THE RESPONSE OF T L INTERBANK

RATES TO W EEKLY MONEY S U P P L Y ANNOUNCEMENTS

WITHIN THE FRAMEWORK OF MARKET EFFICIEN CY

AN M.A. THESIS PRESENTED

By

y a s e m i n b a l

to

The In s titu te o f Econom ics

and Social S cie n ce s in P a rtia l F u llfilm e n t o f th e Requirem ent fo r th e Degree o f

M aster o f A rts in th e s u b je c t of

ECONOMICS

B ilk e n t U n iv e rs ity , 1992

H

g

üOt.s·

• ВЗУ

1 certify that this thesis is satisfactory tor the award of the

degree of Master of Arts.

Assoc. Prof. Dr. Omit EROL

Supervisor

Member of Examining

Assoc.Prof.Dr. A. Erinc yBLDAN

Member of Examining

Committee

Certified that this thesis conforms to the formal standards of

the Institute of Economics and Social Sciences

Prof. Dr. Ali KARAOSMANOOLU

Chairman of the

ACKNOWLEDGEMENTS:

I would lik e to th a n k my s u p e r v is o r Assoc. P ro f. Dr. Umit EROL fo r h is c o n trib u tio n s a p p re cia te d help d u rin g the p re p a ra tio n o f t h is s tu d y .

I ’m a iso g ra te fu i to Assoc. P ro f. E rin e YELDAN and A sst. P ro f. Nedim ALEMDAR fo r t h e ir v a lu a b le comments and help d u rin g my s tu d y .

I w ish to co n ve y my g ra titu d e to my fam ily fOT th e ir patience, g re a t s u p p o rt and encouragem ent.

I would lik e to e x p re ss my sp e cia l th a n k s to my dear frie n d H ande ALKAZAN fo r her g re a t heip and much needed s u p p o rt d u rin g my s tu d y .

I also want to th a n k to M urat KOMEPIK fo r h is car^efui w ritin g and re v is io n s o f th e te x t sy n ta x num erous lim e s.

ABSTRACT

THE RESPONSE OF T L INTERBANK RATES TO W EEKLY MONEY S U P P L Y ANNOUNCEMENTS WITHIN THE FRAMEWORK OF MARKET EFFICIEN CY

In th is s tu d y ,th e e ffe c ts o f w eekly money s u p p ly announcem ents on ch an g e s in T L in te rb a n k ra te s is tested in term s o f m a rket e ffic ie n c y . As a re s u lt o f the model tested, T u rk is h in te rb a n k m arket appeared to be an in e ffic ie n t fin a n c ia i m arket. D u rin g t h is s tu d y , ARIMA based generated money s u p p iy s u rv e y data is used. T h e re fo re a jo in t h y p o th e sis, m arket e ffic ie n c y and e ffe c tiv e n e s s o f ARIMA based s u rv e y data, is te sted. T h is leads to a weak re je ctio n of m arket e ffic ie n c y in TL in te rb a n k m arket.

Key w ords: Money s u p p iy annoucem ents, in te rb a n k rates, a n ticip a te d com ponent o f money s u p p ly announcem ent, u n a n ticip a te d com ponent o f money s u p p ly announcem ent, m arket e ffic ie n c y h y p o th e sis.

ÖZET

FIN AN SAL PİYA SA LA R IN V E R İM LİLİĞ İ ÇERÇEVESİNDE H AFTALIK PARA STOKU D UYURULARIN BAN KALARARASI T L PARA PİYA SA SI FAİZ

h a d l e r i n e e t k i s i

Bu çalışm ada, p a ra sto k u d u y u r u la r in in b a n k a la r arasi T L p a ra p iy a sa si fa iz h a d le rin e olan e tk is i fin a n sa l m a rk e tle rin v e rim liliğ i hip o te zi a ltin d a te s t e d ilm iş tir. S o n u ç o la ra k b a n k a la ra ra s i T L p a ra p iy a s a s in in v e rim liliğ i red e d ilm iş tir. Bu calism ada, zaman s e r ile r i m etoduyla p a ra sto ku ta h m in le ri hesaplanm ış ve m odelde p a ra sto k u a n k e t v e ris i o la ra k k u lla n ilm is tir. Bu du ru m d a fin a n s a l m a rk e tle rin v e rim liliğ i ve p a ra sto k u a n k e tie rin in ARIMA ta b a n li tahm in s o n u c la r iy ia g ö ste rim in in e tk e n iig i b ir lik t e te s t e d ilm iş tir. Bu bağlamda, bu calism an in kapsam inda b a n k a la ra ra s i T L p ara p iy a s a s in i v e rim liliğ i h ipotezi z a y if şnlam da red e d ilm iş tir.

A n a h ta r keiim.eier: P a ra sto k u anonsl^ni, b a n k a ia ra ra si p a ra p iy a sa si fâ i? h a d le ri, beklenen p a ra sto k u , beklenm eyen 0 a ra sto k u , m a rk e tle rin v e rim liliğ i h ip o te zi.

LIST OF T A B LE S

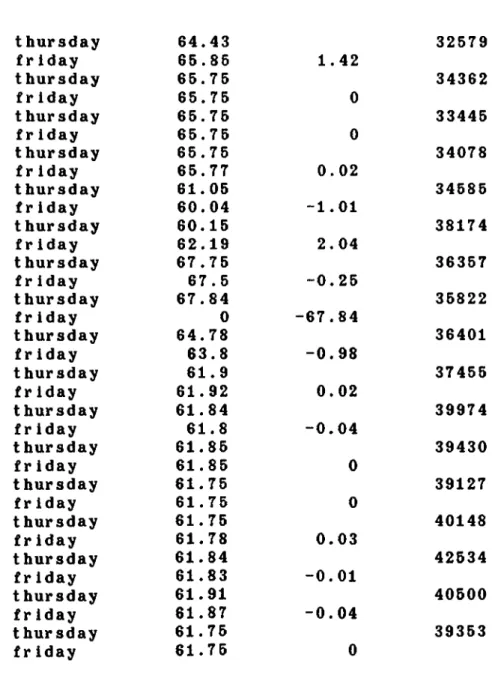

Table IV. 2.1 Money S u p p ly A nnouncem ents Table IV. 2.2 A n ticip a te d Moey S u p p ly Data

Table IV. 2.3 TL In te rb a n k Rates c o rre s p o n d in g to th e day o f announcem ent and th e day a fte r th e announcem ent. Table IV. 2.4 U n a n ticip a te d Money S u p p ly Data

TABLE OF CX3NTENTS ACKNOWLEDGEMENTS ... i ABSTRACT... ... i i OZET ... i i i LIST OF TABLES ... i v TABLE OF CONTENTS ... v INTRODUCTION ... 1 I . CONCEPTUAL BASIS ... 2 1 .1 . INTERBANK rW K ET IN GENERAL ... 2

1 .2 . MONEY SUPPLY ANNOUNCEMENTS ... 4

1 .3 . rW K ET EFFICIENCY HYPOTHESIS ... 6

I I . LITERATURE S U R V E Y ... ... 9

I I I . CASE STUDY : REPUBLIC OF TU R KEY... ... 16

111.1. TL INTERBANK IWIKET IN TU R KEY... 16

111.2. MONEY SUPPLY ANNOUNCEMENT ... 18

IV . MODEL ... 20 I V . 1. STRUCTURAL MODEL ... 20 I V .2 . DATA ... 24 V. EMPIRICAL RESULTS ... 46 CONCLUSION ... 51 REFERENCES APPENDIX

INiTRobUCTION

The p u rp o se o f th is s tu d y is to model and examine the e ffe c ts o f money s u p p ly announcem ents on T.L. In te rb a n k rate s w ith in th e fram e w ork o f m arket e ffic ie n c y . In rece n t y e a rs the e ffe c ts o f money s u p p ly announcem ents on in te re s t ra te s have been stu d ie d e x te n s iv e ly . It is w idely accepted th a t the announcem ent o f an u n e xp e cte d ly la rg e grow th in th e money s u p p ly leads to an

immediate in cre a se in s h o rt term in te re s t rates. S e ve ra l a lte rn a tiv e th e o rie s in th e e x istin g e m p irical lite ra tu re have been c o n s tru c te d to explain th is re la tio n . In t h is s tu d y , ra th e r I fo c u s on m a rket e ffic ie n c y concept, sin ce it w ill be in te re s tin g to examine t h is co n ce p t w ith in th e c o n d itio n s o f a new ly em erging fin a n c ia l m arket, su ch as th e In te rb a n k m a rket in T u rk e y .

In th e f ir s t sectio n , a s u rv e y o f th e con cep tu al b a sis o f th e s tu d y w ill be p rese n ted .S e co n d sectio n in c lu d e s a s u rv e y of th e e m p irica l lite ra tu re , about th e e ffe c ts o f money s u p p ly

announcem ents on fin a n c ia l a sse t m arkets. T h is p ro v id e s th e th e o re tic a l b a ck g ro u n d o f my s tu d y and g iv e s a b ro a d e r view on a rea s o f fu r t h e r re se a rch . T h ird sectio n in tro d u c e s th e em p irical w ork.In se ctio n fo u r th e model is p re se n te d and th e expected re s u lts a re pointed in econ om etric term s. Section f iv e sum m arizes th e e m p irica l fin d in g s and g iv e s in te rp re ta tio n on th e se re s u lts . The la st se ctio n in c lu d e s co n clu sio n o f th e s tu d y .

I. CO N CEPTU AL B A SIS :

1.1) In te rb a n k M a rke t in General

In t h is m arket b a n ks borrow and lend excess re se rv e s, balances held by bank at th e C e n tra l Bank in excess o f those re q u ire d , to each o th e r.

In te rb a n k fu n d s are a d ire c t claim to a d e p o sit at the C e n tra l Bank th a t is th e y are fu n d s held fo r member b a n k s in the C e n tra l Bank th a t can be used to s a tis fy re s e rv e req u ire m en ts.

Most sa le s o f fu n d s are made on an o v e rn ig h t basis, but th e re are lo n g e r m a tu ritie s. O v e rn ig h t tra n s a c tio n s in t h is m arket p ro v id e th e p u rc h a s in g bank w ith a cheap so u rce o f money and a c o n v e n ie n t way to make size a b le day to day a d ju stm e n ts in its re s e rv e s . F o r th e s e llin g bank, th e fu n d s sold p ro v id e a c o n v e n ie n t form o f liq u id ity , s in c e it has th e fle x ib ilit y to a d ju s t to d a ily s w in g s th a t o c c u r in its re s e rv e p o sitio n s.

F o u r ty p e s o f b a n ks deal in t h is m arket. F ir s t th e re are s e lle rs . These a re th e sm alle r s u b u rb a n b a n k s th a t p rim a rily deal w ith c o rre s p o n d e n ts. When th e y have an exce ss balance at hand, u s u a lly d e p o sit at t h e ir c o rre s p o n d e n t bank, th e y ask th e ir c o rre s p o n d e n t to buy them. The c o rre s p o n d e n ts u s u a lly do by th e fu n d s as a s e r v ic e to t h e ir custom ers. Because o f th e p a ssive n a tu re o f t h is p u rch a se , th e b u y in g b a n k s are re fe rre d to as "in te rm e d ia rie s ". In te rm e d ia rie s g e n e ra lly c a r r y a d e fic it balance in t h e ir re s e rv e a cco u n ts equal to th e am ount o f fu n d s th e y expect to p u rc h a se from t h e ir cu stom er banks. If the amount

d iffe re n c e to t h e ir own c o rre s p o n d e n t banks.

The b u y e rs a re p rim a riiy th o se b a n ks th a t a c tiv e iy search o u t fo r th e se fu n d s as a perm anent so u rce o f fu n d s and c a r ry iarge d e fic it p o sitio n s in t h e ir p u rc h a s e s of fu n d s. These b an ks have th e p u ise o f th e m arket and b a s ic a iiy determ ine th e rate at w hich fu n d s a re tra d e d .

The la st g ro u p is desig n a te d as b a la n ce rs o r a rb itra g e rs . A ith o u g h th e se b a n ks are o f medium s iz e to large, th e y do not o p e ra te in g re a t voium es in t h is m a rket o r co n d u ct a la rg e enough c o rre s p o n d e n t b u s in e ss to generate s u ffic ie n t fu n d s to be co n sid e re d as in te rm e d ia rie s. How ever th e ir management is s o p h istic a te d enough to t ig h t ly co n tro l t h e ir re s e rv e position d a ily so th a t th e y can play on both sid e s o f th e m arket as a rb itra g e rs ( T h e Money M arket, M arcia, Stigum ).

The in te rb a n k rate is se t by s u p p ly and demand c o n d itio n s th a t e x ist in th e m arket. How ever th e most im portant fa c to r in the m arket as a whole is th e C e n tra l Bank its e lf. T h ro u g h th e way it c o n d u c ts its open m arket o p e ra tio n s, th e C e n tra l Bank can f a ir ly a c c u ra te ly co n tro l th e excess re s e rv e s in th e b a n kin g system in T u rk e y .

In c o n d u c tin g open m arket o p e ra tio n s, th e C e n tra l Bank aims at c o n tro llin g th e in te rb a n k rate because th e rate p ia y s a v e ry im p o rta n t role in th e s h o rt term o p e ra tin g p ro c e d u re s th a t the C e n tra i Bank fo llo w s to a ch ie ve its lo n g e r term o b je c tiv e s o f m onetary co n tro l and econom ic stim u lu s. T h e re fo re , b a n k s must follow v e ry c lo s e ly what C e n tra l Bank is doing w ith re sp e ct to th e in te rb a n k rate and t r y to a n tic ip a te its a ctio n s in o rd e r to fo re se e th e d ire c tio n in w hich th e ra te can be expected to move in

th e fu tu re .

1.2) Money S u p p ly A nnouncem ents

The e ffe c t o f money on th e ex ante real in te re s t rate is an issu e th a t has a ttra cte d a tte n tio n s o f econom ists fo r decades. T here is a debate in t h is area sin ce th e em p irical s tu d ie s de sig n e d to m easure th e im pact of m onetary p o licy on th e real rate are in c o n c lu s iv e . The reason is that; money, p ric e s and in te re s t ra te s as well as C e n tra l Bank p o licy are all endogenous v a ria b le s and t h is fa c t p re c lu d e s form ation o f an a p p ro p ria te s tr u c tu r a l model th a t is acce p tab le fo r all re s e a rc h e rs . In th is resp e ct, money s u p p ly announcem ent comes to th e p ic tu re . Money s u p p ly announcem ents p re s e n t a u n iq u e o p p o rtu n ity fo r re s e a rc h e rs sin ce th e y a re a b so lu te ly exogenous v a ria b le s u n lik e th e actual money s u p p ly . On each th u rs d a y afte rn o o n money s u p p ly fig u r e is announced by th e C e n tra l Bank. A t th e tim e it is announced, the re p o rte d fig u r e does not depend on th e C e n tra l Bank p o licy , asset p ric e s , o r in fla tio n . T h is means th a t if s ig n ific a n t c o rre la tio n s are found between money s u p p ly announcem ents and ch a n g e s in in te rb a n k ra te s and o v e r a sse t p ric e s , th e causal re la tio n must ru n from th e announcem ent to a sse t p ric e s ra th e r than v ice versa. Indeed w ith in th e co n ce p t o f Rational E xp e cta tio n s the u n a n ticip a te d w eekly ch ange In M1. may be in te rp re te d as an exogenous v a ria b le , th a t cau ses fin a n c ia l v a ria b le s to change a fte r th e announcem ents o f Ml (C o rn e ll, 1983). M oreover, by w o rkin g w ith MSA (Money S u p p ly A nnouncem ents) ra th e r than actual

th e expected and unexpected change in money. W hereas th e o b se rv a tio n in te rv a l o f from 2 h o u rs to 1 tra d in g day at most is re q u ire d to s tu d y th e e ffe c ts o f money s u p p ly announcem ents on in te re s t rates.

Announcem ent phenomenon is im portant and m ust be stu d ie d at t h is point. Announcem ents cause no change in th e q u a n tity of money, th e o n ly th in g th a t ch an g e s w ith announcem ent is th e inform ation se t o f p u b lic and so are th e ir a n ticip a tio n s.

The article^ w ritte n by Nicholas, Small and W ebster proposes th a t a com plete a n a ly s is o f th e announcem ent e ffe c t m ust examine th e lin k between inform ation and in te re s t ra te s as well as th a t between money and in te re s t rates. S in ce in te re s t rate s change in acco rd a n ce w ith th e announcem ents and th e money s u p p ly does not, th e new inform ation in th e announcem ent m ust cause money demand to ch ange th ro u g h a n ticip a tio n mechanism o f people. T h is con cep t b r in g s us to co n ce p t o f m arket e ffic ie n c y .

1 O.A. Nichols, D.H. Small, C.E. W e b s t e r "Why Interest Rates Rise

1.3) M a rke t E ffic ie h c y H yp o th e sis

E ffic ie n t m a rket th e o ry is e s s e n tia ily a s u b se t of the ra tio n a l e xp e cta tio n s th e o ry . The ra tio n a l e xp e cta tio n s sta te s th a t, in a co m p e titive w orld, econom ic a g e n ts w iii e xp io it aii a v a iia b ie in form ation to ta ke a d van ta g e o f any p e rce ive d p r o fit o p p o rtu n itie s . Rationai E xp e cta tio n s H yp o th e sis im piies th a t a g e n ts do not make syste m a tic m istakes in fo re c a s tin g th e fu tu r e and th a t th e d r iv e fo r p r o fit wiii tend to elim inate any o b v io u s o p p o rtu n itie s fo r abnorm ai gain. In d iv id u a i hoid ration ai e xp e cta tio n s w ith re sp e ct to a v a ria b ie if h is p re d ic tio n is th e same as th e v a ria b ie ’ s m athem aticai expected vaiue, co n d itio n a i on an inform ation se t co n ta in in g aii p u b lic ly a v a ila b le inform ation. M a rke t e ffic ie n c y h y p o th e sis as a n a tu ra l extension o f Rational E xp ectation H yp o th esis, sta te s th a t p ric e s in a m arket f u lly re fle c t all a v a ila b le inform ation.

While in v e s tig a tin g th e re la tio n between money s u p p ly announcem ents and in te rb a n k ra te s th e c o n s tra in ts imposed by m arket e ffic ie n c y sh o u ld not be ig n o re d s in c e fin a n c ia l m arkets d is p la y ra tio n a l e xp ectatio n s. The e vid e n ce s u p p o rtin g m arket e ffic ie n c y is q u ite s tro n g and re ce n t w ork in d ica te s th a t a fa ilu r e to impose fin a n c ia l m a rket e ffic ie n c y can lead to m isle ad in g re s u lts .

The term " e ffic ie n c y " re fe rs to how s u c c e s s fu l th e m arket is in e s ta b lis h in g new p ric e s, s u c c e s s being d e fin ed in term s o f w h eth er th e m arket in c o rp o ra te s all new inform ation related with

rates. E ffic ie n c y th e re fo re re fe rs to th e two a sp e cts,th e speed and q u a lity , o f a d ju stm e n t to new inform ation , w hich in o u r case is th e money s u p p ly announcem ent. O b vio u sly ; if th e m arket were d e fic ie n t in te rm s o f th e speed o r q u a lity of its reaction, the inform ed and a le rt o b s e rv e r would have little d iffic u lt y In p ro fitin g from th e s itu a tio n , i.e a rb itra g in g .

In th e lite ra tu re , a d is tin c tio n is made between th re e pote n tial le v e ls o f e ffic ie n c y , each level re la tin g to a s p e c ific se t o f Inform ation w hich is in c re a s in g ly more co m p re h en sive than th e p re v io u s one.

a) Weak E ffic ie n c y

The m arket is e ffic ie n t in th e weak sense if p ric e s f u lly re fle c t th e inform ation im plied by all p r io r p ric e movements. P ric e movements in e ffe c t are to ta lly Ind ependent of p re v io u s movements, im plin g th e absence o f any p ric e p u t te rn s. P ric e s would resp on d o n ly to new inform ation o r to new econom ic eve n ts.

b) Semi s tro n g E ffic ie n c y

The m a rket is e ffic ie n t in th e semi s tro n g sense if p ric e s resp on d in sta n ta n e o u sly and w ith o u t bias to newly p u b lish e d inform ation , w h eth er o r not th e w ars o f inform ation m ight d iffe r am ongst th e m se lve s about th e s ig n ific a n c e o f new data, the im plica tion is th a t th e p ric e s th a t are a c tu a lly a r r iv e d at in su ch a m a rket would in v a ria b ly re p re s e n t th e best In te rp re ta tio n o f inform ation .

c) s tro n g E ffic ie n c y

The m arket is e ffic ie n t in th e stro n g sense if p ric e s f u lly re fle c t not o n ly p u b lish e d inform ation b u t all re le va n t in inform ation in c lu d in g data not yet p u b lic ly a va ila b le . If the m arket w ere s tro n g ly e ffic ie n t, th e re fo re , even an in s id e r would not be able to p r o fit from h is p riv ile g e d positio n .

These th re e le ve ls are not in d e p e n d e n t o f each o th e r. For th e m arket to be e ffic ie n t in the semi s tro n g sense it m ust also be e ffic ie n t in th e weak sense.

The e m p irical re s u lts in d ica te th a t th e w eekly money s u p p ly announcem ents do in fa c t co n tain inform ation. T h u s the inform ation al co n te n t o f money s u p p ly announcem ents m ust be in v e stig a te d to u n d e rsta n d th e a n tic ip a tio n s o f economic ag e n ts about in te re s t ra te s and e ffic ie n c y of in te rb a n k m arket (w hich is re le v a n t fo r th e d eterm in ation o f in te re s t rates).

The ra tio n a lity o f e xp e cta tio n s does not p re c lu d e th e p o s s ib ility th a t th e m onetary a u th o rity may t r y to "fool" th e m a rket to c a r r y o u t some econom ic o b je c tiv e . It o n ly im plies th a t th e m arket fo rm s unbiased e xp e cta tio n s o f economic v a ria b le s . However, t h is im plies th a t th e m a rket would u tiliz e any inform ation contain ed in s e r ia lly c o rre la te d fo re c a s t e rro rs . T h u s th e m a rket would learn and respond to any syste m a tic p o licy action. T h u s th e e ffe c t o f th e s u r p r is e com ponent on in te re s t ra te s sh o u ld re fle c t th e syste m ’s te c h n iq u e s o f o p e ra tio n (or p o licy ru le ) in im plem enting m onetary p o licy . "R ation al" resp o n se o f in te re s t ra te s to th e m onetary announcem ents is taken in th e sense o f c o r re c tly in c o rp o ra tin g th e p o lic y ru le in o p e ra tio n .

In s titu tio n a l s t r u c t u r e and sequence o f e ve n ts s u rro u n d in g announcem ent p ro c e d u re is u sefu l to c la r ify inform ation p ro ce ssin g and a n ticip a tio n mechanism o f econom ic a g e n ts p a rtic ip a tin g in in te rb a n k m arket.

II. LITER A TU R E SU R V EY

In re ce n t ye a rs, th e e ffe c t of money s u p p ly announcem ent on in te re s t ra te s has been stu d ie d e x te n s iv e ly (C orn e ll 1979, 1983, U ric h and W atchell, 1981, 1984, Roley 1983, Grossman 1981). The im pact of u n a n ticip a te d movements in money on sto ck re tu rn s (P e arce and Roley 1983, 1985 and L y n g e 1981) and on fo re ig n exch ange ra te s has also been in v e stig a te d (H a rd o u v e lis 1984, C o rn e ll 1982, Engel and F rie n k e l 1984). G e n e ra lly th e se s tu d ie s fin d th a t th e a n ticip a te d com ponent o f money s u p p ly announcem ent has no e ffe c t on ca p ita l m arket p ric e s . On th e o th e r hand, u n a n ticip a te d ch a n g e s in money g e n erate an in te re s t rate respon se in th e same d ire c tio n th a t is both s ig n ific a n t and prom pt. A d d itio n a lly s ig n a llin g models have been advanced in the lite ra tu re to exp lain th e reaction o f in te re s t ra te s to money announcem ent s u r p r is e s (C o rn e ll 1983,Siegel 1985 and Nicholas, Small and W ebster 1983). In C o rn e ll’ s case, money s u r p r is e s are a sig n a l about fu tu r e real a c tiv ity . In S ie g e l’s model, the announced money s u p p ly re v e a ls inform ation about both th e c u r re n t and fu t u r e sta te s o f real econom ic a c tiv ity . N icholas, Small and W ebster a rg u e th a t when announced money exceed e xp ectation s, th is is a sig n a l th a t fu tu r e money demand will- be h ig h e r, t h is being th e case th e y a rg u e th a t in te re s t ra te s wUt |ijjpp in response, if

in v e s to rs b e lie ve th a t th e sh o ck to money demand w ill d is s ip a te more slo w ly than an e q u a lly la rg e sh o ck to money s u p p ly .

The p a p e r p u b lish e d by C o rn e ll (1983) namely "The Money S u p p ly Announcem ent Puzzle;R eview and In te rp re ta tio n " p re se n ts on e x ce lle n t review and sum m ary o f e x istin g th e o rie s. G en erally I re fe rre d to th a t a rtic le w hile p re p a rin g th e lite ra tu re s u rv e y sectio n .

1) The Expected In fla tio n H yp oth esis:

The most o b v io u s lin k between money announcem ents and s h o rt term in te re s t ra te s is th ro u g h expected in fia tio n . The h y p o th e sis is th a t announcem ent o f an u n a n ticip a te d jum p in th e money sto ck ieads to e xp e cta tio n s o f h ig h e r in fia tio n and th u s to an in cre a se in in te re s t rate s, w hile announcem ent o f an u n a n ticip a te d d ro p in money has th e re v e rs e e ffe ct. One re q u ire m e n t o f th e expected in fla tio n ap p ro ach is th a t p ric e s respond q u ic k ly to ch an g e s in money. If p ric e s ta ke se v e ra l m onths to respond, t h e ir ration al a g e n ts would not a lte r then s h o rt ru n in fla tio n fo re c a s ts on the b a sis o f a money s u p p ly announcem ents and ra te s of re tu rn on s h o rt term a sse ts lik e tre a s u ry b ills would not be a ffected . Because of its v e ry s h o rt term n a tu re , o v e rn ig h t in te rb a n k rate is alm ost c e rta in ly u n a ffe cte d by in fla tio n a ry expectation. Indeed th is issu e was e m p iric a lly tested by T .U ric h and P.W atchell(1984) and th e y a rg u e th a t o n ly p o lic y a n tic ip a tio n s re su lte d from money s u p p ly announcem ents are e ffe c tiv e on th e change in in te rb a n k ra te s and no s ig n ific a n t relatio n is found between in fia tio n a ry e xp e cta tio n s (announcem ents o f consum er and p ro d u c e r p ric e index) and ch an g e in in te re s t rate s. S e ve ra l e m p irical s tu d ie s were

The effe c t s of I nflation and M o n e y S u p p l y a n n o u n c e m e n t s on

Interest R a t e s " (1984)

co n d u cte d to examine th e e ffe c ts o f money s u p p ly announcem ents and asset m arkets. To sum m arize, th e expected in fla tio n h y p o th e sis p re d ic ts th a t in resp o n se to an unexpected In cre ase in th e money s u p p ly :(i) s h o rt-te rm in te re s t ra te s w ill rise , (ii)lo n g term ra te s w ill rise , b u t th e in cre a se w ill be less than s h o rt term ra te s u n le ss th e expected in fla tio n ch an g e s

perm anently; ( ill) th e dom estic c u r re n c y w ill d e p re cia te a g a in st o th e r m ajor c u rre n c ie s (iv ) S to ck p ric e s may move up o r down d e p e n d in g on th e role o f taxes, nominal c o n tra c tin g by firm s and o th e r m a rk e ts’ im p e rfe ctio n s.

2) K e ynesian H ypothesis:

A second lin k between money and a sse t p ric e s in th ro u g h the expected real rate. F o r t h is lin k to w ork, it m ust f ir s t be th e case th a t actu al in n o v a tio n s in money a ffe c t th e ex ante real rate. I t ’ s th e K eynesian liq u id it y p re fe re n c e model w ith s tic k y p ric e s th a t p o s its su ch a re la tio n .

M

Money m a rket e q u ilib riu m co n d itio n - - p — = f( y ,i)

M = The nominal sto ck o f money P = P ric e level

In K e ynesian w orld p ric e s do not a d ju s t in sta n ta n e o u sly to m onetary sh o cks. F o r t h is reason in te re s t rate m ust a d ju s t to b rin g th e money s u p p ly and demand in to e q u ilib riu m . A sudden in cre a se in th e s u p p ly o f nominal money balances cau ses real money balances to ris e because p ric e s a re s lu g g is h . To c le a r money m arket, th e in te re s t rate m ust fa ll to p ro d u ce an o ffs e ttin g in cre a se in money demand. S in ce expected in fla tio n w ill rise , the d e clin e in th e nominal rate m ust be due to a drop in th e ex ante real rate. How ever th is liq u id ity e ffe c t is a s h o rt run phenomenon. The in te re s t rate s t a r t s to re tu rn to its in itia l level as soon as p ric e s begin to a d ju st. When th e a d ju stm e n t of p ric e s is complete, th e in te re s t rate is back at its s ta rtin g point.

I f actual ch a n g e s in money a ffe c t the ex ante real rate, then announced ch a n g e s will also have an impact if th e y a lte r a n tic ip a tio n s re g a rd in g fu tu r e m onetary a u th o rity p o licy . The most common ap p ro ach is to assum e th a t th e c e n tra l bank attem pts to co n tro l th e grow th rate o f m onetary ag g re g a te s. In t h is context, an unexpected Jump in money sto ck leads m arket p a rtic ip a n ts to b e lie ve th a t th e C e n tral Bank w ill have to tig h te n c r e d it to o ffs e t to rise . Because a g e n ts a n ticip a te th a t fu tu r e tig h te n in g w ill lead to h ig h e r ra te s v ia th e liq u id ity e ffe ct, th e y bid a g g re s s iv e ly fo r fu n d s and d r iv e up c u r re n t in te re s t rate. U ric h and W atchell(1984) re fe r to t h is sc e n a rio as th e p o licy a n ticip a tio n e ffe c t and t r y to make a d isc rim in a tio n between p o lic y a n tic ip a tio n s and expected in fla tio n h y p o th e sis.

I f th e p o licy a n ticip a tio n e ffe c t is c o rre c t, money s u p p ly announcem ents sh o u ld have a d iffe r e n t im pact on s h o rt term in te re s t ra te s com pared to long term in te re s t rates. T here are two p o ssib le cases. In th e f ir s t in stance, the a n ticip a te d period of m onetary r e s tr a in t is expected to be s h o rtliv e d . In th a t case, o n ly th e sp o t rate and n e arb y fo rw a rd ra te s are a ffected . On the o th e r hand, if th e a n ticip a te d period of m onetary re s tr a in t is expected to be p rolonged , d is ta n t fo rw a rd rates, and hence longterm ra te s w ill fa ll. The drop o c c u rs because th e liq u id ity e ffe c t is s h o rt iiv e d and because a prolonged period o f m onetary re s tr a in t w ill e v e n tu a lly red u ce expected in fla tio n . H a rd o u v e lis (1984) re la te s th e d u ra tio n o f expectation o f m onetary re s tr a in t p o licy to th e c r e d ib ilit y o f m onetary a u th o rity among p u b lic . T h is em p irical s tu d y conducted by him co n clu d e s th a t m a rket p a rtic ip a n t in USA b e lie ve s th e c r e d ib ilit y of Fed in the s h o rtru n b u t rem ains s u s p ic io u s on s e rio u s n e s s o f F e d ’s m onetary ta rg e ts . The p o licy a n ticip a tio n h y p o th e sis p re d ic ts a d iffe re n t d ire c tio n in fo re ig n exchange m a rkets from th a t o f in fla tio n a ry e xp e cta tio n s h y p o th e sis. T h is p ro v id e s a tool fo r te s tin g those two h y p o th e sis. A c c o rd in g to p o licy a n ticip a tio n h y p o th e sis a rise in th e ex ante real rate w ill cause th e dom estic c u r re n c y to a p p re cia te . As D ornbush (1976) and Engel and F ra n k e l* f1984)

)|c G.A. Hardouvelis, "Market P e r c e p t i o n s of Federal Rese r v e P olicy

and The W e e k l y M o n e t a r y A n n o u n c e m e n t s "

C.Engel , J.Frankel "Why Interest Rates Reacts to Mon e y Su

S u p p l y A n n o u n c e m e n t s :An E x p l a n a t i o n from the F oreign E xchange

d e scrib e , th e m a rket p e rc e iv e s th e change in th e money sto ck as a t r a n s ito r y flu c tu a tio n th a t m onetary a u th o rity w ill re v e rs e in the fu tu r e so th a t a n ticip a te d fu tu r e tig h te n in g ra ise s to d a y ’s real in te re s t rate, cau ses a ca p ita l inflow and a p p re cia te s th e dom estic c u rre n c y . On the o th e r hand, an in cre a se in th e ex ante real rate p ro d u ced by m onetary re s tr a in t sh ould lead to lower sto ck p ric e s . F ir s t th e d is c o u n t rate ris e s to re fle c t the h ig h e r real rate. S e co n d ly, expected co rp o ra te cash flow w ill d e clin e if a g e n ts be lieve th a t an in cre a se in th e real rate d e p re sse s econom ic a c tiv ity .

In sum m ary, th e Keynesian h y p o th e sis p re d ic ts th a t in resp o n se to announcem ent o f an unexpected in crease in th e money s u p p ly : I) S h o rt-te rm in te re s t ra te s w ill rise , ii) long-term in te re s t ra te s w ill e ith e r d e clin e o r remain la rg e ly unaffected d e p en d in g on w hether th e period o f fu tu r e m onetary r e s tr a in t is seen as being perm anent o r tr a n s ito r y , iii) The dom estic c u rre n c y w ill a p p re cia te a g a in st o th e r m ajor c u rre n c ie s and iv ) sto ck p ric e s w ill d eclin e.

III. CASE STUDY: R E P U B LIC OF TU R KEY

III.1) T L In te rb a n k M a rke t In T u rk e y

U n til mid e ig h tie s, th e T u rk is h C e n tra l Bank did not co n tro l money sto ck s t r ic t ly fo r m onetary p o licy p u rp o se s. Economic p o licy in general and m onetary p o licy in p a r tic u la r were not based on the b e lie f th a t th e money sto ck had s ig n ific a n t in flu e n ce on e ith e r p ric e s o r o u tp u t. A m ajor c o n s tra in t on th e C e n tral B a n k ’s b e h a v io r has been the o b lig a tio n to fin a n c e th e g o ve rn m e n t’s b o rro w in g req u ire m en ts. S in ce v ir t u a lly no a tte n tio n had been paid to money sto ck , an expansion in dom estic c r e d it to governm ent s e c to r had not been e n co u n te re d by any s ig n ific a n t squeeze o f p riv a te s e c to r c r e d it t ill mid e ig h tie s. From th a t time an C e ntral Bank has p u t m onetary p o licy in action and trie d to c o n s tru c t m onetary p o lic y to o ls to co n tro l m onetary a g g re g ate s. F o r th a t reason C e n tra l Bank c o n s tru c te d th e In te rb a n k m arket on A p r 2nd, 1986. and s ta rte d to open m a rket o p e ra tio n s on Feb 4th, 1987. Its ta rg e t has become re s tric tio n o f n e ar money aggregate, w hich is Ml w hile w iden ing less liq u id money s u p p ly , M2. Among open m arket o p e ra tio n s, re v e rs e repo has been th e most fre q u e n tly ap p lie d tool o f C e n tra l Bank in o rd e r to re d u ce liq u id it y in th e m arket.

In te rb a n k m arket was c o n s tru c te d to enhance th e re s e rv e movements among th e b a n ks and make b e tte r u tiliz a tio n o f o u r b a n k in g system . In te rb a n k rate is m ainly an in d ic a to r o f liq u id ity level in th e m arket. On th e m a tu rity d a y s o f govern m e n ts bonds in dom estic m arket; on th e p a rtic ip a tio n d a y s o f se v e ra l fu n d s and m u n icip a ls into th e in te rb a n k m arket, on th e day th a t T re a s u ry

p ays its de b t to Z iraa t Bankasi etc. the m arket is h ig h iy liq u id so in te rb a n k rate goes down. W hereas on the wage paym ent days, on th e d a ys th a t bank have to d e p o sit re s e rv e re q u ire m e n ts to C e n tra l Bank, ju s t before th e re lig io u s fe s tiv a ls , on taxation d a ys etc. th e re is tig h te n in g in th e liq u id ity so in te rb a n k rate in cre a se s.

Developm ent o f in te rb a n k m arket can be d iv id e d into th re e p e rio d s. B efore fe b 29 1988, th e in te rb a n k rate s were determ ined by th e fre e m arket co n d itio n s. Between feb 29 and march 21 1988 C e n tral Bank ap p lie d u p p e r and low er lim its on the in te rb a n k rate s to p re v e n t e x ce ssiv e in cre a se o r decrease in ra te s in case o f im balances between s u p p ly and demand fo r re s e rv e s in the m arket. A fte r m arch 21, 1988 C e n tra l Bank in sta lle d two sided quotation system among b a n ks in th e m arket b e sid e s th e old one.

These p e rio d s were re fle cte d in th e in te rb a n k rates. F o r example, be fore feb 29, 1988 s in c e ra te s were form ed u n d e r fre e m arket c o n d itio n s a rate about 60% m ight mean a high in te rb a n k r a t e . p o in tin g to tig h tn e s s of liq u id ity w hile th e same fig u r e m ight mean a low in te rb a n k rate with the in tro d u c tio n of q u o ta tio n s a fte r fe b 29.

T L in te rb a n k m arket b e g in s tra n s a c tio n s about 10 am and ends tra n s a c tio n s about 4 pm on each day. C e n tral Bank e x e rts s u b s ta n tia l pow er on in te rb a n k m a rket and keeps t h is m arket as a tool o f a c h ie v in g its m onetary p o lic y ends. C e n tral Bank e n te rs th e m a rket as a b u y e r o r s e lle r o f re s e rv e s a c c o rd in g to the d ire c tio n o f its m onetary p o licy and makes huge volum e of tra n s a c tio n s . A t th e e a rly d a y s o f th e m arket. C e n tral Bank used it fo r c o n tro llin g th e sp re a d between o ffic ia l and fre e exchange

rates. A fte r th e c o n s tru c tio n o f fo re ig n exchange in te rb a n k m arket in 1987, th a t fu n c tio n was tr a n s fe r r e d to t h is new m arket. A s tu d y con d u cte d by U ..Erol and M .AItinkem er showed th a t creatio n of fo re ig n exch ange in te rb a n k m a rket eiim inated th e need to use in te rb a n k ra te s as a tooi to s ta b iliz e exchange rate m argin e sp e c ia lly b e g in n in g from 1989. However, C e n tral Bank c o n tin u e s to

use T L in te rb a n k m arket d ir e c tly from time to time fo r th e sake of its p o licy . In te rv e n tio n of C e n tra l Bank and s t r ic t m argin of movements on in te rb a n k ra te s h ig h ly re d u ce s th e movement o f th a t m arket fre e ly .

III.2) Money S u p p ly Announcem ent

T u rk is h C e n tra l Bank p u b lis h e s "Money and C re d it S ta tis tic s " in "W eekly B u lle tin of C e n tral Bank o f T u rk is h R e p u b lic" at e v e ry th u rs d a y in a lim ited num ber (aroun d 130). These issu e s are se n t to s e n io r management o f all b a n k s and top m anagers o f governm ent agencies. As soon as th e b u lle tin s are re p ro d u ce d in re q u ire d num ber, th e y a re a v a ila b le fo r u se rs. C e n tra l Bank o rg a n iz e s the d is tr ib u tio n o f th e se issu e s a c c o rd in g to th e p re fe re n c e s of u sers. (Immediate u s e rs ta k e th e issu e d ir e c tly from C e n tra l Bank w hile o th e rs may p re fe r mail). The re p ro d u c tio n of issu e s is com pleted arou n d 2 pm to 4 pm. M oreover th e same s ta tis tic s are in clu d e d in th e "W eekly P re s s B u lle tin ", w hich is also d is trib u te d to g e th e r w ith the"W eekly B u lle tin o f TC C e n tra l B an k", then p re s s makes th e se data p u b lic ly known.

C e n tra l Bank uses lagged re s e rv e acco u n tin g system sim ila r to th a t o f USA. The data c o v e rs th e week end in g th irte e n d ays before th e th u rs d a y announcem ent, in o th e r w ords it belongs to the week th a t is two two w eeks before th e announcem ent. T h is is p a rtia lly caused by th e d if f ic u lt y o f o b ta in in g th e re q u ire d s ta t is t ic s from b a n ks on time.

IV. MODEL

T h is section p re se n ts th e em prical model to be tested to determ ine th e e ffic ie n c y of T u rk is h in te rb a n k m arket. F ir s t the s tr u c tu r a l model is given and then th e data are d e scrib e d .

IV.1) S tr u c tu r a l Model

/

In th e p re v io u s sectio n s, th e M arke t E ffic ie n c y H yp o th esis w ith re sp e ct to money s u p p ly announcem ents and In terb an k rate s Is d iscu sse d in detail As a sum m ary, In an e ffic ie n t in te rb a n k m arket, in te rb a n k rate sh ou ld a lre a d y embed the a n ticip a te d p a rt o f announced Ml and o n ly th e u n a n ticip a te d , o r th e s u rp ris e , p a rt sh o u ld have an e ffe c t th ro u g h th e re v is io n o f m arket p a rtic ip a n ts ’ a n ticip a tio n s . If th e announced Ml is not s u r p r is in g ly d iffe re n t from th a t in fe rre d by th e p a rtic ip a n ts th e re is no need to re v ise fu tu r e p o licy ru le a n ticip a te d and change th e c u r re n t b e h aviou r.

R e ffe rin g to M iskin*(1982), the th e o ry o f rational e xp e cta tio n s (or, e q u iv a la n tly e ffic ie n t m a rkets th e o ry ) in d ica te s th a t in te re s t ra te s in a bond m arket sh o u ld re fle c t all a v a ila b le Inform ation. M arke t uses a v a ila b le Inform ation c o rre c tly in a sse sin g th e p ro b a b ility d is trib u tio n o f all fu tu r e In terest rates.

^ F.S. Misk i n " M o n e t a r y Policy and S h o r t - T e r m Interest Rates: An

EmC-t ' ‘ t- l> = E ( r , / I^_,) = In te re s t rate at time t

I^_^= Inform ation a v a ila b le at time t-1

E ) = The expectation co n d itio n a l on I E^(.../I^_ ^ ) = The m a rke t’s exp ectatio n s

(un biased fo re c a st) assessed at t-1

Denoting th e m a rke t’ s one period ahead fo re c a s t o f the s h o rtra te as r® (=E^ (r^ /

E (r^ - r^ / I^_^) = 0

The above equation sta te s th a t the fo re c a s t e r r o r fo r s h o rt ra te s sh ou ld be u n co rre la te d w ith any lin e a r com binations of inform ation in An e q u iv a le n t re p re se n ta tio n o f th e rational e xp e cta tio n s model w hich s a tis fie s above re q u ire m e n ts is

- r® = (X^ - X® ) + t

X^ = V a ria b le of inform ation re le v a n t to the

d eterm in ation o f sh o rtte rm in te re s t rates. X®= M a rk e t’s e xp e cta tio n s co n d itio n a l on past

inform ation about X^. = A C o e ffic ie n t v e c to r

.= S e ria lly u n co rre la te d e r r o r p ro ce ss

T h is model s tre s s e s th a t an u n a n ticip a te d change in the s h o rt rate w ill o c c u r o n ly when u n a n ticip a te d inform ation h its the m arket. In o rd e r to make the model e m p iric a lly te stab le , M ish kin

in tro d u c e s o n e -p e rio d -a h e a d fo rw a rd ra te s into the model. C o n sid e rin g in te rb a n k m arket, th e d iffe re n c e in in te rb a n k rate s ju s t b efore to ju s t a fte r th e announcem ent show s the re v isio n of m arket a n ticip a tio n on in te rb a n k rate related to the inform ation embedded in money s u p p ly announcem ents on th u rs d a y .

The re g re s s io n equation to be tested in th is model is

r^ - r^ = ag + * Ml® + a2 * (M1^ - M 1 ^

r^ = In te rb a n k rate a fte r th e announcem ent

D

r^ = In te rb a n k rate before th e announcem ent

M1^= A ctual money s u p p ly , M1 announced.

M1^= A n ticip a te d money s u p p ly . Ml fo re ca ste d .

With a more com pact re p re se n ta tio n

= ag + a^ * (M1FRC)^ + a2 * (MISURP)^

The money s u p p ly announcem ents are decomposed into a n ticip a te d and u n a n ticip a te d com ponents to te st the e ffic ie n t m arket h y p o th e sis th a t o n ly th e u n a n ticip a te d com ponents should a ffe c t rates.

M1FRC is th e s e rie s o f a n ticip a te d money s u p p iy . M1SURP is th e s e rie s o f u n a n ticip a te d s u p p ly

O ur n u ll h y p o th e sis p o in tin g e ffic ie n c y of TL in te rb a n k m arket are a^ = 0 and a.^ ^ s ta tis tic a lly .

As su g g e ste d by Grossm an(1981), the e ffe c t of M1SURP on ch an g e s in in te re n s t rate sh ou ld re fle ct, u n d e r ration al e xpectation s, the a n ticip a te d p o licy response to the m onetary s u rp ris e . S in ce th e C e n tral Bank has e ss e n tia lly no inform ational a d van ta g e o v e r th e p u b lic with re sp e ct to w eekly ch an g e s in M1, it re a cts to th e incom ing m onetary data a fte r th e y have been released to th e p u b lic . It is th is p o ssib le reaction by th e C e n tral Bank to th e u n a n ticip a te d change in M1 u n a n ticip a te d by both C e n tral Bank and th e p u b lic th a t t r ig g e r s th e ra te s response. These a re the expected r e s u lts u n d e r ra tio n a lity o f m arkets.

IV.2) Data

The exogenous v a ria b le in my s tu d y is th e money s u p p ly announcem ents o f n a rro w ly defined money s u p p ly , M1. It show s the liq u id ity in th e m arket sin ce it in c lu d e s c u rre n c y and near money ag g re g a te s. C e n tra l Bank revised th e d e fin itio n of Ml and th e m entions it in ta b le s as "new narrow d e fin itio n o f money s u p p ly " .

M1 in c lu d e s th e fo llo w in g

. C u rre n c y in C irc u la tio n . Demand D eposits

. Commercial Account . S a v in g A ccou n t

. D eposits Held at C e n tra l Bank

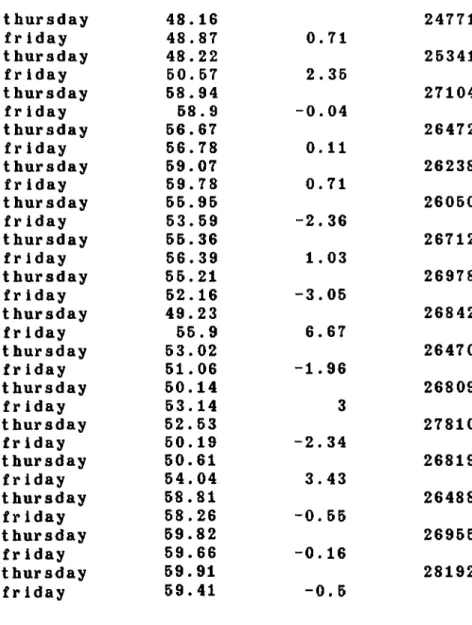

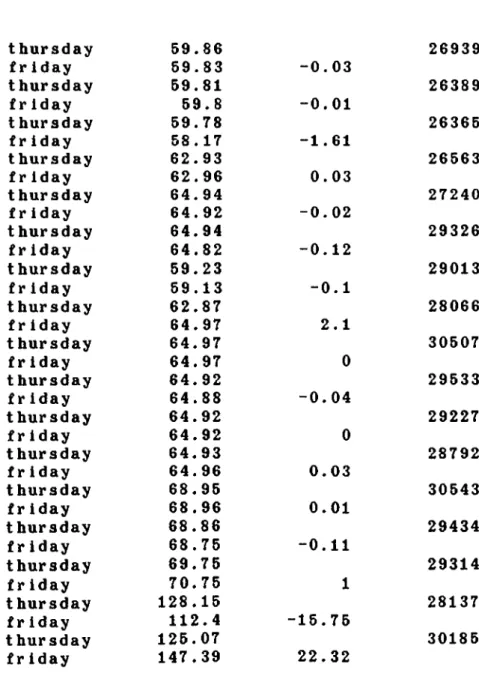

My data period c o v e rs 238 w eekly data from JAN 8th 1988 to J U L 24 1992. These are presented in Table IV .2.1.

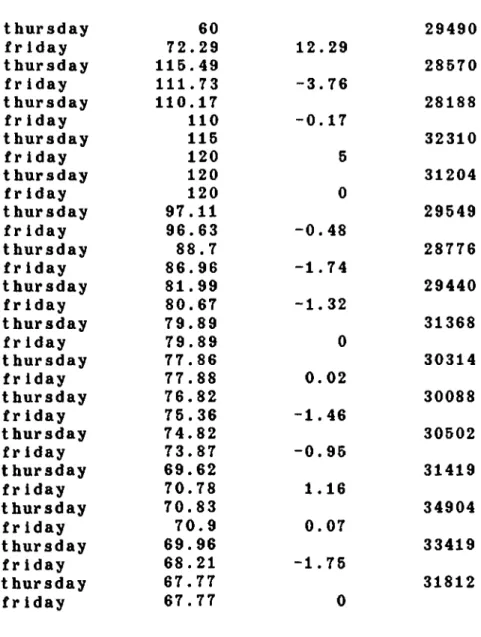

Money S u p p ly A n ticip a tio n data is not re a d ily a v a ila b le as a s u rv e y re s u lt. In USA, Money M a rke t S e rv ic e s Inc. o b ta in s fo re c a s ts of th e change in n a rro w ly defin ed money s u p p ly by q u e stio n in g w ith about 50 governm ent s e c u ritie s d e a le rs on w eekly te lep h on e s u rv e y s . As a re su lt o f h is em p irical s tu d y on s u rv e y e xpectation s, Grossm an(1981) pointed o u t th a t th e s u rv e y e xp e cta tio n s e ffic ie n tly u tiliz e all th e inform ation in a time s e rie s model and In a d d itio n contain autonom ous (n o n e xtra p o la tive ) inform ation . U n fo rtu n a te ly th e re is not su ch a s u rv e y s e rv ic e in T u rk e y . T h is s e rie s was estim ated u sin g time s e rie s a n a ly s is ap p ro ach . In t h is s tu d y the f ir s t 51 o b s e rv a tio n s on Ml announcem ents were taken as a b a sis fo r c o n s tru c tin g s tr u c tu r a l

ARIMA model. The f ir s t d iffe re n c e s e rie s of announcem ents was generated to get a s ta tio n a ry se rie s. A u to c o rre la tio n s fo r 25 lags and p a rtia l a u to co rre la tio n s fo r 18 lags were examined and among se v e ra i a lte rn a tiv e models tested th e a p p ro p ria te model was found to be ARIMA (3,1,2). The r e s u lts g iven at A pp e n d ix A.

A fte r d e term in in g th e s tr u c tu r a i model, ite ra tiv e time s e rie s method was ap p lie d to ARIMA (3,1,2) model to generate a n ticip a te d money s u p p ly s e rie s. T h is method proceeded as follow s: in o rd e r to fo rè c a s t the a n ticip a te d va lu e fo r a s p e c ific wëek all th e p re v io u s ly announced Ml v a lu e s were taken to inform ation bdsfe to re v is e ARIMA (3,2,1) c o e ffic ie n ts . The a n ticip a te d valu e was fo re ca ste d w ith th e se re v ise d c o e ffic ie n ts in the prese n ce o f last o b se rv a tio n added. The fo re c a s ts generated with th is method is ta b u la te d in Table IV .2.2.

TABLE IV.2.1

WEEKLY MONEY

SUPPLY ANNOUNCEMENTS

( TL IN BILLIONS )

Week

1 23

4

5

67

89

10 11 1213

14

15

16

17

18

19

20 2122

23

24

25

26

27

28

29

30

31

32

Ml

4

,19

,2 6 2 2 16770,

6997

6864.

6711

6507,

6449

6684.

6454.

6428

6438.7

6788.5

6809.3

6473.9

6581.3

7081.2

6990.1

6885.8

6642.8

6750.5

7244.9

7120.8

6974.1

6902.4

7297.3

7301.4

7094.6

7144.9

8029.

8228.

8220.

8188,

17

7

2

8237.5

Week

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

Ml

8442.6

8356.4

8359.9

8505.1

9194.6

8941.5

8753.5

8861.6

9208

8874.1

8541.5

8264.5

8504.4

8740.3

8697.3

8527.6

8646.8

9111.9

9044.8

11243.8

9340.8

9242.4

9517.4

9377.2

9419.6

9640.8

10217.9

10019.7

10033.5

10356.7

11067.4

10807.2

65

6667

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

8687

8889

90

91

92

93

94

95

96

W e e kMl

10590.1

10760.4

10913.3

11231.7

11613.3

11745.5

11732.9

12234.9

11903

11963.6

12153.4

12813

12548.1

12784.3

13070.6

14494.3

14113.2

14175.5

14232

14607.4

15410.9

14984.3

14971.5

15138.4

16373.5

16099

16310.6

16235.8

16271.9

17346.1

17092

16786.1

Week

97

98

99

100 101 102103

104

105

106

107

108

109

110 111 112113

114

115

116

117

118

119

120 121 122123

124

125

126

127

128

16896.3

17785.1

17225.2

17175.1

17227.3

18445.8

18073.8

20358.3

18641.2

18426.3

19308.2

18480.3

18347.6

18197

19231

18632.5

18573

18512

19951

19614

19521

19632

19872

22139

21963

21133

21292

22500

21566

21557

21963

23556

M lWEEKLY MONEY SUPPLY ANNOUNCEMENTS

T A B L E I V . 2 . 1 ( C O N T I N U E D )( TL IN BILLIONS )

Week

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

150

151

152

153

154

155

156

157

158

159

160

161

Ml

22979

24653

24845

24059

25240

24679

24771

25341

27104

26472

26238

26050

26712

26978

26842

26470

26809

27810

26819

26488

26955

28192

26939

26389

26365

26563

27240

29326

29013

28066

30507

29533

29227

Week

162

163

164

165

166

167

168

169

170

171

172

173

174

175

176

177

178

179

180

181

182

183

184

185

186

187

188

189

190

191

192

193

194

Ml

28792

30543

29434

29314

28137

30185

29490

28570

28188

32310

31204

29549

28776

29440

31368

30314

30088

30502

31419

34904

33419

31812

32579

34362

33445

34078

34585

38174

36357

35822

36401

37455

39974

Week

195

196

197

198

199

200 201 202203

204

205

206

207

208

209

210 211 212213

214

215

216

217

218

219

220 221 222223

224

225

226

227

Ml

39430

39127

40148

42534

40500

39353

38843

42459

39676

39038

38675

39598

41872

42116

42533

39883

43395

41401

39675

40316

42362

43350

41902

43803

43572

46656

43716

46054

44057

48118

46124

46888

44585

Week

228

229

230

231

232

233

234

235

236

237

238

Ml

49705

46469

46807

50075

57525

53434

50955

49436

49062

56269

54219

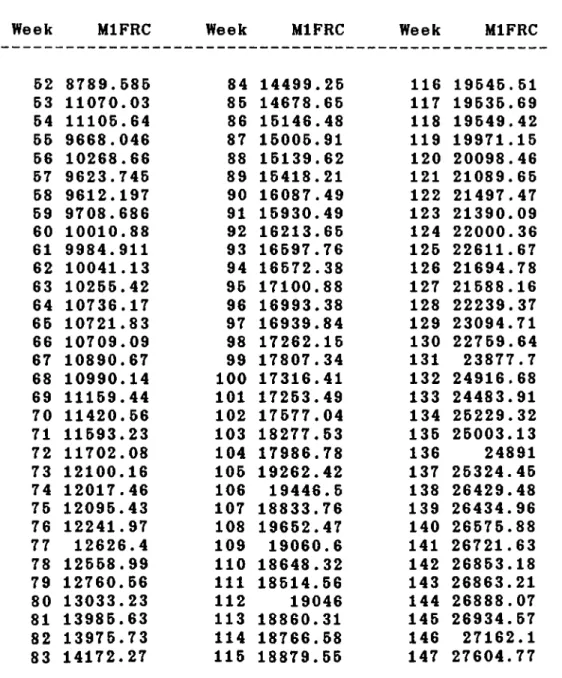

TABLE IV.2.2

ANTICIPATED MONEY SUPPLY (MIFRC)

Week

MIFRC

Week

MIFRC

W e e k M I F R C52 8789.585

84 14499.25

53 11070.03

85 14678.65

54 11105.64

86 15146.48

55 9668.046

87 15005.91

56 10268.66

88 15139.62

57 9623.745

89 15418.21

58 9612.197

90 16087.49

59 9708.686

91 15930.49

60 10010.88

92 16213.65

61 9984.911

93 16597.76

62 10041.13

94 16572.38

63 10255.42

95 17100.88

64 10736.17

96 16993.38

65 10721.83

97 16939.84

66 10709.09

98 17262.15

67 10890.67

99 17807.34

68 10990.14

100 17316.41

69 11159.44

101 17253.49

70 11420.56

102 17577.04

71 11593.23

103 18277.53

72 11702.08

104 17986.78

73 12100.16

105 19262.42

74 12017.46

106 19446.5

75 12095.43

107 18833.76

76 12241.97

108 19652.47

77 12626.4

109 19060.6

78 12558.99

110 18648.32

79 12760.56

111 18514.56

80 13033.23

112

19046

81 13985.63

113 18860.31

82 13975.73

114 18766.58

83 14172.27

115 18879.65

116

117

118

119

120 121 122123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

19645.51

19535.69

19549.42

19971.16

20098.46

21089.65

21497.47

21390.09

22000.36

22611.67

21694.78

21588.16

22239.37

23094.71

22759.64

23877.7

24916.68

24483.91

25229.32

25003.13

24891

25324.45

26429.48

26434.96

26575.88

26721.63

26853.18

26863.21

26888.07

26934.57

27162.1

27604.77

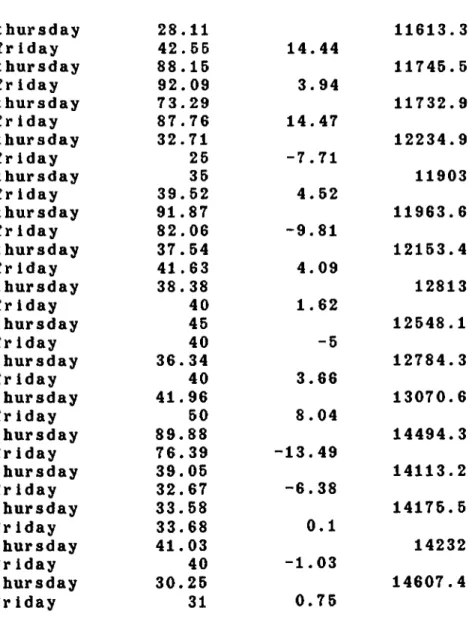

T A B L E I V . 2 . 2 ( C O N T I N U E D )

ANTICIPATED MONEY SUPPLY (MIFRC)

Week

MIFRC

Week

MIFRC

W e e k M I F R C148

149

150

151

152

153

154

155

156

157

158

159

160

161

162

163

164

165

166

167

168

169

170

171

172

173

174

175

176

177

178

179

27073.39

26987.65

27397.68

27840.67

27123.58

27043.66

27260.6

26851.56

26837.75

28469.04

28592.68

28345.84

30254.43

29580.22

29545.12

29640.94

30168.82

29684.14

29676.14

29340.45

29788.01

29661.09

28966.64

29322.28

30822.38

30343.26

29984.09

31093.31

29948.1

30572.49

29980.08

30371.56

180

181

182

183

184

185

186

187

188

189

190

191

192

193

194

195

196

197

198

199

200 201 202203

204

205

206

207

208

209

210211

31210.43

31106.92

32916.5

32691.86

32456.56

33996.75

34246.13

32892.87

33914.47

34808.36

36670.17

35821.05

36070.81

37659.97

37246.16

38242.41

38604.52

39347.43

40794.34

41781

40248.04

40257.15

40815.74

41904.69

39473.93

39366.9

40869.65

40135.17

40216.74

40879.3

42256.7

41427.38

212213

214

215

216

217

218

219

220 221222

223

224

225

226

227

228

229

230

231

232

233

234

235

236

237

238

239

43232.32

42275.51

40121.35

41547.44

42306.21

41884.09

41601.08

43953.81

44122.59

44956.83

44249.3

45553.02

45971.62

46067.41

46800.12

46064.77

46981.92

47869.85

47736.13

45736.34

50240

52734.31

51647.94

51970.98

54631.66

50107.05

54264.4

52923.08

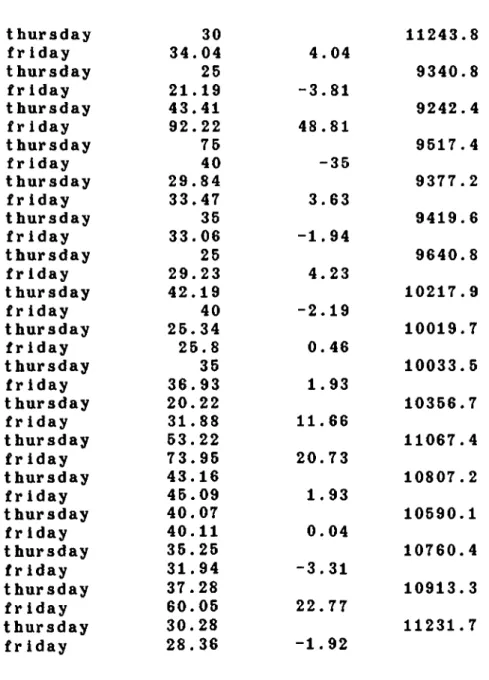

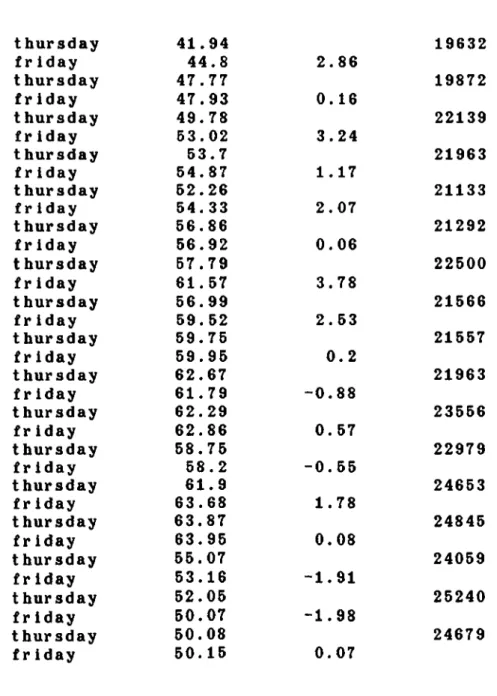

I o bta in ed d a ily tra n sa c tio n w eighted ave ra g e settlem ents of in te rb a n k ra te s c o v e rin g Jan 1989 to Ju l 1992. The change in In te rb a n k rate from ju s t b e fo re to Ju st a fte r th e announcem ents is my endogenous v a ria b le . S in ce th e h o u rly in te rb a n k rate s are not o b ta in a b le w ith in a day from C e n tra l Bank (even clo sin g and b e g in n in g rates), I took th e d iffe re n c e between T h u rsd a y (announcem ent day) ave ra g e and F rid a y ave ra g e to re fle c t the im pact o f announcem ent on in te re s t rates. The data on in te rb a n k ra te s a re p rese n ted in Table IV.2.3.

M1SURP is u n a n ticip a te d th a t is th e s u r p r is e com ponent o f M l. MISURP^ = Act.MI^ - MIFRC^ (A n ticip a te d )