Й Д J Á i I Д О ’ ’’7 '/'i ' ч ' ’ '.·' Î i !»*'.■;»- <■»« ,^βΛ “ •·.■^ vJ ^ Л - V u ·« ,'..,Г'' а Лѵ-і-ц ί}^ ;·3 .î fe’İ Â Î '- j A i J Cl t <y Ъ 7 'iv ■:---' A U Uî f U Í T| Г

USLKIiHT i

t i & і д в іC-Í

'HE EGE-BALTICA A =

S.

IS r > XT»’ C) Hi

’T TT”! '“■!

K o ± o

SUBMITTED TO THE DEPARTMENT OF

MANAGEMENT

AND

GRADUATE SCHOOL OF BUSINESS

ADMINISTRATION

BILKENT UNIVERSITY

IN PARTIAL FULFILLMENT OF THE

REQUIREMENTS FOR THE DEGREE OF

MASTER OF BUSINESS

ADMINISTRATION

BY JOHN STEFAN SYTMEN June 1991

H G

193i c.l

ß

I certify that I have read this thesis and in my opinion it is fully adequate, in scope and quality, as a thesis for the degree of Master of Business Administration.

Doc. Dr. GLiliz Ger

I certify that I have read this thesis and in my opinion it is fully adequate, in scope and quality, as a thesis for the degree of Master of Business Administration.

Yrd. Doc. Dr. G;d 'luradoglu Şengül

I certify that I have read this thesis and in my opinion it is fully adequate, in scope and quality, as a thesis for the degree of Master of Business Administration.

■^frd. Doc. Dr. Can Şimga

ABSTRACT

THE EGE-BALTICA A.§. CASE BY

JOHN STEFAN SYTMEN

Supervisor: Doc. Dr. Giiliz GER

In Turkey today, the amount of insurance policies underwritten in proportion to the population, is much less than in the EEC countries. This provides alive an opportunity for foreign companies to invest in the insurance business in Turkey. However, problems such as low insurance awareness, unequal income- distribution, inflation and low-development of insurance concepts are realities that have to be faced. As the range of products and services is getting wider and wider, moi-e decisions are left to be made by the consumer and the market is being filled by information to support these decisions. One more item to be added to the list of services in Turkey is the insurance concept of Eqe-Baltica A.S. Ege-Ealtica A.S. i;s the joint-venture of two Danish partners. Saltica insurance A/S and the Industrialization Found for Developing countries, and a Turkish partner, Egebank. Ege-Baltica A.S. decided to offer all kinds of non-life

.nsurance, and located the main office in Izmir, Turkeys third large city. The marketing tools are not utilized in the Turkish insuranc.· business, which further enlarges the opportunity for Ege-Baltica A.S. In the turbulent business environment in Turkey, Ege-Baltica A.S. has to m.ake use of professional marketing concepts in order to win market share and survive. Ege-Baltica A.S. must make a segmentation, a targeting and decide on a position in the market to professionally form the marketing mix (4P's)of the company. The marketing mix is the communication interface between the company and the customer. The information, collected form personal interviews and company reports, is formed

into a case and recommendations to the management of Ege-Baltica A.S. are made by analytically building the marketing mix for

ÖZET E G E - B A L T I C A A.Ş. İNC E L E M E S İ JOHN STEFAN S Y T M E N T E Z YÖNETİCİSİ: DOÇ. DR. G U L I Z G E R B u gün A. E. T.

T ü r k i y e ’de n ü f u s a oranla y a z ı l a n s i g o r t a po l i ç e s i sayısı, ü l k e l e r i n i n çok altındadır. Bu da y a b a n c ı ş i r k e t l e r i n T ü r k i y e ’de s i g o r t a alanında y a t ı r ı m y a p m a l a r ı için bir fırsat yara t m â i k t a d ı r . Ancak, s i g o r t a n ı n pok y a y g ı n olmaması, gelir d a ğ ı l ı m ı n d a k i eşitsi z l i k , e n f l a s y o n ve s i g o r t a k a v r a m l a r ı n ı n az âo t i şıTi i ş ! i 5 i , k a r ş ı l a ş ı l a c a k s o r u n l a r d ı r . Bu k o n u d a k i ürün vo h i z m e t l e r * ç o ğ a l d ı k ç a , tüketici d a h a f a z l a k a r a r l a r l a k a r ş ı l a ş m a k t a i vo bu kararları d e s t e k l e m e k üzere, piyasadaki bil,/i g i d e r e k çoğalmaktadır. T ü r k i y e ’de s u n u l a n hizmetler

l i s t e s i n e ^ e k l e n e c e k bir diğer k a l e m de E g e - B a l t i c a A . Ş . ’m n a e tirdi^i s i g o r t a c ı l ı k kavramıdır. E g e - B a l t i c a A.Ş.; Bal t i c a I n s u r a n c e A /S ve gelişmekte o l a n ü l k e l e r için S a n a y i l e ş m e F o n u n d a n o l u ş a n iki DanimarkalI o r t a k ile E g e b a n k ’ ın bir ortak y a t ı r ı m ı d ı r . E g e - B a l t ı c a A.Ş. h a y a t s i g o r t a s ı dışındaki tüm s i g o r t a ç e ş i t l e r i n i sunmaya karar verip, m e r k e z i n i T ü r k i y e ’nin ü ç ü n c ü b ü y ü k şehri o l a n İzmir’e y e r l e ş t i r m i ş t i r . T ü r k i y e ’de p a z a r l a m a a r a ç l a r ı n ı n iyi k u l l a n ı l m a m a k t a olması Ego-B a l t i c a A . Ş . ’nın k a r ş ı l a ş t ı ğ ı bu f ı r s a t ı daha da b ü y ü t m e k t e d i r . T ü r k i y e ’deki dalgalı iş o r t a m ı n d a E g e - B a l t i c a A.Ş. pazar payı k a z a n m a k vo ayakta k a l m a k için p r o f e s y o n e l p a z a r l a m a k a v r a m l a r ı n ı k u l l a n m a k zorundadır. E g e - B a l t i c a A.Ş., ş i r k e t i n p a z a r l a m a f o r m ü l ü n ü p r o f e s y o n e l c e o l u ş t u r m a k ü z o r e bir b ö lme pazarı y a pmalı, hedef kitlesini b e l i r l e m e l i ve p a z a r d a k i k o n u m u n a karar v e r m e l i d i r . P a z a r l a m a formülü, ş i r k e t vo m ü ş t e r i arasındaki i l e t i ş i m ba ğ ı d ı r . Karşılıklı g ö r ü ş m e l e r ve ş i r k e t r a p o r l a r ı n d a n t c o l a n a n veriler, şirketin bir i n c e l e m e s i o l a r a k bir araya ='e*tirilmiş vo ş i r k e t i n ilerdeki p a z a r l a m a k a r a r l a r ı n a yö n e l i k olarak, v e r i l e r i n tahlil e d i l m e s i y l e o l u ş t u r u l a n pazar l a m a f o r m ü l ü ile E g e - B a l t ı c a A.Ş. y ö n e t i m i n e ö n e r i l e r yapılmıştır.

ACKNOWLEDGEMENTS

I gratefully acknowledge patient supervision and helpful comments of Doc. Dr. G Ü 1 İ Z Ger, throughout the preparation of this study. I have also benefitted from suggestions of Yrd. Doc. Dr. Gülnur M. Şengül and Yrd. Doc. Dr. Can Şimga and I would like to express my thank for their valuable suggestions.

TABLE OF CONTENTS

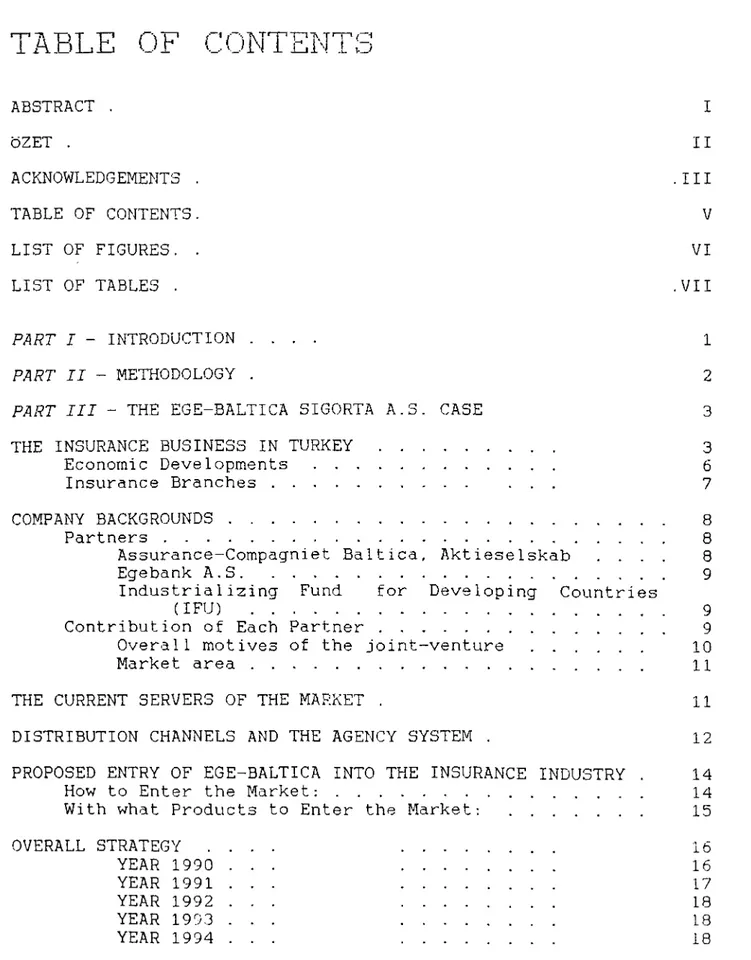

ABSTRACT . ÖZET . ACKNOWLEDGEMENTS . TABLE OF CONTENTS. LIST OF FIGURES. . LIST OF TABLES . II .III V VI .VIII

PART I - INTRODUCTION . . . . PART I I - METHODOLOGY .PART I I I - THE EGE-BALTICA SİGORTA A.3. CASE THE INSURANCE BUSINESS IN TURKEY

Economic Developments . . , Insurance Branches ...

COMPANY BACKGROUNDS ... Partners ...

Assurance-Compagniet Baltica, Aktieselskab . . . Egebank A .S ... Industrializing Fund for Developing Countries

(IFU) ... Contribution of Each Partner ... Overall motives of the joint-venture ... Market area ... THE CURRENT SERVERS OF THE MARKET .

DISTRIBUTION CHANNELS AND THE AGENCY SYSTEM .

PROPOSED ENTRY OF EGE-BALTICA INTO THE INSURANCE INDUSTRY . How to Enter the Market; ... With what Products to Enter the Market: ... OVERALL STRATEGY . YEAR 1990 YEAR 1991 YEAR 1992 YEAR 1993 YEAR 1994 1 2 3 3 6 7 8 8 8 9 9 9 10 11 11 12 14 14 15 16 16 17 18 18 18

RECOMMENDATIONS FROM THE FEASIBILITY GROUP Strengths: ... Weaknesses: ... Opportunities: ... Threats: ... PART I V - THE ANALYSIS

WHY GO ABROAD?

INTERNATIONAL MARKETING DECISION MODEL

THE MODEL AND EGE-BALTICA ... How did Baltica Enter the Turkish Market?

BUILDING A MARKETING MIX FOR EGE-BALTICA ... Segmentation ...

How did Ege-Baltica segment the market? What could Ege-Baltica have done?

Targeting ... How did Ege-Baltica target the market? What could Ege-Baltica have done?

Positioning ... How is Ege—B a 1t i c a 's position in the market? What could Ege-Baltica have done?

MARKETING MIX , Product Price . . Place . . Promotion ENDING REMARKS 19 20 20 20 21 22 23 25 25 27 30 30 30 36 36 36 42 42 43 45 46 47 47 48 50 REFERENCES 52 APPENDIX I: Glossary

APPENDIX II: Aegean Region

APPENDIX III: Customer expectations and image

53 54 55

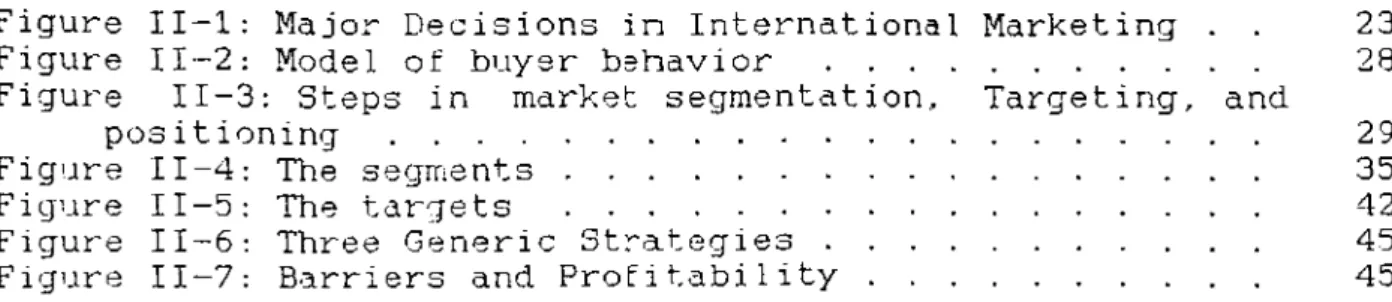

1ST OF FIGURES

Figure II-l: Major Decisions in International Figure II-2: Model of buyer behavior . . . . Figure II-3: Steps in market segmentation,

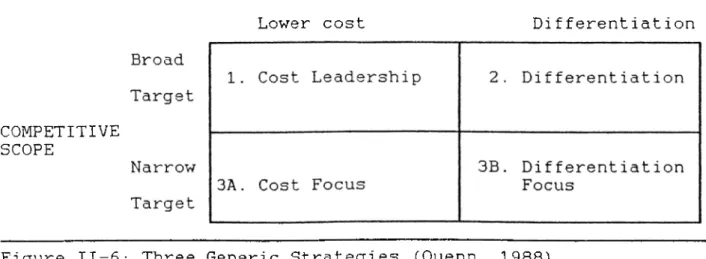

positioning ... Figure II-4 Figure II-5 Figure II-6 Figure II-7 Marketing . . Targeting, and The segments ... The targets ... Three Generic Strategies . Barriers and Profitability

23 28 29 35 42 45 45

LIST OF TABLES

Table I - l : Turkey's place in the insurance world - 1987 . . . 4 Table 1-2: Premium Production (1980 - 1988) ... 6 Table 1-3: Insurance Business on the Basis of Branches

-1988 ... 7 Table 1-4: Branches of Activities of Companies - 1988 . . . 11 Table 1-5: Sales forecasts and the insurance portfolio . . 17 Table Il-la: Major segmentation variables for the individual

insurance business ... 32 Table Il-lb: Major segmentation variables for the industrial

P A R T I - INTRODUCTION

This is a study of the entrance and foundation of a new insurance company in Turkey. The foundation is made upon the concept of a joint-venture composed of the following partners:

- Assurance-Compagniet Baltica, Aktieselskab (DK) - Egebank A.S. (TR)

- Industrialization Fund for Developing Countries - IFU (DK)

Baltica and Egebank are holding 37.5% of the equity each, whereas IFU is holding 25%. The equity capital is TL 5 billion (1989 prices) which is distributed with TL 1.875 billion on the local partner and TL 3.125 billion on foreign partners. The joint- venture is formed with the objective "to underwrite all classes of non-life insurance business". The name of the company is EGE- BALTICA s i g o r t a A.S. and is based in Izmir, Turkey's third

largest city.

One can say many things about Turkey. She is not in Europe nor in the Middle East; you can't say that she is rich, but nor can you say that she is poor. But Turkey is a large country and has a large population that grows faster than any other European country. One will also notice the economic growth rate, which is the highest among other European or Middle Eastern countries.

To find funds for investments in Turkey is sometimes difficult, as the speed and power of the development in the markets are uncontrolled and in most cases unstable, thus easily biased by some change in the environment. This leaves a gap between the amount invested and the realized return, also called risk! But, as increased risk also gives higher returns, Turkey has become an attractive place for foreign investors.

One industry that deals with the business of risk is the insurance industry. The insurance industry claims that 'all risk is insurable'. However the insurance industry in Turkey is currently one of the less developed industries. The need for foreign funds and know-how leaves a great opportunity for investments. This was also how the foundation of Ege-Baltica started. EgeBank pronounced that it would like a foreign partner to form a new insurance company. This news was brought to Baltica Insurance in Copenhagen, and the two future partners made their first meeting in late 1987. This was followed by a large range of small studies and tests of the credibility of a foundation of the new insurance company, and the major report was conducted in October 1989 in Izmir. The name of the report is "Feasibility study for EGE-BALTICA SİGORTA A.S." (Feasibility, 1989).

PART I I - METHODOLOGY

This study is conducted in two main parts, a case part (called part III) and an analysis part (called part IV). The case is build on information collected from the Ege-Baltica feasibility study (Feasibility, 1989) supported by information from a study made by Strateji Research & Planing Ltd· (Strateji, 1987), and through personal interviews with Member of the Board and C.E.O. Mr. Mads Thuesen, C.E.O. Mr. Servet Gürkan, various employees and

impressions formed on the visits to the head office in Izmir. The case was build with the aim of reproducing the foundation decision information, i.e. only submitting the information given to me by the company. The objectives of the study is to analytically evaluate the Ege-Baltica foundation approach with managerial theories and by the use of marketing models. Throughout the analytical part of the study, recommendations and hints about future decisions of Ege-Baltica is given, so that the managers of Ege-Baltica are also able to benefit from the

P ART I I I - THE EGE-BALTICA SİGORTA A.S. CASE

THE INSURANCE BUSINESS IN TURKEY

As it is with all insurance, the business is closely tied to the financial world. In most countries different investment proposals are evaluated by the insurance companies to determine the best deposit of funds, with the highest return and lowest risk. Because the financial markets in Turkey are new, such ties are not well founded. However there is a close relationship between the insurance companies and the Banking world. Thus most of the larger banks have their own insurance companies.

Both the banks and the insurance companies benefit from the relationship, as the banks make a considerable amount of their profits through the insurance premiums, and the insurance companies use the banks' branch offices as agencies. The larger the bank the larger the insurance company. Most larger banks are government owned, so an important portion of the insurance business is influenced by the government.

When the insurance activities are to be measured, the activity is taken as a percentage of the Gross Domestic Product (GDP). If we measure the activity in Turkey, we are able to see that Turkey is ranked at the bottom when compared with other European countries (see Table I-l; the figures for USA and Japan are included for comparison purposes)

If we investigate the reasons for this, we will see that compared to other European countries, the Turkish insurance industry is less developed and less effective in creating funds for investment. Another reason for Turkey being in the lower end of the list is Turkey's high inflation rate and low income level. Furthermore, qualified personnel is hard to find and because of no direct public education in the insurance field, an overall

INSURANCE BUSINESS COUNTRIES WORLD R A N K (*) WORLD SHARE (%) TOTAL BUSINESS/ GDP (.%) USA 1 38.00 9.07 JAPAN 2 22.53 8.69 LIFE W. GERMANY 3 7.60 6.40 & DENMARK 19 0.46 4.17 NONLIFE GREECE 42 0.06 1.24 TURKEY 50 0.03 0.54 LUXEMBOURG -r>.___ 1 _____ . 1 ^ 52 0.02 3.35 Table (Feasibility, 1989)

(*) According to the premiums.

switch to good insurance is not helped by the circumstances.

Uncollected premiums are also a major problem for insurers, resulting in cash-flow difficulties. This is a result of again the low income level, which leads the insurers to offer attractive payment agreements to the customers in order to beat the competitor. Holding these agreements becomes a problem for the customer and thus the cash-flow difficulties.

Yet another reason for the low ranking (as shown in Table I-l) may be the lack of consensus about the solution to applications of marketing. Insurance companies generally have an insufficient understanding of modern marketing because marketing managers mostly come from different departments of the company (usually from the sales force) or are hired directly for their position. In the case where they come from inside the company, they are unaware of modern marketing, and those who come from 'outside' are usually unaware of the problems of the business. When investigating further for the reasons for the insufficiency of the insurance market, we can list the following reasons when looking at the consumer: Low degrees of product awareness, no social or academic education, unequal income distribution and

fatalism and religious factors. If we look at the insurance business we can list following reasons: Lack and fear of competition, mediocre organizations, lack of modern management and marketing skills, passive marketing strategies, failure of developing new products, shortage of technical know-how and skills and incorrect positioning. The economy also bias the insufficiency of the insurance market. Among others, the following factors have an effect: Fear of government's deregulation indicated by professionals of the sector, high inflation and interest rates, government interference, investment fields are underdeveloped for funds accumulated by the sector.

Product awareness is low in the business which is a result of the poor marketing as mentioned before, and one reason for the poor marketing is that the insurance companies are aware of the fact

that they do not have sufficient data on consumer consciousness.

One way insurance companies have tried to increase product awareness is through the most commonly known product - hull policies (also called casco). But hull policies are not among the most profitable and are therefore not enough to make the company profitable. Furthermore some policies may be common such as fire or casualty, but the content is not understood by the consumer. The companies face a great problem of misunderstanding in the coverage limits of the policies. The name is not clear enough to describe the content, and before anything else there has to be a general insurance awareness or a product awareness which is not the case in Turkey at the moment.

A trend in the market shows that household policies and life policies are becoming more popular for general public, and fire, machinery, liability and agricultural policies are common for business circles.

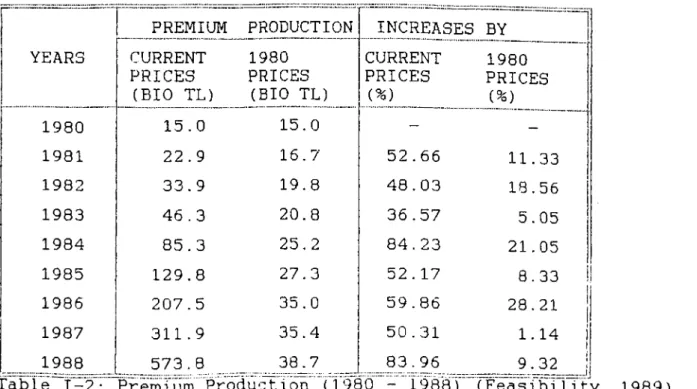

Economic Developments

The insurance sector in Turkey is one of the due to the liberal economic policies that the adopt in 1980. The premium production in period between 1980 and 1988 can be seen insurance market was first regulated by Act. Auditing Act" in 1959. But it was revised and Act. No. 3379 "Law on Control of Insurance" at a modernization of the market, and s t a n d a r d s .

developing sectors, government began to the market for the in Table 1-2. The No. 7379 "Insurance updated by the new in 1987 which aimed to reach European

The developments in the past three years show the following: Life insurance policies have been growing, competition is becoming a challenging problem, the concept of marketing is developing, the money market is becoming more efficient and the number of skilled personnel is increasing. What is then expected from the future? On the basis of the described development, savings-oriented life

PREMIUM PRODUCTION INCREASES BY YEARS CURRENT PRICES (BIO TL) 1980 PRICES (BIO TL) CURRENT PRICES i%) 1980 PRICES (%) 1980 15.0 15.0 - -1981 22.9 16.7 52.66 11.33 1982 33.9 19.8 48.03 18.56 1983 46.3 20.8 36.57 5.05 1984 85.3 25.2 84.23 21.05 1985 129.8 27.3 52.17 8.33 1986 207.5 35.0 59.86 1f 28.21 I 1987 311.9 35.4 50.31 1.14 i t 1988 573.8 38.7 83.96 9.32 1

insurance policies, household package policies, accident insurance policies, health and other type of insurance towards the high income socio-economic groups represent product lines which present opportunities. The product design shows a trend towards packaged, simple and understandable policies, and the insurance sales agencies which do insurance as a secondary business are expected to decrease in number (except banks). The market as a whole will grow at a higher rate.

Insurance Branches

We can split up the different types of insurance in the market into six main groups: Accident, fire, transport, engineering, agriculture and life. Table 1-3 shows the insurance business on the basis of branches in 1988.

A closer look at the table will show that more than 85% of the premium share pertains to accident, fire and transport branches.

INSURANCE BRANCHES

PREMIUM PRODUCTION

CLAIMS PAID TECHNICAL PROFITS

(BIO TL) (%) (BIO TL) (%) (BIO TL) (%)

ACCIDENT 238.7 41.6 112.9 52.0 12.0 16.4 FIRE 145.6 25.4 37.7 20.0 31.9 43.7 TRANSPORT 106.4 18.5 35.0 23.0 24.0 32.8 ENGINEERING 28.9 5.1 9.8 3.0 4.3 5.9 AGRICULTURE 6.4 1.1 3.1 1.0 0.9 1.2 LIFE 47.8 8.3 2.9 1.0 - -TOTAL 573.8 100 201.5 100 73.1 100 table 1-3: Ii (Feasibi1i t y , 1988 1989)

It is also seen that life insurance is occupying a little amount and thus at first it is not included in the Ege-Baltica concept.

COMPANY BACKGROUNDS

The following will describe each of the three partners and their contribution to the joint-venture:

Partners

Assurance-Compagniet Saltica, Aktieselskab

Saltica Insurance A/S is the largest insurance company in Denmark, and has a premium production which is larger than the whole premium production in Turkey. This is how Saltica presented

itself in its annual report (Saltica, 1989):

" S a l t i c a 's business concept has been put into the following words :

'The Saltica Group should be seen as a collection of administratively and financially well-managed firms with an

important position and a clear profile in the security market.'

The Group operates through three principal fields of activity.

S a l t i c a 's original activity which remains its dominant activity is in the Insurance Group which writes direct general insurance, direct life and pension insurance, and a limited volume of reinsurance. Substantial investments take place in the course of the insurance operations. Saltica Insurance is one of Denmark's

largest composite insurance groups.

The Finance Group offers financial services, including banking, stockbroking and portfolio management. Saltica Finance is a major project developer and project administrator in the property m a r k e t .

The Falck Group offers nationwide emergency services and assistance, including automobile services, transport of patients,

fire-fighting and alarm services. The Falck Group is one of Denmark's largest service groups"

Egebank has in the past 60 years served the Turkish market and is one of older Turkish banks today. Egebank is already known in the insurance business since Egebank's own insurance company, Ege Sigorta, has an important premium production in the Turkish market. Egebank has branches throughout all of Turkey, and these bank branches also serve as agencies for Ege Sigorta.

Industrializing Fund for Developing Countries (IFU)

IFU is a financial partner in projects in developing countries^ . The following are some general remarks from the Principles of Operation (IFU, 1988):

"IFU can support sound and productive ventures in developing countries, provided they are commercially viable, stimulate development and are not hazardous to the environment.

IFU can only participate in a joint-venture together with a Danish partner, but funds provided by IFU are not tied to purchases of machinery and equipment from Denmark. The joint- venture should have a significant local equity participation. Local partners may be private persons, companies, finance

institutions, and government bodies".

Contribution of Each Partner

Each individual partner will 'bring something' to the new insurance foundation. The partners will contribute the following:

Baltica:

MarketingTechno 1ogy/EDP

Insurance know-how & New Products Education & Training

Management (1 chief general manager)

Egebank A.S.

^Generally, countries with a GNP per capita not exceeding USD 3,000 are the main activity fields of IFU.

Actuary support Capital

Board/Executive conimittee members

Egebank: Insurance portfolio (Egebank, Ege Sigorta) EDP support

Distribution network Capital

Board/Executive committee members Legal advice and support

I.F.U.: Capital

Board Members

Experience with joint-ventures in Turkey Overall motives of the joint-venture

Insurance is a field of business where efficiency, low expenses, well trained organizations with excellent marketing concepts and knowledge of computer technology are some of the factors that are crucial for the company to survive in the turbulent business environment. The opening of the European markets in 1993 is expected to have a positive effect on the insurance business in Turkey, with an increased number of policies. The expected increased competition as a result of this, will lead to lower premium levels, thus making the above mentioned factors even more crucial. This means that only the best companies will survive. But, the insurance business in Turkey is characterized as not

fully utilized, which makes the business a big potential compared with Europe currently.

EgeBank has a well founded distribution network as well as financial know-how in the industry heavy area of Turkey (the Aegean Region; see Appendix II), and Baltica has a valuable experience in the field of insurance. The objectives of the foundation also fit with Baltica's wishes to expand its activities into Turkey as a part of the internationalization process it is currently undergoing. I.F.U. consider this as an excellent opportunity to promote the economic activities through

investments in developing countries in collaboration with the Danish trades and industries.

Market area

The market area for Ege-Baltica Sigorta A.S. will be all of Turkey. Ege-Baltica will be established in Izmir and will commence business in the Aegean Region; however, it will expand business immediately to cover the whole country. The reason to commence in the Aegean Region is to have footholds in the area where the local partner have stronger relations.

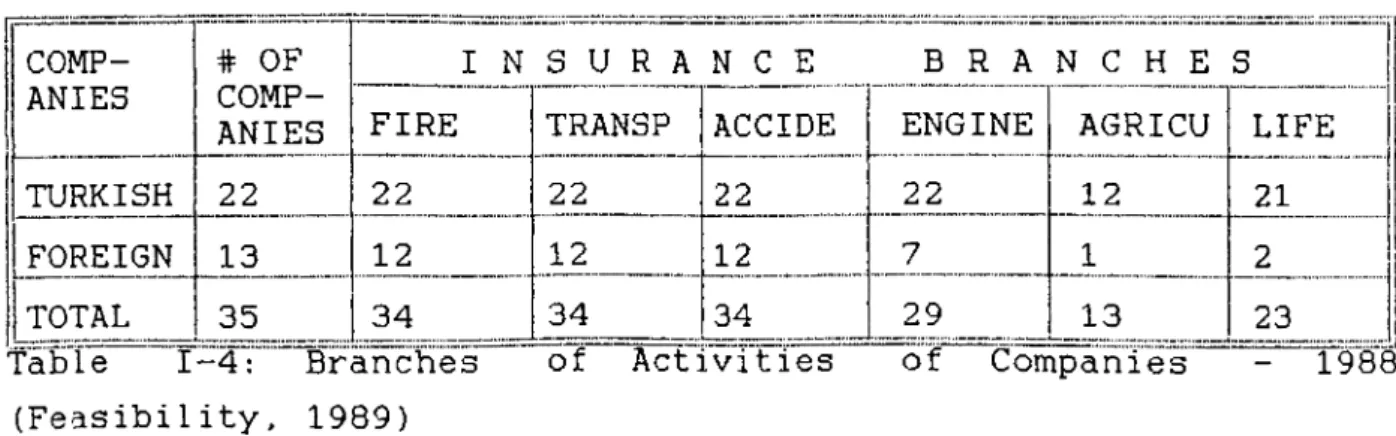

THE CURRENT SERVERS OF THE MARKET

'fhere are 35 insurance companies in the market, of which 13 are foreign, and 4 are reinsurance companies. Among the existing companies, state owned and holding group companies have the largest shares. Tlie state is in direct control of 7 companies and controls some of the others through their capital shares, which means that the state has a market share of 36%.

COMP ANIES # OF COMP ANIES I N S U R A N C E B R A N C H E S

FIRE TRANSP ACCIDE ENGINE AGRICU LIFE

TURKISH 22 22 22 22 22 12 21 FOREIGN 13 12 12 12 7 1 2 TOTAL 35 34 34 34 29 13 23 able 1-4: Branches (Feasibility, 1989) of Activities of Companies 1988

Table 1-4 shows the number of insurance companies according to the insurance branches in which they are licensed.

All insurance companies are, by law, required to place 30^6 of their reinsurance with Milli Reasürans A.S., a state owned

reinsurance company. The remaining business is placed with either the other three Turkish reinsurance companies or with well-known foreign reinsurance companies - mostly from European countries.

Most of the companies, being tied to a bank or to an industrial holding company, already get a substantial portfolio from their groups. In the same manner, state owned insurance companies have their premium income from national banks or state owned enterprises without spending much effort. Therefore, industrial and commercial insurance, which together have a big portion of the existing portfolio, are shared among these companies. The market, then, has a strong competition for the other portion, which is rather small.

On the other hand, the existence of the fixed tariff system in the market prevents the companies from competing on prices. The current Act, which was passed in 1987, introduced some restrictions to premium payments which gave rise to a change in the market on the basis of competition. Until recent years, the competition tended to focus on periods of payments, rather than on new products or marketing tools and techniques. Therefore, it will be very valuable for Ege-Baltica to use such new functions within the market scene - in order to perform with considerable

competitiveness and make use of a differential advantage.

DISTRIBUTION CHANNELS AND THE AGENCY SYSTEM

The largest premium production is made through agents. Agents are not employed by the insurance company, but are paid commission. This means that agents can work for competing insurance companies, and as a natural fact, the agents prefer to issue polices for the companies that pay the highest commission and thus work more actively for that company. There are two types of agents A-type and B-type. A-type agents calculate premiums and issues policies, whereas B-type agents only fill application

forms for the insurance which he/she forwards to the insurance company for their approval.

The commission is set by a tariff system which forces a sealing of 30“% on non-life insurance. Practically all insurance companies pay the maximum commission, and generally, A-type agents earn Ъ% more than B-type a g e n t s .

It is considered that all premium sales of Ege-Baltica will be through agencies, at least for the first years; no direct premium production is foreseen. Since A-type agencies are established to cover their own insurance requirements, and thus do not need to draw on the company, an estimate for B-type agents are made. The estimated number of B-type agency portfolio is TL 40-65 million (1990 figures). Therefore, in order to reach TL 2 billion premium production via B-type agencies, Ege-Baltica has to attract between 30 - 50 agencies for the first year. Proportional to the premium production, the approximate number of agency requirements are as follows: 1990 requires 50 agencies 1991 - 100 -1992 - 150 -1993 - 250 -1994 - 300

-Approximately, 30^ of these agencies can be assumed as A-type agencies and the remaining 70^ as B-type agencies w h ich is also close to the general characteristics of the market structure of the insurance agency system in Turkey. The average estimation of insurance distribution channels in Turkey is: agencies 50%, banks 35% and direct 15%.

PROPOSED ENTRY OF EGE-BALTICA INTO THE INSURANCE INDUSTRY

The following will describe how and with what products Ege- Baltica will enter the insurance market.

How to Enter the Market:

Ege-Baltica must base its image upon an excellent customer oriented service, which should be observed through a focus on: - promotion (advertising)

- Place (Egebank distribution channels/agents)

- knowledge of business techniques (direct jnarketing/edp) - product development (eg. package insurance)

- trust and reliability

- quality service (service management)

To achieve this - it is important for Ege-Baltica that the management makes the organization of the company to p erform with:

- A professional team spirit that reflects a new dynamic, non- bureaucratic, innovative and trustworthy insurance company with

its own "service culture"

- An effective claims handling that will be quick and on time since agents and clients prefer full and on-time claims payment

- Support, care and advice to clients - clear minded and

trustworthy people, who care for their clients. Informative activities are almost nonexistent in the market - w hich makes

it attractive to communicate at a higher extent

- Insurance policies must be formulated well, clear and easy to understand since customers are not fully aware of what they

(the insurance companies)include (clients, agencies and internal personnel will benefit from this as well)

- A back-up service function to agencies in order to observe a current, excellent and close communication with the agencies - Indexation of premiums to keep the value of the sums insured

(due to inflation, premiums might be linked with a foreign currency rate of exchange or indexed to gold)

- A well educated and qualified personnel/highly trained agencies. They should be selected very carefully

- A high integration level of latest technology. Implementation of systems that fits the requirements needed

- Market introductions of innovative combinations of classical products into new packages or preferably new profitable

products within other segments.

- To tailor individual insurance needs with service packages that fits for each client in terms of coverage and protection

- Efficiency in handling the tariff-system - fully adopted and integrated in an internal on-line system procedures

On the assumption that Ege-Baltica can achieve the above - it will be positioned as an insurance company within the Aegean region with a strong image towards an orientation to customer service and performing with a high level of the latest technology.

With what Products to Enter the Market:

The existing insurance products in the market currently can be characterized similar to the degree of industry development - call it underdeveloped. This has to be linked to the fact that public awareness of insurance are generally low, and thus knowledge of what the different branches of insurance covers is not clear. Some policies may be common such as fire or casualty, but the content is not understood which leads to a misunderstanding of the coverage limits of the policy. Ege- Baltica must therefore be aware of this problem and enter with products currently not offered, and served to the market in such way that they are understandable by the customer. The trend towards the product lines which represents future market opportunities is:

- Business interruption coverage - Household package policies - Office package policies - Accident insurance policies

- H ealth and saving oriented insurance towards the high income socio-economic groups

- Credit insurance - Employee insurance

The most essential part of this trend is the expected changes in innovative product design towards packaged, simple, flexible and understandable policies. It is expected that the market has a latent demand for multi-purpose "package" insurance policy groups. This trend could be turned into the advance for Ege- Baltica, as the insurance environment in Denmark is composed according to the above mentioned factors. This know-how will be a valuable asset and when used properly, a differential advantage

for Ege-Baltica.

OVERALL STRATEGY

Ege-Baltica wants slowly to enter the market and steadily increase the sales and market share. The sales forecasts of the Ege-Baltica is presented in Table 1-5 (all figures are at 1990 prices) . As can be seen from the table, Ege-Baltica expects four years to set-up, grow, position and take-off. In the fifth year a steady-state is expected with a reached level of income. The sales in 1994 is expected to be 19 billion, which is equivalent to an 19^ increase in the market. The assumptions and the arguments for estimations of the future premium production are as f o l l o w s ;

- YEAR 1990: The first year, 1990, is the set-up year for Ege- Baltica. The estimation for the premium production in the first year is TL 5 billion, TL 3 billion of which will be inherited from the above two agencies and TL 2 billion will be produced as a new portfolio.

The total value of Egebank and Ege Sigorta portfolios was TL 994,1 million by 1988. The joint portfolio of Egebank and Ege Sigorta for the first six m o nth of 1989 was TL 709,6 million. Considering a homogeneous distribution, the total portfolio by the end of 1989 were expected to be TL 1,42 billion. However, the production in the 11th and 12th month, in general, are higher

i

YEARS COMMENT

GROWTH RATE

(%)

INSURANCE PORTFOLIO (TL BiO)

TOTAL EXISTING P O R T F . NEW P O R T F . 1990 SET-UP - 5 3 2 1991 GROWTH 60,0 8 4 4 1992 POSITION. 37,5 11 5 6 1993 TAKE-OFF 45,5 16 (INSIGNIFICANT) 1994 STEADY-STATE 19,0 19 (INSIGNIFICANT) Table 1-5: Sales (Feasibility, 1989)

than the other months of the year. Therefore, the total portfolio is expected to be around T1 2 billion for 1989, in terms of 1989 prices. The assumed inflation of 60% would increase the value of the same portfolio to T1 3,2 billion, with 1990 prices. To be on the safe side, it had been rounded to T1 3 billion. This assumption also indicates that the opportunity of the real increases in the portfolios of these two agencies are ignored, again to be on the safe side.

The remaining T1 2 billion premium is estimated to be produced as new business, through the efforts of Ege-Baltica.

- YEAR 1991: The second year, 1991, is the growth year for the company. A significant increase (60?6) is expected in the total premium sales, through a better penetration to the market. The total premium sales are expected to be TL 8 billion, where T1 4 billion is expected from Egebank and Ege Sigorta.

Egebank and Ege Sigorta would increase their portfolio by 33% while E g e - B a l t i c a ' s new portfolio w o uld increase by 100?6 to TL 4 billion, due to expected outcome of the management of effective strategies and use of know-how.

- YEAR 1992: The third year, 1992, is the year where much effort is to be put in making the company name, portfolio and existence known in public. The growth rate would be almost half the previous year, 37,5^, but still higher than the general market t r e n d s .

Total sales are expected to be TL 11 billion. TL 5 billion would be from Egebank and Ege Sigorta. TL 6 billion will be sold by other agencies.

- YEAR 1993; As a result of structural developments in the organization and marketing activities, total premium sales are expected to reach TL 16 billion, with an increase of more than 455^.

- YEAR 1994: In the fifth year, 1994, the Company is expected to complete growing process and reach a steady-state condition. The growth of the company and increases in its sales will be equivalent to the real growth of the total market.

Trend analysis estimates the total growth of the Turkish insurance market around 19%, in 1994. Therefore, the sales of Ege-Baltica, with the same rate of increase, is expected to be TL

19 billion.

Taking into consideration the relative less developed insurance market in Turkey, then looking at the possible synergy which can be created among the three founders of Ege-Baltica, the foundation of Ege-Baltica is recommended. With Baltica contributing marketing, know-how and education, Egebank contributing the primary distribution network and IFU contributing capital, the expected synergy seems to be a usable force in the current market.

The idea is for the company to operate within the Turkish non life insurance sector. The company will have its residence in the center of Izmir. It is expected to have an organization consisting of approximately 25 employees in the first three years and should increase gradually to 40 employees after the third year. The distribution network will be through Egebank branch offices as well as through local agencies. At least 50 agents should be established. The marketing strategy and the sales estimates are based upon the assumptions that the insurance portfolio of Egebank as well as Ege Sigorta can be taken into the portfolio of Ege-Baltica Sigorta A.S. It had been one of the strongest assumptions that the company would acquire all the premium through agencies. The opportunities of direct business should be worked out in an action plan. Ege-Baltica should intend to build strategy upon acquisition of business through agencies in the Aegean region - which is considered to be the richest part of Turkey in terms of the consolidation and financial strength of co m p a n i e s .

RECOMMENDATIONS FROM THE FEASIBILITY GROUP

The productivity will increase with an annual rate of approximately 40% afterwards, on the assumptions that the key personnel, capital, technology and know-how can be attracted to the company. The overall analysis of the feasibility study reveals that the project will have the following:

Strengths:

Already existing insurance portfolio to betransferred from Ege Sigorta and Egebank to the new company. Strong distribution network through the 37 branch offices of Egebank as well as the

insurance agencies of Ege Sigorta. Insurance know -how and experience from Baltica - marketing, EDP, management, actuary assistance and education

faci1it i e s .

Weaknesses:

Recruitment of skilled personnel because of highturnover and lack of skilled personnel within the market. Cash-flow problems due to long delays in premium payments. Dependency on policies of

Baltica and Egebank as major partners and possible interference of company objectives.

There are difficulties in interpreting and investigating economical situations of other insurance companies because there are no requirements in the financial statements and accounting principles to give a true and fair view. Companies may display a higher sales value than actually realized.

Opportunities: Turkey is among of the countries which have the opportunity to yield technical profits in the

insurance business. There is a vast potential for non-life insurance in the Aegean region.

Possibilities of combining products in a new way. Synergy effects for Egebank and Ege-Baltica

Sigorta A.S. Liberalization in Turkish insurance market is being realized, especially during the

last few years and is expected to accelerate. Most recent development is the opportunity to transfer capital outside Turkey. Premium, as a percentage

of Gross Domestic Product in 1987, is 0 , 5 4 % and the insurance densities in terms of premiums per head is USD 6,0 in 1987.

Threats;

Possible continuation of economic fluctuations.Increased competition. High inflation environment. Difficulties in poor cash-flow due to uncollected premiums.

P A R T I V - THE ANALYSIS

The insurance business in Turkey is in its growth stage. Insurance policies are not fully developed and the level of awareness among the Turkish population is low. The amount of insurance issued compared to the population and numbers of companies is relatively low, thus leaving a large uninsured market portion. This is an opportunity and Ege-Baltica, being one of the latest entrants in the insurance market in Turkey, has to build a marketing strategy to capture i t ' s part of the market. The synergy that arose as a result of the joint-venture, and the s t r e n g t h of the new company has to neutralize the w e a k n e s s e s and t h r e a t s from the foreign environment in order to meet these o p p o r t u n i t i e s .

In the following I w i 11 try to describe some reasons for entering a foreign market, and introduce a model that guides a company through the complicated row of decisions to be made before going a b r o a d .

WHY GO ABROAD?

Until now we have not actually described what an insurance is! I would like to go around this question in order to describe the former one of "Why go abroad?". An insurance is not a product but it is a product! When you purchase an insurance you do not leave the store with what you paid for! You pay for something that you only may get later. This could be one hour later, or one month later, or one, maybe 4 to 10 years later! Leaving the mystery behind let us take a look at the product and market definitions (Kotler, 1988): the product-oriented definition of an insurance would be "We issue insurance policies", and the market-oriented definition would be "We sell safety". And this is actually what an insurance is all about - safety. An insurance policy is a safeguard against loss, and is made on a piece of paper that

functions as an agreement between the insurer and the insurance company. The insurance company promises to cover losses that only with a little chance would occur, and in return receives an agreed amount of money for that promise. This leads me back to the first question "Why go abroad?". Funds accumulate in an insurance company and an insurance company has to assure a certain level of financial return. This is done by evaluating different investment proposals, where a combination of risk and return is taken into consideration - higher risk -> higher return! For Ege-Baltica one of these investment proposals was to open a new branch in a different country; in this case, Turkey.

INTERNATIONAL MARKETING DECISION MODEL

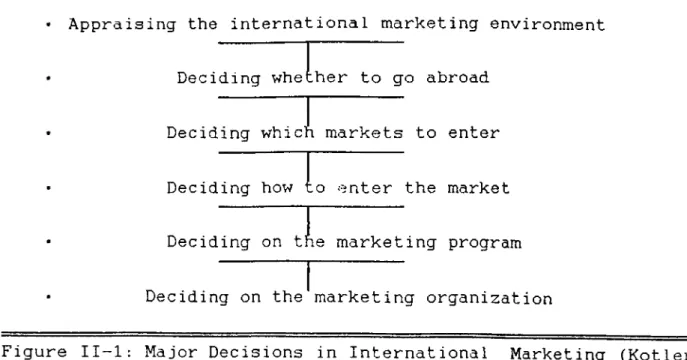

I will in the following introduce a model that describes six basic decisions that a company faces in considering international marketing. (See Figure II-l).

• Appraising the international marketing environment

■ Deciding whe :her to go abroad

■ Deciding whi cl!i markets to enter

■ Deciding how i o enter the market

• Deciding on tllie marketing program

Deciding on the marketing organization

Figure II-l: Major Decisions in International Marketing (Kotler, 1988;p. 381).

■ Appraising the international marketing environment: A company has to learn many things before deciding whether to sell abroad, or not. The company has to acquire a thorough understanding of the international marketing environment, which is different from the environment domestically. Generally five elements are to be considered: The international trade system, the economic environment, the political-legal environment, the cultural environment and the business environment (Bagozzi, 1986; Kotler, 1988). Research and collection of information has to be made to be able to know the 'rules of the g a m e ' .

• Deciding whether to go abroad: Before going abroad, the company should try to define its international marketing objectives and policies, and decide what proportion of foreign to total sales it will seek.

• Deciding which markets to enter: When deciding which markets to enter among many possible ones, three major criteria could be

listed after which some kind of ranking could be made: Market attractiveness, competitive advantage and risk (Kotler, 1989). This ranking should be supported by preparation of a financial analysis to see what could be expected to earn on the investment. Five steps are involved in estimating the probable rate of return on investment (Kotler, 1988):

1. Estimate of current market potential

2. Forecast of future market potential and risk 3. Forecast of sales potential

4. Forecast of cost and profits

5. Estimate of rate of return on investment

• Deciding how to enter the market: Once a company decides to target a particular country, it has to determine the best mode of entry. Its broad choices are indirect exporting, direct exporting, licensing, joint-ventures and direct investment (Albaum, 1989; Kotler, 1988). Each succeeding strategy involves more commitment, risk control and profit potential.

Furthermore, the company has to segment the future market and target a certain group of customers.

■ Deciding on the marketing program: Companies that operate in one or more foreign markets must decide how much to adapt their marketing mix to local conditions. At one extreme are the companies that use a standardized marketing mix worldwide. At the other extreme is the idea of a customized marketing mix. where the producer adjust the marketing-mix elements to each target market, bearing more cost but hoping for a larger market share and return (Albaum, 1989; Bagozzi, 1986; Kotler, 1988). Then there exists many possibilities between these two extremes. In basics the company must make decisions and commitments on Product, Promotion, Price and Distribution Channels (Place), and do research to be able to position the product in the market.

• Deciding on the marketing organization: Companies manage their international marketing activities in at least three ways: Export department. International division and Global organization

(Albaum, 1989; Kotler, 1988).

THE MODEL AND EGE-BALTICA

How did Baltics Enter the Turkish Market?

I will in the following section first try to collect the different decision variables that were crucial to the entrance decision, and then try to find a structure upon which they were built with the aim of spotting a trend in the information collected and used as decision base. By asking the above mentioned question I actually skip the first three decisions in the model described. This is done because I assume that the decision of whether to go abroad and which markets to enter have already been made.

Let us first take a look at the SWOT analysis that were made by the feasibility-study group. An already existing insurance portfolio and a strong distribution network (bank branch offices) combined with the large know-how and experience in the insurance field by Baltica makes the strengths. On the opportunity side, the feasibility group expects a lot from the market. This expectation is build on the assumption that since Turkey has an undeveloped insurance sector, the business must grow in the future, both with the help of market forces and with government interferences (liberalization of the money markets). And when we turn to the more 'negative' expectations (weaknesses, threats), we will notice that problems in recruitment of skilled personnel, cash-flow problems and the existing high inflation environment are some of the crucial issues. But despite these occurable problems, Baltica and Egebank decided to cooperate in the field of insurance believing that the strengths and opportunities weighed heavier than the weaknesses and threats. To be correct this also counts for IFU. These three partners then agreed to enter the Turkish insurance market on a joint-venture basis.

However it is not enough to decide how to enter the market; there must be some statement that shows who in particular you want to sell to. Mentioning this we have hit a weak point on the Ege- Baltica entrance mode. Ege-Baltica has not made any commitment as far as segmenting and targeting is concerned. Moving to the next decision (deciding on the marketing program) we will notice another weak point in the Ege-Baltica entrance mode as there are not sufficient information of how Ege-Baltica as a company is expected to be positioned in the market. This point however is closely related to the segmentation and targeting decision. But a lack of information on these issues results in a weak use (or no use) of the marketing mix tool: the 4P's (Product, price, place, promotion), therefore an unsure and weak marketing plan.

BUILDING A MARKETING MIX FOR EGE-BALTICA

The first thing to be done is to decide on the objectives of the company. Why did the partners of Ege-Baltica d e cide to join forces? The answer to this question is not clear w h e n asked to the managers, but looking at the Saltica annual report we will spot that Baltica is in an internationalization process, achieved by international growth. This is supported by Egebank, who, before the joint-venture, had an insurance company but needed capital to expand its business. IFU's main objective is to support Danish investments in foreign countries. So, combining these individual objectives, we could state that the joint objectives of Ege-Baltica is to gain regional market share in the short-run, and if successful, "fight" for national market-share in the long run. Baltica and IFU's primary concern is to get their return on investment, whereas Egebank needs to grow to survive. Ege-Baltica has to find the best way to gai n market- share by knowing HO W to market which product to WHOM.

To be able to perform a 'perfect' match of the product with the user/purchaser a company has to know who they are selling to. This is a simple and flexible rule that a marketer has to bear in mind when selling the company's products: If you are h ooked on a unique product then find the purchasing group that has a need that is being fulfilled by your product. However, if you are hooked on a unique purchasing group that you want to sell to,

then find a product that can fulfill their needs! One little

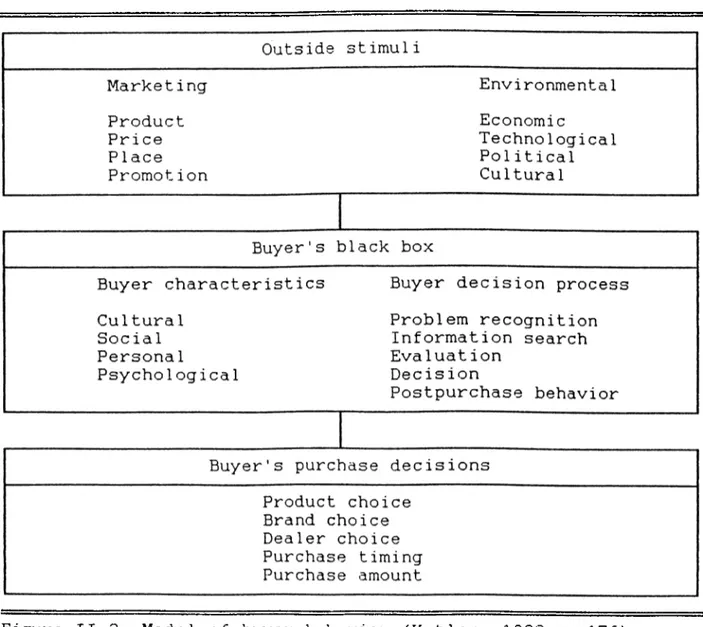

thing is necessary to underlie this rule, and that is the need for information about the purchaser group and their needs and their understanding of the product's advantages and disadvantages. This information is collected by research. One way to get information about the purchaser is to investigate his purchase decisions. What is his product, brand and dealer choices and what is his purchase timings and amounts. This information could be supported by information about the buyer

characteristics: cultural, social, personal and psychological. By collecting and analyzing these information subjects the company can by its marketing mix influence the buyer decision process.

As Figure II-2 shows, the marketing m i x together with some environmental factors makes the outside stimuli which is the bias on the buyer's black box. The black box is what we can call the buyer's mind, or personal characteristics. Depending on the

incoming stimuli (perceived positive or negative), the buyer

Figure II-2: Model of buyer behavior (Kotier, 1988;p. 176)

reacts and performs an activity. This activity should preferably be a purchase of the product. The marketing mix is then used as the communication interface between seller and buyer.

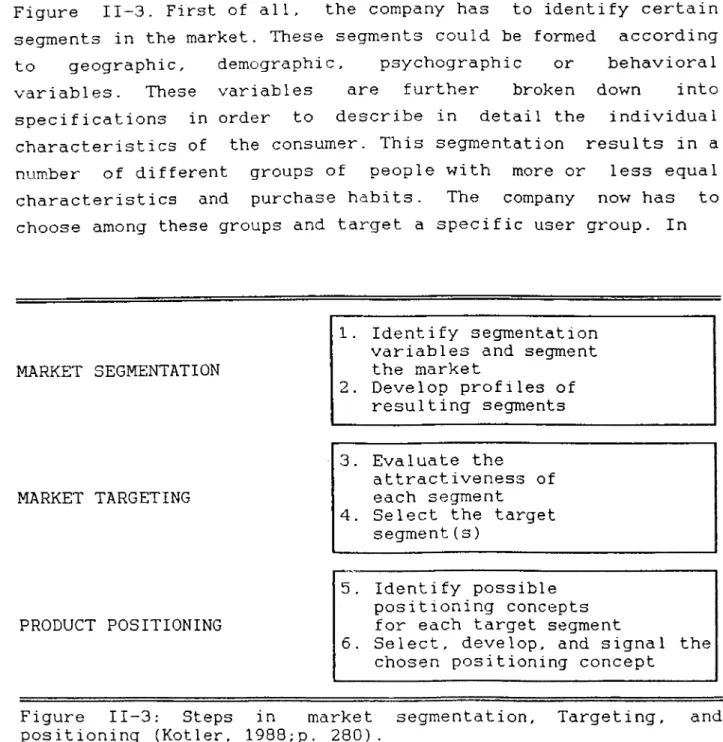

But before being able to form the marketing mix the company has to pass through three major steps. These steps are shown in Figure II-3. First of all, the company has to identify certain segments in the market. These segments could be formed according to geographic, demographic, psychographic or behavioral variables. These variables are further broken down into specifications in order to describe in detail the individual characteristics of the consumer. This segmentation results in a number of different groups of people with more or less equal characteristics and purchase habits. The company now has to choose among these groups and target a specific user group. In

MARKET SEGMENTATION

Identify segmentation variables and segment the market Develop profiles of resulting segments MARKET TARGETING PRODUCT POSITIONING 4. Evaluate the attractiveness of each segment

Select the target s e g m e n t (s )

Identify possible positioning concepts for each target segment

Select, develop, and signal the chosen positioning concept

Figure II-3: Steps in market segmentation. Targeting, and positioning (Kotler, 1988;p. 280).

order to catch the consumer's attention in the market, the company has to emphasize its differences from the other competitors so that the company products are recognized by the s e g m e n t 's customers.

In the following part, each step in building the marketing mix will be evaluated in relation to Ege-Baltica and comments will be made on the part they lightly passed through without further consideration.

Segmentation

Ho w did Ege-Baltica segment the market?

Ege-Baltica has used a geographical segmentation variable as they have stated the market are to be all of Turkey, but with emphasis on the Aegean region. The reason for this geographical emphasis is that Egebank (the local partner) has its stronger relations in this region. The Aegean region is one among seven regions in Turkey and covers 17.12% of the GDP which indicates that the region is one of the more industry heavy ones (see Appendix II). At the same time the Aegean region has one of the larger population increases which is 3.1% which is higher than the country average of 2.5%. Another segmentation variable used by Ege-Baltica is the kind of customer which is split between

industrial and private customers (individual persons).

What could Ege-Baltica have done?

If a company seriously wants to work with a segmented market each segment must be clearly defined. Then, to make a clear segment definition the company must know its market. Customer information has to be collected, first from the whole market, to be able to outline each segment, and then the information has to be specified in order to make a profile of the resulting segments

(Karlof, 1989; Kotler, 1988). Ege-Baltica has not been successful in outlining their segments. Only limited information has been collected from the geographical areas and a weak statement of emphasis on the Aegean region is made. This decision is based on the fact that the Aegean region is one of the richer in Turkey and this region is growing faster than the country average. Without further investigations Ege-Baltica is expecting the Aegean region to be the most promising one.

Ege-Baltica should have gone deeper into research before making decisions about the segmentation. First step is to collect information about the customers to be able to gain insight into motivations, attitudes and behavior. Generally the collected information is grouped in five different clusters (Kotler, 1988): 1- Attributes and their importance ratings, 2- Brand awareness and brand ratings, 3- Product usage patterns (the reason for buying an insurance) , 4- Attitudes toward the product category and 5- Demographics, psychographics, and mediagraphics of the respondents. This leads us to the second step, namely the analysis stage, where the collected data is examined to remove highly correlated variables, and a specified number of maximally different segments are created. The third and last step is to profile the data. Each cluster is profiled in terms of its distinguishing attitudes, behavior, demographics, psychographics, and media consumption habits. Each segment can be given a name based on a dominant distinguishing characteristic. This three step model helps to identify the major segments in a market.

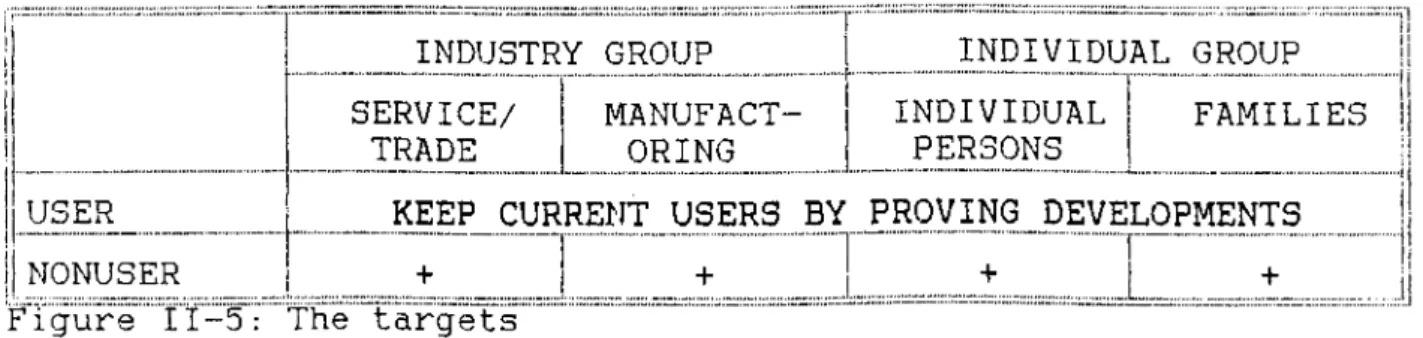

The insurance purchaser group can be split into two groups; an individual group, and an industry group. Each group has differences in their characteristics, and base their insurance needs on these characteristics. Therefore each group have also differences in their insurance needs.

The individual group: Some segmentation variables that could be important for the individual insurance business are listed in Table Il-la. Searching for a match between the product and the

Variable Breakdowns

Geographic

Region Density ClimateDemographic

Family sizeFamily life cycle

Income

Re 1igion Social class

Personality

Marmara, Aegean, Mediterranean Sea, Middle Anatolia, Black Sea, East Anatolia, South East Anatolia Urban, suburban, rural

Hot, cold

1-2, 3-4, 5+

Young, single; young, married, no

children; young, married, youngest child under 6; young, married, youngest child 6 or over; older, married, with

children; older, married, no children under 18; older, single; other

Under T1 1 mill; T1 1-2 mill; T1 2-3 mill; T1 3-5 mill; T1 5-8 mill; T1 8-10 mill; T1 10 mill and over

Muslim, other

Lower lowers, upper lowers, working class, middle class, upper middles, lower,u p p e r s , upper uppers

C o m p u l s i v e , ambitious gregarious, authoritarian,

Behavioral

Benefits User status Loyalty status Readiness stageAttitude toward product

Quality, service, economy Nonuser, regular user None, strong

unaware, aware, informed, interested, desirous, intending to buy

Enthusiastic, positive, indifferent, negative, hostile

Table Il-la: Major segmentation variables for insurance business (Bagozzi, 1986; Kotler, 1988).

the individual

customer we are able to say that Ege-Baltica should in the short- run focus on the Aegean region, where they have their footholds. Depending on the geographical climate, different kinds of accidents get a higher probability, and Ege-Baltica could specialize geographically here to prove their abilities. Further, this argument would be supported by the larger potential in this region, because of the above average population growth rate which will automatically increase the amount of insurance needed. This way, the first major segmentation variable becomes customers in the Aegean region. The next variable to be used is the demographic situation of the individual. Here, we are able to split the population in two, the individual (private) persons and the families. These then become our second segmentation variables. V/hen looking at the Aegean region and splitting the population in individuals and families, a remarkably large portion does not have an insurance. Many are not even aware of the existence of the insurance concept. It is therefore not surprising that a major trend in the Turkish insurance market shows, that the portion of nonusers is much larger than the users. Therefore it is natural to use a USER/NONUSER segmentation variable to further subdivide the individual population.

The industry group: Some segmentation variables that could be important for the industrial insurance business are listed in Table Il-lb; Variable Breakdowns

Geographic

Region Density C 1imateMarmara, Aegean, Mediterranean Sea, Middle Anatolia, Black Sea, East Anatolia, South East Anatolia Urban, suburban, rural

Hot, cold

Demographic

Industry Company sizeOperating Variables

Technology User/non-user status Customer capabilities Service/trade, Manufacturing Very large, large, middle, small very smallHigh, low, etc.

Do have insurance, do not have insurance

Do need, do not need

Purchasing Approaches

Purchasing organization Power structure Purchasing criteriaSituational Factors

Specific application Size of orderPersonal Characteristics

Attitudes toward risk Loyalty

Centralized, decentralized Centralized, decentralized,

engineering-dominated, financially- dominated, etc.

Quality, service, price etc.

Need for specific insurance, general insurance

Full coverage, partial coverage, e t c .

Risk-taking, risk-avoiding No loyalty, high loyalty

Table Il-lb: Major segmentation variables for the industrial insurance business (Bagozzi, 1986; Karlof, 1989; Kotler, 1988).

It is a fact that by far the largest part of the Turkish industry is located in the Marmara and Aegean region. As it is with the individual focus in the Aegean region, Ege-Baltica would have much larger potential in specializing in this region. The Aegean region therefore becomes the first segmentation variable for the industry group as well. The large differences among companies forces a classification of the major lines of business, as each line have different needs of insurance. Where the transportation