GLOBAL ECONOMIC POLICY UNCERTAINTY AND ITS EFFECTS ON SELECTED EMERGING MARKET COUNTRIES

A THESIS SUBMITTED TO

THE INSTITUTE OF SOCIAL SCIENCES OF

ANKARA YILDIRIM BEYAZIT UNIVERSITY

by

Harun Türker KARA

IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR

THE DEGREE OF DOCTOR OF PHILOSOPHY IN

DEPARTMENT OF BANKING AND FINANCE

i Examining Committee Members

Prof. Dr. Ayhan Kapusuzoğlu (AYBU, Banking and Finance) Prof. Dr. Nildağ Başak Ceylan (AYBU, Banking and Finance) Prof. Dr. Afşin Şahin (AHBVU, Banking)

Prof. Dr. Yeliz Yalçın (AHBVU, Econometrics)

ii

PLAGIARISM

I hereby declare that all information in this thesis has been obtained and presented in accordance with academic rules and ethical conduct. I also declare that, as required by these rules and conduct, I have fully cited and referenced all material and results that are not original to this work; otherwise I accept all legal responsibility.

iii

ABSTRACT

GLOBAL ECONOMIC POLICY UNCERTAINTY AND ITS EFFECTS ON SELECTED EMERGING MARKET COUNTRIES

KARA, Harun Türker

Ph.D., Department of Banking and Finance Supervisor: Prof.Dr. Nildağ Başak CEYLAN

April, 2019, 166 + xvi pages

Economic policy uncertainty is a widespread debate area in the modern management, economics and finance. In the management perspective, understanding of organizational environment is one of the key contributor to good governance. In addition to this, macroeconomist focus on some kind of uncertainties such as inflation uncertainty, exchange rate uncertainty and growth rate uncertainty on the way of sustainable growth. As for financial side, the finance – growth nexus cannot separable from uncertainties around the environment.

In recent years especially aftermath of global financial crisis, there has been a common search for novel measurement tool of economic policy uncertainty. Meanwhile, Global Economic Policy Uncertainty Index which is constructed by Baker, Bloom and Davis (2013) became a popular tool in order the grasp the impact of uncertainty both financial and real side of economy. Their method base upon text analysis via word searching from major newspapers of a selected country. The most prominent feature of the index is that its

iv appearance in the media and academic papers. In addition to this, The Global Economic Policy Uncertainty Index provides high frequent and publicly available long span data. Therefore, there are other types of indices which use as a base of it.

Although, there are ample of works concentrate on the influence on economic policy uncertainty in the literature, we focus on emerging market side of these effects. With this regard, we use a Panel VAR model with a sample of twelve countries and their financial variables. According to the model results, economic policy uncertainty impacts stock markets negatively, flattens the yield curve and depreciates the nominal currency.

Keywords: Economic Policy Uncertainty, Emerging Markets, Financial Markets, Panel VAR

v

ÖZET

Küresel Ekonomi Politikalarında Belirsizlik ve Seçilmiş Gelişmekte Olan Ülkelere Etkisi

KARA, Harun Türker

Doktora, Bankacılık ve Finans Bölümü Tez Yöneticisi: Prof.Dr. Nildağ Başak CEYLAN

Nisan 2019, 166 + xvi sayfa

Ekonomi politikalarındaki belirsizlik modern yönetim bilimleri, ekonomi ve finans alanlarında geniş bir tartışma konusu olarak görülmektedir. Yönetim bilimleri perspektifinden işletmelerin dış çevresiyle ilişkisini başarılı bir şekilde yönetmesi iyi yönetişimi sağlamanın bir unsuru olarak görülmektedir. Buna ek olarak özellikle makro ekonomistler enflasyon, döviz kurları ve büyüme oranları kaynaklı belirsizlikler ile ilgilenmekte, finansçılar ise finans ve büyüme ilişkisi bağlamında belirsizlikleri ele almaktadır.

Özellikle küresel kriz sonrası dönemde, ekonomi politikalarındaki belirsizliğin ölçülmesi için yeni araç arayışı hız kazanmaya başlamıştır. Bu bağlamda Baker, Bloom ve Davis (2013) tarafından geliştirilen Küresel Ekonomi Politikaları Belirsizlik Endeksi finansal ve reel açıdan ekonomi politikalarındaki belirsizliğin anlaşılması için sıkça kullanılan bir araç haline gelmiştir. Çeşitli ülkelerin önemli gazetelerinden belirli kelimelerin taranmasına yönelik bir metin analizine dayanmakta olan bu endeksin en önemli yönü hem medyada hem de akademik çalışmalarda oldukça yoğun bir şekilde kullanılması olmuştur.

vi Buna ilaveten, Küresel Ekonomi Politikaları Belirsizlik Endeksi halka açık ve uzun dönemli yüksek frekanslı bir veri tabanı sağlamaktadır. Bu durum bu endeksi baz alan çok sayıda endeksin geliştirilmesine yol açmıştır.

Bu tezde, ekonomi politikalarındaki belirsizliğin etkilerini gelişmekte olan ülkelerin finansal piyasalarına etkisi on iki ülke örneklemi ile Panel Var modeli çerçevesinde ele alınacaktır. Tezin temel bulgularına göre, ekonomi politikalarındaki belirsizlik, hisse senedi piyasalarını olumsuz etkilemekte, getiri eğrisini yapaylaştırmakta ve nominal kur oranlarının değer kaybetmesine yol açmaktadır.

Anahtar Kelimeler: Ekonomi Politikalarında Belirsizlik, Gelişmekte Olan Ülkeler, Finansal Piyasalar, Panel VAR

vii

DEDICATION

viii

ACKNOWLEDGEMENTS

I would like to thank my supervisor Professor Dr. Nildağ Başak CEYLAN who has been wonderful guide for me since the my very first day in the Banking and Finance PhD programme. I would like to thank other members of my PhD thesis committee who are Professor Dr. Ayhan KAPUSUZOĞLU and Professor Dr. Yeliz YALÇIN. Their excellent comments helped me to develop my academic perspective. In addition to this, my PhD thesis committee’s contributions are not limited to the giving comprehensive answers of my questions but asking pathfinder questions on the way of writing this dissertation.

I want to show my deepest appreciation to Professor Dr. ÖZTÜRK, Abdurrahman, Nurullah, Bekir, Soner, Zehra and Harun. The very simple reason is their devoted friendship and friendly solutions whenever and whatever I need. I also would like to express my deepest gratitude to Dr. ÇUFADAR who encourages me to think like an economist, on behalf of my colleagues. And a very special thanks to Dr. BLOOM for his prompt replies.

I would like to thank the Central Bank of Republic of Turkey, TEDU Library, METU Library and AYBU Library for their support during this period. I also would like to acknowledge my colleagues in the Prime Ministry of Turkey, the Ministry of Culture and Tourism and the Ministry of Foreign Affairs. When I was in there, I have an opportunity to visit some emerging countries.

Yes too many thanks, but at least two special ones for Dr. BABACAN and Sümeyra. Neither my English nor my Turkish or any other one gives me the opportunity to express the exact reasons. However, it is good to fell that they know the reasons.

ix TABLE OF CONTENTS PLAGIARISM ... ii ABSTRACT ... iii ÖZET ... v DEDICATION ... vii ACKNOWLEDGEMENTS ... viii TABLE OF CONTENTS ... ix

LIST OF TABLES ... xii

LIST OF FIGURES ... xiv

LIST OF ABBREVIATIONS ... xv

CHAPTER 1 THEORETICAL FRAMEWORK THREE SIDES OF UNCERTAINTY INTRODUCTION ... 1

1.1. Organization and Uncertainty ... 4

1.1.1. The Organization’s Environment ... 5

1.1.2. The Organization and Uncertainty ... 9

1.2. Macroeconomic Uncertainty ... 11

1.2.1. Inflation Uncertainty ... 13

1.2.2. Exchange Rate Uncertainty ... 17

1.2.3. Growth Rate Uncertainty... 21

x CHAPTER 2

THE ANALYTICAL FRAMEWORK OF ECONOMIC POLICY UNCERTAINTY INDICES

2.1. The Structure of Economic Policy Uncertainty Indices ... 27

2.2. The Rationale Behind Economic Policy Uncertainty Indices ... 38

2.3. Analytical Evaluation of Economic Policy Uncertainty Indices ... 39

2.4. Different Types of Economic Policy Uncertainty Indices Based on the GEPU Index ... 40

2.4.1. Financial Stress Indicator (FSI) ... 41

2.4.2. Debt Ceiling and Government Shutdown Index ... 42

2.4.3. Geopolitical Risk Index ... 43

2.4.4. Immigration Related EPU ... 44

2.4.5. Firm-Level Political Risk Index ... 45

2.4.6. US Equity Market Volatility Index ... 46

2.4.7. Monetary Policy Specific Uncertainty Indices ... 47

2.4.8. The World Uncertainty Index ... 50

2.5. Selected Turkey Specific Uncertainty Indices in the Literature ... 51

2.6. Analysis of Economic Policy Uncertainty Indices in the Literature ... 54

2.6.1. The Relationship Between Macroeconomic Variables and Economic Policy Uncertainty ... 54

2.6.2. The Relationship Between Financial Variables and Economic Policy Uncertainty ... 59

2.6.3. The Relationship Between Behavioral Basics and Economic Policy Uncertainty ... 61

xi CHAPTER 3

AN EMPRICAL ANALYSIS:

THE IMPACT OF ECONOMIC POLICY UNCERTAINTY TO EMERGING MARKET COUNTRIES

3.1. Revisiting the Literature about Emerging Economies’ Financial Markets Aftermath

of Global Financial Crisis ... 63

3.1.1. Interest Rates and Yield Curve Side ... 63

3.1.2. Exchange Rate Side ... 67

3.1.3. Stock Market Side ... 70

3.2. Uncertainty and Emerging Economies’ Financial Markets ... 72

3.2.1. Model Selection ... 72

3.2.2. Data Selection and Transformation ... 73

3.2.3. General Model and Procedures ... 74

3.3. Base Model ... 75

3.4. Base Fixed Model ... 81

3.5. Base Reduced Model ... 83

3.6. Foreign Trade Concentration Model ... 89

3.7. Fragile Five Model ... 96

3.8. The Turkey Centered Model... 102

CONCLUSIONS AND POLICY RECOMMENDATIONS ... 107

REFERENCES ... 111

APPENDICES ... 137

APPENDIX A. GEPU ... 137

APPENDIX B. SUPLEMENTARY MATERIALS FOR THE MODELS ... 141

APPENDIX C. QUICK LITERATURE REVIEW ... 150

TEZ FOTOKOPİ İZİN FORMU ... 153

CURRICULUM VITAE ... 154

xii

LIST OF TABLES

Table 1. 1: Financial Development Components ... 25

Table 2. 1. GEPU Media Coverage and Key Features ... 289

Table 2. 2. The FSI Media Coverage ... 41

Table 2. 3. The Debt Ceiling And Government Shutdown Indices’ Media Coverage ... 42

Table 2. 4. Geopolitical Risk Index Media Coverage ... 43

Table 2. 5. Immigration Related EPU Media Coverage ... 45

Table 2. 6. Firm-Level Political Risk Index Text Coverage ... 45

Table 2. 7. US Equity Market Volatility Index Media Coverage ... 46

Table 2. 8. Us Monetary Policy Specific Uncertainty Index Media Coverage... 48

Table 2. 9. Alternative US Monetary Policy Specific Uncertainty Index Media Coverage………...…………48

Table 2. 10. Japanese Monetary Policy Specific Uncertainty Index Media Coverage ... 49

Table 2. 11. The World Uncertainty Index Media Coverage ... 50

Table 2. 12. The Aggregate Economic Uncertainty Index Media Coverage ... 52

Table 2. 13. EPU Index For Turkey Media Coverage ... 53

Table 3. 1. Cross Section Dependence in the Base Model ... 75

Table 3. 2. Panel Unit Root Tests in the Base Model ... 76

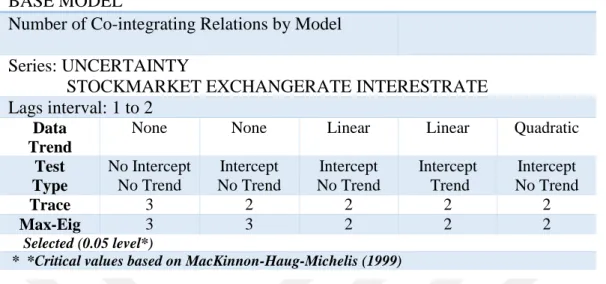

Table 3. 3. Number of Co-Integrating Relations by Model in the Base Model ... 77

Table 3. 4. Lag Length Selection in The Base Model ... 77

Table 3. 5. Forecast Error Variance Decomposition Owing to Uncertainty in the Base Model ………..80

Table 3. 6. table 3. 5. Forecast Error Variance Decomposition Owing to Uncertainty in the Base Fixed Model ... 82

Table 3. 7. Cross Section Dependence in the Base Reduced Model ... 83

Table 3. 8. Panel Unit Root Tests in the Base Reduced Model ... 84

Table 3. 9. Number of Co-Integrating Relations by Model in the Base Reduced Model ... 85

Table 3. 10. Lag Length Selection in the Base Reduced Model ... 85 29

xiii Table 3. 11. Forecast Error Variance Decomposition Owing to Uncertainty in the Base Reduced Model ... 88 Table 3. 12. Cross Section Dependence in the FT Composition Model ... 89 Table 3. 13. Panel Unit Root Tests in the FT Concentration Model ... 90 Table 3. 14. Number of Co-Integrating Relations by Model in the FT Composition Model ... 91 Table 3. 15. Lag Length Selection in the FT Composition Model ... 91 Table 3. 16. Forecast Error Variance Decomposition Owing to Uncertainty in The FT Composition Model ... 95 Table 3. 17. Cross Section Dependence in the Fragile Five Model ... 96 Table 3. 18. Panel Unit Root Tests in the Fragile Five Model ... 97 Table 3. 19. Number of Co-Integrating Relations By Model in the Fragile Five Model ... 98 Table 3. 20. Lag Length Selection in the Fragile Five Model ... 98 Table 3. 21. Forecast Error Variance Decomposition Owing to Uncertainty in the Fragile Five Model ... 101 Table 3. 22. Lag Length Selection in the Turkey Centered Model... 102 Table 3. 23. Number of Co-Integrating Relations by Model in the Turkey Centered Model ... 103 Table 3. 24. Forecast Error Variance Decomposition Owing to Uncertainty in the Turkey Centered Model ... 106

xiv

LIST OF FIGURES

FIGURE 1. 1. What is Bitcoin? ... 7

FIGURE 1. 2. Organizational Environment ... 9

FIGURE 1. 3. Organization and Uncertainty Relationship ... 10

FIGURE 1. 4. The Summary of Macroeconomic Uncertainty ... 13

FIGURE 3. 1. Interaction of Variables under the Base Model ... 78

FIGURE 3. 2. Variance Decomposition of Variables under the Base ModeL... 79

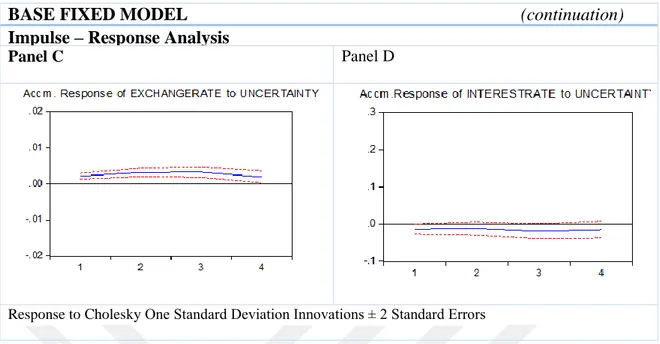

FIGURE 3. 3. Interaction of Variables under the Base Fixed Model ... 82

FIGURE 3. 4. Interaction of Variables under the Base Reduced Model ... 86

FIGURE 3. 5 Variance Decomposition of Variables under the Base Reduced Model ... 87

FIGURE 3. 6. Interaction of Variables under the Foreign Trade Concentration Model .... 93

FIGURE 3. 7. Variance Decomposition of Variables under the Foreign Trade Concentration Model ... 94

FIGURE 3. 8. Interaction of Variables under the Foreign Trade Concentration Model .... 99

FIGURE 3. 9. Variance Decomposition of Variables under the Fragile Five Model ... 100

FIGURE 3. 10. Interaction of Variables under the Turkey Centered Model ... 104

FIGURE 3. 11 Variance Decomposition of Variables under the Turkey Centered Model ... 105

xv

LIST OF ABBREVIATIONS

ATM : Automated Teller Machine AIC : Akaike Information Criterion CBOE : Chicago Board Options Exchange

CBRT : The Central Bank of the Republic of Turkey CDS : Credit Default Swap

CEO : Chief Executive Officer

CO2 : Carbon dioxide

CPI : Consumer Price Index

d.f. : Degrees of Freedom

EGARCH : Exponential Generalized Autoregressive Conditional Heteroscedastic Model

EM : Emerging Market

EME : Emerging Market Economies EPU : Economic Policy Uncertainty

EU : European Union

FDI : Foreign Direct Investment FED : Federal Reserve System FSB : Financial Stability Board FSI : Financial Stress Indicator

FT : Foreign Trade

GARCH : Generalized Autoregressive Conditional Heteroscedastic Model

GDP : Gross Domestic Product

GEPU : Global Economic Policy Uncertainty GRI : Geopolitical Risk Index

HQIC : Hannan–Quinn Information Criterion IMF : International Monetary fund

IPO : Initial Public Offerings

LR : Likelihood Ratio

xvi MS-VAR : Markov-Switching Vector Autoregressive

NVIX : News Implied Volatility PVAR : Panel Vector Autoregressive REER : Real Effective Exchange Rate SIC : Schwartz Information Criteria UEP : Uncovered Equity Parity

UK : The United Kingdom

US : The United States of America

USA : The United States of America VAR : Vector Autoregressive

VIX : CBOE Volatility Index

1

INTRODUCTION

The term “uncertainty” is vital in the understanding of economics, obviously the life. It has been debated since about a century when Knight published his well-known book “Risk, Uncertainty and Profit” in 1921.

Knight (2006) focuses on the differences between “risk” and “uncertainty”. With this regard, he defines uncertainty based on immeasurability whereas risk as some measurable outcomes, initially. He also reported due to state of nature, the risk is negative outcomes steam from unfavorable negative outcomes owing to uncertainty. On the other hand, he highlighted uncertainty creates possible outcomes owing to wishfully thinking regarding future. At this point, he emphasizes that thoughts are drivers of the decision making though they may be wrong.

The nature of economics is in Knight’s interest (2006, p. 54). He emphasizes that the organization of human activities is one of the key points of economists; which may be the initial version of behavioral economics. In addition to this focus on human behavior, he also deals with “profit” and the mechanism which creates it. He states that loss of uncertainty leads loss of profits (Knight, 2006, p. 20).

The search for profit carries us the micro level analysis, namely the firms or organizations. As organizational economists state, the boundaries of organization depend on what will be produced in and outside the organization (Barney and Hesterly, 2006). This decision is responsive to uncertainties and it determines the market and hierarchical mechanisms of organization.

Uncertainties from in and outside organization subject to organizational decisions. The sustainable organizations have to deal with uncertainties which arise from organizational environment. To illustrate, a flexible working demand may be seen as an in-organization problem but the roots of the problem stay in the environmental change.

2 Laws and regulations, economic and political conditions, technological advance, demographic structure and social values are main components of organizational environment. The change in any of them creates uncertainty for organization, hence organization has to cope with them.

Another form of uncertainties may arise from macroeconomic conditions such as inflation, exchange rate and growth. All kind of macroeconomic uncertainties influence all economic agents, namely government, firm, household and foreigners.

One of the macroeconomic uncertainties is inflation uncertainty. Even though time horizon can change the nature of relationship, inflation and inflation uncertainty are positively interlinked (Berument, Yalçın and Yıldırım, 2012). On the other hand, well-known Fisher hypothesis which suggests that there is a statistically significant the relationship between inflation and inflation uncertainty may not be valid in all emerging economies (Berument, Ceylan and Olgun, 2007).

Besides inflation uncertainty, exchange uncertainty has the influence on the health of the economy via its impact on price mechanism (Candian, 2019). To wrap up, all types of macroeconomic uncertainties are structurally detrimental to sustainable economic growth and so growth uncertainty is a vital kind of macroeconomic uncertainties.

The other reasons for uncertainty may be financial frictions and information asymmetries. In this context, financial development which can be measured by an index is a good proxy in order to grasp the effects of financial frictions and information asymmetries. A standard measure of financial development focuses on two dimensions; financial markets and financial institutions. The development of financial markets and financial institutions are to be determined by three criteria which are easy accession to financial resources, financial depth and efficiency. To sum up an optimal level of financial development is a sufficient but not enough criteria to have a sustainable economic conditions.

Up to this point, we focus on different dimensions of uncertainty. Inherently, there are other dimensions of uncertainty but these are enough for drawing the framework of the concept.

3 Aftermath of the global financial crisis, both academics and professionals in finance industry have tried to understand what went wrong. Therefore, they go to the “basics” and see “uncertainty” is a vital tool to grasp economic and financial conditions.

Within this framework, the measurability of uncertainty comes to the agenda. Bloom (2009) and Baker, Bloom and Davis (2013, 2016) construct a novel method to measure uncertainty which organizations, academics and professionals have to cope with. This novel tool gives opportunity to make analyses about the big data world as well.

In the dissertation, we focus on the measurement of uncertainty with the GEPU index. We will decipher the analytical framework of the GEPU index, report pros and cons of it and summarize the literature about GEPU and derivatives. In addition to the GEPU index, we will examine other uncertainty indices in the case of Turkey.

Meanwhile, at the last phase, we will try to understand today’s financial world focusing on financial markets in emerging markets.

In order to do so, this dissertation has been organized as follows:

In the first chapter, we will examine the uncertainty concept from different aspects.

In the second chapter, we will give comprehensible information regarding measurement of uncertainty via concentrating on a novel tool. In this chapter, not only detailed information about the tool will be considered, but also analytical evolution will be made.

In the third chapter, the reaction of the uncertainty and financial markets will be scrutinized in emerging economies with different econometric models.

At the final chapter, we will summarize the conclusion of econometric models and policy considerations under light of these conclusions.

4 CHAPTER 1

THEORETICAL FRAMEWORK THREE SIDES OF UNCERTAINTY

All types of economic crisis change not only the world but also the way of understanding of the world. Aftermath of the latest global financial crisis, namely 2007-08 Financial Crisis or Lehman Crisis, the way of understanding of the world also differs from previous ones. The serotype diagnostic of financial crisis collapsed and academics try to grasp what is the remaining concept in order to understand the world. In this context, the new term which is “uncertainty” is now popular. Apart from Knightian uncertainty1 (1921), we will focus on how uncertainty be understand and measure till global financial crisis and how it change aftermath of it. With this regard, in this chapter, we examine organizational (micro economical), macro-economic and financial sides of uncertainty.

1.1. Organization and Uncertainty (Firm Level Uncertainty)

A well-known standard textbook or a dictionary definition of organization states as follows: “an organized group of people with a special aim, such as a business, government department or non-governmental organization.2” Therefore, when we talk about an organization, the central point is not solely people in it or purpose of it but also the organized structure of it. In this context, organizational economists underline the boundaries of organization, more clearly in or outside the organization. In addition to this, the micro economic theory of firms tries to express the profit maker firms’ decisions.

1 In the Knightian uncertainty case there is any quantifiable knowledge about some possible occurrence, as

opposed to the presence of quantifiable risk, in this case risk can be measurable but uncertainties can not, risk can be predictable but uncertainty cannot predictable; Detailed version of this definition and discussion: (Dana and Riedel, 2017; Nishimura and Ozaki, 2007).

2 See Oxford dictionary or its online version: https://en.oxforddictionaries.com/definition/organization

5 In the organization we comprehend given problems which originates from people, budget constraints or other sources to sum limited uncertainties, but outside the organization there is a more uncertain world and these factors shape the organization as well.

In this section, we deeply analyze the concept of organizational environment different sides. In connection with this point, we draw the outside borders of organization with the aim of grasping how environment affect the organization. We also present what environmental uncertainty is and what are the sources of it. We conclude this section with an overview of literature that analyzes the financial crisis and how organizations react it.

1.1.1. The Organization’s Environment

Organization’s environment is a composite concept with several different dimensions such as political, economic, technological and sociological elements; in short it contains all outside elements in the world. These indefinite dimensions make it tough both to define organizational boundaries and how environment shape the organizations. Hence, we scan the literature in comprehensive way.

All kind of organizations function in macro environment that contains all general elements can potentially have influence on organizations strategic decisions. These are also known as general environment which contains below elements 3:

Laws and regulations

Economic and political conditions

Technological advance

Demographic structure

Social values

To illustrate environmental developments aftermath of global financial crisis we can concentrate on laws and regulations dimension. Initially, the informal group of regulators and central bank experts’ non official meetings in Basel prior to the financial crisis became

6 inevitably formal in April 2009 because of the establishment of the new regularity authority which is called Financial Stability Board (FSB). The FSB’s main function is creating international corporation by bringing together all local institutions which are responsible for financial stability in the G-20 countries (Sahay et al, 2015). At the G-20 meeting policy makers have roles and they draw general framework for responsible authorities. Although, the success of FSB is not scope on this work, it signals the one dimension of environmental change.

One of the other dimension of the general environment is economic conditions. This dimension mainly focuses on interest rates namely weighted cost of capital, inflation, unemployment rates, the output level of a country and the value of the currencies of each country. The economic conditions stress financial and macroeconomic conditions. To illustrate economic conditions in the latest period, we can think about negative interest rates. In the negative interest rate situation, depositors must pay a fee in order to keep their money within the bank but not get any interest payment on deposits. Therefore, banks can lend money more freely and businesses and so individuals can reach funds more easily, but all financial transmission and calculation mechanism can change in this situation such as valuation. In the negative interest rate case, the question of what will the present value of cash flow can be a fascinating question4.

Technological advance is another element of the environment. The Bitcoin and the computer system behind all cryptocurrencies are good examples of technological advance. As it known, bitcoin is a virtual form of monetary unit with no visible exist. In order to understand the Bitcoin system one can scrutinize three disciplines of sciences, namely economics, cryptography and computer science which linked (Berentsen and Schär, 2018). The most important characteristic of the currently existing cryptocurrencies is that most of them are not issued by any individual entity (e.g. a central bank) but by the community of miners who are the users of sophisticated cryptographic algorithms. Cryptography has been used since obsolescence to secure information; but according to economists, it serves to create and control the supply of units of money (Dabrowski and Janikowski, 2018). To sum up, technology is the main driver of money supply in this case.

4 See for example: Jobst and Lin (2016).

7 Technological advance not only affect the supply of money but also change the use of money. Today, we can buy something with bitcoins, without cash our credit cards.

(Berentsen & Schär, 2018)

Figure 1. 1. What is Bitcoin?

Internet of things another technological advance which re-shape organizations’ environment.

It gives chance to the computer or other machineries to connect, interact and exchange data via sustainable networks. The important role of the Internet in business model gained momentum since the 1990s, hence each development of Internet system has caused to a new digital business model types (Fleisch, Weinberger and Wortmann, 2015).

Demographic structure is another element of organizational environment. The distribution of age is a driver of consumer choices as well as labor dynamics. The so-called Y generation focus on work-life balance rather than any other return of work life. The Y generation refers to internet generation and they have more opportunities to access to technology via so many instruments such as computers, cell phones and smart phones (Business Dictionary, 2018). Besides this, they even make their academic research’s via internet technology’s. Therefore, the demographic structure not only affect the final product, but also production line. To illustrate, an academic research now can have made with internet and it published in an online journal.

8 Banking is another good example of how demographic change influence the business model. We see mobile banking, internet banking and physically branch banking in same time. These are suitable for different target groups and mobile banking applications last no more than 20 years.

Social values can vary vide array of society. Even an organization or a nation have characterized social values. Organizations try to have social values that reflects the link between their activities and the norms of society which they exist in order to create organizational legitimacy (Dowling and Pfeffer, 1975). In other words, values are key driver of organizational mission and shed light on the way of organizations aim.

When we look at nation level social values, we can see widespread metrics. For instance, The Hofstede Model explains cultural values. Culture contains collective minding process which differs the group or organization from the others (Hofstede, 2011). The model explains the culture of a group in nation level with six dimensions below:

Power distance

Uncertainty avoidance

Individualism or collectivisms

Masculinity or femininity

Long or short term orientation

Indulgence or restraint

The model also formulizes the culture of a group in nation level with another six dimensions below (Hofstede 2011; Hofstede, Hofstede and Minkov, 2010; Hofstede, Neuijen, Ohayv and Sanders, 1990).

Process or result orientation

Job or employee orientation

Professional or parochial

Open or closed systems

Tight or loose control

9 Organizational or nation level culture can affect the decision process. In high uncertainty avoidance environment laws and rules are important as well as in tight organizations such as banks (Hofstede, 2011).

The other side of organization’s external environment is task environment. An institution or person that has direct relationship with an organization can be part of the task environment. The elements of task environment sectors contain competitors, customers, suppliers and labor supply. If we think about a central bank, the task environment is government, other central banks, other financial institutions, general public and human resources.

Figure 1. 2. Organizational Environment

1.1.2. The Organization and Uncertainty

Communication has a selective position for an organization to cope with uncertainty (Clampitt and Williams, 2005). As they stated, awareness of is the inherent state of nature of uncertainty, building some skills to tolerate for uncertainty and to motivate people for dealing with uncertainty is crucial to sustainable organizational development. Besides this, organizational design can be vital element to fight against uncertainty and awareness of “not

all kind of uncertainties” are harmful for an organization is important to benefit uncertainty

(see for example: Cleden, 2017).

Organization

Task

Environment Genereal Environment

10 Organizational economics which is an interdisciplinary approach also focus on uncertainty. It focuses on what organizations do in or out of the organization namely hierarchical or as a market competitor (Barney and Hesterly, 2006).

Figure 1. 3. Organization and Uncertainty Relationship

From Duncan (1972) and author.

How organizations can cope with an uncertainty is a critical research question. There is a comprehensive and well-known model of this problem established by Duncan (1972) paper. He emphasized the importance of dividing the organizational environment into internal and external environment. The former includes relevant physical and social factors outside the boundaries of the organization. On the other hand, in decision making of an organization the static-dynamic dimension shows the factors which effects decision maker remain stable over time or not and the simple-complex dimension shows the number of factors taken into consideration. If we think about the aftermath of global financial crisis we see dynamic and complex in this regard and the matrix implies high uncertainty.

11 There are also some conceptual methods to deal with organizational environment problems. One is organizational isomorphism which can be defined as the tendency of an organization to resemble other organizations that face similar environmental condition and problems (see, Srikantia and Bilimoria, 1997). It can be solution method for financial institution. To illustrate, the usage of the derivatives in central banking increase aftermath of financial crisis especially in emerging markets. To wrap up, they can change their reaction curve and tools to cope with an uncertainty.

1.2. Macroeconomic Uncertainty

In general, macroeconomic uncertainty thought as an assessing method of overall economic outlook. There are several conventional methods to understand macroeconomic uncertainty such as survey of expectations or reading minutes of monetary policy meetings. Forecast disagreement, both realized risk and Knightian uncertainty (1921) are main drivers of macro-economic uncertainty (Rossi, Sekhposyan and Soupre, 2016).

The major effect on uncertainty can be seen in business cycles and this relationship is two sided and the state of economy is based on interaction between business and financial cycles. For instance, recessions move with financial slump and on the other hand recoveries associated with accelerated credit growth and assets prices (Claessens, Kose and Terrones, 2012). Apart from these similarities there are also some differences between business and financial cycles (Hiebert, Jaccard and Schüler, 2018). These are:

Financial cycles are more volatile

Financial cycles are longer

Financial cycles are more symmetric

The financial cycle is a good measure to understand common movement of credit growth and asset prices. Together with, systemic banking crises can predictable under the light of financial cycle closely. The systemic banking crises most probably seen almost the peak of business cylices and so enables to grasp the risks of future financial crises as an early warning predictor. Moreover, the financial cycle forms on monetary and fiscal policy choices by the decision makers (Borio, 2014).

12 Financial volatility which stems from uncertainty is an independent reason of recessions need for urgent policy responses and recessions also amplify increase in financial market volatility. Hence, the uncertainty has dampened the in aggregate demand (Yıldırım Karaman, 2018).

Asymmetric information can be cause of slump in financial markets and market imperfections (Greenwald and Stiglitz, 1993). These may be reasons of macroeconomic uncertainty. There are some macroeconomic consequences of financial market imperfections (Eslava and Freixas, 2018):

Business cycle, financial cycle and financial structure are interlinked

Inefficient of monetary policy transmission mechanism and liquidity problems

In this regard, the business cycle and financial cycle’s financial imperfections are easy to see. The implementation of lending standards such as tighter standards applied during recessions is responsible for aggregate productivity trend breaking (Figueroa and Leukhina, 2018). Information asymmetries turns around aggregate output may be reason of financial instability and in connection with this, more open local financial markets can reduce the effects of financial market frictions (Fritsche, Pierdzioch, Rülke and Stadtmann, 2015)

The second is financial cycle imperfections. When collateralized loans increase, the lower prices of assets cause reduction in credit. If it creates too much indebtedness, liquidity or working capital problems are on the table. At a final stage, a lower volume of credit decreases asset price. This relation is known as a Fisherian debt deflation (Fischer, 1933). As the collateralized loans increase, the amount of credit will be function of future value of collateral and so a decrease in future price of collateral, reduce today’s credit and investment (Kiyotaki and Moore, 1997).

Inefficient of monetary policy transmission mechanism and liquidity problems are important elements of macroeconomic uncertainty. Central bank funding is a vital element for bank’s balance sheet and daily operations. However, when banks search for extra liquidity from central banks such as bail-out support, there will be an uncertainty because of two equilibria either banks holding liquidity or cash support liquidity (Tirole and Farhi, 2012).

13 The transmission mechanism hence, cannot work efficiently. Banking contagion stems from liquidity shock can easily widespread throughout the economy due to network of banking sector (Allen and Gale, 2000). In addition to this interbank contagion not only originates from uncertainties of banks’ assets and liabilities-side which emphasize maturity mismatches (Tian, Yang and Zhang, 2013).

The reasons of macroeconomic uncertainty can be more than above but the framework is simple. The financial imperfections are a vital element of it. In the following period we see types of macroeconomic uncertainties and in the below figure we can see a comprehensive analysis of macroeconomic uncertainty.

Figure 1. 4. The Summary of Macroeconomic Uncertainty

Source: Bank of England, Quarterly Bulletin, 2013 Q2

1.2.1. Inflation Uncertainty

Inflation uncertainty sets in when information asymmetry arises about level of future prices (Tashkini, 2007). Friedman's (1977) well-known Nobel lecture underlines that inflation uncertainty affects key macroeconomic variables such us output growth and exchange rates.

14 Not only macroeconomists try to figure out the relationship between inflation uncertainty and output growth but financial analysist try to evaluate risk premiums by the help of inflation. Friedman also claims that there is a positive correlation between inflation and nominal uncertainty. His main argument is that inflation creates an extra uncertainty which leads higher inflation in the future. Uncertainty also impact future inflation level as a one of the key driver of expected inflation. If there is no such an uncertainty and stable expectations consumers and businesses can generate better plan for the future (Golob, 1994). Indeed, as means to make a correct saving and investment decisions are difficult under the inflation uncertainty environment. Tashkini (2007) reports that uncertainty about inflation can affect the economy ex ante and ex post channels. There are three ex ante channels. These are:

Initially inflation uncertainty affects financial markets via pressuring long-term interest rates.

Secondly, inflation uncertainty creates an extra uncertainty about other variables that are important in economic decisions.

Last but not least, inflation uncertainty limits businesses to spend resources due to the risks.

Besides ex ante channels there are also ex post route how uncertainty about inflation can affect the economy. When the spread between expected and actual inflation extends, uncertainty amplifies as well.

To summarize, there are four basic hypotheses which show inflation and inflation uncertainty relationship. These are (Ekinci and Genç, 2018):

Friedman-Ball Hypotheses: The high level of inflation increases the inflation uncertainty

Pourgerami-Maskus Hypotheses: The high level of inflation decreases the inflation uncertainty

Cukierman-Meltzer Hypotheses: The high level inflation uncertainty increases the inflation level

Holland Hypotheses: The high level inflation uncertainty decreases the inflation level

15 The cost of inflation is a significant debate realm for macroeconomists for a long time since a surprise in inflation redistributes wealth as Grier and Perry (1998) states. They also report some weaker evidence in G7 countries about the Granger-causality between inflation uncertainty and inflation. In their analysis in US, UK and Germany soaring inflation uncertainty lowers inflation whereas in Japan and France soaring inflation uncertainty raises inflation (Grier and Perry, 1998).

The inflation uncertainty can affect central banks’ reaction function. As it known, central banks not only dislike inflation but also try to support the economy with no surprise in inflation via anchoring expectations and ensuring price stability. Cukierman and Meltzer (1986) show that, soaring inflation uncertainty raise the optimal average inflation rate by increasing the incentive for the policy-maker to create inflation surprises.

Balcilar and Ozdemir (2013) work on the link between inflation and inflation uncertainty in an emerging market country, namely South Africa. Their study investigates the asymmetric and time-varying causality between inflation and inflation uncertainty in the country by the help of conditional Gaussian Markov switching vector autoregressive (MS-VAR) model framework. This study is in the line with Friedman-Ball Hypotheses and implies that past information on inflation can help improve the prediction of inflation uncertainty but not vice versa. In addition to this contribution, authors also suggest some policy implementations. Balcilar and Özdemir (2013) underline that central banks have to implement ensure prompt, effective and efficient policy response and so manage the inflation. As a result of this a central bank can lessen the effects of inflation uncertainty. These will be milestones in transparency and accountability.

Bamanga et. al. (2016) study another emerging market country Nigeria. The authors see that Friedman-Ball Hypotheses, which states that a rise in the average rate of inflation leads to more uncertainty about future rate of inflation, holds in the Nigerian case. Under the time varying process using a GARCH framework Bamanga et. al. (2016) state that monetary authorities aim to continuously price stability consistent with sustainable economic growth to reduce the negative consequences stem from uncertainty. Further, the authors stress that Nigeria may need stabilization programs, particularly in agriculture sector during periods of high inflation, to reduce social cost of inflation.

16 Ndiaye and Konte (2017) have studied on West African Economic and Monetary Union (WAEMU). Their paper aims an empirical analysis concerning the relationship inflation uncertainty and economic growth in these countries. In the paper they use VAR-GARCH model to show inflation uncertainty and economic growth relationship. They report that Friedman-Ball Hypotheses is true for some WAEMU countries such as Guinea-Bissau. They furthermore acknowledge differences in the transmission mechanisms of inflation uncertainty between countries.

There are some papers which focus on Turkish case as well. One of them is Erdem’s (2017) paper. This paper focuses on food inflation in Turkey and the data in the paper covering the period of 2005-2017 for Turkey. This paper investigates that, there is one-way causality from food inflation to inflation uncertainty for Turkish economy. Nevertheless, there is no opposite causality from inflation uncertainty to food inflation.

Kaya Samut (2014) focuses on decomposition of different price components influence on inflation uncertainty rather a single one such as food. Kaya Samut reports that the effect of inflation uncertainty on the price components of general price level differ hence, the effects of price elements of general price level on the inflation uncertainty differ as well. To illustrate, household prices and inflation uncertainty are the causes for each other but price components such as clothing and health prices cause inflation uncertainty, to wrap up, this relationship is one-sided. Besides this one sided relationship to compete to inflation uncertainty, there are some examples of other side which inflation uncertainty to component. For example,inflation uncertainty is main reason of soaring food and dwelling prices.

Hülagü and Şahinöz (2012) look for a novel proxy in order to interpret inflation uncertainty. They use inflation expectation deviations to map inflation uncertainty in Turkey by analyzing the CBRT’s Survey of Expectations data. The paper focuses on the disagreement of the survey contributors. As inflation targets are nominal anchors for expectations in CBRTs full-fledged inflation targeting regime, disagreement may decline. To be specific, they provide enough evidence about inflation uncertainty decreases with the operation of the full-fledged inflation targeting regime since 2006 due to inflation targets become nominal anchors for expectations but not the level of inflation.

17 Saatçioğlu and Korap (2009) find that inflation leads to inflation uncertainty, the conditional variance of inflation responses less to prior negative shocks rather than to positive ones. Moreover, inflation causes inflation uncertainty as Friedman-Ball Hypotheses stated, however statistically significant evidence in the opposite side. They use contemporaneous Exponential GARCH (EGARCH) estimation methodology and cover from January of 1987 to July of 2008. They also suggest that forthcoming papers should be analyze the effects of transition to an explicit inflation targeting framework.

Göktaş and Çımat (2016) aim to both measure the contribution of main expenditures groups of CPI level and calculate the relative weights of these groups in inflation uncertainty. They find that “clothing and footwear” and “recreation and culture” sub-groups price uncertainties move in reverse direction whereas the other main expenditure group moves in the same direction with long run inflation uncertainty. The average weight of these two opposite sub-groups is approximately eleven percent between 1994-2013. On the other hand, within fluctuations seen in the general level of prices stem from mainly “Transportation”, “Food, Beverages, Tobacco” and “Clothing and Footwear” sub-groups.Göktaş and Çımat (2016) emphasize that oil prices have been a significant role in not only affecting inflation but also uncertainty of it.

1.2.2. Exchange Rate Uncertainty

Exchange rate uncertainty come into consideration aftermath of Bretton Wood System and the implementation of flexible exchange rate regime (Irwin, 2017). One basic impact of exchange rate uncertainty can be seen in international trade side. Exchange rate volatility can reduce level of export and so income from export. On the other hand, there will be an income effect which leads from risk aversion due to the shrinking export income.

In order to aside the negative effects of substitution effects, exporters aim to sell more (Kasman and Kasman, 2005). Besides these effects, exchange rate uncertainty is related with transaction costs (Sercu, Uppal and Van Hulle, 1995).

18 There are ample of works on exchange rate and international trade relationship. The most important finding is exchange rate uncertainty and international trade relationship do not depend on short term causality but long term policy signals. As IMF scholar Ghosh, Ostry and Qureshi (2015) state signals from policy makers create stable exchange rate and this help decreasing other costs such as transportation, too. Besides that, the exchange rate uncertainty brings about currency misalignments.

The currency misalignments are the main reason of the relatively high import prices. In this context, the effects of misaligned currency and export subsidy or import tax or prices are similar. Firms don’t reflect undervaluation or overvaluation of the exchange rate and do not fully adjust their price in the buyer’s country (Goldberg and Knetter, 1997). The last but obviously not least issue on the connection between exchange rates and trade is how exchange rate misalignments affect trade policy (Bussière, Gaulie and Steingress, 2017). The latest analysis on this topic is largely focused on contingency measures. The majority of the analysis reveal that long lasting periods of overvalued exchange rates often bring use of more tight protectionist trade policies 5.This situation also creates so-called currency wars.

Currency war which is another side of exchange rate uncertainty became a common debate topic aftermath of 2007-08 Global Financial Crisis. Former Fed governor Ben Bernanke (2015) in the Mundell-Fleming Lecture stressed the topic as follows:

“I heard two related complaints at international meetings and through the media: First, that the United States was engaging in ‘currency wars’ – a phrase used most prominently by Brazilian finance minister Guido Mantega in 2010, following the Fed’s introduction of a second round of quantitative easing – by choosing policies that would weaken the dollar and thereby unfairly increase US competitiveness at the expense of trading partners …”

The currency war is in relation with policy decisions. Influencing the direction of exchange rates for the benefit of country’s trade balance can be defined as “currency wars”. The concept was developed by former Finance Minister of Brazil Guido Mantega in September 2010 in response to quantitative easing in the Federal Reserve aftermath of the latest global financial crisis.

5 see for example: Knetter and Prusa (2003).

19 Minister Mantega’s implied criticism was about the effects of the quantitative easing particularly emerging market economies (Eichengreen, 2013). Some countries adopted novel policy tools to confront currency appreciation or use advantage of depreciation in countries in a flexible exchange-rate regime aftermath of the latest global financial crisis. To illustrate, Turkey make adjustment in reserve requirements and countries such as Philippines, Taiwan, Brazil, Chile, Thailand and India implement interventions policy to the foreign exchange market indirectly by talking or any other style (Pisani Ferry and Darvas, 2010).

In the recent episode, when the developed countries such as the USA, the United Kingdom, Japan and the Eurozone experienced broadly similar deflationary pressures, quantitative easing and unconventional money policy implementations responsible for currency depreciation in most emerging market countries. More focus international coordination of monetary policy might have reduced uncertainty however the collaboration mechanism still on the table (Eichengreen, 2013).

There are ample of works on exchange rate uncertainty especially for Turkey. Saatçioğlu and Karaca (2011) focus on exchange rate and export relation in Turkey. Their sample period is from 1981, May 1, when Turkey introduced flexible exchange rate system after to 2001, February 22 the date exchange rates were left free floating. Saatçioğlu and Karaca (2011) report that exchange rate uncertainty is harmful for export both short-run and long-run. They also underline stability of exchange rate is beneficial for foreign trade.

Köse, Ay and Topallı (2008) indicate that exchange rate volatility affects exports negatively not only in the long-run but also in the short-run. These findings are similar with previous works such as Saatçioğlu and Karaca (2011).Indeed, as authors found ten percent increase in the real exchange rate uncertainty, decreases the total real export revenue approximately two percent, ceteris paribus. But Köse and his friends didn’t focus on different exchange rate regimes in their sampling period which is 1995-2008. On the other hand, the results highlight that real exchange rate volatility has more effect than relative price and foreign real income on real export of Turkey.

20 Tarı and Yıldırım (2009) also study about exchange rate uncertainty and export link. They concentrate on the volume of exports and indicate that exchange rate uncertainty have no impact on export volume in short-run but negative effects in the long-run. The authors state that exporters accept the short-term movements in exchange rate as given therefore they have no response to it. As a policy implementation they recommend to exporters to learn and use hedging strategies.

Eren Sarıoğlu, (2013) turn her attention to the exchange rate uncertainty and sector based exports for Turkey. The paper states that exchange rate uncertainty does not have any statistically significant effect on the exports of chemistry, automotive, electric-electronic and iron-steel industries of the country in the long term.

One can see there are too many papers about exchange rate uncertainty and export relationship. Further, there are also same papers show exchange rate uncertainty and investment decisions.

Koç and Değer (2010) analyze relationship between exchange rate uncertainty and domestic investments. They state that there is no harmony of the literature but many theoretical studies have demonstrated negative effects of uncertainties on investments. According to the empirical findings there is a one-sided causality from exchange rate uncertainty to domestic investments. In the light of these empirical findings, one can say the exchange rate uncertainty as a noticeable contributor of investment decisions in Turkish economy.

Şahin and Sekmen (2013) study on links between financial markets and exchange rate uncertainty. To come to the point, the empirical results show that exchange rate uncertainties have a statistically significant effect on selected firms of the stock exchange market of Turkey. Moreover, Şahin and Sekmen (2013) report that, plus stable inflation rates, predictable exchange rate path is positive for stock exchange markets.

One appealing paper is about dollarization and exchange rate uncertainty in Turkey. Sever (2012) indicate that there is a two-way relationship between dollarization and exchange rate uncertainty in Turkey and it lasts half a year. However, the effects of dollarization on exchange rate uncertainty are more powerful.

21 Besides this, after the six month, dollarization is the reason of exchange rate uncertainty, still. Taking into account, when dollarization decreases, exchange rate uncertainty become less, this is the main contribution of the paper.

As it known, Republic of Turkey, former Ministry of Industry and Trade prepared Turkey's Industry Strategy Document in 2010 because of Turkey’s EU candidacy process. Meanwhile, Kılıç and Yıldırım (2016) and Kılıç (2014) show that an increase in the real exchange rate increases import but does not significantly decrease exports. Furthermore, real exchange rate uncertainty affects export volume positively; but import volume negatively.

1.2.3. Growth Rate Uncertainty

A positive relationship between output growth and output growth uncertainty is meaningful for many people. When output growth rises, it leads to inflationary pressures therefore the monetary policy makers decide to implement tight monetary policy in order to reduce the average rate of inflation and hence the probability of inflation uncertainty soaring real uncertainty is on the table (Fountas, Karanasos and Kim, 2006). In addition,Black (1987) obviously states that more output uncertainty can cause higher output growth. He states that investment in a riskier technology would be followed by higher average output growth. The reverse relationship is also seen in famous Taylor Rule when inflation taken in consideration. To summarize more inflation leads to low growth and lower output uncertainty (Taylor, 1979). Moreover, irreversible investment creates negative relationship between growth uncertainty and average growth (Henry, Olekalns and Summers, 2001). Furthermore, Baker, Bloom and Davis (2013) state that there are too many empirical findings which suggest that uncertainty increasing in recessions and decreasing in booms, so it is counter cyclical.

Lensink (2001) make a powerful empirical study about growth and growth uncertainty. The paper states that when uncertainty increases, it has a significant and negative effect on economic growth. They also report inflation uncertainty have robust and negative effect on economic growth. The policy suggestions for increasing uncertainty are increasing financial institutions transparency and constituting credibility of them.

22 There are some works for Turkey which examine the growth uncertainty and growth relationship in wide perspective. Policy makers aim to reach sustainable development with price stability in order to maintain welfare of the public. Terzioğlu (2017) states that CBRT use output uncertainty to create uncertainty on inflation. The empirical results show that the relationship between output uncertainty and growth till 2003 is negative while after 2003 is positive. He signs turning point is the changing role of CBRT in that process.

Output uncertainty is also important to shape monetary policy.Delle Chiaie (2009) indicate that the decisions of policy makers and inflationary pressures don’t depend on the potential output uncertainty. Moreover, author stresses the importance of the calculation method of output gap because the empirical finding show that central bank makes a continuously big error in the output gap forecasting once using bivariate model that consists output and inflation.

1.3. Financial Uncertainty

(Finance – Growth Nexus: Real Side of Finance and Economics Intersection)

Endogenous growth based on that financial development is one of the key element of sustainable economic growth. According to this theory, financial growth causes more economic growth because of its positive effect on resource allocation, capital accumulation and technological innovation (Levine, 2005; Ang, 2008; Beck, Demirgüç-Kunt and Levine 2010; Arayssi and Fakih, 2017). In this regard what causes financial uncertainty and how it effects the growth are major questions.

There are two main hypotheses which focus on finance-growth nexus. One of them is 'supply-leading' hypothesis which postulates that financial system efficiency leads high economic growth6. On the other hand, the second one is, though there is not too much evidence on it, “demand-following hypothesis” which postulates a causal link from economic growth to financial development7.

6See for example: Schumpeter (1911); Hicks (1969); Levine and Zervos (1998); Arayssi and Fakih (2015); Chow, Vieito and Wong (2019).

7 See for example: Robinson (1952); Kuznets (1955); Friedman and Schwartz (1963); Abosedra and Fakih (2014).

23 Indeed, supply-leading hypothesis also named as “finance-led growth hypothesis” and “demand-following hypothesis” also named as “growth-led finance hypothesis” (Nyasha and Odhiambo, 2018).

One focus area of “supply-leading hypothesis” is foreign direct investment side. The inflow of capital on direct investment is a sign of financial development but the relationship between these variables are not overt according to the literature. FDI and growth performance are highly correlated in some countries (see for example: Aduda, Chogii and Murayi, 2014; Quinonez, Saenz and Solorzano, 2018; Hayat, 2018). To illustrate, Ayaydın (2010) states that, there is a one-way relationship between these variables, author states that foreign direct investment causes economic growth a percent. On the other hand, Acar (2016) shows that there is no statistically important relationship between these variables in Turkey.

There are some other theories which focus on finance-growth nexus. These are “feedback hypothesis”, or the ‘bi-directional causality” which hypothesizes a two sided causality between financial development and economic growth (see for example: Marques, Fuinhas and Marques, 2013) and “neutrality hypothesis” which assumes no causality between financial development and economic growth8. To wrap up, these theoretical diversifications stem from the dynamic empirical literature which show the interaction of financial development and economic growth vary in each country (Nyasha and Odhiambo 2018).

King and Levine (1993) make a clear summary of Schumpeter’s (1911) idea and give more evidence about growth and financial development nexus. The banks and other financial institutions have an intermediary function between innovators and owners of capital. Hence, the bank loans create the new combination “innovative ideas” that causes economic growth for benefit of the whole society (Zhang and Chen, 2015). On the other hand, 2018’s nobel prize economist Romer (1990) also thinks about this relationship and writes that creative destruction leads technological change and so growth.

8 See for example: Sahay et al (2015).

24 With this regard, “too much finance” literature also exists9. The theory studies on how much finance is supportable for sustainable economic growth. The empirical results give evidence about that there is a threshold effect in the finance–growth relationship. To pure and simple, there is a clear threshold; beyond this optimal level, too much finance is inevitably harmful for economic growth and emphasize that an ‘‘optimal’’ level of financial development is more vital to achieve sustainable economic growth (Law and Singh, 2014).

As financial development increases up to a threshold point which is approximately half percentage, impact on growth of financial development increases whereas the impact starts to decline at the right of optimum level. To illustrate, the impact of the financial development is so minimal in the developed countries such as Japan and US, but it is high in low income countries (Sahay et al, 2015).

The openness of financial markets in emerging economies improve the liquidity conditions for financial market and hence financial institutions invest in riskier assets (Lee and Chou, 2018). On the other hand, financial openness which is integration of a country in global goods and capital markets may flourish financial development (Rajan and Zingales, 2003). To illustrate, robust higher trade openness enhances expansion in credit volume and reduction in the both cost and risk of credit (Ashraf, 2018). Moreover, this kind of financial development can be a driver of economic growth.

Financial openness improves liquidity conditions in the domestic market. Beside this, the impact of the financial openness on the emerging markets has more crucial role than the developed markets (Lee and Chou, 2018). Furthermore, financial openness gives important tools for effective monetary policy and stabilize macroeconomic environment (Mendonça

and Nascimento, 2018). There are also institutional effects on financial openness. Openness of stock and bond markets, namely financial openness may cause to better quality of such relevant institutions (Kant, 2018). Besides this financial openness can affect financial variables such as exchange rates. For instance, financial openness can decrease the negative effect of exchange rate flexibility on growth rate uncertainty (Rodriguez, 2017).

9 See Arcand, Berkes and Panizza (2015).

25 In order to clarify the role of uncertainty in the financial development concept we examine how financial development is measured. Sahay et al (2015) give a detailed framework of financial development. They stress financial development have influence on saving, resource allocations (that is investment) and risk appetite, these are also channels for growth-finance nexus. Their method which is also used by IMF in order to measure financial development construct an index. This index has three pillars which focus on financial depth, financial access and financial efficiency in both institutions and market side.

Table 1. 1: Financial Development Components

D e p t h A c c e s s E f f i c i e n c y

Financial Institutions

Private Sector Credit to GDP

Pension Fund Assets to GDP

Mutual Fund Asset to GDP Insurance Premium to GDP Commercial Banks Branches per 100.000 adults ATM per 100.000 adults Net Interest Margin Lending-Deposit Spreads Non interest Income to Total Income Return on Assets Return on Equity Financial Markets Stock Market Capitalization to GDP Stocks traded to GDP International Debt Securities of Government to GDP

Total Debt Securities of non-financial firms to GDP

Total Debt Securities of Firms to GDP

Percent of Market Capitalization of top ten firms

Total number of issuers of debt Stock Market Turnover Ratio Source: Sahay et al (2015)

26 Moreover, as a denominator, GDP has an important role in index, the fluctuation on GDP creates uncertainty and impact the financial development. Financial development has a role in banking crises with some channels (Mathonnat and Minea, 2018). Besides this financial development has an influence on R&D expenditure and leads growth (Maskus, Neumann and Seidel, 2012).

The well-organized IMF report gives some revisiting of finance-growth nexus and stylized facts on finance-growth nexus (Sahay et al (2015). These are:

There is a statistically limited relationship between finance and growth. The curve of growth and financial development is a bell-shaped one which means from a point the relationship turns negative.

This fact emphasize too much finance is unusual, once more. Aftermath of latest global financial crisis it can be seen too much paper about on this debate. Panizza (2018) also looks over this inverted relationship in a critical perspective and pinpoint the importance of drives of this link. He reports that crisis, misallocation of talents, different types of finance and financial instruments and politic environment can be reasons of the crisis.

The finance-growth nexus is independent from income level of country the opposite of common belief and mainly depend on financial deepening rather than financial efficiency and financial access pillars.

The momentum of financial development is important because deepening in financial institution may be driver of financial instability.

The financial development’s effect on financial stability is not clear whether it promotes or not.

27 CHAPTER 2

THE ANALYTICAL FRAMEWORK OF ECONOMIC POLICY UNCERTAINTY INDICES

Aftermath of global financial crisis, the early warning systems on state of economy become important. In order to understand the trend and structure of state of economy and sentiment of decision makers both academicians and professionals try to develop new tools. Economic Policy Uncertainty Indices are popular examples of them. These indices are used in many academic paper and investor analysis. In this chapter we review Economic Policy Uncertainty indices from A to Z by focusing a specific one.

2.1. The Structure of Economic Policy Uncertainty Indices

Global Economic Policy Uncertainty (GEPU) Index is combination of 20 independent country indices. The country indices which are the components of GEPU come from developed countries, namely Australia, Canada, France, Germany, Ireland, Italy, Japan, the Netherlands, Spain, Sweden, United Kingdom and the United States and emerging ones, namely, Brazil, China, Chile, Greece, India, Mexico, Russia, South Korea. The weight of each country in an GEPU index depends on the country’s GDP weight in total GDP of sample countries. Indeed, the construction process of GEPU Index is dynamic and ongoing process because Baker, Bloom and Davis10 (2013, 2016) makes innovation in the index via adding new countries or term sets continuously (Policy Uncertainty, 2018).

The GEPU Index is a good proxy to detect global uncertainty because the sample countries of it consists approximately seventy-five percentage of world GDP so the GEPU Index demonstrates the general tendency of global economy. Besides this advantage, some of the sample countries are also key to understand global economy.