AENSI Journals

Australian Journal of Basic and Applied Sciences

ISSN:1991-8178Journal home page: www.ajbasweb.com

Corresponding Author: A. Serdar Yücel, Fırat University School of Physical Education and Sports (BESYO), Elazığ, Turkey. Mob: +904242370000-5730 E-mail: asyucel@firat.edu.tr

Analysis of Preference Levels of Bank Customers in Terms of Housing Loan

1Murat Korkmaz, 2Sefer Gümüş, 3Nur Dilbaz Alacahan 1Güven Group Co. Inc. Finance Director, İstanbul -Turkey

2Beykent University, Faculty of Management, Department of Marketing, İstanbul-Turkey

3Çanakkale 18 Mart University, Faculty of Economics and Administrative Sciences, Department of Economics, Çanakkale-Turkey A R T I C L E I N F O A B S T R A C T

Article history:

Received 2 March 2014 Received in revised form 13 May 2014

Accepted 28 May 2014 Available online 23 June 2014

Keywords:

Bank, Client, Housing, Housing Loan, Preference

Background: Housing, which is one of the most significant features of economic and social aspects of life of a society, represents knowledge on development levels of societies while it contributes greatly to the shaping of cities. While housing is of significant importance for the people in terms of satisfying a need in developed countries; namely directly related to the need for housing, in our country housing is considered an investment tool to acquire an income in future namely an income from the rent with the purpose of getting unearned income because of the inadequacy in social security system. Objective: This study was conducted to determine the preference levels of bank customers as to housing loan. Data was gathered from 300 participants. Random sampling technique was utilized in this study. Findings gathered from the questionnaire were analysed using SPSS Statistical Analysis Program. The questionnaire was proved to be reliable since 0,782 reliability value based on “Cronbach’s Alpha” value was obtained as a result of the analysis. Frequency analysis, t-test, variance analysis, reliability analysis and factor analysis methods were used as statistical analysis techniques. Results: The findings of the study revealed that there was no statistically significant difference between housing loan usage levels of bank customers with regards to their gender and marital status. However, a significant difference was observed in the bank type where the loan was received. Considering income levels, bank customers whose income level is 2001 TL and above prefer housing at a high level. Conclusion: At the end of the study it was concluded that income level, interest rates, real estate prices, and so on some factors caused to be prefered the banks for taking loans by the clients.

© 2014 AENSI Publisher All rights reserved. To Cite This Article: Murat Korkmaz, Sefer Gümüş, Nur Dilbaz Alacahan, Analysis of Preference Levels of Bank Customers in Terms of Housing Loan. Aust. J. Basic & Appl. Sci., 8(9): 115-124, 2014

INTRODUCTION

One of the fundamental needs of humans, namely housing, is met in a physical environment called dwelling. While dwellings which are the most significant parts of economic and social life of societies contribute greatly to the shaping of cities, they also represent the levels of development of the societies as well as their knowledge. In addition, a dwelling satisfies the fundamental need of an individual and a family with its housing characteristics thus has a social dimension which brings a number of people or organizations together in terms of the society and the economy. The concept of housing which has such significant features, and enables the interaction of many economic and societal actors as well as communicates with almost all subsectors of the economy, becomes a challenging product to conceptualize because of its social and symbolic dimensions (Güvenç ve Işık, 1999).

While the concept of housing sits at the centre of housing finance system and usually is a real estate property, real estate is defined as immovable property which cannot be moved without destroying or altering its nature (Akkaya, 2011). Besides, housing is a kind of closed or semi-closed safe shelter where individuals protect themselves from dangers and natural disasters and pursue their private lives (Şıpka, 2002). In other words, housing is a house, dwelling, residence or a place where an individual resides without any aim to settle (Akkaya, 2011). Housing is a product which has a surrounding and physical size, which is required to have the necessary features for people to meet their fundamental needs such as nutrition, dressing and inhabiting in a safe and healthy way (Özkan, 1981).

According to another definition focusing on motivation of supply groups and investment process which complements the meaning of housing for users, housing is a kind of capital goods which produces interest. In

terms of its function, housing, which is dependent on soil, and aims at meeting people’s housing requirement in an appropriate settlement scale, is a long term product intended to be used (Kömürlü, 2006).

While housing is of significant importance for people in terms of satisfying a need in developed countries; namely directly related to the need for housing, in our country housing is considered an investment tool to acquire an income in future namely an income from the rent with the purpose of getting unearned income because of the inadequacy in social security system. In addition to all these, Akkaya thinks that Turkish people attach sentimental importance to real estate (Akkaya, 2011).

People in developed countries do not consider real estate as an investment tool and/or a way to receive rental income which is the case in Turkey taking into account the assurance in the social security system as well as income earned while working and after retirement, and humane living conditions provided by above-mentioned income (Akkaya, 2011).

The issue of housing will be on the agenda for a long time because of current housing shortage in our country, rapid population growth, which puts pressure on the housing issue, as well as insufficiencies in dwelling production. 50% of current number of total housing is comprised of unauthorized/unregistered dwelling and the percentage of ownership is around 60%. The percentage of ownership is around 70% in the USA and 67% in UK (Akkaya, 2011).

Compared to other countries in terms of ownership, the percentage of our country remains very low. Especially when we consider that 50% of current number of total dwellings is comprised of unauthorized/unregistered ones, 60% of dwellings is above 20 years and 40% of dwellings needs alterations, it is understood that the housing requirement is a serious problem of qualified housing (Akkaya, 2011). Housing demand which emerges as one of the primary demands for accommodation develops as a consequence of the phenomena of urbanization and replacement of the population due to industrialization and urbanization in some countries. But the fact that people gather in cities in the process of societal development, cultural transformations and modernization, and cities accommodate people more than their current capacities results in a variety of problems and an increase in housing demand. In addition, higher levels of income and living standards’ reaching higher levels day by day cause changes in people’s demands and admiration thus current housing opportunities cannot satisfy the needs (Yiğit, 2009).

Rapid population growth and urbanization, distributed families because of cultural changes, increase in income levels and life standards lead to 300 000 housing needs every year in Turkey. Therefore, in addition to satisfying the housing need with a housing policy to be determined in our country, other points such as encouraging registered dwelling production, development of projects regarding transformation and renovation, and establishing housing policies regarding earthquake and other natural disasters should be targeted and the housing issue should be tackled qualitatively beyond quantitatively (Akkaya, 2011).

The problem of housing need was brought forward with the Universal Declaration of Human Rights of 1948 as a result of the emergence of housing need following changes and developments occurring in a number of important factors in the world, thus it was acknowledged that housing was a fundamental right. When housing was accepted as a human right, defining the qualification of enough housing for everybody in detail became significantly important and this principle was included in country’s all policies including the constitution since it was accepted as a valid principle for our country, as well. The fact that the concept of housing which is an indispensable need of all societies since the establishment of the world, has a variety of functions including being a dwelling opportunity, a tool for investment, a contributor for economic development, and an assurance for individuals for their futures (Yiğit, 2009).

The main concern of long term housing finance system which is presented as a solution for housing problem is dwellings, and its main objective is to enable consumers to have dwellings with institutional methods.

The phenomenon of housing as a product which influences the economy as a whole, the fact that the number of those who need this product increases day by day, and the fact that owning dwellings gets harder because of high prices, enhance the importance and necessity of housing finance. Housing finance means providing people or institutions who want to buy dwellings with the required funds or in other words, housing finance is defined as the procedure of providing loan for consumers to buy dwellings, renting houses to consumers through financial renting, providing loans for consumers under the guarantee of houses they own (Yiğit, 2009).

Considering the housing need stemming from social, economic and cultural structure of our country, and production, it seems that the housing problem will be on the agenda for a long time, thus housing finance system will still continue for years (Akkaya, 2011).

Housing sector finance is directly related to two important issues. First one is that individuals provide long-term housing finance with institutional methods, second one is enabling real estates, which are dead investments in balance sheets of corporations, to gain mobility. Achieving success in both issues depends on not only establishing macroeconomic balances in a healthy way but also development of financial markets and the strong link between real estate finance and capital markets (Yiğit, 2009).

A good housing finance system must be in a way which collects necessary funds from economic units (such as household, corporations, public sector) which are fund surplus then transfers them middle- or low-income individuals who have demanded fund (who are in need of loan to buy dwellings). Through such a finance method, a profit should be ensured for people who will be able to lend their savings on the other hand necessary loan conditions should be provided for debtors to repay the loans. If the system is implemented correctly, people will not need to save money to buy dwellings and they will be dwelling owners by using their savings for repayment of their loans with sufficient repayment conditions (Uludağ, 1997).

When housing demand is considered from saving-owners' aspect, it is more based on utilizing savings rather than satisfying needs (Aksoy, 1993). The fact that people perceive dwellings as an investment tool increases the attention and demand directed to housing. As a result of such different views on housing, housing finance problem emerges because of imbalance between demands and supply, and because those, who demand dwellings, cannot afford the prices since their level of income is not sufficient (State Planning Organization, 1989).

Various problems emerge in a finance system which cannot develop housing quality and increase housing supply, and which cannot establish a balanced relationship among state, financial organizations, housing producer and household (Yiğit, 2009).

While income, adaptation, household and financial conditions determine housing demand, present housing stocks and housing standard greatly contribute to welfare and development of the society. Therefore, it is not surprising to see that housing has always been important from political aspect, and it pursues education and health care services as a focal point in terms of providing social opportunity (Yiğit, 2009).

There is no single universal housing finance which was preferred by all countries (Yalçıner, 2006). Housing finance system of each country depends on various factors such as development of the country, structure and order of capital markets, political regime which is applied in the country. Housing finance markets of countries which have high level of savings and stable economic indicators, functions in an efficient and productive way (Yiğit, 2009).

In developing countries, however, noninstitutionalized markets are seen because the most adverse thing which effects real estate finance in developing countries is that loans are short-term. Providers of loans prioritize short-term loans since savings are at low levels in the economy. This situation blocks the efficiency of the system applied in such countries. In least developed countries, financial sectors do not function well because of general instability, high levels of inflation rates and low level of savings, thus this situation directly reflects on housing finance (Yiğit, 2009).

In the light of this information, it is seen that preference levels of customers while using housing loans vary. In previous studies conducted on this topic, it was shown that some factors affected the preference of banks by customers to receive loans. Yiğit’s study titled “Comparative Analysis of Tendency of Mortgage Loan Use and Factors Affecting Bank Choice: A Case Study of Ankara”, showed that customers considered mortgage loans in housing loan use. It was stated that in terms of determining factors, monthly payment was in the first place of the list with average 4,97 points, which was followed by interest rates with 4,81 points, term and real estate prices with 4,77, and bank charges with 4,73. The least importance was attached to convenience provided by the bank with 3,18 points and rate of exchange with 2,26 points. It was found out that with 5 average points, interest rate was the most important factor for customers in their preferences for mortgage loan. It was followed by term rates and commission rates factors which had the same arithmetic average with 4,73, bureaucratic conveniences factor with 3,48, guarantees factor with 3,12, bank personnel factor with 2,27, location of the bank branch factor with 2,22 and bank image factor with 1,97. Three factors form the most important information source which banks take into account in mortgage loan demands of consumers. These have been identified as credit account and credit performance of the customer, who will use the loan, income level and stability of the customer, intelligence report about the customer which will be obtained from banking system. In the same study, reasons which enable banks to be preferred for mortgage loans were studied with bank-customer comparative analysis and no significant difference was stated in terms of bank and customer in the answers for factors such as low term and commission rates, location of the bank branch. On the other hand, it was shown that there was significant difference in factors such as bank image, guarantees, bureaucratic conveniences, bank personnel. According to comparison between the factors considered while using housing loans and employer type, statistically significant difference was observed in terms of employer type in the answers stated for the factor of conveniences provided by bank. According to the average scores, it was seen that people employed in private sector gave more importance to this factor (Yiğit, 2009).

In another study “A Case Study of Kayseri related to Customers Individual Bank Preferences” conducted by Yıldırım and Karamustafa (Karamustafa & Yıldırım, 2007), it was aimed to determine the reasons for bank preferences of customers and the reasons for changing their banks. According to the results of the study, factors of “reliable bank”, “service provision in banks without long lines”, “widespread ATMs and variety of service”, consecutively, were among the factors which affected the bank preferences more; on the other hand, the study revealed that the effect of factors of “acquainted/friend bank employee”, “physical appearance of bank

personnel”, “intensive advertisement activities of the bank” was quite low. In the light of these findings, it is probable for banks to implement medium- and long-term plans for preserving and increasing their market share in order to attract customers (potential customers) taking into account the factors determined by the studies as having high level of influence on bank preferences of customers. According to the findings of the study conducted by Yıldırım and Karamustafa, factors influencing decisions of customers to change their present banks were consecutively “constant mistakes in transactions”, “delay in transactions”, “no solutions to be presented for problems”. It was observed that factors such as “physical atmosphere of the bank and lack of comfort”, “non user-friendly internet banking”, “non-user friendly telephone banking” had low level of influence. In the same study, statistically significant differences were found in bank preferences of customers according to the independent variables such as gender, age group, marital status, education level, employment in an income producing work, sector of work and monthly income (Karamustafa & Yıldırım, 2007).

As a whole, the present study aimed at analysing the current preference levels of bank customers in terms of housing loans. Data were gathered through a questionnaire study which was administered to bank customers residing in Istanbul province.

Aim, Scope and Method:

This study was conducted to determine the preference levels of bank customers as to housing loan. Data was gathered from 300 participants. Random sampling technique was utilized in this study. The measuring instrument questionnaire used in the study was administered to 50 participants prior to the study. Findings gathered from the questionnaire were analysed using SPSS Statistical Analysis Program. The questionnaire was proved to be reliable since 0,782 reliability value based on “Cronbach’s Alpha” value was obtained as a result of the analysis. Pre-test was administered to consumers from Halkalı and Başakşehir areas of Istanbul. The study was conducted among bank customers who reside in “Halkalı, Başakşehir, Ataşehir ve Bahçeşehir” areas of Istanbul. The main reason why Istanbul province was chose is the housing need of residents of this city and high amount of housing demand from the residents related to dwellings built by TOKI (Housing Development Administration of Turkey). In the study, it was aimed at determining the factors which affected the preference levels of bank customers in terms of housing loans. Demographic features of individuals was considered independent variable. Dependent variable of the study was housing loan preference level. Dependent variable was determined as Likert-scale ranging from 1-5. Frequency analysis, t-test, variance analysis, reliability analysis and factor analysis methods were used as statistical analysis techniques.

Reliability Analysis:

Tablo 1: Reability statistics.

Cronbach's Alpha Number of Items

,892 30

The Table above shows Cronbach’s Alpha coefficient which was obtained from the results of reliability analysis. Reliability coefficient was calculated as 0,892. According to this figure, the analysis was reliable at almost 89% level. It is concluded that the study is highly reliable based on the reliability analysis.

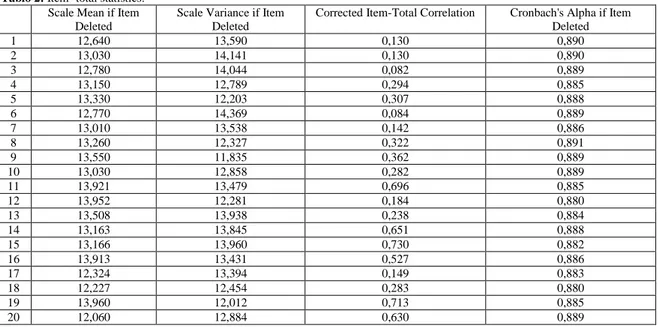

Tablo 2: Item- total statistics. Scale Mean if Item

Deleted

Scale Variance if Item Deleted

Corrected Item-Total Correlation Cronbach's Alpha if Item Deleted 1 12,640 13,590 0,130 0,890 2 13,030 14,141 0,130 0,890 3 12,780 14,044 0,082 0,889 4 13,150 12,789 0,294 0,885 5 13,330 12,203 0,307 0,888 6 12,770 14,369 0,084 0,889 7 13,010 13,538 0,142 0,886 8 13,260 12,327 0,322 0,891 9 13,550 11,835 0,362 0,889 10 13,030 12,858 0,282 0,889 11 13,921 13,479 0,696 0,885 12 13,952 12,281 0,184 0,880 13 13,508 13,938 0,238 0,884 14 13,163 13,845 0,651 0,888 15 13,166 13,960 0,730 0,882 16 13,913 13,431 0,527 0,886 17 12,324 13,394 0,149 0,883 18 12,227 12,454 0,283 0,880 19 13,960 12,012 0,713 0,885 20 12,060 12,884 0,630 0,889

21 13,669 12,370 0,692 0,871 22 12,275 12,226 0,686 0,884 23 13,538 13,766 0,890 0,885 24 13,745 12,634 0,826 0,881 25 12,492 12,499 0,466 0,883 26 13,168 12,393 0,436 0,872 27 13,392 13,024 0,017 0,881 28 13,285 13,228 0,316 0,885 29 13,180 13,141 0,741 0,890 30 13,589 12,409 0,273 0,884

The Table above demonstrates corrected item-total correlation for each item, and scale mean, variance scale and Cronbach’s Alpha coefficient of item if it is deleted. What matters here is Cronbach’s Alpha coefficient which was obtained in the case of deletion of an item. If this value was significantly different from the reliability coefficient value which was 0,892, the item would be deleted. Considering Cronbach’s Alpha coefficients of the items, it is seen that there was no question to be removed from the analysis because these values are not significantly different from 0,892.

Frequency Analysis:

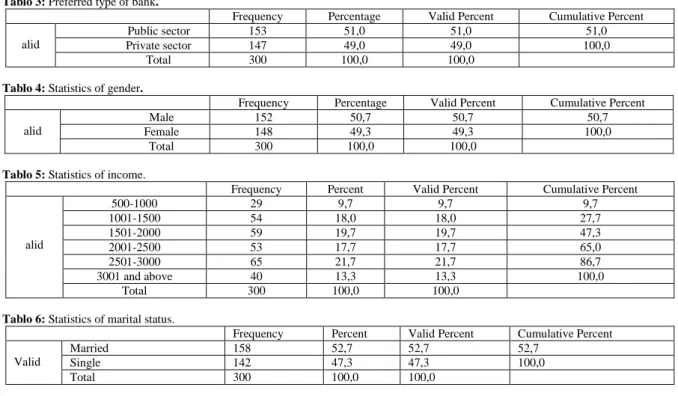

The Table below shows frequency analysis of type of banks used for loan, gender, marital status and income levels of bank clients.

Tablo 3: Preferred type of bank.

Frequency Percentage Valid Percent Cumulative Percent V

alid

Public sector 153 51,0 51,0 51,0

Private sector 147 49,0 49,0 100,0

Total 300 100,0 100,0

Tablo 4: Statistics of gender.

Frequency Percentage Valid Percent Cumulative Percent V

alid

Male 152 50,7 50,7 50,7

Female 148 49,3 49,3 100,0

Total 300 100,0 100,0

Tablo 5: Statistics of income.

Frequency Percent Valid Percent Cumulative Percent

V alid 500-1000 29 9,7 9,7 9,7 1001-1500 54 18,0 18,0 27,7 1501-2000 59 19,7 19,7 47,3 2001-2500 53 17,7 17,7 65,0 2501-3000 65 21,7 21,7 86,7 3001 and above 40 13,3 13,3 100,0 Total 300 100,0 100,0

Tablo 6: Statistics of marital status.

Frequency Percent Valid Percent Cumulative Percent

Valid

Married 158 52,7 52,7 52,7

Single 142 47,3 47,3 100,0

Total 300 100,0 100,0

Variance Analysis t-tests:

H0: There is no statistically significant difference between the preference levels of bank customers in terms

of housing loans with regard to the bank type where they use loans.

H1: There is statistically significant difference between the preference levels of bank customers in terms of

housing loans with regard to the bank type where they use loans.

Tablo 7: Group statistics.

Preferred type of bank N Mean Std. Deviation Std. Error Mean Level of preference in terms of

housing loan

Public sector 153 3,2353 1,15146 ,09309

Private sector 147 2,7075 1,19480 ,09855

In the Table above, mean, standard deviation and standard error values of bank customers’ levels of preference in terms of housing loan based on the bank type are presented.

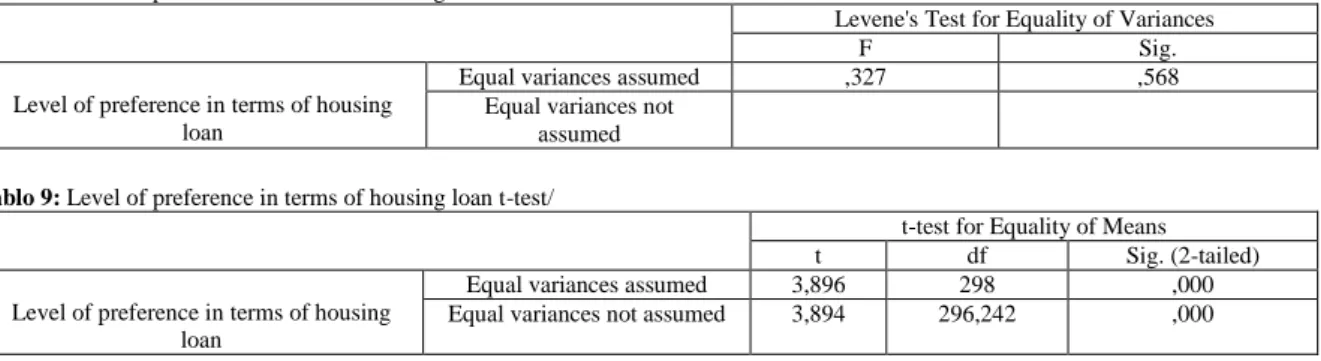

In the table below homogeneity test result related to variances is presented for bank customers’ levels of preference in terms of housing loan based on the bank type. It was found that the variances were homogeneous between the groups according to the result of Levene test (p>0.05).

Tablo 8: Level of preference in terms of housing loan levene test.

Levene's Test for Equality of Variances

F Sig.

Level of preference in terms of housing loan

Equal variances assumed ,327 ,568

Equal variances not assumed

Tablo 9: Level of preference in terms of housing loan t-test/

t-test for Equality of Means

t df Sig. (2-tailed)

Level of preference in terms of housing loan

Equal variances assumed 3,896 298 ,000

Equal variances not assumed 3,894 296,242 ,000

The table above shows the result of t-test. under the assumption of equal variances, there is a statistically significant difference between the preference levels of bank customers in terms of housing loans with regard to the bank type where they use loans (p<0.05). Accordingly, bank customers who get loans from public sector banks prefer to use housing loan more.

H0: There is no statistically significant difference between the preference levels of bank customers in terms of housing loans based on gender.

H1: There is statistically significant difference between the preference levels of bank customers in terms of housing loans based on gender.

Tablo10: Level of preference in terms of housing loan (group statistics of gender).

Gender N Mean Std. Deviation Std. Error Mean

Level of preference in terms of housing loan

Male 152 3,0461 1,23599 ,10025

Female 148 2,9054 1,16256 ,09556

In the Table above, mean, standard deviation and standard error values of bank customers’ levels of preference in terms of housing loan based on gender are shown.

Tablo 11: Level of preference in terms of housing loan levene test.

Levene's Test for Equality of Variances

F Sig.

Level of preference in terms of housing loan

Equal variances assumed ,689 ,407

Equal variances not assumed

In the table above homogeneity test result related to variances is presented for bank customers’ levels of preference in terms of housing loan based on gender. It was found that the variances were homogeneous between the groups according to the result of Levene test (p>0.05).

Tablo 12: Level of preference in terms of housing loan t- test.

t-test for Equality of Means

T df Sig. (2-tailed)

Level of preference in terms of housing loan

Equal variances

assumed 1,015 298 ,311

Equal variances not

assumed 1,015 297,647 ,311

The table above shows the result of t-test. Under the assumption of equal variances, there is no statistically significant difference between the preference levels of bank customers in terms of housing loans based on gender (p>0.05). In addition, male and female bank customers prefer to use housing loan almost at the same level.

H0: There is no statistically significant difference between the preference levels of bank customers in terms of housing loans based on their marital status.

H1: There is statistically significant difference between the preference levels of bank customers in terms of housing loans based on their marital status.

Tablo 13: Level of preference in terms of housing loan (group statistics of marital status).

Marital status N Mean Std. Deviation Std. Error Mean

Level of preference in terms of housing loan

Married 58 3,0253 1,21534 ,09669

Single 42 2,9225 1,18546 ,09948

The Table above presents mean, standard deviation and standard error values of bank customers’ levels of preference in terms of housing loan based on their marital status.

Tablo 14: Level of preference in terms of housing loan levene testi

Levene's Test for Equality of Variances

F Sig.

Level of preference in terms of housing loan

Equal variances assumed ,000 ,994

Equal variances not assumed

In the table above homogeneity test result related to variances is presented for bank customers’ levels of preference in terms of housing loan based on their marital status. It was found that the variances were homogeneous between the groups according to the result of Levene test (p>0.05).

Tablo 15: Level of preference in terms of housing loan t-testi.

t-test for Equality of Means

T Df Sig. (2-tailed)

Level of preference in terms of housing loan

Equal variances assumed ,740 298 ,460

Equal variances not assumed ,741 295,996 ,459

The table above shows the result of t-test. Under the assumption of equal variances, there is no statistically significant difference between the preference levels of bank customers in terms of housing loans based on marital status (p>0.05). According to this, single and married bank customers prefer to use housing loan almost at the same level.

H0: There is no statistically significant difference between the preference levels of bank customers in terms of housing loans based on their income levels.

H1: There is statistically significant difference between the preference levels of bank customers in terms of housing loans based on their income levels.

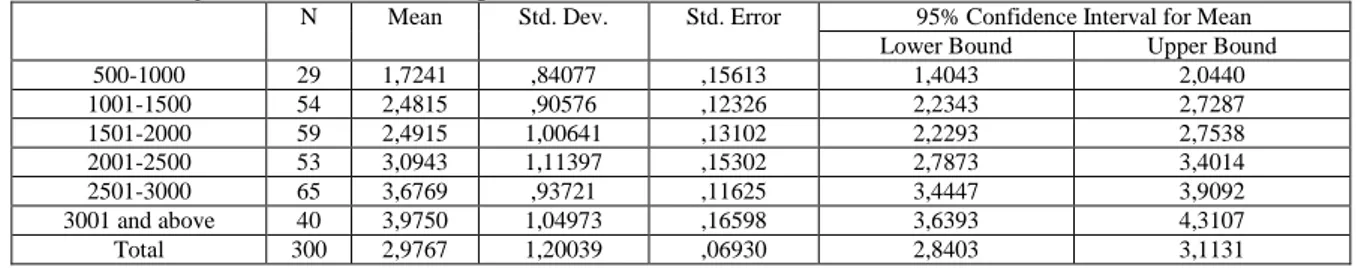

Tablo 16: Level of preference in terms of housing loan (income)

N Mean Std. Dev. Std. Error 95% Confidence Interval for Mean

Lower Bound Upper Bound

500-1000 29 1,7241 ,84077 ,15613 1,4043 2,0440 1001-1500 54 2,4815 ,90576 ,12326 2,2343 2,7287 1501-2000 59 2,4915 1,00641 ,13102 2,2293 2,7538 2001-2500 53 3,0943 1,11397 ,15302 2,7873 3,4014 2501-3000 65 3,6769 ,93721 ,11625 3,4447 3,9092 3001 and above 40 3,9750 1,04973 ,16598 3,6393 4,3107 Total 300 2,9767 1,20039 ,06930 2,8403 3,1131

The Table above presents mean, standard deviation and standard error values of bank customers’ levels of preference in terms of housing loan based on their income levels.

Test of homogeneity of variances:

Tablo 17: Level of preference in terms of housing loan (levene statistics).

Levene Statistic df1 df2 Sig.

,660 5 294 ,654

In the table above homogeneity test result related to variances is presented for bank customers’ levels of preference in terms of housing loan based on their income levels. It was found that the variances were homogeneous between the groups according to the result of Levene test (p>0.05).

Tablo 18: Level of preference in terms of housing loan ANOVA testi.

Sum of Squares df Mean Square F Sig.

Between Groups 145,098 5 29,02 29,859 ,000

Within Groups 285,739 294 ,972

Total 430,837 299

Variance analysis is presented in the table above. Under the assumption of equal variances, there is no statistically significant difference between the preference levels of bank customers in terms of housing loans based on their income levels (p>0.05).

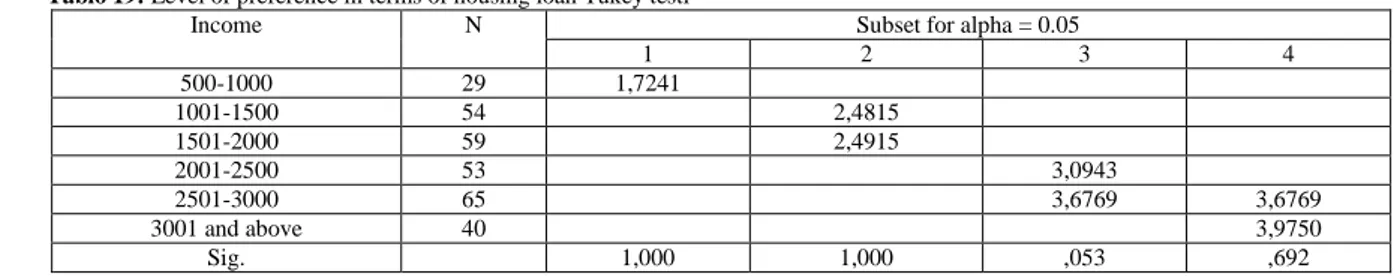

Results of Tukey multiple comparisons are presented in the table above. According to the results, preference level of those whose income level is between 500 – 1000 TL is at the lowest level and they usually do not prefer to use loan compared to average preference level. There is no significant difference between the preference levels of bank consumers whose income levels is between 1001-1500 and those between 1501-2000 TL. But, according to overage score values of these customers, their levels of housing loan use is close to middle level. No significant difference exists between consumers whose income levels between 2501-3000 TL

and those whose income levels is 3001 TL or above in terms of housing loan use. The levels of those customers in terms of housing loan use is above the average.

Tablo 19: Level of preference in terms of housing loan Tukey testi

Income N Subset for alpha = 0.05

1 2 3 4 500-1000 29 1,7241 1001-1500 54 2,4815 1501-2000 59 2,4915 2001-2500 53 3,0943 2501-3000 65 3,6769 3,6769 3001 and above 40 3,9750 Sig. 1,000 1,000 ,053 ,692 Factor Analysis:

A factor analysis was conducted on 30 questionnaire questions which were answered by the individuals. The results of factor analysis are shown in the table below:

Tablo 20: Bartlett’s Test of Sphericity Statistics.

Kaiser-Meyer-Olkin Measure of Sampling Adequacy. ,851

Bartlett’s Test of Sphericity Statistics Chi-Square statistics 3827,709

Df 666

Significance ,000

Bartlett’s Test of Sphericity was applied to the answers given for this study. According to its results, significant correlation was found between the variables with 5% margin of error since the significance value was 0,000. The scale was found to be appropriate for factor analysis with approximately 85% according to KMO measure of sampling adequacy.

Tablo 21: Factor analysis.

Factors Eigenvalues Percentage of explained variance Cumulative Percentage

1 8,789 29,297 29,297

2 6,632 22,107 51,403

3 4,856 16,187 67,590

4 2,354 7,847 75,437

5 1,435 4,783 80,220

According to factor analysis, five factors whose eigenvalues were above 1, were detected. Five factors which were obtained explained 80,220% of the whole variance. Accordingly, factor analysis was conducted since the percentage of explained level was bigger than 2/3. The percentage of explained variance was quite high according to the analysis result.

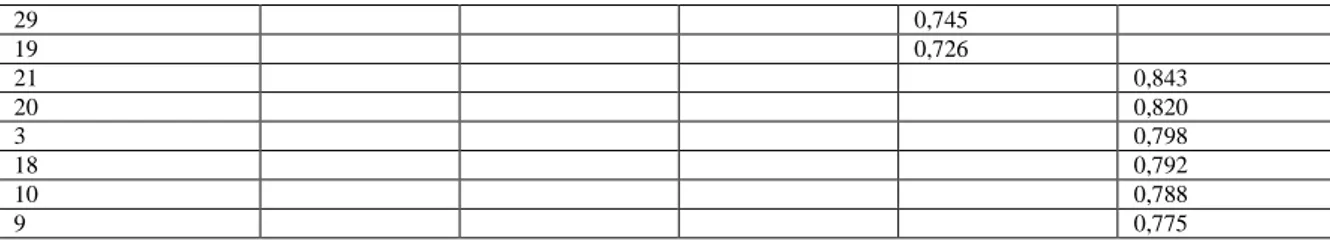

Tablo 22: Component transformation matrix

Question Component 1 2 3 4 5 16 0,986 28 0,962 1 0,954 24 0,926 12 0,926 14 0,909 26 0,907 15 0,900 23 0,895 2 0,891 17 0,900 7 0,880 22 0,843 6 0,820 13 0,900 4 0,895 5 0,891 30 0,862 27 0,839 8 0,778 25 0,763 11 0,760

29 0,745 19 0,726 21 0,843 20 0,820 3 0,798 18 0,792 10 0,788 9 0,775

Component transformation matrix regarding to all questions was provided in the table above. The matrix displays which questions load on which factor. For each question, correlation values between the question and the factor it belonged were presented in the table. All 30 questions were identified under five factors according to this analysis. With these five factors, 80% of total variance was able to be explained and this percentage can be considered quite successful one. Following the factor analysis, five factors were named as follows:

Tablo 23: Factors

FACTOR NAME OF THE FACTOR

1. Factor Attitude of bank consumers towards housing loans 2. Factor Tendency of bank customers in terms of loan use 3. Factor Attitude of bank consumers towards public sector banks 4. Factor Attitude of bank consumers towards private sector banks 5. Factor Economic conditions of bank customers

RESULTS AND DISCUSSION

In this study, factors affecting the preference levels of bank customers in terms of housing loan were analysed. It was indicated that the study had quite high reliability value at the level of 89% following the reliability analysis of the study. The findings of the study revealed that there was no statistically significant difference between housing loan usage levels of bank customers with regards to their gender and marital status. However, a significant difference was observed in the bank type where the loan was received. Bank customers who receive loans from public state banks much more prefer to have housing loan. The fundamental reason for this is the trust shown to public sector banks and rates of interest. Considering income levels, bank customers whose income level is 2001 TL and above prefer housing at a high level. Bank customers whose income level is low or at the middle level prefer to get housing loan relatively at lower level. According to this, individuals whose income level is high, have higher level of housing loan use compared to individuals with low income levels. Five factors were obtained according to the factor analysis based on the answers given to the questionnaire by bank customers. These factors explain 80% of total variance. These factors are as follows: attitude of bank consumers towards housing loans, tendency of bank customers in terms of loan use, attitude of bank consumers towards public sector banks, attitude of bank consumers towards private sector banks, economic conditions of bank customers.

REFERENCES

Akkaya, C., 2011. Mortgage System, Practices in our Country and other Countries (Mortgage Sistemi, Ülkemizde Ve Diğer Ülkelerdeki Uygulamaları), Ministry of Environment and Urbanization, General Directorate of Land Registry and Cadastre, Board of Directors, Ankara, pp: 9-12.

Aksoy, A., 1993. Promotion and Finance of Construction Sector (İnşaat Sektörünün Teşviki Ve Finansmanı), Gazi University Faculty of Economics and Administrative Sciences Journal, 9(2): 291.

Güvenç, M., O. Işık, 1999. Emlak Bank 1926-1998, İstanbul, Emlak Bank Publications, pp: 1.

Karamustafa, K., M. Yıldırım, 2007. A Case Study of Kayseri related to Customers Individual Bank Preferences Tüketicilerin Bireysel Banka Tercihine İlişkin Kayseri İlinde Yapılan Bir Araştırma, Journal of Economic and Social Studies, Fall, Volume:3, Year:3, Issue: 2(3): 56-92.

Kömürlü, R., 2006. Resource Generation Model Approaches regarding Mass Housing Production in our Country (Ülkemizde Toplu Konut Üretimine Yönelik Kaynak Oluşturma Model Yaklaşımları), Yıldız Technical University, Graduate School of Natural and Applied, PhD Dissertation, İstanbul: 19.

Özkan, E., 1981. Housing Problem in Turkey and Housing Production Finance Opportunities within Economic Limits (Türkiye'de Konut Sorunu Ve Ekonomik Sınırlamalar İçinde Konut Üretimini Finanslama Olanakları), Trabzon, Karadeniz Technical University, Faculty of Construction and Architecture Publications, pp: 8.

Şıpka, Ş., 2002. Consent of Spouse regarding Family Dwelling Procedures in Turkish Civil Code (Türk Medeni Kanunu’nda Aile Konutu İle İlgili İşlemlerde Diğer Eşin Rızası), İstanbul: 68.

Systems (Alternatif Konut Finansmanı Sistemleri Özel İhtisas Komisyonu Raporu), Ankara, State Planning Organization Publication No: Dpt: 2178 – Öik, pp: 3.

Uludağ, İ., 1997. Alternative Finance Systems and Techniques in Housing Production which are appropriate for Regional Conditions (Konut Üretiminde Bölgesel Koşullara Uygun Alternatif Finansman Sistemleri Ve Teknikleri), İstanbul, İstanbul Chamber of Commerce Publications.

Yalçıner, K., 2006.”Risks in Securitized Loans in Exchange for Mortgage” (İpotek Karşılığı Menkulleştirilmiş Krediler Sisteminde Riskler), Karınca Postası, Issue: 832, April, pp: 10.

Yiğit, M., 2009. Comparative Analysis of Tendency of Mortgage Loan Use and Factors Affecting Bank Choice: A Case Study of Ankara (İpotekli Konut Kredisi Kullanma Eğilimi Ve Banka Seçimini Etkileyen Faktörlerin Karşılaştırmalı Analizi: Ankara Bölgesinde Bir Uygulama), MA Thesis, Graduate School of Social Sciences, Department of Management, Division of Finance, Ankara.