1

A GROWING ECONOMIC SEGMENT

IN A DEVELOPING ECONOMY:

WOMEN ENTREPRENEURS AND THEIR PROBLEMS IN TURKEY

Serap Çabuka, Selin Köksal Araç b*, Hatice Doğan Südaşc

aDepartment of Business Administration, Çukurova University, Adana, Turkey, cabuks@cu.edu.tr bDepartment of Business Administration, Çukurova University, Adana, Turkey, skoksal@cu.edu.tr cDepartment of Business Administration, Çukurova University, Adana, Turkey, hdogan@cu.edu.tr

Abstract

Recent studies show that the number of women entrepreneurs has been increasing in both developing and developed countries, even though entrepreneurship-a critical tool for economic development- is perceived as male-dominated area. In 2012, an estimated 224 million women have contributed to economy all over the world (in 67 economies) by establishing new businesses or running their existing businesses (Kelley et al., 2013). The contribution of women entrepreneurs to economy, society and employment is very crucial especially for developing countries. This exploratory and descriptive study was conducted to find out some implications about financial and marketing problems of women entrepreneurs in one developing economy, Turkey. The main purpose of this pilot study is to reveal the financial constraints and financial based marketing problems of women-owned micro and small enterprises (MSEs) in Turkey where women entrepreneurs rate is high as compared with female labour force participation rate. The data were collected from 130 Turkish women entrepreneurs through survey method. The results indicate that the biggest obstacles in running women owned small businesses are financial problems and the need for professional development. The women entrepreneurs need additional skills and knowledge especially in finance and women owned small enterprises have limited marketing abilities as a result of financial constraints.

Keywords: women entrepreneurs, developing economies, micro and small enterprises (MSEs), financial based marketing problems, Turkey

Jel Codes: M13, M21, O10

* Corresponding author: Çukurova Üniversitesi, İktisadi ve İdari Bilimler Fakültesi, 2. Blok, İşletme Bölümü, Ofis No:118 01330 Sarıçam/ADANA. E-mail address: skoksal@cu.edu.tr Fax: 0090 3223387286

2 Introduction

Both micro and small enterprises (MSEs) and female enterprises have drawn considerable attention in recent years depending on their contribution to employment and economic development (Mathew, 2010; Vita et al., 2014; Nichter and Goldmark, 2009; Tambunan, 2009). Micro and small enterprises supply the largest amount of work opportunities in both developing and developed countries (Mead and Liedholm, 1998; Özbek 2008) and the number of women entrepreneur has been progressively increasing in these countries (Vita et al., 2014; Brush et al., 2009). In developing economies, both MSEs and women enterprises have become important economic drivers as a result of lack of job opportunities and the need of self-employment (Liedholm and Mead, 1999; Hiscrih and Öztürk, 1999). In addition to their economic outcomes, these enterprises also create remarkable social and political output (Fielden et al., 2003; Jamali 2009). Although they contribute to economic and social development, these businesses have several barriers such as lack of financial resources, limited access to markets, insufficient financial, managerial and marketing skills (Vita et al., 2014; Abor and Quartey, 2010). Finance and marketing which serve for each other are inseparable parts of any enterprises. The financial constraints hinder marketing activities of businesses which require substantial amount of budget (Weinrauch et al., 1991) and market failure may create larger financial problems in the long run. This exploratory study has examined the financial and marketing problems of women owned micro and small enterprises in Turkey based on survey method with a sample of 130 women entrepreneurs.

The Role of Micro and Small Enterprises (MSEs) for Developing Economies

The vast majority of businesses in both developed and developing economies are micro and small enterprises (MSEs) (Nichter and Goldmark, 2009; Sandberg, 2003; Tambunan, 2009). The MSE businesses provide substantial amount of employment opportunities and economic output in many regions (Mead and Liedholm, 1998; Abor and Quartey, 2010; Nichter and Goldmark, 2009). For example, the number of small businesses in the United States was 28.2 million in 2011 and these businesses have 99.7 percent of employer firms and make up 48.5 percent of the private sector workforce (US Small Business Administration, 2014). Similarly, the percentage of small and medium enterprises (SMEs) is 99.6 in Turkey and the 96 percent of these enterprises is MSEs (Özbek, 2008; TMMOB Report, 2012). Some researches claim that actual numbers of MSEs are not known and official figures may generally underestimate the real number and the contribution of these

3

enterprises (Mead and Liedholm, 1998; Nichter and Goldmark, 2009; Liedholm and Mead, 1999).

The employment and income have been increasing in many developing countries in relation to MSEs (Liedholm and Mead, 1999). This micro and small enterprises contribute to employment through generating new businesses or growing of existing ones (Mead and Liedholm, 1998). The role of MSEs varies notably across countries depending on economic output (Nichter and Goldmark, 2009). These businesses are very central to well being of developing economies which are based on small-scale production (Tybout, 2000). The relationship of economic development and MSEs has been interpreted in two different ways: Some observers think that the increasing number of income and employment with MSEs is encouraging sign for economy, on the other hand, other observers claim that a large number of people working in MSEs is a sign of failure to supply productive jobs (Liedholm and Mead, 1999).

Beyond their economic contribution, MSEs also create some social and political outcomes. For example, these businesses increase self confidence and empowerment of the individuals, contribute social change, political stability and democracy (Fielden et al., 2003; Liedholm and Mead, 1999). Notwithstanding the recognition of their contributions to economy, the development of these businesses is restricted by various factors such as limited access to international markets, lack of management, marketing and finance skills (Abor and Quartey, 2010). The MSEs are mostly owned by women in many countries (Liedholm and Mead, 1999) and female entrepreneurs generally have greater personal, professional and societal problems than male entrepreneurs during initiation and running their business (Welsh et al., 2014).

The Role of Women Owned Enterprises for Developing Economies

The number of women entrepreneurs has been increasing in both developed and developing economies in recent years (Welsh et al., 2014; Vita et al., 2014; Brush et al., 2009). Around 126 million women started or run new businesses in 67 economies around the world in addition to 98 million existing women enterprises in 2012 (Kelley et al., 2013). Women entrepreneurship has drawn considerable attention by researchers in recent years depending on its contribution to economic development through new business creation (Jamali, 2009; Mathew, 2010; Vita et al., 2014; Verheul, 2006).

4

Entrepreneurship is defined as the catalytic agent in society which creates new businesses, innovative products and exchange (Mathew, 2010). Women entrepreneurs create employment, innovation and wealth creation in many economies (Brush and Cooper, 2012). Entrepreneurship is essential for dynamism of modern market and women entrepreneurs have significant role for both economic and social development (Vita et al., 2014; Jamali 2009). In addition to their contribution to employment and economic growth, women entrepreneurs also increase diversity of entrepreneurship. The diversity of sectors, products, processes and targeted markets create liberal market environment where customers have more preferences and lead to increase quality of entrepreneurship (Verheul, 2006). Women entrepreneurship also accelerates social change with transformation of gender role identities (Vita et al., 2014) and provides new paths for female contribution to social and economic life (Jamali, 2009).

Women start their businesses with the motivation to utilize opportunities in developed countries while other women are motivated by necessity in less developed economies (Brush and Cooper, 2012). Turkey is one of the developing economies where women start their business as a result of limited job opportunities and self-employment need (Hiscrih and Öztürk, 1999; Soysal, 2010). The self-employed women rate is 10,8% in Turkey (TUIK Report, 2012) which is very high as compared with female labour force participation rate. The high rate of women entrepreneurs in consideration of female labour force participation reflects the economic development level of a country (Jamali, 2009). The general conditions for entrepreneurship in the developing economies (Verheul, 2015) and entry barriers faced by women to access the formal labour market (Vita et al., 2014) have resulted in increasing number of women owned businesses. Women entrepreneurs in developing economies overcome occupational discrimination and social norms through running their own businesses (Ufuk and Özgen, 2001). Women entrepreneurs has critical importance for developing countries in terms of their contribution to modernization and economic development (Lerner at al., 1997).

The Interdependency of Marketing and Finance for Women Owned Enterprises

Starting and running a business have potential risks and require considerable effort. The risk is generally greater for female entrepreneurs who have also some additional problems related to being a woman (Hisrich and Brush, 1983). Women entrepreneurs face many personal, professional and societal challenges in both starting and operating phases of their businesses (Welsh et al., 2014). Social framework which includes organized social life, family and workplace influences women's entrepreneurial activities and their performance (Lerner et

5

al., 1997). The growth and performance of women enterprises are considerably affected by social norms and the level of support (Jamali, 2009).

Family support and funding are two of the biggest barriers faced by women entrepreneurs in starting and running their businesses (Winn, 2005). Mathew (2010) showed that the major obstacles to women enterprises are access to finance, access to markets and access to networks. Hiscrich and Brush (1983) found that the biggest problems of women entrepreneurs during start-up stage are lack of business and financial training, acquiring credit and lack collateral. The most important factors that influence the participation of women in business in developing economies are the availability of business skills training, access to networks and business support systems, the influence of religion and the social segregation (Vita et al., 2014).

Women entrepreneurs generally start their business with lower amount of capital and lower ratios of debt finance (Bruin et al., 2007). Micro and small women enterprises generally face greater financial problems than do larger businesses because of several factors such as a lack of collateral, bias against to women enterprises and small firms (Nichter and Goldmark, 2009). These financial constraints lead women entrepreneurs to launch their businesses basically through their own resources and savings or loan from family or friends (Nichter and Goldmark, 2009). These small businesses have limited budget for marketing activities because of constraint financial resources and they need to find low-cost methods to carry out their marketing activities (Weinrauch et al., 1991). But the competitive market environment generally requires more comprehensive marketing and branding strategies which create substantial amount of costs and might not be affordable for small businesses. Capitalization barriers may result in low performance in the long term due to hindered marketing ability and the lack of competitive power against large financially big businesses (Jamali, 2009; Weinrauch et al., 1991). The market success is substantially depends on financial resources. On the other hand, women entrepreneurs can overcome financial problems through being successful in the market place or may face bigger financial problems in the case of market failure. Therefore, marketing and finance are interdependent parts of any businesses. The relationship of market success and financial resources is very crucial for women enterprises who mostly have problems in access to finance and access to markets. The level of financial support and market success of these enterprises are considerably related to the perceived role of women in the society. Brush et al. (2009) built "5M" framework for women entrepreneurs which is extended form of "3M" (markets, money and management). "3M" framework

6

includes three basic construct to launch and run any enterprises, Brush et al. (2009) argued the necessity of extending the framework by adding "motherhood" and "meso/macro environment" facets for women entrepreneurs who are more likely to be influenced by social and regional conditions. The influence of motherhood and meso/macro environment factors are larger in developing countries than in developed ones. Turkey is one of the developing countries where family orientation is very strong and considerably forms the work life of women (Hisrich and Öztürk, 1999). Motherhood represents family/household context that has greater impact on women than man; the meso environment includes institutions such as occupational networks and business associations which are intermediate structures between macro society and micro level business environment; the macro environment contains national level policies, laws, culture and economy (Brush et al, 2009).

The market, money and management factors are mediated by motherhood and meso/macro environment for women enterprises (Brush et al, 2009). The motherhood and meso-macro environment significantly affect the financial support for women enterprises which is very important to afford marketing costs and become a successful brand in the market place. Accordingly, access to finance and the opportunities in the market are substantially shaped by social norms, access to business networks and general economic condition in a country.

Methodology

This exploratory and descriptive study has examined women owned MSEs in the Turkish context based on questionnaire with a sample of 130 women entrepreneurs. The sampling frame includes women owned MSEs in the city of Adana. The participants are registered Adana Chamber of Commerce, Adana Chamber of Industry or a member of Adana Union of the Chambers of Artists and Artisans. The pre-test has been conducted with 15 women entrepreneurs and face to face survey method has been used. The questionnaire includes 5M framework items, marketing and branding efforts items and some demographic questions. 5M framework items were adapted from Brush et al., (2009) and Welsh et al., (2014) and branding involvement items were adapted from Emirza (2010).

The demographics of respondents can be seen in Table 1 below. The largest age group among participants is 30-39 years old (40,8 %) followed by 40-49 years old (30%). Only 1,5% of women participants are 60 and over. The 66,9 % of participants are married and 81,5% of them have children. 36,9% of participants have college or undergraduate degree. The women participants are graduated from different departments of universities such as

7

business, banking, economics, accounting, insurance, law, office management, public administration, pharmacy, cosmetologist, geography, history, child development, designing, automotive engineering, chemistry, communication or electric engineering. The second largest group of education level is high school degree (30%).

Table 1. Demographics of Participants

Characteristic Frequency Percent

(%) Age 20-29 15 11,5 30-39 53 40,8 40-49 39 30,0 50-59 17 13,1 60 and over 2 1,5 No Answer 4 3,1 Marital Status Single 40 30,8 Married 87 66,9 No Answer 3 2,3 Children Yes 106 81,5 No 22 16,9 No Answer 2 1,5 Education Primary School 18 13,8 Secondary School 12 9,2 High School 39 30,0 College 16 12,3 University 32 24,6 Master 1 0,8 PhD 9 6,9 No Answer 3 2,3 Total 130 100,0

The descriptive characteristics of the sample businesses can be seen on Table 2 below. The majority of the sample businesses have been running for more than 5 years and 79,2% of women entrepreneurs have 51% or more of the businesses. The major areas of business activity are haberdashery (16,2%), beauty salon (13,8), direct sales (8,5%), hand crafts (7,0%), tailoring (6,2%) designing (6,2%), food (%4,6), accounting (3,9%), health services (3,9%), childcare (3,9%), legal services (3,9%), education (3,9%), insurance (3,1%), technology and programming (1,6%) , shoes (1,6%), agriculture (1,6%), tourism (1,6%),

8

consultation (0,8%) and other services (8,5%). The 59,2% of the enterprises are non-family businesses and 47,6% of women started their businesses alone.

Table 2. Descriptive Characteristics of the Sample Businesses

Characteristic Frequency Percent (%)

Age of Business

Less than 1 year 12 9,2

1 to 2 years 16 12,3

3 to 4 years 21 16,2

More than 5 years 81 62,3

Percentage of ownership

50 % or less 27 20,8

51% or more 103 79,2

Major area of the business activity

Haberdashery 21 16,2 Beauty saloon 18 13,8 Direct Sales 11 8,5 Hand Crafts 9 7,0 Tailoring 8 6,2 Designing 8 6,2 Food 6 4,6 Accounting 5 3,9 Health Services 5 3,9 Legal services 5 3,9 Child care 5 3,9 Education 5 3,9 Insurance 4 3,1

Technology and Programming 2 1,6

Tourism 2 1,6 Agriculture 2 1,6 Shoes 2 1,6 Consultation 1 0,8 Other Activities 11 8,5 Starting

Started business alone 62 47,6

Started business with the husband 29 22,3 Started with another family member 19 14,6

Started business with a non-family member

12 9,2

Bought the business from family member

5 3,8

Bought business from non-family member

1 0,8

Inherited business from a family member

1 0,8

Inherited business from a spouse 1 0,8 Enterprise...

9

Family business 53 40,7

Non-family business 77 59,2

Total 100,0

Findings

The majority of women enterprises (91,5%) were started locally and 82,3% of them are still run locally. 7 percent of women enterprises included neighbouring cities and larger area (region) in the start-up phase and the percentages of these enterprises (13%) are higher currently. 1,5 percent of women started their business nationally and the rate of national women enterprises has increased to 4,6 percent. The women enterprises have expanded their market geographically from start-up to current phase.

Table 3. Geographical Scope of the Business

Geographical Scope (Start-up phase) Frequency Percent (%) Local 119 91,5 Neighbouring cities 1 0,8 Regional 8 6,2 National 2 1,5

Geographical Scope (Current)

Local 107 82,3

Neighbouring cities 5 3,8

Regional 12 9,2

National 6 4,6

Total 100,0

Women entrepreneurs specified that the triggering factors to be an entrepreneur are financial needs, entrepreneurial spirit and the need of independence. Almost the half of women entrepreneurs started their business due to financial needs.

Table 4. Main Reasons to be an Entrepreneur

Main Reasons Frequency Valid Percent (%)

Financial needs 56 49,6

Entrepreneurial Spirit 33 29,2

The need of independence 24 21,2

Total 100,0

The biggest obstacles of women entrepreneurs in running their businesses are financial problems, professional development needs and work-family conflict. The majority of women

10

entrepreneurs (77,4%) mentioned that their biggest problems in running their businesses are based on financial resources and costs.

Table 5. The Biggest Obstacle in Running the Business

Obstacle Frequency Valid Percent (%)

Financial problems 65 77,4

Professional development needs 11 13,1

Work-family conflict 8 9,5

Total 100,0

The self assessment of women entrepreneurs on management skills is shown on Table 6. The most of women entrepreneurs evaluate themselves as good or excellent in interpersonal communication, general management, idea generation/product innovation, organization and planning, sales and marketing. Financial skills are perceived as the most unsatisfying aspect of their self ratings.

Table 6. Self-assessment on Management Skills

Skills Poor(%) Fair(%) Good(%) Excellent(%) Total (%)

Finance 15,2 33,6 36,0 15,2 100,0

Marketing 2,4 18,5 46,0 33,1 100,0

Sales 3,2 16,1 45,2 35,5 100,0

Organization and Planning 4,8 7,3 46,8 41,1 100,0

Idea Generation/Product Innovation

- 12,1 45,2 42,7 100,0

General Management 4,0 10,3 47,6 38,1 100,0

Interpersonal Communication 2,4 4,8 44,0 48,8 100,0

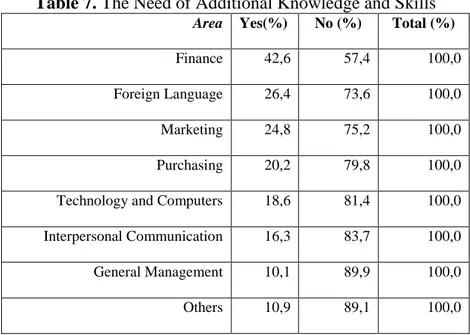

The considerable number of women participants (42,6%) reported their needs to improve financial knowledge and skills. The need of professional improvement in finance is followed by the need of additional skills and knowledge in foreign language (26,4%), marketing (24,8) and purchasing (20,2%).

11 Table 7. The Need of Additional Knowledge and Skills

Area Yes(%) No (%) Total (%)

Finance 42,6 57,4 100,0

Foreign Language 26,4 73,6 100,0

Marketing 24,8 75,2 100,0

Purchasing 20,2 79,8 100,0

Technology and Computers 18,6 81,4 100,0 Interpersonal Communication 16,3 83,7 100,0 General Management 10,1 89,9 100,0

Others 10,9 89,1 100,0

The women entrepreneurs mainly fund their businesses with their own savings in both start-up and running phases as can be seen on Table 8. The substantial number of women entrepreneurs also prefers borrowing from family and friends, whereas commercial bank loan, investment bank loan and government program are not primarily sources of funding for women owned small enterprises.

Table 8. Financial Sources Source of Funding First 6 months

(%) 6 months-1 year (%) 1-3 years (%) After 3 years (%) Own Savings 50,8 27,7 23,1 18,5

Borrowing from family 30,0 15,4 8,5 4,6

Borrowing from friends 13,8 8,5 3,8 3,1

Commercial bank loan 6,9 6,2 9,2 7,7

Investment bank loan 3,8 3,1 4,6 3,1

Government program 3,1 3,8 1,5 1,5

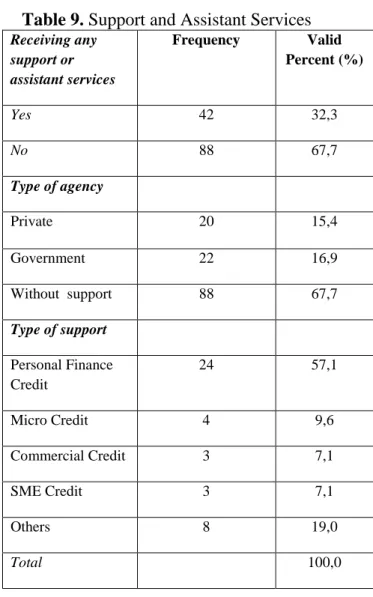

The majority of women entrepreneurs (67,7%) specified that they have not received any support or assistant services from government or private institutions. The most preferred type of support is personal finance credit (%57,1) followed by micro credit (9,6%) commercial credit and (7,1) and SME Credit (7,1%).

12 Table 9. Support and Assistant Services

Receiving any support or assistant services Frequency Valid Percent (%) Yes 42 32,3 No 88 67,7 Type of agency Private 20 15,4 Government 22 16,9 Without support 88 67,7 Type of support Personal Finance Credit 24 57,1 Micro Credit 4 9,6 Commercial Credit 3 7,1 SME Credit 3 7,1 Others 8 19,0 Total 100,0

The participants were asked to rate their satisfaction with the support/services if they have received. Type of support/services, the amount received, the support process, attitude toward the business owner as customer, quality of material received were evaluated by women business owners. The majority of support receivers stated that they have been satisfied with the services of government or private institutions.

Table 10. Level of Satisfaction with any Support/Services Received

Very Dissatisfied (%) Dissatisfied (%) Neither Satisfied Nor Dissatisfied (%) Satisfied (%) Very Satisfied (%)

Type of support or service 0,0 11,9 23,8 59,5 4,8

Amount received 0,0 12,5 22,5 62,5 2,5

13

Attitude toward you 0,0 7,5 15,0 77,5 0,0

Quality of material received 0,0 7,9 18,4 73,7 0,0

The marketing and branding efforts of women owned small businesses are shown on Table 11 below. The vast majority of women enterprises do not have marketing department, professional marketing manager, determined advertising budget and distribution network. 32,3 percent of women enterprises have promotion activities aimed at final consumer. 23,4 percent of women entrepreneurs have registered trademark and 20,9 percent of them sells the products with their own brand name. 10,8 percent of women enterprises have trained manager about branding and 8,1 percent receives consultancy about branding. The reported percentage of activities indicates that women entrepreneurs have limited marketing and branding abilities.

Table 11. Marketing and Branding Efforts

Frequency Valid

Percent (%)

Promotion activities aimed at final consumer 42 32,3

Registered trademark 26 23,4

Selling with its own brand name 23 20,9

Marketing department 17 15,2

Determined advertising budget 16 14,4

Distribution network 15 11,3

Training about branding 12 10,8

Receiving consultancy about branding 9 8,1

Professional marketing manager 8 7,2

Conclusion

MSEs and women owned enterprises provide considerable amount of employment opportunities and economic output in both developing and developed economies (Nichter and Goldmark, 2009; Vita et al, 2014). These enterprises have critical importance especially for developing economies where productive job opportunities are limited and the need of self-employment is high (Hiscrih and Öztürk, 1999; Tybout, 2000). Although they have remarkable outcomes for economy, these enterprises have several obstacles such as limited access to finance, limited access to markets and insufficient managerial skills (Abor and Quartey, 2010; Welsh et al., 2014). This exploratory and descriptive study aimed to reveal financial barriers and financial based marketing problems of women owned MSEs in one developing economy, Turkey.

Research results show that the main factors to be an entrepreneur for women are financial needs, entrepreneurial spirit and the need of independence. This results confirm that

14

the high rate of women entrepreneurs in Turkey is a result of necessity. Women entrepreneurs reported their biggest obstacles in running their businesses as financial problems, professional development needs and work-family conflict. The lack of financial resources and high costs were mentioned as the most important problems by the vast majority of women and the considerable number of women entrepreneurs reported their needs to improve financial knowledge and skills. The main sources of funding of women enterprises are own savings, borrowing from family and friends, whereas the formal loan (e.g. commercial bank loan) is not generally preferred from women owned micro and small enterprises. The majority of women entrepreneurs did not received any support or assistant services from government or private institutions and the most of support receivers are satisfied with the services of government or private institutions.

The vast majority of women enterprises do not have marketing department, professional marketing manager, determined advertising budget, distribution network, training or consultancy about branding. The results indicate that women owned MSEs have limited marketing abilities. The marketing and branding activities which require substantial amount of budget are hindered by financial constraints in women owned MSEs. Women owned small enterprises need to find alternative ways to overcome capitalization problems, otherwise financial problems may result in low performance in the long term due to insufficient marketing ability and the lack of competitive power against large businesses (Jamali, 2009; Weinrauch et al., 1991). Governments and non-governmental organizations can help to solve the financial problems of women owned small enterprises through several steps. First of all, women should be informed about alternative funding options and supported to improve their financial skills. Secondly, the number of private and governmental financial support opportunities for women owned small enterprises should be increased and the processes of these supports should be made easier to overcome financial problems which are the barriers of marketing abilities and the firm performance in the long run.

References

Abor, J. & Quartey, P. (2010). Issues in SME Development in Ghana and South Africa, Journal of Finance and Economics, 39, 218-228.

Bruin, A., Brush, C. and Welter, F. (2007), Advancing a Framework for Coherent Research on Women’s entrepreneurship , Entrepreneurship Theory & Practice, 31 (3), 323-39.

15

Brush, C. G., Bruin, A. & Welter, F. (2009). A Gender-Aware Framework For Women's Entrepreneurship, International Journal of Gender and Entrepreneurship, 1 (1), 8-24. Brush C.G. & Cooper S.Y. (2012). Female Entrepreneurship and Economic

Development: An International Perspective, Entrepreneurship & Regional Development, 24 (1-2), 1-6.

Emirza, E. (2010). Endüstriyel İşletmelerde Markalaşma Düzeyinin Ölçülmesine Yönelik Bir Alan Araştırması, Ticaret ve Turizm Eğitim Fakültesi Dergisi, Sayı: 2, 129-143.

Fielden S.L. Davidson M. J. Dawe A., & Makin, P. J. (2003),Factors Inhibiting The Economic Growth of Female Owned Small Businesses In North West England, Journal of Small Business and Enterprise Development, 30 (2), 152 - 166.

Hisrich R.D. &Brush C. (1983). The Woman Entrepreneur: Management Skills and Business Problems, Journal of Small Business Management, January, 30-37.

Hisrich R.D. & Öztürk S.A. (1999). Women Entrepreneurs in a Developing Economy, Journal of Management Development, 18 (2), 114-125.

Jamali, D. (2009), Constraints And Opportunities Facing Women Entrepreneurs In Developing Countries, Gender in Management: An International Journal, 24(4), 232 - 251.

Kelley, DJ, Brush, CG, Greene, PG, & Litovsky, Y. (2013). Global Entrepreneurship Monitor: 2012 Women’s Report. Boston: The Center for Women’s Leadership at Babson College and London Business School.

Liedholm C.E. & Mead D. C. (1999). Small Enterprises and Economic Development: The Dynamics of Micro and Small Enterprises, Routledge: Newyork.

Lerner M., Brush C., Hisrich R. (1997). Israeli Women Entrepeneurs: An Examination of Factors Affecting Performance, Journal of Business Venturing, 12, 315-339.

Mathew, V.( 2010). Women Entrepreneurship in Middle East: Understanding Barriers and Use of ICT For Entrepreneurship Development, Int Entrep Manag J , 6, 163–18. Mead, D. C., & Liedholm, C. (1998). The Dynamics of Micro And Small Enterprises In

Developing Countries. World Development, 26(1), 61–74.

Nichter S., Goldmark L. (2009). Small Firm Growth in Developing Countries, World Development, 37:9, 1453-1464.

16

Özbek, Z. (2008). Kobi'lerin Türk Ekonomisine Etkileri, Uluslararası Ekonomik Sorunlar, s.49-57.

Sandberg, K. W. (2003). An Exploratory Study Of Women in Micro Enterprises: Gender-Related Differences, Journal of Small Business and Enterprise Development, 10(4), 408-417.

Soysal, A. (2010). Türkiye'de Kadın Girişimciler: Engeller Ve Fırsatlar Bağlamında Bir Değerlendirme. Ankara Üniversitesi SBF Dergisi, 65(01), 83-114.

Tambunan, T. ( 2009). Women Entrepreneurship In Asian Developing Countries: Their Development And Main Constraints, Journal of Development and Agricultural Economics, 1 (2), 27-40.

TMMOB Report 2012, Küçük ve Orta Ölçekli Sanayi İşletmeleri, Mrk Baskı ve Tanıtım: Ankara.

TUİK. (2012). İstatistiklerle Kadın. http://www.tuik.gov.tr/PreHaberBultenleri.do?id=13458 Tybout, J. R. (2000). Manufacturing Firms In Developing Countries: How Well Do They Do,

And Why?. Journal of Economic Literature, 38(1), 11–44.

Ufuk, H. &Özgen Ö. (2001). Interaction Between the Business and Family Lives of Women Entrepreneurs in Turkey, Journal of Business Ethics, 31, 95-106.

United States Small Business Administration (2014). Statistics of US Businesses And Nonemployer Statistics. Washington, DC: United States Small Business Administration.

Verheul I, Stel A. V. & Thurik R. (2006) Explaining Female And Male Entrepreneurship at The Country Level, Entrepreneurship & Regional Development: An International Journal, 18 (2), 151-183.

Vita L.D., Mari M. & Poggesi S. (2014). Women Entrepreneurs in and from Developing Countries: Evidences from the Literature. European Management Journal, 32, 451-460.

Weinrauch, J D., Mann, O.K., Robinson P.A.. & Pharr, J (1991). Dealing with Limited Financial Resources: A Marketing Challenge for Small Business, Journal of Small Business Management , 29 (4), 44.

17

Welsh, D.H.B, Memili, E., Kaciak, E. &Miyuki, O. (2014). Japanese Women Entrepreneurs: Implications for Family Firms. Journal of Small Business Management, 52 (2), 286-305.

Winn J. (2005). Women Entrepreneurs: Can We Remove The Barriers, International Entrepreneurship and Management Journal 1, 381–397.