HARD LANDING IN TURKISH ECONOMY

Zümrüt İmamoğlu* ve Barış Soybilgen

†Executive Summary

In December, the Industrial Production Index (IPI) decreased by 1.5 percent from November. Export import volume indices also decreased by 4.6 and 6.4 percent, respectively. Declines in the indices negatively affected the economic outlook for the 4th quarter. The Quarterly IPI was almost stagnant.

Moreover, gold excluded exports and imports experienced slumps. However, we still expect a small revival in the 4th quarter compared to the 3rd

quarter in which real GDP grew by only 0.2 percent. According to the December data, we revised down our 4th quarter growth forecast from 1.2 percent to 0.6 percent. The corresponding year on year (YoY) growth rate is 2.4 percent and our annual GDP growth rate estimate for 2012 is 2.6 percent.

In December, trade deficit was $1 billion lower than the same month of the previous year. The 12-month CAD was $50.8 billion in November, and it decreased to $48.9 billion in December. However after the revision in tourism income accounts by TurkStat the current account was revised down to $46,9 billion. We expect the current account deficit to the GDP ratio to be 5.9 percent for 2012.

* Dr. Zümrütİmamoğlu, Betam, Research Associate. zumrut.imamoglu@bahcesehir.edu.tr

† BarışSoybilgen, Betam, Research Assistant,

baris.soybilgen@bahcesehir.edu.tr

Table 1: Betam’s quarterly and annual growth rate forecasts

Source: Betam

*sa: seasonally and calendar day adjusted **ca: calendar day adjusted

The decline in the IPI lowered the spirits

In our monthly reviews during the last two months, Betam expected a revival in the economy depending on October and November data. After the announcement of December data, our expectations deteriorated. However, the general economic outlook of the economy is still better than the 3rd quarter.

Due to the 1.5 percent decline of the IPI in December, the IPI only increased by 0.1 percent in

2012 4th Quarter

Forecast Real GDP growth, %

(quarter on quarter, sa*) 0.6

Real GDP growth, %

(year on year, ca**) 2.4

Current account deficit

(% of GDP, annual) 5.9

2012 Annual Growth

Real GDP growth, % 2.6

Economic Outlook and Forecasts:

February 2013

the 4th quarter from the 3rd quarter.1 In other

words, industrial production almost did not change in the 4th quarter. Industrial production (according

to revised data) was also almost stagnant in the 3rd

quarter. In December, imports and exports experienced sharp declines. Gold excluded imports and exports decreased by 11 and 9.5 percent respectively.

On the other hand, other economic indicators that indicate a revival in the last quarter still remain intact. Leading indicators that still imply a revival are the consumer goods and investment goods imports and production. Moreover, while durable goods production decreases, non-durable goods production increases. Even though real sector confidence index began to deteriorate in December, it increased significantly quarter on quarter (QoQ). As in the 4th Quarter, IMKB 100

continued to surge in January. Although automobile production experienced a slump in December, it increased 4 percent QoQ.

Even though there is no increase in the IPI, other economic indicators for consumption and investment are positive. This indicates that part of consumption and investment is met by inventories. In the third quarter, the revival in consumption was balanced by the increase in inventory. This can also happen in the last quarter. According to these developments, we revised our growth forecasts down. Betam’s first QoQ growth forecast was 1.2 percent. We lowered this forecast to 0.6 percent. The corresponding YoY growth rate is 2.4

1 This report was written before the revision and release of

January data which shows a better outlook for the fourth quarter. Our analysis and forecasts will be updated later in March.

percent. After the revision, we lower our annual growth forecast for 2012 from 2.7 to 2.6 percent.

Hard Landing in the Economy

In our 3rd quarter growth review research brief, we

indicated that the annual growth rate for 2012 cannot be above 3 percent and the economy was proceeding to make a “hard landing”. The 4th quarter economic indicators that are finalized after the announcement of December data point out the accuracy of our forecast. From now on, discussions about growth will move away from whether landing was hard or soft, rather, they will focus on whether growth can be revived in 2013 or not.

Even though December data lowered the spirits, Turkish Exporters Assembly data indicate that exports in January may offset the fall in December. Following this, IPI may also increase in January. However, IPI has been following a volatile path for a long time. Hence, an increase in January will not be enough to make a conclusion. In policy side, there is not much change. Monetary policy is still expansionary. Because of concerns about credit growth, TCMB increased required reserve ratios slightly, but loan rates are still very low. Exports, which were not sufficiently large to carry growth to the targeted level in 2012, are not expected to push the GDP to the 4 percent in 2013 either without any major changes in the global outlook. In order to achieve 4 percent growth, domestic demand should be revived. In the last quarter, we see some signs regarding the revival, but it is not yet evident in the production data. First

quarter data will contain major information for 2013 growth.

Consumption carries the growth

Consumer confidence index increases in the last three quarters. This is a good sign for coming months. Durable consumer goods production decreased by 0.5 percent in the 4th quarter from the previous quarter, whereas non-durable goods production increased by 2.8 percent in the same period. Furthermore, consumer goods imports increased by 3.1 percent in the last quarter. Both production and imports data indicate a revival in consumption expenditures. Overall, we expect private consumption expenditures to contribute positively to the real GDP growth in the 4th

quarter.

Investment expenditure is increasing

Real sector confidence index increased by 4.6 percent in the 4th quarter from the previous

quarter. In the same period, automobile production increased by 4.0 percent. In line with these increases, investment goods imports and investment increased by 4.7 percent and 3.3 percent respectively. On the other hand, IPI was almost stagnant in the last two quarters. Moreover, capacity utilization rate (CUR) decreased by 0.2 percent in the last quarter. In spite of adverse signs in the IPI and CUR, we expect private investment expenditures to increase in the last quarter from the previous quarter.

Net exports are ineffective in this quarter

Figure 2 shows monthly changes of seasonally adjusted import and export volume indices. In the 4th quarter, export volume index and import

volume index decreased by 5.6 percent and 0.6 percent, respectively. However, the declines are mostly due to decreases in gold trade. In fact, when we adjust the trade data for gold (i.e., excluding gold imports and exports), we see that the real exports and real imports actually increased by 3.0 percent and 1.7 percent, respectively. Overall, it is very likely that net exports contribute negatively to 4th quarter real GDP growth.

However, when the gold trade is excluded, we expect the contribution of net exports to be close to zero.

Current account deficit returns to pre-crisis level

In December, trade deficit fell from $8.1 billion to $7.2 billion from the same month of the previous year. The decline in imports contributed more to the fall in the current account deficit than the increase in exports. Gold exports are the engine of the annual increase in exports. The 12-month CAD was $50.8 billion in November. In December, it decreased to $48.9 billion and due to a revision in tourism income accounts it has revised further down to $46.9 billion. We expect the 12-month current account deficit to the GDP ratio, which was 7.2 percent at the end of the third quarter, to fall down to 5.9 percent at the end of the fourth quarter. The contribution of tourism income accounts to the decline in the current account deficit has been 0,2 percentage points for 2012.

Table 2: Monthly and quarterly changes of Betam’s selected indicators (real and sa) Indicators October November December January 2012 3

rd Quarter 2012 4th Quarter Exports

3,4

-4,8

-4,6

**

3,7

-5,6

Imports-1,4

4,7

-6,4

**

-0,5

-0,6

Intermediate goods import

3,4 3,9 -5,0

** 0,3 1,7

Consumer goods import

7,9 4,8 -16,3

** -0,6 3,1

Investment goods import

7,6 4,9 -10,2

** -0,6 4,7

Exports without gold***

2,7 4,3 -9,5

** -1,1 3,0

Imports without gold***

1,9 3,8

-10,9

** 0,3 1,7

Industrial Production Index (IPI)

-2,4 1,3 -1,5

** 0,1 0,1

Nondurable consumer goods

3,0 0,5 -3,5

** 1,3 2,8

Durable consumer goods

-3,9 6,3 -15,1

** 1,6 -0,5

Intermediate goods

-0,3 2,2 -5,1

** -0,2 -0,1

Investment goods

3,5 1,8 -7,7

** -3,5 3,3

Capacity Utilization Rate (CUR)

0,7 -0,9 0,3

-0,5 -1,1 -0,2

Nondurable consumer goods

0,1 0,1 0,0

0,6 -0,4 0,2

Durable consumer goods

-0,9 -1,3 -0,2

1,0 -1,8 -2,2

Intermediate goods

0,2 -0,5 1,5

-1,5 -0,9 -0,1

Investment goods

0,3 -0,3 1,8

-1,0 -2,1 0,3

Manufacturing Orders Index

5,2 1,9 **

** -4,1 5,9

Domestic Orders

6,9 6,1 **

** -2,9 9,0

Foreign Orderrs

3,6 -5,4 **

** -5,7 1,6

Soft Data

Consumer confidence index

(Turkstat)

-1,6 4,2 0,4

1,7 -2,2 -1,5

Reel sector confidence index

4,5 0,7 -1,0

-2,6 -3,1 4,6

Financial Data

IMKB 100 (Stock Exchange)

0,6 5,7 5,7

4,0 9,6 8,9

Other

Special consumer tax* (SCT)

11,5 -8,6 4,6

** 3,0 8,7

Automobile production

4,7 0,5 -10,7

2,3 -3,2 4,0

Source: TurkStat,CBRT,Treasury,ISE,Betam. All series are real (or inflation adjusted) wherever necessary and seasonally adjusted. *This tax is collected on sales of goods such as gas,fuel oils,alcohol,tobacco products and automobiles.

**Data not yet released.

Figure 1: Capacity utilization rate and industrial production index (sa. left axis for CUR and right axis for IPI)

Source: TurkStat, Betam.

Figure 2: Volume indices of exports and imports (sa)

Source: TurkStat, Betam.

Figure 3: Ratio of current account deficit to GDP (yearly)

Source: CBRT, TurkStat, Betam.

95 100 105 110 115 120 125 130 135 60 65 70 75 80 85 Ja n -0 7 Ma y -0 7 Se p -0 7 Ja n -0 8 Ma y -0 8 Se p -0 8 Ja n -0 9 May -09 Se p -0 9 Ja n -1 0 May -10 Se p -1 0 Ja n -1 1 Ma y -1 1 Se p -1 1 Ja n -1 2 Ma y -1 2 Se p -1 2 Ja n -1 3 CUR IPI 120 140 160 180 200 220 240 Ja n -07 Ma y-07 Se p -0 7 Ja n -08 Ma y-08 Se p -0 8 Ja n -09 Ma y-09 Se p -0 9 Ja n -10 Ma y-10 Se p -1 0 Ja n -11 Ma y-11 Se p -1 1 Ja n -12 Ma y-12 Se p -1 2 Export Import 0.0 2.0 4.0 6.0 8.0 10.0 12.0 200 8Q 1 200 8Q 2 200 8Q 3 200 8Q 4 200 9Q 1 200 9Q 2 200 9Q 3 200 9Q 4 201 0Q 1 201 0Q 2 201 0Q 3 201 0Q 4 201 1Q 1 201 1Q 2 201 1Q 3 201 1Q 4 201 2Q 1 201 2Q 2 201 2Q 3 2012 Q 4 *

Figure 4: Weighted Average Interest Rates for Turkish Lira Banks' Loans (%)

Source: CBRT.

Table 3: The change in the total credit growth and GDP growth (Quarterly) The change in the credit growth Real GDP growth (YoY)

March 08 32.5 7.0 June 08 11.4 2.6 September 08 9.8 0.9 December 08 -15.7 -7.0 March 09 -38.4 -14.7 June 09 -38.5 -7.8 September 09 -68.0 -2.8 December 09 156.4 5.9 March 10 78.3 12.6 June 10 62.6 10.4 September 10 30.0 5.3 December 10 34.2 9.3 March 11 7.8 12.1 June 11 13.1 9.1 September 11 17.4 8.4 December 11 -18.1 5.0 March 12 -9.3 3.4 June 12 -10.2 3.0 September 12 -24.8 1.6 December 12 4.2

Source: CBRT, TurkStat, Betam.

5 7 9 11 13 15 17 19 21 Jan ‐10 Fe b ‐10 Ma r‐ 10 Ap r‐ 10 Ma y‐ 10 Ju n ‐10 Ju l‐ 10 Au g‐ 10 Se p ‐10 Oc t‐ 10 No v‐ 10 De c‐ 10 Jan ‐11 Fe b ‐11 Ma r‐ 11 Ap r‐ 11 Ma y‐ 11 Ju n ‐11 Ju l‐ 11 Au g‐ 11 Se p ‐11 Oc t‐ 11 No v‐ 11 De c‐ 11 Jan ‐12 Fe b ‐12 Ma r‐ 12 Ap r‐ 12 Ma y‐ 12 Ju n ‐12 Ju l‐ 12 Au g‐ 12 Se p ‐12 Oc t‐ 12 No v‐ 12 De c‐ 12 Jan ‐13 Cash Vehicle Housing Commercial

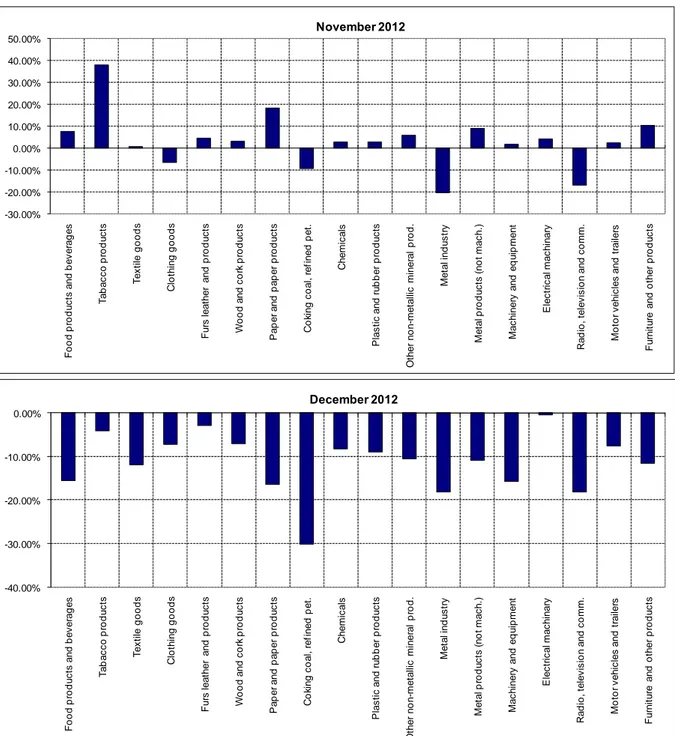

Figure 5: Monthly changes of manufacturing industry exports (sa)

Source: TurkStat, Betam.

-40.00% -30.00% -20.00% -10.00% 0.00% F ood pr odu c ts a n d be v e ra ge s T a ba c c o pr odu c ts T e x ti le goods C lot h in g go ods F u rs l e a ther an d p ro d u c ts W o od a n d c o rk pr odu c ts P a p e r a n d pa pe r pr od u c ts C o ki ng c o a l, r e fi ned p e t. C hem ic al s P la s ti c a n d r u bb e r pr odu c ts O ther no n-m e ta ll ic m iner a l p ro d . Me ta l in d u s tr y M e ta l p ro d u c ts ( n o t m a ch .) M a c h in e ry and eq ui p m en t E lec tr ic al m a c h inar y R a di o, t e le v is ion a n d c o m m . M o to r v ehi c les and t rai le rs F u rn it ur e an d o ther p ro d u c ts December 2012 -30.00% -20.00% -10.00% 0.00% 10.00% 20.00% 30.00% 40.00% 50.00% F o o d pr odu c ts a n d be v e ra ge s T a ba c c o pr od u c ts T e x ti le good s C lot h in g g oods F u rs leat her and p ro d uc ts W ood a n d c o rk pr odu c ts P a p e r a n d p a p e r pr od u c ts C o ki ng c o al , re fi ned p e t. C hem ic al s P las ti c an d r u b b er p ro d uc ts O ther no n-m e ta ll ic m iner al p ro d . Me ta l in d u s tr y M e ta l pr od u c ts ( n o t m a c h .) M a c h iner y an d eq ui p m ent E lec tr ic al m a c h in ar y R a di o , t e le v is ion a n d c o m m . M o to r v ehi c les and t rai le rs F u rn it u re and o ther p ro d uc ts November 2012