CONFIDENTIAL REVENUE AND PROFIT

FORECASTS

MANAGEMENT AND

FINANCIAL A N M . Y S T S ;

T 77

f V < - 'T‘ 0

EVIDENCE

l.tx

t M M -

L

jX iwi X uN

X X i.‘*^U x

. *4*.

Ti

‘

*

i

ipN

0

^

vL··3b

M.T P M

o, /

1*1

n ^ T ^ T F o ' . T Q

hi. ■

X i .1.

V.J

_L O

TO THE DEPARTI-IENT OF

MANAGEMENT

7

\ T'.Tr\

T

, n p

P t

i

*T‘ T r'OxT

; ' i

*W.·

L/il

OF

BILK

T T T -T~~i Ui - i i 7 X| o T p ' M * T ‘ n * p

I N

X ¿“"X X t. .p b-x

pi Tv P P ^ T 7v

j

.

L

R E Q U ' 1

.u A \. j^iX

I'^K

^

^ ^

- r ~ v /- " '; P “ v t - r - . T T * r - J 1P \ - f — ! i ““ ·! T p T P * ! ~ i f—j

T

T \

i. i i iL. L·^ Xj Lo irL £lj Xli

O X ‘

7*. o TT'^ TT; r-T t ? T O T T o T 1s t o’xi~l i·—.·^ .1 .i_i i x s„v i

-L,··

i._i _L i M ill

7\ rsiyT T > T T Q p - ’P P

T n ^ T

i.J_ _L SwA X IV/D. X X. '^„..»1. ■'<

<1^

S£^2

C’ONFIDENTIAL, RlL\Ali:LiljE AIID PROFIT

FORECASTS IVY MANAGEMErTr AND

FINANCIAL ANAi,YSTS: EVIDENCE

r'ROM TURKEY

SUBr-ITTTED 'LCi

IiEPARTMENT OF

lACEME

GRADUATE

3

CiL')iJL, OF BUSINESS

ADMINISTRATION

1 1 1 ’

BiLKEirr !_n'ri

vli

:

u

-

y

;

i t y

in

p a r t i a l

FUL,F

I

I,T

,MENT C)]· THE REQUI

PT:MENTS

FOR THE iJlIGREE OF

'''lASTER OF’

BUSINESS

ADMINISTRATION

HF-^éu

-er

с-г.

I certify that 1 have t ead this thesis and that in iny

opinoin it is fully adequate, in scope and in quality,

as a thesis foi' the degree, of Master of business

administrât i o n .

Assiirth Prof. Dr. Can Çimga

I certify that I have read this thesis and that in my

opinoin it is fully adequate, in scope and in quality,

as a thesis for tlie degree of Master of business

administration.

Assist. Prof. Dr. Dilek bnkal

I certify that I have read this thesis and that in my

opinoin it is fully adequate,, in scope and in quality,

as a thesis for the degree, of Mast er of business

a d m i n i s t r a t i o n .

Adm inis t r- a t. i o n .

ÖZET

Bu araştırma 1984 yılında Hollanda’da Schreuder ve Klaassen

tarafından yapılmış olan "Yönetici ve Mali Analistlerin gizli

Ciro ve Kar tahminleri" adlî ç a l î ş m a l a n m n Türkiye’ye

uyarlanmasıdır. Amaç, yöneticilerin ciro ve kar tahminlerinin

doğruluğunun, mali analistlerinin .tahminlerinin doğruluğu ile karşılaştırmasıdır. Bu çalışma adi geçen çalışmadan şu konularda farklılık göstermektedir: (a)Yayınlanmış veriler yerine gizli verilere dayalıdır, (b)Ciro ve kar verileri bu çalışmaya dahil edilmiştir, ve fclSapmaların beklentilerden ne derece farklı

oldukları incelenmiştir. Çalışmada yönetici ve finansal

analistlerin İstanbul Menkul Kıymetler Borsasındaki 18 firma için

kullanılmıştır. Bulgulara göre yöneticilerin tahminleri önemli

boyutlarda olmasa da analistlerir,ikinden daha iyidir. Hatalar

Schreuder ve Klaassen’inkilere -yakın olmakla birlikte daha

küçüktür. bte yandan, ciro ve kar tahmin hataları farkı dünya

genelindeki göstergeden farklı olarak küçük çıkmıştır.

ANAHTAR SÖZCÜKLER

Yönetici, Analist, Ciro Tahmini, Kar Tahmini, Tahminlerin

ABS T RA C T

This study is a rei.) 1 i''nf· ion oi a study conducted by Schreuder and

Klaass e n in the Netheilands, in 1984 called "Confidential Revenue

and Profit Forecasts by Management and Financial Analysts". The

aim of the study is to examiné the accuracy of management's

internal

forecast of revenue and

profit,

taking analysts'

forecasts as a standard of comparison for Turkey. This research

design differs from the previous research in that (a) it is based

on confidential

instead of published data, (b)

it includes

revenue and profit data, and (c)

it investigates the extent to

whic h the

forecasters themselves' v/ere surprised by the actual

outcomes. For the study, management and analysts' forecasts on 18

companies in Istanbul Stock Exchange were collected. The findings

show that managers p e rform slight'ly but not significantly better

than the analysts.

The errors are close but smaller than the

Schreuder and Klaassen's study, and the difference between the

revenue and profit forecasts'

error is small whereas it

is much

higher for w o r l d revenue and profit forecast errors difference.

KEYWORDS

Management, Analysts, Revenue Forecast, Profit Forecast, Accuracy

of Data.

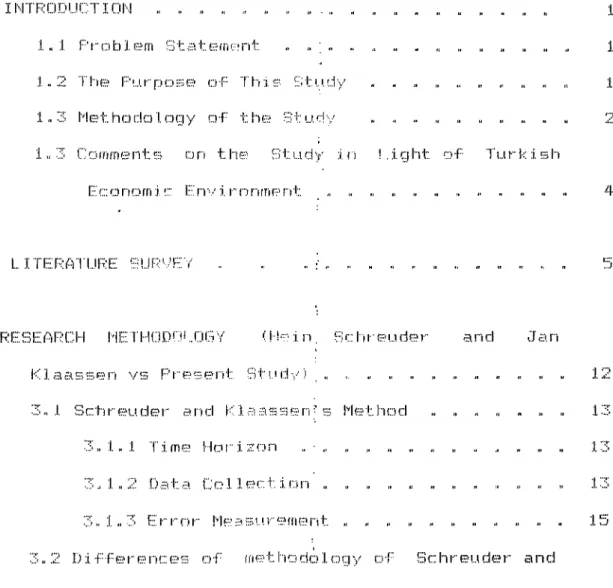

TABLE OF CONTENT

1.. INTI-ADDUCT I O N ... ...

;!. „ :l. 1"· I ·· □ b 10 IT I :;:31 a 10 ill (r- n t .. ; ...

;l. n 2 T’!" 10 I"·' [j. I- p o 0 df· T' l-i :i, 1 1 \ í;:I y .. .... ... 1..3 M 0 t h o d a l n g y d-F t h 0 Bturíy ... ... ;l. ·:!- r· ÍJ ÍÍI m 0 n 10 □ r i 11· 10 9 1 li d y j, n |.. ;j. g h ·(: r:) -F T u r I·;: :i. b h

I::· c:; o n D ÎÎI ;i 0 E n :i. i" n r'l ry 101" 1 (: ...

2.. i.ci:t e r a i i j r e c u r v e

-r e s e a -r c h N E TI-IDD'T..ÜCY (i-ia :i. n . Sr:; l-ii-0u d0i- a n d J a n

K ;i. a a ·::> s 0 i 'l v i;:; I"· r 0 0 i i t S 11 · d -v' ... . ... . J. 2 3„ 1 S r h r01..1 d0|· a n d K I a a0S0n - s N0thc:)d .. .. .. 13 3 1 1 T i fyy0 :i. z o n „ · . ... ... ;l. 3

.. :l... 2 D a t a C 0 J. 10 c" F ;i. íjii .. ... ... 13 />.. ;[.. ■ ··· I::· r I- (") I- !’!0 a u i- 0 m 0 r-it ... « J. 5 3 M 2 D ;i. -f·· f 0 r 0 n c 01::; o -i · fi 101 1'l o í:;Iq ]. o g y o -i·· S c:: h r 0 u d 01- a n d

■i.. i D i. i" f er eiiires ni'· hio !: hnclo I C'qy o f tl'ie p r e s e n t s t u d y f r o m Heir> S c h r e u d o i n n d J y n Ifl. ua ss er f' s ... 19 T i m e l ier 1 11 „ ... 3 „ 3 „ 2 nalv.a Cαl]erl·io!i „ „ ... 3 „ ’1„.::. Firoi" l''■|eas^..u'eme'l'ít .. '3 „ 3i „ '^1· :i: !:s t a n b u ]. !■:! t o r:: I·:; E r h a n g e ... 3 „ : 3 5 „ C ; (d p a i a n i i s ij J: t l"i 0 111 e i- i::i 11..! d i e s

19

20

4,. A n a l y s i s o f F o r e c a s t E r r o r s · „ 4„ 1 F; evenue F o r e c a s t s . -1·2 I"·' r !::) -f · :i. t !-" o r e ' a t <;■; ... 4 „ 3 Fv ar ec as t Eri'oi M u I i. ip 1 1 er 2 7 2 93:1.

3 4'5 A C o fii p a I " :i. s c:) n c:) f ■ H a r i a q e (ii e n t a r i c.! A n a ].'/ s t !B " F o r e c a s i: s

6„ Concli..u:;li ng Fismai ’k s „

A p I“) e I··) d i I ;i V :i, s i t e d c o in a I ’i i e s 1 4 2

Ap p B n d i K 1 1 ! V i s i t e ij B i" o I··: e s 4 4

A p p e n d i ;< 1 1 1 „ V 1 s 1 1 e d B a n l i '·■;· 45

LIST OF TABLES

1" a b J. e .I..!. I) :i. 11·" i b li t. i o n □ f · I·’; I··· E: " a ·{·· M a i") a g e (ii 0 n t a n d

A n a l y s t s " F · o r e s a s t s o d R B v e n u e 2 8

T‘ a b J. 0 11 ]; (Joillp a i·*· a t i v 0 A r i a ]. y íb i. ·;;:>■ ..

T a b ]. 0 Ï ' J A V 01··· a çi 0 o f I···' r 0 d :i. c t ;i. g n JE i··· i- □ i··· 3 ;l T' a b 10 V D i 11 " i I") 1..11 ;i. o r i c:) t· R " s o f· M a n a g 0 m e n t a n d

A n a l y s t s " F o r e c a s t s o r F T o f i t .. „ „ „ „ ,, „ 3 2

T a b l e V I A [Tl. a s s ;i. fti. c a t i o n o f· ’ t h e R e v e n u e a n d FA·“ o f i t P r 0 d :\: c. t :i. o n E i·" 1·“ o i·" í:;> A c c o 1·" d i n g t o S i g n ...

T a b l e V I I (!2:;)m|jai · i s o n o f m a n a g e m e n t v i s a v i s t h e A n a l y s t s ... . .. n ... ■ ... . 3 7

1-

i n t f;:

o d u c t i o n1-1 P r o b l e m Statement

T h i E sti..·. ■;.■/ a t t0iTiptE> t o r s p l i c a t E a p r e v i o u s s t u d y c o n d u c t e a in l V b 4 b y F-!ein S c h r e u d e r a n d J a n K l a a s s e n "Con-f i d s “;t ial i a e v e n u e a n d P’r o f i t F o r e c a s t s b y h a n a q e m e n t a n d F i n a n c i a l A n a l y s t s : ; E v i d e n c e f r o m c h e N e t n e r 1 a n d s , w i t h t h e a i m o t e x a m i n i n g t h e a c c ’. v a c y o f m a n a g e m e n t ' s i n t e r n a l t - o r e c a s t s o r r e v e n u e a n d p r c r i t s , t a k i n g a n a l y s t s ' • f o r e c a s c a s a s t a n d a r d c-p c u m p a r i s o n in Tur-:;ey.1

h2 The P u r p o s e of This Study

R e c e n t Ivj, i n t e r e s t in c o r p o r a t e f o r e c a s t s h a s i n c r e a s e d s i g n i f i c a n t 1 y a r o u n d t h e w o r l d . T h e p r o f i t a n d !·*' e '/ e n Li e f o r e c: a rii. t f o i- c o !·“ p o !·" a t i □ n ?:> h a v e a g r e a t e f t· e c t o n s h a r e h o 1 d e r s w h o a r e c o n t i riuous ly e v a l u a t i n g c o m p a n i e s ' f Li t Li r e i r! t h e iv\ a i- k e t .. A p a r t f r o m i n f l u e n c i n g t h e d e c i s i o n m a k i n g p r o c e s s o f i n v e s t o r s a n d c r e d i t o r s : , s u c h f o r e c a s t s o r e s t i m a t i o n s c a n e f f e c t o t h e r e s t i m a t i o n s a t n a t i o n a l l e v e l f o r w h i c h t h e y m i g h t c o n s t i t u t e a s o u r c e ^ s u c h a s e s t i m a t i o n s o f e c o n o m i c

1

:i. 11 d ;i. r: a t о i- ü" j ;i. I ·: 0 гч i · о i < t, h 1 · a t r:·.. m r. 1 n p \'· a i. i · г u I a t: :i о г ] с η îï) | :) a 1 " :i. !·:; α η апірпд :і. пгімг:; Ι·. |· ¡ г, 1·,) fîiake г ρ ρ ρ ι ιι· (::0 al lo с:: а t inn,, о h η „

l....ong t e r i n da / е 1 о р т е n t > p 1 ann:i ng a n d i n v e s t m e n t

1··· e c| 1..1 :i. I- E c а J c:; u l а t :i. о n íí:; а b о и 1: f ix t u ι·" e d i г e с:: t а η (;:1 i π d :i. г e с t

ί") e ΐΊ e τ' i t ';;> а ι ίd г: г - 1 ; ·:!> t о d e k e ι " îïi :і. iίe ' t !ίe ι ϊι с:· ?:::· t Ь e η e t· :i. c :i a l „ в o c i a 1

D !··· p I··· i V a t e f· i n a n e i a J. c:; o u 1- î;;; e o i·· a c: t ;i. o rı t o f · o 11 o w .. k) u c la I " e V e 1ΊIX e a n ci p ı-· c ) t· ;i t f · n ı- e c a s t. c:> " a e c:: u r- a c y a n a J. y в ;i. s e:: o 1 ..11 ci Ь e a p p ]. i. 0 d t o t a c t i. c;: a i. d c :i. ■::> i. o n c:; ' c n ιίc:: e i " n i. ιί g a π e n 1 0 1·“ p r i c:> 0 ,,

]. i к 0 e 1 e c t :i. o n o f · t !ί e r * i. g Ιίt i n v e t îîî e !" 11 ,, c o ш];:) a r i s o n b 01 и 00 n a 11 a 1 у -a 0 !;;> a n d d e v 0 ]. o }::) îîi e \ı t o t· j::) i " o g ! " a îîi .. Ί " l"i i. !·:; i. γί ci о -f ■ 0 с о η о îï) i. с а I" I d f ;i. г ) a г) с ;i. a 1 t о о i. I" 1 a v e a ci a p 10 d 11") 0 in !=:;· 01 v 0 ·:;> t. c:) t i"i 0 c h a n g :i. n g 1- 0 q \.x :i. i" erne n t о f· в о с ;i. e t у .. N о w t h e y m и. в t г e в p о η d e f f ec:: t i v e 1 у t o t h e d i a l lenge" of- ес::опс:)т i c:: g r o n t h a n d d e v e l op m e n t ..

:l. и Z M e 11") D c:l о I a g y c:) ·ί·’ 1 1") 0 S t u c:l y

The p r e s e n t s t u d y i s агі i n v o s t i g a t i o n o f t h e ac::c:ur ac::y о f 11 ) 0 p I " о f ■ i t a Г ) c:l i " 0 v e n и e Í" c:) 1 ' e c:: a t !;:> íí1 a ci e b y I: I") 0 fïi a i ) a g e in 0 1") t a n d 1:1") 0 f :i. i") a г ) c:: :i. a I a г ) a 1 у :::: 1.1:::..

To

test

Hie d.ccuracy, t;lie

first step in Schreuder and

Klcicissen study (!9R4) wur; I,·') .find the compcinies v/liich would

provide dutu.

'iiie companies to be included in this study

(preferably upon face to face

interviews) for profit and

revenue est iina t<^s for 1990 are a small

sample of

18, of

those listed

in Istanbul

Stock Exchange market who were

w i ll i n g to give the necessary information

(Appendix 1).

The second step was the d e t e r m ination of analysts who could

provide forecasts on previously selected firms.

After the

completion of these two steps by l.he end of 1990, the range

of error's and relative

accuracy of both groups are

d e termined upon formal publication of actual

figures in

1991.

Thirdly,

the prediction ei't'ors associated· w ith the

m an agement forecasts of revenue and. pi'-ofits were compared.

The final step is the classification of the prediction

errors by sign,

followed, by ■ the comparison of management

and analysts' forecast.s for which Wilcoxon and Sign Tests

are used'.'

:l. » 3 Comme ntl!» on the !3

Envi ronment

i n , I.... i

(3

h t

Of Г

Ur к i

Hh E c. о n о

mi о

D e s p i t e t h e g l o b a l t r e n d , i m p o r t a n c e o f t h i s i s s u e is n o t a p p r e c i a t e d t o i t s e x t e n t in Turkey,, H e n c e , in t h i s s t u d y the? aid! woul. d be cjet t i nci a s c l o s e a s p o s s i b l e t o t h e s t u d y underiv.ciken by H e i n B c t i r e u d e r a n d J a n K l a a s s e n in T h e N e t |■■ıer 1 a n d s ,, T h e r e l a t i v e l y y o u n g e r s t o c k m a r k e t in T" u. r к e у , 1 ;i, m i t e d <s e r v i c: e s |::) r о v i d e d b у i) i·“ о к e r a g e f ■ i r m s a n d f e w e r n u m b e r o f f o r e c a s t s t u d i e s c a n be i n c l u d e d a m o n g t h e c o n d i t i o n s t h a t di-Ffer f r o m T h e N e t h e r l a n d s a n d h i g h l y i n f l u e n c e t h e study,. L a c k o f l e g a l a u t h o r i t y a m p l i - F i e d t h e c o m m o n di-Ff i c u l t i e s ust.i.al ly f a c e d in d a t a c o l l e c t i o n

process,,

'

Ttie (iiairi r e a s o n in иги::1егt a k i nq t h i s s t u d y u n d e r s u c h b i n d i n g c o n s t r a i n t s a n d i nadogriat e d a t a , is e s s e n t i a l l y to c r e a t e an a v ) a r o n e s s a n d di'aw a t t e n t i o n t o t h i s subject,.T h e clef i c i ei'ic i e s o F ttie s t u d y m a i n l y s t e m f r o m i m p e r f e c t s t a t e o f i i i v e s t m e n t a c t i v i t i e s a n d r e l u c t a n c e o f b a n k i n g a n d b r o k e r a g e i n s t i t u t i o n s in r e v e a l i n g t h e i r e s t i m a t i o n „ I I a d 111 e y l:;t e e r i tn o i·- e e i " :i. o u s a n d w i 11 i n g t o

1 i i r i [)ri 1: e , l:hey wmilrl ·■! I so benofit. oi' at;

least be able

1,0

llieit aı·í·nı acy ati'l pi^rf ovinaiure as well.

2. LITERATURE SURVEY

t'orporate planning models are a set of accounting

st.atenients i atber ttu'in per formance

indicators of any .sort,

of optimization a n a l y s i s .

They simply provide a series of

snapshots that

reveal accounting

impact of

certain

strategies or financial

p'-'licy decisions.

Under specified

assumptions,

financial managers have a great role to

evaluate

the (•■'Miipany' s l.rne financial picture to make

intelligent financial

d,ecisi6n.s.

The objectives of the

ma n agement slvuld be to ar.d;.' in the stockholders'

best

interest.

On the other hand, financial a n a l y s t s ’ forecasts

should respond to an overwhelming public need.

Competent

analysts

can

provide

imppi'tant services

to clients

I'-egardl ess of their

income or age.

The most important

question is not Irow much clients have or earn, but how much

m oney tliey retain and how it is aligned with their goals.

In the last decade, interest in corporate forecast has

increased significantly,

and

especially earnings,

one

component, of coi |)orate forecasts,

represent an important

/ a I- :i. a b I e :i. i" i íü· t о c !·:; v a ]. i ,i a 1: :i. о i" i a n d í:í^ 0 ]. 0 c t ;i. о ιί .. E. a i- ιί i ιί g íb a i- 0 a в ίτι 0 г;і t α iïiD V 0 1,1 ,¡. t h с а s II Г J. о н s а η d t I i 0 i r f a r ec:: a в t :i. в c o n в i d 0 r 0 d ; , t Ιί0Ι··· 0 · ί · · π Γ 0 , i т р о г I;; a r ı t F o r p redi e t ;i. n q f u t u r e I- 01 1.1 r n B n P a 10 1 J. ( :l. 97 6 ) ¿ T a g q i ( 19 7 B ) N i c: h □ 1 в a n d T 's a y

( ;l. 979 ) , Í··' 0 n n a ιί ( ;1.9 7 B ) a ιί cl W y îïi i 0 ( j. 9 B 4 ) ;i. ιί c;l i c: a t e t Ιί a t m a ΙΊ a g o îti 0 1 · 11 t o r 0 c: a c; 1:.: c; a | j p o a ı · t o Ιί a vo a ιί i n f o r îti a t ;i. o ιί cd n 1 0 r-ı t „ W DI ' l·: b ■ / (¿i ;i. V o ]. у a n d I .. a к o n ;i. c:· Ιίd к ( J. 7· 7 6 ) a ιί d E! 11 o ιί ,, (·ί г" u b 0 1 " a ιί (;:Ι (3 и 11 0 1< :i. η ( ;1.9 В ) -б Ιίоη t Ιί а t s t o c l·: ρ ı- :i. c:: 0 îtidv 0 m 0 ιί t íhí a 1·“ 0 r o I - 1··· 0 ]. a t o (;:l w ;i. t Ιί i" ov :i. -б :i. o ιίб: :І: ιί а η а 1 у в t " в f· о r 0 с: a в t в □ E e a r n i n g в и I n 19 В 2 F r i e d a n d - G i v o l y a n d i n 1976 G o n o d o в , D G p 1.1 c: h a ιί c:l Γ·’ 0 n îti a ιί c gîti p a 1- о c:l 1 1 :i 0 a îcібgс: i а t i о ιί b 01 w 0 0 ιί в t gс к р I··· :і. с: о m о ѵ о îtiоιί t :б а η і:;1 t Ιίо ρ ι·" ο c;l i с;; t i о і" і о і-1 " о і· · в о к а η а 1 у бі t в *' •f· G I- о с: а :Б t а η d t i îtiо -боі·· ;і. обб·· îtig d è 1 б> , а ιί c:l t ' gu η d в i g η :¡. f· i c: a r'i t r e i a t i G П В .. I n v o B t o r B b o h a v o i n a w a y w h i c : h i в m o r e

c: G ΙΊ б; i Бі. t о ιί t w :i. t l ı a ιί a ]. у б; 1: б; · f" с; · і · о о: а б> t; б> к о г îîi а г I-:: 0 t 0 ιίοс: t а t i gιίв o f G a r n i п д в и

Γ· :i. η a ΙΊ c. i a I t Ιίо (ίi- у h а б> I. οίιί g ρ a в t u ]. a 1 0 d a ιί a в б^ gс і а t i g ιί b 01 w o o η ρ I " o f i 1 1Б Б· η d t Ιίо \· а ]. и. о . g f с о m îtigιί б> t (ίоб I·;; „ ti g c;l :i. g I :i. a n ;l. a r i d M i ]. 1.0 1 " i 1Ί t h 0 ;i. 1- |ί :i. gιίо о ‘ :i. η cj ^ ' i ίgi- l·: о ιί t Ιίо í::: gб; t о t · с а р :і. t а 1 с: G 1- р (Ί I··· а t о а I и а t :і. η η а ιί d с: а |ί ί I : а I s 1 1- u c: t u r 0 -б Ιί (ίw t Ιί a t a m a .1G I " d o t o i " îti i r i a n t о f t; h 0 a .!. u 0 о ί·· t Ιίg ·ι·· :і. γ" îti g г t h о в u îti g t· t h e v a İ L i o B o f a i l Γϊ ι ί τ γ' β в о о и г i t і о б р, i в t h e ρ r D d i . . i c t o f / о ι·ί |Ί ο r I; 0 d 10 ··/ 0 1 π f· 0 ·,/ 0 1 p q η a η η I i ! ;i I о a I" η ;i. η g !н> g о ιίоi·· а t о d b y t: Ιίg

a s s e t s c u r l : an h I у l i a l u l . i iirian hi ie u r u ' k e h c a p i t o 1 i z a h ;ion r a t e f o r t l i a t r i f t k c l o s e (.Jam'';: <' Van I l o i n e , 1.989, C ' l i . 9 )

t>ne <;if tba j iri| Ч O'f an t .¡яттмя uri'ier this suh.ject

is the

T'epi esenf at i v'-uK-'ss '■>f

iiio п.0';рмпем1.

earnings

forecasts.

Tinh''''ff (1978) p r i ' h ' 8 I li^

f iisl cliaracterist' i c.s ttiot vrere

sys t: eiTia t i'■‘o 1 1 у 8 i f t'^'i.'^n t

l)e<v/een firms which pu.blished

management earnings

ff>) eca.si-s in the Wall Street Journa 1

and those wliicfi did not

He concluded that published

forecast

may not

have

ihe representativeness of the

foi ecast асчаи асу v/liicii non- loi erasts firms miglit report if

forecard s v;er e r eqn i r ег] .

Thi

h>'potheses ar e important

fc4' the V opr escrit a I i vi->ness :

(1) eoininyn variability, (2)

security analysts'

mean

absolute relative

prediction

errors,

and (3) systematic market risk ( be ta).

In 1985,

Clifford, 'Г. Cor e;-:tended and improved the work of Imhoff by

investigating firm size as a difference variable and by

using

experimental

design

which

controlled

interdependencies between test variables.

Also contrary to

the findings of .Tmhoff,

tire re.su Its of the beta tests

reported in tlie .study were

iii congruence with earlier

research v/hich have reported po.şitive relationships between

beta and eai'nings variability.

On the other hand, the

results founded by Clifford T„.

Cox are consistent with

1 ml'·) G Ff fît a i η j. у :¡

.fív? I·· n :i. г I q ·/ a i " :i. a Ь i 1 ;i. i: y :i s q i · 0 a 101- F o 1- π o n d :i. в c ]. o í::í i ιί g ■f :i. I " ίϊ) a n c:l :i. z 0 .i. í:;: ]. a i " g 0 r -F □ 1- d ;i. <::· c ]. o s ;¡. n g f : i 1- s ..

.y 10 íT I a t :i. c I·- i I·:; :i la ^ i i (■ :· F í:;; i g ιη i y ;j. c a n t ]. y d i f f· 01- 0 n t. b 01 w 00 Γ Ι 1 1 í 0 t w a g 1 " o u ρ ..

A a I- 0 1.1 ]. t 0 a 1- ιί :i. i" i g v a 1- :i. a b ;i. 1 i t y a n d f ‘ ;i. 1- íti í::> :i. z 0 i I" I f· ]. u 0 n c:: 0 t* o i·- 0 c a t a c c u i" a c:: y a n d i ιίf · o 1- ai a t ;i. o ιί cq ιί101” 11 Б o t Ιί

Б Ιίgιί t Ιί a t t Ιίgi- 0 rn a y b 0 1 1' 10 00ιί f· ]. ;i. t o f i" 0 p i·- 0 s 0 ιί t a t ;i. v 0 n 0 íü; в

b 01 ΙΊ 00ΙΊ ("I :i. :Б 0 ]. o в i ΙΊ g f· ;i i- fy 1 a ιίd ιίf jγί c;l :i. c: ]. o в ;i. ιίg -F :¡. 1- m í;:> ..

В 0í: оιί d i ίϊι P G ! " t a i"11 :i. ·;;;■ u 0 . :i. îz t l' i 0 i·" 0 J. a t ;i. v 0 a c: c u r a c:: y g -f iïi a Γ Ι a g 0 iïi 0ιί t a n d f ;i. n a n g ;i. a ). a 11 a ]■ y 1: " 0 a i " г і :i. г 1 g îüi F gi- 0 c a 1:::· t в a n d t I"i 0 t :i. Í ÍI i ΙΊ g .. Ί ’ Ι' ι 0 t u d :i. 0іі:; оιί t l"i :ί. в ι..ι b i 0 c; t Ιί a v e |;:) i " o d и c 0 d d i ·}·· f · 0 Г" 0111 í:;; g n F 1 i c: I: ;i. r'1 g i ” 0 1;;: i.í l i: a i" 1 c:! n □ c: gi"iíüí :i. в 10 n t c o I") r ]. и в i G I" I í::> 0íti0 1 " g 0 d к

В а : í . (") a 1 " ] y a n d Ί ' ιί a 1 · к ( :l. 9 7 ) ,, c o ιί <:h t г" u c 10 d t l i 0 i i-a ίϊΐ I") 1 0 u 0 1"1 t Ιί a F a n a J. */ F F g i · 0 с“ а в F а і " 0 :ί. í:;; íbü0 d p i " i g I " t o t Ιίe

re 10а в0 G F F he m a n a g0Ш e n t f Ь г е е а в і , b u t t h e y f G u n d t h a t m a n a g 0 m 0 n F f · o r 00 a в t i в m o re a ç 0 u 1- a t e o n t Ιί e a v e r age.. T Fi 0 i r prGİ;:)İ0iîı vjas n o t t e be a İzle t e m e a b u r e t Fi i в di Ff er еги::: e

в i g n i F i r a n t l y ..

Ri'land ( :І.97В) a n d J a g g i ‘ ( 19 80 ) i n c l u d e d analysts·' •i" c:) I- e (::: a is t ;i. ή;; ·:ι; u e d I :· о 1:1ί Ь e Г о г е - а η г:! а ί" t e і " t Ιί e ι- e 1 e а s e o -f manageiiıent f or ec as (·; i г ı t he i r sa;fii}j ] e s o f a n a 1 y s t s f oi"ecast s .. A 11 h o u g h 1:1" ı e у { · o u г ı d 1 1 · ı a 1: 11" ı e r e w a "ü n o s 1 g n i f i c a n t d i f {” e I··· e г і c e i n 11" ı e ı · e l a t ;i. e a c c u ı- a c у c:) f t h e a n a 1 у s t ·{·· D r e c a ü;; t s ;i. s <::: u e î;;I u Ь e n u e ιί t t o 11· ı e îîi a ιί agence η t f · o r e c a s t s t Ιί ο i r Г i nd i i'ıgs d i Г Геі" ni i t Ιί i- eci’ai· d t o t he reí at i v e a с с ш" a с y о f · а η а 1. у і: F о | · е с а і: ιί :і. ί> и е d ρ і · і о і " 1: о îï і а ιί а g е îïіе η t ·' i::;..

R: і.д 1 a ιί d " í:::· ρ ι- ο h 1. e in ч а iiо t t n b'e a h 1. e t o ı- e j e c t t Ιί e i ı u 1 1

Ιίуijоt h e :іί· ( e c:| u a i. a с;: с ; и і" а с у > >]а c:j ci :і. " 'Ί ιίа s t с;) ί" i ηd îtia n a g e i'· s "

•{■•o r ec: a s t s iuo | · e a c; c u ı · a t e „

1 m Ιί(·;Ί· ·ί ' а ιίd Γ· а ι ' e i ;l ί ·) ^ ' e η a m :i. г ) e ' ;l t Ιίe ı " ci l a I:; ;i. v e a c:: c: u ı ■· a c y

0 -f · fTi a ΓΤ a c j e пт e ιίi · a n d гл it a I у s 1: о а r ιί :і: ιί g 'ί f о r e с: а t <ί ιί e а ι- e t t с:) t h e m a ΙΊ a g e π ı e г 11 f o ı ■ e c a :ί t I İ t r·^ f · r:· ш ı f;;l r ] n i g n i ·(■· ;i. г a ιί I c:l :i. F f· e i " e n c: e

1 n a c c u r ac: y ..

W a y İTİ i Γ- e ( :l. 9 Б '5 ) c; o itd ı..' г ir e (;:l a t ı..ı d у a !ίc:· ı..ı t t Ιί e ι·" e 1 a t i v e a c: c: u ı- a c; у o i·· a ιί a ]. у ü;í t e a i " n I n ( ;ı !:;> f c:) ı- e c: a c; I;: s ρ ı- e |::) a ı- e c.i b o t Ιί b e -f" o ı- e a ΙΊ d a i·· t. e ı ” \· n 1 u г т t a ı- v' îtt a ιί a g '···· /тт e г т t e a ı- ιί :i. ιίci f о | · e с; а s t s .. I η t Ιί e hl a у пт :і. г е t e ?ί t ·ι t Ιί e ν e 'ίі.д .1. F e г e b a ίΊ e d c:) гт .1. a i ’ g e i" ·ί a îït |::t .1. e s t h a гт t |··τ e |::) i " e v :i. о u c: о г т e и Ιί :і. с Ιί siд g g e t t Ιί a t a ιί y a c: c: і.д r a c: v d ;i. f · f" e Г" e n c: e ·;:> b e t и e e г т îti a ιί a g e îtt e г т 1;; a г т a 1 y c: t a Г" e g +· ·:!> i..i c: h

π:; ί:·\ ίίι ρ .1, 0 И 0 ч/ ίΐ) i. !··· 0 "Г |·ίγίi - i 0 (;;| l· f ] a ■·;· i ) πι a г ) a (:j 0 ín 0n t: f · 01 - 0 r; a в t a г" e „ o n a \ /0f·a q0 і п о і в г- f::i..iraLo l; Іплі 1■, a n aI у в і в ·ι··(:;)γo c a s t в p r e p a r e d

b 0 о Г" 0ll ia Г" I a q 0îï101" 1 i ί· о i " 0c a 1". r · · ( b ) a ιίa .I. у ::·> t ·{·· о i " 0c: a г:> t; в p г" e |;:) a i·" 0c:l

a ·[ · ■[■;. 0 1 " ■(: Ιίо îïi a : ) ■ ' (::| в к\e π t f o i " 0 r: a i: a ı " 0 'і;> 0ιί ;i. i:: ;i. v 0 t o t Ιί0 n Li in la 0 r

D f ■ a ΙΊ a :i. у t f la l j, o и i n g l· p 0 f i ı · m ,/ ;i. f" :i ·1: ;j. h ;i. q h ( t; Ιίi " 00 (a r

■ y

m o r e ) Ιί0 f o u n d thaï;. t h e r e ;i. в no в;і. q n i f i c a n t d i f f e r en ce ,, i i" i t i в n o t t !ί0 ííiariaqemerit í-or e c a o t i в inore a c c u r at e ..

T h e m a i n p r o b l e m i n a l l B t u d i o B и а в t h e e x a c t t i m i n g (j ·{·· a ΙΊ a .I. у t f" о r 0 0 a t · ! ; ; Г Ιί e y .a J. 1 i: ι· · ;i. 0 d t о f · i ιί d а η а ]. у в t •f · о )··· 0 с: а 1: <;:> d a t e d а ιί e а г ' а р ·ίîü; :і. b ]. 0 t о t Ιί e d a t e (а ·{·· t Ιί e in a ΙΊ a g o n i e r i t f о г е с а í:;; t..

ln 1986;, J o h n M.. Н а S B011 a n d R o b e r t H.. JenningB.,

e X a ill ;i. г 1 e d t Ιί e a (a c: :i. a t :¡. (a ιί la 01 о e e ιί r e ]. a t i v e -f · (a 1- 0 c: a t a c:: c;: 1..11 " a c: у a n d t h e t i m i la q о f t Ιί e 1· · 010 e о t· t Ιί e t· ta 1- 0 c: a в t в .. T Ιί e у f a ix n d

]. a s e r 01 a t; :i. (a ιίa; Ιί;i. p ;; m a r i a q 0 ni e ιί t t· (a i " e c: a в t -a :i. i::> и e d

B u b B e q u e n t ly to., с о i nc i d e n t a 1 ly o i t h „ a n d u p t o f o u r w e e k в p I- ;i. (a I- I: о a* n a J. у la 1: f оi- (a c a t ia a 1- 0 -a :i. q ιί ;i. t· i c a ri 1:1 у m (a i" 0 a c: c;: u 1- a t la t Ιί ai ΙΊ t Ιί0 a ιίa 1 у в t a> " 0 a> t i m a t e a> à i" 1 d t Ιί e c:: (a ιίвe ιίвuв оt· aria 1 у в t

•f · о г 0 с а а; t п а і ' е m (а і · о а\ с с і г а· 1: е Іа е g ;і. ιίη i η g a i;: I:; Ιί e ιίi η t Ιί w e e I··

a -F10 1" t Ιί e i" 0 İ. 0 a ^a e (a f· t !ί e m a n a g é ni e ιί t -f · (a ι·- e c a в t ..

T lie f ;ί. ría 1 [;:) о :i. ni: i. в а Ьоі.д 1:' Ι·: Ιίο eFf" i c i 0 nc y o F t he nia i- l·; e t w i t la i " 0 ·::> p e c F t о t la 0 la a i “ t :l. c. 1.1 ]. a i " a / a ;i. l a b i 1 i t y i la -F о ι·" m a t i о η

since market efficiency and information efficiency go in

the

same

direction.

In

.,1 986

N.Niarchos

and

M.

Geo rg a k o p o u lo s investigated thé effect of Annual Corporate

Profit Reports on the Athens ' Stock Exchange using the

research teciinique developed hy Ball and Brown which is a

variant of the me t h od of residual analysis which has been

used in many laler paper.s (Fama, Fischer,. Jensen and Roll,

S o n d e r (1969)).

Ball and Brown examined the association

between changes in accounting profits and changes in stock

r e t u r n s (1960).

Niarchos and Georgakopoulos failed to

confii''m the typical NYSE (New Yor'k Stock Exchangel.i'-eaction.

They found that

if actual

profits differed

from expected

profits, the market has reacted

in the same direction,

particularly, the market d i s m im j na fed betv/een positive and

negative profit change group.s as early as nine montlis prior

to the announcement montti and

the Greek Stock Market was

not e f f i c i e n t (1986,) ; investors' reacted slowly and gradually

to new information.

These findings are consistent with the

Lev and Ychalomi's on the

Israeli Stock Market(1972) and

Deakin,

Norwood

and

Smith

on

the

Tokyo

Stock

Exchange (1974) .

'I’he main factors of this inefficiency are :

--small number' of active traders

-bulk of

transactions

that are done

.by a few

institutional investors (banlcs and investment companies)

..1") I··· í·:·' '::l o m ;i. n a ! i c í::? o f ··:; m a J · f" a ’ni :i. l / o r ;i. e n t b d c. o n c 0 1" r·) s a n d t İI0 a b s E 1100 ( jf ;i. r !···■(::) i-p o |· 1·. ;¡. on ■0oi..ip l e d w :i. t h 1110 f e a r o f !-0İ :i i igi.A:i. i rv::i 1110 0í:,ríl·· ¡-n;| •{••afíii l y ..o i Mned un: i t s t o t h e pub.i. İ0 ífil 1 i t a l e s au a :i. ríe t s t o c l·: i 0 B u e s ..

·· .i 11 I: i. ·'■■ I'' i. 0 11 ■ ·' I '·: B t ·(: ;i r, g O i· C”i I··· e 01 b a n I:i 1 · 1 g y b10 ííi wh i c:: h

m a I 0 í;:; b o r 1 · n b j, r· 1 □ 11 n 1.; o n |, y í ' j. 0 ; ;i. b .1r. b u t a .1. n p o b i b .1.0 a t

I Qi/ier c n y I· s

3J:íE B E A R C H M E T HüDüLüG Y ( M e i n S c h r e u d e r a n d J a n I C l a a s B e n v s F T e s e n t S t u d y )

I n t |·uy·/ Fo 11 0 Vi :i r ig bb c i·; ;i. o n 0 0 v·} i. | ]. ;¡. r bt d0í!::.(::: r i l::)0 t liE í y 1011" I o d u B 0 d b y S c h r 0 u d 01 " â r· 1 d \<1. a a 0 n a n d t l 'i 0 n t h e d i f" ·{■· 0 r 0 n c 0 :ii> Q í · t h :i.;;;; t u d y f'' ■ o í n · !;:> c I") i " 0 u c;l 0 1 " a n d \<1 a a bb 0 n b t u c:l y a n d f· I- o í í I 1:; li 0 o t h (■·:· r p i- 0 v :¡. ova t vad ;i. 0 íüí 0 :i. ]. l b 0 p i- 0 í;:> 0 n 10 d «

3 M :l. S c li I- e u c:| 0 r" a n c:l l< :i. a a <:·> !B e i")' ::·> I'"! 01 h o d

3 m ;I. m :I. T i m e H a r :i. z o n

! 1)0 yf-!P.r i n Il0;i i i Brhi'·0u(:l0r a n d J a n K l a a B S E n s t u d y

w a ; l . '7b)in. I o aii·:·ur·0 ·(; 11 r;· i- e p ) · · 0 0 1-|i” ^ t ;i.v0 1" 1 e □ f 11")e i::it u c ;ly ,,

tl"i0y a p p l i e d t e s t s t(j ceiiipare ’w;i.tli a p r e v i o u s l y c o n d u c t e d

■f o I ■· e c a 1: 1 h a I': I ) a e c o ·.·' e i" c··? d t ·) e p e i· · ;i. o r;| b e t w e 0 n 19 7 -^l· 197 9..

3m 1 «2 D a t a C o U e c t i o n

T’ I' l 0 s. t. u d y o f !"10 i n i::> c h I··· 01.1 d 0 1··· a n d J a n K 1 a a s s 0 n c o v 01··· s a 1 1 ;l. 9:-’i c o in p a n i 0 ·;:> ]. i 10 f;i o n 1: l· 1 e A in 101- d a in s t o c: l·: 0 c h a n g e a n d al 1 t h e 2 B 5 inenibei-s o f t h e D u t c h F i n a n c i a l Analysts'*

F 0 d 0 1 " a t i o n M I n t h 0 t■ :i. r s t s 1‘ 0 p 11" 10 y 0 n t a s h □ r' t

q u 0 t :i. o n n a i 1" 0 ai::j k :i. n •:;i f" o 1" 1 1")0 · c o in|:;) a n ;i. 0 <i:>" i n 10 r n a 1 a 10s

I··· e v e n u0 a n d p i- o F i (: f·o i·' 0c a liii 1: i··or J. 9 B 0 „ 'T In0i:·:·0 w e i" 0 d 0 p o i::; :i. t e d “ :i. i") a e a 10 d 0 ¡' 11·' 0 ]. o p 0 a ;i. o t In 0 a n a :i. y t d 0 p o i 10 d t In 0 ;i. i- f · o 1- 0 c a 1: ::=> a 1;; -;i a in 0 i"i o 'I: a i ' y u n t :i. 1 t In e a |::) |::) i- o v a 1 o f t h e a n n u a l r e p o r t s o-t c o m p a n i e s by t h e Board.. T h e

I·” 0s 0 a I" r I") 0 1··· t:;: ( E) c l-i I-· 0\jd 0! · a n d 1 < J. a a !ii 0 n :l. 9 i::) ^1·) a ;i. <:;> tj g u a i·" a n 'tee d n o t t o d e r i v e i n d i v i d u a l d a t a o n t h e c o m p a n i e s or t h e a n a ;i. y s t f· 1 ·

o

i/i t In 0 p u b J. i c:; a t ;i.o

n o f·I: I"

10 i i ' 1- es

0 a i- c I")...1. n q a t; I'i e i·- ;i. n g 1 1"i 0 d a t. a a I if, p a i· ' I;.; ;i. c:: ;i. p a n t , w 0 1 " e a k 0 d t □ ;i. r‘i d ;i. c:: a I·: 0 t i/ i q r a n g 0 lii; a i " o u n d t h 0 ;i. r ' ‘ b 001. (::i u 0 s '' p o i n t 0 ·;;> t :i. ni a 1:0 <::> o f i ·· 0 v' 0 w 1, i r· a n d |·;) 1 ·· q ;··· ■[ t

;l. .. A 5 0 % p 1- 0 d ;i. c (: ;j. o n :i. n i; 0 i· · v a 1 d 0 n o t ;i. n g t h 0 a i" 0 a Ia) :i. c l"i 1:ii0y 0;ip0c:;t0d i. ! 10 o u t c o m e t o bo in u i t h 5 0 X c e r t a i n t y a n d

2 M i-'i ;l. 0 0 7n |;:) i- 0 i;:l i c t :i. o n i n 1:0 1- v a I ;i. r ) d i c: a t ;i. n g t li 0 r a n g 0 w 1"] :i. c; I'l 1.110 y t· 011 v\o u ]. d :i. n a n y ’’ 0 v 0 n t c;: o n t a :i. n t h 0 a c t u a 1

outcome.. T h e y w e r e a o k o d t o d e f i n e t h i s r a n g e w i t h i n a s r I a I " I " o w I i ly I :i. t <::> a p o <::> i::;· i b 10..

r I'l 0 a :i. iyy v) a t. o iyy ;i. j- i i i i 1 i ; ·: 0 ’ 1 110 (0 p 0 c t. 0 d ) d :i. f· f 0 1·- 0 n c 0 b 01 w 00 n t h 0 yy I a n a g 0 yy 10 n 1:" f o 1- 0/;:; a <;;; 1: a n d 11‘ y 0 a c t u a ]. c;) ix t. c o yyy 0 f o r ;!.980,, in o r d e r t o b e a b l e t o eaayyyirye t h e i n v o l v e d u ry r; 01" t a ;i. n I;; ;i. 0 .. I '· o r I: l-i 0 r e j::) 1· · 0 s e n t a t i v 0 n 0 s o -f t l-y 0 s a yyy |;:) il. 0,, a f t e r t h e (a) d u a l t e a t s o f t h e v a r i a b i l i t y o f r e v e n u e a n d p r o f i tS;. a n d ( b) t h e absr il ut e p r e d i c t i o n er r o r s r e s u l t i ng f royyy t he ap'p 1 i c a t i ory o f tvjo i (·;;/0111.10 aiyd p r o f i t for-ecast i ng

yyy o d 01,, 5 yy 1 a ry a q 0 yy 1 e r 11: 0 1: i 1 y 1 a |·. ··' s ‘ a r 0 i. n c ]. 1.1 d 0 d ..

TI y 0 y I 0 c 0 :i. V 0 d 12 -^1· a n a 1 v :;i; t. · t· o r 0 c a ia t s b l\ t: t li e 1..10 s t. ;i. o n o f la o w yyy a ry v ;i. r 1 c.l i v ;i. r\ 1.1 :^y, ;|. a r y a ]. ks la a oa 1::) a i·" t: i c :i. p ay 10 d w a o p 0 la t D d i c u la la i o n f ) .1. 1 (: la oa c o i .1,1. ,d a; a y Vri a t la a t a 1: 10 a s t 0 a la a 1 y s 1: :::> w o r I··: :i. la g f (a i- I '\· d i. f · f i- (a r y t. (a i " q a la i z a I: :i. (a n s u c la a a;

b a n k 3 „ p 0 r I <i;;. ;i. o n k n I' i cj ,, ;i. | vi' u r" a r) r 0 c n ii] p a n ;i. e s a n c:l b i··· a I0 1·" ·;:> p r 0 p a r e d ■!·· oi'0 0 0 01:0 , a n d i:!i0 iiiajori t y p r e p a r i n g B 2 -for ec-aBt s N 0 !··· 0 a m n n g t |-i 0 i/ i n i- !··: :i 11 n pi 0 f;, p ]. 0 f" n i- n) a . j □ i- D \..i t c |··) b a n I0;..

:*!:

..:l.

HEii:

r

r

o

i·- M 0 aBui-0 m 0 nt

I bie iiU;?a0 1..1 r a 0 0 0^! l■a■:'ı dal:0r ail 1-10 t Iib a c c u r a c y o f t h e

ii) a I"I a □ o ill0 n I: a 11 d ·.' i t a i. ·;/ r· I; ■ f o i" 0 c a !!::■ I- ·"! a 1- 0 ( B r\ h 1·" e u d 01 ■' a n d Klaaccen., 1984,, p 64) ::

;l... T‘ I'10 b s D 11..11··. 0 1··' 1- 0 d ;i. i: :i r 1 I:;· r 1 ■ n r (A I'·· I:::;)

AF'E A U 9 X)

2 T110 !·■;: 0 j. a 1.1 ■'/ 0 !' · !·■· 0 d :i. c t :i. □ r 1 I!·) i · r o 1- (R p- p;) Rl··'l;·· X..X ; /'rtiyi-j ( X ;·;

x; M T' I t 0 A b ?::> o I u 1:0 I·'·' o ] a 1: ;i. 0 I···')" 0 d ;i. c t i o n F. i " 1- c:· r (A R I···' I;:·) AIXF-E A B B (X-X) X A B S (X)

here:;

X :: T' I") 0 a c t u a 1 i- 0 1:;:· o 1 · 1;: 0 c;l )· · 0 v 0 n u 0 □ i" p i- o -f 11

:: T I ·) o f n I· · 00 a 10 d 1" 0 / 0 i t u 0 o 1" p i·- o f i t A B !;;i:: A )::.i ·■;: o .11\ 1:0 v a I r.i 0

T h e X'lFd:” 13 nitly n e e d o n m a t c h e d p a i r s b a s i s for· c D m p a r a t i v 0 p u i· · p o ·;:! 0 :!;>.. T I 't 0 I·':! I"·’ El ;i. <i:> t I 't 0 m o s t a p p i· ' o p 1' :i. a t e

ill0a iiiiu I··· 0 D f 11··)0 a c: c u 1" a c:; y b- "·? c a u s0 o -f i 1 3 :i. n 101" p 1·- e t a b i 1 i t y b u t t h e r e is a l s o a d i s a d v a n t a g e o f b e c o m i n g v e r y l a r g e

w 11(;ѵМ I !.. 11V."' d 0 П О iTi :i ΓΊ a t о i· · э, p p i ·· n a c Iί0 t: cj z 01 " c ) a г) d t. I ’l 0 π в с: 0 s s i h v

t o p ı··· (") V ;i. c;| 0 1: h 0 d :i. ·;:? 11· · ;i. I ;) u. !;: i o i ı ^ a .!. □ n q и :i. t Ιί îî) 0 a ı..\ ı·" 0 · : : > Ί ' Ιίüб

'•••|·'0/ с а 1 c u 1 at c d a n o t Ιί β γ'· ev г о г metí- i e f o r l; h o p r o f i t 1 ·■ e;) I " 0 e a t; vj Ιί ;i. e;; Ιί iî· i. i: :i. у a 10 I:: Ιί e з e |ίi " o b l 0îîî -üji;

Ί" Ιί0 I I ÍJ I- iî » a .1. i z 0 d F’ !- 0 d :i, e 1: ;i o г î ΙΞ ı-1- o ı · ( İM I···’ E· )

I II Ί:;; ( X..X ) / a t. d ( X ό o h o r 0

t d ( ; i ; T h 0 t; a ιί d a r d · c:l 0 \/ ;j. a 1: i ·::) ιί o ·(■· p i " o -f i t s b 01 iAi 0 0 Π 1: h 0 p I " 0 d 010 1 " îî ı ;i. ιίo d ρ e ı· · ;i. o d ; l . 97 4.1979 ;i. n t Ιί0 a b o v e s t u d y M

Ί” Ιί0 NI·" Б. 1: а к е з h Ιίо ѵо ]. а t::і. 1 ;і. t; у о ■(·· t Ιί0 p ι·" о - ί- ;і. t ·}·· i g i..i 1·“ 0 i n t o a c c o u n t a n d ínay tlii..'s ‘ b o a m o r e a p p r o p r iate., a n d c o m p a r a b l e m e a s u r o i-f- . o l a t i 1;і t i e s di-fí-or w i d e l y a m o n g t h e

(J b ?:::· 0 1- v a t :i. о ιίs ( t) eh 1 · 0 u d 01 · a ιίd I·· ; J aa н:> e n ,, 1 9 В M ·p p 6 9 ) ..

I"· i ΙΊ a 11у a 1o r 1 g o i 1 11 t h 0 0.· 01· · r o 1- îîi0 a î::> ı.ı 1·- 0îîî0ιί t üü t o îîia I·:; 0 a e 1a zi ;i. f · ;i. î;:; a t :i. o ιί o f" 1: h 0 ı · 0 v e ι ί u0 a ιί d |:;) ı·· o -f· :i. t p r*· 0c;l :i. e t ;i. o γί

01··· I··· o !·■· iz a ΙΊ d t (Ί e o fîî ΙΊ a ı■" 0 t Ιίo j j e r r o rî/1 a γί e 0z; o t iîia γίa g e îîîe γί t a γί d a ΓΊ a ]. y :Z I: i: w o 1.; 0 z: 1: z> i " 01 a I; 0 d t o 0 a e: Ιί ot Ιί0 1- w 0 Г" e u zi 0 d

••••Wi 1e o z o n t o s t .S i g n t o s t

3.2 Differences of m e t h o d o l o g y of Schreuder and Klaassen's

study from the previous ones

Hein Schreuder and Jan Klaassen, in 1984 produced an

evidence

from i’he

Netherlands about the confidential

revenue and profit

forecasts by management and financial

analysdns.

Tliey found that management is shown to forecast

revenues ■uid profits slightly,

but not significantly,

better tha)i the analysts di".',

i'h':^ir research differs from

the previovis ono.s on the follfvnng conditions:

1. It is based on cfuif i dent 1 a I

instead of published

dat'.a.

Tliey

aslv'dman<iqem'.'nI. and atualysts to make internal,

confidential forecosl'.s I'

ik'

v;!! I.

othem

(or to produce such

forecasts for this ocras ion).

This w o u 1d prevent some

behavioral effects on manipulation of outcomes in order to

meet previously published forecasts.

Confidence would lead

to a greater representativeness of their sample.

2. The study covers both revenue and profit forecasts

of the same companies.

This would enable them to compare

their accuracy .

Spec i f i r'a 1 1 y ,

tlie

study tested the

existence and

the magnitude of

the forecast

error

multipl i e r s of Ijiri.

3. They asked the

forecasters to express their own

17

uncertainties and the actual outcomes that also surprised

managers and researchers.

4.

They estahli.shed direct contacts with respondents,

so they had the opportunity of asking more questions with a

prepared

q u e s tionnaire to get t)arkgroi.ind information which

could

help

in

exp I ana t :i r).n

of

the

results.

This

questionnaire covered fa) ctiepks on data they used.

Or) some characteristics of the forecasts provided, (c) an

identification of tlie main factors causing foi''ecast er.roi''S

according to the coi'porations, and (d) possible contacts

w ith analysts.

On the other hand Sclrreuder and Klaassen

did not t'epoi'’t how many of the analyst forecasts were

issued before and after the 'management forecasts for the

relative accuracy and the timing purposes.

3.3 Differences of methodology of the present

study from

Hein Schreuder and Jan Klaassen's

3.3.1 Time Horizon

T i m e h.is an e c on o m i c value and is an important

el e m en t of the analysis;

this study's time period covers

the last

3 m o n t h s of 1990 w h ereas the base study

(Hein

S c h r e u d e r

and

Jan

PC

1rl cl

S S 0 r:)

period

is

1 year.

Th

d i f f i c u l t y i s

in e:Impressing

"t- n e resul ts of these

thre·

m o n t h s a.s i f

they wer e for one year

rer iod .

Tal•m i ng

months' figures as r e p r e s e n t a t i v e s of anr.iial

figures is a

v e r y i mportant s h o r t c o m i n g e s p e c i a l ly

in a co'untry whose

e c o n o m i c

c o n di t io n s are

changing continuously,

who.se

e c o n o m i c and political conditions are very different from

Ne t h e r l a n d s .

And also the period that formed th«= basis of

this s t u d y came aft er the Gulf Crisis.

The study needs to

c o n s i d e r the p o s s i b i l i t y of pessimism, of

the forecasts,

h o w e v e r s i m i l a r t e n d e n c i e s due to the same effect would be

o b s e r v e d for the o t h e r group of forecasters, canceling out

d i s t o r t i n g e f fe c t s w i t h respect to pessimism.

3 . 3 . 2 D a t a C o l l e c t i o n

D e s p i t e t h e g l o b a l ly ı n o r e a s i n g i n t e r e s t in c:orp)orate 7“Q r" O S a s p a n d o i r e c t or i n d i r e c t e f t e c t s o n e c o n o m i c 1 n c 1 c ap D "" B .i tine i m p c r t a n c e o-f t h i s i s s u e is n o t a p p r e c i a t e d P C i t s e x t e n t in TLirkoy,. D u r i n g o u r i n t e r v i e w s w e o b s e r v e d p h a t m o s t o f t h e p r i v a t e b r o k e r s o e r c e i v e t h e m a p p e r a s a n u n n e c e s s a r y a n d e x c e s s i v e w o r k l o a d o n t h e P o s o n n e 1 >1 l"io wx?l· 1 xi ixe (jr k !"·g o n co:i-ixoat e n o r e c a s t s . 11sheLi 1 c:i □ s n o t e d t h a t , hov·;evei·".. s o m e b a n k s ha ·/e i-ec:e n 1 1 y s t a r t e d o n m a k e s u c h f ·:;?!·"e c a c t s a n d t n u s r^av^ to: he exclu=:‘!ed

•t" i" o· in t h e a ij o V 0 c n e !· · a ]. i z a a 1 o n« A J. t nc; l( g in p r" e a e n a J. y t h e i·” e a ;·' e f e -- p i o n e e !-· s t in e c o n c e p t s e e in 'bo n a e b e a n a e e İİ. □ p e cl a n d ixthe !·■■ b a n k s i u p o n i"' e a ]. i z i ixg t ine i m p o p a n o e « h a e st a r t e d o !·· a r" e e r i o lis 1 y c: =0 r - xi 1 d 0 r :i. n g e s t a lx 1 i s in 1 r i q a d .h c · c !- e e a !·" o ix □ I" o: Li p s « B u t I w o Li 1 d (X o ix s i d e p Li h t i n g s o rn e (x -f· r e s p o n B i bi 1 i t y o ix t lx e i::;i li b ]. x: a n d 1 ix \/ e s t o r" s w ix o a 1- e n o t e d L i o a t e d a n d s o a r e n o t coixsc i d l i s i y a n d □ r o p e r iy e v a l u a t i n g t h e s t o c k s ( f o r e x a m p l e , o n e b a n k e v e n a d i x i t t e d t h a t I w a s t h e f i r s t o n e t o c o m e a n d a s k f o r t h i s i n f o r m o - t i o n a l t h o u g h it w a s e a s i l y a v a i l a b l e f o r e v e r y b o d y ) . D a t a c o l l e c t e d f o r t h i s s t u d y c o n s i s t o f t h e o o m p a IX i e s ^ o w i ·! f o i·" e c a xi t x> o f r e v e nli e a n d p r o f i t s t · c;) 1·" t !x e

·■()

y e a r i 9ѵ0ч a n a l у a t в " f a r s c a s t s , a n d a c t u a l У і д и ; ‘а в f o r t h e sanie p e r i o d . rlanaqsiTient t o r e c a s t s w e r e r e o e i v s c in D c t o b e r 1 V г.! M o s t o-f t.hG a n G l y s t s p r (J c: t G iij G r GGG tVvG □ rOL::I 3 " •V- D r e c a s t 3 i ■“ ,■ ···, Г” G r G G a :Bt d a t a Ll 3 0 d :i. n ■■•ectaticns a-“ '':tr t h e t n i r d q u a r t e r f i n a n c i a l r e s u l t s a r e k n o w n b y t'.e manageiiient a n d an alysts,, T h e a c t u a l -Fi c u r e s w e '·■· e a v a i l s a 1. e c n у a f b a i' F" e b i- u a ■" у 19 91 T a b l e I A n a l y s t s u o m p a n i s;

0roups

I 1 I 11 „ I 9.(4 ^

( J. )

< 3’;

(li) *

9

10

1 1

12

13

14

15

16

17

1E2

T o t a l18

18

4 17 16 = 7 3 * n u m b e r o f p e o p l e i n t h g r o u p■"

1

1 ; :i?aiTip.L0 CDn't-\inB I'd L-Uiiip-in i 0= ^ -For acaa-’t: 5 F r o m IB d i f f e r a n a ¡yianagBrs. 7 3 a n a l y s t s " f o r e c a s t s in d i f f e r e n t c o m b i n a t i o n s o F a n a l y s t s a n d d a t a w a r s p r a p a r a d by 13 a n a l y s t s w o r k i n g -for o d i - F f a r a n t or g a n i z a t i o n s u ( T a b l e I) G u t Q-f t h e c o m p a n i e s l i s t e d in I s t a n b u l S t o c k b..: c!"! a !Z G a ^ □ n 11·' 1 b c □ rn o a n 1 a s i ^ a r* e i n c 1 u d a d ;i. n t I'ya s t u d y . D a o a r m i n a o i o n Oif t h e .lOinDanias t o b e s c u d i e d is i d e a l l y b a s e d o n a s c i a n t i - f i c s a m p l i n g w i t h s o m a p r a - d e t ei-"mi n e d G r i t e !·■■ i a , riO'rie v e r , i n c n 1 s c a s e t ran c: ·■■; 1 v z :·* 1 1 e r i a h a d t o b e " a v a l l a b i i it y" a n d " a c c e s s ioi 1 it y" G u i c r t h e c o m D a n i e s 1 n t e I- \/ i z?' e d (3-4; ’i in a o a r' e 1 i s c e (d r? in n (■. e I t a n i:i li ]. S t oc !<

E ;·: I"; a n q e . m a in y w e !·“ e a g a 1 n :::: t i·" e e a ii. i n g s ¡n c h -f· □ r” m a t i o n k ) e i;:i cj n G t :< n o w w h e t in 0 r t h e y in a Z: b e e n s 0 1-' i o u s. ]. y 1 n · / □ .i. / 0 6 i ¡n z: Li z; In f c r" e c a s t s .. o r w h s t in o r t h e y c! i d n c t t a k o t In :i. s s t u d y s e r" i. D u s 1 ■./ D I··· d i d n a t -f 1 ;n d i t i n t oz !·" 0 s n :i. ¡n g . D a t c: o 1 1 0 c t i o r i a ]. Z: D 1 a c k 0 d -f a r in a 1 a li t In o i- i t y (t n 0 r- e w a s n o n o t r y d D c u ii)e n t a t ]. G n o r a u t ino r i z a t i □ n ) t In a t w o u 1 d in a v0 r:0 ]. |;i zi* id as a g Li a !·“ a n t e e in p 0 r s li a d i n □ t In e c □ ¡r 1 p a n :l. e s t in a t t In 0 c: o n f · ;i. (d is n t :i. a 1. i n f □ 1·"m a t i. o n p r □ v i d0d wcju 1 cl n o t be p u b 1 i shed.. T h e g ix ai·" aiitee p r o v i d e d b y t h e B i l k e n t U n i v e r s i t y w a s a c c e p t e d b y o n l y a s i n q l e cnfiipany.. A d d i t i o n a l l y : , I l a c k e d a p r o - f e s s i o n a l title., w h i c h p r o b a b l y h a v e a f f e c t e d t h e i r w i l l i n g n e s s a d v e r s e l y - H o w e v e r ^ s o m e d i d p a r t i c i p a t e a n d a l l t h e w i 11 i ng c o m p a n i e s h a d t o b e i nc 1 tidedu

D a t a c u l l a c t a d w e r a p r o v i d e d d u r l a g facie t o f a c e i n t e r v i e w E w i r h o e o p i e w h o w o r k o n t h i s i s s u e at v a r i o u s l e v e l s o f m a n a g e m e n t . In t h i s r e s p e c t , t h e d a t a c a n be p e r c e i v e d tc? е е relatj. v e l y m o r e r e l i a b l e b e c a u s e t h e y r e f l e c t e d t h e a c t u a l e x p e c t a t i o n s o f m a n a g e m e n t w h o a r e r e s p o n s i n l e for' b u d g e t i n g ( e x c e p t o n e c o m n a n v w h i c h i n c i- 0 d i u 1 V e X a g g e !■" a t e d - 1 r :i. :::> t* a m (j u s :i. n t h i s r e s j~ e c t ) I n t h e m a r k e t » a c o m m o n c o m p l a i n t is t n a c c o m p a n i e s " t o p ГПa г!a g e 1!!e n t о r- e - e ;·" r e d e 11 iie i·" t о ciec 1 a r e t o e ]. о w t a r g e r s о

tnat

cheV

c

l- Id

he

f:)erceived as

a n -c i c i D a c e cJ. о i·" v·; e i·" e e :' a g g e i- a t i n c i n -f · о r in a t i о r'i IS d e 1 1 о e r“ a l e ]. у d i s g i..i i s o d о 01 i; p a n i e s for" f e a i- t h a t :i. t w о и. i d b e js u !·■ p о s 0 s . k ie b e l i e v e t h at hl· ma n n a c l· e a 1 о г·g rj ;j. t h c o m p e t it i o n - - p n o b i a o f t e n c a u s e s s u c h be ha r / i o r - S i n c e t h e s o u r c e o f d a t a in t h i s s t u d y c a m e m o s t l v f r o m l o w e r l e v e l e ;-i e c u t i V e IE irJ h о a e p r“ о b a 1;j I у m о r e t' 1 e ;·; i s l e i. n i- e v e a 1 :i. n g t a r g e t s ( e x c e p t i o n w a s a l r e a d y a n o u t l i e r ^ whc3 d i d n o t e v e n h a v e a g e n e r a l i d e a o n w h a t w a s g o i n g o n ) . W e b e l i e v e t h a t d a t a p r o v i d e d is c l o s e r t o w h a t t h e y a c t u a l l y fo recast.. c e r f o r m i n g a b o i v e r h - s 1 s u a t :i. o n . n-;-‘ t e n не-г - V- f:: r. ] ·^- !. s o b y tae u s e d f o r c t h e r C o l l e c t i n g d a t a f r o m t h e a n a l y s t s c o n s t i t u t e d t h e m a j o r d i f f i c u l t y » A l t h o u g h t h e n u m b e r o f c o m p a n i e s a n d i n t i 11! t i o ris t h a t s h o u 1 c:l h a v e b e e n c o n d u c t i ng f i na nc :i. a I