ECONOMY CONTINUES TO SLOWDOWN

Zümrüt İmamoğlu* and Barış Soybilgen

†Executive Summary

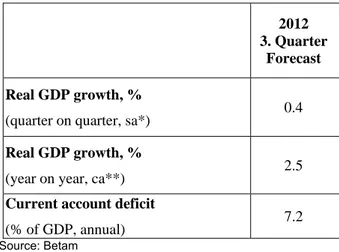

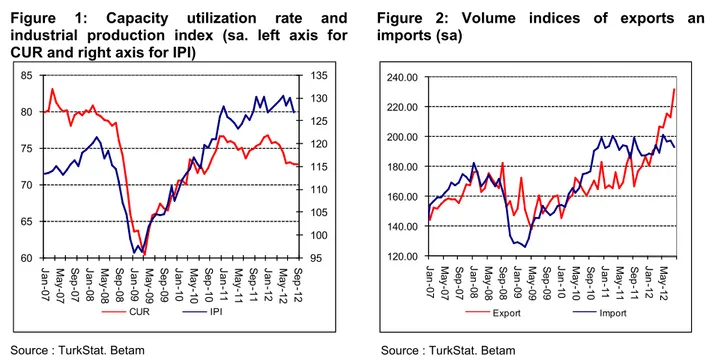

In August, the Industrial Production Index (IPI) decreased by 2.3 percent from July. Export Volume Index increased by 8.7 percent and the Import Volume Index decreased by 2.0 percent. The fall in IPI in August is in line with the ongoing decrease in capacity utilization rate (CUR). When gold exports are excluded, the increase in total exports reduces to 4.6 percent. Following the July and August data, we expect a decline in private investment expenditures in the third quarter. On the other hand, we expect a limited increase in private consumption. Betam’s forecast for the third quarter GDP growth this month has decreased to 0.4 percent quarter on quarter (QoQ) from the previous 0.6 percent. The corresponding forecast on year on year (YoY) growth rate is down to 2.5 percent from the previous 2.7 percent.

The 12-month current account deficit had fallen to $61.4 billion in July. In August, it further decreased by $2.8 billion to a sum of $59 billion. We estimate the ratio of the current account deficit to GDP to fall down to 7.2 percent at the end of the third quarter.

* Dr. Zümrüt İmamoğlu, Betam, Research Associate. zumrut.imamoglu@bahcesehir.edu.tr

† Barış Soybilgen, Betam, Research Assistant,

baris.soybilgen@bahcesehir.edu.tr

Table 1. Betam’s quarterly and annual growth rate forecasts

Source: Betam

*sa: seasonally and calendar day adjusted **ca: calendar day adjusted

Industrial production slowed down

In August, the Industrial Production Index (IPI) decreased by 2.3 percent from July and fell by 1.5 percent compared to the same month of the last year. However, the decline from the previous year was caused by holiday days. Calendar day corrected IPI increased by 1.2 percent in August from the same month of the last year. Nevertheless, the data indicates a sharp slowdown in growth. Because the inventory investment surged in the second quarter and capacity utilization rate has been in a downward trend for a long time, the decline in IPI was expected. But we will have to wait for the September data to see if it continues.

2012 3. Quarter

Forecast Real GDP growth, %

(quarter on quarter, sa*) 0.4

Real GDP growth, %

(year on year, ca**) 2.5

Current account deficit

(% of GDP, annual) 7.2

Economic Outlook and Forecasts:

October 2012

The CUR, by the way, continued to decline in September (Figure 1).

July and August data imply a decline in investment expenditures in the third quarter. Both investment goods imports and production declined in the third quarter from the previous one and the real sector confidence index continued to deteriorate. On the other hand, we expect a limited increase in the private consumption expenditures. The contribution of net exports to the real GDP growth seems to increase due to the surge in exports in August. However, gold adjusted export data indicates that the contribution of net exports to growth will be limited. Taking into account the slowdown in IPI and the gold adjusted export data, Betam revised its growth forecast for the third quarter and reduced it to 0.4 percent from the previous 0.6 percent. In line with this revision, the YoY growth forecast is reduced to 2.5 percent from the previous 2.7 percent.

The decline in the GDP growth rate has increased the pressure on the Central Bank of Turkey. The government is trying to compensate for the decline in tax revenues that deteriorates the budget balance, by increasing indirect tax rates which in return gets reflected on prices. This makes the Central Bank’s job to keep prices stable more difficult. Although, the Central Bank became an independent institution responsible for price stability after the reforms in 2001, fiscal policy is still very influential over inflation in Turkey. If a new structural tax reform is not implemented, the vicious cycle of “low growth – deterioration in budget balance – increase in indirect taxes – increase in inflation – tight monetary policy – low growth” cannot be broken.

In a situation like this, it would be very costly to comprise price stability for the sake of growth. In the past, Turkish economy suffered greatly from doing so. Same mistakes shouldn’t be repeated.

Uncertainty in consumption indicators

The economic indicators we use to forecast the private consumption expenditures are volatile. Last month the indicators were mostly positive; this month the outlook became negative. Consumer goods imports decreased by 6.9 percent in August from the last month. Nondurable and durable consumer goods productions decreased by 1.8 percent and 1.5 percent, respectively, in August. The consumer confidence index decreased by 1.4 percent in July. In spite of the negative outlook this month, we expect a small increase in private consumption expenditures. Yet again, this might show up as an increase in inventories if actual consumption continues to decline.

Investment expenditure is on the decline

After decreasing for 5 consecutive months between April and August, real sector confidence index showed a small increase in September. Even though investment goods imports increased both in September and August, overall it decreased by 8 percent in the third quarter from the previous quarter. Other economic indicators that we use to forecast the private investment expenditure are mostly negative. Automobile production increased by 8 percent in August but it decreased by 0.2 percent in September. Capacity utilization rate fell by 0.2 and 0.1 percentage points in August and September, respectively. Industrial production

index also decreased in August, by 2.3 percent. Overall, Betam expects a decrease in private investment expenditure in the third quarter.

The contribution of net exports to growth is decreasing

Figure 2 shows monthly changes of seasonally adjusted import and export volume indices. In August, export volume index increased by 8.7 percent whereas import volume index decreased by 2.0 percent. Exports excluding gold increased by 4.6 percent, in real terms.1 The third quarter QoQ increase in the export volume index is only half as much as the increase in the last quarter (Table 2) and the import volume index shows only a small decline. We expect the contribution of net exports to GDP growth to be limited in the third quarter.

Current account deficit is close to 7 percent

The current account deficit was $1.2 billion in August with the help of increasing tourism revenue and gold exports. The 12-month current account deficit fell to $59 billion at the end of August. At the end of 2011, the current account deficit was $77.1 billion. We expect the current account deficit to the GDP ratio, which was close to 10 percent at the end of 2011, to decline to 7.2 percent at the end of the third quarter. One of the main factors in the sharp decline in the current account deficit in August was the net gold exports

1

Gold exports only contribute to the components of GDP but not the overall real GDP growth. Gold exports show the contribution of net exports to growth to be higher than regular times, but the contribution of inventory investment becomes lower than normal. Therefore, in our forecasts we use gold excluded imports and exports.

that amount to $1.4 billion. In previous months, net gold exports were small, usually fluctuating around zero. We expect the decline in the current account deficit to slowdown in the fourth quarter as base effect from the previous year slowly disappears.

Table 2. Monthly and quarterly changes of Betam’s selected indicators (real and sa)

Indicators June July August September

2012 2. Quarter 2012 3. Quarter Exports

4.7

-1.2

8.7

**

11.7

6.0

Imports-1.9

0.1

-2.0

**

2.8

-0.3

Intermediate goods import

-1.5 0.9 -2.9

** 5.0 1.2

Consumer goods import

-9.6 5.8 -6.9

** 1.8 0.6

Investment goods import

-27.6 12.4

1.4

** -7.8 -8.0

Industrial Production Index (IPI)

-1.5 1.3 -2.3

** 1.3 -0.7

Nondurable consumer goods

-6.9 5.6 -1.8

** 2.3 1.3

Durable consumer goods

-6.5 4.1 -1.5

** 1.2 -0.6

Intermediate goods

-1.1 0.9 -1.7

** 1.8 -0.3

Investment goods

-7.9 4.4 -7.6

** 1.6 -3.6

Capacity Utilization Rate (CUR)

-1.4 0.1 -0.2

-0.1 -2.5 -1.8

Nondurable consumer goods

0.0 0.1 -0.6

0.1 -0.5 -1.3

Durable consumer goods

-0.9 0.2 -0.3

0.4 -0.2 -0.5

Intermediate goods

-0.6 0.3 -0.6

-0.5 -2.1 -1.0

Investment goods

-1.4 -0.6

0.6

-1.2 -1.5 -2.5

Manufacturing Order Index

-4.7 -3.3

**

** 3.0 -4.5

Domestic Orders

-5.1 0.9 **

** 1.6 -2.0

Foreign Orderrs

-3.8 -7.9

**

** 4.7 -7.4

Soft Data

Consumer confidence index

(Turkstat)

-0.4 1.3 -1.4

** -2.2 0.6

Reel sector confidence index

-3.4 -0.5 -1.4

0.9 -0.6 -4.0

Financial Data

IMKB 100 (Stock Exchange)

5.1 3.2 3.5

1.3 -1.4 8.7

Other

Special consumer tax* (SCT)

-2.0 0.0 2.1

** 4.7 1.5

Automobile production

-10.4 -2.7

8.0

-0.2 -3.2 -3.4

Source: TurkStat. TCMB. Treasury. IMKB. Betam. All series are real (or inflation adjusted) wherever necessary and seasonally adjusted.

*This tax is collected on sales of goods such as gas. fuel oils. alcohol. tobacco products and automobiles. **Data not yet released

Figure 1: Capacity utilization rate and industrial production index (sa. left axis for CUR and right axis for IPI)

Source : TurkStat. Betam

Figure 2: Volume indices of exports and imports (sa)

Source : TurkStat. Betam

Figure 3: Ratio of current account deficit to GDP (yearly)

Source: TCMB. TurkStat. Betam

Figure 4: Weighted Average Interest Rates For Turkish Lira Banks' Loans (%)

Source: TCMB 95 100 105 110 115 120 125 130 135 60 65 70 75 80 85 Ja n -0 7 Ma y-0 7 Se p -0 7 Ja n -0 8 Ma y-0 8 Se p -0 8 Ja n -0 9 Ma y-0 9 Se p -0 9 Ja n -1 0 Ma y-1 0 Se p -1 0 Ja n -1 1 May -11 Se p -1 1 Ja n -1 2 Ma y-1 2 Se p -1 2 CUR IPI 120.00 140.00 160.00 180.00 200.00 220.00 240.00 Ja n -0 7 Ma y-07 Se p -0 7 Ja n -0 8 Ma y-08 Se p -0 8 Ja n -0 9 Ma y-09 Se p -0 9 Ja n -1 0 Ma y-10 Se p -1 0 Ja n -1 1 Ma y-11 Se p -1 1 Ja n -1 2 Ma y-12 Export Import 0.0 2.0 4.0 6.0 8.0 10.0 12.0 2008( 1) 2008( 2) 2008( 3) 2008( 4) 2009( 1) 2009( 2) 2009( 3) 2009( 4) 2010( 1) 2010( 2) 2010( 3) 2010( 4) 2011( 1) 2011( 2) 2011( 3) 2011( 4) 2012( 1) 2012( 2) 2012( 3) * 0 5 10 15 20 25 30 Fe b ‐08 Ap r‐ 08 Ju n ‐08 Au g‐ 08 Oc t‐ 08 De c‐ 08 Fe b ‐09 Ap r‐ 09 Ju n ‐09 Au g‐ 09 Oc t‐ 09 De c‐ 09 Fe b ‐10 Ap r‐ 10 Ju n ‐10 Au g‐ 10 Oc t‐ 10 De c‐ 10 Fe b ‐11 Ap r‐ 11 Ju n ‐11 Au g‐ 11 Oc t‐ 11 De c‐ 11 Fe b ‐12 Ap r‐ 12 Ju n ‐12 Au g‐ 12 Cash Vehicle Housing Commercial

Figure 5: Monthly changes of manufacturing industry exports (sa)

Source: TurkStat. Betam

-10.00% 0.00% 10.00% 20.00% 30.00% 40.00% F ood pr odu ct s an d be ve ra g es Ta b ac co pr od uc ts Te xt ile go ods C lo th in g good s F ur s l eat her and p ro d uc ts W o od an d c o rk pr od uc ts P ape r a nd pa p er pr odu ct s C o ki ng c o al , r ef in ed p et . C hem ic al s P las tic an d ru b b er p ro d uc ts O ther no n-m et al lic m in er al p ro d . Me ta l i nd us tr y M et al pr od uc ts (n o t m ac h. ) M ac hi ner y an d eq ui p m ent E lec tr ic al m ac hi nar y R adi o, te le vi si on a nd c o m m . M o to r v ehi cl es and t rai le rs F ur ni tur e and o ther p ro d uc ts August 2012 -40.00% -30.00% -20.00% -10.00% 0.00% 10.00% 20.00% F ood pr odu ct s an d be ve ra g es Ta b ac co pr od uc ts Te xt ile go ods C lo th in g good s F ur s l eat her and p ro d uc ts W o od an d c o rk pr od uc ts P ape r a nd pa p er pr odu ct s C o ki ng c o al , r ef in ed p et . C hem ic al s P la st ic a nd ru bbe r pr od uc ts O ther no n-m et al lic m ine ra l p ro d . Me ta l i nd us tr y M et al pr od uc ts (n o t m ac h. ) M ac hi ner y an d eq ui p m ent E lec tr ic al m ac hi nar y R adi o, te le vi si on a nd c o m m . M o to r v ehi cl es and t rai le rs F ur ni tu re and o ther p ro d uc ts July 2011