IS EURO A FETTER?

Seyfettin Gürsel*, Zümrüt İmamoğlu and Ayberk Yılmaz

Executive Summary

As the European countries are trying to recover from the global crisis, Europe’s common currency area is facing problems. As the austerity measures, public debt burden is pushing for, are preventing more stimuli for domestic demand, the Southern economies are feeling the need for a boost to exports to drive them out of the recession. But the Euro is an obstacle against a real exchange rate depreciation which could be a quick way of gaining competitiveness in the short run. In this research brief, we compare the growth performance of the PIIGS and the Eastern European countries and their real exchange rate depreciations. Has the Euro been a fetter for the PIIGS and the countries that peg their currencies to the Euro? We find that the euro-pegged Croatia and Italy, Spain and Greece among the Southern euro area economies seem to have suffered the most from the Euro. Among the Eastern European countries who have not yet adopted the Euro, Czech Republic, Poland and Hungary benefited from sizable depreciations. Although a depreciation of the real exchange rate cannot be a single recipe for economic growth, our brief overlook shows that those countries who were not fettered by the Euro did in fact get a boost in terms of economic growth, and those who were fettered suffered more.

PIIGS still struggling, is Euro to blame?

One major problem with the euro area is that since its establishment constituent economies have been diverging in terms of productivity and inflation while the opposite evolution has been hoped for. Furthermore since the crisis they are now on different growth paths. The Greek economy is still contracting, and the other Southern economies are trapped in very low growth regime. While PIIGS are struggling with fiscal problems, Germany is growing at a slow but steady pace with a solid fiscal stance. The PIIGS1 countries not only face the burden of their fiscal mess but also feel the weight of Euro as their

currency. With no possibility of depreciation, it is hard to recover from the crisis already with a weak competitive power in a world economy hit by sluggish demand. Germany, on the other hand had gone through a series of reforms before the crisis, therefore; it is more successful in keeping its prices at competitive levels as its robust recovery shows it. Unlike the PIIGS, some of the Eastern European countries that are not in the euro area enjoyed sizable exchange rate adjustments trough depreciations during the crisis, helping boost their exports and growth. If the PIIGS were not in the euro area, could they have recovered faster?

* Prof. Seyfettin Gürsel, Betam, Director, seyfettin.gursel@bahcesehir.edu.tr

Dr. Zumrut Imamoglu, Betam, Research Associate, zumrut.imamoglu@bahcesehir.edu.tr

Ayberk Yilmaz, Betam, Intern, ayberk.yilmaz@stu.bahcesehir.edu.tr

1 The PIIGS countries are Portugal, Ireland, Italy, Greece and Spain.

Research Brief 11/122

Empirical evidence shows that keeping the real exchange rate (RER) at competitive levels can be critical for jump-starting growth.2 An undervaluation of the RER would shift the resources towards the tradable

goods sector, boosting exports, while an overvaluation would shift them towards the non-tradable goods sector. With no frictions, the market determined RER would adjust to equate the marginal returns on tradable and non-tradable goods, optimizing their contributions to growth. Within the euro area such an adjustment is not easy. A large fraction of RER changes stems from changes in the nominal exchange rate (NER). It is hard to argue that the market determined NER for Euro would be optimal for Germany and also be optimal for PIIGS economies at the same time, especially since divergent dynamics have put these economies out of sync. Besides, asymmetric fiscal policies across countries can easily cause RER misalignments. Increased public spending tends to increase prices and therefore causes economies with loose fiscal policies to have overvalued RERs. Common currency obstructs adjustment through nominal exchange rate depreciations.

After the crisis while the RER adjustment in PIIGS economies were hampered by the common currency, some Eastern European economies had sizable RER adjustments. In this research brief we ask the question “Have these adjustments helped these Eastern European countries recover from the crisis faster than the euro area countries? Is the Euro nothing but a fetter for the PIIGS as they are struggling to recover?”

Changes in the RER and economic growth

Figure 1 shows the real exchange rate (RER) and real GDP changes for the PIIGS and the Eastern European countries on the same diagram. Germany is added as benchmark. The horizontal axis represents the percentage change in the real GDP, between its pre-crisis peak and the first quarter of 2011.3 Only for two countries, Germany and Poland, the change in real GDP is positive during this period.

For all other countries the real GDP is still below its pre-crisis level.

The vertical axis represents the percentage change in the RER for the same periods for each country.4

The RER deviations for the Euro zone countries stem from inflation differences. The same is true for Bulgaria and Croatia who are both outside the Euro zone but peg their currencies to the Euro. Figure 1 shows that for most countries, the RER is still below its pre-crisis value except for Greece and Bulgaria whose currencies have appreciated in real terms. But Ireland and Hungary apart, the depreciation remained very limited, between 2 to 3%, for Italy, Spain and Portugal, also for Croatia and Romania. Depreciation rates were 11% for Ireland and 6.2% for Hungary.

The diagram shows a negative relationship between RER appreciation and economic growth. On average a large depreciation in the exchange rate seems to be associated with high growth.5 We partition the

graph into 4 different zones, shown by the red lines in the figure. Each zone includes a group of countries

2 See Eichengreen (2008), Rodrik (2009).

3 Specific dates for each country and the associated real GDP changes are given in Table 1 and Table 3. 4 Specific dates for each country and the associated RER changes are given in Table 5 and Table 6. 5 The correlation coefficient is -0.47.

that shows similar traits in terms of growth and real exchange rate changes. We analyze in detail the cases for countries in different zones on the diagram and the special cases for some countries.

Zone 1: The zone of miracles

The first zone can be called as “the zone of miracles” as in this zone a country, despite an appreciation of its currency, would also have grown out of the recession. Such a case is possible for countries that receive large amounts of capital inflows.6 However, this was not the case in the Eastern European

countries and neither in the euro area given its historically low interest rates due to the financial crisis. Therefore, Zone 1 is empty on our diagram.

Zone 2: The frontrunners

The second zone is where we expect the high growth performers to be; a sizable real exchange rate depreciation (more than – 4%) and positive GDP growth. Poland and the Czech Republic lie here as well as Germany.

Poland was almost untouched by the crisis having only one quarter of negative growth. The Polish ruble though depreciated by 28% in real terms after the collapse of Lehman Brothers, the highest decline among the Eastern European countries, and it was still 14 percent below its pre-crisis level by the end of first quarter in 2011 (see Table 5). Czech Republic had a sizable, 16.4%, exchange rate depreciation as well during the crisis and the RER remained 5.2 percent below its pre-crisis value by the end of the first quarter. It certainly helped Poland and the Czech Republic to have an undervalued currency during the recovery period. Table 1 shows the changes in real GDP during the contraction and recovery periods of Eastern European countries and Table 2 shows the growth contributions of GDP components for the recovery period. Net exports contributed 4.6 points to Poland’s 7.9 percent real GDP growth and 2.8 points to Czech Republic’s 4.4 percent growth.

In Germany, the RER has depreciated by 5.9% after the crisis. Part of this was due to appreciation of the Japanese Yen which helped German exporters to stay relatively competitive in the world market. And part of it is that German inflation was lower than the Southern European economies. The divergence of PIIGS and Germany on the RER depreciation is evident in the figure. RERs of PIIGS economies have depreciated only 2.3% on average from their pre-crisis level, significantly lower than their common currency partner.

Zone 3: The disappointers

The third zone in the diagram is where two exceptional cases Ireland and Hungary lie. These are countries that had large depreciations but also performed poorly in terms of economic growth. In Ireland’s case, real depreciation of almost 12 percent is huge compared to other Euro zone countries. This large 6 Countries subject to high capital inflows during the global crisis, such as Brazil and Turkey, did experience high growth rates and an appreciation in their currency. But this was mainly due to large amounts of capital flight to safe heavens and markets with high interest rates. Switzerland is a good example for Europe.

decline in RER is due to the drop in overall price level, the CPI. But most of the decline is due to the drop in housing prices, not in tradable goods prices. Figure 2 shows the change in CPI for Ireland and the change in CPI excluding housing prices. The decline in the CPI is more than twice that of the change in the price level when housing prices are not included. The CPI decreased by 7.7% while the CPI excluding housing decreased by only 3.5% between Sep 2009 and Jan. 2010. It seems that most of the decline in RER stems from the crash in the housing market during the crisis and cannot be expected to help boost economic growth through exports. Never the less; exports were the main driver of economic growth for Ireland because historically they constitute a large fraction (above 100%) of GDP. However, domestic demand in Ireland is by far and large depressed therefore it is one of the worst performers in Europe in terms of economic growth.

Hungary is a special case. Hungary entered the crisis era with serious macro imbalances. In 2006 the budget deficit had reached 9.2%. In 2007 inflation rate had hit 8%, and external debt reached almost 100% of its GDP by the end of 2008. The austerity program put in place by the new government cut the budget deficit down to 3.4% in the next two years, but depressed domestic demand significantly at the same time. By the time the crisis hit, Hungary still had its fiscal policy oriented towards reducing its budget deficit and was not able to provide any stimuli to the economy. The IMF, ECB and the World Bank had to provide help for Hungary to prevent collapse of country’s economic and financial system.

Table 2 shows the contributions to GDP growth during the recovery phase. Consumption and investment demand subtracted from growth and government expenditures did not add much. Growth was mainly driven by foreign demand. As Figure 6 shows Hungary’s RER depreciated by 21.6% after crisis and was still 6.2% lower than its pre-crisis peak by the end of the first quarter in 2011. And net exports contributed 5.3 percentage points to economic growth. Without the domestic turmoil, Hungary would actually take place in Zone 2 along with Poland and the Czech Republic.

Zone 4: The fettered

Lastly, the fourth zone on the diagram is where southern euro area countries and euro-pegged currency countries (Bulgaria and Croatia) lie. These countries’ RERs differ only due to inflation differences; therefore, most of them lie near the same horizontal line, around the 2% depreciation mark. The exceptions are Greece and Bulgaria who had high inflation during the period considered.7 Their RERs

have appreciated by 2.0% and 2.6%, respectively. The outsider in this zone is Romania who is neither in the euro area nor has pegged its currency to the Euro. Romania’s RER declined by 12 percent after the Lehman collapse but gained most of its value afterwards and now is only 2% below its pre-crisis level. None of the countries in Zone 4 has recovered from recession. Greece, Italy, Spain and Portugal are having difficulty in driving the domestic demand due to austerity measures imposed to take public debt under control. The decrease in domestic demand in these countries is the main hindrance to economic growth, but being in the Euro zone is not helping either. Table 4 shows the contributions of GDP components to economic growth for the PIIGS and Germany. Contribution of net exports to GDP growth 7 The Greek inflation is mainly caused by the public debt problems.

was very limited in Spain and Greece and it was negative in Italy. In fact Greece only had a positive net exports contribution due to the decrease in its imports, exports actually decreased throughout the recovery period. Croatia too has suffered from pegging its currency. The RER depreciation in Croatia was small, 2.5% since the peak before the crisis, compared to other Eastern European countries as Table 5 and Figure 6 show. Croatia’s net exports subtracted 1.9 points from economic growth.8

In comparison, for Germany the contribution of net exports was 3.7 percentage points to an overall 7.3% GDP growth. It seems that Italy, Spain and Greece are the fettered countries along with Croatia who loosely pegs its currency to the Euro.

Portugal and Bulgaria, the other two countries that lie in this zone, were able to boost their exports despite the Euro fetter. Contribution of net exports to growth was significantly larger in Portugal than other Southern European countries. It was 3.6 percentage points, almost as high as Germany. Bulgaria also had a high contribution from net exports, 5.8 percentage points, the highest among the Eastern European countries, although it had pegged its currency to the Euro.9

Romania was one of the worst performers in terms of GDP losses in Eastern Europe. It is actually very hard to say whether Romania has entered the recovery phase yet or not. Figure 7 shows that only in the last three quarters, 3Q2010 and 1Q2011, the GDP growth seems to pick up but only at a mere 0.3% rate. Table 2 shows the contributions to growth during these three quarters. However, the statistical discrepancy is high which makes it hard to interpret the results but it seems that Romania’s domestic demand is depressed and the net export contribution is also very low. What puts Romania in a difficult position is that although the RER depreciated by 12.5 percent during the crisis, it appreciated back with almost no growth in real GDP.10 Low domestic demand and no further help from currency depreciation

places Romania in the fettered zone in our diagram.

Political will and the solidarity will be crucial for the future of Europe

The euro-pegged Croatia and Italy, Spain and Greece among the Southern euro area economies seem to have suffered the most from the Euro. Portugal and Bulgaria, on the other hand, had relatively better export performance although they, too, are among the Euro-bound countries. Among the Eastern European countries who have not yet adopted the Euro, Czech Republic, Poland and Hungary benefited from sizable depreciations. But Romania, despite an initial large depreciation during the crisis, is still struggling for recovery. Although a depreciation of the real exchange rate cannot be a single recipe for economic growth, and further research is needed to understand the full dynamics (especially for Portugal, Bulgaria and Romania), our brief overlook shows that those countries who were not fettered by the Euro did in fact get a boost in terms of economic growth and those who were, suffered more.

Domestic demand across Europe is severely depressed and will remain so in the near future. The Southern European countries are in need of a boost from exports to recover from the crisis. A 8 See Table 2. We call the period between 1Q2010 and 1Q2011 the recovery period although economic growth was slightly negative but this is mostly because Croatia’s economy started to shrink again in the last two quarters. See Figure 6 for the path of economic growth.

9 See Table 2 for contributions to growth for Bulgaria. 10 See Table 5 for RER changes and Figure 6 for its path.

depreciation of currency could help give them exactly what they need. However, the fear of collapse of the entire euro area due to eventual exits from Euro has so far been a stronger concern for the Europeans than giving the Southern countries more competitive power. With no possibility of depreciation, exports which are already the main driver of economic growth cannot grow any faster, unless there are new gains in productivity. But this requires strong political will to make difficult structural reforms and important resource transfers from North to South. Are the political will and intra-Europe solidarity powerful enough to achieve these goals? That is the crucial question for the future of Europe.

Figure 1. PIIGS & East Europe, Growth – Change in Real Exchange Rate

Source: CEIC Global Database, Betam. The diagram shows the change in the RER and the real GDP growth rates for each country between their peak before the crisis and the end of first quarter in 2011.

References

Dornbusch, R. 1980. Open Economy Macroeconomics, New York: Basic Books.

Eichengreen, B. 2008. “The Real Exchange Rate and Economic Growth.” Working Paper No:4. The Commission on Growth and Development. World Bank, Washington, DC.

Feldstein, Martin. 1997. “The political economy of the European Economic and Monetary Union: Political sources of an economic liability.” Journal of Economic Perspectives 11:23-42.

Rodrik, D. 2009. “The Real Exchange Rate and Economic Growth.” In Brookings Papers on Economic Activity, Fall 2008, ed. D.W. Elmendorf, N. G. Mankiw, and L. H. Summers, 365-412.

András Inotai, 2010 Hungary Country Report. In: Bertelsmann Stiftung (ed.), Managing the Crisis. A Comparative Assessment of Economic Governance in 14 Economies. Gütersloh: Bertelsmann Stiftung.

Table 1. Eastern European Countries: Growth in Crisis and Recovery Periods

Crisis Period Growth(%) Recovery Period Growth(%) GrowthOverall Czech Re-public 3Q08 – 2Q09 -4.9 2Q09-1Q10 4.5 -0.6 Hungary 1Q08 – 3Q09 -8.4 3Q09-1Q11 3.5 -5.1 Poland 3Q08 – 4Q08 -0.4 4Q08-1Q11 7.9 7.5 Romania 2Q08 – 1Q10 -9.0 1Q10-1Q11 0.3 -8.7 Bulgaria 4Q08 – 4Q09 -8.9 4Q09-1Q11 4.3 -5.0 Croatia 2Q08 – 1Q10 -9.9 1Q10-1Q11 -0.8 -10.7

Source: Country statistical agencies, IMF, Betam.

Table 2. Eastern European Countries: Contributions to Growth in Recovery Period

Period GDP C G I EX IM NX St. Disc. Czech Repub-lic 2Q09 – 1Q11 4.4 -0.3 0.0 2.1 33.0 -30.2 2.8 -0.2 Hungary 3Q09 – 1Q11 3.0 -0.4 0.0 -0.1 29.6 -24.3 5.3 -1.7 Poland 4Q08 – 1Q11 7.9 3.7 0.9 2.8 4.6 -2.4 2.2 -1.6 Romania 3Q10 – 1Q11 0.3 -0.4 -0.7 14.3 10.9 -10.0 0.8 -13.8 Bulgaria 4Q09 – 1Q11 4.3 0.6 0.8 -0.1 13.0 -7.2 5.8 -2.8 Croatia 1Q10 – 1Q11 -0.8 0.0 -0.2 -0.7 -4.6 2.6 -1.9 2.0

Source: Country statistical agencies, IMF, Betam.

Table 3.

PIIGS Seasonally and Working Days Adjusted GDP Growth Rates

Crisis Period GDP growth (%) Recovery Period GDP growth (%)

Portugal 4Q07 – 1Q09 -3.9 1Q09 – 1Q11 1.2 Ireland 4Q07 – 4Q09 -12.6 4Q09 – 1Q11 1.3 Italy 1Q08 – 2Q09 -6.9 2Q09 – 1Q11 2.0 Greece 3Q08 – 4Q10 -10.0 4Q10 – 1Q11 0.2 Spain 1Q08 – 4Q09 -4.9 4Q09 – 1Q11 0.9 Germany 2Q08 – 1Q11 -6.6 1Q09 – 1Q11 7.3

Source: Country statistical agencies, IMF, Betam.

Table 4. PIIGS and Germany Seasonally and Working Days Adjusted Contributions to Growth in Recovery Period Period GDP C G I EX IM NX St. Disc. Portugal 1Q09 – 1Q11 1.2 0.5 -0.8 -1.9 5.8 -2.2 3.6 -0.3 Ireland 4Q09 – 1Q11 1.3 -1.1 -0.6 -2.2 11.8 -4.0 7.8 -2.7 Italy 2Q09 – 1Q11 1.9 1.2 -0.2 2.0 3.5 -4.6 -1.1 0.0 Greece 4Q10 – 1Q11 0.2 0.8 -1.2 -0.4 -1.0 1.9 0.9 0.0 Spain 4Q09 – 1Q11 0.9 1.0 0.1 -1.6 4.6 -3.1 1.5 0.0 Germany 1Q09 – 1Q11 7.3 0.8 0.9 2.2 10.3 -6.6 3.7 -0.3

Source: Country statistical agencies, IMF, Betam.

Crisis Period Change in RER (%) Recovery Period Change inRER (%) ChangeOverall Czech

Republic Jul08 – Feb09 -16.4 Feb09 - Apr2011 13.4 -5.2 Hungary Jul08 – Mar09 -21.6 Mar09 - Apr2011 19.7 -6.2 Poland Jul08 – Feb09 -28.3 Feb09 - Apr2011 19.6 -14.2 Romania Aug08 – Feb09 -12.5 Feb09 - Apr2011 11.9 -2.0

Bulgaria Jul08 – Jun10 -2.8 Jun10 - Apr2011 6.2 3.2

Croatia Jul08 - Dec10 -4.8 Dec10 - Apr2011 2.5 -2.5

Source: Country statistical agencies, IMF, Betam.

Figure 2. CPI and CPI excluding Housing for Ireland, (2006=100)

Source: Central Statistics Office of Ireland, Betam.

Source: Country statistical agencies, IMF, Betam.

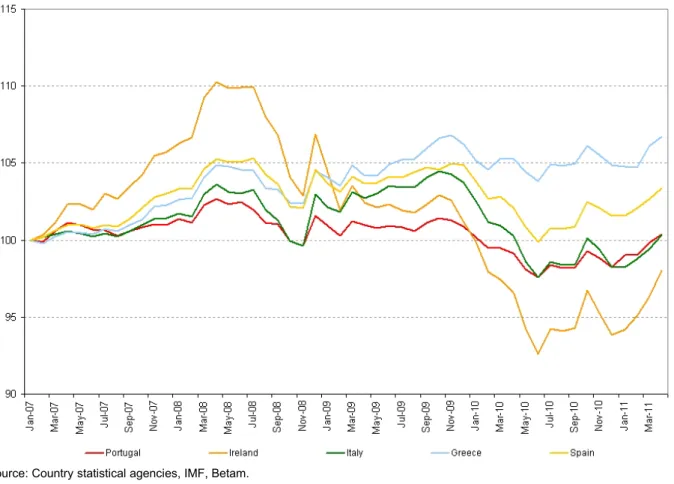

Figure 4. PIIGS, GDP Index 2007=100

Source: Country statistical agencies, IMF, Betam.

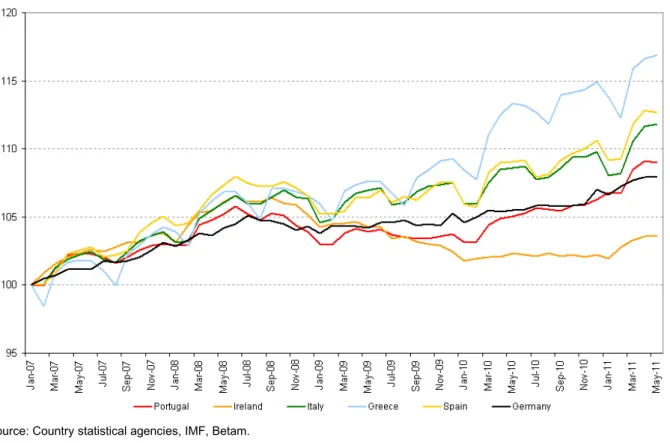

Source: Country statistical agencies, IMF, Betam.

Figure 6. East Europe, Real Effective Exchange Rates, CPI Based 2006=100

Source: Country statistical agencies, IMF, Betam.

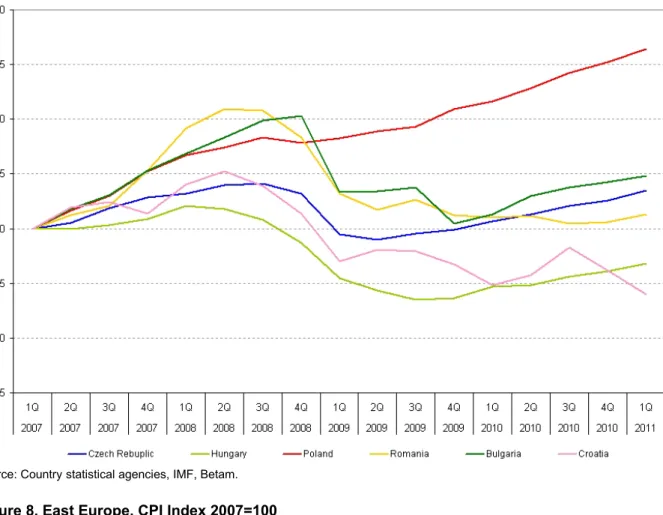

Source: Country statistical agencies, IMF, Betam.

Figure 8. East Europe, CPI Index 2007=100