ТЫЕ IMPACTS OF GLOBAL CRISES ON DEVELOPING ECONOMIES: THE CASE OF TURKEY

A Master’s Thesis by SEVİNÇ TEKİNDOR Department of International Relations Bilkent University Ankara July 1999

t i

T g

THE IMPACTS OF GLOBAL CRISES ON DEVELOPING ECONOMIES: THE CASE OF TURKEY

The Institute of Economics and Social Sciences of

Bilkent University

by

SEVİNÇ TEKİNDOR

In Partial Fulfillment of the Requirements for the Degree of MASTER OF INTEIWATIONAL RELATIONS

in THE DEPARTMENT OF INTERNATIONAL RELATIONS BiLKENT UNIVERSITY ANKARA July 1999

Approved by the Institute of Economics and Social Sciences. Prof Dr. Ali L. Karaosmanoglu

I certify that I have read this thesis and have found that it is fully adequate, in scope and quality, as a thesis for the degree of Master of IR in International Relations.

Asst. Prof Dr. Giilgiin Tuna Thesis Supervisor

I certify that I have read this thesis and have found that it is fully adequate, in scope and quality, as a thesis for the degree of Master of IR in International Relations.

Asst. Prof Df. Nur Bilge Criss Examining Committee Member

I certify that I have read this thesis and have found that it is fully adequate, in scope and quality, as a thesis for the degree of Master of IR in International Relations.

Asst. Prof Dr. Mustafa Kibaroğlu Examining Committee Member

ABSTRACT

Tekindor, Sevinç

M.A., Department of International Relations Supervisor: Asst. Prof Dr. Gülgün Tuna

THE IMPACTS OF GLOBAL CRISES ON DEVELOPING ECONOMIES: THE CASE OF TURKEY

July 1999

In this thesis, after explaining the development of Asian crisis, an attempt is made to show how the Asian crisis affected the Turkish economy within the framework of deficiencies of developing countries during the economic globalization process. Here, it is aigued that globalization in itself is not a bad thing for developing countries, but rather, ‘imperfect globalization’ creates problems for them as the recent Asian crisis demonstrated. Although the Asian crisis did not cause total collapse in the Tmkish economy, it triggered discussions about overhauling of the current economic policies. Without structural adjustments and revision of outmoded mechanisms, no country can be able to catch up with developed countries and benefit from riclmess that globalization promises to bring.

Keywords: Globalization, Finance, Asian Crisis, Turkey, Financial Crisis, East Asia

ÖZET

KÜRESEL KRİZLERİN GELİŞMEKTE OLAN EKONOMİLERE ETKİLERİ: TÜRICİYE ÖRNEĞİ

Tekindor, Sevinç

Yüksek Lisans, Uluslararası İlişkiler Bölümü Tez Yöneticisi: Yrd. Doç. Dr. Gülgün Tuna

Temmuz 1999

Bu çalışmada, Asya krizinde yaşanan evreler üzerinde durulduktan sonra, gelişmekte olan ülkelerin ekonomik küreselleşme sürecine uyum eksiklikleri ele alınmış ve krizin Türkiye ekonomisini nasıl etkilediği, bu genel çerçeve içinde değerlendirilmiş; gelişmekte olan ülkelerde sorunların asıl kaynağını bir bütün olarak küreselleşmenin değil, Asya krizinde de görüldüğü gibi “dengesiz küreselleşme” nin oluşturduğu tartışılmıştır. Her nekadar Asya krizi Türkiye ekonomisinde toptan bir çöküşe yol açmamışsa da, halihazırdaki ekonomik politikaların gözden geçirilmesi sürecim hızlandırmıştır. Bu tez, gelişmekte olan ülkelerin gelişmiş ülkeleri yakalayabilmeleri ve küreselleşmenin getirilerinden yararlanabilmeleri için ekonomilerinde modası geçmiş düzenlemeleri yeni baştan ele alarak yapısal ayarlamalar yapma gereğini ortaya koymaktadır.

Anahtar Kelimeler: Küreselleşme, Finans, Asya krizi, Türkiye, Finansal kriz. Doğu Asya

ACKNOWLEDGMENTS

I would like to express my deep gratitude to my supervisor Asst. Prof. Dr. Gulgun Tuna for her guidance, suggestions and valuable encouragement throughout the development of this thesis.

I am also very much indebted to Mr. Brian Rodrigues for both his moral support and helps in the editing of this thesis.

I would like to thank Asst. Prof Dr. Nur Bilge Criss and Asst. Prof Dr. Mustafa Kibaroglu for reading and commenting on this thesis and for the honor they gave me by presiding the jury.

I feel deeply thankful to my mother and father, who have never ceased to support me in every single moment of my life, for their understanding and

encouragement during my graduate studies. I will never forget the efforts of my parents in motivating me when I was under distressful conditions during the process of writing this thesis.

My sincere thanks are extended to my friends, of whom Firas Jabloun and Tank Oğuzlu come fust for their moral and academic support in development of this study.

TABLE OF CONTENTS

List of Tables...viii List of Figures... List of Abbreviations... ... Introduction... Chapter 1 ... 1. What is Globalization?...51.1. The Historical Evolution of a Global Capitalist Economy...10

1.2. Characteristics of Economic Globalization ... 12

1.3. Repercussions of Globalization... 18

1.4. The Role of Globalization in the Asian Crisis...22

Chapter I I ... 28

2.1. The Asian C risis... 28

2.1.1. The Reasons for the Asian Crisis... 31

2.2. The Russian C risis...42

2.2.1. Russia’s Way Towards Market Economy... 44

Chapter I I I ... 51

3.1. The Consequences of the Crises for the Turkish Economy... 51

3.1.1. Liberalization in Turkey since 1980s... 52

3.1.2. The Impacts of the Crises on the Turkish Economy... 60

3.1.3. Sectoral Analysis... 68

3.1.4. Government Measures to Address the C risis...72

Conclusion... 75

Policy Alternatives for the Turkish Economy...78

Appendix The Chronology of the Crisis... 82

Select Bibliography... 107

LIST OF TABLES

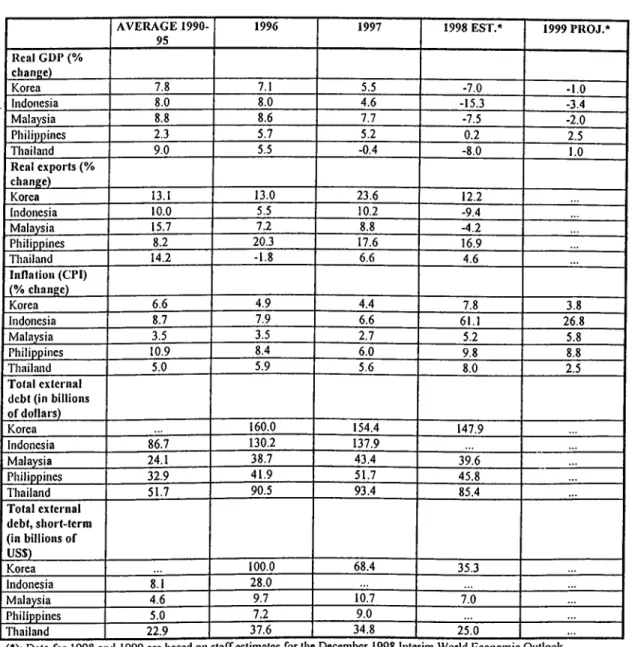

Table 2.1 Some macroeconomic indicators for the crisis countries... 31

Table 2.2 Some features of the Asia-pacific countries... 33

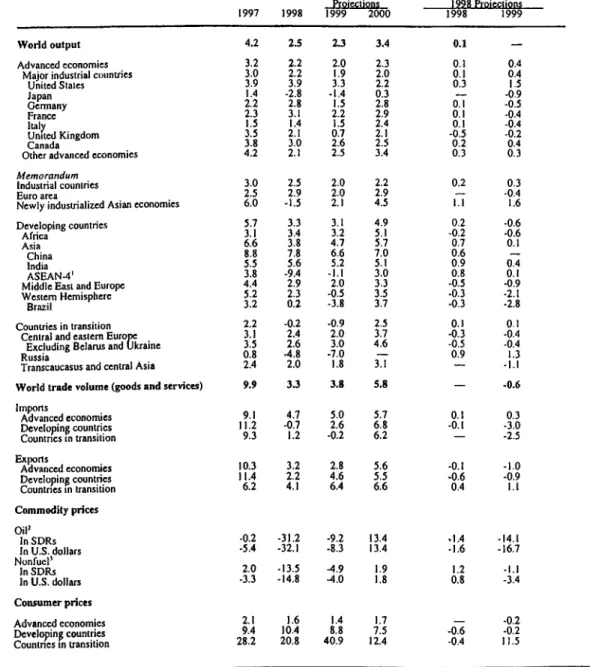

Table 2.3 Overview of the World Economic Outlook Projections...41

Table 2.4 Russian Federation: Recent Macroeconomic Developments and 1999 Baseline Scenario...50

Table 3.1 Real GDP of OECD countries... 59

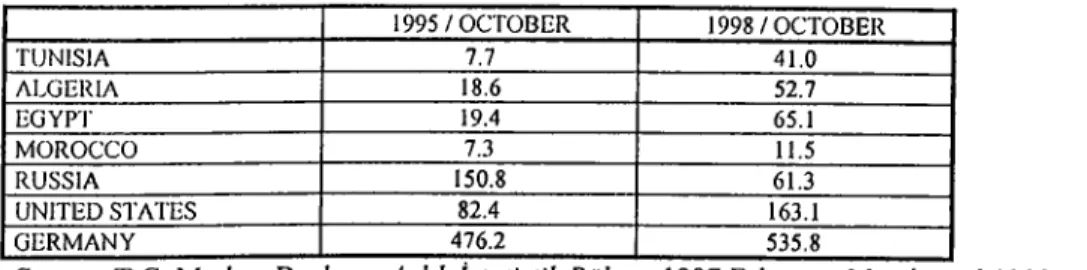

Table 3.2 The Main Trading Partners of Turkey... 61

Table 3.3 Exports to Some Countries... 65

Table 3.4 Clothing, Textile and Leather Exports to Some Countries...70

Table 3.5 Iron and Non-iron Metals Exports to Some Countries... 71

Table 3.6 Demand, output and prices... 72

LIST OF FIGURES

Figure 1,1 World FDI and Trade Flows, 1982-1993 ... 13

Figure 1.2 Macroeconomic Indicators for D C s...25

Figure 2.1 Ratio of short-term debt to foreign reserves, 1994 and 1997...34

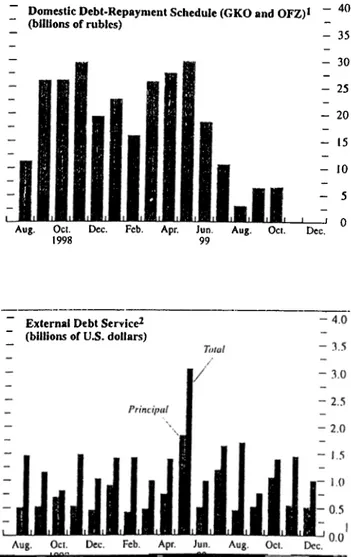

Figure 2.2 Russia: Federal Government Domestic and External D ebt...49

LIST OF ABBREVIATIONS

DCs Developing Countries

DTM Undersecretariat of Foreign Trade DPT State Planning Organization (SPO)

EU European Union

EDI Foreign Direct Investment

GDP Gross Domestic Product

GNP Gross National Product

Goskomstat State Statistics Committee of Russia IMF International Monetary Fund

IMKB Istanbul Stock Exchange NIC Newly Industrialized Countries

OECD Organization for Economic Co-operation and Development SEE State Economic Enterprises

SIS State Institute of Statistics of Turkey

TUSIAD Turkish Industrialists’ and Businessmen’ Association UNIDO United Nations Industrial Development Organization

Introduction

Globalization, an expansion of liberal values, gained momentum in the 1980s. In particular, integration in the world economy and massive improvement in communication and information technologies marked the process of globalization which turned the World into a huge town. Finance is a very significant element of globalization and in the 1990s a certain integration has been created in the financial markets. As a consequence of globalization, cross-border financial movements have rapidly increased both in scale and mobility. The fundamental reasons for this financial globalization are chiefly the improvement in communication and information technologies, which has made financial transactions easier and less costly, and governmental deregulation.'

During the initial period of globalization, the Newly Industrialized Countries’ (NIC) economic growth was remarkable. The East Asian NIC consist of the Four Tigers (Hong Kong, Singapore, South Korea, and Taiwan) and some Southeastern Asia countries like Malaysia, and Indonesia. Since the 1960s, East Asian NIC have been using the export-led growth model in order to achieve economic development. As this is a liberal model, liberals put forward the East Asian

’ Roy E. Allen. 1994. Financial Crises and Recession in the Global Economy, Aldershot; Brookfield, vt.: Edward Elgar, 3-11.

NIC as an example of their success. These “emerging markets” were also shown as a model for the other developing countries.

As a result, nobody was expecting a crisis of such depth and complexity to happen in the region. In July 1997, the so-called Asian crisis started in Thailand with the devaluation of the Thai baht. Then, with a domino effect, it passed on to Malaysia, South Korea, Indonesia, Hong Kong, the Philippines, and Taiwan. Finally, the region became an area of instability. In time, the impacts of the crisis on the other developing countries started to become evident. In Russia, it led to an additional crisis which has had considerable effects on Turkey.

The main purpose of this thesis is to examine the effects of the Asian crisis on Turkey. It is worth mentioning that, it is actually the Russian crisis which has had negative impacts on the Turkish economy resulting from the close economic ties between the two countries. The stabilization program applied by the Turkish government also has played a role in creating economic instability by deepening the effects of global crisis.

In the first chapter, the main goal is to analyze the trend of globalization in the world economy through a historical view. After defining variou.s meanings of globalization, I will particularly emphasize economic globalization.

After describing major tenets of economic globalization, especially with its repercussions on developing countries, the main focus will turn to the Asian crisis of

developing countries and the world economy. The Asian Crisis is explained as a typical example to show the distortions of imperfect globalization. Moreover, the Russian crisis has been cited as it has affected Turkey through the close economic links between these countries. The Russian crisis is a showcase highlighting how the economy oi a country can collapse due to an economic crisis occurring in another region as a result of the increased integration among the countries. ‘What are the reasons for the emergence of the Asian Crisis?’; ‘How did the crisis evolve?’; ‘How did the Russian crisis start and develop?’ and ‘How was Russia integrated to the global economy?’ will be the major questions to be answered here.

In the third chapter, the main focus will be turned to Turkey in order to show the effects of the Asian crisis on its economy. Rather than the crisis in the Far East, its repercussions on Russia affected Turkey, for Russia is one of the biggest trading partners of Turkey whereas Turkey’s trade volume with the Far East Asia, save Japan, does not constitute a significant value. While highlighting the impacts of the Asian crisis on Turkey, I also aim at explaining the process by which Turkey was integrated to the global world economy. Therefore, the chapter includes a brief description of the economic integration of Turkey and the mechanisms of globalization in Turkey. There will also be an evaluation of the degree of integration that the Turkish economy has achieved. Depending on this factor, the impact of the Asian via the Russian crisis on the Turkish economy will be analyzed. The major sectors of the Turkish economy which have been affected by the crisis—due to their high degree of integration into the world economy—will also be described.

The conclusion section will be an overall evaluation of the preceding parts with a view to prescribing some recipes for developing countries—mainly Turkey, which want to be exempted from the negative repercussions of economic globalization.

In constructing the thesis a variety of sources are utilized. In addition to books and journal articles, which cover the process of economic globalization, official sources, such as publications of state institutions and reports of international economic institutions are also cited. Another important source of information concerns newspapers and magazine articles, for the crisis has been very recent and the number of academic studies, covering the issue, has not been sufficient to rely on. However, it must be noted that the Asian Crisis is a very difficult topic to analyze as it is still continuing and its effects on different countries are not fully known yet. Although this thesis is dealing with the most up-to-date consequences of the crisis on the Turkish economy, it should be admitted that there can be changes in the findings by the time that new data on the crisis are gathered.

CHAPTER I

1. What is Globalization?

Since the development of capitalist economy for centuries and its spread from its original landscape, namely Europe, to other parts of the world, the international society has been characterized by globalization. The universalization of the capitalist economic principles all over the world, especially since the victory of the largest capitalist state—the USA—in the Second World War, accelerated the process of globalization in numerous areas. Globalization gained momentum in the twentieth century with repercussions on various aspects of life. One should not confine the effects of globalization only to the field of economics; instead, it is a fact today that the world is experiencing this trend in many spheres, such as culture, society, and politics.

Nevertheless, the aim of this chapter is not to discuss the full details of the globalization process, but to figure out first its evolution, and second, to describe the characteristics of globalization particularly with respect to economics. In doing this, major attention will be paid to the fundamental features of the globalization process with a view to highlighting both positive and negative attributes. The main argument in this section is that globalization should not be taken as a fact that bolsters the

economic development of many developing countries; instead, it may possess many alarming features for these countries, which aim at catching up with the industrially developed countries. If one wants to understand the effects of the latest Asian crisis on the developing countries, particularly over Turkey, she/he should comprehend the process by which developing countries became integrated with the international economy. In this study, an attempt will be made to understand this mechanism.

Before investigating the ‘globalization’ concept, it will be beneficial to understand what the word ‘global’ refers to. Richard O’Brien, in his book entitled

Global Financial Integration: The End o f Geography, puts forward the differences

among the words international, multinational, and global in order to eliminate the confusion that sometimes occurs in their usage.

International means activities taking place between nations... multinational describes activities taking place in more than one nation...global should refer to operations within an integral whole, if it is to have a separate meaning from the foregoing terms. Global combines the elements of international and multinational with a strong degree of integration between the different national parts...A truly global service knows no internal boundaries, can be offered tlii'oughout the globe, and pays scant attention to national aspects. The nation becomes irrelevant, even though it will still exist. The closer we get to a global, integral whole, the closer we get to the end of geography.^

^ Richard O ’Brien. 1992. Global Financial Integration: The End o f Geography. London: Royal Institute o f International Affairs, 5.

In its simplest form, globalization indicates the economic, social, political and cultural integration of the world. As stated by Rana E§kinat, “in order to understand globalization, a good start would be to imagine a world without any borders”. During the globalization process, ideological polarization disappears, cross-border economic transactions increase, liberal values spread, and the cultures and belief systems of different nations become known worldwide. Moreover, “the universalization of political systems, democracy, human rights, religion and secularism, and environmental issues can all be considered in the globalization concept”.'*

Although globalization has taken place in various forms, ranging from politics to culture, the clearest effects of this trend are seen in the field of economics. As stated by Nunnenkamp and Gundlach, “globalization refers to an evolving pattern of cross-border activities of firms involving international investment, trade and cooperation for purposes of product development, production and sourcing, and marketing”.^

While the repercussions of the development of a global economy have been observed since the 1970s, the traces of political globalization might be backed to the end of the Cold War. As communism left the political agenda in the aftermath of the dissolution of the Soviet Union, the liberal democracy of the West began to reign in

^ Rana Eşkinat. 1998. Küreselleşme ve Türkiye Ekonomisine Etkisi. Eskişehir; Anadolu Üniversitesi, 7. Gül G. Turan. Dünyada Küreselleşme ve Bölgesel Bütünleşmeler Alt Komisyomu Raporu. Özel İhtisas Komisyonu Raporu - Ek 1. Aralık 1993, 1.

^ Peter Nunnenkamp and Erich Gundlach. Globalization o f Manufacturing Activity: Evidence and Implications fo r Industrialization in Developing Countries. Background paper prepared for Global

the ex-communist territories. The globalization of liberal democracy as the major type of political regime led to the emergence of like-units on the global arena. Some called the triumph of liberal democracy the end of history.^ Some, on the other hand, emphasized the renewed importance of cultural forces—the growing desire to be part of a tribe or civilization that excludes and barely tolerates the rest of the world.^

Although there are many works on the subject of globalization, the concept remains unclear. As James N. Rosenau indicates.

Different observers use it [globalization] to describe or assess different phenomena and often there is little overlap among the various usages. Even worse, the elusiveness of the concept globalization is seen as underlying the use of a variety of other similar terms: world society, interdependence, centralizing tendencies, world system, globalism, universalism, internationalization, globality— these are also viewed as buzz words that come into play when efforts are made to grasp why public affairs today seem significantly different from the past.*

In one sense, globalization is a development beyond the nation-state. It also defines a new type of opposition between capital and labour brought about by the rise of finance capital. It also refers to the separation between skilled and unskilled

Forum on Industry: Perspectives for 2000 and Beyond, New Delhi, India, 16-18 October 1995, UNIDO, 1.

® For the arguments about the liberalization o f the world economy and the end o f history see, Francis Fukuyama. 1992. The End o f History and the Last Man. New York: Free Press.

For a detailed explanation o f cultural globalization see, Samuel Huntington. 1996. The Clash o f Civilizations and the Remaking o f World Order. New York: Simon and Schuster; and Robert Kaplan.

1996. The Ends o f the Earth: A Journey at the Dawn o f the 2T' Century. New York: Random House. * See, James N. Rosenau, “The Dynamics o f Globalization: Toward an Operational Formulation”,

labour. In another sense, it refers to the expansion of world trade with the inclusion of new players from developing countries. As mentioned above, the main area of focus in this study is economics. Globalization is meant to be a kind of systemic transformation of the world economy that will result in new structures and new modes of functioning.

Globalization entails two interrelated, technologically driven phenomena. First, dramatic increases in the cost, risk, and complexity of teclmology in many industries render even the largest national markets too small to serve as meaningful economic units. Second, and more important here, the emerging global world economy is electronic, integrated through infonnation systems and technology rather than organizational hierarchies.^

Economic globalization assumes that firms are not confined to their own national markets and produce to sell to the world. This kind of trans-boundary economic transaction eliminates the boundaries among states and contribute to the emergence of similar economic units all over the world with a goal of producing and selling both in domestic and external markets. When the kind of production becomes global, the authority of the state over economic units diminishes. This logic, influenced by the writings of Karl Marx and Friedrich Engels, sees globalization as the last stage of capitalism, “which is eroding the power and autonomy of the nation state, either through assimilation into a homogeneous global culture or the violent rejection of it.”‘° The obvious decline in state power and the spread of capitalism to

’ Stephen J. Kobrin, “Back to the Future Neo-medievalism and the Post-modern Digital World

'Economy", Journal o f International Affairs, Spring 1998, Vol.51 Issue.2, 361.

'® Daniel Drezner, “Globalizers o f the World Unite!”, Washington Quarterly, Winter 1998, Vol.21 Issue 1,210.

various parts of the globe point to the capitalistic nature of globalization.' Today, it goes without saying that the triumph of capitalism is beyond any doubt.

1.1. The Historical Evolution of a Global Capitalist Economy

Looking at globalization from the angle of capitalism requires a brief examination of the historical evolution of the capitalist economy in order to comprehend the true nature of the global economy of today. After the transformation of economic structure from feudalism to capitalism with the advent of the sixteenth century, capitalist principles began to dominate economic activities, particularly in its place of birth—Europe. Market oriented production designs replaced the ‘self sufficiency’ of feudal production. People began to produce not only for their needs but also for the market. This led to accumulation of wealth in the hands of people, who, in turn, tried to invest this wealth in every possible place. At the beginning, the boundaries of the markets were national. People were producing in order to satisfy the needs of their nationals. With the advent of the Great Industrial Revolution, there took place immense increases in production. The domestic markets were not enough for the capitalist firms. In order to find both new markets for their goods and new places for investing the surplus wealth, a period of colonialization started. Lenin’s theory of imperialism deals with the development of capitalism beyond the frontiers of its home, Europe. Together with the spread of capitalism to various parts of the world, a sort of global economic order, which was based on the major principles of capitalism, began to evolve. This trend reached a climax in the post-Second World War era with

the establislimeiit of the Bretton Woods system. The major economic adjustments of the post-War era were made with a view to regulating all economic activities along the rules of capitalism.

'I'o describe the process of the globalization of finance, Gilpin proposes a tluee-stage evolution. The first stage covers the period between 1870 - 1914, during which the global financial flow of capital was ruled from London, and England was the most important finance exporter. The second stage covers the inter-war period, 1920 - 1939, during which the United States began to replace of England as the global finance exporter. However, the great depression of the 1929 indicated the weaknesses of the regulation of global financial movements. The period since 1947 is the last stage in which the leadership of the United States was confirmed with New York being the financial capital of the world. The creation of international financial institutions helped the globalization of the world economy alongside the principles of capitalism.II

However, if globalization refers to the superiority of finance over industry, its real roots go back to the dissolution of the Bretton Woods System in the first half of 1970s.

The growth of what constitutes ‘global finance’ occurred as a result of the decline and breakdown of Bretton Woods ‘Golden Age’. Fundamental to this decline, was the breaking of the stability conditions of Bretton Woods. In combination with the dollar’s weakened international role, oil rent hikes, growth of petro-dollars and Third World debt, a heady brew

" Robert Gilpin. 1987. The Political Economy o f International Relations. New Jersey: Princeton University, 3 0 8 - 3 1 4 .

was created which matured in the 1980s under a global' rubric.

This creation had a simple material necessity; to absorb excess dollar deposits by creating forms of financial liability to fund industrial development and restructuring in the developing world.

What is understood by globalization today is to a great extent the reign of finance all over the world. All international adjustments are aimed at providing finance with easy access to everywhere. For example,

the clauses of the General Agreement on Trade and Tariffs (GATT) or the World Trade Organization (WTO) go far beyond the traditional objectives of fair-trade agreements. Their primary objective is to promote capital mobility. The agreements they reach are actually not so much fair-trade agreements as agreements for the free circulation of funds, with the intention to establish new international property rights for foreign investments and to create new limits to national and govermnent regulations.'^

1.2. Characteristics of Economic Globalization

One of the most obvious features of economic globalization is the explosion of financial exchange. One indication that shows this trend is the amount of increase in

Leslie Budd, “Globalization, Territory and Strategic Alliances in Different Financial Centers”,

Urban Studies, March 1995, Vol.32 Issue.2, 348.

the overall financial flows between 1960 and 1989. During this period, the exchange of manufactured products doubled while the flow of capital increased fourfold (see Figure 1.1).

Figure 1.1 World FDI(a) and Trade(b) Flows, 1982 - 1983

Source: Nuniiciikanip and Guiidlacli, 1995, UNIDO.

(a) Total FDI outflows

(b) World merchandise exports plus exports of commercial services.

Today a kind of global economy has emerged with an increasing sliaie of GNP directly dependent on foreign exchange and international financial capital flow. Nowadays, it is obvious that the finance sector has supremacy over industry.’'* Another example of the explosion in financial exchange is the turnover rate in the London Eurodollar market. While the turnover rate in the entire year of 1970 was $59 billion, the turnover rate on an average working day reached to $900 billion by the mid-1980s.15

Leslie Budd, 1995, “Globalization...”, 348.

Roy E. Allen. 1994. Financial Crises and Recession in the Global Economy, Aldershot; Brookfield, vt.: Edward Elgar, 1.

The other important characteristic of economic globalization is seen in the growing role of computers and electronics in the financial sector.

By reducing the cost of long distance transactions and permitting communication in ‘real time’ anywhere in the world, thus providing instantaneously information crucial to price structuring—information that used to take weeks to reach a few financial centres—the new communication tecluiologies have made possible an unprecedented financial flow. Currency moves from one end of the globe to the other, searching for the best returns at the speed of lights.'®

In the globalization of finance, government deregulation played an important role. The abandonment of market protectionism, the removal of ceiling on interest rates, reduction of taxes and brokerage commissions on financial transactions encouraged foreign financial firms and multinational corporations to invest abroad.'^

An important feature of globalization is the monopolization of capital at the hands of multinational companies. Today the major players in the world economy are not the states that used to dominate almost every sphere of life in times of modernity. Since the advent of the Westphalian state system in 1648, up until the begimiings of 1970s, the state was the dominant actor in the field of economics as well as others. Currently, the multinational corporations dominate investment and trade, while financial markets dictate the rules and the banks control the financial sector.'* With the increasing role of multinational companies, a new principle entered into the

Alain de Benoist, 1996, “Confronting...”, 119. Roy E. Allen, 1994, Financial...,2 -6 .

vocabulary of economics, “deterritorialization of capital”. T h e new understanding does not recognize any barriers before the flow of capital across borders.

In other words, the territory is being replaced by network, which no longer corresponds to particular territory but is inscribed within the world market, independent of any national political constraints. For the first time in history, economic and political spaces are no longer bound together. This is the deeper meaning of globalization.^®

With globalization, the market has turned out to be universal. Firms produce their goods with a view to selling them in as many places as possible. Domestic market-oriented production models of the nineteenth and early twentieth centuries are being replaced by an export-oriented production type. The amazing financial power of these multinational corporations is illustrated by the financial resources at their disposals. “The budget of General Motors ($132 billion) is greater than the GNP of Indonesia; Ford’s ($100.3 billion), greater than the GNP of Turkey; Toyota’s greater than the GNP of Portugal; Unilever’s greater than the GNP of Pakistan; Nestle’s greater than the GNP of Egypt”.21

In addition to the growing role of non-governmental trade companies, international institutions of governmental character have also increased their leverage over the functioning of international economics. It is no secret any more that the International Monetary Fund (IMF), the World Bank, and the World Trade

'’ Alain de Benoist, 1996, “Confronting...”, 122. Alain de Benoist, 1996, “Confronting...”, 123. Alain de Benoist, 1996, “Confronting...”, 123.

Organization (WTO) are the major actors in the world economy?^ In today’s economic order, the main function of these international institutions is to regulate the world economy in line of the capitalist principles and to set the stage for integration of developing countries with the developed ones. The increasing role of these institutions in internal affairs of states’ puts the latter in a position of ‘recipe- receiver’ whenever things go wrong at home. The economic crises in developing countries, such as the 1996 Mexico crisis and the 1994 Turkey crisis, have witnessed the interference of the International Monetary Fund in the domestic policies of these countries. If such countries aim at relieving the burdens of economic crises, they have to implement recipes of international institutions, such as the IMF and the World Bank.

The increasing role of international institutions is accompanied by a relative decline in the authority of states. Since the Treaty of Westphalia, the major unit of international relations has been the state. Sovereignty of the state over the territory it rules has remained unchallenged up until the emergence of non-state actors, which have potential sources of authority. In fact, the competence of state authority has been called into question since the advent of the post-War period in 1945. The establishment of international institutions, inter-govermnental organizations, non state actors and supranational organizations began to question hitherto well- established state authority after international economics began to globalize.

For the influence o f governmental international institutions see, Michael Tänzer, “Globalizing the Economy: The Influence o f the International Monetary Fund and the World Bank”, Monthly Review: An Independent Socialist Magazine, September 1995, Vol.47, 1-15.

The main reason for the decline of state authority can be attributed to the vulnerability of the state’s decisions to the policies of non-state actors. No state, today, can take and implement economic decisions independent of the dispositions of multinational corporations, which operate in more than one country and adjust their economic policies in accordance with the economic policies of the countries where they are located. Multinational corporations are free to move across countries in search of the cheapest labour, the low-protected economic environment, the lowest taxes and the most generous subsidies. “There is no longer any need to identify themselves [multinational corporations] with a nation or to allow a sentimental attachment to hinder their projects. They are totally out of control”. Such change in state authority is revolutionary in the sense that it undermines one of the foundations of modern politics: national sovereignty. According to Badie,

globalization... destroys sovereignties, cuts tlirough territories, abuses established communities, challenges social contracts and renders obsolete earlier concepts of international security...Thus sovereignty is no longer the undisputed fundamental value it was, while the idea of outside interference slowly but surely changes connotation.^**

In addition to multinational corporations, regional institutions also challenge the authority of the state. For example, the European Union, as a kind of supranational institution, presides over its member states particularly in regard to economics.^^

Alain de Benoist, 1996, “Confronting...”, 130.

Quoted in Alain de Benoist, 1996, “Confronting...”, 130. Bertrand Badie, “Mondialisation et Société Overte”, Apresdemain, April - May 1996, 10.

The signing of the Maastricht Treaty solidified the authority of the Union’s various organs at the expense of the member states. In financial matters the Union requires an authority over that of the state. Given the fact that regional unifications or gathering of states under a common authority is a kind of globalization movement, the challenge of state authority brings into question the loyalties of individuals. For example, a Belgian citizen can sue his/her state before the European Court of Human Rights for any grievances brought about by the actions or decisions of that state.

Singular territorially-based authority is also compromised by the increased importance and power of international institutions, which, in turn, reflect the fact that many problems facing states at this point, such as the environment, crime, corruption, the spread of disease and maintenance of an open international system of trade and investment, camiot be solved nationally. Non-state actors have also rendered political authority ambiguous. Dramatic advances in telecommunications, in particular, the convergence of telecommunications and computers, have been a prime cause of the increased number of NGOs such as Amnesty International, Transparency International and Green Peace, all of which have a significant role in manipulating domestic politics of states.

1.3. Repercussions of Globalization

As to the repercussions of globalization on the world economy, including the developed and the developing countries, there are chiefly two different views. Optimists regard the triumph of international capitalism as lai'gely a positive

development. Governments may have lost some of their freedom in directing economies as they wish, but the world is benefiting from faster teclmological progress, historically unprecedented opportunities for the relief of global poverty, and greater freedom for millions of people across the globe.^^

The pessimists agree on the need for a balance between an effective state and the economic efficiency that market forces can provide. 7’hey also agree that market forces, for reasons of teclmology and ideology, have lately gained the upper hand. But unlike the optimists, the pessimists find this deeply disturbing. In their view, the gains from globalization are far smaller than the optimists suppose, and the drawbacks much greater. And such benefits, as there may be, will be divided unfairly within society—a crucial point that the optimists tend to ignore. The new global capitalism, the pessimists concede, will certainly emich many—but capitalists rather than workers. Moreover, those who get paid less among the workers will be the unskilled. Globalization will widen inequality, exacerbate poverty and increasingly lead to social exclusion27

Within this general characterization of the effects of globalization, this thesis argues that the arguments of the pessimists hold truer than those of the optimists. The first indication that supports the view of the pessimists relates to the increased economic disparity between the developed and the developing countries. The gap between the average GNP of the developing countries and that of the developed ones has widened during the last 25 years.

“The Future o f the State”, Economist, September 20 1997, Vol.344 Issue.8035, 6. “The...”, Economist, 1997, 6.

Polarization among countries has been accompanied by increasing income inequality within countries. The income share of the richest 20 per cent has risen almost everywhere since the early 1980s, in many cases reversing a post war trend. In more than half of the developing countries, the richest 20 per cent today receive over 50 per cent of the national income. Those at the bottom have failed to see real gains in living standards and, in some cases, have had to endure real losses. In many countries, the per capita income of the poorest 20 per cent now averages less than one tenth that of the richest 20 per cent.^*

Another indication that shows the disparity between developed and developing countries relates to the rates of GNPs. “The real GNP per person in the Southern hemisphere today is only 17% of that in its Northern counterpart. The industrial world, which represents only a quarter of humanity, possesses 85% of the world’s wealth.”^^ While the rich countries have got richer, the poor countries have become poorer since the 1970s. “In 1965, the average per capita income of the G-7 countries was 20 times that of the world’s poorest seven countries. By 1995, it was 39 times as niuch.”^°

While globalization leads to the widening of the gap between rich and poor countries, it also exacerbates the living conditions of the masses in developing countries. The best suitable working conditions for multinational companies require the cheapest labour, the lowest taxes and the most generous subsidies. The states which implement such regulations, attract more multinational corporations for

Ruben Ricupero, “Growth and Globalization”, UN Chronicle, 1997, Vol.34 Issue.4, 43. Alain de Benoist, 1996, “Confi'onting...”, 127.

investment. Wherever liberal adjustment has been made, the results have been a worsening of the masses’ living conditions and an increase in social instability. As for countries that refuse to satisfy these demands, they are simply marginalized, ignored and finally expelled from international circuits. As countries become more integrated into the global economy, the living conditions of the masses get worse.

A direct consequence of this reasoning leads to the weakening of the welfare-state of the post-War period. The priority of capital over other components of production led to the erosion of the compromise between labour and capital which was assured by the welfare-state. Globalization of wages and capital reverses the course of economic and social policies prevalent during the decades of post-War growth.

The welfare state was the result of the historical compromise between capital and labour. It was a strategic adjustment of capital to meet a number of social demands. Globalization broke this social contract. Beginning in the 1970s, the economic logic of capitalism began to discomiect itself from social preoccupations, which led to the questioning of the hierarchy of wages and of mechanisms of social cohesion.^^

The question of “how to exploit the allocative functions of self-regulating markets effectively without incurring unequal distribution and social costs that undermine the

For a discussion o f globalizations effects on welfare-states see, Paul Bowles and Barnet Wagman, “Globalization and the Welfare-state: Four Hypotheses and some Empirical Evidence”,

Eastern Economic Journal, Summer 1997, Vol.23 Issue.3, 317-337. 32

integration of liberal societies”” has been the puzzle of the developed world for the last 20 years, as the globalization process accelerated.

Although negative effects of globalization on developing countries are immense, contributions of a global economic enviromnent to the development process of such countries are undeniable. “With small domestic markets, backward technology and inadequate capital, third-world countries have everything to gain from ending their relative isolation and developing close economic ties with the rest of the world.

1.4. The Role of Globalization in the Asian Crisis

Globalization, in its spirit, aims at eliminating the distinction between the developed and developing countries. The main argument that lies behind support for the integration of the developing countries into the world economy indicates that the only way for the developing countries to become developed is to be a part of the global capitalist system. However, the current crisis and problems that the developing countries face shows that globalization contains dangers for the developing countries as interdependency among the countries function to the disadvantage of the developing countries.

” Jurgen Habermas, “Beyond the Nation State”, Peace Review, June 1998, Vol.lO Issue.2,235. “The...”, Economist, 1997, 6.

The countries which are willing to integrate into the global market system have to realize some reforms in order to be eligible for being a part of the global capitalist economy. Jeffrey Sachs, a Harvard professor, has listed the six common points of the reforms as follows: open international trade; currency convertibility; private ownership as the main engine of economic growth, corporate ownership as the dominant organizational form for large enterprises; openness to foreign investment; and membership in key international economic institutions, including the International Monetary Fund (IMF), the World Bank, and the GATT, which is now superseded by the World Trade Organization (WTO).^^

Until the recent crisis, the East Asian countries, which mostly adopted the said reforms, were examples of success for the rest of the world, achieving high growth rates by opening up to the international market. In the last 20-30 years, particularly Hong Kong, Singapore, Taiwan, and South Korea reached a point where they could have been considered as developed countries. A positive coiTelation between the level of globalization and the growth rate was established.

As is stated by Numienkamp and Gundlach, the distinction between the success rates and the ability to attract FDI and international business cooperation of the East Asian countries and the other developing countries rested in the difference between macroeconomic stability, investment, and human capital formation (Figure 1.2). However, the global crisis showed that the integration process of the developing countries into the world economy, particularly the East Asian countries, was imperfect.

As stated in the United Nations’ World Economic and Social Survey, shortcomings and inherited risks of globalization played crucial roles in the emergence of the crisis. One of the shortcomings is the lack of participation of all the countries in the globalization process. And the second is that “international financial flows seemed to seize up in crisis every few years: first in Europe in 1992, then in Latin America in 1994-1995 and currently in Asia”.^*’

With the Asian crisis, some risks of globalization have also become evident. The major one is the vulnerability of the developing countries, which is caused by their integration into the international market. “Countries that have increased the role of international trade in their economies are suffering, to varying degrees, the consequences of a slowdown in trade; exporters are facing a weakening of international prices, particularly for some commodities.”^’

The countries which opened up to the world market, became greatly vulnerable to international capital flows, in particular to short-term ones. The remarkable growth rates that the East Asian countries achieved in the last 20 years prevented these states from realizing the potential dangers of the uncontrolled short term international capital Hows for their economies. When the views are taken into consideration that the global financial transactions are totally out of state control and that finance is completely defenseless against speculative attacks, the fragility of the economies of the developing countries favouring short-term international capital inflows can be better understood.

UN, World Economic and Social Survey 1998, New York: United Nations, xii. ” UN, World... 1998, xii.

Figure 1.2 Macroeconomic Indicators for DCs(a) Inflation^ p c r c c m C lo g s c a l e ) 1000 100 10 1

East Asia South Latin Sub- Central AvSia America Saharan Europe

Africa

Invcslmcnt^

p c r c c n i

30

15

East Asia South Asia Latin America Sub-Saharan Africa Centra! Europe ^ Schooling^ Years 10

East Asia ^ South Latin A sia America Sub- Saharan Africa ^ Central Europe^

Source: Niinnenkamp and Gundlach, 1995, UNIDO.

East Asia: China, Indonesia, Rep. Of Koiea, Philippines, Thailand; South Asia: Bangladesh, India, Nepal, Pakistan, Sri Lanka; Latin America: Areentina, Brazil, Chile, Colombia, Mexico; Sub-Saharan Africa: Cameroon, Cole d’Ivoire, Ghana, Kenya, Tanzania: Ccn^tral Europe: Bulgaria, Hungary, Lithuania, Poland, Romania.

(a) Population weighted averages (b) Annual average, 1980-1992

(c) In percent of GDP, average for 1980-1992, in constant international prices (d) Excluding Lithuania

(e) Average years of schooling of the working age population, 1985 (i) Excluding China

Moreover, an additional cause for the vulnerability of the developing countries during the globalization process was their inability to form proper financial institutions. The unprecedented levels of capital flows with the globalization of the financial markets make it necessary to have institutions to supervise the international capital inflows to the country—for instance, to ensure the profitable use of foreign capital, there should be supervision over the finance sector by the government. If the East Asian countries had been capable of establishing the necessary institutions and mechanisms for the supervision of their finance sector and international capital flows, they might have prevented the crisis.

Finally, the impact of globalization on the contagion of the crisis is worthy of mention. The increased level of integration into the world market led to a collapse in the economies of some of the developing countries, which were also suffering from domestic economic, problems and had close economic ties with the crisis countries. In some other developing economies such as Turkey, even if the Asian crisis did not result in an economic collapse, some adverse effects were still felt. The developing countries which apply export-oriented growth models, are affected severely by the recession in the world economy and by increased international competition in general, and by the worsening economic conditions of the East Asian countries in particular. The countries which are only specialized in a limited number of export goods and have a limited number of trading partners obviously felt the negative impacts of the crisis more than the others. As a last aspect of the role of globalization in the contagion of the crisis, the adverse effects of change in investor confidence on developing economies as a consequence of the crisis in the East Asian countries can be mentioned. The developing countries, which participate in the

globalization process, are highly vulnerable to investor confidence as they are in need of foreign capital in order to finance their economies. When the economies of the East Asian countries collapsed, this development also affected investor confidence in the other developing countries, diminishing the possibility of foreign borrowing and lowering international capital inflow to these countries.

As demonstrated above, although the liberals favour globalization as the only way for the poor countries to develop, the recent crisis has shown that globalization itself can exacerbate economic conditions in developing countries. Therefore, globalization as a whole should not be proposed as a recipe for countries which aim at catching up with the level of developed countries.

CHAPTER II

2.1. The Asian Crisis

The East Asian NIC have been facing a huge and unexpected economic collapse since the summer of 1997, which is now affecting a very large part of the world economy, marking the end of the Asian miracle. For the admirers of the Asian system, a crisis was something very unlikely to occur in that region. Until very recently, they were holding up the Asian model as an example for the other developing countries, but. the crisis showed that the model was not as perfect and useful as it was thought.

In July 1997, the crisis reared its head in Thailand with the devaluation of the Thai baht. With a domino effect—most popularly called ‘contagion’—it influenced Malaysia, South Korea, Indonesia, Hong Kong, the Philippines, and Taiwan. Besides their economies, the financial crisis also affected the political life of the countries. For example, in Indonesia, President Suharto was forced to resign by a public frustrated by the economic conditions.

The crisis in Thailand appeared with the bursting of the bubble in asset prices in the begimiing of the 1990s. When asset prices decreased, the quality of

banks and finance company loan portfolios and balance sheets also deteriorated due to the decline in the “value of borrowers’ net worth”.^*

Another trigger for the crisis was the slowdown in the export growth of Thailand. The appreciation of the dollar against the yen caused loss of competitiveness for Thailand in the international market as its local currency was pegged to the dollar. Coupled with the slowdown in the demand growth of the region as a consequence of the problems seen in the Japanese economy, Thailand’s export earnings diminished, which led to current account problems.

Moreover, pegging the currency to the dollar prevented the local borrowers from being more aware of the foreign currency risk. Therefore, the local borrowers did not hesitate to increase short-term borrowing, which later on became an important factor leading to the crisis. Such developments created loss of investor confidence, increasing the. pressure on the Thai baht. The Thai government tried to defend the exchange rate peg by raising the interest rates and using foreign exchange reserves.

However, on July 2, 1997, the Thai government could no more stand the pressures on the baht. Therefore, the Bank of Thailand announced a managed float of the baht and called on the International Monetaiy Fund for technical assistance. The announcement effectively devalued the baht by about 15-20%.

World Bank, Global Economic Expectations and Developing Countries 1998/99, New York: Oxford, 68.

After the collapse of the Thai baht, the other neighboring countries started to feel the pressure on their currencies. The Malaysian ringgit, Philippine peso, and Indonesian rupiah were allowed to float. Sometime later, in order to regain competitiveness in the international markets a 25-30% devaluation came to force in these currencies. In Korea, the first signs of economic instability showed itself with bankruptcies of huge firms such as Hanbo Steel. In October, Korea was also obliged to devalue its local currency, the won.

Currently, the region is an area of instability. Foreign capital flow to these countries was cut off and the difficult situation in the financial markets caused loss of investor confidence, putting the other developing countries under pressure. In order to restore their economies, the crisis economies started to implement strict finance policies in order to regain lost confidence. For instance, Thailand, on the condition of revising its financial system, accepted emergency-case credit from the IMF.

It is not only the Asian countries who were affected by the crisis. The devaluation of the Asian currencies caused big losses in the stock exchange markets of Germany, the United States, and Russia’s economy collapsed. The stock exchange markets of the Latin American NIC—Argentina, Brazil and Mexico—were also hit by the crisis. The Asian crisis has thus turned into a global slump rather than merely being a regional economic collapse. A chronology of the crisis is presented in the Appendix to provide further detail.

2.1.1. The Reasons for the Asian Crisis

Taking into account the remarkable economic development in the Asia-Pacific countries, a financial crisis was not something expected to occur there. Unlike the countries of the 1994 Mexico crisis, the East Asian countries were not suffering from severe macroeconomic imbalances which could lead to a crisis on such a scale (Table 2

.

1).

39Table 2.1 Some macroeconomic indicators for the crisis countries

AVERAGE 1990- 95 1996 1997 1998 EST.* 1999 PROJ.* Real GDP (% change) Korea 7.8 7.1 5.5 -7.0 -1.0 Indonesia 8.0 8.0 4.6 -15.3 -3.4 Malaysia 8.8 8.6 7.7 -7.5 -2.0 Philippines 2.3 5.7 5.2 0.2 2.5 Thailand 9.0 5.5 -0.4 -8.0 1.0 Real exports (% change) Korea 13.1 13.0 23.6 12.2 Indonesia 10.0 5.5 10.2 -9.4 Malaysia 15.7 7.2 8.8 -4.2 Philippines 8.2 20.3 17.6 16.9 Thailand 14.2 -1.8 6.6 4.6 Innation (CPI) (% change) Korea 6.6 4.9 4.4 7.8 3.8 Indonesia 8.7 7.9 6.6 61.1 26.8 Malaysia 3.5 3.5 2.7 5.2 5.8 Philippines 10.9 8.4 6.0 9.8 8.8 Thailand 5.0 5.9 5.6 8.0 2.5 Total external

debt (in billions of dollars) Korea 160.0 154.4 147.9 Indonesia 86.7 130.2 137.9 Malaysia 24.1 38.7 43.4 39.6 Philippines 32.9 41.9 51.7 45.8 Thailand 51.7 90.5 93.4 85.4 Total external debt) short-term (in billions of US$) Korea 100.0 68.4 35.3 Indonesia 8.1 28.0 Malaysia 4.6 9.7 10.7 7.0 Philippines 5.0 7.2 9.0 Thailand 22.9 37.6 34.8 25.0

(*): Data for 1998 and 1999 arc based on staff estimates for the December 1998 Interim World Economic Outlook,

Michel Camdessus, “Economic and Financial Situation in Asia; Latest Developments”, background paper prepared for presentation in ‘Asia-Europe Finance Ministers Meeting’, Frankfurt, Germany, January 16 1999, 12-13.

When the Asian crisis is analyzed, some common elements such as capital outflows, falling currencies, failing banks, and loss of confidence, can be observed. However, it is still not possible to say that all the crisis countries shared similar features leading to a collapse in their economies. Patrick Artus, Professor of Economics in the University of Paris, prepared a table showing the differences among the Asia-pacific countries (Table 2.2).40

As can be seen from the table 2.2, there are certain differences among the countries in question, so it is not possible to prepare a list of causes which fits to all of the countries. Nevertheless, they have common vulnerabilities. The most striking one is the extensive short-term foreign debt of the financial institutions of the East Asian NIC which are very weak in structure and lack domestic supervision (see Figure 2.1). The fragile financial sector and insufficient domestic governance made the East Asian economies “vulnerable to changes in market sentiment, a deteriorating external situation, contagion” and to speculative attacks.'* *

Patric Artus, Stephan Schulmeister, and Michael Ehrke. “The East Asian Crisis: What Must Be Done”, Internationale Politik und Gesellschaft, Nr. 2/1998, Bonn; Friedrich Ebert Foundation, 208.

'll Timothy Lane, Atish R. Ghosh, Javier Hamann, Steven Phillips, Marianne Schulze-Ghattas, and

Tsidi Tsikata. 1999. IMF-Supported Programs in Indonesia, Korea and Thailand: A Preliminary Assessment, Washington: International Monetary Fund, 6.

Table 2.2 Some features of the Asia-pacific countries

LO

Figure 2.1 Ratio of short-term debt to foreign reserves, 1994 and 1997

250

---200

150

100

East Asia average June 1994:100 Juoe 1997:134

Latin An>erica average June 1994: 93 June 1997: 87 1 o CJ o V a

The large-scale short-term foreign capital gathered by the financial institutions was given as credit to the local businessman who used it in risky projects, without much supervision by the bank. Generally, that capital was not used efficiently. Instead of using it in investment for production, the money was forwarded to real estate. Many hotels, and luxurious buildings were built but there were not enough buyers, so those businessmen who invested their money in these assets faced difficulty when they wanted to recuperate their money.

The factors which allowed the financial sector to behave in such a reckless way are diverse, among them, the lack of domestic supervision and massive deregulation during the financial liberalization. Moreover, the pegged exchange rates heavily encouraged external borrowing and the usage of this money in low-quality investments. The success of the East Asian countries in achieving remarkable growth rates also led to foreign investors willing to invest in these countries regardless of the financial weaknesses these countries have.

Partly because of the large-scale financial inflows that their economic success encouraged, there were also increased demands on policies and institutions, especially those safeguarding the financial sector; and policies and institutions failed to keep pace with these demands. Only as the crisis deepened were the fundamental policy shortcomings and their ramifications fully revealed.'*^

As a consequence of all the factors mentioned above, the financial institutions did not hesitate to deteriorate the quality of their loan portfolios and take part in high-risk projects. Such recklessness caused the financial institutions to be

IMF Staff, “The Asian Crisis: Causes and the Cures”, Finance and Developmenl{\MF), June 1998, V0I .3 5N0.2, 18.

highly vulnerable to a change in the market sentiment and to the depreciation of the local currencies against the dollar. As most of the short-term foreign debt was in dollars, the depreciation of the local currencies against dollar made it very difficult for the financial institutions to pay back their debts. This explains the large amount of financial institution bankr uptcies which occurred during the crisis.

The loss of competitiveness of some of the East Asian countries in the international markets also played a role in deepening the crisis. When the dollar was artificially undervalued against the Japanese Yen, the crisis countries which pegged their local currencies to the dollar—such as Thailand, Malaysia, Indonesia— possessed strong competitive power in the world market which helped them to achieve high economic growth rates. But when the dollar started to appreciate against the Yen as of mid-1995, the currencies of the East Asian NICs also appreciated. As a consequence of this, the products of these countries became more expensive than Japanese products and they lost their competitive power leading to export slowdowns in 1996-97. As they were not able to export as in the past, their economic growth also slowed down.

There were other factors which also contributed to the worsening of the crisis. The reluctance of the crisis govermnents to introduce reforms prevented the restoration of investor confidence in these countries. Although the IMF provided 36 billion dollars to support reform programs in Indonesia, Korea, and fhailand, the

goveniments hesitated to introduce the required reform which caused declines in currencies and stock markets, worsening the crisis effects on the countries.'*^

There are also alternative ideas about the reasons for the crisis which are mainly divided according to beliefs about the Asian system. Admirers of the Asian miracle refrain from blaming the system. According to them, the slowdown in economic growth in the region is due to ‘periodal’ factors, and when this period ends, the East Asian NICs will continue to grow. They do not believe that the Asian Tigers have any structural problems that they have to address. They believe that the high economic growth achieved in the previous years is the result of the governments’ sensible economic policies and the profit seeking behavior of the people.'*'*

For the Asian miracle skeptics, however, there is something obviously wrong with the Asian system. Paul Knugman claims that the system contains structural corruption. In his article “The Myth of the Asian Miracle”, which was published in 1994, he argued that there was no sign of efficiency in the East Asian NICs although there was economic growth. He described the Asian growth as “working harder not smarter”'*^ and stated that “the miracle turns out to have been based on perspiration rather than inspiration”.'**’ Krugman, chiefly blames the distorted system for the crisis. He names the rotten sides of the system as ‘Asia’s

IMF Staff, “The Asian...”, 1998, 19.

DTM, “Asya Mucizesi sona ini erdi?”. Dünya Ekonomileri Bülteni, April 1998, no. 13, 35-44. '•^Paul Krugman, “Whatever Happened To The Asian Miracle?”, http://web.mit.edu/kruginan/www, 1.