WEAK REVIVAL

Zümrüt İmamoğlu* and Barış Soybilgen

†Executive Summary

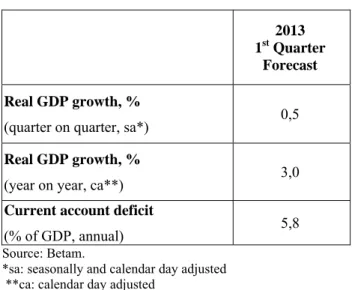

In January, the Industrial Production Index (IPI) increased by 2.3 percent from December. Export volume index decreased by 0.4 percent while import volume index increased by 5.7 percent. The increase in the IPI is small and does not indicate a strong revival. Consumption and investment indicators also show weak signs of revival. Betam’s quarter on quarter (QoQ) forecast for the first quarter of 2013 is 0.5 percent. The corresponding year on year (YoY) growth rate is 3 percent.

In January, the trade deficit was almost at the same level as the same month of the previous year. The 12-month current account deficit (CAD) which was $46.9 billion dollar at the end of 2012 did not change much and was $46.8 billion in January. We expect the current account deficit to the GDP ratio to be 5.8 percent at the end of the first quarter of 2013. A revival in domestic demand and hence imports might push this rate up in the coming months.

* Dr. Zümrüt İmamoğlu, Betam, Research Associate. zumrut.imamoglu@bahcesehir.edu.tr

† Barış Soybilgen, Betam, Research Assistant,

baris.soybilgen@bahcesehir.edu.tr

Table 1: Betam’s quarterly and annual growth rate forecasts

Source: Betam.

*sa: seasonally and calendar day adjusted **ca: calendar day adjusted

The economy continues to grow but not as much as desired

After the revisions in the IPI, the data show that the industrial production in the last quarter in 2012 was stronger than the previous quarter. The IPI, which declined 0.6 percent in the third quarter, increased 0.7 percent in the last quarter. In the first quarter of 2013 though, there is no sign of revival in production. The increase in the IPI in January does not fully compensate for the drop in December. If the IPI does not continue increasing

in February and March, 1st quarter industrial

production on average might remain the same as in the previous quarter.

2013 1st Quarter

Forecast Real GDP growth, %

(quarter on quarter, sa*) 0,5

Real GDP growth, %

(year on year, ca**) 3,0

Current account deficit

(% of GDP, annual) 5,8

Economic Outlook and Forecasts:

March 2013

On the other hand, the increase in import volume index in January compensated for the decline in December and pushed the index up to its November level. Imports excluding gold continue to increase QoQ. The surge in investment goods imports implies a strong revival in investment while the increase in intermediate goods imports indicates a revival in both industrial production and investment. However, the increase in imports which is higher than the increase in exports causes net exports to subtract from the real GDP growth. Consumption indicators still do not show strong signs of growth. Non-durable consumer goods production continues to increase, however, durable goods production has been decreasing for the last two quarters. Automobile production increased in January, but it declined QoQ. Without a boost to durable goods, it’s hard to speak of a strong revival in private consumption expenditures. Moreover, consumer confidence index remained stagnant in January.

January data indicate that the economy continues to grow but at a slow rate. Our indicators imply that the economy is in a transition state from export oriented growth to domestic demand driven growth. Betam’s quarter on quarter (QoQ) forecast for the first quarter of 2013 based on January data is 0.5 percent. The corresponding year on year (YoY) growth rate is 3 percent.

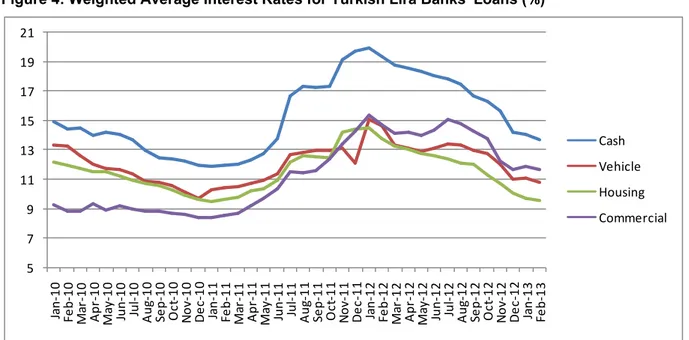

Transition period

Policies that try to stimulate domestic demand are gradually becoming effective. Growth rate of bank loans is above the desired 15 percent, and

investment is slowly recovering. Even though this revival increases imports, we have not yet seen strong increases in industrial production. As long as the rate of increase in exports remain lower than the rate of increase in imports, Central Bank’s growth strategy for 2013, “allowing revival of domestic demand as much as the increase in net exports” is in danger of failure. Betam expects the

current account deficit at the end of 1st quarter to

be close to 5.8 percent. If the revival in domestic demand becomes stronger, the current account deficit might increase further, but indicators so far show that the revival is weaker than expected.

Private consumption expenditure indicators show a mixed picture

Consumer goods imports and non-durable goods production increased by 8.3 percent and 2.0 percent, respectively, following declines in both in December. Durable goods production, on the other hand, continues its downward trend. The consumer confidence index decreased slightly, by 0.1 percent, in February. Special consumption tax (SCT) revenue increased 3.7 percent in January, but mostly due to increases in tax rates on tobacco products. Overall, it’s too early to have a clear picture of private consumption expenditure in the

1st quarter. February and March data releases will

hopefully yield clearer signals.

Private investment expenditure is increasing

Real sector confidence index increased 3.0 percent in February following a decline of 2.4 percent in January. Investment goods imports and investment goods production recovered slightly in January

following the declines in December. Capacity utilization rate (CUR) continues its volatile trend. The 2.3 percent increase in IPI in January is a

positive sign for 1st quarter growth, but it is not

strong enough to push the average quarterly index above fourth quarter. However, if investment goods imports and production continue to grow at the same pace in the coming months, private investment expenditures might contribute

positively to GDP growth in the 1st quarter.

Contribution of net exports might turn negative in the 1st quarter

Figure 2 shows monthly changes of seasonally adjusted import and export volume indices. In January, export volume index decreased by 0.4 percent whereas import volume index increased by

5.7 percent. Since the 2nd quarter of 2011, net

exports have been contributing positively to GDP

growth. This trend might come to an end in the 1st

quarter of 2013 if imports continue to increase at the current rate.

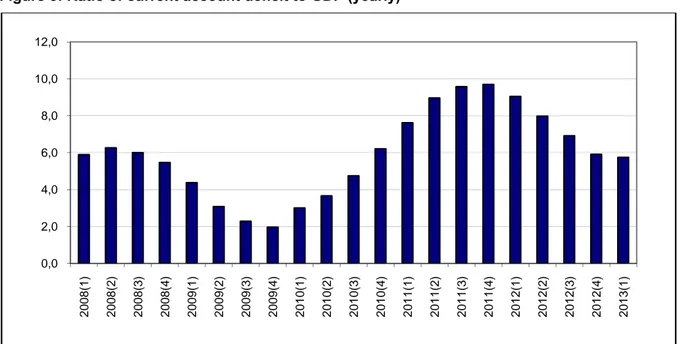

Current account deficit remains stagnant in the first quarter

Due to a revision in tourism income accounts, 2012 current account deficit fell to $46.9 billion and the end of year current account deficit realized as 6 percent. In January, trade deficit increased slightly, from $7.1 billion to $7.3 billion, compared to the same month of the previous year. Gold trade with Iran seems to have ceased for now and is not as influent as last year.

The 12-month CAD was $46.8 billion at the end of January. As the impact of base effect weakens and weaker recovery than expected in domestic demand continues, the current account deficit remains stagnant. We expect the current account deficit which was 6 percent at the end of 2012 to be 5.8 percent at the end of the 1st quarter of 2013.

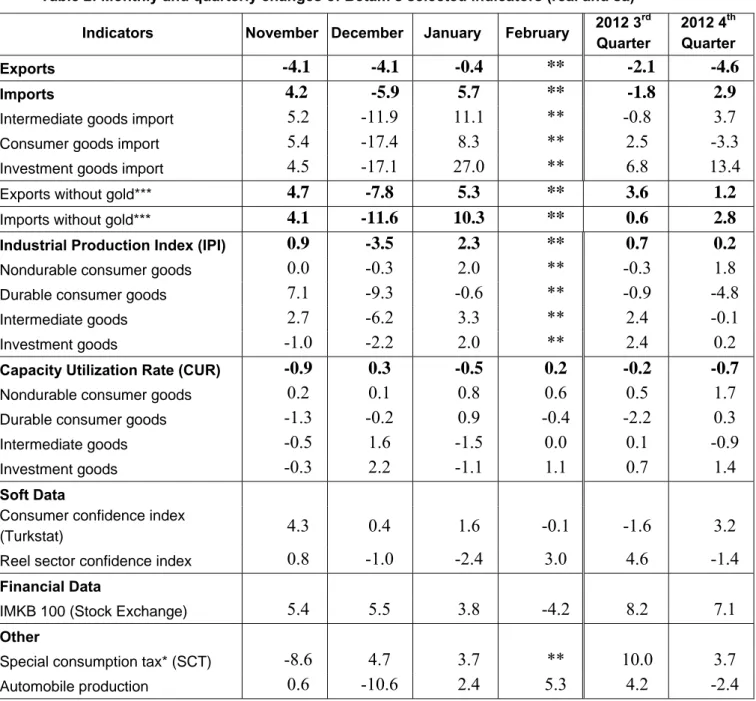

Table 2: Monthly and quarterly changes of Betam’s selected indicators (real and sa) Indicators November December January February 2012 3

rd Quarter 2012 4th Quarter Exports

-4.1 -4.1 -0.4 ** -2.1 -4.6

Imports4.2 -5.9 5.7 ** -1.8 2.9

Intermediate goods import

5.2 -11.9 11.1 ** -0.8 3.7

Consumer goods import5.4 -17.4 8.3 ** 2.5 -3.3

Investment goods import4.5 -17.1 27.0 ** 6.8 13.4

Exports without gold***4.7 -7.8 5.3 ** 3.6 1.2

Imports without gold***

4.1 -11.6 10.3 ** 0.6 2.8

Industrial Production Index (IPI)

0.9 -3.5 2.3 ** 0.7 0.2

Nondurable consumer goods

0.0 -0.3 2.0 ** -0.3 1.8

Durable consumer goods7.1 -9.3 -0.6 ** -0.9 -4.8

Intermediate goods2.7 -6.2 3.3 ** 2.4 -0.1

Investment goods-1.0 -2.2 2.0 ** 2.4 0.2

Capacity Utilization Rate (CUR)

-0.9 0.3 -0.5 0.2 -0.2 -0.7

Nondurable consumer goods

0.2 0.1 0.8 0.6 0.5 1.7

Durable consumer goods-1.3 -0.2 0.9 -0.4 -2.2 0.3

Intermediate goods-0.5 1.6 -1.5 0.0 0.1 -0.9

Investment goods-0.3 2.2 -1.1 1.1 0.7 1.4

Soft Data

Consumer confidence index

(Turkstat)

4.3 0.4 1.6 -0.1 -1.6 3.2

Reel sector confidence index0.8 -1.0 -2.4 3.0 4.6 -1.4

Financial Data

IMKB 100 (Stock Exchange)

5.4 5.5 3.8 -4.2 8.2 7.1

Other

Special consumption tax* (SCT)

-8.6 4.7 3.7 ** 10.0 3.7

Automobile production0.6 -10.6 2.4 5.3 4.2 -2.4

Source: TurkStat,CBRT,Treasury,ISE,Betam. All series are real (or inflation adjusted) wherever necessary and seasonally adjusted. *This tax is collected on sales of goods such as gas, fuel oils, alcohol, tobacco products and automobiles.

**Data not yet released.

Figure 1: Capacity utilization rate and industrial production index (sa. left axis for CUR and right axis for IPI)

Source: TurkStat. Betam.

Figure 2: Volume indices of exports and imports (sa)

Source: TurkStat. Betam.

Figure 3: Ratio of current account deficit to GDP (yearly)

Source: CBRT. TurkStat. Betam.

75 80 85 90 95 100 105 110 115 120 55 60 65 70 75 80 85 Ja n -0 7 Ma y -0 7 Se p -0 7 Ja n -0 8 Ma y -0 8 Se p -0 8 Ja n -0 9 Ma y -0 9 Se p -0 9 Ja n -1 0 May -10 Se p -1 0 Ja n -1 1 Ma y -1 1 Se p -1 1 Ja n -1 2 Ma y -1 2 Se p -1 2 Ja n -1 3 CUR IPI 70 80 90 100 110 120 130 140 Jan -0 7 Ma y-07 Se p -0 7 Jan -0 8 Ma y-08 Se p -0 8 Jan -0 9 Ma y-09 Se p -0 9 Jan -1 0 Ma y-10 Se p -1 0 Jan -1 1 Ma y-11 Se p -1 1 Jan -1 2 Ma y-12 Se p -1 2 Jan -1 3 Export Import 0,0 2,0 4,0 6,0 8,0 10,0 12,0 2008(1) 2008(2) 2008(3) 2008(4) 2009(1) 2009(2) 2009(3) 2009(4) 2010(1) 2010(2) 2010(3) 2010(4) 2011(1) 2011(2) 2011(3) 2011(4) 2012(1) 2012(2) 2012(3) 2012(4) 2013(1)

Figure 4: Weighted Average Interest Rates for Turkish Lira Banks' Loans (%) Source: CBRT. 5 7 9 11 13 15 17 19 21 Jan ‐10 Fe b ‐10 Ma r‐ 10 Ap r‐ 10 Ma y‐ 10 Ju n ‐10 Ju l‐ 10 Au g‐ 10 Se p ‐10 Oc t‐ 10 No v‐ 10 De c‐ 10 Jan ‐11 Fe b ‐11 Ma r‐ 11 Ap r‐ 11 Ma y‐ 11 Ju n ‐11 Ju l‐ 11 Au g‐ 11 Se p ‐11 Oc t‐ 11 No v‐ 11 De c‐ 11 Jan ‐12 Fe b ‐12 Ma r‐ 12 Ap r‐ 12 Ma y‐ 12 Ju n ‐12 Ju l‐ 12 Au g‐ 12 Se p ‐12 Oc t‐ 12 No v‐ 12 De c‐ 12 Jan ‐13 Fe b ‐13 Cash Vehicle Housing Commercial

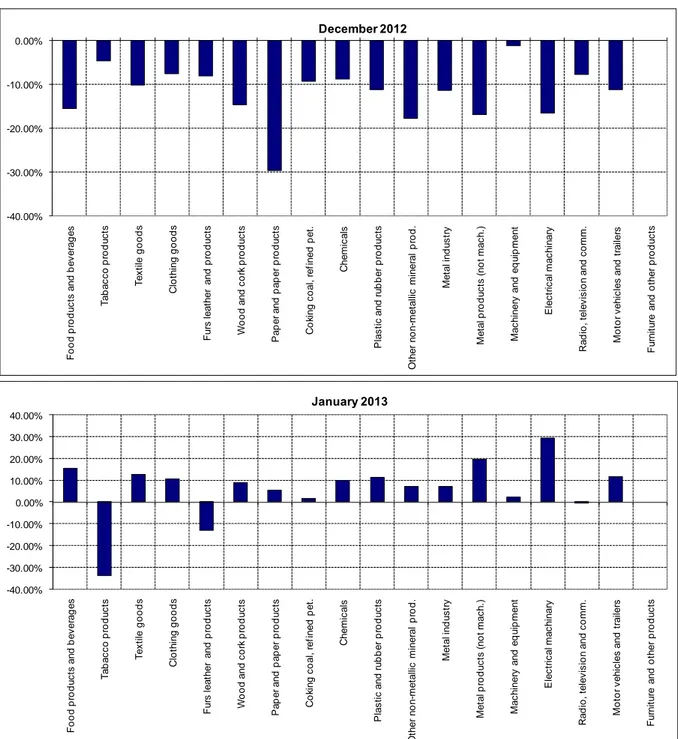

Figure 5: Monthly changes of manufacturing industry exports (sa)

Source: TurkStat. Betam.

-40.00% -30.00% -20.00% -10.00% 0.00% 10.00% 20.00% 30.00% 40.00% F o o d pr odu c ts a n d be v e ra ge s T a ba c c o pr odu c ts T e x ti le g oods C lot h in g goo ds F u rs l e a th e r a n d pr odu c ts W o od a n d c o rk pr odu c ts P a p e r a n d pa pe r pr odu c ts C o ki n g c o al , r e fi ned p e t. C hem ic al s P la s ti c a n d r u bb e r pr o d u c ts O ther no n-m e ta lli c m iner al p ro d . Me ta l in d u s tr y M e ta l pr odu c ts ( n ot m a c h .) M a c h iner y an d eq ui p m ent E lec tr ic al m a c h inar y R a di o, t e le v is ion a n d c o m m . M o to r v e hi c les and t rai le rs F u rn it ur e a n d o ther p ro d u c ts January 2013 -40.00% -30.00% -20.00% -10.00% 0.00% F o o d pr odu c ts a n d be v e ra ge s T a ba c c o pr od u c ts T e x ti le good s C lot h in g g oods F u rs leat her and p ro d uc ts W ood a n d c o rk pr odu c ts P a p e r a n d p a p e r pr od u c ts C o ki ng c o al , re fi ned p e t. C hem ic al s P las ti c an d r u b b er p ro d uc ts O ther no n-m e ta ll ic m iner al p ro d . Me ta l in d u s tr y M e ta l pr od u c ts ( n o t m a c h .) M a c h iner y an d eq ui p m ent E lec tr ic al m a c h in ar y R a di o , t e le v is ion a n d c o m m . M o to r v ehi c les and t rai le rs F u rn it u re and o ther p ro d uc ts December 2012