my study tried to cover all aspects of foreign direct investment and foreign trade relations both in Ethiopia and Turkey.

I believe that the study makes some contributions to those who want go further on the economic relationship between Turkey and Ethiopia in foreign Trade and Investment performance.

The findings are different on various dimensions of performance to rate the percent of profitability in investments or to the total number of attempted to invest, measuring the profit and loss, Holding on the period that the investors or company needs to continue holding on the stock and market. I tried to compare different aspects of ownership advantages including management and employee levels of trade and foreign investment.

1.6 Motivation

First, Turkey is one of the world's largest growing national economy and Ethiopia also is one of the fastest growing Economy in the world; secondly, Turkey is an important source of foreign trade and foreign direct investment as well as Turkish foreign investment has large outflow in Africa especially in Ethiopia; thirdly, there are very limited studies in the area of foreign trade and foreign direct investment that research area will focusing on the Economic relation between Turkey and Ethiopia. It is this which motivate the researcher to carry out this scientific study, i.e. desire to know the extent of foreign trade and foreign direct investment relation between Turkey and Ethiopia.

1.7 Organization of the Thesis

After the introduction, the second section presents the main research analyses, and findings. But before that the first part of this empirical study explores the general highlight of foreign trade and foreign direct investment by comparing and analyzing between Turkey and Ethiopia.

8

In this Section a brief discussion of Literature Review on Foreign Trade and Investment and the growth experience of Turkey and Ethiopia have given. Historical relationship between Turkey and Ethiopia, Ethiopia-Turkish Investments and Business background, The agreements of Trade and investment that held by Turkey and Ethiopia and Turkish engagement and Turkey‘s success in recent profile in terms of Economy have been illustrated. I also tried to highlight in the relation of foreign trade with investment and investment policy. And then tried to show the foreign trade and foreign direct investment flows in the two countries and the trade relations between Turkey and Ethiopia.

Section 3 describes about the Methodology, the research design, and the data analysis. The section mentions some challenges in the relations of trade and Investment between Turkey and Ethiopia, It also tried to show the results of the study, finally, concludes the thesis with the recommendation.

9

2. TURKEY AND ETHIOPIA’S FOREIGN TRADE AND INVESTMENT RELATIONS

2.1 Foreign Trade

2.1.1The Definition of Trade

The word ―Trade" in this thesis refers to cross-border exchange of merchandise goods or trade in goods and services. Local or domestic sales of goods and services are not regarded as trade for the purpose of my study. Normally, trade should include trade in goods and trade in services. Since trade in goods is distinct from trade in services. Foreign trade is importing and exporting goods or services. The other name of foreign trade is international trade which is outflow and inflow of goods or services of a country.

Exports of manufactured goods total US $11.2 trillion in 2016, representing more than 70 percent of total world exports in 2016. Nevertheless, trade in services is becoming increasingly important in international trade. It accounted for almost 12.78% of total world trade in 2017, and its share of world trade is steadily growing. Another important development with respect to trade in services is that it has been finally recognized as a type of trade (WTO 2017). So what does trade in service mean? International trade agreements define trade in service as delivery of service like labor and capital movement from one country to another country through cross border, consumption abroad, commercial presence and/or presence of natural person. Domestic since trade policies have been subject to discipline under the WTO regime known as the General Agreements on Trade in Services (GATS) since 1995 (World trade organization 2017).

Trade in services likewise has a close relationship with cross-border investment. Policies regulating services may have dynamic effects on related FDI, and FDI may have impact on trade. The GATS to some extent regulates service-related FDI for the first time in the WTO regime. Since the establishment of a "commercial presence" in a foreign country normally involves a FDI commitment, the grant to

10

foreign-service suppliers of the rights of entry, establishment and operation by the relevant clauses under the GATS can be interpreted as extending such rights to service-related FDI. Consequently, the national treatment and Most- Favored-Nation (MFN) principles and other basic rules under the GATS can be applicable to service-related investment. However, we should note that these rights for trade in services and impliedly, for service-related investment, are subject to the limitations and/or conditions on market access and national treatment that a member has specified in its Schedule of Specific Commitments (world trade organization 2017).

In general foreign trade or external trade is a trade between the different countries of the world. It is also called as International trade, External trade or Inter-Regional trade. It consists of imports, exports and entre pot. The inflow of goods in a country is called import trade whereas outflow of goods from a country is called export trade. Many times goods are imported for the purpose of re-export after some processing operations. This is called entre pot trade. Foreign trade basically takes place for mutual satisfaction of wants and utilities of resources.

Due to the implementation of the liberalization process since the 1980s, the Turkish economy has experienced a period of substantial growth. Foreign trade, in respect of both exports and imports, has grown rapidly and notable changes in the structure of exports have been observed. In this regard, industrial products have gained prominence over agricultural products.

Starting in particular in 1980 and continuing up to the mid-1990s, significant developments have been observed in the market share held by labor-intensive industrial products such as textiles and clothing, iron and steel, and foodstuffs (The Multilateralization of International Investment, page 53).

2.1.2 Importance of Foreign Trade

As Foreign trade is also known as to an important tool for economic growth, foreign trade leads to division of labor and specialization at the world level. Some countries have abundant natural resources. They should export raw materials and

11

import finished goods from countries which are advanced in skilled manpower. This gives benefits to all the countries and thereby leading to division of labor and specialization.

Due to specialization, unproductive lines can be eliminated and wastage of resources avoided. In other words, resources are channelized for the production of only those goods which would give highest returns. Thus there is rational allocation and utilization of resources at the international level due to foreign trade.

Prices can be stabilized by foreign trade. It helps to keep the demand and supply position stable, which in turn stabilizes the prices, making allowances for transport and other marketing expenses. Foreign trade helps in providing a better choice to the consumers. It helps in making available new varieties to consumers all over the world. Foreign trade is highly competitive. To maintain and increase the demand for goods, the exporting countries have to keep up the quality of goods. Thus quality and standardized goods are produced. Imports can facilitate standard of living of the people. This is because people can have a choice of new and better varieties of goods and services. By consuming new and better varieties of goods, people can improve their standard of living (Yavan, N. (2010), p.23)

Foreign trade helps in generating employment opportunities, by increasing the mobility of labor and resources. It generates direct employment in import sector and indirect employment in other sector of the economy. Such as Industry, Service Sector (insurance, banking, transport, communication), etc.

Imports facilitate economic development of a nation. This is because with the import of capital goods and technology, a country can generate growth in all sectors of the economy, i.e. agriculture, industry and service sector. During natural calamities such as earthquakes, floods, famines, etc., the affected countries face the problem of shortage of essential goods. Foreign trade enables a country to import food grains and medicines from other countries to help the affected people (J. Viner, p. 146).

12

Every country has to maintain its balance of payment position. Since, every country has to import, which results in outflow of foreign exchange, it also deals in export for the inflow of foreign exchange. A country which is involved in exports earns goodwill in the international market.

2.1.3 International Trade Theories

We looked the trade definition in the above that trade is exchange of goods or services between two persons whether they are natural or artificial person, and then foreign trade (international trade) is the exchange of goods or services between two people or two companies found in two different countries.

Historians and observers put that trade was begun before five thousand years in ancient city of Mesopotamia now nearly Modern Iraq (Matt Ridley, 2010). Since history shows that agriculture and agriculture products were in ancient city of Mesopotamia and the trade was in it. Along with that trade was also happened in China, Greece and India. What happened is that when things couldn‘t get locally People started looking around communities, and outside of their surroundings eventually countries. Then after trade evolved in to different levels and ways of trading by raising and collapsing of different empires from country to country as trade regulations. For example Merchants from Europe were going to India for the purpose of trade and using red sea to pass to India. Red sea trade line was under the control of powerful Ottoman Empire and became restricted to European Traders. Because of that exploration came down in 15th and 16th century. As a result of Red Sea becoming under the control of Powerful Ottoman Turkish Empire at that time and by the intention of coming to India for trade, the European explorer like from Portugal, France, England, Spain and others reached South America and North America claiming a new land for them. Spices and slave became basic trade elements and the needs for labor capital highly increased. Due to that international trade had been developed more and gradually evolved to modern global trade.

13

In order to describe the International trade, Economists have put the theory in to classical country and modern firm based theories, like firms based trade or factor proportion trade theory. These are consists of classical trade theory; factor proportion theory; and product life cycle theory

2.1.3.1 Classical trade theory

Classical trade theory is developed in 16th century, this defines that the dimensions which country‘s exporting and importing that relates with other countries. That is, countries are able to gain if each devotes resources to the generation of goods and services in which they have an economic advantage Therefore, classical trade theory effectively describes the scenario where a country generates goods and services in which it has an advantage, for consumptions, and exports the surplus or avoiding the deficit (Ricardo, p. 176). In short the theory encourages exports and discourage imports since it states that the country wealth is measures by the gold availability in the country. This makes the trade to be restricted in some and make not to flow the trade naturally as it is. Economic advantages/disadvantages may arise from country differences in factors such as resource endowments, labor, capital, technology or entrepreneurship. Thus, classical trade theory contends that the basis for international trade can be sourced to differences in production characteristics and resource endowments which are founded on domestic differences in natural and acquired economic advantages.

2.1.3.2 The Factor proportion theory

Factor proportion trade is a theory that countries produce and export goods which its required resources were in great supply, therefore, cheaper supply or countries import goods which its required resources were in short supply, therefore, higher demand. This is two Swedish economists, Heckscher‘s and Ohlin‘s Theory in 1900s. That means factor proportion trade theory is based on supply and demand that is if the supply is greater than the demand then that factors or resources would be cheap and/or if the demand is greater than the supply then the factors or resources would be

14

expensive (wall street journal, 2012). In contrast to classical trade theory, Factor proportion trade theory can provide a clear advantage provided for trading countries. Since countries will give more attention in order to produce and export goods or services.

2.1.3.3 Product life cycle theory

This trade theory is developed by Vernon (1960s) in Harvard Business School and stated that product life cycle has three different stages: new product, maturing product, and standardized product. The theory showed that a trade cycle emerges where a new product is produced completely in the home country and developed in to a mature product, then produced by its foreign subsidiaries and finally anywhere in the world in low cost production process will be at their lowest cost (Vernon, 1966, 1971; Wells, 1968, 1969).

The advantage for this theory of the international product life cycle is used to describe the innovation that technology and new market expansions are important things in international trade. That means innovation and developing new product have high relation with technology. The market structure is critical factor to determine the extent and type of international trade.

While the product life cycle theories are sensitive, the other international trade theories will have important considerations by a government involvement and regulation. However, it remains that these theories make several assumptions which detract from their potential significance and contribution to international business. For instance, they assume that: factors of production are immobile between countries; perfect information for international trade opportunities exists; and, traditional importing and exporting are the only mechanisms for transferring goods and services across national boundaries.

15 2.2 Investment and the Definition

2.2.1 The Definition

There are many definitions of Foreign Direct Investment (FDI), but the most accepted definition is that of the World Trade Organization (WTO). According to the WTO, foreign direct investment is considered as any investment where the investor from a country invests in a foreign country in the creation of the asset (property) of the enterprise, with the right to control its business (World trade Organization). International monetary fund (IMF) and The Organization of Economic Cooperation and Development (OECD) also defines foreign direct investment (FDI) as owning 10% or more of the business.

Businesses that make foreign direct investments are known as multinational corporations (MNCs) or multinational enterprises (MNEs). Foreign direct investments in other words is the action of Acquiring ownership of property of all activities and operation by Multinational Enterprises (MNEs) which is from home country to Host country.

According to the WTO, foreign direct investment (FDI) occurs when an investor based in one country (the home country) acquires an asset in another country (the host country) with the intent to manage that asset. This definition stresses that FDI is an asset. The United Nations Conference on Trade and Development (UNCTAD) defines FDI as an investment involving a long-term relationship and reflecting a lasting interest and control by a resident entity (the foreign direct investor or parent enterprise) of one country in an enterprise (foreign affiliate) resident in a country other than that of the foreign direct investor. This definition does not tell us what exactly an investment is. The International Monetary Fund (IMF) defines FDI as capital in any of the following three form:

1) Equity capital; this is the value of a foreign investor's investment in shares of an enterprise in a foreign country. An equity capital stake of 10 per cent or more of the ordinary shares or voting power in an incorporated enterprise, or its equivalent

16

in an unincorporated enterprise, is normally considered as a threshold for the control of assets. This category includes both mergers and acquisitions (M&A) and "Greenfield" investments (the creation of new facilities).

2) Reinvested earnings; Reinvested earnings are a transnational corporation's (TNC) share of affiliate earnings not distributed as dividends or remitted to the TNC. Such retained profits by affiliates are assumed to be reinvested in the affiliates. Reinvested earnings can represent up to 60 per cent of total outward FDI from countries such as the United States and the United Kingdom.

3) Other capital. It refers to the short or long-term borrowing and lending of funds between TNCs and their affiliates. The IMF definition emphasizes FDI as capital (Glossary of IMF).

In practice, many countries define FDI in both of two ways. For statistical purposes, FDI is defined as foreign capital that a foreign firm or individual intends to bring or actually brings into the host country for a long-term business operation. For legal purposes, FDI is treated broadly as the entire business operation undertaken by a foreign firm or individual in the host country. Based on these authoritative definitions and the common FDI practice, define FDI as assets that are controlled and managed by a foreign firm or individual in a host country for a long-term business operation. An asset is property or an item controlled by an economic entity as a result of a past transaction or event (Glossary of IMF 2003). Assets can be categorized into three basic types: current assets, fixed assets and intangible assets. Current assets are cash, accounts receivable, materials and inventories that in the ordinary course of operation are likely to be consumed or converted into cash within 12 months of the last financial year. Fixed assets include items such as buildings and machine. Intangible assets include patents and goodwill, etc.

An asset as FDI can be a foreign asset that is brought into the host country by the foreign firm or individual, or it can be an asset that is borrowed by the foreign firm or individual in the host country. However, host countries normally require a foreign firm or individual to bring in some assets from foreign source in order

17

to qualify itself/himself as FDI. A long-term business operation must be a production facility, a trading entity, or a service presence.

Portfolio foreign investment, which takes the forms of foreign stocks, bonds and other financial instruments, is distinct from FDI in that there is no intention to manage the invested assets. Since portfolio investment does not serve the function of international production and distribution of goods, it does not have any link with trade. Therefore, it is not relevant to the thesis and will not be discussed or dealt with here.

2.2.2 Foreign direct investment theories

The theories explain the reason why foreign direct investment theories occurred, not the history and evolution of FDI. Reasons and conditions for foreign direct investment to be existed are mentioned by some Theorists. Kindleberger (1969) and Hymer (1970) noted some determinants of foreign direct investment. (a) Market disequilibrium hypotheses, (b) Government-impose distortions, (c) Market structure imperfections, and (d) Market failure imperfections.

When trade had developed and became internationally widened, crossing border and conducting the trade operation became challenge through politically, geographically and economically, limitations have been occurred. Due to this international trade limitations foreign direct investment have been occurred. From this;

a) Limitation to export: exporting may be limited by different cases like distance and other trade barriers. That means exporting can be limited by transportation cost if the distance is far from home to host. When transportation costs are high, exporting becomes unprofitable. For this kind of limitations, foreign direct investment will be a kind solution. Foreign direct investment have actual response for the other trade barriers and provide incentives related to taxes like high custom duty and/or import tariffs.

b) Licensing limitations in market imperfections: licensing may be a result in a company‘s giving valuable technology know-how to foreign competitor.

18

International business involves licensing like copyrights, patents, trademarks and technology. So when companies wants to control on the technological know-how and over the company‘s management operations as well as the business strategies or wants to control the overall activities therefore foreign direct investment occurred. In some cases foreign direct investments may be found as a very good advantage for economy (European Journal of Interdisciplinary Studies P. 106).

2.2.3 Types of Foreign Direct Investments

Foreign direct investment is a form of international inward or outward capital flow. Foreign direct investments happened when a company invests directly in a new markets of foreign country. This will be occurred in one of three forms of foreign direct investment namely; green field investment (establishing completely new company operation) or by merging with existing company in foreign country. Foreign direct investment also can be taken in the form of joint venture which owned by several firms.

Most international investments involves the form of merging with existing company in foreign country. This is because of merging with existing company in foreign country is easier and less risk than green field investment in order to acquire the required assets rather than from build assets from the beginning. Investing in already existed company also the commitment is quicker than green field investment. The other reason is that Companies probability in increasing the efficiency of acquired unit by transferring capital, management experience and technology (paradigm P. 126).

Foreign direct investment is made by a firm or individual in one country for the purpose of business in another country. The investors buy equities of foreign based companies and establishes to control over the entities. This occurs in three types of foreign direct investment when the investors invest in a foreign country directly.

19

Establishment of wholly owned companies: the other name of this type of investment is green field investment. This occurs when a new operation is established in a foreign country. Foreign direct investment can be held and sorted into Joint Venture and Individual Investments. Joint ventures are the combination investment of external firms with local firms, agreeing to create the joint goals and in order to reach their interests. This is include that bilateral and multilateral investments which is can be jointed investors who came from two or more collective countries of prime contractor.

Regardless of the various forms of investment, all forms of foreign direct investment have positive and negative impacts on the host Country‘s economy. Without any interference from any previously set conditions within any existing organization. The FDIs can be distinguished between Horizontal foreign direct investment (when investments made on the same production or service activity), and Vertical foreign direct investment (when investments made on the different production but may be complementary products or service).

2.2.4 Direct versus indirect investing

According the definition, investing is committing a resource by achieve something with the expectation of income or profit in the future. We can see investing categories as direct and indirect investing. Investors can use direct or indirect type of investing. Direct investing is when investors invest directly in private company and will have a direct ownership in the property. Thus, in investing directly through financial markets investors take all responsibility in operating management as well as the risk and the success. Direct investment enables a company exercise to control on future decisions. Because direct investments can involve in management participation. (Matthew, p.53)

In contrary, in indirect type of investing investors are purchasing shares in a fund which invests on behalf of other investors. The investors will have no ownership and operating the management directly. Which means indirect investing

20

makes investors free from making decisions on their properties. The operating activities of the management of the investment is managed by financial institutions like investment companies, insurance companies, commercial banks etc.…

When the investors use indirect investment, the amount of investment is not so much, that is, it allows investors lower amount than direct investing. Moreover the liquidity of indirect investing is high so that can easily buy and sell the shares. The return in indirect investing is also low. In contrary, direct investing needs more amounts and the return is also big. In the risk for investor using indirect investing is relate with the financial institutions and/or the managers.

2.2.5 Investment environment

Investment environment defined as factors that affect and determine the investment. Investment environment is the existing effects of international development economy in the market available for investor and the places for transactions with the investment assets. Since Investment in financial assets differs from investment in physical assets in those important aspects.

I mean in investment environment there are determinants that investors should consider. Factors of investment like marginal efficiency of capital, government policies, the amount of profit and rate of interest, peaceful atmosphere, investment facilities (Bank services, insurance, transportation, communication systems) technical reasons and other factors (future expectation, political incentives, level of education, expert availability etc.) must be considered. Because investment in a given economy depends on marginal efficiency of capital and rate of interest. When the rate of interest does not change, Interest rate determines the volume of interest in economy that is marginal efficiency of capital (Ormiston et al., 2015).

There are two types of profit expectation; short term expectation and long term expectation. Profits, available demand, prices and income affect the short term expectation. Whereas long term expectation are influenced by external factors, such as, population growth, innovations, foreign trade and so on.

21

Investment includes two types of assets. Namely; Financial assets and Real or Physical assets. Physical assets determine the productive capacity and net income of the economy. Financial assets are derivatives, whereas most physical assets are not. Financial assets will be divisible. When investor buy or sell some part of assets. There are three types of financial assets; fixed income or debt, common stocks or equity and Derivative securities. Financial assets is differ from physical assets by its liquidity characteristics. Financial assets are easy to buy and sell the shares of the assets and the asset can easily convert in to cash. But physical assets needs long term to acquire the assets. Financial assets are easier to obtain the necessary information about the assets than physical assets.

2.2.6 Importance of FDI

Foreign direct investment is associated with a lot of advantages in the form ownership of the company, in the form of participating in the management of the company, in the form of accepting risk of the company, in the form of technology transfer of the company, in the form of growth of the company are all a positive side of foreign direct investment. Of course foreign direct investment may have a disadvantage. But foreign direct investment (FDI) have been usually seen as important catalysts for economic growth in the developing countries.

Because of foreign direct investment there may be technology transfer from country to country then it develops more in the form of competition. It has also an advantage for the country by stimulating to increase the domestic investment & giving stimulations for local economy and by improving human capital or by facilitating some facilities in the host country. Foreign direct investments have an advantage of bringing new technology and new system of business practices. That is by increasing the country‘s GDP and export competitiveness in the world. There will be an efficient resource of allocations and productivity. When the productivity increase there will be an employment.

22

Foreign Direct Investment brings new management practices and organizational structure in addition to enhancing more quality of goods and more options to customers by providing skilled labor training in the host country to facilitate optional production. FDI encourages the incorporation of new inputs and technologies in the production systems of host countries. The country that face from foreign currency problem foreign direct investment may be taken as the main advantages for the solution of the problem. The tax revenue which collected from the multinational companies is another advantage as again.

Foreign direct investment have also negative impacts on country‘s economy since the FDI outflow of capital in the form of dividend or profit and interests so that affects the level of income and leaves the country in the long-run growth unchanged. This is because of long-run growth can be arise by technological progress and/or population growth of the country. FDI may considered as an important source of human capital and technological diffusion. But it has also a negative side in exploitation for a cheap manual labor. Because of capital intensive machinery, foreign direct investment may be a cause for unemployment.

Technology transfer: Technology transfers is the most important mode that developing country benefited from foreign direct investment. Technology is the most important source of multinational companies as a source development in developed country. This developed country have a higher level of technology than developing countries. They can generate resource easily in the way of foreign direct investment. This foreign direct investment brings for the host country new technology and business practices.

Human capital enhancement: The main important of foreign direct investment on human capital is employment. The employee in the company will have skills and experience through their jobs or through special training.

Foreign direct investment will have a positive impacts on environmental and social concerns. Because foreign direct investment has the potential to bring social

23

and environmental benefits to host country‘s economy. There is a risk, however, that foreign-owned enterprises may have more concession demand than the local investors.

2.3 Relationships

2.3.1 Background Information on Africa and the Relation with Turkey

Africa is the second-largest and second most populous continent after Asia on earth with an estimated population in 2016 of 1.2 billion people which is about 14 percent of the World‘s population. Africa is home to 54 recognized sovereign states and countries, 9 territories and 2 de facto independent states with very little recognition. The most populous states are Nigeria, Ethiopia, Egypt, Zaire, and South Africa. Nowadays many of the challenges faced by missionaries working in Africa can be traced to the history of the continent and the impact of unjust European colonization. Despite Africa's great natural resources and energy potentials, industrialization is in its infancy (Beckwith, C., and Fisher, A., African Ark 1993).

2.3.2 Africa – Turkey Relation in Economy

Turkey‘s trade and economic enhancement strategy bilateral relation with African countries started and strengthened after 2002. Africa was under the control of colonial and racist European country for a years. Europeans still maintained substantial control over their former colonies. After put an end to these racist and colonial European country, still continue maintaining substantial control over their former colonies. This is because of Africa is a source of raw material and to provide their imbalanced trade of products. They considered themselves as Africa‘s first partner in trade.

To end this imbalanced relations, African countries began looking to China and Turkey as a new Economic and trade partners. China and Turkey have been considered by Africans as an alternative to 100 years of exploitation of European colonial country. Nowadays, China became a largest trading partner for Africa.

24

Turkey also began to look economic opportunity in Africa and offer to participate in foreign direct investment and in development as a new economic bilateral relation. The number of the countries with which Turkey signed Trade and Economic Cooperation Agreement increased to 54 from 23 in 2003. This bilateral agreement held between Turkey and all African countries except Eritrea. African countries agreed to have free trade area. This African Continental Free Trade Area (AfCFTA) will open economic appetites since the new agreement outlined in the African Continental Free Trade Agreement among 54 of the 55 African Union members.

The free-trade area is the largest in the world in terms of participating countries. So it makes especial opportunity for those who want to participate in foreign direct investment. The African continental free trade area have abolished custom duties by 90% in intra continental trade. This will increase the intra continental trade by 35% within Africa. That means participating by investment or trade with one of these member countries have a great opportunity. Prevention of double taxation agreements is also increasing and this makes the relation strength.

After the revival in Turkey‘s interest in Africa, Africa-Turkey economic relation have been seen in a good manner. In the side of Turkey, the economic relation is considered as opportunities for their trade alliance of global market place. Initially the relation was passive, Turkey began focusing more to Africa and developing the relations. Turkish development organization Turkey‘s International Cooperation Agency (TIKA) have a good role for the relation by opening Offices in 21 countries of the African continent. Turkey‘s trade volume with Africa also reach 179 billion US dollar. Turkey‘s Import and Export, share of Africa in Turkey‘s trade, share of Turkey in Africa‘s trade volume and Turkish foreign direct investment in Africa are all highly increasing. Increased the volume of trade, and the lowering of barriers to trade between Turkey and Africa, leads to improved bilateral relations between them (turkey Africa business forum 2017).

African countries look turkey as an alternative trade partner. In trade relation, inward and outward of goods or services have to be balanced. Otherwise, the

25

unbalanced trade, if the gap is too high between the two side it can lead to trade wars and tariff disputes with other competitors. Since bilateral and multilateral economic relations can be changed in to negative competition and may affect the alliances of economic health of nations, despite to develop, encourage, and maintain the relations. The relations between Turkey and Africa comprise several areas, like developing the diplomatic and political relations, economic and cultural cooperation etc.

Moreover, Turkey‘s relations with Sub Sahara African countries were speeded up after 2005. The new African policy looks to Turkey‘s foreign policy towards Africa in general and its relations with Sub Saharan Africa in particular. Turkey‘s emerging interests in Sub Sahara Africa are also in the areas of economic, military and humanitarian affairs (Beseny, 2012). In this regard, Turkish international organizations namely, the Foundation for Human Rights and Freedoms and Humanitarian Relief (IHH) and Turkish International Development Cooperation Agency (TIKA) played the most important roles in gaining prominence relations for Turkey in the region.

Turkey had established good economic ties with most countries of the Sub Saharan Africa. Particularly trade has been dramatically increasing. For example, in 2009, Turkey had signed an agreement with Sudan regarding free trade and tourism to further develop the relations between the two countries. The agreement was between both sides, including the declaration pertaining to the establishment of High Level Strategic Cooperation mechanism between them.

An Investments were also parts of Turkey‘s economic interest in this countries. In the past few years, the Turkish investors started to discover the markets of sub-Saharan Africa. Turkey military/security interests in Sub Sahara Africa include fighting piracy in Red Sea region, maintaining stability in and beyond the Red Sea region such as Somalia and Sudan. Turkish government is working out general peace all over Somalia. Beside its security interest, Sub Saharan Africa is the destination for military market of some Turkish companies (Beseny, 2012).

26

In all above engagements, Turkish international organizations have played significant roles. After the proclamation of the Africa plan, two NGO‘s are the main organizers of the whole program is the IHH. In 2006, TUSKON was organized a ‗Turkish-African Trading Bridge, a huge campaign facilitating the meeting of all the possible economic actors who are interested in bilateral relations. The relations include the humanitarian campaigns, and cultural and educational developments. Now TIKA has over twenty offices in all over the world, from which three are for the African continent. The relations make both Turkey and Africa beneficial in all aspects.

Making alliance and increasing relations is not only a government activity. It involves also people and non-governmental activity. For this a good example is Turkish foreign relations towards other countries like sub-Saharan Africa has been implemented and cooperated with non-state entities in a multitude of spheres. In fact, non-state actors of Turkey interact with Sub-Saharan African governments in three ways. These are; Cooperative interaction, Complementary interaction and Supplementary interaction.

Cooperative interaction occurs when non-state and state actors directly cooperate in order to achieve a common goal. Although underlying motivations may vary for each actor, their actions are congruent, i.e., they are in agreement about what needs to be done.

In complementary interaction, actors have different goals. They do not actually work on the same project, but coordinate their activities. The spheres of action mostly comprise trade, investment, and transportation.

The third category is supplementary interaction, where non-state actors take on most of the responsibilities, there is a minimal involvement of State Based Actors (SBA) and their control over outcomes. The spheres of action are providing humanitarian/developmental aid, establishing mechanisms of intercultural exchange, as well as promoting private interests. Briefly, there are the general frameworks of Turkey‘s relations with regard to Sub Sahara Africa. Despite its generality, there are